Summary Of the Markets Today:

- The Dow closed up 237 points or 0.58%, (Closed at 39,896, New Historic high 40.907)

- Nasdaq closed up 1.39%,

- S&P 500 closed up 0.97%, (Closed at 5,559, New Historic high 5,603)

- Gold $2,543 up $5.70,

- WTI crude oil settled at $74 down $2.23,

- 10-year U.S. Treasury 3.875 down 0.017 points,

- USD index $101.88 down $0.59,

- Bitcoin $58,897 up $459 or 0.79%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

US stocks experienced a strong rally on Monday, closing at session highs and marking their best week in a year.

Key Drivers of the Rally:

- Technology and Consumer Discretionary Stocks: These sectors led the gains, with the S&P 500 achieving its longest winning streak since November, now at eight consecutive days. Notably, Nvidia and Tesla saw significant increases in their stock prices, contributing to the Nasdaq’s performance.

- Market Recovery: This upswing follows a period of volatility earlier in August, where concerns about a potential recession had led to a sell-off. Recent data indicating improved inflation and consumer spending have helped ease these fears.

Economic Outlook:

Investor sentiment is shifting towards optimism regarding the economy, with Goldman Sachs reducing its recession forecast from 25% to 20% over the next year. There is growing speculation about the Federal Reserve’s next moves, with traders anticipating a 72% chance of a 0.25% interest rate cut in September.

Upcoming Events:

Attention is now focused on Fed Chair Jerome Powell’s upcoming speech at the Jackson Hole symposium, which could provide further insights into monetary policy. Additionally, the Democratic National Convention is underway, potentially influencing political and economic expectations.Overall, the stock market’s recent performance reflects a recovery from earlier losses and a more stable outlook for the economy.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

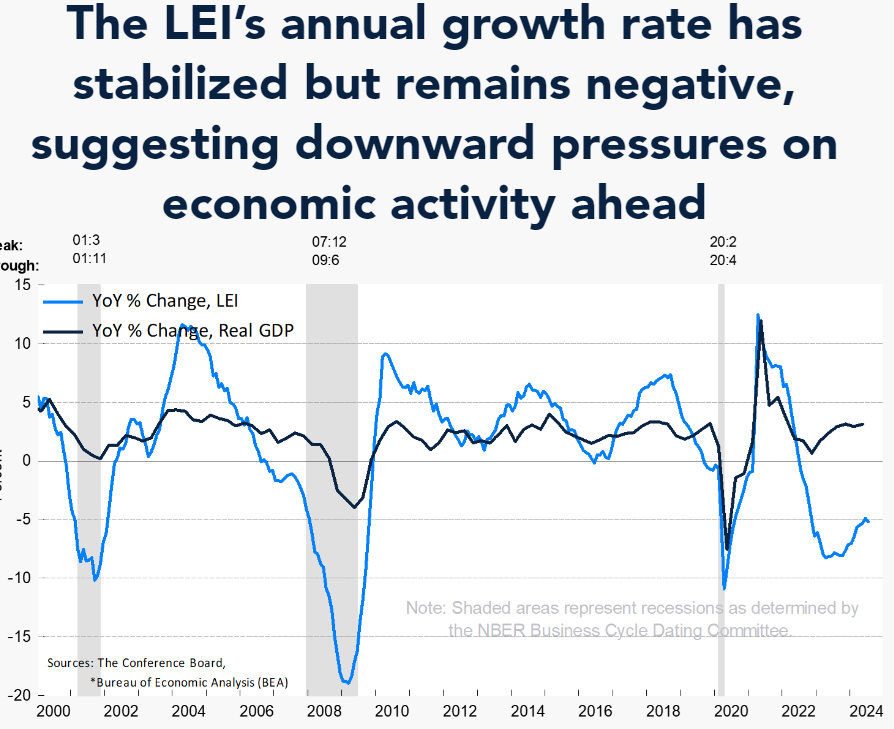

The Conference Board Leading Economic Index® (LEI) for the U.S. fell by 0.6 percent in July 2024 to 100.4 (2016=100), following a decline of 0.2 percent in June. Over the six-month period ending in July 2024, the LEI fell by 2.1 percent, a smaller rate of decline than its −3.1 percent over the six-month period between July 2023 and January 2024. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board perspective:

