Summary Of the Markets Today:

- The Dow closed down 234 points or 0.60%,

- Nasdaq closed down 1.05%,

- S&P 500 closed down 0.77%,

- Gold $2,429 down $3.50,

- WTI crude oil settled at $75 up $2.21,

- 10-year U.S. Treasury 3.955 up 0.068 points,

- USD index $103.20 up $0.230,

- Bitcoin $54,755 down $1,296 or 2.31%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

U.S. stocks declined on Wednesday, failing to extend Tuesday’s rebound that had snapped a three-day losing streak for major averages. Here are the key points:

- Intra-day Volatility:

All three major averages had been up more than 1% at some point during the session before reversing course. - Sector Performance:

Chip stocks led the losses, with AI leader Nvidia (NVDA) falling more than 5%. - VIX Movement:

The VIX, known as Wall Street’s “fear gauge,” rose about 5 points to close just below 28 on Wednesday. - Notable Earnings: Disney (DIS) reported a profit in its streaming unit for the first time last quarter but saw its shares fall more than 4%. Airbnb (ABNB) stock fell almost 14% after offering a current quarter forecast below expectations. Super Micro Computer (SMCI) stock fell over 20% due to disappointing margins.

- Market Outlook:

Analysts suggest that the market may experience an extended period of “choppy waters” as it navigates through August, with a battle between fear and greed causing strong up and down days. - Economic Data:

Investors are awaiting the weekly jobless claims report on Thursday, which is considered “very important” for gauging economic health and potential recession risks.

The market’s reversal on Wednesday highlights the ongoing uncertainty and volatility as investors continue to assess economic conditions and corporate performance.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Here is a summary of headlines we are reading today:

- What’s Behind the 4.38% Spike in Natural Gas Futures?

- Oil Prices Continue to Climb as Wall Street Braces for Showdown with Iran

- Lucid Receives $1.5 Billion Lifeline from Saudi Investment Fund

- War Enters New Phase as Ukraine Launches Offensive in Russian Territory

- Glencore Scraps Plan to Spin Off Its Coal Business

- Qatar to Invest in U.S.-Backed Critical Minerals Initiative

- Stocks close lower on Wednesday as market’s comeback attempt fizzles out: Live updates

- Jamie Dimon says he still sees a recession on the horizon

- NASA has about a week to decide on returning Boeing’s Starliner with crew or empty

- Weekly mortgage refinance demand soars 16% as rates sink to lowest level in over a year

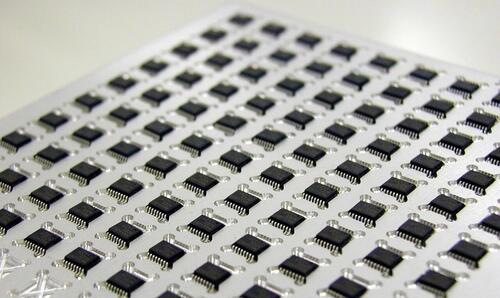

- Combatting China’s Legacy Chip Threat: Time To Revive Section 421

- ‘Warren Buffett stayed calm and clear-headed amid chaos’: Here’s my biggest lesson from the Great Recession

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

What’s Behind the 4.38% Spike in Natural Gas Futures?Natural gas futures surged 4.38% on August 7, 2024, shaking off the recent bearish sentiment that had been weighing on prices. This unexpected rally raises questions about the underlying dynamics of the market and what factors are driving this renewed optimism. Several elements could be contributing to this sudden rise: Bargain hunting: After a period of sustained decline due to increased production and mild weather forecasts, natural gas prices may have reached a level that some investors perceive as a bargain. This could be attracting buyers… Read more at: https://oilprice.com/Energy/Natural-Gas/Whats-Behind-the-Sudden-Spike-in-Natural-Gas-Futures.html |

|

American Shale Consolidation Continues with Rumors of Another SaleAs consolidation in the American shale patch continues, Bloomberg has cited unnamed sources as saying that Franklin Mountain Energy is gearing up to be the next sales target in Texas’ Permian basin. Led by refining billionaire Paul Foster, Bloomberg reported on Wednesday that sources close to the matter say Franklin Mountain has hired Jefferies FInancial Group Inc to manage the sale of the refiner, with price expectations at around $3 billion. Denver-based Franklin Mountain Energy is one of the last privately held holdouts in… Read more at: https://oilprice.com/Energy/Crude-Oil/American-Shale-Consolidation-Continues-with-Rumors-of-Another-Sale.html |

