Summary Of the Markets Today:

- The Dow closed down 611 points or 1.51%,

- Nasdaq closed down 2.43%,

- S&P 500 closed down 1.84%,

- Gold $2,479 down $1.10,

- WTI crude oil settled at $74 down $2.41,

- 10-year U.S. Treasury 3.799 down 0.178 points,

- USD index $103.21 down $1.210,

- Bitcoin $62,550 down $2,747 or 4.21%,

- Baker Hughes Rig Count: U.S. -3 to 586 Canada +8 to 219

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

The US stock market experienced a significant downturn today following the release of the July jobs report, which indicated further cooling in the labor market. This development has intensified concerns about a potential recession and raised questions about the Federal Reserve’s interest rate strategy. Key points from the market reaction:

Economic concerns:

- The weak jobs report has fueled fears of an economic slowdown

- Investors are worried that the Federal Reserve may have maintained high interest rates for too long

Interest rate expectations:

- Market forecasts now indicate a higher likelihood of a 0.5 percentage point rate cut in September

- Treasury yields declined, with the 10-year yield falling below 4%

Tech sector impact:

- Intel’s stock plummeted by 29% following disappointing guidance and layoff announcements

- Amazon’s shares fell by 12.5% after missing quarterly financial projections

Broader economic indicators:

- Factory orders declined by 3.3%, the largest drop since April 2020

- Manufacturing activity and construction spending were lower than expected

The market reaction reflects growing uncertainty about the economic outlook and concerns that the Federal Reserve’s monetary policy may be too restrictive, potentially risking a “hard landing” for the economy.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

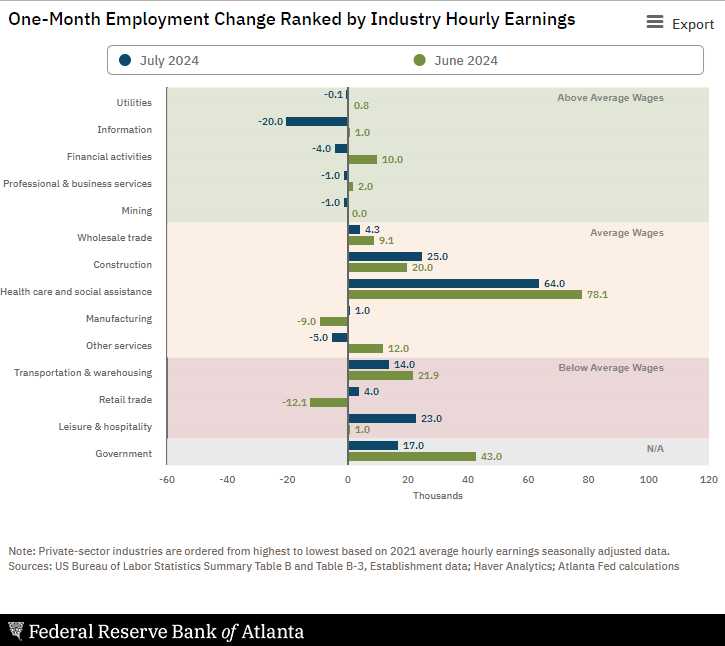

The unemployment rate rose to 4.3% in July 2024, and nonfarm payroll employment grew by 114,000 – the second-worst growth this year. Employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs (see employment change bar chart in second graph below). The household survey (which produces the unemployment rate) shows employment growth of only 67,000 – versus the headline establishment survey’s 114,000 (see red bar on graph below). Further, the primary reason for the significant jump in the unemployment rate is because the household survey added 420,000 people to the workforce – not that a lot of people lost their jobs. Looking at the employment-population ratio which has been worsening since April 2024, it declined this month and remains below the levels seen from 2018 to 2020. Also from the establishment survey, Over the last year – the number of people unemployed has increased 380,000 or 21% year-over-year. To say the economy is stumbling at this point may turn out to be an understatement.

Contrary to the June 2024 Federal Reserve Industrial Production 1.1% year-over-year growth, the US Census manufacturing data shows new orders for manufactured goods in June 2024 declined 5.2% year-over-year. This data moves industrial production into a significant recession in June 2024, and early data has July 2024 manufacturing data also in a recession. Remember that imports are increasing which only suggests that despite the current policy to increase US manufacturing – manufacturing is leaving the country.