The LEI continues to fall on a month-over-month basis, but the six-month annual growth rate no longer signals recession ahead. In July, weakness was widespread among non-financial components. A sharp deterioration in new orders, persistently weak consumer expectations of business conditions, and softer building permits and hours worked in manufacturing drove the decline, together with the still-negative yield spread. These data continue to suggest headwinds in economic growth going forward. The Conference Board expects US real GDP growth to slow over the next few quarters as consumers and businesses continue cutting spending and investments. US real GDP is expected to expand at a pace of 0.6 percent annualized in Q3 2024 and 1 percent annualized in Q4.

Here is a summary of headlines we are reading today:

- Aluminum Prices Continue to Slide

- WTI Sheds Nearly 3% as China Demand Dulls

- Russian Oil Depot Fire Rages on After Ukraine Drone Attack

- A Strong HODLing Trend Emerges in Bitcoin

- U.S. Gasoline Prices Fall to Lowest Since March, Diesel Hits Multi-Year Lows

- Colombia Bans Coal Exports to Israel

- S&P 500, Nasdaq post eighth positive session as stocks extend their winning run: Live updates

- SEC charges Carl Icahn with hiding billions in loans backed by IEP stock

- Import Volumes Surge At Nation’s Busiest West Coast Ports Amid Strike & Global Trade War Fears

- Energy prices forecast to rise by 9% in October

- Nvidia’s stock is up 30% from August lows — and earnings could further its momentum

- Treasury yields hold in narrow range as investors await Fed’s Jackson Hole conference

- The Fed’s big hole en route to Jackson Hole: getting out of its own way

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Aluminum Prices Continue to SlideVia Metal Miner The Aluminum Monthly Metals Index (MMI) continued to drop, with a 5.14% decline from July to August. The price of aluminum continued to deflate before finding a bottom at the close of July. Overall, aluminum prices witnessed a 9.07% decline throughout the month, followed by a modest 2.26% rise during the first half of August. High Chinese Aluminum Supply Offers Bearish Risk Aluminum prices appeared to stabilize during August, although risks remain to the downside. For instance, global inventory levels remain relatively well-stocked.… Read more at: https://oilprice.com/Metals/Commodities/Aluminum-Prices-Continue-to-Slide.html |

|

Are Georgia and Kyrgyzstan Facilitating Russia’s Evasion of Sanctions?Recent investigations into trade involving Georgia and Kyrgyzstan reveal indicators of sanctions-busting behavior involving Russia. In Georgia, the investigative outlet iFact published findings of suspicious patterns in an article titled “How Georgia Facilitates Russia’s Military Supply Chain.” To compile their report, journalists posed as individuals interested in shipping so-called “dual-use” goods to Russia from Georgia. In conversations with couriers, they found that there were few barriers to sending… Read more at: https://oilprice.com/Geopolitics/International/Are-Georgia-and-Kyrgyzstan-Facilitating-Russias-Evasion-of-Sanctions.html |

|

WTI Sheds Nearly 3% as China Demand DullsWeak Chinese demand indicators continued to drag oil prices down on Monday, with the U.S. benchmark poised to lose nearly 3% and Brent crude not far behind. At 2:46 p.m. ET on Monday, West Texas Intermediate (WTI) was trading down 2.75% at $74.54, while Brent crude was trading down 2.32% at $77.83. Gaza ceasefire talks underway on Monday and billed as “probably the best, maybe the last opportunity” to achieve a ceasefire deal were also thought to be putting downward pressure on oil prices. However, China demand appears to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Sheds-Nearly-3-as-China-Demand-Dulls.html |