|

Georgia’s Export Potential: Unveiling Promising Sectors for GrowthMany Georgian economic sectors are well positioned to increase exports to Europe, according to the findings of a new study commissioned by the European Union and United Nations. The report’s contents paint a picture of an economy eager to do business with Europe at a time when many Georgians say the government is undermining the country’s relationship with the EU. The UN report, titled “Georgia’s Economy Sectors with High Growth and Export Potential,” is based on interviews with industry stakeholders and provides… Read more at: https://oilprice.com/Geopolitics/International/Georgias-Export-Potential-Unveiling-Promising-Sectors-for-Growth.html |

|

Oil Prices Continue to Climb as Wall Street Braces for Showdown with IranThe U.S. crude oil benchmark rallied nearly 2.5% on Wednesday, with Brent crude not far behind, as Wall Street held its breath over an anticipated response by Iran to Israel’s assassination of the Hamas leader on Iranian territory. On Wednesday at 1:09 p.m. ET, WTI was trading up 2.53% (compared to gains of nearly 3.5% just an hour earlier), at $75.05. Brent crude was trading up 2.28% at $78.22, still failing to breach the $80 mark. News reports of Israel stockpiling blood supplies and shoring up their underground bunkers in preparation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Continue-to-Climb-as-Wall-Street-Braces-for-Showdown-with-Iran.html |

|

Lucid Receives $1.5 Billion Lifeline from Saudi Investment FundAn affiliate of Saudi Arabia’s Public Investment Fund has thrown struggling electric car maker Lucid Group a $1.5 billion lifeline (second one of the year). This comes as Lucid prepares to launch its first sport utility vehicle amid a downturn in the EV automotive space. Lucid revealed it entered into agreements with its majority stockholder, Ayar Third Investment Company, an affiliate of the Saudi PIF, to purchase $750 million of convertible preferred stock through a private placement and provide a $750 million unsecured loan. Lucid… Read more at: https://oilprice.com/Energy/Energy-General/Lucid-Receives-15-Billion-Lifeline-from-Saudi-Investment-Fund.html |

|

Why Virgin Atlantic’s Ad About Flying on Cooking Oil Was BannedWhen a Virgin Atlantic flight powered solely by cooking oil successfully jetted from London to New York last year, the airline’s billionaire co-founder Richard Branson was showered with praise. Politicians, aviation executives, and journalists, many of whom were invited on board, hailed the achievement as a milestone in the sector’s battle to decarbonize, while the flight itself was watched worldwide. “I was just thinking of my history of firsts across the Atlantic and all my previous ones I’ve ended up being pulled out… Read more at: https://oilprice.com/Energy/Energy-General/Why-Virgin-Atlantics-Ad-About-Flying-on-Cooking-Oil-Was-Banned.html |

|

War Enters New Phase as Ukraine Launches Offensive in Russian TerritoryA Ukrainian ground assault on Russian regions across the border continued on Wednesday for their second day, forcing Russia to evacuate residents from the Kursk region, sparking a backlash against President Vladimir Putin for failing to thwart the attacks. According to The Moscow TImes, this latest campaign by Ukraine is “larger in scale and more prepared than previous efforts”. The English-language daily cited local officials as reporting at least five people had been killed in the attack so far, and scores of others injured. Some… Read more at: https://oilprice.com/Latest-Energy-News/World-News/War-Enters-New-Phase-as-Ukraine-Launches-Offensive-in-Russian-Territory.html |

|

EPA Audits Potential Fraud in U.S. Biofuels Supply ChainThe U.S. Environmental Protection Agency (EPA) is carrying out audits at least two biofuel producers over the used cooking oil in their supply chains amid concerns about fraudulent use of such oils to claim government subsidies and tax reliefs, EPA spokesperson Jeffrey Landis told Reuters on Wednesday. U.S. biofuel producers can benefit from a range of state and federal subsidies, including tradable credits under the Renewable Fuel Standard (RFS) and other new subsidies in programs under the Inflation Reduction Act (IRA). The EPA launched audits… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EPA-Audits-Potential-Fraud-in-US-Biofuels-Supply-Chain.html |

|

Oil Prices Climb as Crude Inventories DeclineCrude oil prices climbed higher today after the Energy Information Administration reported an inventory decline for the week to August 2. This compared with a draw of 3.4 million barrels for the last week of July. A day earlier, the American Petroleum Institute reported an estimated build of 180,000 barrels for the week to August 2, surprising markets and pressuring oil prices. The API also estimated large builds in gasoline and middle distillate inventories for the period. In fuels, the EIA estimated inventory builds. Gasoline stocks added 1.3… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-as-Crude-Inventories-Decline.html |

