Summary Of the Markets Today:

- The Dow closed up 462 points or 1.14%, (Closed at 41,175, New Historic high 41.208)

- Nasdaq closed up 1.47%,

- S&P 500 closed up 1.15%,

- Gold $2,547 up $29.70,

- WTI crude oil settled at $75 up $1.88,

- 10-year U.S. Treasury 3.803 down 0.059 points,

- USD index $100.69 down $0.82,

- Bitcoin $63,644 up $3,261 or 5.40%,

- Baker Hughes Rig Count: U.S. -1 to 585 Canada +2 to 219

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

Federal Reserve Chair Jerome Powell signaled that the time has come to begin cutting interest rates, reflecting confidence in the Fed’s fight against inflation. Markets reacted positively, with major stock indexes rising over 1% following Powell’s comments. Traders are pricing in a high likelihood of a rate cut in September, with debate over whether it will be 25 or 50 basis points. The 10-year Treasury yield fell to around 3.8%, near its lows for the year. Real estate stocks led gains in the S&P 500, rising 3.5% for the week as the best-performing sector.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Federal Reserve Chair Jerome Powell’s Jackson Hole speech on Friday signaled a significant shift in the central bank’s focus, laying the groundwork for upcoming interest rate cuts. Here are the key points from his address:

Labor Market Focus

Powell emphasized the cooling labor market, mentioning labor conditions 27 times in his speech, compared to 19 times in last year’s address. This shift indicates that the Federal Open Market Committee is now paying closer attention to employment trends after two years of intense focus on inflation.

Readiness for Rate Cuts

The Fed Chair explicitly stated that “the time has come” to begin cutting interest rates. This clear message suggests that the central bank is preparing for a policy pivot in the near future.

Economic Outlook

Despite recent data revisions showing weaker job growth earlier in the year, Powell’s speech did not express serious concerns about an imminent recession or significant job losses. Instead, the focus seems to be on the diminishing threat of elevated wage growth keeping inflation too high.

Inflation Progress

Powell noted that inflation has significantly decreased from its peak, with the consumer price index declining from 9% in June 2022 to below 3% in July 2024. He highlighted the importance of anchored inflation expectations in facilitating disinflation without the need for economic slack.

Market Expectations

Following Powell’s speech, market expectations for a September rate cut remained high. However, the majority of traders anticipate a quarter-point (25 basis points) reduction, with some seeing a possibility of a larger half-point (50 basis points) cut.

Policy Approach

Powell emphasized the need for a careful approach, stating that the Fed is prepared to raise rates further if necessary but intends to hold policy at a restrictive level until confident that inflation is moving sustainably toward their 2% objective. In conclusion, Powell’s Jackson Hole speech marked a turning point in Fed policy, signaling a readiness to begin cutting interest rates while maintaining a cautious stance on inflation and closely monitoring labor market conditions.

Sales of new single-family houses in July 2024 were 6.6% above July 2023 – significantly better than the 9.0% last month. The median sales price of new houses sold in July 2024 was $429,800. The average sales price was $514,800. The seasonally-adjusted estimate of new houses for sale at the end of July was 462,000. This represents a supply of 7.5 months at the current sales rate. Sales of new homes has been relatively good since the 2Q2023.

Here is a summary of headlines we are reading today:

- $1 Trillion LNG Infrastructure Boom Threatens Climate Goals

- U.S. Oil, Gas Drilling Activity Declines

- The Time Has Come For Rate Cuts… and Higher Oil Prices

- Oil Jumps 2% During Fed Jackson Hole Meeting

- California Taxpayers to Foot $8.5 Billion Bill for Rooftop Solar Subsidies

- Dow closes more than 450 points higher as Powell signals Fed rate cuts are coming: Live updates

- Markets are now wondering whether the Fed might cut by half a point in September

- 10-year Treasury yield slides after Powell remarks point to Fed rate cuts

- Bitcoin rises after Fed Chair Powell lays groundwork for interest rate cuts: CNBC Crypto World

- Stocks making the biggest moves midday: Cava, Intuit, Ross Stores, Workday and more

- America’s Power Grid Adds Most Generating Capacity In 21 Years As AI Data Center Demand Surges

- WazirX security breach: Crypto platform to resume INR withdrawals in phases starting August 26

