Summary Of the Markets Today:

- The Dow closed up 51 points or 0.13%,

- Nasdaq closed up 0.51%,

- S&P 500 closed up 0.47%,

- Gold $2,468 up $4.20,

- WTI crude oil settled at $77 up $0.89,

- 10-year U.S. Treasury 3.940 down 0.057 points,

- USD index $103.13 down $0.080,

- Bitcoin $60,697 down $996 or 1.61%,

- Baker Hughes Rig Count: U.S. +2 to 588 Canada -2 to 217

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

- Major Comeback on Wall Street: This recovery came after Monday’s significant losses, which marked the worst rout of the year. The CBOE Volatility Index, a measure of market fear, had soared to its highest levels since the pandemic earlier in the week.

- Market Volatility and Economic Indicators: The week was marked by tremendous volatility, with Monday’s sell-off driven by concerns over a potential recession and weak economic indicators. However, by Thursday, a positive report on weekly jobless claims helped to reassure investors, leading to a rally where the S&P 500 and Nasdaq both gained over 2%.

- Upcoming Economic Events: Looking ahead, significant economic data is expected, including the Consumer Price Index for July, which will be released on Wednesday. This data is crucial as it could influence the Federal Reserve’s decision on interest rate cuts, potentially as soon as September. Additionally, jobless claims and a consumer sentiment survey are expected later in the week, which will provide further insights into economic resilience and inflation expectations.

- Individual Stock Movements: Nvidia was a focal point for investors, experiencing volatility throughout the week. Its stock closed slightly down as investors awaited further catalysts in the AI sector. Nvidia’s earnings report is anticipated at the end of the month, making it the last of the “Magnificent Seven” companies to report.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The outlook for the U.S. economy is more mixed than three months ago, according to the Philadelphia Fed’s Third Quarter 2024 Survey of Professional Forecasters. The panelists predict GDP will grow at an annual rate of 1.9% this quarter, down from 2.0% in the previous survey. The forecasters also see higher unemployment rates across all horizons compared with the previous survey.

Median Forecasts for Selected Variables in the Current and Previous Surveys

| Real GDP (%) | Unemployment Rate (%) | Payrolls (000s/month) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Previous | New | Previous | New | Previous | New | ||||

| Quarterly data: | |||||||||

| 2024:Q3 | 2.0 | 1.9 | 4.0 | 4.2 | 147.3 | 143.9 | |||

| 2024:Q4 | 1.5 | 1.7 | 4.0 | 4.3 | 129.7 | 125.4 | |||

| 2025:Q1 | 1.8 | 1.7 | 4.1 | 4.3 | 144.2 | 128.7 | |||

| 2025:Q2 | 2.0 | 1.8 | 4.1 | 4.3 | 108.7 | 116.2 | |||

| 2025:Q3 | N.A. | 2.2 | N.A. | 4.3 | N.A. | 145.8 | |||

| Annual data (projections are based on annual-average levels): | |||||||||

| 2024 | 2.5 | 2.6 | 3.9 | 4.1 | 212.6 | 210.1 | |||

| 2025 | 1.9 | 1.9 | 4.1 | 4.3 | 140.6 | 130.0 | |||

| 2026 | 1.9 | 2.3 | 4.1 | 4.2 | N.A. | N.A. | |||

| 2027 | 2.1 | 2.0 | 4.1 | 4.2 | N.A. | N.A. | |||

Here is a summary of headlines we are reading today:

- Oil Rig Count Rises As WTI Jumps To $77

- Taylor Swift’s Colossal Carbon Footprint

- Report: Biomass Plant Is The UK’s Top Carbon Polluter

- Brent Flirts With $80 as Recession Fears Ease

- Energy Investors Are Eyeing Utility Stocks

- Oil Prices Bounce Back From Eight-Month Lows

- Stocks close higher, clawing back much of the week’s losses in major recovery from Monday’s sell-off: Live updates

- Stellantis laying off 2,450 plant workers due to discontinuation of Ram ‘Classic’ pickup truck

- Wall Street will get key insight on the consumer, inflation in the week ahead as recession fears swirl