Here is a summary of headlines we are reading today:

- U.S. Oil and Gas Drilling Activity Slows Amidst Price Plunge

- Imperial Oil Q2 Earnings Surge by 68%

- Chevron Ditches California for Texas

- The Risk of a Regional War in the Middle East

- Dow closes down 600 points, Nasdaq enters correction after weak jobs report: Live updates

- Intel heads for worst day on Wall Street in 50 years, falls to lowest price in over a decade

- Mortgage rates plunge to the lowest level in over a year after weak employment report

- Berkshire’s mounting cash pile could top $200 billion as Buffett continues selling stock

- Car Repos Rise 23% YoY

- Financial Strain On American Households Hits Retailers Hard

- Recession fears fuel swings in interest-rate expectations and 2-year Treasury yield

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Aston Martin Raises £135m Debt for Production ExpansionAston Martin has raised £135m through a debt placing as it looks to shore up the balance sheet ahead of a production ramp-up later this year. The marque said it had raised around $90m (£70.7m) by issuing 10 percent senior secured notes and a further £65m through 10.4 percent senior secured notes, due to mature in 2029. Net proceeds from the offering are expected to be used by Aston Martin to repay borrowings under its existing super senior revolving credit facility. The carmaker has struggled for years under a burgeoning debt… Read more at: https://oilprice.com/Energy/Energy-General/Aston-Martin-Raises-135m-Debt-for-Production-Expansion.html |

|

U.S. Oil and Gas Drilling Activity Slows Amidst Price PlungeThe total number of active drilling rigs for oil and gas in the United States fell this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 3 to 586 this week, compared to 659 rigs this same time last year. The number of oil rigs stayed the same this week, after gaining five rigs in the week prior. Oil rigs now stand at 482—down by 43 compared to this time last year. The number of gas rigs fell by 3 this week to 98, a loss of 30 active gas rigs from this time last year. Miscellaneous rigs stayed… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-and-Gas-Drilling-Activity-Slows-Amidst-Price-Plunge.html |

|

OPEC+ to Reevaluate Production Cuts as Brent Crude Prices FalterOPEC maintained steady oil production in July, averaging 26.99 million barrels per day—a slight decrease of 60,000 bpd from June levels, according to a Bloomberg survey. Venezuela and Iran accounted for most of the 60,000 bpd dip, with both countries experiencing decreased demand from China. OPEC and its allies held a monitoring meeting earlier this week as the group hopes to gradually unwind its production cuts starting in Q4. OPEC has cautioned, however, that any changes to its planned supply increases will depend on market conditions.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-to-Reevaluate-Production-Cuts-as-Brent-Crude-Prices-Falter.html |

|

Imperial Oil Q2 Earnings Surge by 68%Canadian producer Imperial Oil saw its net profit soar by 68% in the second quarter from year-ago levels as the highest second-quarter production in over 30 years and narrowing Canadian crude price discounts to the U.S. benchmark more than offset weaker refining results. Imperial Oil, majority owned by U.S. supermajor ExxonMobil, reported on Friday a net income of US$818 million (C$1.133 billion) for the second quarter, up from US$488 million (C$675 million) for the second quarter of 2023. Cash flow from operating activities also jumped as Imperial… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Imperial-Oil-Q2-Earnings-Surge-by-68.html |

|

Chevron Ditches California for TexasAfter more than a century of operations in California, energy giant Chevron announced that it will move its San Ramon headquarters to Houston, Texas. Bloomberg states the move was primarily due to the state’s “adversarial” regulations toward the fossil fuel industry. Chevron’s move is more evidence the multi-year mass exodus of companies and residents fleeing the high tax and high crime state is still underway. “There will be minimal immediate relocation impacts to other employees currently based in San Ramon. The company expects all corporate… Read more at: https://oilprice.com/Energy/Energy-General/Chevron-Ditches-California-for-Texas.html |