|

Will Iran Risk Sanctions by Selling Missiles to Russia?A new report says Iran is preparing to export Fath-360 and Ababil close-range ballistic missiles (CRBMs) to Russia and has started training Russian personnel to use the former. There have been several reports since Russia launched its full-scale invasion of Ukraine in February 2022 claiming Iran was gearing up to sell or had already supplied Russia with ballistic missiles. None of the reports was confirmed by U.S. or Ukrainian officials, and Iran continues to deny having armed or planning to arm Russia. Analysts who spoke to RFE/RL were unsure… Read more at: https://oilprice.com/Geopolitics/International/Will-Iran-Risk-Sanctions-by-Selling-Missiles-to-Russia.html |

|

Russian Oil Depot Fire Rages on After Ukraine Drone AttackA raging fire continued on Monday at a Russian oil depot in the southern Rostov region, a day after Ukraine launched a drone attack on the facility, with local media reporting that at least 40 firefighters have been injured so far while attempting to put the fire out. Early on Sunday, Ukraine targeted Russia’s Kavkaz oil and petroleum storage facility in Rostov, prompting an air defense response that led to a fire at the facility, which is located around 150 miles from the border with Ukraine. According to The Kyiv Independent, citing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Depot-Fire-Rages-on-After-Ukraine-Drone-Attack.html |

|

UN Watchdog Warns of Potential Nuclear Disaster at ZaporizhzhiaVia SchiffGold.com, A nuclear tragedy could be “dangerously close,” according to the UN’s top nuclear watchdog. “Let me put it plainly–two years of war are weighing heavily on nuclear safety at Zaporizhzhia Nuclear Power Plant,” said Rafael Mariana Grossi, Director General of the International Atomic Energy Agency (IAEA). “…Reckless attacks must cease immediately.” Zaporizhzhia is a small town at the edge of Russian-occupied territory in Ukraine, home to Europe’s largest nuclear… Read more at: https://oilprice.com/Geopolitics/International/UN-Watchdog-Warns-of-Potential-Nuclear-Disaster-at-Zaporizhzhia.html |

|

Libyan Central Bank Kidnapping Highlights Oil Wealth RivalryAfter the kidnapping of one of its employees and a rival government attempt to oust its head, the Libyan Central Bank on Monday said it had resumed operations, as a battle intensifies to control the financial institution that handles the country’s oil revenues. Libya’s Presidential Council, controlled by rival government forces in Tripoli, are jockeying with the rival government in the east–controlled by strongman General Khalifa Haftar–to insert their own central bank governor. Tripoli has attempted to force eastern-aligned… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyan-Central-Bank-Kidnapping-Highlights-Oil-Wealth-Rivalry.html |

|

A Strong HODLing Trend Emerges in BitcoinRecent data from Bitcoin Magazine Pro shows a significant trend among Bitcoin holders: nearly 75% of all circulating Bitcoin has remained dormant for over six months. This strong HODLing behavior reflects a steadfast belief in Bitcoin’s long-term value, despite market fluctuations. Bitcoin Magazine Pro X The “HODL Waves” chart, a tool that visualizes the age of Bitcoins based on when they last moved, illustrates how various groups of holders react to market conditions. The dominance of older coins (those held for… Read more at: https://oilprice.com/Energy/Energy-General/A-Strong-HODLing-Trend-Emerges-in-Bitcoin.html |

|

U.S. Gasoline Prices Fall to Lowest Since March, Diesel Hits Multi-Year LowsU.S. drivers are seeing relief from high gasoline prices at the pump, GasBuddy data showed on Monday. According to GasBuddy, the nation’s average gasoline prices dipped for a third week in a row on Monday, falling another 4.2 cents from this time last week, reaching $3.37 per gallon. The national average is now 11.4 cents per gallon below this same time a month ago. Diesel prices are also down week over week, falling to $3.69 per gallon for a new multi-year low. “Gasoline and diesel prices continue to trail off across much of the country… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Fall-to-Lowest-Since-March-Diesel-Hits-Multi-Year-Lows.html |