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

$1 Trillion LNG Infrastructure Boom Threatens Climate GoalsThere is a massive natural gas project pipeline for the next decade, as several world powers have increased their gas production in line with the rise in demand. Much of this production increase will come from wealthy Western countries, with several states using gas as a transition fuel in the shift away from more polluting coal and oil. However, this is leading climate activists to point out the hypocrisy of these states calling for a green transition while also contributing heavily to the rise in global gas production. The demand for natural… Read more at: https://oilprice.com/Energy/Energy-General/1-Trillion-LNG-Infrastructure-Boom-Threatens-Climate-Goals.html |

|

Russia’s Coal Reserves to Last Over a Century Despite Market PressuresRussia has announced that it possesses more than a century’s worth of coal reserves, signaling its enduring role as a key player in the global energy landscape despite facing Western sanctions. According to Alexander Kozlov, Russia’s Minister of Natural Resources and Environment, the country’s coal reserves are estimated at an impressive 273 billion metric tons, with 46.4 billion tons currently being extracted. Even with increased production, which hit 392 million tons in 2023, Kozlov emphasized that Russia’s coal supply will last for more than… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Coal-Reserves-to-Last-Over-a-Century-Despite-Market-Pressures.html |

|

U.S. Oil, Gas Drilling Activity DeclinesThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 1 to 585 this week, compared to 632 rigs this same time last year. The number of oil rigs stayed the same this week after falling by 2 in the week prior. Oil rigs now stand at 483—down by 29 compared to this time last year. The number of gas rigs fell by 1 this week to 97, a loss of 18 active gas rigs from this time last year. Miscellaneous rigs stayed… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drilling-Activity-Declines.html |

|

KazMunayGas Hasn’t Been Asked to Reduce Output In Line With New OPEC+ PlanKazakhstan may have announced a significant update to its oil production compensation plan to OPEC on Thursday in response to its overproduction in July—a sign that on paper, at least, it is committed to the OPEC+ agreement. But Kazakstan’s National Company, KazMunayGas, hasn’t been given any instructions to cut its oil production in line with that new compensation plan, Interfax reported on Friday. Kazakhstan has long touted its dedication to meeting its obligations under the OPEC+ framework, while consistently failing to reach… Read more at: https://oilprice.com/Latest-Energy-News/World-News/KazMunayGas-Hasnt-Been-Asked-to-Reduce-Output-In-Line-With-New-OPEC-Plan.html |

|

OMV Announces Major Gas Discovery In Norwegian SeaAustria’s integrated energy company OMV (OTCPK:OMVJF) has announced a major natural gas discovery in the Norwegian Sea. In a statement released on Friday, OMVB said it had found preliminary estimated total recoverable natural gas volumes of up to 140 million barrels of oil equivalent (boe) after completing a drilling operation in the Norwegian Sea targeting its Haydn/Monn exploration prospects. The deepwater prospect is located 300 km west of the Norwegian mainland at a water depth of 1,064m. “This latest commercial discovery will further advance… Read more at: https://oilprice.com/Energy/Natural-Gas/OMV-Announces-Major-Gas-Discovery-In-Norwegian-Sea.html |

|

The Time Has Come For Rate Cuts… and Higher Oil PricesIn the wake of U.S. Federal Reserve Chair Jerome Powell’s recent comments suggesting the end of the aggressive rate hikes that dominated 2023, oil prices have seen a notable boost. Powell’s speech at the Jackson Hole Economic Symposium today hinted at a potential rate cut in the near future, a move that would ease borrowing costs and likely stimulate economic activity. This has led to a surge in market optimism, with both WTI and Brent crude prices climbing significantly. WTI crude is currently trading at $74.48 per barrel, marking a 2.01% increase,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Time-Has-Come-For-Rate-Cuts-and-Higher-Oil-Prices.html |

|

Oil Jumps 2% During Fed Jackson Hole MeetingWTI crude rose more than 2% as the Fed delivered its Jackson Hole meeting. Stocks, bonds, and gold prices rose during the meeting, as the dollar lost some of its strength. Oil prices have been rangebound this week, recovering after the frenzy seen in the first two weeks of August, with ICE Brent settling in a narrow band between $76 and $78 per barrel. Overall sentiment has been improving after the US Federal Reserve’s July meeting notes indicated September would be the most probable date for the much-anticipated interest rate cut. If Jackson… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Jumps-2-During-Fed-Jackson-Hole-Meeting.html |

|

Morgan Stanley Cuts Oil Price Forecasts Amid Rising Supply and Weakening DemandMorgan Stanley has revised its oil price forecasts downward, reflecting expectations of increased supply from OPEC and non-OPEC producers amid signs of weakening global demand, the bank said in a report this week. The firm now anticipates that while the crude oil market will remain tight through the third quarter, it will begin to stabilize in the fourth quarter and potentially move into a surplus by 2025. The adjustment comes as Morgan Stanley lowers its global oil demand growth estimate to 1.1 million barrels per day (bpd) for 2024, down slightly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Morgan-Stanley-Cuts-Oil-Price-Forecasts-Amid-Rising-Supply-and-Weakening-Demand.html |

