Summary Of the Markets Today:

- The Dow closed up 743 points or 1.85%, (Closed at 40,954, New Historic high 40.989)

- Nasdaq closed up 0.20%,

- S&P 500 closed up 0.64%, (Closed at 5,667, New Historic high 5,670)

- Gold $2,472 up $42.90,

- WTI crude oil settled at $81 down $1.05,

- 10-year U.S. Treasury 4.162 up 0.065 points,

- USD index $104.22 up $0.03,

- Bitcoin $65,126 up $364 or 0.56%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Advance estimates of U.S. retail and food services sales for June 2024 were up 0.2% year-over-year but down significantly from last month’s 3.2%. If you adjust for inflation, retail sales contracted. My numbers are different from the headline view as I do not use seasonally adjusted data which shows sales of $703.6 billion in June 2024 vs $$702.2 billion in June 2023 [you do not need to seasonally adjust data if you are using year-over-year comparisons]. The major declines were in motor vehicle sales and building materials. These are two sectors which decline early in a recession. This is not good news economically.

Import prices increased from 1.4% year-over-year in May to 1.6% in June 2024. Export prices increased from 0.5% year-over-year in May to 0.7% in June 2024. Like a broken record, I keep warning readers that the underlying inflation dynamics is growing – and the end to inflationary pressures is not within eyesight.

Here is a summary of headlines we are reading today:

- Construction Costs Remain Elevated Despite Stabilizing Base Metals

- Gulf Oil Producers Invest Heavily in Carbon Capture and Hydrogen

- IMF Cuts Saudi Economic Growth Projection On Oil Cuts

- WTI Falls To $80 Despite Expectations of Global Q3 Supply Deficit

- Exxon Plans Seventh Oil Project Offshore Guyana

- Trump’s VP Choice Could Signal Rollback of Climate Protections

- Dow rallies 700 points for best day in more than a year, Russell 2000 small-cap index jumps 3%: Live updates

- Elon Musk says SpaceX and X headquarters moving to Texas, blames new CA trans student privacy law

- Brain implant patient says OpenAI’s tech helps him communicate with family

- “Evacuate Now” Illinois Residents Told To Flee As Dam Failure Imminent

- Interest rates could stay higher for longer, warns IMF

- 2-year Treasury yield finishes lower for fourth session in a row after U.S. retail sales come in flat

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Construction Costs Remain Elevated Despite Stabilizing Base MetalsVia Metal Miner The Construction MMI (Monthly Metals Index) held true to its year-long sideways trend, only budging down 1.07%. While base metals prices in the construction market remain fairly stable, construction projects overall still continue to battle with elevated rates. This is especially true in the private sector. However, the market continues to push through more than a year of elevated interest rates and remains resilient, despite ongoing labor shortages. Metals Prices Stable, but Construction Costs Remain High The U.S. construction… Read more at: https://oilprice.com/Metals/Commodities/Construction-Costs-Remain-Elevated-Despite-Stabilizing-Base-Metals.html |

|

Gulf Oil Producers Invest Heavily in Carbon Capture and HydrogenAs hydrocarbons producers reap sustained revenue from high global prices, national oil companies (NOCs) in the Gulf are accelerating investment in carbon capture, utilisation and storage (CCUS); hydrogen; and cleaner sources of energy to make their activities less carbon-intensive and support the energy transition. Gulf NOCs’ low-cost production advantages and massive hydrocarbons resources mean that CCUS can reduce emissions for the coming decades as the world continues to rely on oil and gas amid the energy transition. Moreover, with the… Read more at: https://oilprice.com/Energy/Energy-General/Gulf-Oil-Producers-Invest-Heavily-in-Carbon-Capture-and-Hydrogen.html |