|

European Natural Gas Price Rally Loses MomentumThe big rally in Europe’s natural gas prices that kicked off in July appears to have run out of steam thanks to high inventory levels and easing supply jitters. Dutch front-month futures, Europe’s gas benchmark, were quoted at €39.70 per megawatt-hour on Monday at 0815 hrs ET, largely unchanged over the past 10 days but considerably higher than the price a month ago at €30.10 per megawatt-hour. The threat to supply pushed prices to the highest since December earlier in August, helping divert more liquefied natural gas… Read more at: https://oilprice.com/Energy/Natural-Gas/European-Natural-Gas-Price-Rally-Loses-Momentum.html |

|

German Politician Looks to Revive Russian Oil ImportsSara Wagenknecht, founder of Germany’s ultra-left party BSW, has announced plans to lift the embargo on Russian oil if her party participates in the Brandenburg state government. Wagenknecht argues that resuming the supply of Russian oil to the Schwedt refinery would be more efficient and economical than the current situation, where the refinery operates at reduced capacity. In 2021, before the war in Ukraine, the PCK Schwedt refinery operated at 98.8% capacity. However, due to the embargo on Russian oil imposed in early 2023, the refinery’s capacity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Politician-Looks-to-Revive-Russian-Oil-Imports.html |

|

Niger Aims to Become Major Oil ExporterNiger has resumed oil exports after it reached an agreement with neighboring Benin following a recent border dispute. Niger stopped crude shipments in June after the West African nation closed a pipeline operated by China National Petroleum Corp. that links the Agadem oil field to the Sèmè Kpodji terminal in Benin. “We’ve reached an agreement. Loading of crude started this morning,” Benin Energy Minister Samou Adambi told reporters on Monday, with Prime Minister Ali Lamine Zeine’s office confirming the resumption of shipments. Niger… Read more at: https://oilprice.com/Energy/Crude-Oil/Niger-Aims-to-Become-Major-Oil-Exporter.html |

|

Russia Reiterates Claims of U.S. Involvement in Nord Stream ExplosionsRussia’s Foreign Minister Sergei Lavrov has claimed that the United States issued the order for the 2022 attacks on the Nord Stream gas pipelines. On 26 September 2022, a series of underwater explosions occurred on 3 of 4 pipes of the Nord Stream 1 (NS1) and Nord Stream 2 (NS2) natural gas pipelines. Both pipelines were built by the Russian majority state-owned gas company, Gazprom, to transport natural gas from Russia to Germany through the Baltic Sea. Lavrov made the comments when speaking to reporters during a visit to Azerbaijan on Monday,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Reiterates-Claims-of-US-Involvement-in-Nord-Stream-Explosions.html |

|

Colombia Bans Coal Exports to IsraelColombia’s president has signed a decree banning the exports of coal to Israel in a bid to push Tel Aviv to end the war in Gaza. According to a Bloomberg report, the decree was signed last week. Colombia is the biggest supplier of coal to Israel. It is also the sixth-largest seaborne coal exporter in the world and the second-largest in South America. Last year, Colombia exported 56.4 million tons of the commodity. The ban on coal exports to Israel was first announced in June, with President Gustavo Petro saying on X “We are going to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Colombia-Bans-Coal-Exports-to-Israel.html |

|

Fatal Explosion Rocks Louisiana Natural Gas PipelineAn explosion at an offshore natural gas pipeline in Louisiana’s Plaquemines Parish has killed a man, the local police reported, adding that the fire was still burning at the site. The explosion was reported to the Plaquemines Parish police on Saturday evening, with one person reported missing at the site. “For reasons still under investigation, an explosion and fire occurred while Nichols was believed to be working on the pipeline,” the police said in a Facebook post. “Nichols died as a result, and with the assistance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fatal-Explosion-Rocks-Louisiana-Natural-Gas-Pipeline.html |

