Summary Of the Markets Today:

- The Dow closed up 243 points or 0.61%,

- Nasdaq closed up 0.03%,

- S&P 500 closed up 0.38%,

- Gold $2,484 down $23.30,

- WTI crude oil settled at $77 down $1.20,

- 10-year U.S. Treasury 3.837 down 0.017 points,

- USD index $102.61 up $0.05,

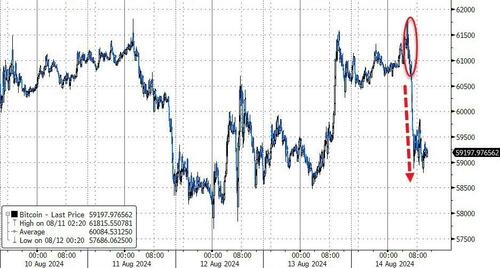

- Bitcoin $58,981 down $1,622 or 2.68%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

US Stocks Edge Higher: On Wednesday, US stocks mostly rose as Wall Street reacted positively to new consumer price data. Inflation Data: The Consumer Price Index (CPI) indicated that price increases remained steady in July, with consumer prices rising 2.9% year-over-year, marking the first time headline inflation has dipped below 3% since 2021. Core inflation, excluding food and energy, rose 3.2% year-over-year, aligning with Wall Street forecasts. Impact on Federal Reserve Policy: The inflation data strengthens the case for a possible interest rate cut by the Federal Reserve. The Producer Price Index, which measures wholesale inflation, rose 2.2% year-over-year, close to the Fed’s 2% target. These signals suggest the Fed might be closer to a rate cut, with traders speculating on whether the cut will be 25 or 50 basis points.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index (CPI) declined modestly from 3.0% year-over-year in June to 2.9% in July 2024. The index for all items less food and energy also modestly declined from 3.3% year-over-year in June to 3.2% in July 2024. Looking at the individual components, they were mixed and the bottom line is that together they added up to little change in the CPI. You need to step back to understand that in June 2023, the CPI stood at 3.1% and 13 months later the CPI stands at 2.9%. IMO, nothing short of a recession will force a drastic change in inflation. For the time being, it is endemic in the economy.

The National Federation of Independent Business (NFIB) has released the 11th edition of its quadrennial report, “Small Business Problems and Priorities,” based on a nationwide survey of small business owners. This 2024 report highlights the challenges faced by small businesses, focusing on 75 critical issues impacting Main Street. Key findings from the report include:

- Cost Pressures: The “Cost of Health Insurance” continues to be the top issue for small business owners since 1986. The “Cost of Supplies/Inventories” has risen significantly in importance due to historic inflation, moving from 12th place in 2020 to 2nd in 2024. Additionally, the costs of fuels and electricity are significant concerns, with “Interest Rates” also rising dramatically in importance from 56th to 13th place since 2020.

- Tax-Related Issues: “Federal Taxes on Business Income” is the most severe tax-related problem, ranked 4th, with concerns about the potential expiration of the Small Business Deduction in 2025. “State Taxes on Business Income” is also a critical issue for many business owners.

- Uncertainty: Economic and governmental uncertainties have increased in importance. “Uncertainty over Economic Conditions” is now the 3rd most severe problem, while “Uncertainty over Government Actions” ranks 8th. Additionally, finding qualified employees remains a critical issue, ranking 5th.

The report underscores the need for policymakers to address these challenges to support small businesses, which employ nearly half of the private sector workforce.

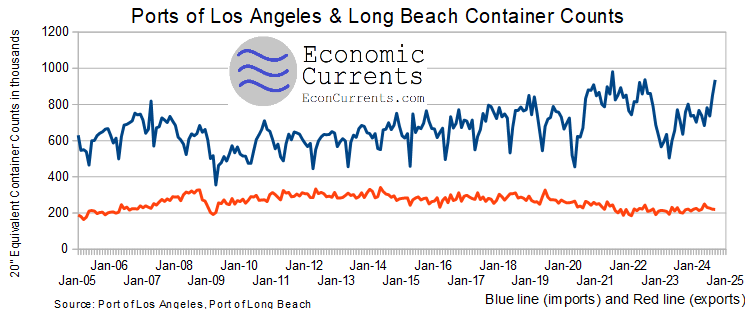

The Ports of Los Angeles and Long Beach which account for 40% of the high value container shipments in and out of the U.S. had a significant increase in July 2024. Imports are up 47% year-over-year whilst exports are up 10% year-over-year. This suggests the U.S. economy is strengthening and/or manufacturing is declining and being replaced by imports.