|

Kenyan Government Rejects Tullow Oil’s Field PlanLast year, TotalEnergies (NYSE:TTE) and Africa Oil (OTCPK:AOIFF) announced they had abandoned the multi-billion dollar South Lokichar project in Kenya, leaving British exploration firm Tullow Oil (OTCPK:TUWLF) (OTCPK:TUWOY) as the oilfield’s sole owner following a multiyear effort to get development off the ground. The two partners held a 25% stake apiece in the Lokichar field but withdrew after an unsuccessful drawn-out process to find a fourth partner. The long-delayed project aims to tap 460M barrels of oil in multiple fields in a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kenyan-Government-Rejects-Tullow-Oils-Field-Plan.html |

|

UK Fund Faces Headwinds as Energy Storage Challenges EmergeGore Street Energy fund said it remains confident in delivering strong returns to investors despite “challenging” conditions in Britain’s energy storage market over the last year. Annual earnings before interest, taxation, depreciation and amortisation (EBITDA) at the London-listed fund came in broadly level at £28.4m, up from £27.8m the year prior. But net asset value (NAV) fell from £556.3m to £540.7m as NAV per share plunged to 64.5p, down from 100.8p. Pat Cox, Chair of the company, said: “Despite… Read more at: https://oilprice.com/Energy/Energy-General/UK-Fund-Stumbles-on-Energy-Storage-Challenges.html |

|

Central Asian Giants Target $10 Billion in Annual TradeKazakhstan and Uzbekistan have announced a goal of more than doubling trade volume in “the coming years.” To hit that very ambitious target, top officials from both countries intend to remove trade barriers. The two countries accounted for 57 percent of all trade in Central Asia in 2023, with bilateral turnover amounting to $4.5 billion during the year. The pace of trade has dipped so far this year, with total volume totaling $1.2 billion during the first four months of 2024. Nevertheless, during regular bilateral consultations in Astana… Read more at: https://oilprice.com/Geopolitics/International/Central-Asian-Giants-Target-10-Billion-in-Annual-Trade.html |

|

IMF Cuts Saudi Economic Growth Projection On Oil CutsThe International Monetary Fund (IMF) has downgraded its growth forecast for the Saudi economy due to ongoing oil production cuts by OPEC+. The IMF now sees 2024 growth clocking in at just 1.7%, nearly a percentage point lower than its earlier projection of 2.6%. The effects of the cuts are expected to spill over into the coming year, with the IMF projecting GDP growth of 4.7% in 2025, a downward revision of 1.3 percentage points from April. Thankfully, Saudi Arabia is increasingly becoming less reliant on oil to power its economy. Earlier in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IMF-Cuts-Saudi-Economic-Growth-Projection-On-Oil-Cuts.html |

|

Canada’s Oil Industry Enjoys Boom Year, But There’s a CatchCanada’s oil industry is enjoying a boom year with the start of the Trans Mountain Expansion Project in May, which tripled the volumes Alberta’s oil producers can send via the pipeline to the Pacific coast. But the ambitious climate policies of the federal government of Prime Minister Justin Trudeau – with plans to cap emissions on hydrocarbon production – are angering energy producers and alienating voters. Canada’s federal policies to reduce greenhouse gas emissions include policies such as more taxes, including carbon taxes on the… Read more at: https://oilprice.com/Energy/Energy-General/Canadas-Oil-Industry-Enjoys-Boom-Year-But-Theres-a-Catch.html |

|

Russia’s Novatek Slashes Gas Output at Sanctioned Arctic LNG 2The Arctic LNG 2 project in Russia, which Western sanctions have hit in recent months, significantly reduced its production of natural gas in May as it hasn’t exported any LNG yet, a source with knowledge of output data told Reuters on Tuesday. Arctic LNG 2, in which Russian gas producer and LNG exporter Novatek has 60%, extracted 55 million cubic meters of natural gas in May, down from 215 million cubic meters in April, according to Reuters’s source. Located in the Gydan Peninsula in the Arctic, the Arctic LNG 2 project… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Novatek-Slashes-Gas-Output-at-Sanctioned-Arctic-LNG-2.html |