|

Exxon Delays Startup of $10-Billion Golden Pass LNG Export ProjectExxonMobil is delaying the start-up of its joint venture Golden Pass LNG export project in Texas to late 2025 from the first half of next year after work at the facility stalled following the bankruptcy of the lead contractor, Exxon’s CFO Kathy Mikells told Bloomberg in an interview on Friday. The delay in the timeline for the start-up means that Exxon and its partner in the project, Qatar’s state firm QatarEnergy, will launch the export plant about six months later than originally scheduled, Mikells told Bloomberg. In a setback for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Delays-Startup-of-10-Billion-Golden-Pass-LNG-Export-Project.html |

|

Oil Prices Fall Back as Demand Concerns ReturnOil prices were dropping on Friday morning as traders returned to focus on demand concerns in the light of no immediate escalation in the Middle East following Iran’s assassination of Hamas’ political leader.Friday, August 2nd, 2024With the OPEC+ meeting failing to surprise the markets this week, the sudden escalation of geopolitical tensions after Israel’s strike in Lebanon and the assassination of Hamas leader Ismail Haniyeh in Iran could have sent oil prices soar. Instead, the lack of an Iranian retaliation and continuous demand… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Fall-Back-as-Demand-Concerns-Return.html |

|

Exxon Tops Q2 Estimates on Record Permian and Guyana ProductionExxonMobil (NYSE: XOM) beat Wall Street estimates with the second-highest earnings for the second quarter in a decade as the acquisition of Pioneer Natural Resources fueled a record quarterly production and the highest oil production since the Exxon and Mobil merger. Exxon said on Friday that its second-quarter 2024 earnings came in at $9.2 billion, or $2.14 per share assuming dilution. That was higher than the analyst estimate of $2.02 compiled by The Wall Street Journal. The $60-billion Pioneer acquisition, which Exxon completed during the second… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Tops-Q2-Estimates-on-Record-Permian-and-Guyana-Production.html |

|

Saudi Arabia’s Economy Struggles With OPEC+ CutsFears of Middle Eastern Flareups Prompt Traders to Hedge Bets – Israel’s assassination of a top Hezbollah commander in Beirut and Hamas leader Ismail Haniyeh in Tehran has raised the geopolitical risk premium in oil prices as potential retaliation from Iran could prompt a new spiral of escalation in the Middle East. – According to Bloomberg, more than 300,000 Brent call option contracts were traded on Wednesday, the largest single-day volume since Israel’s April attack on the Iranian consulate in Damascus. – The traded volume… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabias-Economy-Struggles-With-OPEC-Cuts.html |

|

A Week of Turmoil in Oil MarketsThe crude oil market experienced significant volatility this week, with prices spiking due to a combination of geopolitical tensions and supply concerns, but ultimately being held back by demand uncertainty. Middle East Powder Keg Ignites Oil Rally The week began with oil prices edging lower, but geopolitical events quickly took center stage. On Wednesday, oil futures surged by over $2 a barrel following the assassination of Hamas leader Ismail Haniyeh in Iran. This event, coupled with the killing of a senior Hezbollah commander in Beirut the day… Read more at: https://oilprice.com/Energy/Energy-General/A-Week-of-Turmoil-in-Oil-Markets.html |

|

Protests in Venezuela After Maduro Claimed Victory in Disputed ElectionPolitics, Geopolitics & Conflict Deadly protests have ensued following Maduro’s claim of victory in Sunday’s presidential elections in Venezuela. Venezuela has already cut diplomatic ties with Peru for questioning the election results, and Colombia is now also pressuring Maduro, while the opposition is watching its window of opportunity steadily close. Opposition leaders claim that they have had access to 90% of the votes and by their count, Edmundo Gonzalez won twice as many votes as Maduro. The streets of Venezuela are waiting… Read more at: https://oilprice.com/Energy/Energy-General/Protests-in-Venezuela-After-Maduro-Claimed-Victory-in-Disputed-Election.html |

|

The Risk of a Regional War in the Middle EastOil markets now view the Middle East conflict as having escalated to its most dangerous point since October 7th, and Iran’s anticipated response to the killing of the leader of Hamas will now determine whether this is going to be a full-blown regional (or wider) war. Early on Wednesday, Israel assassinated Hamas leader Ismail Haniyeh. The fact that Haniyeh was assassinated on Iranian territory cannot go unanswered, putting Tehran in a very difficult position. It has no choice but to respond, and the response will need to be proportional.… Read more at: https://oilprice.com/Energy/Energy-General/The-Risk-of-a-Regional-War-in-the-Middle-East.html |