|

Republicans and Democrats Sharply Divided on EnergyEnergy and climate issues have long been a point of division in American politics, with Democrats generally believing in investing in renewable energy sources while Republicans are more supportive of expanding energy production more broadly, including the use of fossil fuels and nuclear energy. This visualization, via Visual Capitalist’s Kayla Zhu, shows the portion of Democrat (and Democrat-leaning) and Republican (and Republican-leaning) U.S. adults who favor expanding various energy sources in the United States. The figures come from a Pew Research… Read more at: https://oilprice.com/Energy/Energy-General/Republicans-and-Democrats-Sharply-Divided-on-Energy.html |

|

Regulatory Challenges Force Equinor to Halt Offshore Wind Project in VietnamNorway’s state-controlled energy giant Equinor ASA (NYSE:EQNR) has abandoned plans to invest in Vietnam’s offshore wind sector, dealing a significant blow to the country’s green energy ambitions. According to the World Bank, over the past couple of years, Vietnam has attracted plenty of interest in its clean energy sector thanks to the country’s strong winds in shallow waters near coastal, densely populated areas. Unfortunately, recent political turbulence in the country has paralyzed regulatory reforms and discouraged investors. For instance,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Regulatory-Challenges-Force-Equinor-to-Halt-Offshore-Wind-Project-in-Vietnam.html |

|

UK Electricity Bills to Jump 10%Household electricity bills in the UK will rise by 10% this October after regulator Ofgem raises the energy price cap in response to higher wholesale electricity costs for suppliers. “We know that this rise in the price cap is going to be extremely difficult for many households,” Ofgem chief executive Jonathan Brearley said, as quoted by the Financial Times. “Anyone who is struggling to pay their bill should make sure they have access to all the benefits they are entitled to, particularly pension credit, and contact their energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Electricity-Bills-to-Jump-10.html |

|

IEA Roadmap Guides New Methane Reduction Funding SchemeA group of 50 organizations including the International Energy Agency and the Climate Bonds Initiative has set up a scheme to fund oil and gas companies committing to methane emission reduction, Bloomberg reported, noting the funding will take the form of so-called transition bonds. The group will release its recommendations on the idea at the next COP event and illustrate it with two demonstration deal, the report said, citing Climate Bonds Initiative chief executive Sean Kidney. Regulators have started paying a lot more attention to methane emissions… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Roadmap-Guides-New-Methane-Reduction-Funding-Scheme.html |

|

California Taxpayers to Foot $8.5 Billion Bill for Rooftop Solar SubsidiesCalifornians are facing a bill of $8.5 billion in rooftop solar power subsidies following an overhaul of the state’s subsidy scheme for the alternative energy source. According to a Reuters report, the California Public Utilities Commission two years ago overhauled its subsidy regime for rooftop solar, making the installations less attractive by offering lower rates for the electricity their owners sell into the grid. Yet those who had signed up for the subsidies before that year will continue to receive their higher rates, while Californians… Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-Taxpayers-to-Foot-85-Billion-Bill-for-Rooftop-Solar-Subsidies.html |

|

BP Buys Stake in Chinese Sustainable Fuel FirmBP has acquired an interest in a Chinese company that develops sustainable aviation fuel—an alternative to jet fuel seen as a tool for lowering the emissions footprint of the air transport industry. The stake represents 15% of the SAF unit of Zhejiang Jiaao Enprotech Stock Co. and cost BP around $50 million, Bloomberg reported, citing a statement by BP’s Chinese unit. The Chinese company is in the process of building a sustainable aviation fuel factory that will have an annual capacity of half a million tons. Construction should be… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Buys-Stake-in-Chinese-Sustainable-Fuel-Firm.html |

|

Oil Prices Remain Vulnerable to Demand FluctuationsCrude oil prices were set for yet another loss this week as demand pessimism continue to pressure traders into selling, alleviating supply concerns. Brent crude and West Texas Intermediate trended higher earlier in the day but were set to end the week lower than they started it, under the weight of economic reports pointing towards lower global demand for oil. Manufacturing data from key markets in Europe, Asia, and the U.S. showed a slowdown in demand for products, which by extension gets translated into lower demand for energy. In the U.S., the… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Remain-Vulnerable-to-Demand-Fluctuations.html |

|

Dow closes more than 450 points higher as Powell signals Fed rate cuts are coming: Live updatesStocks rallied on Friday after the central bank chief spoke in Jackson Hole, placing the indexes on pace for winning weeks. Read more at: https://www.cnbc.com/2024/08/22/stock-market-today-live-updates.html |