|

WTI Falls To $80 Despite Expectations of Global Q3 Supply DeficitOil prices are falling on Tuesday morning as weaker-than-expected economic data from China sparks demand concerns. WTI crude fell back to the $80 handle ahead of this week’s crude inventory data reports. Despite this, traders remain positive that the current quarter could be the tightest of the year for global crude supplies, with inventories depleting rapidly and Brent crude futures potentially rising to $90 a barrel. OPEC+ Set Its Sight on Curbing Overproduction- The OPEC+ meeting on June 1 might have disappointed markets and brought… Read more at: https://oilprice.com/Energy/Energy-General/WTI-Falls-To-80-Despite-Expectations-of-Global-Q3-Supply-Deficit.html |

|

UK’s First New Coal Mine in 30 Years Faces Legal ChallengeClimate campaigners are challenging the UK’s approval of the first new coal mine in the country in three decades, with the High Court beginning hearings on the case on Tuesday. The UK’s previous Conservative government approved in December 2022 the Woodhouse Colliery project in Whitehaven, northwest England, developed by West Cumbria Mining. Earlier this year, West Cumbria Mining (WCM) said that it “continues to focus on preparatory works prior to commencement of real construction activity,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UKs-First-New-Coal-Mine-in-30-Years-Faces-Legal-Challenge.html |

|

Africa Emerges as Focal Point in Global Oil and Gas ExplorationThe skewed activity is highlighted by explorers demarcating assets within their portfolios as ‘core’ areas of operations, with the majority of guided exploration spending being directed towards exploring these areas. Secondly, the acceleration of development of proven basins amid the rise of renewable sources of energy has been demonstrated by the recent flurry of activity within the Guyana Basin and Namibia’s sector of the Orange Basin. These basins have not only seen an increase in activity but have also in recent years contributed… Read more at: https://oilprice.com/Energy/Crude-Oil/Africa-Emerges-as-Focal-Point-in-Global-Oil-and-Gas-Exploration.html |

|

Russia’s Crude Oil Exports Slip To Lowest Level Since JanuaryRussian seaborne crude oil exports dropped in the four weeks to July 14 to the lowest levels since January, pointing to a likely improving compliance with the OPEC+ deal, vessel-tracking data monitored by Bloomberg showed on Tuesday. The four-week average level of Russia’s crude shipments fell to around 3.11 million barrels per day (bpd) in the four weeks to July 14, down by around 180,000 bpd from the four-week average from the week prior, according to the data reported by Bloomberg’s Julian Lee. The latest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Exports-Slip-To-Lowest-Level-Since-January.html |

|

India Increases Windfall Tax on Crude OilIndia has raised its windfall tax on petroleum crude effective July 16, the government said in a notification on Monday. The windfall tax on petroleum crude was revised up to $83.75 (7,000 Indian rupees) per metric ton, up from $71.78 (6,000 rupees) per ton. The raised tax, which is being levied in the form of a Special Additional Excise Duty (SAED), will be effective for two weeks starting on Tuesday. India first introduced the windfall tax in July 2022, joining other governments in taxing excessive profits at the energy… Read more at: https://oilprice.com/Energy/Crude-Oil/India-Increases-Windfall-Tax-on-Crude-Oil.html |

|

Exxon Plans Seventh Oil Project Offshore GuyanaExxonMobil continues to bet big on Guyana, planning a new project set for start-up in 2029 and expected to boost Guyana’s oil production capacity to over 1.4 million barrels per day (bpd). The development plan for the Hammerhead project entails the drilling of up to 30 wells in the Hammerhead discovery from 2018 in the Stabroek Block, according to Exxon’s plan which the Guyana government made public on Monday. Exxon is the operator of the Stabroek Block offshore Guyana, from which the U.S. supermajor and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Plans-Seventh-Oil-Project-Offshore-Guyana.html |

|

Trump’s VP Choice Could Signal Rollback of Climate ProtectionsEnvironmental campaigners have slammed Donald Trump’s pick for running mate, Ohio Republican Senator J.D. Vance, saying that he is a climate change denier and a “Big Oil sell-out” who will strongly support continued fossil fuel production. Trump announced on Monday that he had picked Vance, 39, once a critic of the former president but now a staunch supporter, to run for vice president on the GOP ballot in the November election. Climate campaigners are alarmed by Vance’s track record of denying human-caused… Read more at: https://oilprice.com/Energy/Energy-General/Trumps-VP-Choice-Could-Signal-Rollback-of-Climate-Protections.html |

