Summary Of the Markets Today:

- The Dow closed up 555 points or 1.39%,

- Nasdaq closed up 2.34%,

- S&P 500 closed up 1.61%,

- Gold $2,493 up $13.30,

- WTI crude oil settled at $78 up $1.00,

- 10-year U.S. Treasury 3.919 up 0.097 points,

- USD index $103.03 up $0.46,

- Bitcoin $57,053 down $1,637 or 2.79%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

Stocks surged on Thursday as Wall Street reacted to positive signals regarding the U.S. consumer and labor market. Key factors influencing the market included Walmart’s earnings report, government retail sales data, and jobless claims updates. Walmart’s Performance: Walmart’s stock jumped over 6% following a strong earnings report that exceeded expectations for both earnings and revenue. The company also raised its full-year outlook, projecting sales growth between 3.75% and 4.75% and adjusted earnings per share between $2.35 and $2.43. Retail Sales and Jobless Claims: Retail sales for July rose by 1%, significantly surpassing Wall Street’s 0.4% estimate, indicating a resilient U.S. consumer base. Additionally, weekly jobless claims fell to 227,000, defying expectations of an increase and contributing to the positive market sentiment. Market Recovery: After a challenging start to August, stocks have rebounded, driven by cooling recession fears. The S&P 500 and Nasdaq have recovered from earlier losses, with the S&P 500 up nearly 7% and the Nasdaq more than 8% since the sell-off on August 5. The Information Technology sector, led by companies like Nvidia, has been a significant driver of this recovery.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production fell to -0.2% year-over-year in July 2024 – down from 1.1% gain year-over-year in June. Components manufacturing was up 0.1% year-over-year (down from 0.6%), utilities declined 0.1% year-over-year (down from 7.9%), and mining declined 1.5% year-over-year (from -1.2% in June). Capacity utilization moved down to 77.8 percent in July, a rate that is 1.9 percentage points below its long-run (1972–2023) average. The authors claim that Hurricane Beryl impacted industrial production by 0.3% which seems to ring true. However, these are not numbers that I would be bragging about as they indicate a very weak industrial sector. Note that the problem is not only in the U.S. as China’s factory output slowed for a third straight month in July.

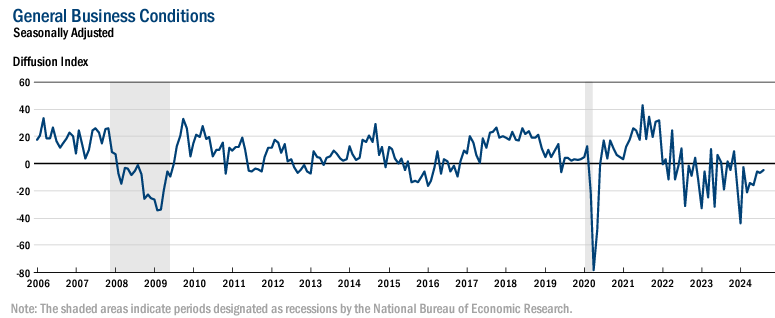

The August 2024 Philly Fed Manufacturing Business Outlook Survey shows that manufacturing activity in the region softened overall. The survey’s indicators for current general activity, new orders, and shipments all declined, with the former turning negative. The employment index suggests declines in employment overall. The diffusion index for current general activity fell from 13.9 to -7.0, its first negative reading since January. The indexes for new orders and shipments also declined but remained positive for the second consecutive month: The new orders index decreased 6 points to 14.6, and the shipments index fell 19 points to 8.5. Poor growth data in the manufacturing sector continues.

Business activity edged slightly lower according to the August 2024 New York Fed Empire State Manufacturing Survey. The headline general business conditions index was little changed at -4.7. New orders declined modestly, while shipments held steady. There is little good news in the manufacturing sector.