|

Markets are now wondering whether the Fed might cut by half a point in SeptemberThe odds of something even more aggressive, like a half-point move, grew quickly Friday. Read more at: https://www.cnbc.com/2024/08/23/markets-now-wonder-if-the-fed-might-cut-by-half-a-point-in-september.html |

|

Microsoft plans September cybersecurity event to discuss changes after CrowdStrike outageIndustry participants will discuss the idea of relying more on a safer part of Windows than the privileged kernel mode that CrowdStrike software uses. Read more at: https://www.cnbc.com/2024/08/23/microsoft-plans-september-cybersecurity-event-after-crowdstrike-outage.html |

|

Bronfman’s Paramount bid could keep Shari Redstone involved at the companyEdgar Bronfman Jr. is open to having Shari Redstone remain involved at Paramount if the special committee accepts his consortium’s bid for a controlling stake. Read more at: https://www.cnbc.com/2024/08/23/bronfman-paramount-bid-shari-redstone.html |

|

Workday stock gains as software provider widens 2027 margin targetWhile Workday trimmed subscription software growth guidance, it surprised analysts by calling for a higher adjusted operating margin. Read more at: https://www.cnbc.com/2024/08/23/workday-stock-gains-as-software-provider-widens-2027-margin-target.html |

|

As the Fed gears up for rate cuts, here’s what income investors need to doThe Federal Reserve rate cuts are going to affect your fixed income portfolio. Here’s what the experts say to do. Read more at: https://www.cnbc.com/2024/08/23/as-fed-gears-up-for-rate-cuts-heres-what-income-investors-need-to-do.html |

|

RFK Jr. endorses Trump after weeks of back-channel courtshipKennedy had dropped in the polls in recent weeks. He blamed Democrats for running a relentless campaign against his independent candidacy. Read more at: https://www.cnbc.com/2024/08/23/rfk-jr-says-in-court-filing-that-hes-endorsing-trump-ending-his-presidential-hopes.html |

|

10-year Treasury yield slides after Powell remarks point to Fed rate cutsThe U.S. 10-year Treasury yield fell Friday as Federal Reserve Chair Jerome Powell signaled to rate cuts ahead at the annual Jackson Hole symposium. Read more at: https://www.cnbc.com/2024/08/23/us-bonds-treasury-yields-in-focus-amid-powells-jackson-hole-speech.html |

|

Why Ford believes its $1.9 billion shift in EV strategy is the right choice for the company, investorsThe shifts in the automaker’s electric vehicle strategy will cost the Detroit automaker up to $1.9 billion in expenses and write-downs. Read more at: https://www.cnbc.com/2024/08/23/ford-ev-strategy-smaller-cars.html |

|

Bitcoin rises after Fed Chair Powell lays groundwork for interest rate cuts: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Dennis Kelleher of Better Markets discusses his op-ed encouraging Kamala Harris to reject pressure from the crypto industry. Plus, Wyoming Gov. Mark Gordon discusses the state’s stablecoin project. Read more at: https://www.cnbc.com/video/2024/08/23/bitcoin-rises-fed-chair-lays-groundwork-for-rate-cuts-crypto-world.html |

|

42-year-old sold his startup for $1.3 billion—he started by buying a $17,500 camera he couldn’t affordYears before Emery Wells sold his startup Frame.io for $1.28 billion, a rash decision to buy a camera he couldn’t afford changed the trajectory of his career. Read more at: https://www.cnbc.com/2024/08/23/how-frame-io-ceo-built-billion-dollar-business-sold-to-adobe.html |

|

The big mistake that can leave you ‘highly disappointed’ with your vacation, says travel agent for billionairesJaclyn Sienna India, a travel agent for the mega-rich, says billionaires and everyday spenders make this common mistake when planning their vacations. Read more at: https://www.cnbc.com/2024/08/23/the-big-mistake-that-can-leave-you-highly-disappointed-with-your-vacation.html |

|

Stocks making the biggest moves midday: Cava, Intuit, Ross Stores, Workday and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/08/23/stocks-making-the-biggest-moves-midday-cava-intu-rost-wday.html |

|

Gaslighting AP Touts Chicago’s Mostly ‘Peaceful’ DNC Riots; Social Media Says OtherwiseAuthored by Ben Sellers via Headline USA,

From boarded-up businesses and torn-down fences, to flag-burnings, bomb threats and bloody assaults, to hecklers forcing an early wrap on Nancy Pelosi’s interview with Stephen Colbert, the unrest in Chicago during the Democratic National Convention has been a maelstrom of festering chaos befitting of the party that birthed it with reckless social experiments, identity politics and tacit support for terrorists.

|

|

Must Watch: RFK Exposes DNC Corruption, Suspends Campaign, Backs Trump In Battleground StatesThe 2024 presidential election race is about to take its next unexpected turn…

|

|

Rand Paul Asks Why TSA Is Using Terror Watch List To Spy On Americans “Based On Their Political Views”Based On Their Political Views”Authored by Steve Watson via Modernity.news, GOP Senator Rand Paul has written to the Transportation Security Administration (TSA) asking for answers as to why the agency appears to be using terrorist watch lists as a way of surveilling Americans according to their political opinions.

