Summary Of the Markets Today:

- The Dow closed up 56 points or 0.14%, (Closed at 40,890, New Historic high 40.974)

- Nasdaq closed up 0.57%,

- S&P 500 closed up 0.42%, (Closed at 5,621, New Historic high 5,633)

- Gold $2,550 down $0.60,

- WTI crude oil settled at $72 down $1.22,

- 10-year U.S. Treasury 3.801 down 0.017 points,

- USD index $101.19 down $0.25,

- Bitcoin $61,550 up $2,528 or 4.28%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

U.S. stocks closed higher on Wednesday, marking a rebound after breaking their longest winning streak of the year. This upward movement came as investors analyzed the Federal Reserve’s latest meeting minutes, which indicated that most officials support a potential rate cut in September if inflation continues to decline. The market’s focus has shifted towards the labor market’s impact on Fed policy, especially as new data revealed that the U.S. economy had 818,000 fewer jobs than previously reported as of March 2024. Despite this adjustment, economists noted that the labor market is softening but not in a state of rapid decline. Investors remain cautious ahead of Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole symposium, with heightened expectations for a September rate cut. In corporate news, Target’s shares surged over 11% after reporting earnings that exceeded Wall Street expectations, while Macy’s shares fell nearly 13% following a sales decline. Overall, the S&P 500 is now less than 1% away from its all-time high, reflecting a broader recovery trend in the market.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Bureau of Labor Statistics (BLS) has benchmarked the establishment survey with the results released today. These revised counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. This had lead to significant downward revisions to previously reported employment gains, indicating a slower job growth than initially estimated. My take on this revision

Major Revision Details

The BLS revised job gains downward by 818,000 for the 12-month period ending in March 2024. This substantial adjustment represents a reduction of 0.5% of total employment from April 2023 to March 2024.

Sector-Specific Impacts

The revision affected various sectors differently:

-

- Professional and business services saw the largest absolute decrease, with 358,000 fewer jobs than previously reported.

- Leisure and hospitality followed with a reduction of 150,000 jobs.

- The information sector experienced the most significant percentage decline at 2.3%.

Economic Implications

This revision has several implications for the economy:

-

- It suggests that job growth was slower than initially thought, with approximately 2.1 million jobs created in the year ending March 2024.

- The unemployment rate has remained relatively stable at around 4%, despite the downward revision.

- The revision has added to concerns about a potential economic slowdown.

- It has sparked discussions about whether the Federal Reserve should have considered cutting interest rates sooner.

The Federal Reserve today released the minutes of the Federal Open Market Committee for the meetings held on July 30–31, 2024. There seems to be a sense when reading the minutes, that the Federal Reserve is close to reducing the federal funds rate by 25 basis points – likely at their next meeting. Highlights of the minutes:

Participants observed that inflation had eased over the past year but remained elevated and that, in recent months, there had been some further progress toward the Committee’s 2 percent inflation objective … participants judged that recent data had increased their confidence that inflation was moving sustainably toward 2 percent. Almost all participants observed that the factors that had contributed to recent disinflation would likely continue to put downward pressure on inflation in coming months …

Participants assessed that supply and demand conditions in the labor market had continued to come into better balance. The unemployment rate had moved up but remained low, having risen 0.7 percentage point since its trough in April 2023 to 4.1 percent in June … Regarding the outlook for the labor market, participants discussed various indicators of layoffs, including initial claims for unemployment benefits and measures of job separations. Some participants commented that these indicators had remained at levels consistent with a strong labor market …

participants observed that consumer spending had slowed from last year’s robust pace, consistent with restrictive monetary policy, easing of labor market conditions, and slowing income growth. They noted, however, that consumer spending had still grown at a solid pace in the first half of the year, supported by the still-strong labor market and aggregate household balance sheets …

Participants discussed the risks and uncertainties around the economic outlook. Upside risks to the inflation outlook were seen as having diminished, while downside risks to employment were seen as having increased. Participants saw risks to achieving the inflation and employment objectives as continuing to move into better balance, with a couple noting that they viewed these risks as more or less balanced …

Some participants observed that the banking system was sound but noted risks associated with unrealized losses on securities, reliance on uninsured deposits, and interconnections with nonbank financial intermediaries … Participants generally noted that some banks and nonbank financial institutions likely have vulnerabilities associated with high CRE exposures through loan portfolios and holdings of CMBS …

