Summary Of the Markets Today:

- The Dow closed up 81 points or 0.20%,

- Nasdaq closed down 0.93%,

- S&P 500 closed down 0.51%,

- Gold $2,362 down $53.40,

- WTI crude oil settled at $78 up $0.51,

- 10-year U.S. Treasury 4.251 down 0.049 points,

- USD index $104.40 down $0.01,

- Bitcoin $64,663 down $703 or 1.08%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

- Dow leads stock comeback from steep sell-off: The focus is shifting to the economy as GDP and jobless reports exceed expectations .

- US economy booms as GDP growth blows past expectations: The GDP grew at a 2.8% annualized rate in Q2, much higher than economists expected .

- Stellantis stock sinks on results, following rivals GM, Ford: Stellantis’ stock performance in light of recent results .

- Chipotle to splurge on bigger portions to keep diners happy: Chipotle’s strategy to maintain customer satisfaction .

- Flamin’ Hot Cheetos dispute winds up in court: Legal issues surrounding the popular snack .

- US 30-year fixed-rate mortgage edges up to 6.78%, Freddie Mac says: Latest mortgage rate figures from Freddie Mac .

- OpenAI announces AI-powered search tool SearchGPT: Launch of OpenAI’s new search tool, SearchGPT .

- Workers at GM seat supplier in Missouri reach tentative agreement, end strike: Resolution of the strike at a GM seat supplier .

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies surged 97% to 234 in June from 119 in May. It is up 98% from 118 CEO exits recorded in the same month last year. The perspective from Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc:

Leaders are anticipating a sea change as we enter the second half of this year, perhaps politically, but certainly technologically. New leadership is often necessary during periods of change.

The advance estimate of 2Q2024 Real gross domestic product (GDP) increased at an annual rate of 3.1% year-over-year. In the first quarter, real GDP increased 2.9% year-over-year. The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. On the other hand, inflation marginally worsened with the implicit price deflator rose to 2.6% year-over-year from last quarter’s 2.4%. Advance estimates can be significantly different than the “final” GDP growth numbers. As I have previously stated – inflation is not going away.

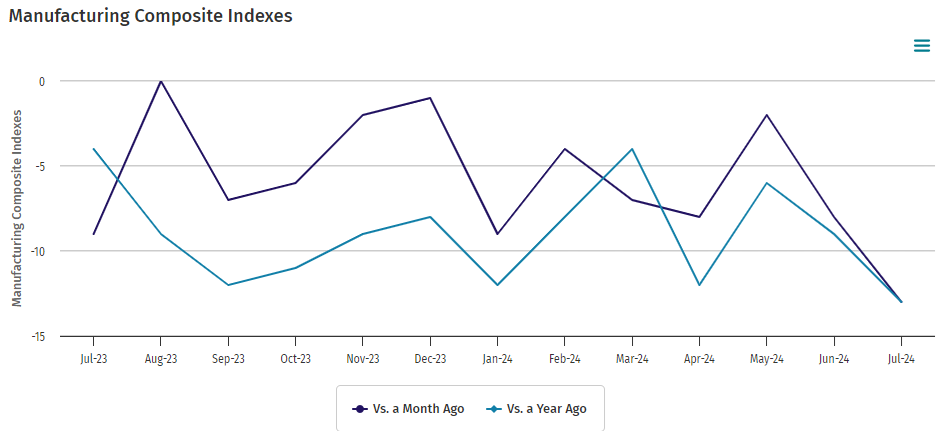

New orders for manufactured durable goods in June 2024 declined 10.2% year-over-year from the 1.5% decline last month The decline can be laid on civilian aircraft (Boeing) but there were no bright spots as manufacturing continues to fade.

Here is a summary of headlines we are reading today:

- China’s Rare Earths Strategy, Explained

- Grid-Enhancing Technologies: The Answer to Growing Power Needs?

- U.S. Boosts Natural Gas Power as Wind Output Slumps to 33-Month Low

- U.S. Hits Record High Electricity Generation From Natural Gas

- Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

- S&P 500, Nasdaq close lower Thursday as tech comeback attempt falters: Live updates

- Lineage begins trading in the market’s largest IPO of 2024

- Ford shares, on pace for worst day since 2008, lead autos rout after company’s disappointing earnings

- Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day sale

- Bitcoin sinks to $64,000 level alongside tech stock rout: CNBC Crypto World

- Southwest to get rid of open seating, offer extra legroom in biggest shift in its history

- ChatGPT reveals search feature in Google challenge

- This bond-market signal of impending recessions went on a wild ride. Here’s its message.