Paul addressed the letter to TSA Administrator David Pekoske, and cited recent revelations that former Democratic Representative Tulsi Gabbard as well as a woman married to a federal air marshal whistleblower have both been placed on the ‘Quiet Skies’ program watch list and subjected to enhanced surveillance.

|

|

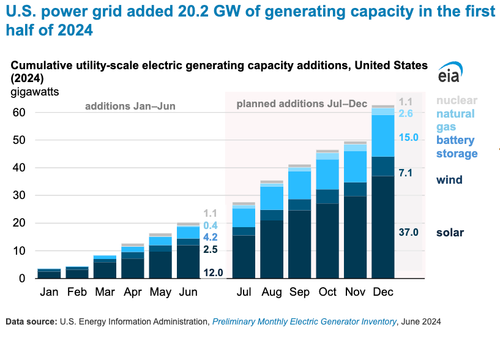

America’s Power Grid Adds Most Generating Capacity In 21 Years As AI Data Center Demand SurgesThe Energy Information Administration’s Preliminary Monthly Electric Generator Inventory report released earlier this week revealed that developers and power plant owners added 20.2 gigawatts (GW) in new capacity in the first half of 2024, a 21% year-over-year rise amid increasing demand from AI data centers, reshoring trends, and other electrification trends. Solar power led the way, contributing 12 GW, or 59% of all new additions, with Texas and Florida accounting for 38% of the growth in the first half. Battery storage capacity also saw significant growth, with around 21% of the capacity gains. Wind power added about 12% (2.5 GW).

However, rising energy demand on power grids, from AI data centers and other electrification trends, which we outlined in “The Next AI Trade,” have also slowed the retirement of coal and NatGas power generators.� … Read more at: https://www.zerohedge.com/commodities/americas-power-grid-adds-most-generating-capacity-21-years-ai-data-center-demand-surges |

|

Time has come for interest rate cut, says Fed chairThe remarks signal a new fight for the US central bank, after two years battling inflation. Read more at: https://www.bbc.com/news/articles/cewln7544xwo |

|

Ex-Boeing staff claims electrical faults ‘concealed’A campaign group has accused Boeing of concealing information about electrical problems on a plane. Read more at: https://www.bbc.com/news/articles/cwy3lxqlwl1o |

|

Royal Mail fails to meet spring delivery targetsRoyal Mail delivered less than 80% of first class post on time between April and the end of June. Read more at: https://www.bbc.com/news/articles/c0k4n255nv3o |

|

NSE rejig: Vodafone Idea to exit Nifty 500, Nifty Midcap 100Vodafone and 26 other stocks are exiting the Nifty 500 index while Trent and Bharat Electronics joined the Nifty 50, from which LTI Mindtree and Divi’s Laboratories exited. Effective from September 30, 2024, these changes will come into effected. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-rejig-vodafone-idea-to-exit-nifty-500-nifty-midcap-100/articleshow/112746688.cms |

|

Nifty Bank Reshuffle: State-run Canara Bank makes entry while Bandhan Bank pushed outJM Financial reports that Canara Bank’s addition to the 12-stock Nifty index is projected to attract inflows of $84 million, while Bandhan Bank’s removal could lead to outflows of $47 million. The NSE Indices committee announced these changes on Friday, set to take effect from September 30th (based on the closing prices of September 27th). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-bank-reshuffle-state-run-canara-bank-makes-entry-while-bandhan-bank-pushed-out/articleshow/112746090.cms |

|

WazirX security breach: Crypto platform to resume INR withdrawals in phases starting August 26WazirX will lift the suspension on INR balance withdrawals starting August 26. Users can withdraw 66% of their balances by September 22. A breach in its multisig wallet resulted in a loss of $230 million, leading WazirX to adopt a Singapore scheme to fairly resume cryptocurrency withdrawals after user approval. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/crypto-news/wazirx-security-breach-crypto-platform-to-resume-inr-withdrawals-in-phases-starting-august-26/articleshow/112746807.cms |