Here is a summary of headlines we are reading today:

- Brent Crude Falls Below $80

- Iron Ore Prices Plunge Below $100

- Jet Fuel Demand Recovery Grinds to a Halt

- Oil Prices Fall After the EIA Reports an Inventory Build

- U.S. Inflation Drops Below 3%, Boosting Hopes of an Interest Rate Cut

- Here’s the inflation breakdown for July 2024 — in one chart

- Mortgage refinancing surges 35% in one week, as interest rates hit lowest level in over a year

- S&P 500 closes higher for fifth straight day as easing inflation bolsters rate cut hopes: Live updates

- DraftKings reverses plans for a tax on customers as FanDuel parent Flutter wows Wall Street

- Crypto investors weigh new inflation data that clears way for potential rate cuts: CNBC Crypto World

- Mortgage Refi Activity Jump Most Since 2020 As Lenders See Gloom Ending

- Crypto Tumbles As ‘Harris/Biden’ Admin Moves Another 10,000 ‘Silk Road’ Bitcoin To Coinbase

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Armenia-Azerbaijan Peace Talks Progress Despite Lingering HurdlesArmenia and Azerbaijan have succeeded in removing one major obstacle, but large potholes remain on the road to a durable peace deal between the longtime enemies. The Armenian Foreign Ministry confirmed in early August that Azerbaijani officials had agreed to drop a provision from a draft peace agreement that would give Baku a land corridor connecting the Nakhchivan exclave to Azerbaijan proper. The matter of extraterritorial rights for Azerbaijan concerning what is known as the Zangezur corridor had been a sticking point in ongoing peace negotiations.… Read more at: https://oilprice.com/Geopolitics/International/Armenia-Azerbaijan-Peace-Talks-Progress-Despite-Lingering-Hurdles.html |

|

Brent Crude Falls Below $80The U.S. crude oil benchmark, WTI reversed gains from earlier this week on Wednesday, responding to an unexpected build in U.S. crude stockpiles after a series of drawdowns, and as an Iranian attack on Israel appears to have been temporarily shelved for leverage. At 3:03 p.m. ET, Brent crude was trading down 0.90%, just below the $80 mark, while WTI was trading down 1.44% at $77.22. The Energy Information Administration (EIA) earlier on Wednesday released its weekly inventory report, showing a 1.4-billion-barrel increase in stockpiles for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Crude-Falls-Below-80.html |

|

Iron Ore Prices Plunge Below $100Via Metal Miner Iron ore prices hit the headlines again after dipping below the psychological barrier of US $100 per ton this Monday. It was the fourth time it crossed the threshold in a fortnight. This recent drop was nearly 30% below iron ore’s peak of $144 a ton, which it achieved in January this year. As a result, Singapore futures fell 1.7% to US $99.40 a ton by Monday afternoon. According to a Reuters report, the sixth straight week of declines stems from China’s steel mills struggling, while port inventories of the… Read more at: https://oilprice.com/Metals/Commodities/Iron-Ore-Prices-Plunge-Below-100.html |

|

Pemex Plans $1.65 Billion Gulf Oilfield RedevelopmentMexico’s state-run oil and gas giant Pemex has signed a deal to redevelop Gulf of Mexico oilfields in a $1.65-billion investment plan that aims to increase output 10 times in the next 3.5 years. Citing unnamed sources close to the deal, Pemex (Petroleos Mexicanos) has struck a deal with CEM Oil and Gas, a Mexican private-sector player, to redevelop the Bacab and Lum fields in the Gulf of Mexico. The Bcaba and Lum oilfields produce heavy oil in shallow water at a depth of around 200 feet; however, according to data from Offshore Technology,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pemex-Plans-165-Billion-Gulf-Oilfield-Redevelopment.html |

|

Chinese EV Makers Set Sights on Southeast Asia and BeyondWhen it comes to electric vehicle (EV) production, China has been dominating. The Asian giant was little known for its automaking capabilities until recently, but it has become a major force for EV production, with several new automakers popping up in recent years. Some companies, such as BYD, have already become popular around the globe, while other smaller companies are quickly rising to rival well-known international players by producing competitive low-cost EVs. With more companies showcasing EVs in Singapore this month, China is showing the… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-EV-Makers-Set-Sights-on-Southeast-Asia-and-Beyond.html |