|

S&P 500, Nasdaq post eighth positive session as stocks extend their winning run: Live updatesThe S&P 500 is coming off its best week of 2024. Read more at: https://www.cnbc.com/2024/08/18/stock-market-today-live-updates.html |

|

GM lays off more than 1,000 salaried software and services employeesGM is laying off more than 1,000 salaried employees in its software and services unit following a review to streamline the operations, CNBC has learned. Read more at: https://www.cnbc.com/2024/08/19/gm-lays-off-more-than-1000-salaried-software-and-services-employees.html |

|

California cracks down on organized retail crime with new package of lawsRetailers have called on governments to do more to combat retail theft, citing it as a growing challenge that’s impacted profits, customers and staff. Read more at: https://www.cnbc.com/2024/08/19/california-retail-crime-laws-crack-down-on-organized-rings.html |

|

DNC 2024 Live updates: Biden, Clinton prepare for tonight; planned protests in Chicago beginDay one of the DNC will showcase Joe Biden’s legacy, with speeches by the president, first lady Jill Biden and former Secretary of State Hillary Clinton. Read more at: https://www.cnbc.com/2024/08/19/dnc-2024-live-updates-day-1.html |

|

These high-yielding assets tend to do well in rate cutting cycles. What to knowPreferred securities have historically done well in the months and weeks heading into the last four Fed rate-cutting cycles, says Bank of America. Read more at: https://www.cnbc.com/2024/08/19/these-high-yielding-assets-tend-to-do-well-in-rate-cutting-cycles.html |

|

SEC charges Carl Icahn with hiding billions in loans backed by IEP stockCarl Icahn and his company settled with the SEC over allegedly failing to disclose billions of dollars worth of personal margin loans pledged against his stock. Read more at: https://www.cnbc.com/2024/08/19/sec-charges-carl-icahn-with-hiding-billions-worth-of-stock-pledges.html |

|

Trump Media shares sink to post-merger low as DJT slump continuesThe share price of Trump Media, which trades under the ticker DJT, had surged after Donald Trump was nearly assassinated at a campaign rally. Read more at: https://www.cnbc.com/2024/08/19/trump-media-djt-stock-harris-earnings.html |

|

Google IPO banker tracks two-decade journey from Silicon Valley upstart to $2 trillionTwenty years after its IPO, Google is worth more than $2 trillion. Michael Grimes recalls the milestone occasion in 2004. Read more at: https://www.cnbc.com/2024/08/19/google-ipo-banker-tracks-two-decade-journey-from-silicon-valley-upstart-to-2-trillion-.html |

|

Former New York Rep. George Santos pleads guilty to wire fraud, identity theftFormer Rep. George Santos was expelled from Congress after questions were raised about the New York Republican’s resume and his use of campaign funds. Read more at: https://www.cnbc.com/2024/08/19/former-new-york-rep-george-santos-pleads-guilty-to-wire-fraud-identity-theft.html |

|

Democrats grant special convention access to more than 200 content creatorsMore than 200 content creators are attending the Democratic National Convention in Chicago to make content supporting Vice President Kamala Harris’ campaign. Read more at: https://www.cnbc.com/2024/08/19/democratic-national-convention-grants-special-access-to-over-200-content-creators.html |

|

British tech entrepreneur Mike Lynch reported missing after superyacht sinks off SicilyBritish tech entrepreneur Mike Lynch is missing after the sinking of a superyacht off the coast of Sicily, sources familiar with the matter told CNBC. Read more at: https://www.cnbc.com/2024/08/19/mike-lynch-reported-missing-after-superyacht-sinks-off-sicily.html |

|

Phil Donahue, talk show host pioneer and husband of Marlo Thomas, dies at 88His cause of death was not disclosed, though loved ones said he’d been suffering from a “long illness.” Read more at: https://www.cnbc.com/2024/08/19/phil-donahue-talk-show-host-pioneer-and-husband-of-marlo-thomas-dies-at-88-.html |