|

Dow rallies 700 points for best day in more than a year, Russell 2000 small-cap index jumps 3%: Live updatesThe bull market broadened out further on Tuesday with industrial and small cap shares soaring. Read more at: https://www.cnbc.com/2024/07/15/stock-market-today-live-updates.html |

|

Andreessen Horowitz founders plan to donate to pro-Trump super PACMarc Andreessen and Ben Horowitz, co-founders of venture firm Andreessen Horowitz, plan to donate to PACs supporting Donald Trump’s campaign. Read more at: https://www.cnbc.com/2024/07/16/andreessen-horowitz-founders-plan-to-donate-to-pro-trump-pacs.html |

|

House Democrats circulate letter urging DNC not to rush Biden nominationPresident Biden has faced mounting pressure to drop out of the race after his debate flop against Donald Trump in June. Read more at: https://www.cnbc.com/2024/07/16/house-democrats-letter-dnc-biden-nomination.html |

|

Iran plot to kill Trump prompted Secret Service to boost protection before rally shootingThe Secret Service has faced criticism over the attempted assassination of Donald Trump by Thomas Crooks, weeks after learning of the Iran plot. Read more at: https://www.cnbc.com/2024/07/16/trump-iran-kill-plot-secret-service.html |

|

Stocks are booming in 2024, but financial advisors say it may be time to get a little defensiveA surge in tech has driven the S&P 500 to new heights this year, but now may be a good time to look at underappreciated corners of the market. Read more at: https://www.cnbc.com/2024/07/16/stocks-are-booming-but-it-may-be-time-to-get-a-little-defensive.html |

|

Elon Musk says SpaceX and X headquarters moving to Texas, blames new CA trans student privacy lawSpaceX CEO and X owner Elon Musk said Tuesday he will move the headquarters of both companies from California to Texas. Read more at: https://www.cnbc.com/2024/07/16/elon-musk-says-spacex-hq-officially-moving-to-texas-blames-new-ca-trans-student-privacy-law.html |

|

Why the Social Security Administration may want you to update your personal account onlineThe Social Security Administration is upgrading its online services, which will require some users to update their personal accounts. Read more at: https://www.cnbc.com/2024/07/16/social-security-administration-wants-you-to-update-your-online-account.html |

|

Brain implant patient says OpenAI’s tech helps him communicate with familyNeurotech startup Synchron has built a new chat feature for its patients using the latest models from OpenAI. Read more at: https://www.cnbc.com/2024/07/16/neuralink-rival-synchron-is-using-openai-models-to-power-chat-feature.html |

|

Here are 6 buying categories cheaper today than they were before the pandemicPrices naturally rise over time, but the pandemic pushed inflation to decades highs. These few categories, however, are cheaper than they were pre-pandemic. Read more at: https://www.cnbc.com/2024/07/16/6-things-cheaper-today-than-before-pandemic.html |

|

Trump shooting motive unknown three days after assassination attemptThe FBI obtained the phone of Thomas Crooks, who shot at Donald Trump and others during a campaign rally in Pennsylvania. Read more at: https://www.cnbc.com/2024/07/16/trump-shooting-motive-unknmown-assassination-attempt.html |

|

Trump endorses vaccine conspiracy theory in leaked call with RFK Jr.The call allegedly came a day after Donald Trump survived an assassination attempt at a campaign rally. Read more at: https://www.cnbc.com/2024/07/16/trump-vaccines-rfk-jr.html |

|

Trump VP pick Vance once called on GOP to fight student loan forgiveness ‘with every ounce of our energy’On the list of things Donald Trump and his newly chosen running mate, Sen. JD Vance, agree on: Students should not get their debt canceled. Read more at: https://www.cnbc.com/2024/07/16/trump-vp-vance-on-student-loan-forgiveness.html |