Job seekers’ relocating for new jobs rose to 2.7% in the second quarter, up from 2.1% in the first quarter* and 2.4% in the same quarter last year. While the rate is rising after falling to historic lows in 2023, it is still not at levels seen pre-pandemic. Andrew Challenger, Senior Vice President and economic expert for Challenger, Gray & Christmas added:

The rise in the relocation rate suggests finding jobs close to home is becoming a bit more difficult. With more companies mandating time in the office, job seekers are beginning to recognize the need to move to where the jobs are.

Prices for U.S. imports ticked up to 1.6% year-over-year in July 2024 from 1.5% the previous month. Export prices likewise rose from 1.0% year-over-year in June to 1.4% in July. Import price increases affect retail prices.

Retail trade sales were up 2.6% year-over-year in July 2024 – and increase from June’s flat sales. Nonstore retailers were up 6.7 percent (±1.4 percent) from last year, while food services and drinking places were up 3.4 percent (±2.1 percent) from July 2023. The data in many sectors was weak but the non-store retailers (say Amazon) were the bright spot of this report. However, I was personally surprised by the strength of this data – and this should work against those who believe the economy is weakening and therefore the Fed should cut the federal funds rate.

In the week ending August 10, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,500, a decrease of 4,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 240,750 to 241,000. There is little indication in unemployment claims that the economy is weakening.

Here is a summary of headlines we are reading today:

- Russia Expands ‘Dark Fleet’ to Evade LNG Sanctions

- The Real Reason Iran Hasn’t Retaliated Against Israel

- Supply Chain Woes Worsen After Chinese Port Closure

- Oil Prices Climb 2% as Gaza Ceasefire Talks Begin

- U.S. Set to Slowly Refill SPR as Crude Buys Extend Into 2025

- Stocks close higher, S&P 500, Nasdaq notch six-day winning streak as comeback rally gains steam: Live updates

- Ex-Google CEO Eric Schmidt sees Nvidia as big AI winner: ‘You know what to do in the stock market’

- Here’s the deflation breakdown for July 2024 — in one chart

- Meta CEO Mark Zuckerberg receives letter from lawmakers concerned about illicit drug ads on Facebook and Instagram

- Walmart says prices are coming down — except in one key area

- US Inflation falls to 3-year low, clearing the way for Fed to begin cutting rates

- 2-year Treasury yield jumps by most in 4 months on positive retail-sales data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Unexpected Tariff Hike Strains China-Kazakhstan RelationsWheat woes will hit Kazakhstan during the second half of 2024. A projected overabundance of the country’s chief agricultural export commodity is expected to keep prices down. Compounding the challenges, Kazakhstan has suspended wheat exports to China for an undetermined period following unilateral tariff changes by Beijing. The Kazakh Ministry of Agriculture reported that “more wheat was sown than expected” this spring, meaning that the coming weeks should yield “a high harvest, and, consequently, low prices.” In the… Read more at: https://oilprice.com/Geopolitics/International/Unexpected-Tariff-Hike-Strains-China-Kazakhstan-Relations.html |

|

Russia Expands ‘Dark Fleet’ to Evade LNG SanctionsRussia’s push to navigate sanctions and maintain its foothold in the global LNG market is gaining momentum with the deployment of a second vessel from its Arctic LNG 2 project. The tanker, Asya Energy, part of what’s being dubbed a “dark fleet,” recently departed from the sanctioned terminal in northern Russia, signaling Moscow’s continued efforts to circumvent Western restrictions. This development is similar to its first LNG tanker that was part of the Arctic LNG 2 project, known as the Pioneer. That vessel was last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Expands-Dark-Fleet-to-Evade-LNG-Sanctions.html |

|

The Real Reason Iran Hasn’t Retaliated Against IsraelIran has kept the world on edge since it promised to strike Israel more than two weeks ago — a move experts say could plunge the region into an all-out war. The promised attack by Islamic republic is meant as retaliation for the July 31 killing in Tehran of Ismail Haniyeh, the political leader of the U.S.- and EU-designated Palestinian terrorist group Hamas. Supreme Leader Ayatollah Ali Khamenei said after the assassination that Iran was “duty-bound” to avenge its “guest.” An Iranian attack has been “imminent” for the past two weeks, and this… Read more at: https://oilprice.com/Geopolitics/International/The-Real-Reason-Iran-Hasnt-Retaliated-Against-Israel.html |