- 10-, 30-year Treasury yields end lower for second time in three sessions despite solid U.S. GDP data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Rare Earths Strategy, ExplainedVia Metal Miner Chinese geologists recently discovered two new minerals – oboniobite and scandio-fluoro-eckermannite – at Inner Mongolia’s Bayan Obo, the world’s largest rare earths mine. According to media reports, the discovery was a joint effort by the CAS Institute of Geology and Geophysics, Inner Mongolia Baotou Steel Union Co., Ltd., Baotou Research Institute of Rare Earths, and Central South University. As announced by Li Xianhua from the CAS Institute of Geology and Geophysics, the International Mineralogical… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Rare-Earths-Strategy-Explained.html |

|

Tajikistan’s Debt Crisis Risk Tied to Rogun Dam, World Bank CautionsA new World Bank report gives Tajikistan passing grades for its present economic performance but cautions that an excessive state role in the economy poses a significant threat to continuing stability. The bank’s report on Tajikistan specifically focuses on “the impact of enterprises with state participation and competitive neutrality.” It starts with praise, noting that the Tajik economy grew by 8.3 percent in 2023 and 8.2 percent during the first quarter of this year. Growth, the report adds, was driven by increased revenue… Read more at: https://oilprice.com/Energy/Energy-General/Tajikistans-Debt-Crisis-Risk-Tied-to-Rogun-Dam-World-Bank-Cautions.html |

|

Valero Energy Sees Q2 Net Income Cut in HalfValero Energy Corporation (NYSE: VLO) announced its financial results for the second quarter of 2024, revealing a notable decrease in net income. The company reported net income attributable to Valero stockholders of $880 million, or $2.71 per share, down significantly from $1.9 billion, or $5.40 per share, in the same period last year. In the refining sector, Valero saw a decline in operating income to $1.2 billion from $2.4 billion in Q2 2023. Despite this, the company highlighted robust performance in its U.S. wholesale system, with sales surpassing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Valero-Energy-Sees-Q2-Net-Income-Cut-in-Half.html |

|

China Begins Work on Massive Afghan Copper MineChinese engineers and the Taliban government officially started work on a massive project in Afghanistan to mine the world’s second-largest deposit of copper. At the July 24 event at Mes Aynak, some 40 kilometers southeast of the capital, Kabul, Taliban officials along with Chinese businessmen and diplomats carried out a ribbon-cutting ceremony as work began on the construction of a road to the mining site. A $3 billion deal signed in 2008 gave the Chinese state-owned China Metallurgical Group Corporation (MCC) a 30-year mining concession, but… Read more at: https://oilprice.com/Metals/Commodities/China-Begins-Work-on-Massive-Afghan-Copper-Mine.html |

|

Grid-Enhancing Technologies: The Answer to Growing Power Needs?Authored by Andrew Phillips via RealClearEnergy, The rise of AI data centers, growing electrification, and industrial growth is heralding a new era of U.S. power consumption. As our country advances, so too must our power grid. Building new transmission lines can take a significant amount of time and investment. With America’s growing power appetite not slowing down and an increasing need for renewables to meet net-zero targets, interim steps can be taken to ensure continued reliable, affordable electricity to keep pace with our growing economy.… Read more at: https://oilprice.com/Energy/Energy-General/Grid-Enhancing-Technologies-The-Answer-to-Growing-Power-Needs.html |

|

Europe’s Power Prices Could Rise as France Curbs Electricity ExportsFrance, the biggest net electricity exporter in Europe, plans to limit power exports to neighboring countries, which could lead to higher prices in other European power markets such as Italy, Switzerland, Belgium, and Germany. France, which derives about 70% of its electricity from nuclear energy, returned last year to the top spot of Europe’s net power exporters, as its nuclear fleet returned from maintenance and domestic demand was lower, analysts at Montel EnAppSys said early this year. The Montel EnAppSys analysis published… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Power-Prices-Could-Rise-as-France-Curbs-Electricity-Exports.html |