- Bitcoin bounces back above $60,000 as cryptocurrency’s rise continues to end week: CNBC Crypto World

- 10-year Treasury yield dips as traders weigh state of U.S. economy after latest data

- 10-, 30-year Treasury yields finish lower to close volatile week in bond market

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Liberty Steel to Target Automotive, Defense SectorsVia AGMetalminer.com According to Liberty’s Steel’s parent company, GFG Alliance, the steel industry leader’s flats producer at Dunaújváros plans to target the automotive and defense sectors. This shift will occur upon the commissioning of two electric arc furnaces, which will replace the two blast furnaces currently occupying the Hungarian site. A source at the company told MetalMiner that Dunaújváros had some past exposure to the automotive sector with its finished products, but has mainly targeted… Read more at: https://oilprice.com/Metals/Commodities/Liberty-Steel-to-Target-Automotive-Defense-Sectors.html |

|

Kazakhstan Now Seeks $160B from International Oil CompaniesKazakhstan’s legal battle against international oil majors involved in the Kashagan oil field has intensified, with the nation’s claims now exceeding $160 billion. The dispute centers around allegations of corrupt deals and financial mismanagement, adding another $10 billion to the already massive demands. The Kashagan project, a massive offshore field in the Caspian Sea, has been plagued by delays and cost overruns since its inception over two decades ago. Major players in the industry, including Eni SpA, Shell Plc, ExxonMobil Corp.,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Now-Seeks-160B-from-International-Oil-Companies.html |

|

Can Geoengineering Stop Global Warming?This year, a trial is being run to see if using technology to deflect the sun could help cool the planet. Meanwhile, another scientist hopes to spray sulfur dioxide into the stratosphere to reduce global temperatures. These are just some of the innovative trials taking place to curb the effects of global warming until greater decarbonization is seen. The question now is whether these geoengineering, delay-oriented technologies will have a significant effect on global warming, as a mid-term control measure, or whether they present a major risk to… Read more at: https://oilprice.com/Energy/Energy-General/Can-Geoengineering-Stop-Global-Warming.html |

|

Oil Rig Count Rises As WTI Jumps To $77The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday. The total rig count rose by 2 to 588 this week, compared to 654 rigs this same time last year. The number of oil rigs rose by 3 this week after holding steady the week prior. Oil rigs now stand at 485—down by 40 compared to this time last year. The number of gas rigs fell by 1 this week to 97, a loss of 26 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 6.… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rig-Count-Rises-As-WTI-Jumps-To-77.html |

|

Woodside Unlikely To Face Rival Bid in Deal for U.S. LNG Firm TellurianAustralia’s Woodside Energy is unlikely to have to contend with a rival bid for U.S. LNG firm Tellurian, sources close to the proposed deal told Reuters on Friday. Last month, Woodside Energy announced an agreement to buy Tellurian for $1.2 billion as it seeks to turn into a “global LNG powerhouse”. Woodside has entered into a definitive agreement to acquire all issued and outstanding common stock of Tellurian, including its owned and operated U.S. Gulf Coast Driftwood LNG development opportunity. Tellurian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Woodside-Unlikely-To-Face-Rival-Bid-in-Deal-for-US-LNG-Firm-Tellurian.html |

|

Taylor Swift’s Colossal Carbon FootprintTaylor Swift, the pop icon renowned for chart-topping hits and sold-out stadiums, has recently come under scrutiny for another reason entirely: her colossal carbon footprint. While her musical talents are undeniable, her penchant for private jet travel has raised eyebrows and ignited discussions about environmental responsibility in the celebrity sphere. The phrase “Taylor Swift’s shoes must be made of carbon” has become a sardonic commentary on her frequent flights and the resulting emissions. But just how much jet fuel… Read more at: https://oilprice.com/Energy/Energy-General/Taylor-Swifts-Colossal-Carbon-Footprint.html |

|

Report: Biomass Plant Is The UK’s Top Carbon PolluterA biomass power station operated by energy group Drax is the UK’s top emitter of carbon dioxide, emitting more than four times the emissions of the UK’s remaining coal power plant, a new report by climate think tank Ember showed on Friday. Drax power station in North Yorkshire in England is burning wood for electricity and emitted last year more CO2 that the next four power stations combined, according to Ember’s new annual ranking of official data. The report collated official data from the UK Emissions Trading Scheme… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Report-Biomass-Plant-Is-The-UKs-Top-Carbon-Polluter.html |

