Summary Of the Markets Today:

- The Dow closed down 1,034 points or 2.60%,

- Nasdaq closed down 3.43%,

- S&P 500 closed down 3.00%,

- Gold $2,453 down $17.70,

- WTI crude oil settled at $74 up $0.24,

- 10-year U.S. Treasury 3.771 down 0.023 points,

- USD index $102.64 down $0.560,

- Bitcoin $53,467 down $4,471 or 8.03%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

Wall Street experienced a significant sell-off on Monday, driven by mounting concerns about the health of the U.S. economy. Key indices saw substantial losses:

- Dow Jones Industrial Average fell over 1,000 points.

- Nasdaq Composite dropped by more than 3.4%.

- S&P 500 declined nearly 3%, marking its worst start to any month since 2002.

The CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” reached its highest level since the early days of the COVID-19 pandemic before retreating. Treasury yields also fell, with the 10-year Treasury yield hovering near 3.8%. The sell-off was exacerbated by a disappointing U.S. jobs report, which heightened fears that the Federal Reserve may have delayed cutting interest rates for too long. Almost 100% of bets are on the central bank to cut rates by 0.5% by its September meeting. Major companies were significantly impacted:

- Apple (AAPL) declined about 5%.

- Nvidia (NVDA) fell over 6%.

- Tesla (TSLA) dropped more than 4%.

Cryptocurrencies also suffered. The sell-off had a global impact, with Japan’s Nikkei 225 experiencing its largest-ever daily loss of over 12% following a surprise interest rate hike by the Bank of Japan. This led to heavy selling as speculators liquidated their holdings due to the sharp rise in the Japanese yen against the U.S. dollar. The U.S. market is heading into a quieter week of data and earnings, with weekly unemployment claims due Thursday expected to draw significant attention

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

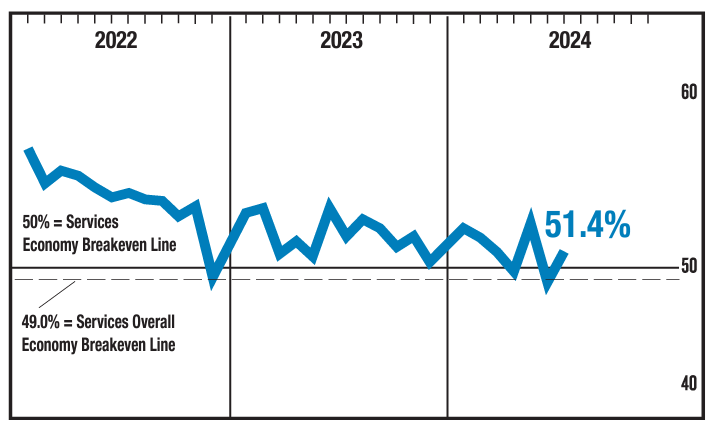

In July 2024, the Services PMI® registered 51.4%, 2.6 percentage points higher than June’s figure of 48.8%. For those who read my August 2024 economic forecast, you will KNOW that last month’s 48. 8% was a recessionary flag. July’s reading of 51.4% moves the economy into weak growth. The U.S. is basically a services economy so a negative or weak services datapoint should alert one to the higher possibility of a recession. The economic fundamentals have been weak this entire year – nothing changed this past week except that Wall Street woke up that the economy was weak. At this point, we are forecasting more of the same weakness. Could there be a recession? – possible but not ordained. I see nothing more than a weak economy but when an economy is weak it is not capable of absorbing a black swan event (say a military conflict in the middle east) – the economy is set up for a recession. Personally, I am not hunkering down but just more careful on spending and investing – I have been in this mode since 4Q2023.

Here is a summary of headlines we are reading today:

- Climate Change and Hard Labor: The Rising Toll on Outdoor Workers

- Understanding China’s Weakening Metal Demand

- Germany’s EV Sales Sink 37% as Subsidies End

- Nigeria Loses $1,000 per Barrel of Crude Oil It Exports

- U.S. Gasoline Prices Continue to Drop

- How Conflict in the Middle East Could Send Oil Prices Soaring

- Woodside Buys U.S. Clean Ammonia Project for $2.35 Billion

- Dow tumbles 1,000 points, S&P 500 posts worst day since 2022 in global market sell-off: Live updates