|

Russia’s Drilling Activity Slumps From Record High Amid OPEC+ CutsRussia’s oil industry has slowed drilling activity this year from the record highs seen in 2023, as Moscow is limiting production as part of the OPEC+ deal and working to boost its compliance rate. In the first half of 2024, rigs employed by Russian oil companies drilled a total of 14,370 kilometers (8,930 miles) of production wells in Russia, down by 2.5% compared to January-June 2023, industry data seen by Bloomberg News showed on Friday. Drilling at Russia’s oil production wells likely beat a post-Soviet record in 2023, industry… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Drilling-Activity-Slumps-From-Record-High-Amid-OPEC-Cuts.html |

|

Chevron Misses Q2 Earnings EstimatesChevron Corporation (NYSE: CVX) booked second-quarter earnings below analyst expectations, weighed down by lower refining margins and weak natural gas prices, as it announced the relocation of the company’s headquarters from San Ramon, California, to Houston, Texas. The U.S. oil and gas supermajor reported on Friday earnings of $4.4 billion, for second quarter 2024, or $2.43 per diluted share, down from $6.0 billion in earnings and $3.20 EPS for the same period of 2023. The Q2 2024 earnings per share came in below the analyst consensus view… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Misses-Q2-Earnings-Estimates.html |

|

Oil Trading Giant Vitol to Buy Asian Trader Noble ResourcesVitol has agreed to buy Asian energy products and industrial raw materials trader Noble Resources Trading Limited for $209 million, the world’s largest independent oil trader said on Friday. Vitol will acquire Noble Resources at a purchase price equivalent to $0.63 per share on a debt-free / cash-free basis, which works out to around $208.9 million, the Singapore-listed company said. The transaction, which is subject to customary conditions precedent, is expected to close before the end of 2024. Noble Resources is one of Asia’s leading… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Trading-Giant-Vitol-to-Buy-Asian-Trader-Noble-Resources.html |

|

Dow closes down 600 points, Nasdaq enters correction after weak jobs report: Live updatesStocks slid Friday as a much weaker-than-anticipated jobs report for July ignited worries that the economy could be falling into a recession. Read more at: https://www.cnbc.com/2024/08/01/stock-market-today-live-updates.html |

|

Google pulls AI ad for Olympics following backlashGoogle was criticized for using artificial intelligence to write a fan letter to an Olympic athlete. Read more at: https://www.cnbc.com/2024/08/02/google-pulls-ai-ad-for-olympics-following-backlash.html |

|

Job growth totals 114,000 in July, much less than expected, as unemployment rate rises to 4.3%Nonfarm payrolls were expected to increase by 185,000 in July, according to the Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2024/08/02/job-growth-totals-114000-in-july-much-less-than-expected-as-unemployment-rate-rises-to-4point3percent.html |

|

Intel heads for worst day on Wall Street in 50 years, falls to lowest price in over a decadeIntel shares cratered on Friday, dragging down Asian stocks including Samsung and TSMC as well as other chipmakers. Read more at: https://www.cnbc.com/2024/08/02/intel-share-plunge-drags-down-global-chip-stocks-from-tsmc-to-samsung.html |

|

Mortgage rates plunge to the lowest level in over a year after weak employment reportThe recent high on the 30-year fixed mortgage was 7.52% in late April, and home sales have been falling ever since. Read more at: https://www.cnbc.com/2024/08/02/mortgage-rates-lowest-level-in-a-year.html |

|

These stocks have fallen too much, too fast and could be due for a rebound after broad market sell-offCrowdstrike is one of this week’s most oversold names. Read more at: https://www.cnbc.com/2024/08/02/these-stocks-have-fallen-too-much-too-fast-and-could-be-due-for-a-rebound-after-broad-market-sell-off.html |

|

Kamala Harris raised $310 million in July, dwarfing Trump haul for monthVice President Kamala Harris saw a fundraising boom after President Joe Biden endorsed her candidacy against Donald Trump, the Republican nominee. Read more at: https://www.cnbc.com/2024/08/02/harris-campaign-fundraise-trump-election.html |