|

Russia’s Oil Production Down in July, Compensatory Cuts ComingRussia’s crude oil production was down in July compared to June, the Russian Energy Ministry said on Friday, and more cuts are coming. Russia’s oil production came in at 67,000 bpd above its quota for July, but was down in July compared to June due to “one-off supply scheduling issues”. According to the Energy Ministry, August and September production levels will “remedy this.” Russia had already agreed to compensate for everything it has overproduced since April of this year. The compensatory cuts will come… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Production-Down-in-July-Compensatory-Cuts-Coming.html |

|

Iran Finds New Buyers of Its OilIran seems to have found new buyers of its crude oil as cargoes have been recently tracked to move to Oman and Bangladesh, Reuters reported on Friday, citing shipping sources and data. Iran’s oil production has been recently estimated to have hit its highest level since 2018, as Tehran looks to boost output and exports, and export revenues with these, despite the U.S. sanctions. Earlier this year, tankers were sighted and tracked near ports in Bangladesh and Oman, per available shipping data quoted by Reuters. Last month, Iran’s… Read more at: https://oilprice.com/Energy/Crude-Oil/Iran-Finds-New-Buyers-of-Its-Oil.html |

|

Brent Flirts With $80 as Recession Fears EaseOil prices are slowly but surely recovering after four consecutive weeks of declines, with Brent nearing $80 as geopolitical risk and demand optimism boost bullish sentiment. Friday, August 9th, 2024Recovering from Monday’s giant stock selloff, oil prices are set for a much-needed weekly gain after four straight week-over-week losses as ICE Brent flirts with the $80 per barrel mark again. Fears of an impending economic recession were alleviated by stronger US jobs data and with markets closely following Iran’s retaliation vis-a-vis… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Flirts-With-80-as-Recession-Fears-Ease.html |

|

EV Tariffs Row Escalates as China Challenges EU Duties at WTOChina has filed a formal complaint at the World Trade Organization (WTO), challenging the European Union’s decision to impose provisional anti-subsidy tariffs on imports of China-made electric vehicles. The EU launched in October 2023 anti-subsidy investigations into EU imports of EVs from China to determine whether the value chains in China benefit from illegal subsidies. In June, the European Commission “provisionally concluded that the battery electric vehicles (BEV) value chain in China benefits from unfair subsidization,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EV-Tariffs-Row-Escalates-as-China-Challenges-EU-Duties-at-WTO.html |

|

Energy Investors Are Eyeing Utility StocksSaudi Government’s Milking of Saudi Aramco Leads to Underperformance- Saudi Aramco has posted a 3.4% year-over-year decline in its Q2 net income, dropping lower to 29.07 billion due to lower oil sales volumes and weaker refining margins. – The Saudi national oil company has been bearing the brunt of OPEC+ voluntary production cuts, because of which it has underperformed all Western oil majors, down more than 17% since the beginning of 2024. – Saudi Arabia’s oil rent has been hovering between 20% and 25% of the country’s… Read more at: https://oilprice.com/Energy/Energy-General/Energy-Investors-Are-Eyeing-Utility-Stocks.html |

|

Protests and Political Unrest Disrupt Libya’s Largest OilfieldPolitics, Geopolitics & Conflict On Friday, Ukraine was entering its third day of a brazen ground-troop incursion across the border into Russia’s Kursk region. Heavy fighting is forcing civilian evacuations and the need for humanitarian aid. Kyiv on Thursday claimed to have taken control of a Russian gas-metering station in Sudzha (Kursk region), the point where Russian gas flows into Ukraine and onto Europe. In Libya, the NOC has announced a gradual reduction of output for the country’s largest oilfield, Sharara, and declared force majeure… Read more at: https://oilprice.com/Energy/Energy-General/Protests-and-Political-Unrest-Disrupt-Libyas-Largest-Oilfield.html |