|

Oil Prices Jump 2% on Geopolitical Risks and Tightening SupplyOil prices have gained 2% in today’s trading session, primarily driven by escalating geopolitical tensions in the Middle East and compounding supply concerns. The surge is a stark reminder of the oil market’s sensitivity to geopolitical risk and the fragile balance between supply and demand. Find more oil prices from around the world here The Middle East, a critical linchpin in global oil production, has been experiencing heightened volatility. Recent events, ranging from military escalations to political instability, have ignited fears of potential… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Jump-2-on-Geopolitical-Risks-and-Tightening-Supply.html |

|

CNOOC Adds Massive Gas Reserves in South China Sea DiscoveryChina’s authorities have approved the proved gas in-place volumes of over 100 billion cubic meters in a new discovery in the western part of the South China Sea, which is the world’s first large ultra-shallow gas play in ultra-deepwater, state oil and gas giant CNOOC said on Wednesday. The proved gas in place at the Lingshui 36-1 gas field, which stands at over 100 billion cubic meters, is now made official after the Chinese governmental authorities approved it, two months after the company announced the major exploration breakthrough… Read more at: https://oilprice.com/Latest-Energy-News/World-News/CNOOC-Adds-Massive-Gas-Reserves-in-South-China-Sea-Discovery.html |

|

Higher Crude Prices Help Tullow Oil Boost First-Half ProfitIndependent producer Tullow Oil reported on Wednesday more than doubled profit after tax for the first half of 2024 amid higher oil and gas production and increased crude oil realizations. Tullow Oil, which is focused on developing projects in and offshore Africa, booked a profit after tax of $196 million for the first half, up from $70 million for the same period of 2023. Revenue fell to $759 million from $777 million. However, Tullow Oil’s realized oil price of $77.70 per barrel after hedging was higher than the $73.30 a barrel realized… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Higher-Crude-Prices-Help-Tullow-Oil-Boost-First-Half-Profit.html |

|

Glencore Scraps Plan to Spin Off Its Coal BusinessMining and commodity trading giant Glencore is ditching plans to spin off its coal business as shareholders continue to see value in it and aren’t sure a metals-only Glencore would have seen a higher market valuation. After receiving the final regulatory approval for the acquisition of Elk Valley Resources (EVR), the coal business of Teck Resources, Glencore said last month that “we will shortly commence a consultation process to assess shareholder views regarding the potential demerger of the combined coal and carbon steel materials… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Glencore-Scraps-Plan-to-Spin-Off-Its-Coal-Business.html |

|

Qatar to Invest in U.S.-Backed Critical Minerals InitiativeQatar will invest $180 million in a Europe-based critical minerals investment company, joining the U.S. development bank in supporting the firm that invests in key metals for the energy transition outside China. Qatar Investment Authority (QIA), the Gulf nation’s sovereign wealth fund, said on Wednesday it would invest $180 million in TechMet, an investment company focused on building businesses across the critical minerals value chain, from extraction and processing to refining and recycling. With the funds, Qatar’s wealth fund will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-to-Invest-in-US-Backed-Critical-Minerals-Initiative.html |

|

U.S. Appeals Court Vacates FERC Authorization for Rio Grande LNGA U.S. appeals court has vacated the remand authorization of NextDecade Corporation’s Rio Grande LNG export project issued by the Federal Energy Regulatory Commission on the ground that the FERC should have issued a supplemental Environmental Impact Statement (EIS) during its remand process. NextDecade (NASDAQ: NEXT), whose Rio Grande LNG project is already under construction in Texas, saw its shares plummet on the NASDAQ after the court’s decision and closed down 17.87% on Tuesday. The company said in a statement that it “is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Appeals-Court-Vacates-FERC-Authorization-for-Rio-Grande-LNG.html |

|

Stocks close lower on Wednesday as market’s comeback attempt fizzles out: Live updatesStocks fell Wednesday, losing the gains from earlier in the session. Read more at: https://www.cnbc.com/2024/08/06/stock-market-today-live-updates.html |

|

Jamie Dimon says he still sees a recession on the horizonDimon, leader of the biggest U.S. bank by assets and one of the most respected voices on Wall Street, has warned of an economic “hurricane” since 2022. Read more at: https://www.cnbc.com/2024/08/07/jamie-dimon-still-sees-a-recession-ahead.html |

|

As inflation fury lingers, politicians join customers in pushing companies to cut pricesCompanies like Kroger, Walmart and McDonald’s are getting caught in the political messaging around inflation ahead of the 2024 election. Read more at: https://www.cnbc.com/2024/08/07/2024-election-inflation-grocery-prices-a-top-issue.html |