In their consideration of monetary policy at this meeting, participants observed that recent indicators suggested that economic activity had continued to expand at a solid pace, job gains had moderated, and the unemployment rate had moved up but remained low. While inflation remained somewhat above the Committee’s longer-run goal of 2 percent, participants noted that inflation had eased over the past year and that recent incoming data indicated some further progress toward the Committee’s objective. All participants supported maintaining the target range for the federal funds rate at 5-1/4 to 5-1/2 percent, although several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision …

Many participants noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment. A couple participants highlighted in particular the costs and challenges of addressing such a weakening once it is fully under way. Several participants remarked that reducing policy restraint too soon or too much could risk a resurgence in aggregate demand and a reversal of the progress on inflation. These participants pointed to risks related to potential shocks that could put upward pressure on inflation or the possibility that inflation could prove more persistent than currently expected.

Here is a summary of headlines we are reading today:

- Investors Are Flocking to Gold

- EU Slashes Proposed Tariffs on Tesla’s China-Made EVs

- Nigeria’s Massive Dangote Refinery Taking Less American Crude

- Will Buffett Step in to Keep Occidental Afloat?

- Oil Ticks Higher as EIA Reports Inventory Draws Across the Board

- Texas Faces Growing Electricity Needs

- Fed minutes point to ‘likely’ rate cut coming in September

- Nonfarm payroll growth revised down by 818,000, Labor Department says

- U.S. job growth revised down by the most since 2009. Why this time is different

- Epic Systems is building more than 100 new AI features for doctors and patients. Here’s what’s coming

- ‘The Descent Is Upon Us’: Forget The Sahm Rule, This Indicator Has Perfectly Predicted Every US Recession Since 1930

- Red-hot rent rises cool but tenants still struggling

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Putin Looks to Reassert Influence in the CaucasusIt’s clear following Russian President Vladimir Putin’s two-day visit to Azerbaijan that he wants to remain a powerbroker in the Caucasus. Whether he has the means to do so, however, remains an open question. Putin’s August 18-19 trip to Baku occurred against a backdrop of the collapse in Russia’s strategic partnership with Armenia, the result of which has seen Yerevan enhance its political and security ties with the West, and an ongoing Ukrainian offensive in Russia’s Kursk region. Despite this, Putin maintained a… Read more at: https://oilprice.com/Geopolitics/International/Putin-Looks-to-Reassert-Influence-in-the-Caucasus.html |

|

Beijing Calls for Higher Investment in Renewable and Power Grid TechnologyChina’s state planner has called for more investment in equipment upgrades to help support the country’s energy transition. The energy upgrade plan calls for investment in renewable and power grid technologies, energy conservation, and coal power plant flexibility—areas that Beijing has signaled will be key to the transition from coal to lower-carbon power. The plan reiterates existing regulations on equipment upgrades, including one that requires wind farms older than 15 years, or with less than 1.5 megawatts (MW) of capacity, to be retrofitted.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Beijing-Calls-for-Higher-Investment-in-Renewable-and-Power-Grid-Technology.html |

|

Investors Are Flocking to GoldThe price of gold hit an all time high of $2,513.79 (£1,932.87) per ounce on Tuesday morning as investors hope the US central bank will cut interest rates. The surge in the price of the precious metal, a safe haven asset for investors due to its real-world use cases and widely held intrinsic value, means the gold price has now risen by nearly 22 percent this year alone. It also takes the price of a standard 400 troy ounce bar of gold, which weighs 12.4kg, to $1m (£768.9m) for the first time ever. Growing expectations of a rate cut from… Read more at: https://oilprice.com/Metals/Gold/Investors-Are-Flocking-to-Gold.html |

|

Iran Appoints New Oil Minister, Warns Reserves Are LimitedIran has appointed a new oil minister, Mohsen Paknejad, following a vote of confidence in parliament on Wednesday, Azerbaijan’s Trend news agency reported. Paknejad, an oil ministry veteran who previously held the position of deputy oil minister from 2018 to 2021, took the podium on Wednesday to bemoan the state of affairs in Iran’s oil industry. The new oil minister called on Tehran to boost production, warning that fossil fuel reserves will remain limited over the next two decades, without significant development efforts. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Appoints-New-Oil-Minister-Warns-Reserves-Are-Limited.html |