- $1 trillion wipeout: Market rout punishes megacap tech

- Warren Buffett’s decision to sell stocks and raise record cash before sell-off sends wake-up call

- Bitcoin plunges sharply as recession fears drive global market sell-off: CNBC Crypto World

- Stocks making the biggest moves midday: Robinhood, Nvidia, Intel and more

- Alphabet Shares Tumble After Losing DoJ Antitrust Suit Over Search

- 10-year Treasury yield ends at lowest level since July 2023 as recession fears linger

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Geothermal Market Poised for Accelerated Growth in Coming YearsGeothermal energy is set to play a significant, albeit small role in the power mix of the future, building on its currently modest 0.3% share of the world’s power supply. As global economies ramp up their efforts to decarbonize, the importance of renewable baseload energy sources such as geothermal is expected to increase in the coming years. Installed geothermal power generation capacity currently stands at 16.8 gigawatts electric (GWe) worldwide, with almost 800 megawatts electric (MWe) expected to be added this year. This year’s… Read more at: https://oilprice.com/Alternative-Energy/Geothermal-Energy/Geothermal-Market-Poised-for-Accelerated-Growth-in-Coming-Years.html |

|

Climate Change and Hard Labor: The Rising Toll on Outdoor WorkersWho will pay for the cost of overheated humans in the age of climate change? One of the inevitable consequences of climate change is that in most places temperatures will rise. This may seem welcome (at least for a while) in cooler regions, but most people live in temperate and tropical zones. When the Walt Disney Co. built Disney World in central Florida—it opened in 1971—the location was warm and sunny three seasons of the year, even if a little hot in the summer. Now, central Florida is not just a little hot in the summer; it has… Read more at: https://oilprice.com/The-Environment/Global-Warming/Climate-Change-and-Hard-Labor-The-Rising-Toll-on-Outdoor-Workers.html |

|

Understanding China’s Weakening Metal DemandVia Metal Miner The bears continued to make their way into the Rare Earths MMI (Monthly Metals Index), with yet another drop in price action, this time by 6.93%. Many factors pulled at rare earths prices overall, including oversupply, weak demand for metals within China and shifting dynamics in global rare earths supplies. It seems China’s over-production of rare earths continues to contribute to a massive supply glut, leading to cheaper prices and bearish sentiment. See why technical analysis is a superior forecasting methodology over fundamental… Read more at: https://oilprice.com/Metals/Commodities/Understanding-Chinas-Weakening-Metal-Demand.html |

|

Germany’s EV Sales Sink 37% as Subsidies EndThe biggest European car market, Germany, saw the sales of electric vehicles plummet by 36.8% in July from a year earlier, as EV sales are softening worldwide and as Berlin ended subsidies at the end of 2023. New car registrations of battery vehicle vehicles (BEVs) in Germany slumped to 30,762 vehicles in July from the same month of 2023, the latest data rom the German Federal Motor Transport Authority showed on Monday. July marked the largest annual drop in EV sales since the government ended subsidies for EV acquisitions in December 2023. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-EV-Sales-Sink-37-as-Subsidies-End.html |

|

Fact-Checking the Biden Administration’s SPR NarrativeOn July 29, multiple news outlets reported that the Biden Administration has replenished the 180 million barrels of oil it removed from the Strategic Petroleum Reserve. One headline read “U.S. Restores SPR to pre-2022 Levels.” An article in The Hill reported: “The Biden administration says it has replenished the 180 million barrels of oil it withdrew from the nation’s Strategic Petroleum Reserve in response to high prices following Russia’s invasion of Ukraine.” It is absolutely false that the SPR has been replenished.… Read more at: https://oilprice.com/Energy/Crude-Oil/Fact-Checking-the-Biden-Administrations-SPR-Narrative.html |

|

Nigeria Loses $1,000 per Barrel of Crude Oil It ExportsNigeria is losing $1,000 on every barrel of crude oil it exports, due to a lack of the added value from refining, Nigerian media quoted energy policy expert Henry Adigun as saying at a conference. This loss is no longer sustainable, Adigun said. The Nigerian federal government is supporting local refineries, but the regulator, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), is not empowered in its statutes to support a monopoly of fuel supply and distribution, the local newspaper The Sun quoted Adigun as saying. Nigeria… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Loses-1000-per-Barrel-of-Crude-Oil-It-Exports.html |