|

Rystad: OPEC’s Oil Reserves are Much Lower Than Officially ReportedRystad Energy’s latest research shows global recoverable oil reserves held largely steady at around 1,500 billion barrels, down some 52 billion barrels from our 2023 analysis. Of this year-over-year decrease, 30 billion barrels are due to one year of production, and 22 billion barrels are mostly due to downward adjustments of contingent resources in discoveries. The largest downward revisions are seen in Saudi Arabia, where development priorities have shifted from offshore capacity expansions to onshore infill drilling. The only country with… Read more at: https://oilprice.com/Energy/Crude-Oil/Rystad-OPECs-Oil-Reserves-are-Much-Lower-Than-Officially-Reported.html |

|

Russia Says There Isn’t Discord with OPEC+ over Oil OverproductionThere is no discord between Russia and OPEC+ over Moscow’s recent poor compliance with the group’s production cuts, Russian Deputy Prime Minister Alexander Novak said on Thursday. The overproduction of some OPEC+ members – most notably Iraq, Kazakhstan, and Russia – has been an issue for the alliance, which has tentative plans to start easing part of the voluntary cuts in the fourth quarter of this year, market conditions permitting. “We don’t have any friction, as you put it,” Novak told reporters in Moscow… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Says-There-Isnt-Discord-with-OPEC-over-Oil-Overproduction.html |

|

Centrica’s Profits Decline Amid Return to Market NormalcyThe owner of British Gas, Centrica, has blamed “normalising” market conditions after two years of bumper results for its heavy slide in profit in the first half of this year. Centrica—the FTSE 100 constituent that owns British Gas and looks after Scottish Gas and Bord Gáis—reported a near 50 percent decline in adjusted operating profit for the six months to 30th June, from £2.1bn to £1bn. Basic earnings per share dropped from 25.8p to 12.8p, and its free cash flow fell from £1,377m to £816m.… Read more at: https://oilprice.com/Energy/Natural-Gas/Centricas-Profits-Decline-Amid-Return-to-Market-Normalcy.html |

|

U.S. Boosts Natural Gas Power as Wind Output Slumps to 33-Month LowU.S. natural gas-fired power generation jumped this week amid the lowest wind power output in 33 months seen on Monday while demand for cooling is rising in the summer. On July 22, wind power output in the Lower 48 states was at its lowest level in the country since October 4, 2021, per preliminary data from the U.S. Energy Information Administration (EIA) cited by Reuters. This was despite constantly rising wind power capacity installations over the past three years. The hot summer with low wind speeds has led to low wind power generation, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Boosts-Natural-Gas-Power-as-Wind-Output-Slumps-to-33-Month-Low.html |

|

U.S. Hits Record High Electricity Generation From Natural GasOn July 9, 2024, U.S. power plant operators in the Lower 48 states generated 6.9 million MWh of electricity from natural gas, marking a record high since the collection of hourly data began on January 1, 2019. This surge in natural gas-fired generation was driven by exceptionally high temperatures across the country and a significant decrease in wind generation. The National Weather Service reported that temperatures on July 9 were well above average nationwide, with particularly high temperatures on the West Coast and East Coast. Concurrently,… Read more at: https://oilprice.com/Energy/Energy-General/US-Hits-Record-High-Electricity-Generation-From-Natural-Gas.html |

|

Repsol Doubles Q2 Earnings on Higher Oil PricesSpanish energy giant Repsol more than doubled its second-quarter net income from a year earlier as higher oil prices offset lower gas realizations and weak refining margins. Repsol reported a net income of $713 million (657 million euros) for the second quarter this year, more than double compared to $334 million (308 million euros) for the same period of 2023. The company, which is expanding its renewables assets and generation, continues to book most of its earnings from the upstream division, which benefited from higher oil prices in the second… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Repsol-Doubles-Q2-Earnings-on-Higher-Oil-Prices.html |

|

Mexico May Need to Import Crude and Cease Exports After 2030Crude oil producer and exporter Mexico could see itself in need of crude imports in 2030 as its field production is set to rapidly decline at the end of this decade while it expands its refining capacity, Reuters reported on Thursday, citing projections from the Mexican Energy Ministry. Currently, Mexico pumps around 1.8 million barrels per day (bpd) of crude and condensates and is betting on a major new refinery to process some of the crude into fuels and end its dependence on fuel imports. However, the new fields that have started up recently… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mexico-May-Need-to-Import-Crude-and-Cease-Exports-After-2030.html |