|

EU Slashes Proposed Tariffs on Tesla’s China-Made EVsThe European Commission announced this AM that, in its ongoing findings of an anti-subsidy investigation into Chinese imports of battery electric vehicles, all Tesla vehicles imported from China will be subject to a 9% tariff. Proposed tariffs on other EV companies were revised slightly ahead of what could become EU trade policy later this year. Of all the proposed duties on Chinese EVs imported to the EU, Tesla appears to be the big winner and will pay the lowest rate of 9%. Reuters noted the EU “set a new reduced rate of 9% for Tesla, lower than… Read more at: https://oilprice.com/Energy/Energy-General/EU-Slashes-Proposed-Tariffs-on-Teslas-China-Made-EVs.html |

|

Nigeria’s Massive Dangote Refinery Taking Less American CrudeNigeria’s Dangote mega refinery is now poised to import the lion’s share of its feedstock from domestic sources for Q3, according to Bloomberg data, indicating a reduction of U.S. crude oil intake. In the second quarter of this year, the embattled Dangote refinery was acquiring less than 75% of its crude feedstock from domestic sources. Developments at Nigeria’s Dangote refinery can easily impact oil prices, as they did in July, when Dangote said it might resell imported U.S. oil as it shifts its focus to domestic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigerias-Massive-Dangote-Refinery-Taking-Less-American-Crude.html |

|

EU Mulls Open-Ended Immobilization of Russian AssetsThe European Union and the Group of Seven (G7) leading industrialized nations are slowly gearing up new legislation that will allow a $50 billion loan to go to Ukraine by the end of the year. The political decision for that loan was already agreed when the G7 met in Italy for its annual summit on June 13-15. In the communique from the meeting, it was stated that “we decided to make available approximately $50 billion leveraging the extraordinary revenues of the immobilized Russian sovereign assets, sending an unmistakable signal to President… Read more at: https://oilprice.com/Geopolitics/International/EU-Mulls-Open-Ended-Immobilization-of-Russian-Assets.html |

|

Greek Oil Tanker On Fire, Adrift in Red Sea As Gaza Talks FalterA Greek-flagged oil tanker is on fire and drifting crewless in the Red Sea after coming under attack by Yemen’s pro-Iranian Houthis, in a sign of escalation after a brief pause on activities in the run-up to the latest round of Gaza ceasefire talks. According to the Associated Press, citing British maritime authorities, the oil tanker is no longer under anyone’s command, and came under attack by armed groups traveling on small vessels some 90 miles from the Yemeni port city of Hodeida. The vessel was also reportedly struck by… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Greek-Oil-Tanker-On-Fire-Adrift-in-Red-Sea-As-Gaza-Talks-Falter.html |

|

China Prods Pakistan to Ramp Up Security and GovernanceThe Communist Party of China is officially atheist but China’s premier, Li Qiang, recently had a “come to Jesus” meeting with Pakistan’s prime minister, Shehbaz Sharif. China is frustrated by Pakistan’s inability to protect Chinese workers on the $62 billion China-Pakistan Economic Corridor (CPEC), a key part of China’s Belt and Road Initiative (BRI). Aside from killing Chinese citizens, the violence has contributed to CPEC’s slow rollout in a country that needs more electricity, more clean water, more… Read more at: https://oilprice.com/Geopolitics/Asia/China-Prods-Pakistan-to-Ramp-Up-Security-and-Governance.html |

|

Will Buffett Step in to Keep Occidental Afloat?Shares of Occidental Petroleum have dropped below $56, raising questions about whether Warren Buffett’s Berkshire Hathaway will step in as it has in the past. Berkshire Hathaway, Occidental’s largest shareholder with nearly a 30% stake, has previously purchased millions of shares whenever Occidental’s price dipped below $60, a pattern that analysts have dubbed “the Berkshire put.” But this time, the absence of such purchases is raising eyebrows.For the past month, Occidental has traded under $60, the longest stretch since January, when a similar… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Will-Buffett-Step-in-to-Keep-Occidental-Afloat.html |

|

Oil Ticks Higher as EIA Reports Inventory Draws Across the BoardCrude oil prices moved higher today after the U.S. Energy Information Administration reported a decline in inventories for the week to August 16. Those shed 4.6 million barrels over the period, compared with a build of 1.4 million barrels that surprised traders last week. On Tuesday, the American Petroleum Institute reported another unexpected inventory increase, but a moderate one, at 347,000 barrels. In fuels, the EIA also estimated draws in inventories. Gasoline inventories fell by 1.6 million barrels over the week to August 16, which compared… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Ticks-Higher-as-EIA-Reports-Inventory-Draws-Across-the-Board.html |