|

Big Tech’s Got a Conflict Minerals ProblemAccording to its conflict minerals report (CMR) for 2023, Amazon cannot rule out having sourced minerals from nine of ten African countries where human rights-violating militias finance themselves through mining. These countries are the Democratic Republic of the Congo, the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola. But, as Statista’s Florian Zandt shows in the chart below, the other four members of GAMAM, a group synonymous with the moniker Big Tech, also potentially… Read more at: https://oilprice.com/Metals/Commodities/Big-Techs-Got-a-Conflict-Minerals-Problem.html |

|

U.S. Gasoline Prices Continue to DropU.S. prices at the pump slid by 3.5 cents over the past week, hitting a national average of $3.44 per gallon on Monday and down 37.2 cents from a year ago, according to GasBuddy, as oil prices reel from three consecutive weeks of declines. The national average price per gallon at the U.S. pump is now down 5.6 cents from a month ago, with diesel prices also falling 2.3 cents last week and now resting at 39 cents lower than a year ago. “With oil prices plummeting due to new concerns over the U.S. economy after a poor jobs report,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Continue-to-Drop.html |

|

Oil Price Collapse Halted by Tensions in the Middle EastBrent crude and U.S. benchmark WTI fell by more than 3% on Friday and then continued to drop on Monday morning amid growing fears of a U.S. recession. The drop in oil prices has now been somewhat tempered by rising tensions in the Middle East. At 10:30 a.m. ET on Monday, Brent crude was trading down 0.86% at $76.15, while West Texas Intermediate (WTI) was trading down 1.03% at $72.76. Recession fears took charge early on Monday morning, with analysts largely determining that without swift U.S. interest rate cuts, economic growth will suffer and… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Price-Collapse-Tampered-by-Tensions-in-the-Middle-East.html |

|

U.S. Power Plants Hold the Highest Coal Stock Levels Since 2020U.S. electric power plants held a total of 138 million short tons of coal at the end of May, the highest level since the slump in power and coal demand at the start of the pandemic in early 2020, the U.S. Energy Information Administration (EIA) said on Monday. In recent years, coal stocks at power plants in the spring – when they are at the year’s highest in preparation for summer demand – have dropped from record highs due to the lower overall share of coal in U.S. power generation. For example, the U.S. power sector consumed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Power-Plants-Hold-the-Highest-Coal-Stock-Levels-Since-2020.html |

|

How Conflict in the Middle East Could Send Oil Prices SoaringEver since Hamas launched multiple coordinated attacks against Israel on 7 October last year, the Middle East has been on the verge of spiraling into an out-of-control regional and perhaps global conflict. Perhaps no time has looked potentially more perilous for the region and for those countries connected to it through politics, economics, or energy prices than right now. On 27 July, Iranian-backed Lebanese terrorist organization Hezbollah killed 12 children and young adults in a rocket strike on a playing field in the Israeli-occupied Golan Heights.… Read more at: https://oilprice.com/Energy/Energy-General/How-Conflict-in-the-Middle-East-Could-Send-Oil-Prices-Soaring.html |

|

Libya’s Largest Oilfield Halts ProductionSharara, the largest oilfield in Libya, fully halted oil production on Monday after output was curbed during the weekend due to protests, sources with knowledge of the field’s operations told Bloomberg. Sharara, which has the capacity to pump more than 300,000 barrels per day (bpd) of crude oil, last produced around 270,000 bpd on Saturday. However, the field began to gradually cut production on Saturday after workers at the oilfield were told to do so, according to Bloomberg’s anonymous sources. Earlier on Monday, Libya’s internationally… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Largest-Oilfield-Halts-Production.html |

|

European Natural Gas Prices Plunge by 5% Amid Commodity RoutEuropean benchmark natural gas prices plunged by 5% on Monday amid strong pipeline supply from Norway a broad sell-off in all markets amid fears of a worsening U.S. economy. The Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, was down by 5% to $38.16 (34.80 euros) per megawatt-hour (MWh) at 11:57 a.m. in Amsterdam. Gas prices in Europe had surged by 13% last week amid concerns about supply from the Mediterranean with the escalating tension between Israel and Iran. Stronger demand for liquefied natural gas (LNG) in Asia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Natural-Gas-Prices-Plunge-by-5-Amid-Commodity-Rout.html |