|

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand WeaknessOil prices were trading down nearly 2% in early-morning trading on Thursday, with markets attempting to digest the impact of lagging Chinese consumption on other positive U.S. inventory reports against the backdrop of another interest rate cut by Beijing. At 6:50 a.m. ET on Thursday, Brent crude was trading down 1.77% at $80.26, while the U.S. benchmark, West Texas Intermediate (WTI), was trading down 1.80% at $76.19. Though this week saw another big U.S. crude inventory draw reported by the Energy Information Administration (EIA),… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Tank-on-Fears-Chinas-Rate-Cuts-Herald-Demand-Weakness.html |

|

TotalEnergies Misses Earnings Estimates Amid Weak LNG Sales and Refining MarginsFrench supermajor TotalEnergies (NYSE: TTE) reported lower-than-expected net income for the second quarter of the year amid lower LNG sales and prices and weaker refining margins. TotalEnergies reported on Thursday an adjusted net income of $4.7 billion for the second quarter, down by 9% from the first quarter and also down from the $4.96 billion earnings for the second quarter of 2023. The Q2 2024 adjusted net income missed the analyst consensus estimate of a net profit of $4.96 billion. TotalEnergies’ upstream production averaged 2.44 million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Misses-Earnings-Estimates-Amid-Weak-LNG-Sales-and-Refining-Margins.html |

|

S&P 500, Nasdaq close lower Thursday as tech comeback attempt falters: Live updatesThe S&P 500 and Nasdaq Composite slid on Thursday, adding to their losses. Read more at: https://www.cnbc.com/2024/07/24/stock-market-today-live-updates.html |

|

OpenAI announces a search engine called SearchGPT; Alphabet shares dipOpenAI announced a prototype of its SearchGPT search engine on Thursday. Read more at: https://www.cnbc.com/2024/07/25/openai-announces-a-search-engine-called-searchgpt.html |

|

Lineage begins trading in the market’s largest IPO of 2024Lineage, the largest temperature-controlled warehouse REIT in the world, rose by as much as 5% after going public under the ticker symbol “LINE.” Read more at: https://www.cnbc.com/2024/07/25/lineage-goes-public-largest-ipo-2024.html |

|

Ford shares, on pace for worst day since 2008, lead autos rout after company’s disappointing earningsShares of Ford were off by more than 18% in early trading Thursday – on pace for their worst decline since 2008. Read more at: https://www.cnbc.com/2024/07/25/ford-gm-stellantis-stocks-fall-after-disappointing-earnings.html |

|

These stocks have strong balance sheets as broader market sells offWolfe Research shared its latest list of stocks with high free cash flow. Read more at: https://www.cnbc.com/2024/07/25/these-stocks-have-strong-balance-sheets-as-broader-market-sells-off.html |

|

Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day saleWarren Buffett’s holding company sold more Bank of America shares this week, reducing its holding across six consecutive trading days. Read more at: https://www.cnbc.com/2024/07/25/berkshire-dumps-2point3-billion-of-bank-of-america-in-a-6-day-sale-.html |

|

Harris blasts Trump vision as one of ‘chaos, fear and hate’ in fiery teachers union speechVice President Kamala Harris argued that Donald Trump and his Republican allies want to bring the United States back to the past, not into a brighter future. Read more at: https://www.cnbc.com/2024/07/25/kamala-harris-teacher-union-trump.html |

|

Bitcoin sinks to $64,000 level alongside tech stock rout: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, CNBC Crypto World provides an inside look at the crypto conference Bitcoin 2024 in Nashville, Tennessee. Read more at: https://www.cnbc.com/video/2024/07/25/bitcoin-sinks-to-64000-level-alongside-tech-stock-rout-cnbc-crypto-world.html |

|

Viking Therapeutics stock jumps nearly 30% after drugmaker moves weight loss injection to late-stage trialIt brings the drugmaker one step closer to joining the market for GLP-1s, which analysts say could grow into a $150 billion market by the end of the decade. Read more at: https://www.cnbc.com/2024/07/25/viking-therapeutics-stock-jumps-on-weight-loss-injection-trial-plans.html |