|

Dubai Port Operator Sheds 60% Profits Amid Red Sea DisruptionDP World, a key Dubai-based port operator, reported earnings on Thursday, showing a ~60% profit plunge due to Red Sea attacks by Yemen’s pro-Iran Houthi rebels, who claim to be retaliating for Israel’s assault on Gaza, the Associated Press reports. During the same reporting period last year, DP World recorded $651 million in profit. A year later, thanks in part to ongoing Houthi attacks on the Red Sea shipping lane, DP World’s profits are down to $265 million. “The year 2024 has been marked by a deteriorating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Dubai-Port-Operator-Sheds-60-Profits-Amid-Red-Sea-Disruption.html |

|

Supply Chain Woes Worsen After Chinese Port ClosureThe closure of Ningbo Beilun’s Phase III Terminal is expected to have cascading effects on the main trans-Pacific trade lanes out of Asia, and the supply chain at large, in the midst of the peak shipping season. As Stuart Chris reports for FreightWaves, container traffic has been halted at Ningbo following a shipboard explosion involving hazardous materials at one of the world’s busiest intermodal hubs. The explosion aboard the Yang Ming vessel YM Mobility on Friday reportedly involved organic peroxide materials. There were no injuries… Read more at: https://oilprice.com/Geopolitics/International/Supply-Chain-Woes-Worsen-After-Chinese-Port-Closure.html |

|

Did Kazakhstan Just Shift the Balance of Power in the Space Race?A new agreement for Kazakhstan to join Chinese-led plans to build and operate a research base on the moon could set the stage for deepening cooperation between the two countries as Beijing makes strides toward becoming a leading power in space. The July 3 agreement was signed on the sidelines of the Shanghai Cooperation Organization summit and admitted Kazakhstan as the 12th member of the International Lunar Research Station (ILRS), a Chinese-led initiative with Russia’s Roskosmos for a lunar base that was announced in 2021 and includes Azerbaijan,… Read more at: https://oilprice.com/Energy/Energy-General/Did-Kazakhstan-Just-Shift-the-Balance-of-Power-in-the-Space-Race.html |

|

Oil Prices Climb 2% as Gaza Ceasefire Talks BeginAfter shedding gains on Wednesday following a U.S. crude inventory build and the Biden administration’s suggestion that a Gaza ceasefire deal could halt an Iranian attack on Israel, prices are now reversing again, with WTI gaining nearly 2% and Brent solidly back above the $80 mark. At 12:16 p.m. ET on Thursday, U.S. benchmark West Texas Intermediate (WTI) was trading up 1.81% at $78.37 per barrel, while Brent crude was trading up 1.86% at $81.24. Despite data showing a surprise U.S. inventory build, U.S. economic data appears… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Climb-2-as-Gaza-Ceasefire-Talks-Begin.html |

|

Supply Risks Support Natural Gas Prices in the Near TermNorwegian maintenance and concerns about supply due to the conflicts in the Middle East and Ukraine will support near-term natural gas and LNG prices, RBC Capital Markets said in a note on Thursday. All these factors move “the risk barometer a notch higher” this summer, the bank said. Maintenance and unplanned outages in Norway, Europe’s single largest natural gas supplier, are the price drivers to watch this summer, according to RBC Capital Markets. A new wave of planned maintenance is coming in September and could put upward… Read more at: https://oilprice.com/Energy/Natural-Gas/Supply-Risks-Support-Natural-Gas-Prices-in-the-Near-Term.html |