|

San Francisco downtown is a ‘ghost town’ that needs revival, mayoral candidate saysDemocrat Mark Farrell, former interim Mayor of San Francisco, is proposing a 20-year vision to revitalize the city’s downtown. Read more at: https://www.cnbc.com/2024/07/16/san-francisco-downtown-is-ghost-town-mayor-candidate-mark-farrell.html |

|

Joe Scarborough Has On-Air Hissy Fit About Being Sidelined On MondayAuthored by Matt Margolis via PJMedia.com, On Monday, MSNBC pulled “Morning Joe” off the air. Sources told CNN that the network pulled the broadcast to “avoid a scenario in which one of the show’s stable of two dozen-plus guests might make an inappropriate comment on live television that could be used to assail the program and network as a whole.”

In other words, MSNBC didn’t trust the “Morning Joe” team to be adults. An MSNBC spokesperson later denied what sources had told CNN.

|

|

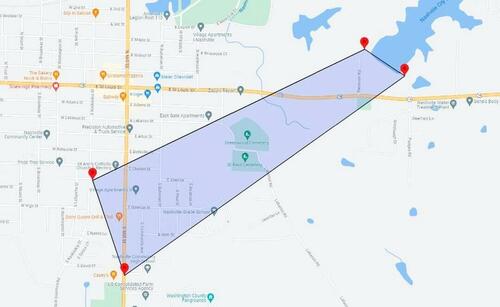

“Evacuate Now” Illinois Residents Told To Flee As Dam Failure ImminentResidents in Nashville City, Illinois were ordered to “evacuate now” on Tuesday ahead of an imminent dam failure.

A map posted by the Washington County Emergency Management Agency shows the evacuation area amid an imminent dam failure in Nashville, Ill., on July 16, 2024. (Washington County Emergency Management Agency)” Attention … the Failure of the Nashville dam is imminent. Please evacuate your home at this time. If you are in the grey box, you need [to] evacuate now!” said the Washington County Emergency Management Agency on Facebook. According to officials, the Nashville City Reservoir Dam “has been overtopped with flood waters.” “The Red Cross has been activated,” officials said in a separate post, adding that a shelter was being used in Nashville’s West Walnut Street. Read more at: https://www.zerohedge.com/weather/evacuate-now-illinois-residents-told-flee-dam-failure-imminent |

|

“This Is How Republics Collapse”: Another Adverse Decision Sends Press & Pundits Into Hair-Pulling MeltdownAuthored by Jonathan Turley, “This is how republics collapse.” Those ominous words captured the hand-wringing, hair-pulling reaction to the dismissal of the Florida case against Donald Trump by Judge Aileen Cannon. It was not just that she reached a conclusion long supported by some conservative lawyers and a Supreme Court justice. To rule in favor of Trump in such a dismissal is, once again, the end of Democracy as we know it.

Read more at: https://www.zerohedge.com/political/how-republics-collapse-another-adverse-decision-sends-press-pundits-hair-pulling-meltdown |

|

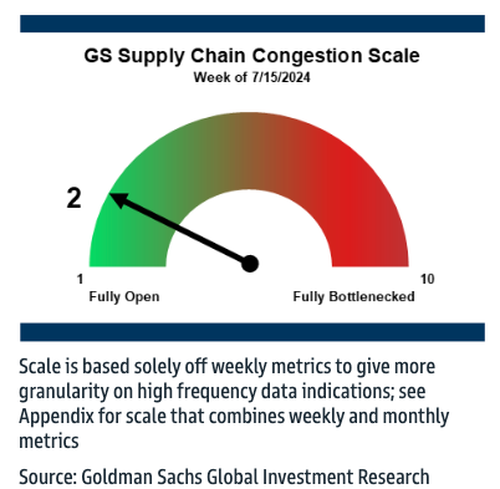

Goldman’s Supply Chain Index Set To “Congest” For First Time In 1.5 YearsGoldman’s Jordan Alliger released his latest supply chain congestion note on Monday, informing clients that for the first time in 1.5 years, the supply chain congestion index is on the verge of rising from two to three, with ten being the most congested. This resurgence in snarled supply chains is driven mainly by increasing container ship backlogs and soaring ocean container shipping rates.