|

‘Let’s go’: Harris agrees to debate Trump, accuses him of ‘backpedaling’ on Sept. 10 dateABC News had been scheduled to hold a debate on Sept. 10 with Donald Trump and President Joe Biden, who withdrew from the race. Read more at: https://www.cnbc.com/2024/07/25/harris-trump-debate-2024-election.html |

|

Southwest to get rid of open seating, offer extra legroom in biggest shift in its historySouthwest is under pressure to drum up revenue from an oversupplied U.S. market and an activist investor. Read more at: https://www.cnbc.com/2024/07/25/southwest-airlines-seat-assignments.html |

|

Many early-adopting EV owners around the world want to gas up againBuyer’s remorse is booming in the EV market, as many electric vehicle owners say they may go back to gas cars with their next auto purchase. Read more at: https://www.cnbc.com/2024/07/25/ev-owners-want-to-buy-gas-cars-again.html |

|

How stocks perform historically on presidential election years — and why this year is differentWith Election Day just a few months away, here’s how the market tends to fare with its historical averages. Read more at: https://www.cnbc.com/2024/07/25/how-stocks-perform-historically-on-presidential-election-years-and-why-this-year-is-different.html |

|

The Future Of Bitcoin In America Will Be Decided At The Ballot BoxAuthored by Senator Bill Hagerty via BitcoinMagazine.com, As Americans head to the polls this fall, their decision regarding who will lead our country will also determine the fate of crypto here in the United States, and our security, prosperity, and freedom are at stake.

This week, I will join President Trump and thousands of crypto market participants in Nashville for Bitcoin 2024, the world’s largest Bitcoin conference. This year, the conference is held in my home state at a time that is clearly the tipping point for the future of crypto technology in the U.S. This fall, the future of crypto in America is on the ballot as our nation decides who will lead the Executive and Legislative branches of our nation. The contrast between Democrat and Republican approaches to crypto is stark. The Biden Administration has … Read more at: https://www.zerohedge.com/crypto/future-bitcoin-america-will-be-decided-ballot-box |

|

US Doctors Stunned By Number Of Gaza Children With Headshot WoundsIsraeli Prime Minister Benjamin Netanyahu has called Israel the “most moral army in the world,” but a high volume of deeply troubling wounds seen by American surgeons volunteering in Gaza is casting doubt on that claim. Dr. Mark Perlmutter, an American surgeon with heavy catastrophe-zone experience, is among those stunned by the civilian devastation they’ve recently witnessed in Gaza, and especially by a high volume of what appear to be precision rifle-fire wounds on children — including toddlers.

Perlmutter (second from left) with the volunteer medical team that spent few weeks in Gaza (Photo: Dr. Feroze Sidhwa via Politico) “All of the disasters I’ve seen, combined – 40 mission trips, 30 years, Ground Zero, earthquakes, all of that combined – doesn’t equal the level of carnage that I saw against civilians in just my first week in Gaza,” Dr. Mark Perlmutter, an orthopedic surgeon and vice president of the In … Read more at: https://www.zerohedge.com/geopolitical/us-doctors-stunned-number-gaza-children-headshot-wounds |

|

The SEC’s Climate Disclosure Rule Is A Dark Cloud Over Energy AbundanceAuthored by Stone Washington via RealClearEnergy, The Securities and Exchange Commission (SEC) climate disclosure rule posts real problems for public companies. The SEC’s mission is to do facilitate capital formation and maintain market efficiency, but for the first time in its 90-year history, the SEC has injected political risk factors into its traditionally principles-based disclosure framework.

Leading up to the new rule, the SEC buckled under pressure from left-wing special interests to impose the first environmental disclosure mandate on public companies. If the SEC’s final rule is allowed to go into effect by the courts, it will be a financial disaster for the public markets. My latest Read more at: https://www.zerohedge.com/political/secs-climate-disclosure-rule-dark-cloud-over-energy-abundance |

|

Trump: Israel Needs To End War Quick & Have Better ‘Public Relations’The day before Republican presidential nominee Donald Trump is expected to meet with Prime Minister Benjamin Netanyahu at Mar-A-Lago, the former US president has a message for Israel: end the war quickly and bring the hostages home as soon as possible. Trump is urging a quick end the conflict, and in a rare moment of criticism said that Israel must better manage its “public relations.” The war should stop quickly “because they are getting decimated with this publicity, and you know Israel is not very good at public relations,” Trump said a new Fox interview.