|

U.S. Coal Miners to Merge in $5.2B DealSaint Louis, Missouri-based coal miner Arch Resources Inc. (NYSE:ARCH) and Canonsburg, Pennsylvania-based Consol Energy Inc.(NYSE:CEIX) have announced they will combine in an all-stock “merger of equals” to create Core Natural Resources in a deal valued at $5.2B. Under the deal terms, Arch Resources shareholders will receive a fixed exchange ratio of 1.326 shares of Consol common stock for each share of Arch common stock owned. Currently, Arch Resources has a market value of $2.29-billion following a 24% crash in its share price while Consol Energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Coal-Miners-to-Merge-in-52B-Deal.html |

|

Why Goldman Sachs Thinks European Natural Gas Prices Will StabilizeUkraine’s incursion into Russia’s Kursk region earlier this month rattled the European natural gas market, pushing prices above 40 euros per megawatt-hour amid concerns that Russian natural gas supplies to the EU might be severed. However, prices have since receded, with Goldman’s Samantha Dart telling clients Monday that the price rally is mostly “overdone.” Last week, Ukraine’s president claimed that troops have control over the Russian town of Sudzha, about six miles inside Russian territory. Within the town is a critical gas measuring… Read more at: https://oilprice.com/Energy/Energy-General/Why-Goldman-Sachs-Thinks-European-Natural-Gas-Prices-Will-Stabilize.html |

|

U.S. Crude Oil Exports To Peak In 2024U.S. crude oil exports are set to grow this year by the smallest margin after a decade of rapid growth. Crude exports from U.S. ports have averaged 4.2 million barrels per day so far this year, up a mere 3.5% Y/Y compared to a robust 13.5% growth in 2023. This year’s growth clip is the lowest since 2015, when the country lifted a 40-year federal ban on the export of domestic crude. “U.S. crude exports are plateauing due to a combination of slowing supply growth and easing demand – particularly from Asia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Crude-Oil-Exports-To-Peak-In-2024.html |

|

Texas Faces Growing Electricity NeedsTexas used a record amount of electricity on Tuesday, the Electric Reliability Council has reported, noting that the data has yet to be made official after calculating meter readings. Bloomberg said in a report on the news that the record was driven by higher demand for air conditioning amid August temperatures. The publication also recalled that this year’s summer in Texas is still cooler than the summer of 2023, when demand for electricity broke record on 21 occasions. Earlier in the year, ERCOT forecast that electricity demand in the Lone… Read more at: https://oilprice.com/Energy/Energy-General/Texas-Faces-Growing-Electricity-Needs.html |

|

Fed minutes point to ‘likely’ rate cut coming in SeptemberThe Federal Reserve on Wednesday released minutes from its July 30-31 policy meeting. Read more at: https://www.cnbc.com/2024/08/21/fed-minutes-july-2024.html |

|

Nonfarm payroll growth revised down by 818,000, Labor Department saysThe U.S. economy created far fewer jobs than originally reported in the 12-month period through March 2024, the Labor Department reported. Read more at: https://www.cnbc.com/2024/08/21/nonfarm-payroll-growth-revised-down-by-818000-labor-department-says.html |

|

U.S. job growth revised down by the most since 2009. Why this time is differentThere’s a lot of debate about how much signal to take from the 818,000 downward revisions to U.S. payrolls — the largest since 2009. Is it signaling recession? Read more at: https://www.cnbc.com/2024/08/21/us-job-growth-revised-down-by-the-most-since-2009-why-this-time-is-different.html |

|

Target CEO addresses ‘price gouging’ accusations in retailAfter Democratic presidential candidate Kamala Harris outlined a plan to stop price gouging, Target CEO Brian Cornell said there’s no room for the tactic. Read more at: https://www.cnbc.com/2024/08/21/target-ceo-brian-cornell-weighs-in-on-price-gouging.html |

|

These are the most important stocks in the U.S., according to Bank of AmericaBank of America is laying out a list of what it deems to be the most important stocks in the U.S. Read more at: https://www.cnbc.com/2024/08/21/most-important-stocks-in-the-us-according-to-bank-of-america.html |

|

Microsoft will release controversial Windows Recall AI search feature to testers in OctoberIt has been a bumpy rollout for a feature that was designed as an early example of an artificial intelligence model running locally on a Windows PC. Read more at: https://www.cnbc.com/2024/08/21/microsoft-recall-ai-search-for-windows-insiders-releases-in-october.html |