|

Trump to counter Harris with competing economic agenda rolloutThe Trump campaign is working to refocus the ex-president’s message on key policy issues after Harris replaced President Joe Biden as the Democratic nominee. Read more at: https://www.cnbc.com/2024/08/19/trump-economic-plan-harris-dnc.html |

|

Import Volumes Surge At Nation’s Busiest West Coast Ports Amid Strike & Global Trade War FearsThe ports of Los Angeles and Long Beach, which handle about a third of all US container imports, recorded the third-strongest month ever in July. This surge comes as companies rush to import goods ahead of potential tariffs on Chinese products and the looming threat of dockworker strikes that could roil supply chains. Bloomberg reports that Los Angeles and Long Beach Ports recorded import volumes in July that nearly eclipsed an all-time high reached in May 2021. Back then, government helicopter money dished out to consumers through stimulus checks caused an explosion in consumer buying of goods primarily produced in China and Asia. In return, import volumes on West Coast ports soared, unleashing some of the worst-ever supply chain snarls. Demand is now driven by importers trying to avoid potential US tariffs on Chinese goods and potential dockworker strikes that could erupt as early as October. “We’re in a strong position heading into the peak shipping season as consumers purchase back-to-school supplies and shippers move goods ahead of potential tariff increases,” Port of Long Beach CEO Mario Cordero wrote in a statement, adding, “We have plenty of capacity across our terminals and cargo continues to move efficiently and sustainably.” Read more at: https://www.zerohedge.com/markets/import-volumes-surge-nations-busiest-west-coast-ports-amid-strike-global-trade-war-fears |

|

Democrats Exclude Bitcoin And Crypto From 2024 Platform, Aligning With Past HostilityAuthored by Nik Hoffman via BitcoinMagazine.com, The Democratic Party’s official 2024 platform was released today on day one of the Democratic National Convention, without any mention of Bitcoin or cryptocurrency.

This decision aligns with the past four years of the Biden-Harris administration’s hostility towards the industry. Despite the growing significance of Bitcoin and digital assets, neither Kamala Harris or Tim Walz, who are running for president and vice president in the upcoming election this November, has prioritized the inclusion of Bitcoin and crypto in the party’s agenda.

|

|

GM Continues Reversing Pandemic Hiring Spree With 1,000 Layoffs Of Tech WorkersGeneral Motors continues reversing its pandemic-era hiring spree, during which it hired thousands of engineering and software development employees to bolster its ambitions in the electric vehicle space and connected-car services. As the downturn in the EV market persists, consumer demand weakens, and recession risks rise, the legacy automaker is preparing to cut at least a thousand tech employees to streamline operations. CNBC reported Monday that layoffs at GM will affect at least 1,000 salaried employees globally in its software and services division. The layoffs will include 600 jobs at the company’s tech campus near Detroit. This comes five months after the automaker’s software chief, Mike Abbott, stepped down, citing ‘health reasons.’

In June, GM promoted two former Apple executives, Baris Cetinok and Dave Richardson, to advance its electric, autonomous, and … Read more at: https://www.zerohedge.com/markets/gm-reverses-pandemic-hiring-spree-1000-layoffs-tech-workers |

|

Suicide-Bombing Strikes Tel Aviv For 1st Time In Many Years, Hamas Vows More To ComeOn Monday Hamas and Islamic Jihad (PIJ) claimed responsibility for a rare terrorist attack which targeted the heart of Israel’s Tel Aviv. That’s when a powerful explosive device ripped through a south Tel Aviv neighborhood. A suicide bomber was observed carrying a backpack before it apparently detonated early, killing the culprit and injuring an innocent bystander who was on a motorized scooter. Times of Israel reports that “The Shin Bet said it was still working to confirm the identity of the bomber, a man in his 50s, although Hebrew media outlets reported that he was believed to be a Palestinian from the Nablus area in the West Bank.” The last suicide bombings in Tel Aviv were in the early and mid-2000s.