Via AP Trump has repeatedly blamed Biden’s foreign policy weakness for enabling the whole crisis in the first place, having previously asserted that the Hamas terror attack on Israel that killed 1,200 people and … Read more at: https://www.zerohedge.com/political/trump-israel-needs-end-war-quick-have-better-public-relations |

|

UK secures seabed land deal to boost windfarmsGB Energy to partner with the Crown Estate to push forward offshore windfarm projects Read more at: https://www.bbc.com/news/articles/crglp32zzw2o |

|

ChatGPT reveals search feature in Google challengeOpenAI is working on adding new search powers to its artificial intelligence (AI) bot. Read more at: https://www.bbc.com/news/articles/c897qz1qex9o |

|

Ex-minister brands Post Office cases ‘corrupt’Management culture was “insensitive and dismissive to the point of abject rudeness”, Greg Clark says. Read more at: https://www.bbc.com/news/articles/c728kjx3rz8o |

|

After strong IPO response, Sanstar shares to debut tomorrow. Here’s what GMP suggestsSanstar’s shares debuted on exchanges after a highly subscribed IPO. Expected to list at a 32% premium, the company planned to use the proceeds for expansion, debt repayment, and other needs. Sanstar, a major producer of plant-based specialty products in India, recorded considerable revenue and profit growth. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/after-strong-ipo-response-sanstar-shares-to-debut-tomorrow-heres-what-gmp-suggests/articleshow/112011363.cms |

|

Indigo Q1 Results preview: PAT may decline by up to 28% YoY on weak load factor, Delhi T1 crisisInterGlobe Aviation, India’s top airline by market share, was expected to see a substantial drop in its year-on-year net profit for Q1FY24 due to higher fuel costs, a weak load factor, and the Delhi T1 terminal roof collapse. Brokerage estimates indicated mixed sequential profit growth and varying revenue projections. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/indigo-q1-preview-pat-may-go-decline-by-up-to-28-yoy-on-weak-load-factor-delhi-t1-crisis/articleshow/112012444.cms |

|

What does the Budget mean for common man, youth & industry? Nirmala Sitharaman explainsFinance Minister Nirmala Sitharaman addressed Congress’ claims that BJP has borrowed their ideas, highlighted job creation efforts, defended initiatives like internships and angel tax abolition, and discussed subsidies and reforms. She emphasized youth employment schemes and criticized Congress for past inaction. Sitharaman also commented on the humour in media portrayals. Read more at: https://economictimes.indiatimes.com/markets/expert-view/what-does-the-budget-mean-for-common-man-youth-industry-nirmala-sitharaman-explains/articleshow/112006782.cms |

|

This bond-market signal of impending recessions went on a wild ride. Here’s its message.The spread between 10- and 2-year Treasury yields reached its least-negative level in two years on Wednesday, helped by traders’ expectations that the Federal Reserve needs to start cutting interest rates. Read more at: https://www.marketwatch.com/story/this-bond-market-signal-of-impending-recessions-went-on-a-wild-ride-heres-its-message-54162861?mod=mw_rss_topstories |

|

Paris Olympics offer a reset for sponsors after years of troubled gamesThe Paris Summer Olympics could mark a reset for major sponsors after years of games held against the backdrop of geopolitical issues and the COVID-19 pandemic, according to branding expert Jim Andrews. Read more at: https://www.marketwatch.com/story/paris-olympics-offers-a-reset-for-sponsors-after-years-of-troubled-games-42fbbdab?mod=mw_rss_topstories |

|

10-, 30-year Treasury yields end lower for second time in three sessions despite solid U.S. GDP dataTreasury yields finished mostly lower on Thursday as long-term government debt rallied, even after data on the second quarter showed the U.S. economy still has surprising strength left. Read more at: https://www.marketwatch.com/story/treasury-yields-slide-ahead-of-u-s-gdp-report-and-amid-broad-risk-off-mood-e698d741?mod=mw_rss_topstories |