|

Ex-Google engineers who founded Character.AI re-join company with new AI partnershipOne of the founders previously criticized the tech giant for moving too cautiously to release AI products. Read more at: https://www.cnbc.com/2024/08/02/ex-google-engineers-from-characterai-re-join-company-with-ai-partnership-.html |

|

Delta CEO offers employees free flights after CrowdStrike-Microsoft chaosCEO Ed Bastian earlier this week said the massive IT outage cost the company about $500 million. Read more at: https://www.cnbc.com/2024/08/02/delta-ceo-offers-employees-free-flights-after-crowdstrike-microsoft-chaos.html |

|

Here’s where the jobs are for July — in one chartHiring in the U.S. slowed significantly last month with information and financial sectors leading the job losses. Read more at: https://www.cnbc.com/2024/08/02/heres-where-the-jobs-are-for-july-in-one-chart.html |

|

How an Elon Musk PAC is using voter data to help Trump beat Harris in 2024 electionTesla CEO Elon Musk says he created America PAC, which collects data in swing states key to the 2024 election between Donald Trump and Kamala Harris. Read more at: https://www.cnbc.com/2024/08/02/elon-musk-pac-voter-data-trump-harris.html |

|

Berkshire’s mounting cash pile could top $200 billion as Buffett continues selling stockThe Omaha-based conglomerate’s cash hoard is likely to exceed its previous record of $189 billion when it reports quarterly earnings Saturday. Read more at: https://www.cnbc.com/2024/08/02/berkshires-cash-pile-could-top-200-billion-as-buffett-sells-stock.html |

|

Kamala Harris’ tax records reveal ‘fairly basic’ approach that may have missed savings, advisor saysAs the de facto Democratic nominee, Vice President Kamala Harris’ financial records are under fresh scrutiny. Here’s what to know about her tax returns. Read more at: https://www.cnbc.com/2024/08/02/kamala-harris-tax-records-reveal-fairly-basic-approach-experts-say.html |

|

Harris Has Enough Virtual Votes To Be Democratic NomineeTo the surprise of nobody, Vice President Kamala Harris has passed the threshold required to become the Democratic presidential nominee.

During a Friday Democratic National Committee (DNC) virtual roll call vote just two weeks after President Joe Biden was coup’d out of the race, Harris, who ran unopposed, secured the minimum required 2,350 votes after the roll call began at 9 a.m. on Thursday. “I am honored to be the presumptive Democratic nominee for President of the United States and I will tell you, the tireless work of our delegates, our state leaders, and our staff has been pivotal to making this moment possible,” Harris – or whoever wrote that, said in a Friday statement, adding that she will officially accept the nomination next week after the virtual voting period ends. “As chair of this great party, as chair of this party that is built on hope, I am so proud to confirm that Vice President Harris has earned more than a major … Read more at: https://www.zerohedge.com/political/harris-has-enough-virtual-votes-be-democratic-nominee |

|

Car Repos Rise 23% YoYAuthored by Martin Armstrong via ArmstrongEconomics.com, The private debt crisis is becoming apparent in America after car repossessions jumped 23% during the first half of 2024. Data shows that 1.6 million Americans will have their car repossessed by the bank before the end of the year, a slight increase from the 1.5 million autos repossessed in 2023 and a drastic upturn from the 1.1 million in 2021.

Obviously, the cost of purchasing a car have drastically risen with inflation, interest hikes, and supply chain shortages. Americans simply cannot afford new autos and car dealerships can do nothing to entice purchases. New car inventory in the US rose 36% this year, close to February 2021 levels before the supply chain crisis put a dent in imports. Yet, the average list price of a new car is $49,096 and far more than the average American can afford. The average new vehicle will sit in a dea … Read more at: https://www.zerohedge.com/personal-finance/car-repos-rise-23-yoy |

|

XY Marks The Spot: Second Olympic Boxer Who Failed Gender Test Beats Woman To TearsOn Thursday we reported that one of two boxers banned from competing by the International Boxing Association (IBA), Algerian Imaine Khelif, brutalized a female opponent at the 2024 Olympics in Paris – hitting her so hard that she quit the match just 46 seconds in after taking two massive shots to the head.