|

Iraq Moves to Profit-Sharing Terms in New Oil and Gas ContractsOPEC’s second-largest producer, Iraq, seeks to attract more investment in its oil and gas industry by moving to profit-sharing contracts for new bid rounds from the technical service contracts it has awarded so far. The biggest change in Iraq’s petroleum regulatory landscape in decades is being made to attract higher bids and more investments in its huge oil and gas reserves, government officials have told Reuters. Under the profit-sharing contracts, the winners of the licensing rounds are being offered a share of the revenue from the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-Moves-to-Profit-Sharing-Terms-in-New-Oil-and-Gas-Contracts.html |

|

U.S. Set to Slowly Refill SPR as Crude Buys Extend Into 2025The United States will continue to buy crude when prices are in the $70s a barrel or lower and plans to add several million barrels of crude to the Strategic Petroleum Reserve early next year. The U.S. Department of Energy (DOE) is continuing its efforts to bolster the depleted SPR with new oil purchases. DOE’s Office of Petroleum Reserves has recently announced a call for bids to supply up to 1.5 million barrels of oil to the Bayou Choctaw site in January 2025. An additional solicitation will follow on August 12, 2024, for another 2 million barrels… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Set-to-Slowly-Refill-SPR-as-Crude-Buys-Extend-Into-2025.html |

|

Iran’s Central Bank Hit by Major CyberattackThe opposition and Saudi-affiliated Iran International is reporting that the Central Bank of Iran has been hit with a large-scale cyber attack which is caused major disruption to the banking system across the Islamic Republic. The outlet says the impact of the attack if far-reaching, suggesting it could be one of the largest cyberattacks on Iran’s state infrastructure to date, coming amid soaring regional tensions with Israel. Earlier Wednesday, Iran’s Supreme leader, Ayatollah Ali Khamenei, warned the country about threats of irregular warfare,… Read more at: https://oilprice.com/Geopolitics/International/Irans-Central-Bank-Hit-by-Major-Cyberattack.html |

|

Russian Fuel Exports to Asia via Africa Reach All-Time HighRussian exports of petroleum products to Asia via the southern tip of Africa nearly doubled in July from a month earlier to hit an all-time high, according to LSEG shipping data reported by Reuters. Last month, Russia’s shipments of fuels via the Cape of Good Hope en route to Asia jumped to a record-high volume of 1.1 million metric tons, as more tankers took the longer route instead of the Suez Canal, per the data. Since the end of 2023, many ship owners and vessel charterers have opted to use the longer route via the Cape of Good Hope to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Fuel-Exports-to-Asia-via-Africa-Reach-All-Time-High.html |

|

Orsted Delays U.S. Offshore Wind ProjectOrsted is delaying construction and start-up at a U.S. offshore wind project, which resulted in impairment losses incurred for the second quarter of the year, the world’s biggest offshore wind project developer said on Thursday. Wind power developers warned earlier this year that last year’s challenges in the industry would continue in 2024, too. The wind industry, especially offshore wind, has been plagued by cost increases, rising interest rates, quality issues with turbines, and delays and cancelation of projects. In its half-year… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Orsted-Delays-US-Offshore-Wind-Project.html |

|

Norway’s Oil Investment Set for Record High in 2024Higher costs and ongoing field developments are set to boost oil and gas investments to a record high offshore Norway, the top hydrocarbon producer in Western Europe, according to new data from Statistics Norway. Total investments in oil and gas activity in 2024, including pipeline transportation, are estimated at an all-time high of $24 billion (257 billion Norwegian crowns), Statistics Norway said on Thursday in its third-quarter survey of oil companies’ investment plans. The latest estimate is 4.1% higher compared to the investment plans… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Oil-Investment-Set-for-Record-High-in-2024.html |

|

BP Says Venture Global Doesn’t Need More Time to Launch LNG PlantU.S. LNG developer Venture Global doesn’t need additional time to start up production at its Calcasieu Pass LNG facility, its customer BP has told U.S. regulators. The UK-based energy supermajor, along with Shell, Repsol, Eni, and Edison, became foundational buyers of Venture Global’s LNG even before it started producing. They paid for the construction of the Calcasieu Pass facility and secured long-term supply from it. The facility started producing in early 2022—right on time for Europe, which was beginning to experience a shortage.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Says-Venture-Global-Doesnt-Need-More-Time-to-Launch-LNG-Plant.html |