|

Woodside Buys U.S. Clean Ammonia Project for $2.35 BillionTwo weeks after announcing a major push into the U.S. LNG business, Australian group Woodside Energy said on Monday it would acquire a clean ammonia project in Texas for $2.35 billion in cash as it seeks to grow its lower-carbon offering and cut emissions from its products. Woodside will buy the OCI clean ammonia project in Beaumont, Texas. The project is under construction and targets the production of first ammonia from 2025 and lower carbon ammonia from 2026, the Australian energy group said in a statement on Monday. First ammonia production,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Woodside-Buys-US-Clean-Ammonia-Project-for-235-Billion.html |

|

Carlyle to Sell U.S. Power Plant Giant to Quantum Capital for $3 BillionGlobal investment firm The Carlyle Group has agreed to sell Cogentrix Energy, the owner of more than a dozen U.S. power plants, to private equity group Quantum Capital for $3 billion, the Financial Times reports. Carlyle bought the North American power generation assets held by Cogentrix Energy from Goldman Sachs Group back in 2012. Earlier this year, FT reported that Carlyle had hired investment bank Lazard and law firm Latham & Watkins to advise the group on a potential sale of Cogentrix. A transaction could value the power group at up to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Carlyle-to-Sell-US-Power-Plant-Giant-to-Quantum-Capital-for-3-Billion.html |

|

Dow tumbles 1,000 points, S&P 500 posts worst day since 2022 in global market sell-off: Live updatesThe U.S. stock market fell under pressure amid a broad global equity market sell-off. The losses come after the Nasdaq Composite fell into correction on Friday. Read more at: https://www.cnbc.com/2024/08/04/stock-market-today-live-updates.html |

|

Here are all the reasons why Monday’s major market wreck is happeningAny number of suspects could be blamed for Monday’s market beatdown. Read more at: https://www.cnbc.com/2024/08/05/here-are-all-the-reasons-why-mondays-major-market-wreck-is-happening.html |

|

$1 trillion wipeout: Market rout punishes megacap techThe seven most-valuable U.S. tech companies lost a combined $1 trillion in market value at the start of trading on Monday. Read more at: https://www.cnbc.com/2024/08/05/1-trillion-wipeout-market-rout-punishes-mega-cap-tech.html |

|

Google loses antitrust case over searchGoogle has illegally held a monopoly in search and text advertising, a federal judge ruled on Monday Read more at: https://www.cnbc.com/2024/08/05/google-loses-antitrust-case-over-search.html |

|

Wharton’s Jeremy Siegel says Fed needs to make an emergency rate cutWharton’s Jeremey Siegel called on the Fed to make an emergency 75 basis-point cut in the federal funds rate after Friday’s jobs report. Read more at: https://www.cnbc.com/2024/08/05/whartons-jeremy-siegel-says-fed-needs-to-make-an-emergency-rate-cut.html |

|

Warren Buffett’s decision to sell stocks and raise record cash before sell-off sends wake-up callMany Buffett watchers view the accelerated sale of his top holdings as a pessimistic call on the markets as well as the economy. Read more at: https://www.cnbc.com/2024/08/05/warren-buffetts-decision-to-sell-stocks-and-raise-record-cash-before-sell-off-sends-wake-up-call.html |

|

Some customers at Charles Schwab and other brokerage firms report issues logging in during market sell-offCharles Schwab said on Monday afternoon that the technical issue has been resolved. Read more at: https://www.cnbc.com/2024/08/05/charles-schwab-says-it-has-a-technical-issue-during-stock-market-sell-off.html |

|

Investors are unwinding the biggest ‘carry trade’ the world has ever seen, SocGen strategist saysCarry trades refer to trades wherein an investor borrows in a currency with low interest rates and reinvests the proceeds in higher-yielding assets elsewhere. Read more at: https://www.cnbc.com/2024/08/05/carry-trades-a-major-unwinding-is-underway-amid-a-stock-sell-off.html |

|

Bitcoin plunges sharply as recession fears drive global market sell-off: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Matt Hougan, chief investment officer at Bitwise Asset Management, discusses the steep drop in crypto markets amid a global market sell-off. Read more at: https://www.cnbc.com/video/2024/08/05/bitcoin-plunges-recession-fears-global-market-sell-off-crypto-world.html |