|

Warren Buffett now owns more T-bills than the Federal ReserveThe Omaha, Nebraska-based conglomerate held $234.6 billion in short-term investments in Treasury bills by the end of the second quarter. Read more at: https://www.cnbc.com/2024/08/07/warren-buffett-now-owns-more-t-bills-than-the-federal-reserve.html |

|

These high-dividend-yielding stocks could see a rebound as rates decline, BMO saysThese dividend stocks are poised to move higher after the Federal Reserve starts cutting rates, says BMO. Read more at: https://www.cnbc.com/2024/08/07/these-high-dividend-yielding-stocks-could-see-a-rebound-as-rates-decline-bmo-says.html |

|

In a reversal, Disney’s media assets are starting to generate more excitement than its parksFor the first time in more than two years, Disney’s media assets are outshining the parks division. Read more at: https://www.cnbc.com/2024/08/07/disneys-media-assets-parks.html |

|

NASA has about a week to decide on returning Boeing’s Starliner with crew or emptyThe agency expects to decide “roughly by mid-August,” a deadline driven by the scheduled launch of the next NASA crew. Read more at: https://www.cnbc.com/2024/08/07/nasa-deadline-returning-boeing-starliner-with-crew-or-empty.html |

|

Weekly mortgage refinance demand soars 16% as rates sink to lowest level in over a yearMortgage interest rates dropped last week to the lowest level since May 2023, causing a surge in mortgage demand from both homebuyers and especially current homeowners. Read more at: https://www.cnbc.com/2024/08/07/weekly-mortgage-refinance-demand-soars-16percent-as-rates-sink-to-lowest-level-in-over-a-year.html |

|

Google’s antitrust ruling has experts looking to 25-year-old Microsoft case for answersThe historic antitrust case against Microsoft in 1999 provides some clues as to what Google can expect after Monday’s ruling. Read more at: https://www.cnbc.com/2024/08/07/googles-antitrust-ruling-bears-resemblance-to-microsoft-monopoly-case.html |

|

Ether pulls back again following slight rebound with other risk assets: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Nick Cowan of Valereum weighs in on this week’s crypto sell-off and Marathon Digital CEO Fred Thiel explains how bitcoin miners navigate through crypto and stock market volatility. Read more at: https://www.cnbc.com/video/2024/08/07/ether-pulls-back-again-following-slight-rebound-with-other-risk-assets-cnbc-crypto-world.html |

|

Clean energy tax breaks more popular than expected, as U.S. households claimed $8.4 billion in Inflation Reduction Act credits for 2023, officials sayTwo tax credits enhanced and extended by the Inflation Reduction Act are more popular than officials projected. Read more at: https://www.cnbc.com/2024/08/07/american-households-claimed-billions-in-clean-energy-credits-in-2023.html |

|

Disney beats estimates as combined streaming services turn a profitDisney beat estimates as its combined streaming businesses — Disney+, Hulu and ESPN+ — turned a profit for the first time. Read more at: https://www.cnbc.com/2024/08/07/disney-dis-q3-earnings-report-2024.html |

|

No Debate Required With Natural GasAuthored by David Callahan via RealClearEnergy, It often feels like common ground is a rare commodity in today’s highly charged political climate, where heated debate emphasizes our differences more often than our shared values. As policy solutions are advanced in the coming months of the election season on key issues related to the economy, national security and the environment, we are reminded that not everything has to be partisan or divisive.

Natural gas transcends political boundaries and arches political divides by providing economic growth, advancing U.S. energy security and making substantial environmental progress. By recognizing the many benefits of this critical energy source, we can forge a path forward that unites perspectives in pursuit of a stronger America. Nowhere in the country is this partnership, and the opportunities it creates, more apparent than in Pennsylvania. Producing nearly 20% of Am … Read more at: https://www.zerohedge.com/energy/no-debate-required-natural-gas |

|

‘Stolen Valor’: Walz Under Fire For Bailing On Iraq Tour, Then Lying About Combat DeploymentKamala Harris’ VP pick Tim Walz has come under fire over his extreme left-wing policies, from joking about helping illegal immigrants into the country by investing in a ‘ladder company,’ to signing a law that gives them driver’s licenses, to delaying the deployment of the National Guard during the Georger Floyd riots.