|

Stocks close higher, S&P 500, Nasdaq notch six-day winning streak as comeback rally gains steam: Live updatesBetter-than-expected retail sales data out Thursday helped assuage investor’s recession worries, alongside a favorable initial jobless claims reading. Read more at: https://www.cnbc.com/2024/08/14/stock-market-today-live-updates.html |

|

Warren Buffett did something curious with his Apple stock holdingThe identical 400 million share count in Apple and Buffett’s oldest and longest position Coca-Cola prompted some to believe he is done selling the tech stock. Read more at: https://www.cnbc.com/2024/08/15/warren-buffett-did-something-curious-with-his-apple-stock-holding.html |

|

Ex-Google CEO Eric Schmidt sees Nvidia as big AI winner: ‘You know what to do in the stock market’Former Google CEO Eric Schmidt said in a recent talk at Stanford that, while he isn’t giving investment advice, Nvidia is the top beneficiary of the AI boom. Read more at: https://www.cnbc.com/2024/08/15/eric-schmidt-on-nvidia-you-know-what-to-do-in-the-stock-market.html |

|

Here’s the deflation breakdown for July 2024 — in one chartPrices in some areas of the U.S. economy have deflated, meaning they’ve declined. Read more at: https://www.cnbc.com/2024/08/15/deflation-inflation-cpi-july-2024.html |

|

United CEO expresses ‘renewed confidence’ in Boeing after meeting with new leader OrtbergUnited’s CEO Kirby had lunch with Boeing’s new CEO Kelly Ortberg in Texas this week. Read more at: https://www.cnbc.com/2024/08/15/united-ceo-scott-kirby-expresses-renewed-confidence-in-boeing-after-meeting-ceo-kelly-ortberg.html |

|

Leon Cooperman slashes Microsoft holding, says he’s conservative on markets due to fiscal debtCooperman believes the widening U.S. fiscal deficit could become a crisis down the road. Read more at: https://www.cnbc.com/2024/08/15/cooperman-cuts-microsoft-holding-says-hes-conservative-on-markets.html |

|

Meta CEO Mark Zuckerberg receives letter from lawmakers concerned about illicit drug ads on Facebook and InstagramA bipartisan group of lawmakers sent Meta CEO Mark Zuckerberg a letter expressing concern about illicit drug advertisements running on the company’s apps. Read more at: https://www.cnbc.com/2024/08/15/lawmakers-letter-to-meta-ceo-mark-zuckerberg-about-illicit-drug-ads.html |

|

Walmart says prices are coming down — except in one key areaWalmart said inflation was flat in its latest quarter, and revenue growth came from selling more units rather than from higher prices. Read more at: https://www.cnbc.com/2024/08/15/walmart-says-prices-are-coming-down-except-in-one-key-area-.html |

|

Goldman Sachs jumps into bitcoin ETFs while rivals retreat, and one hedge fund gets bullish on minersNew SEC filings show banks and hedge funds jumping into spot crypto products, though ether ETFs won’t be accounted for until November. Read more at: https://www.cnbc.com/2024/08/15/goldman-sachs-jumps-into-bitcoin-etfs-while-morgan-stanley-retreats.html |

|

NBCUniversal is pinning Peacock’s streaming success on its $2.45 billion per year NBA dealNBC Sports is banking on the long-term success of Peacock and sports as the linchpin to making its $2.45 billion bid for the NBA profitable. Read more at: https://www.cnbc.com/2024/08/15/nbc-nba-media-rights-key-for-peacock-streaming-growth.html |

|

38-year-old American expat lives on $73,000 in one of the world’s most expensive countries: ‘I feel safe, I feel at home’Jewells Chambers launched the All Things Iceland podcast in 2018 as a passion project. Now it’s her full-time job. Read more at: https://www.cnbc.com/2024/08/15/american-expat-budget-in-iceland.html |