|

Harris allies make a pitch to CEOs that she would be good for businessVice President Kamala Harris’ allies in the business community have been privately lobbying CEOs at the Democratic National Convention to back her. Read more at: https://www.cnbc.com/2024/08/21/harris-business-allies-taxes-trump.html |

|

Five bodies recovered in wreckage of superyacht that sank off SicilyThe ship was violently rocked by a storm around 4 a.m. local time Monday while it was anchored near the Sicilian port of Porticello. Read more at: https://www.cnbc.com/2024/08/21/mike-lynch-missing-search-for-sicily-yacht-passengers.html |

|

Epic Systems is building more than 100 new AI features for doctors and patients. Here’s what’s comingHealth-care executives are visiting Epic’s headquarters this week to learn about its new software products and updates. Read more at: https://www.cnbc.com/2024/08/21/epic-systems-ugm-2024-ai-tools-in-mychart-cosmos-.html |

|

Bitcoin and ether rise as investors grow confident Fed will cut rates: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Anthony Scaramucci, founder of SALT and managing partner at SkyBridge Capital, discusses the factors driving markets and crypto’s role in the 2024 election. Read more at: https://www.cnbc.com/video/2024/08/21/bitcoin-ether-rise-investors-grow-confident-fed-will-cut-rates-crypto-world.html |

|

The Democratic playlist to nominate Harris: Lil Jon, Beyoncé, Taylor Swift, SpringsteenThe Democratic National Convention’s roll call playlist to nominate Vice President Kamala Harris featured Lil Jon, Beyoncé, Taylor Swift and Bruce Springsteen. Read more at: https://www.cnbc.com/2024/08/21/dnc-songs-harris-lil-jon-springsteen-beyonce-taylor-swift.html |

|

Harris wants to forgive medical debt for millions of AmericansVice President Kamala Harris is calling for the forgiveness of medical debt for millions of Americans. Around 1 in 5 U.S. households reported carry the debt. Read more at: https://www.cnbc.com/2024/08/21/harris-wants-to-forgive-medical-debt-for-millions-of-americans.html |

|

The VIX level that can help chart the path for where the stock market goes nextCanaccord Genuity sees Wall Street’s so-called ‘fear gauge’ as central to determining the future path of prices. Read more at: https://www.cnbc.com/2024/08/21/the-vix-level-that-can-help-chart-a-path-for-where-stocks-go-next-.html |

|

Judge: Virginia School District Must Allow Transgender Student On Girls’ Tennis TeamAuthored by Katabella Roberts via The Epoch Times, A federal judge has ruled that a Virginia school district may not prevent a transgender student from playing on a girls’ middle school tennis team while the student’s lawsuit against the school board continues.

Judge M. Hannah Lauck of the U.S. District Court for the Eastern District of Virginia handed down the ruling against Hanover County Public Schools on Aug. 16. In issuing the preliminary injunction, the judge said she found the 11-year-old student—identified in court documents only as “Janie Doe”—would likely succeed in the claim that the Hanover County School Board violated both Title IX and the Equal Protectio … Read more at: https://www.zerohedge.com/political/judge-virginia-school-district-must-allow-transgender-student-girls-tennis-team |

|

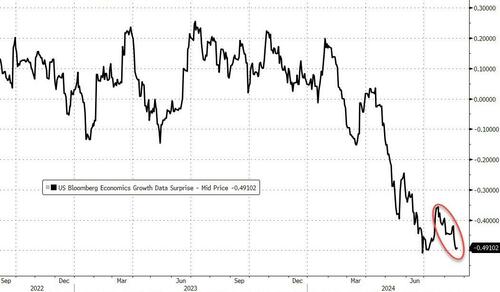

‘The Descent Is Upon Us’: Forget The Sahm Rule, This Indicator Has Perfectly Predicted Every US Recession Since 1930Authored by Joe Sullivan-Bissett via BondVigilantes.com, The Sahm rule has triggered: markets, please prepare for landingThe economic cycle is at an interesting inflection point where the effects of higher interest rates are becoming evident in numerous ways, be it a slowdown in the labour market, falling inflation, or wavering consumer and business confidence. Whilst a lower rate of inflation is welcomed, the important question remains: have interest rates been too high for too long, and has this caused irreparable damage to the economy in its current cycle? In this blog, I discuss the breaching of the Sahm rule, and whether the Federal Reserve (Fed) can manage to coordinate a ‘soft landing’, where monetary policy tools are used to reduce inflation to target levels, without pushing the economy into a recession. Before assessing whether the Fed might be able to achieve this goal, let’s take a step back and assess how the recent inflation predicament arose. Inflation take-off caused by post-COVID money supply and the invasion of UkraineFor the 10 years that followed the Global Financial Crisis and preceded the COVID-19 era, inflation in the US ran at an average of 1.8% per year – almost in line with the Fed’s long-term target of 2%. Then, the COVID-19-induced economic shutdowns reduced inflationary pressures as economic act … Read more at: https://www.zerohedge.com/markets/descent-upon-us-forget-sahm-rule-indicator-has-perfectly-predicted-every-us-recession-1930 |