Read more at: https://www.zerohedge.com/geopolitical/suicide-bombing-strikes-tel-aviv-1st-time-many-years-hamas-vows-more-come |

|

Who is British tech tycoon Mike Lynch?The co-founder of British tech firm Autonomy was once labelled the UK equivalent of Bill Gates. Read more at: https://www.bbc.com/news/articles/cdxl5kpvrg9o |

|

Energy prices forecast to rise by 9% in OctoberA forecaster says bills will rise in the run-up to winter while experts say few cheap fixed deals exist. Read more at: https://www.bbc.com/news/articles/cy54r9r1355o |

|

Ted Baker: What went wrong for the fashion label?The brand known for its quirky advertising and signature floral prints is the latest casualty on the High Street. Read more at: https://www.bbc.com/news/articles/czxle8zyzgxo |

|

Vedanta estimated to have raised Rs 3,200 cr from HZL OFSVedanta will utilise the proceeds generated from the OFS for deleveraging its balance sheet and investment in its growth projects. This, coupled with the Rs 8,500 crore qualified institutional placement, will help bring down debt at the company as well as at the group level. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vedanta-estimated-to-have-raised-rs-3200-cr-from-hzl-ofs/articleshow/112633193.cms |

|

Around 39% equity MFs outperform respective benchmarks in July 2024. Smallcaps draw a blank: ReportA Prabhudas Lilladher (PL) study revealed that 78% of value, contra, and dividend yield funds outperformed their benchmark, the NIFTY 500 – TRI. Specifically, 25 out of 32 schemes surpassed the index. In the largecap mutual fund category, 58% schemes outperformed the S&P BSE 100 – TRI, with 18 out of 31 active large-cap funds delivering higher returns. Read more at: https://economictimes.indiatimes.com/mf/mf-news/around-39-equity-mfs-outperform-respective-benchmarks-in-july-2024-smallcaps-draw-a-blank-report/articleshow/112627978.cms |

|

Antfin Singapore to sell Zomato shares worth $408 million via block deal: ReportAntfin currently holds 4.3% stake in the food delivery platform. At the floor price, the shares will be available for sale at a discount of 4.6% over Monday’s closing price of Rs 263.24 on the NSE. Zomato’s shares rose 6% intraday following UBS’s target price hike. The company posted a substantial increase in profit and revenue for the June quarter, doubling its market capitalization in 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/antfin-singapore-to-sell-zomato-shares-worth-408-million-via-block-deal-report/articleshow/112629087.cms |

|

Nvidia’s stock is up 30% from August lows — and earnings could further its momentumNvidia shares are up more than 30% from their low point earlier in August, helped by a six-day winning streak that’s their longest in almost five months. Read more at: https://www.marketwatch.com/story/nvidias-stock-is-up-30-from-august-lows-and-earnings-could-further-its-momentum-bb084d1f?mod=mw_rss_topstories |

|

Treasury yields hold in narrow range as investors await Fed’s Jackson Hole conferenceYields on U.S. government debt finished little changed on Monday, as traders looked ahead to this week’s release of the Federal Reserve’s July meeting minutes and the start of the central bank’s Jackson Hole conference. Read more at: https://www.marketwatch.com/story/bond-yields-steady-as-investors-position-for-jackson-hole-conference-9a570a04?mod=mw_rss_topstories |

|

The Fed’s big hole en route to Jackson Hole: getting out of its own wayU.S. central bank needs to steer real interest rates down to the 2% range. Read more at: https://www.marketwatch.com/story/recession-isnt-the-biggest-risk-to-the-economy-its-the-fed-20f458a4?mod=mw_rss_topstories |

Via ReutersIsraeli police and intelligence have labeled it a terror attack after t …

Via ReutersIsraeli police and intelligence have labeled it a terror attack after t …