|

Jet Fuel Demand Recovery Grinds to a HaltAfter an optimistic start to the summer that sent jet fuel demand soaring, analysts now caution that global jet fuel demand is set for a slowdown in tandem with consumer spending, with the potential to weigh heavily on oil prices. Weaker-than-expected consumption in the United States and China is now putting the brakes on fuel demand growth, which typically accounts for around 7% of global oil demand, as reported by Reuters. Based on Goldman Sachs data, as reported by Reuters, global jet fuel demand through July this year averaged around… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Jet-Fuel-Demand-Recovery-Grinds-to-a-Halt.html |

|

Public-Private Partnerships Key to a Clean Energy Growth in the UKIn 100 days, global political, business, and climate leaders will have gathered in Baku, Azerbaijan, for COP29. The annual COP meeting is the culmination of a year of hard work and progress to meet our climate targets. I, along with City firms, will be at COP29 offering our help to meet net zero. As a country with significant oil and gas production, Azerbaijan’s role as host will be significant in how we address the global transition to clean energy. Given COP29’s motto of ‘In solidarity for a green world’, we’ll also… Read more at: https://oilprice.com/Energy/Energy-General/Public-Private-Partnerships-Key-to-a-Clean-Energy-Growth-in-the-UK.html |

|

Was it an Accident? China’s Narrative on Baltic Pipeline Damage QuestionedChina has, for the first time, acknowledged that the Chinese-owned cargo ship NewNew Polar Bear was responsible for damaging the Balticconnector gas pipeline in October 2023. However, European officials may not be buying the explanation for how. Finding Perspective: The South China Morning Post reported on August 12 that Chinese authorities conducted their own internal investigation and have shared the results with the Estonian and Finnish governments. According to the Chinese report seen by some ministries, the incident is said to be an accident… Read more at: https://oilprice.com/Energy/Energy-General/Was-it-an-Accident-Chinas-Narrative-on-Baltic-Pipeline-Damage-Questioned.html |

|

Breakthrough Drilling Technology Could Unlock 5 Billion Barrels of OilRecent developments in ultra-high-pressure drilling technology like the one U.S. supermajor Chevron uses at its new Gulf of Mexico project could unlock more than 5 billion barrels of known but previously inaccessible oil deposits globally, including more than 2 billion barrels in the U.S. Gulf of Mexico alone, analysts have said. Chevron announced earlier this week a breakthrough ultra high-pressure drilling technology as it launched production at its $5.7-billion Anchor project in the Gulf of Mexico, making history with the first-ever successful… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Breakthrough-Drilling-Technology-Could-Unlock-5-Billion-Barrels-of-Oil.html |

|

Oil Prices Fall After the EIA Reports an Inventory BuildOil prices moved lower today, after the U.S. Energy Information Administration reported an inventory build, countering API’s weekly estimate for oil stocks. The EIA saw oil inventories add 1.4 million barrels in the week to August 9, which compared with a decline of 3.7 million barrels for the previous week. The API, a day earlier, estimated a 5.2-million-barrel decline in crude oil inventories for the week to August 9. In fuels, the EIA estimated negative inventory changes for the reporting period. Gasoline stocks fell by 2.9 million barrels… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Fall-After-the-EIA-Reports-an-Inventory-Build.html |

|

UK Court Dismisses Challenge Against Net-Zero Gas Power PlantLondon’s High Court dismissed on Wednesday a lawsuit claiming that a proposed gas-fired power plant with carbon capture has been unlawfully approved by the government. The Net Zero Teesside Power (NZT Power) is a joint venture between international oil majors UK and Equinor and could generate up to 860 megawatts (MW) of flexible, dispatchable low-carbon power equivalent to the average electricity requirements of around 1.3 million UK homes. The project is planned to be a first-of-a-kind fully integrated gas-fired power and carbon capture… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Court-Dismisses-Challenge-Against-Net-Zero-Gas-Power-Plant.html |