|

Oil Markets on Edge as Israel Prepares for an Iranian RetaliationWall Street is more nervous this week than it was last week, with U.S. benchmark oil prices gaining 3.5% at one point on Wednesday, as Israel (and everyone else in the region and beyond) waits for a response from Iran in retaliation for the assassination of Hamas’ Haniyeh on Iranian territory, which Israel has not yet acknowledged. Israel is shoring up its internal defenses for war. The panic has begun. Flights over Iranian and Lebanese airspace are being avoided, amid growing fears of a regional military conflict. United Airlines suspended… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-on-Edge-as-Israel-Prepares-for-an-Iranian-Retaliation.html |

|

Oil Prices Bounce Back From Eight-Month LowsThis week, crude oil prices rebounded sharply from their recent lows, driven by a potent mix of geopolitical risks, tightening supply, and improving economic indicators. Both Brent and WTI benchmarks recorded gains for three consecutive sessions, marking a significant turnaround from Monday’s eight-month lows. Middle East Conflict Ignites Supply Concerns The specter of escalating conflict in the Middle East emerged as a primary catalyst for oil’s upward movement. The recent assassinations of senior Hamas and Hezbollah members have heightened fears… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Bounce-Back-From-Eight-Month-Lows.html |

|

Stocks close higher, clawing back much of the week’s losses in major recovery from Monday’s sell-off: Live updatesThe S&P 500 managed to erase much of the week’s losses. Read more at: https://www.cnbc.com/2024/08/08/stock-market-today-live-updates.html |

|

Stellantis laying off 2,450 plant workers due to discontinuation of Ram ‘Classic’ pickup truckStellantis will indefinitely lay off up to 2,450 U.S. plant workers later this year as it discontinues production of an older version of its Ram 1500 pickup. Read more at: https://www.cnbc.com/2024/08/09/stellantis-layoff-workers-ram-pickup-truck.html |

|

Tesla’s board faces questions from Elizabeth Warren about Musk’s corporate ‘entanglements’In a 10-page letter to Tesla’s chair on Thursday, Elizabeth Warren asked the automaker’s board if it’s monitoring Elon Musk’s activities at his other ventures. Read more at: https://www.cnbc.com/2024/08/09/elizabeth-warren-letter-to-tesla-chairwoman-robyn-denholm-about-musk.html |

|

Wealthy investors find opportunities in stock market sell-offsWealth advisors say their clients saw the drop in stock prices as an opportunity for tax savings and estate planning. Read more at: https://www.cnbc.com/2024/08/09/wealthy-investors-find-opportunities-in-stock-market-sell-offs-.html |

|

Trump wants to cut taxes on Social Security — but it could threaten benefits, experts sayFormer President Donald Trump this week repeated his plan to eliminate taxes on Social Security benefits. But the plan could threaten entitlements, experts say. Read more at: https://www.cnbc.com/2024/08/09/trump-plan-cut-taxes-on-social-security-benefits.html |

|

Wall Street will get key insight on the consumer, inflation in the week ahead as recession fears swirlWith growth concerns moving to the fore, how the U.S. consumer is faring could be key to understanding what’s next for markets and the economy. Read more at: https://www.cnbc.com/2024/08/09/wall-street-will-get-key-insight-on-the-consumer-inflation-in-the-week-ahead-as-recession-fears-swirl.html |

|

JPMorgan Chase is giving its employees an AI assistant powered by ChatGPT maker OpenAIThe move by JPMorgan, the largest U.S. bank by assets, shows how quickly generative AI has swept through America since the arrival of ChatGPT in late 2022. Read more at: https://www.cnbc.com/2024/08/09/jpmorgan-chase-ai-artificial-intelligence-assistant-chatgpt-openai.html |

|

Bitcoin bounces back above $60,000 as cryptocurrency’s rise continues to end week: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ben McMillan, chief investment officer of IDX Digital Assets, weighs in on this week’s volatility and Resy co-founder Ben Leventhal explains how his new web3 project would allow for diners to pay for meals in crypto. Read more at: https://www.cnbc.com/video/2024/08/09/bitcoin-bounces-back-above-60000-cryptocurrency-rise-continues-end-week-cnbc-crypto-world.html |