Photo by Jim WATSON / AFP via Getty Images And while there’s much more to discuss, Walz has come under the most intense scrutiny for embellishing his military record, when in reality he bailed on his National Guard battalion – instead running off to Congress after learning that he would be deployed to I … Read more at: https://www.zerohedge.com/political/stolen-valor-walz-under-fire-bailing-iraq-tour-then-lying-about-combat-deployment |

|

Combatting China’s Legacy Chip Threat: Time To Revive Section 421Authored by Jonathan Harman & Lillian Ellis via RealClearDefense, The People’s Republic of China (PRC) has long sought to make geopolitical competitors dependent on it for materials necessary for national security by oversaturating the market with cheap Chinese products. Using that same strategy, the PRC is now looking to gain a monopoly on legacy chips—less advanced microchips required for both civilian and military technology. To combat this and future Chinese market threats to American national security, Congress should reinstate and modernize Section 421 of the 1974 Trade Act to allow the federal government to evaluate and recommend tariffs to the President for specific Chinese imports.

The PRC has long achieved dominance in international markets by subsidizing strategic industries to overproduce and flood the market with cheap products. … Read more at: https://www.zerohedge.com/geopolitical/combatting-chinas-legacy-chip-threat-time-revive-section-421 |

|

I Thought Gold Was A Safe Haven! Why Did It Tank With Stocks?Authored by Mike Maharrey via Money Metals, And in the blink of an eye, the expectation of a “soft” landing turned into worries about a crash landing!

It was a bloody Monday in the stock market as analysts digested the dreary jobs report released Friday and suddenly discovered the rot in the economy’s foundation. They fretted that the Federal Reserve waited too long to cut interest rates and worried its lallygagging would tip the economy into a recession. (I have argued for months that the problem started long before the first Fed rate hike. It began when the central bank decided to keep the easy money spigot wide open for more than a decade. You can read more about that HERE … Read more at: https://www.zerohedge.com/political/i-thought-gold-was-safe-haven-why-did-it-tank-stocks |

|

Bensons for Beds buys 19 Carpetright storesFurniture chain Bensons buys 19 Carpetright stores after carpet retailer collapse. Read more at: https://www.bbc.com/news/articles/c0jpw9709n0o |

|

Online platforms warned over disorder violence riskThe open letter comes as social media firms face increasing scrutiny over their role in the disorder. Read more at: https://www.bbc.com/news/articles/c2076n7w4qlo |

|

Inside Out 2 boosts Disney as theme parks struggleDisney swings to a pre-tax profit, largely thanks to the highest-grossing animated film ever. Read more at: https://www.bbc.com/news/articles/c049p51qkd0o |

|

Sebi’s proposals aim to curb use of offshore structures for derivative trades, say sourcesThe Securities and Exchange Board of India (SEBI) on Tuesday proposed that offshore derivative instruments (ODIs) issued by offshore funds should be backed only by cash equity or debt positions and not derivatives. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebis-proposals-aim-to-curb-use-of-offshore-structures-for-derivative-trades-say-sources/articleshow/112349742.cms |

|

Rupee slips to record low as pressure from carry trade unwind lingersThis decline was influenced by the unwinding of carry trades and high local dollar demand. Central bank interventions helped limit the currency’s losses, with the rupee expected to remain under pressure. Read more at: https://economictimes.indiatimes.com/markets/forex/rupee-slips-to-record-low-hurt-by-elevated-ndf-dollar-demand-importer-hedging/articleshow/112344259.cms |

|

Tech View: Nifty likely to witness continuation of pullback rally. Here’s how to trade on ThursdayDespite recent volatility, the index has found support around 24,000 and its 50-day exponential moving average, leading to a relief rally. This suggests a potential short-term reversal, but confirmation will depend on further upward movement. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-likely-to-witness-continuation-of-pullback-rally-heres-how-to-trade-on-thursday/articleshow/112349532.cms |

|

The Fed appears to have finally created the recession it wantedU.S. central bank engineers an economic slowdown whenever unemployment is low and the president is a Democrat. Read more at: https://www.marketwatch.com/story/the-fed-appears-to-have-finally-created-the-recession-it-wanted-474b8216?mod=mw_rss_topstories |

|

‘Warren Buffett stayed calm and clear-headed amid chaos’: Here’s my biggest lesson from the Great RecessionIs it folly to look the other way? Read more at: https://www.marketwatch.com/story/warren-buffett-stayed-calm-and-clear-headed-amid-chaos-heres-the-biggest-lesson-i-learned-from-the-great-recession-b542d14f?mod=mw_rss_topstories |

|

Oil prices end higher as data shows drop in U.S. crude inventoriesOil futures rose Wednesday, finding support as the stock market continued its recovery from a global rout that had served to pull down commodity prices. Read more at: https://www.marketwatch.com/story/oil-prices-lifted-as-stocks-extend-bounce-and-traders-eye-middle-east-tensions-fc9b90d2?mod=mw_rss_topstories |