|

U.S. Inflation Drops Below 3%, Boosting Hopes of an Interest Rate CutUS inflation reached its lowest since March 2021 in July, coming in at just 2.9 percent and further strengthening the case for an interest rate cut from the Federal Reserve. Analysts had expected US inflation in July to come in at three percent, unchanged from where it had fallen to in June. While this is still above the Fed’s two percent target, it represents a significant fall from the highs of 9.1 percent just two years earlier. Core inflation, or inflation without volatile components like food and energy, reached 3.2 percent, its lowest… Read more at: https://oilprice.com/Energy/Energy-General/US-Inflation-Drops-Below-3-Boosting-Hopes-of-an-Interest-Rate-Cut.html |

|

Russia Extends Gasoline Export Ban Until the End of 2024Russia is extending its ban on gasoline exports from October to the end of December 2024, as it seeks to keep domestic supply stable amid seasonal demand and scheduled repairs at refineries, the Russian government said on Wednesday. In the autumn of 2023, Russia banned exports of diesel and gasoline in an effort to stabilize domestic fuel prices in the face of soaring prices and shortages as crude oil rallied and the Russian ruble weakened. Prior to implementing the ban, Russia had raised mandatory supply volumes for motor gasoline and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Extends-Gasoline-Export-Ban-Until-the-End-of-2024.html |

|

Germany Seeks Arrest of Ukrainian Diver Suspected of Nord Stream SabotageGerman investigators have identified and sought an arrest warrant for a Ukrainian diver who has allegedly played a role in the sabotage of the Nord Stream gas pipelines in the Baltic Sea two years ago, joint research by German media outlets Die Zeit, Süddeutscher Zeitung, and ARD showed on Wednesday. The German authorities reportedly believe the person had helped plant explosives that later blew up the pipelines. Germany sent in June a European arrest warrant to Poland, where the suspect, a Ukrainian native identified only as Volodymyr Z.,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Seeks-Arrest-of-Ukrainian-Diver-Suspected-of-Nord-Stream-Sabotage.html |

|

Russian Crude Oil Shipments Bounce Back From 11-Month LowRussian crude oil exports by sea increased by an average 80,000 barrels per day (bpd) in the four weeks to August 11 as Moscow’s shipments began to recover from their lowest four-week average level hit two weeks ago, vessel-tracking data monitored by Bloomberg showed on Wednesday. The four-week average exports out of Russia’s oil terminals jumped to a five-week high of 3.19 million bpd in the four weeks to August 11, per the data reported by Bloomberg’s Julian Lee. Last week saw the second consecutive increase in four-week average… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Crude-Oil-Shipments-Bounce-Back-From-11-Month-Low.html |

|

Here’s the inflation breakdown for July 2024 — in one chartThe consumer price index has risen 2.9% since July 2023, the lowest annual reading since March 2021. Read more at: https://www.cnbc.com/2024/08/14/heres-the-inflation-breakdown-for-july-2024-in-one-chart.html |

|

Mortgage refinancing surges 35% in one week, as interest rates hit lowest level in over a yearApplications to refinance a home loan surged 35% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Read more at: https://www.cnbc.com/2024/08/14/mortgage-refinancing-surges-35percent-in-one-week-as-interest-rates-hit-lowest-level-in-over-a-year.html |

|

S&P 500 closes higher for fifth straight day as easing inflation bolsters rate cut hopes: Live updatesThe 30-stock Dow rose following a largely in line July inflation print. Read more at: https://www.cnbc.com/2024/08/13/stock-market-today-live-updates.html |

|

Mars to acquire snack maker Kellanova in $36 billion dealAfter separating from Kellogg in 2023, Kellanova will become part of Mars Snacking, adding billion-dollar brands Pringles and Cheez-Its to the portfolio. Read more at: https://www.cnbc.com/2024/08/14/mars-to-acquire-kellanova-in-36-billion-deal-.html |

|

Michael Burry of ‘The Big Short’ fame made Chinese internet companies his top bets last quarterMichael Burry, known for calling the subprime mortgage crisis, completely revamped his portfolio last quarter. Read more at: https://www.cnbc.com/2024/08/14/michael-burry-of-big-short-fame-loaded-up-on-chinese-internet-stocks.html |

|

DraftKings reverses plans for a tax on customers as FanDuel parent Flutter wows Wall StreetEarlier this month, DraftKings said it would introduce a surcharge on users in states where taxes on sports betting are highest. FanDuel wouldn’t follow suit. Read more at: https://www.cnbc.com/2024/08/14/draftkings-reverses-plans-for-a-user-tax-as-fanduel-wows-wall-street.html |