|

10-year Treasury yield dips as traders weigh state of U.S. economy after latest dataU.S. Treasury yields were slightly lower early Friday as investors continue to assess weekly jobless claims data. Read more at: https://www.cnbc.com/2024/08/09/10-year-treasury-yield-dips-after-jobs-data-fuels-stock-rally.html |

|

Ukraine unleashes large drone attack on Russian airfield as Kyiv’s offensive continuesUkrainian drones struck a key military airfield in Russia’s Lipetsk region, as Kyiv continues its largest offensive on Russian soil since the start of the war. Read more at: https://www.cnbc.com/2024/08/09/kyiv-offensive-ukraine-unleashes-drone-attack-on-russian-airfield.html |

|

MLB will host its first game at a NASCAR track, aiming to break attendance recordThe game is set for Aug. 2, 2025, between the Atlanta Braves and the Cincinnati Reds. It will also be the first in-season Major League Baseball game held in Tennessee. Read more at: https://www.cnbc.com/2024/08/09/mlb-will-host-its-first-game-at-a-nascar-track-aiming-to-break-attendance-record.html |

|

Fitness club company Life Time, heavily invested in pickleball, creates its own ball for the booming sportThe chain of “athletic country clubs,” which has invested heavily in pickleball, said it has made a stronger and faster ball for the sport. Read more at: https://www.cnbc.com/2024/08/09/life-time-creates-its-own-pickleball-as-the-sport-booms.html |

|

Trump says he should get a say on Federal Reserve interest rate decisionsThe comments seem to reinforce reporting earlier this year that advisors close to Trump are looking at a host of changes for the Fed. Read more at: https://www.cnbc.com/2024/08/08/trump-says-he-should-get-a-say-on-federal-reserve-interest-rate-decisions.html |

|

Virginia Mandates Paper Ballots, Tracking, And Proof Of Residency For 2024 ElectionVirginia Governor Glenn Youngkin (R) on Wednesday signed an executive order to implement various security measures ahead of the November election – including the use of paper ballots, tracking possession of ballots during early voting, matching the number of ballots casts with then number of voters who have checked in, and the number of ballots sent to voters.

The order also requires absentee ballots to be requested before being mailed to voters, in addition to rejecting ballots mailed back unless the voter provides the last four digits of their Social Security number and birth year. The state notably uses paper ballot counting machines that aren’t connected to the internet and are tested before elections. Meanwhile, Youngkin also ordered the state to update its voter rolls – including adding or removing people based on whether th … Read more at: https://www.zerohedge.com/political/virginia-mandates-paper-ballots-tracking-and-proof-resideny-2024-election |

|

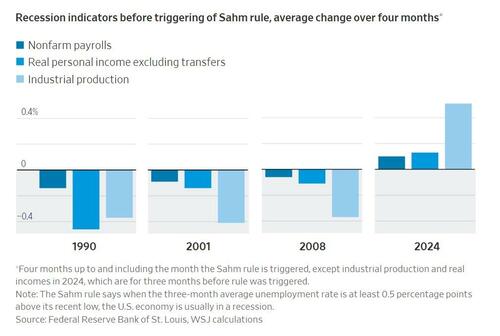

Recession-Risk Reality-CheckAuthored by Mike Shedlock via MishTalk.com, Greg Ip says the conditions for recession are not in place. I disagree. And I show where and how he went wrong.

The chart itself explains where Ip went wrong. See if you can figure it out. “This Doesn’t Look Like Recession” Says Greg IpPlease consider This Doesn’t Look Like Recession. Here’s How One Could Happen.

|

|

Cadbury Doubles Prices Of Candy Bars For ‘First Time In Decade’This year, an increasing number of the world’s top candy companies have been sounding the alarm about skyrocketing cocoa prices, leading them to hike candy bar prices. The real culprit here isn’t as much corporate greed but rather adverse weather conditions, such as drought in West Africa, which has decimated cocoa harvests and caused worldwide supply concerns. No matter how often politicians tell their constituents that voting for them will bring down overall inflation, we find that somewhat to believe, especially for food, as it will remain sticky in the years ahead. Cadbury Australia is the latest confectionery company to warn about rising candy bar prices due to high cocoa prices. It said Freddo Frogs and Caramello Koalas prices will now double. “Due to the record global price of cocoa and increased input costs, we have adjusted the RRP from $1 to $2, the first price change in over a decade,” Cadbury wrote in an Instagram statement.