|

Starbucks is giving incoming CEO Brian Niccol $85 million in cash and stock as he departs ChipotleStarbucks plans to pay incoming CEO Brian Niccol $10 million in cash and $75 million in equity awards when he joins the company from Chipotle. Read more at: https://www.cnbc.com/2024/08/14/starbucks-new-ceo-brian-niccol-compensation-chipotle.html |

|

Mason Morfit’s ValueAct bought more Disney and Salesforce shares in the second quarterThe hedge fund raised its holdings in the blue-chip stocks as their shares floundered. Read more at: https://www.cnbc.com/2024/08/15/morfits-valueact-bought-more-disney-and-salesforce-in-second-quarter.html |

|

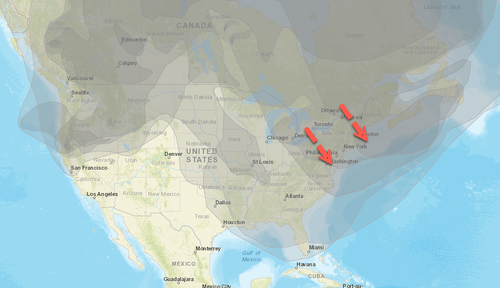

Canadian Wildfire Smoke Pours Into US NortheastWildfire smoke from Canada has poured into the Northeast and Mid-Atlantic areas of the United States, raising air quality alerts across the region. “That haze you might notice is wildfire smoke moving in from Canada. The thickest is aloft and to our north, but the current weather pattern may allow more into the area over the next few days,” Washington Post’s Ian Livingston said in a forecast for the DC metro area. Livingston continued, “… thicker patch of smoke drifted south under high pressure. The smoke is mainly aloft, but some is making it to the surface, which means a code yellow/moderate air-quality index in parts of the area and especially to our north.” The wildfire and smoke map from AirNow shows Canadian wildfire smoke is pouring into the eastern part of the US.

AirNow shows that many of the air quality monitors in both regions are registering ‘moderate’—unhealthy for sensitive groups. Read more at: https://www.zerohedge.com/weather/canadian-wildfire-smoke-pours-us-northeast |

|

US Army Soldier Pleads Guilty After Selling Military Secrets To ChinaAuthored by Frank Fang via The Epoch Times (emphasis ours), A U.S. Army intelligence analyst has pleaded guilty to charges accusing him of selling military secrets to China for a total of $42,000, according to the Department of Justice.

Read more at: https://www.zerohedge.com/political/us-army-soldier-pleads-guilty-after-selling-military-secrets-china |

|

Waymo Robotaxi’s Late-Night Honking Nightmare Sparks Outrage Among San Fran ResidentsResidents in downtown San Francisco have been furious about Waymo robot taxis honking at each other in the middle of the night. Residents spoke with NBC Bay Area about the honking chaos coming from Waymo cars in a parking lot near their apartment building in the South of Market neighborhood near 2nd Street.

The residents said peak honking occurred at 0400 local time. A video uploaded on X by ABC7 News shows what residents have been dealing with for weeks…

|

|

Cambridge To Fully Fund Palestinian Scholars, Students In Deal To End OccupationAuthored by Dominic Vogelbacher via The College Fix, University of Cambridge leaders have agreed to a list of concessions to convince pro-Palestinian demonstrators to end a three-month-old encampment set up at a high-profile zone along the prestigious British institution, including a pledge to fully fund Palestinian scholars and students.