|

North Carolina AG office eyes Elon Musk’s pro-Trump PAC after voter data complaintAmerica PAC, which Elon Musk says he has created and is backing Donald Trump, treated users of its website differently in battleground states. Read more at: https://www.cnbc.com/2024/08/05/trump-elon-musk-pac-election-north-carolina.html |

|

Stocks making the biggest moves midday: Robinhood, Nvidia, Intel and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/08/05/stocks-making-the-biggest-moves-midday-hood-nvda-intc-and-more.html |

|

Wall Street’s ‘fear gauge’ — the VIX — hits highest level since the pandemic market plunge in 2020The Cboe Volatility Index briefly broke above 60 on Monday morning, up from about 23 on Friday. Read more at: https://www.cnbc.com/2024/08/05/wall-streets-fear-gauge-the-vix-rises-to-the-highest-since-2020.html |

|

Prepare for a new high-volatility market regimeKatie Stockton breaks down the CBOE Volatility Index. Read more at: https://www.cnbc.com/2024/08/05/prepare-for-a-new-high-volatility-market-regime.html |

|

Former Secret Service Chief Wanted To Destroy Cocaine EvidenceAuthored by Susan Crabtree via RealClearPolitics, Former Secret Service Director Kimberly Cheatle and others in top agency leadership positions wanted to destroy the cocaine discovered in the White House last summer, but the Secret Service Forensics Services Division and the Uniformed Division stood firm and rejected the push to dispose of the evidence, according to three sources in the Secret Service community.

Multiple heated confrontations and disagreements over how best to handle the cocaine ensued after a Secret Services Uniformed Division officer found the bag on July 2, 2023, a quiet Sunday while President Biden and his family were at Camp David in Maryland, the sources said. At least one Uniformed Division officer was initially assigne … Read more at: https://www.zerohedge.com/political/former-secret-service-chief-wanted-destroy-cocaine-evidence |

|

Iraq Base Housing American Forces Comes Under Brief Rocket AttackUpdate(1519ET): While this doesn’t yet look like the start of the big attack that the world has been on edge about, rockets have hit Iraq’s Ain al-Asad air base, which hosts American and international soldiers, during the evening hours of Monday (local time). “Two Katyusha rockets were fired at Iraq’s Ain al-Asad air base on Monday, which hosts US and other international forces in western Iraq, security sources said,” Reuters reports, citing sources who say at least one rocket landed inside the base and that casualties or damage are as unclear at this point.

Over the weekend Israeli Prime Minister Netanyahu warned that a multi-front war is on the horizon, involving Hezbollah, the Houthis, and Iraqi paramilitary groups – all supported by Iran. For this reason (the possibility of a ‘five-front’ war) as well as deep internal divides inside Israel, US-based geopolitical strategist and professor of international relations at the University of Ch … Read more at: https://www.zerohedge.com/geopolitical/iran-says-it-must-punish-israel-wont-be-dissuaded-biden-hold-situation-room-meeting |

|

Alphabet Shares Tumble After Losing DoJ Antitrust Suit Over SearchIn what could be a ground-breaking victory for the Justice Departments, a federal judge ruled Monday that Google’s payments to make its search engine the default on smartphone web browsers violates US antitrust law. As Bloomberg reports, Judge Amit Mehta in Washington said that the Alphabet Inc. unit’s $26 billion in payments effectively blocked any other competitor from succeeding in the market The Justice Department and states had sued Google, accusing it of illegally cementing its dominance, in part, by paying other companies, like Apple and Samsung, billions of dollars a year to have Google automatically handle search queries on their smartphones and web browsers.

Having recovered some of the losses overnight, this new DoJ headline has smacked GOOGL shares back down near the lows of the day (down around 6%)… Read more at: https://www.zerohedge.com/markets/alphabet-shares-tumble-after-losing-doj-antitrust-suit-over-search |

|

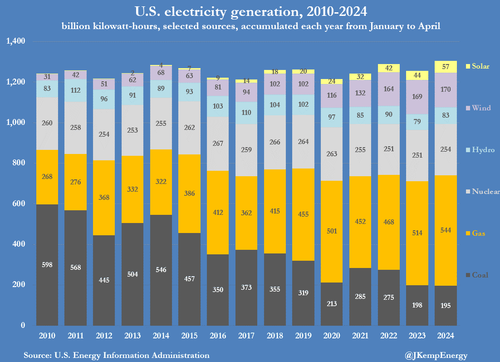

US Power Producers Binge On Ultra-Cheap GasBy John Kemp, Senior Energy Analyst U.S. electricity generators consumed a record amount of gas in the first four months of the year as prices slumped to the lowest level in real terms for more than half a century. Ultra-low prices encouraged more power production from some of the least-efficient single-cycle gas and steam turbines at the expense of coal.