|

A U.S. construction boom is sending rents lower and creating perks for rentersNewly built apartment buildings are helping increase the supply of available rental units in some parts of the country. The result? Price cuts and added perks. Read more at: https://www.cnbc.com/2024/08/14/heres-where-rent-concessions-are-happening-the-most-in-the-us-.html |

|

Trump looks to sharpen his edge on the economy in battleground North CarolinaThe speech comes as Trump works to retool his campaign after Vice President Kamala Harris replaced President Joe Biden on the Democratic ticket. Read more at: https://www.cnbc.com/2024/08/14/trump-economy-speech-north-carolina.html |

|

Crypto investors weigh new inflation data that clears way for potential rate cuts: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Brian Estes, CIO of Off the Chain Capital, weighs in on the impact of key inflation data on crypto prices and explains how crypto is influencing the upcoming U.S. presidential election. Read more at: https://www.cnbc.com/video/2024/08/14/crypto-investors-weigh-new-inflation-data-that-clears-way-for-potential-rate-cuts-cnbc-crypto-world.html |

|

Google’s live demo of Gemini ramps up pressure on Apple as AI reaches smartphone usersWhile Google’s live demo on Tuesday had some bugs, the company showed it’s closer than its rivals to bringing artificial intelligence to smartphones. Read more at: https://www.cnbc.com/2024/08/14/google-live-gemini-demo-lifts-pressure-on-apple-as-ai-hits-smartphones.html |

|

World’s largest sovereign wealth fund posts $138 billion in first-half profit as AI demand boosts techNorway’s massive sovereign wealth fund on Wednesday posted first-half profit of 1.48 trillion kroner ($138 billion). Read more at: https://www.cnbc.com/2024/08/14/worlds-largest-sovereign-wealth-fund-posts-138-billion-in-h1-profit.html |

|

Wizz Air launches $550 ‘all you can fly’ annual subscription passTravelers in Europe can now take unlimited flights for 499 euros ($550) a year under a new travel subscription service from budget carrier Wizz Air. Read more at: https://www.cnbc.com/2024/08/14/wizz-air-launches-550-all-you-can-fly-annual-subscription-pass.html |

|

Reddit’s increased reliance on Google traffic has Wall Street anxious to see if visitors sign upReddit is currently benefiting from a Google search update, but it’s unclear how well the company will attract new users excited enough to create accounts. Read more at: https://www.cnbc.com/2024/08/14/reddits-increased-reliance-on-google-traffic-has-wall-street-anxious.html |

|

Mortgage Refi Activity Jump Most Since 2020 As Lenders See Gloom EndingMortgage lenders have endured a brutal 2.5-year period of the Federal Reserve’s interest rate hiking cycle, with a high rate environment pressuring refinance applications to multi-decade lows. However, those lenders who weathered the downturn—dodging widespread layoffs, industry consolidation, and scraped by on Ramen Noodles and Zyn pouches—are now seeing a serious surge in activity as mortgage rates slide on rising recession probabilities. For the week ending August 9, the Mortgage Bankers Association’s refinancing index jumped a whopping 34.5% to a more than two-year high of 889.3.

The refinancing index’s weekly change recorded the biggest weekly change since the first week of March 2020, a period in time when the Fed slammed interest rates to the zero lower bound in response to the China virus. Read more at: https://www.zerohedge.com/markets/mortgage-refi-activity-jump-most-2020-lenders-see-gloom-ending |

|

Watch: Tulsi Gabbard Suing Biden/Harris Admin For Placing Her On Terrorist Watch ListAuthored by Steve Watson via Modernity.news,. Former Democratic Representative Tulsi Gabbard is taking legal action against the Biden/Harris Administration after she discovered that she has essentially been placed on a terrorist watch list.