The student organization Cambridge for Palestine has occupied King’s Parade with a large encampment since May 6. King’s Parade is a highly touristic area with massive foot traffic in front of the historic King’s College gates and chapel, built in 1446. On the other side of the street is the Corpus Clock, one of Cambridge’s famous tourist attractions. To end the occupation, the university recently committed to giving Palestinians undergra … Read more at: https://www.zerohedge.com/geopolitical/cambridge-fully-fund-palestinian-scholars-students-deal-end-occupation |

|

Thousands of train fare prosecutions to be quashedAs many as 74,000 cases could be overturned following a key ruling by the UK’s chief magistrate. Read more at: https://www.bbc.com/news/articles/cyx0p18kq74o |

|

Faisal Islam: Why solid growth complicates the Budget masterplanHaving inherited an economy growing at a normal rate, can the chancellor justify tax rises this autumn? Read more at: https://www.bbc.com/news/articles/c8xl8le91qyo |

|

Train drivers’ pay offer good deal, minister insistsThe Conservatives have accused the government of “caving to the unions” and paving the way for tax rises. Read more at: https://www.bbc.com/news/articles/cp9r15xxz3zo |

|

These 8 equity mutual funds receive over Rs 3,000 crore inflow in JulyAround eight equity and equity-oriented mutual funds have received more than Rs 3,000 crore inflows in July. There were around 600 equity and equity-oriented mutual funds in the said period. (Source: ACE MF) Read more at: https://economictimes.indiatimes.com/mf/analysis/these-8-equity-mutual-funds-receive-over-rs-3000-crore-inflow-in-july/heavy-inflows/slideshow/112542059.cms |

|

Interarch Building Products IPO: Price band, GMP among 10 things to knowInterarch Building Products’ IPO was open from August 19-21, targeting approximately Rs 600 crore through fresh shares and an offer for sale. The company, known for its pre-engineered steel buildings, exhibited substantial financial growth in FY24. The price band for the shares ranged between Rs 850-900 per share. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/interarch-building-products-ipo-price-band-gmp-among-10-things-to-know/articleshow/112543564.cms |

|

US Inflation falls to 3-year low, clearing the way for Fed to begin cutting ratesThe lowest year-over-year inflation in more than three years was recorded in July at 2.9%, as reported by the Labor Department. Consumer prices rose just 0.2% from June to July. As housing costs are expected to rise more slowly, and the job market is weakening, the Federal Reserve might consider cutting interest rates in September. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-inflation-falls-to-3-year-low-clearing-the-way-for-fed-to-begin-cutting-rates/articleshow/112539423.cms |

|

2-year Treasury yield jumps by most in 4 months on positive retail-sales dataU.S. government debt sold off on Thursday, sending most yields higher, after a stronger-than-expected retail-sales report for July soothed concerns about the risk of an impending recession. Read more at: https://www.marketwatch.com/story/treasury-yields-nudge-lower-ahead-of-u-s-retail-sales-report-7f5aef9f?mod=mw_rss_topstories |

|

Why Real Madrid’s Vinícius Jr. may decline a $1 billion offer from another clubCarlo Ancelotti, Vinícius’s coach at Madrid, said rumors of a transfer to Saudi Arabia are ‘pure speculation’ Read more at: https://www.marketwatch.com/story/why-real-madrids-vinicius-jr-may-decline-a-1-billion-offer-from-another-club-b7904c3e?mod=mw_rss_topstories |

|

Americans die younger than people in other countries. So why are we subsidizing their healthcare?We’re suckers when it comes to drug prices. Read more at: https://www.marketwatch.com/story/americans-die-younger-than-people-in-other-countries-so-why-are-we-subsidizing-their-healthcare-31886650?m |

The Department of Justice (DOJ) in Washington on July 29, 2024. (Madalina Vasiliu/The Epoch Times)Sgt. Korbein Schultz was an army intelligence analyst with the First Battalion of the 506th Infantry Regiment at Fort Campbell, an army installation on the Kentucky-Tennessee border. He was arrested at the military base in March following an indictment by a federal grand ju …

The Department of Justice (DOJ) in Washington on July 29, 2024. (Madalina Vasiliu/The Epoch Times)Sgt. Korbein Schultz was an army intelligence analyst with the First Battalion of the 506th Infantry Regiment at Fort Campbell, an army installation on the Kentucky-Tennessee border. He was arrested at the military base in March following an indictment by a federal grand ju …