Now, the second boxer banned by the IBA, Taiwan’s Lin Yu-Ting, easily dispatched with another female boxer – Uzbek Sitora Turdibekova, similarly reducing her to tears.

|

|

Financial Strain On American Households Hits Retailers HardAuthored by Michael Wilkerson via The Epoch Times, If anyone still believes that the U.S. economy is doing just fine, they should take a closer look at what is happening to the retailers that depend upon the faithful American consumer to “shop, shop, shop” to keep the economy afloat. American consumers are rapidly running out of firepower, and now, so too are the retailers that depend on them.

Consumer Spending CutsAmerican consumers, increasingly overextended on credit card debt, and having depleted their pandemic-accumulated savings, have started to close their wallets to all but essential, non-discretionary purchases such as food and fuel. The portion of surveyed Americans who state a positive intent to purchase big ticket items such as a home, an automobile, or a major appliance has fallen substantiall … Read more at: https://www.zerohedge.com/personal-finance/financial-strain-american-households-hits-retailers-hard |

|

TikTok sued for ‘massive’ invasion of child privacyThe US says TikTok obstructed parents trying to cancel their children’s accounts. Read more at: https://www.bbc.com/news/articles/cllyl14mr8lo |

|

Stock markets plunge as weak US jobs fuel fearsWorse-than-expected employment data adds to concerns that the US is facing a slowdown. Read more at: https://www.bbc.com/news/articles/c7202xvpwn5o |

|

Rolls-Royce to give each worker £700 in sharesThe reward to staff comes after the business, which makes jet engines, posted strong profits. Read more at: https://www.bbc.com/news/articles/c51y1eqpqwxo |

|

Britannia Q1 Results: Cons PAT jumps 10.5% YoY to Rs 506 crore, misses estimatesBritannia on Friday reported a 10.5% YoY rise in its June quarter consolidated profit to Rs 506 crore while revenue rose 4% YoY to Rs 4,130 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/britannia-q1-results-cons-pat-jumps-10-5-yoy-at-rs-506-crore-revenue-rises-4/articleshow/112225995.cms |

|

Delhivery Q1 Results: Company swings to black, posts Rs 54 crore profit, revenue jumps 12% YoYDelhivery Q1 Results Q1FY25: Its revenue from services jumped 12.6% year-on-year (YoY) to Rs 2,172 crore, up from Rs 1,930 crore in the same quarter of the previous year. | Quarterly Reports Latest News Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/delhivery-q1-results-company-swings-to-black-posts-rs-54-crore-profit-vs-loss-a-year-ago/articleshow/112224544.cms |

|

Options trading on expiry day like playing in casino for jackpot: Sebi officialRaising the red flag over the heightened retail frenzy in the zero-sum game of options trading, markets regulator Sebi’s whole-time member Ananth Narayan on Friday pointed out how some traders are treating expiry day trading as playing in a casino for a jackpot. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/options-trading-on-expiry-day-like-playing-in-casino-for-jackpot-sebi-official/articleshow/112225450.cms |

|

2-year Treasury yield sinks to lowest closing level since May 2023 after soft July jobs reportTreasury yields plummeted on Friday, sending the policy-sensitive 2-year yield down by the most in more than a year, after a weaker-than-expected July jobs report boosted traders’ expectations for aggressive interest-rate cuts by the Federal Reserve. Read more at: https://www.marketwatch.com/story/treasury-yields-slip-further-on-economic-fears-ahead-of-u-s-jobs-report-f6ee634b?mod=mw_rss_topstories |

|

Recession fears fuel swings in interest-rate expectations and 2-year Treasury yieldRecession fears, a growth scare, and a Federal Reserve policy mistake. A combination of all three things gripped the U.S. government debt and interest-rate corners of the financial market on Friday, as traders weighed two days of weaker-than-expected data and translated that into large swings in fed-funds futures and the yield on the policy-sensitive 2-year Treasury note. Read more at: https://www.marketwatch.com/story/recession-fears-fuel-swings-in-interest-rate-expectations-and-2-year-treasury-yield-21a5467f?mod=mw_rss_topstories |

|

Money is flowing into big-bank bonds as a haven from Friday’s stock-market plungeThe market movements suggest that investors are selling stocks and putting the money into bank bonds in search of yield. Read more at: https://www.marketwatch.com/story/capital-is-flowing-into-big-money-center-bank-bonds-during-stock-market-plunge-563d924a?mod=mw_rss_topstories |