Gabbard, a military veteran, had it brought to her attention by Federal Air Marshal whistleblowers that she has been marked under the Quiet Skies program, a TSA scheme that seeks to identify travellers who may pose a risk to aviation security. Those on this watchlist are not banned from flying, but are subject to enhanced searches and surveillance at airports, including having armed Air Marshals accompanying them on flights. The whistleblowers have informed Gabbard that she is being monitored by two Explosive Detection Canine Teams, one Transportation Security Specialist specializing in explosives, one plainclothes TSA Superv … Read more at: https://www.zerohedge.com/political/watch-tulsi-gabbard-suing-bidenharris-admin-placing-her-terrorist-watch-list |

|

Crypto Tumbles As ‘Harris/Biden’ Admin Moves Another 10,000 ‘Silk Road’ Bitcoin To CoinbaseBitcoin prices fell this morning in reaction to the lackluster CPI (as rate-cut expectations dipped). That selloff broke through $60,000 and accelerated further as headlines broke that the US government moved 10,000 seized Bitcoin from the Silk Road dark web marketplace to a Coinbase wallet Wednesday.

According to the onchain analytics firm, Arkham Intelligence, the funds were seized during the Silk Road raid and are currently valued at $593.91 million. Read more at: https://www.zerohedge.com/crypto/crypto-tumbles-harrisbiden-admin-moves-another-10000-silk-road-bitcoin-coinbase |

|

Make America SocialistAuthored by James Rickards via DailyReckoning.com, When a relatively unknown individual steps on the political stage as a candidate for high office, both sides race to “define” the candidate and stamp his image in the public mind. Since the Democrats knew they would pick Gov. Tim Walz of Minnesota for their VP candidate, they had time to pre-produce the public image. He’s not particularly fit or good-looking. No problem! They pushed him as a folksy, down-to-earth Midwestern type who could relate to everyday Americans and understand their problems. Maybe he’s a bit on the heavy side but that’s OK, so are millions of Americans, and it just shows he likes to chow down on popular meals like burgers, hot dogs, chili and whatever else you might find at a barbecue. Well, it took the Republicans a few days to catch up, do the needed research and tell us about the real Tim Walz. It turns out he is one of the most far-left radical politicians in the history of America. Read more at: https://www.zerohedge.com/political/make-america-socialist |

|

Train strikes near end as union and government agree dealThe proposed offer has “no-strings” and sees a backdated pay rise and increases in future for drivers. Read more at: https://www.bbc.com/news/articles/cp9rxdrj713o |

|

Inflation rate rises for first time this year to 2.2%The UK inflation rate has risen to 2.2%, but this was not as high as economists had forecast. Read more at: https://www.bbc.com/news/articles/ceq59pqr9qxo |

|

Mars to buy Pringles and Pop-Tart maker for $36bnConfectionery giant Mars strikes deal to snap up Pringles-maker Kellanova for nearly $36bn. Read more at: https://www.bbc.com/news/articles/cj62715djg9o |

|

Darne Ka Kya? Rakesh Jhunjhunwala family recalls his life mantra on death anniversaryOn his second death anniversary, Rakesh Jhunjhunwala’s family and Rare Enterprises honored the legendary investor with a newspaper ad. Known as the ‘Big Bull’ of Indian stock markets, Jhunjhunwala’s mantra, ‘the less you fear, the more you gain,’ was spotlighted in a poem, reflecting his philosophy and legacy. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/darne-ka-kya-rakesh-jhunjhunwala-family-recalls-his-life-mantra-on-death-anniversary/articleshow/112520349.cms |

|

20 times return in 20 yrs: Nifty beats S&P, goldIndian equity indices are currently on a bull run and analysts believe that India is a long-term story. The indices have remained resilient despite various announcements coming in on taxation in the budget and SEBI’s effort to reduce the speculative trading in the derivatives segment.In the last 2 months, Nifty has rallied by 1,000 points from 23k mark to 24k in a span of just 17 trading days while the second rally from 24k to 25k was achieved in 24 trading sessions.Online investment platform FundsIndia collated the CAGRs of Nifty along with other indices wherein the former has outperformed the latter in a span of 20 years. Here is the list: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/20-times-return-in-20-years-nifty-trumps-sp-500-gold-other-asset-classes/stock-ing-up/slideshow/112513345.cms |

|

Tech View: Nifty traders awaiting breakout on either side. Here’s how to trade on FridayThe market recently broke below the crucial support of the ascending trend line, and the significant gap down on August 5th remains unfilled, indicating a negative outlook. A decisive drop below 23,900 could lead to a short-term downward correction. The immediate resistance is at 24,250-24,300 levels, according to Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-traders-awaiting-breakout-on-either-side-heres-how-to-trade-on-friday/articleshow/112528479.cms |