Read more at: https://www.zerohedge.com/commodities/cadbury-doubles-prices-candy-bars-first-time-decade |

|

Donald Trump Jr. Is Launching A Crypto-Platform To “Take On” The BanksAuthored by Martin Young via CoinTelegraph.com, Donald Trump Jr. has announced plans to launch a new decentralized finance (DeFi) cryptocurrency platform to address inequality in banking access. However, the platform is still in the early stages and will take some time to become a reality.

During a Q&A session on subscription-based platform Locals on Aug. 8, Donald Trump Jr, the eldest son of presidential candidate and former President Donald Trump, said he wasn’t launching a memecoin but working on a crypto platform to take on the banks.

|

|

Final offer of £5.4bn for Hargreaves Lansdown takeoverPlans for the financial firm’s future have been announced by the company’s new owners. Read more at: https://www.bbc.com/news/articles/ckg2vyk0ne5o |

|

Vinted U-turns on delivery changes after backlashThe popular app was trialling a new way of choosing postage but users said it made selling more difficult. Read more at: https://www.bbc.com/news/articles/cgedy443ldqo |

|

Asda to put more staff on checkouts in storesThe firm denied the move was about shoppers’ preference for a human to help them rather than a machine. Read more at: https://www.bbc.com/news/articles/c3w6q4x99pwo |

|

Mutual fund SIPs hit another record high. Top 5 takeaways from AMFI dataSIP inflows hit a new record, surpassing Rs 23,000 crore with a 10% surge Read more at: https://economictimes.indiatimes.com/mf/analysis/mutual-fund-sips-hit-another-record-high-top-5-takeaways-from-amfi-data/slideshow/112405336.cms |

|

Tech View: Nifty ends week with Hammer candle. Here’s how to trade on MondayJatin Gedia of Sharekhan observes that the Nifty, after a drop from 25,100 to 23,900, is currently in recovery mode. He predicts a potential rally towards 24,520-24,651, aligning with the 50% and 61.82% Fibonacci retracement levels. The immediate support level is anticipated at 24,200-24,150, coinciding with the 40-day moving average Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-ends-week-with-hammer-candle-heres-how-to-trade-on-monday/articleshow/112405580.cms |

|

Vijay Kedia’s portfolio flares up, 2 stocks turn multibaggers in CY24ETMarkets analyzed investor Vijay Kishanlal Kedia’s portfolio as of the June ’24 quarter. His stakes in 14 companies total ₹1,545 cr, with 9 delivering double-digit returns and 3 becoming multibaggers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vijay-kedias-portfolio-flares-up-2-stocks-turn-multibaggers-in-cy24/slideshow/112396288.cms |

|

10-, 30-year Treasury yields finish lower to close volatile week in bond marketYields on U.S. government debt ended mixed on Friday but higher for the week, as investors assessed the fallout from a volatile period in fixed-income markets this week. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-at-end-of-volatile-week-for-bonds-bbd0b85c?mod=mw_rss_topstories |

|

What’s next for bond markets after a week of wild volatilityIt has been months since traders in the $27 trillion U.S. government debt market have seen a week like the one that’s about to end, with volatility so strong that it sent the benchmark 10-year Treasury yield through an unusually large range over the past five days. Read more at: https://www.marketwatch.com/story/whats-next-for-bond-markets-after-a-week-of-wild-volatility-3761c64c?mod=mw_rss_topstories |

|

Rocket Lab’s Archimedes engine test ‘a significant catalyst’ for new Neutron rocket, Cantor saysRocket Lab reported a 71% second-quarter revenue hike after the market close Thursday. The company also said that it successfully fired its Archimedes engine for the first time. Rocket Lab shares are up 14.6% Friday. Read more at: https://www.marketwatch.com/story/rocket-labs-archimedes-engine-test-a-significant-catalyst-for-new-neutron-rocket-cantor-says-33246374?mod=mw_rss_topstories |