|

Trump Endorsement? RFK Jr To “Address The Nation” Friday MorningAmid a flurry of speculation that he will endorse Donald Trump (following news reports – which he since denied – that he failed to clinch a cabinet job with Kamala Harris in exchange for his endorsement there), Robert F. Kennedy, Jr. said he will make a speech in Phoenix on Friday, his campaign announced, as the independent presidential candidate considers whether to drop out of the race and endorse former President Donald Trump. The campaign said Kennedy will “address the nation” Friday morning, without sharing details of what he will be speaking about. Kennedy’s speech will come days after his running mate, Nicole Shanahan, said in a podcast interview on Tuesday that the campaign is considering whether to “join forces” with Trump to prevent the “risk” of Vice President Kamala Harris winning the election. Overnight, in an interview Trump said that he would certainly consider a cabinet position for RFK Jr in exchange for an endorsement. “I would love that endorsement because I’ve always liked him” Trump said. Then when asked if he would also consider adding him to the administration, Trump responded that “I like him a lot I respect him a lot uh I probably would if something like that would happen… He’s very different kind of a guy, very smart guy, and yeah I would be honored by that endorseme … Read more at: https://www.zerohedge.com/markets/trump-endorsement-rfk-jr-address-nation-friday-morning |

|

FOMC Minutes Show “Vast Majority” See September Cut As AppropriateFOMC Minutes Show “Vast Majority” See September Cut As AppropriateSince the last FOMC meeting on July 31st, bonds and bullion have soared while the dollar and oil have floored, with stocks roller-coastering to a modest gain…

Source: Bloomberg A lot has happened in that brief three weeks with both soft and hard macro data declining, prompting growth scares which terrified stock investors (and then prompted them to BTFD).

Source: Bloomberg …but the last few days have seen bonds r … Read more at: https://www.zerohedge.com/markets/fomc-minutes-8 |

|

Cost of public services drives up government borrowingBorrowing hit £3.1bn last month, the highest level for July since 2021, official figures show. Read more at: https://www.bbc.com/news/articles/cq5d3xjl764o |

|

McDonald’s to open 200 new restaurants in growth drive‘Drive to’ sites – with a small seating area and no drive-through – will be tested as part of the offer. Read more at: https://www.bbc.com/news/articles/cn8751455xzo |

|

Red-hot rent rises cool but tenants still strugglingThe cost of renting a newly-let home has risen at its slowest rate for nearly three years, data shows. Read more at: https://www.bbc.com/news/articles/cj627rr3wk9o |

|

These 7 FMCG stocks hit 52-week highs, rally up to 35%India’s benchmark index, the Sensex, gained around 102 points on Wednesday, closing at 80,905. During this rise, seven stocks in the BSE FMCG index reached their highest prices in the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-7-fmcg-stocks-hit-52-week-highs-rally-up-to-35/slideshow/112684968.cms |

|

Tech View: Nifty making higher highs on daily, weekly charts. Here’s how to trade on ThursdayNagaraj Shetti of HDFC Securities believes the Nifty’s short-term outlook remains positive, but with limited movement. The market is poised to test the resistance level of 24,960, established during the opening down gap on August 2nd. If successful, the Nifty could reach 25,100 within the next week. Immediate support is currently at 24,650. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-making-higher-highs-on-daily-weekly-charts-heres-how-to-trade-on-thursday/articleshow/112685425.cms |

|

Sebi slaps penalty of Rs 11 lakh on IIFL Securities in violation of stock brokers’ normsIIFL Securities has been imposed with a Rs 11 lakh penalty by Sebi for breaching stock broker regulations. An inspection in August 2022 uncovered lapses such as faulty fund settlement and inaccurate retention statements. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-slaps-penalty-of-rs-11-lakh-on-iifl-securities-in-violation-of-stock-brokers-norms/articleshow/112685602.cms |