But record combustion by generators made little impact on swollen gas inventories amid continued growth in gas production and sluggish exports. Generators produced a record 1,334 billion kilowatt-hours (kWh) between January and April, according to the latest data from the U.S. Energy Information Administration. Read more at: https://www.zerohedge.com/markets/us-power-producers-binge-ultra-cheap-gas |

|

Google’s monopoly of online searches is illegal, US judge rulesThe decision could reshape how technology giants do business in the future. Read more at: https://www.bbc.com/news/articles/c0k44x6mge3o |

|

Is the US really heading for recession?Weak jobs figures have spooked stock markets but does this mean a downturn is on the way? Read more at: https://www.bbc.com/news/articles/cvgdd0xvxd7o |

|

US stocks tumble on fears over slower growthUS stock markets follow Asia and Europe down, amid fears of a downturn in the American economy. Read more at: https://www.bbc.com/news/articles/c6p224j24x0o |

|

Vedanta Q1 Preview: Revenue may go up by up to 15% YoY; 59% uptick in EBITDA seenNuvama has projected the highest adjusted PAT figure for Vedanta but anticipates a 30.8% decline in net profit growth. In contrast, Kotak and Phillip forecast PAT growth of up to 242% year-on-year. Kotak has the highest revenue estimate at Rs 38,674 crore, expecting an over 15% year-on-year increase. The company will announce its earnings on Tuesday, August 6. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/vedanta-q1-preview-revenue-may-go-up-by-up-to-15-yoy-59-uptick-in-ebitda-seen/articleshow/112295405.cms |

|

Holding on to cash, next market sell-off will be worst in lifetime, warns Jim RogersVeteran investor Jim Rogers anticipates a severe financial collapse due to rising global debt. Rogers disclosed holding substantial cash reserves. Warren Buffett’s Berkshire Hathaway also increased cash holdings to $277 billion following significant stock sales. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/holding-on-to-cash-next-market-sell-off-will-be-worst-in-lifetime-warns-jim-rogers/articleshow/112289848.cms |

|

Japan’s Nikkei enters bear market zone with 26% dip but Nifty down only 4% from peakWhile Nifty’s nearly 4% fall from its peak over the last couple of sessions rests on imported factors, its Asian peer Nikkei 225 has plunged by 26% and entered a bear market on setback to its yen carry trade, following Bank of Japan’s decision to hike policy rate by 25 bps. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/japans-nikkei-enters-bear-market-zone-with-26-dip-but-nifty-down-only-4-from-peak/articleshow/112293717.cms |

|

‘She’s now down to her last few dollars’: My friend quit her job, blew her inheritance and will take vacations using credit cards. Will she ever see sense?“She has over $70,000 in her retirement fund, but says that’s for emergencies.” Read more at: https://www.marketwatch.com/story/shes-now-down-to-her-last-few-dollars-my-friend-quit-her-job-blew-her-inheritance-and-will-take-vacations-using-credit-cards-will-she-ever-see-sense-f94bd271?mod=mw_rss_topstories |

|

10-year Treasury yield ends at lowest level since July 2023 as recession fears lingerThe yield on the 10-year Treasury finished at its lowest level in more than a year on Monday as worries about a U.S. recession persisted, despite data which showed the services side of the economy continued to grow last month. Read more at: https://www.marketwatch.com/story/bond-yields-continue-to-slide-on-expectations-of-aggressive-fed-easing-104c1b81?mod=mw_rss_topstories |

|

Oil prices end lower as global stock-market rout sparks sellingOil futures finished with losses but off their session lows on Monday, pulled down by a continued rout in global equity markets sparked by fears that the U.S. economy may be heading toward recession. Read more at: https://www.marketwatch.com/story/oil-prices-sharply-lower-as-global-stock-market-rout-sparks-selling-5274e149?mod=mw_rss_topstories |