“While our weekly bottleneck scale remained slightly below the level of ‘3’ this week as the overall scale remained unchanged at ‘2’, the absolute level of our congestion index increased once again versus the prior week (+3.5% w/w; Exhibit 1); should next week’s index reading show an increase of just ~1%, the weekly bottleneck scale would push up to a level of ‘3’ for the first time in over a year and a half,” Alliger explained. Read more at: https://www.zerohedge.com/markets/goldmans-supply-chain-index-set-rise-first-time-15-years |

|

Interest rates could stay higher for longer, warns IMFInflation is proving persistent in some countries, the fund says, making it trickier for rates to be cut. Read more at: https://www.bbc.com/news/articles/czrjpp494m2o |

|

Fujitsu witness had limited Horizon knowledge – inquirySecurity analyst Andy Dunks gave evidence in dozens of cases despite “limited” Horizon knowledge. Read more at: https://www.bbc.com/news/articles/c250e8r7x4vo |

|

All water firms now investigated for sewage spillsAll 11 companies in England and Wales are now being probed after the regulator expands its investigation. Read more at: https://www.bbc.com/news/articles/crg5ev7e46mo |

|

Ola Electric IPO pricing likely at about 25% lower than private valuation of $5.4 billion: sourcesOla Electric IPO valuation is likely at $4 billion, down 25% from $5.4 billion in last funding round The IPO seeks Rs 5,500 crore through a fresh issue and 95.2 million shares offer-for-sale. Initially targeting $6-7 billion, the valuation was adjusted to entice investors for post-issue profit. Read more at: https://economictimes.indiatimes.com/tech/startups/ola-electric-ipo-pricing-likely-at-30-lower-than-private-valuation-of-5-5-billion/articleshow/111786351.cms |

|

Vedanta to use Rs 8,500 crore QIP to repay Union Bank of India, Oaktree and Deutsche BankThe funds raised will help reduce overall indebtedness, cut debt servicing costs, and improve the debt-to-equity ratio. It will enable better utilisation of internal accruals for business growth and expansion, Vedanta stated in its QIP filing to stock exchanges. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vedanta-to-use-rs-8500-crore-qip-to-repay-union-bank-of-india-oaktree-and-deutsche-bank/articleshow/111789382.cms |

|

Sebi proposes new asset class between mutual funds and PMS with Rs 10 lakh ticket sizeEligible mutual funds must have a minimum operational history of 3 years and an average AUM of at least Rs 10,000 crore over the same period. Additionally, neither the sponsor nor the AMC can have faced any regulatory action under sections 11, 11B, or 24 of the SEBI Act, 1992 within the past 3 years. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-proposes-new-asset-class-between-mutual-funds-and-pms-with-rs-10-lakh-ticket-size/articleshow/111784273.cms |

|

Traders pivot back to multiple rate-cut view, reviving one of 2024’s biggest trading themesIt didn’t take long for one of the biggest and most important trading themes at the start of 2024 to come back in the minds of investors and traders, after having faded a month ago. Read more at: https://www.marketwatch.com/story/traders-pivot-back-to-multiple-rate-cut-view-reviving-one-of-2024s-biggest-trading-themes-175c6039?mod=mw_rss_topstories |

|

No, TikTok ‘finfluencer,’ waiting to claim Social Security is not a ‘big con’Yes, sometimes it makes sense to claim at 62 — but there’s a catch. Read more at: https://www.marketwatch.com/story/no-tiktok-finfluencer-waiting-to-claim-social-security-is-not-a-big-con-1bcd8069?mod=mw_rss_topstories |

|

2-year Treasury yield finishes lower for fourth session in a row after U.S. retail sales come in flatYields on 2- and 10-year U.S. government debt end at the lowest levels in four to five months on Tuesday, after June retail sales came in unchanged and traders priced in multiple rate cuts from the Federal Reserve by year-end. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-ahead-of-u-s-retail-sales-data-c5717a39?mod=mw_rss_topstories |