Summary Of the Markets Today:

- The Dow closed up 429 points or 1.09%,

- Nasdaq closed up 1.18%, (Closed at 18,647, New Historic high 18,655)

- S&P 500 closed up 1.02%, (Closed at 5,634, New Historic high 5,635)

- Gold $2,378 up $7.50,

- WTI crude oil settled at $82 up $1.01,

- 10-year U.S. Treasury 4.278 down 0.020 points,

- USD index $105.03 down $0.100,

- Bitcoin $57,449 up $599 or 1.03%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

May 2024 sales of merchant wholesalers were up 1.9% from the revised May 2023 level. Total inventories of merchant wholesalers were down 0.5% from the revised May 2023 level. The May inventories/sales ratio for merchant wholesalers was 1.35. The May 2023 ratio was 1.39. My bottom line is that employment is growing in this sector (even faster than sales growth) whilst inventories are marginally falling – this seems to be a relatively above average sector in the economy right now.

Fed Chair Powell’s second day of the semiannual monetary policy testimony navigated politically charged questions which he declined to answer. Powell reiterated that he was not sending any signals about the outlook for monetary policy when he said that the risks are more balanced to the outlook in the context of the dual mandate. He said, “The job is not done on inflation,” and that there has been “considerable softening in the labor market”. I smiled when I read many stock market pumpers mistook his statements yesterday to mean that a federal funds rate cuts were coming soon.

Here is a summary of headlines we are reading today:

- Serbia’s Nuclear Future: A Delicate Balancing Act Between East and West

- BP Predicts Global Oil Demand Will Peak In 2025

- Hedge Funds Are Headhunting Succesful Power Traders

- Honeywell to Buy Air Products’ LNG Technology for $1.8 Billion

- The Countries Increasing Their Coal Dependency Despite Climate Pledges

- HubSpot shares plunge 12% on report that Alphabet is shelving interest in acquiring software company

- S&P 500 closes above 5,600 for the first time, lifted by gains in Big Tech: Live updates

- Key inflation report looms on Thursday as traders grow more confident in Fed rate cut

- Senators strike bipartisan deal for a ban on stock trading by members of Congress

- Goldman says investors should start shifting out of cash. Here’s where it sees opportunity

- Bitcoin hovers at $57,000 as Fed Chair Powell continues testimony on Capitol Hill: CNBC Crypto World

- Musk defeats ex-Twitter staff seeking $500m in severance

- Wall Street is becoming more skeptical of artificial-intelligence hype helping to power stocks

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Serbia’s Nuclear Future: A Delicate Balancing Act Between East and WestDriven by a need to diversify its energy sector and pivot away from cheap Russian gas, Serbia is moving to end the country’s decades-old policy banning the construction of nuclear power plants on its territory. Several Serbian ministries announced on July 10 that the country is weighing whether to end the 35-year-old, Yugoslav-era ban on nuclear reactors and said public debate was being opened on the shake-up of Belgrade’s long-standing energy policy. If successful, the Serbian government could also find itself on a new geopolitical… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Serbias-Nuclear-Future-A-Delicate-Balancing-Act-Between-East-and-West.html |

|

Suriname’s Mega Oil Boom Is Back on TrackA fiscal crisis, near economic collapse, and civil unrest have the government of Suriname, one of South America’s poorest countries, hungrily eyeing neighboring Guyana’s oil boom, which made that country the world’s fastest-growing economy. A spiraling cost of living and deep economic crisis sparked by the COVID-19 pandemic saw violent protests erupt at the start of 2023. These triggered further instability in the former Dutch colony which is struggling to regain its footing after a decade of despotic rule by military… Read more at: https://oilprice.com/Energy/Crude-Oil/Surinames-Mega-Oil-Boom-Is-Back-on-Track.html |

|

LME Returns to Court Over $12 Billion Nickel Trading FiascoThe London Metal Exchange (LME) is back in court this week as it seeks to defend against Elliott Investment Management’s application to appeal the nickel case. Elliott Associates along with Elliott International issued judicial review proceedings against LME to challenging its decision to cancel $12bn of trades in ‘3M’ nickel futures on the morning of 8 March 2022 following sharp price rises. In early March 2022, nickel prices rose very dramatically. At 08:15am on 8 March 2022, the LME suspended nickel trading, later publishing… Read more at: https://oilprice.com/Metals/Commodities/LME-Returns-to-Court-Over-12-Billion-Nickel-Trading-Fiasco.html |

|

BP Predicts Global Oil Demand Will Peak In 2025British Oil & Gas giant BP Plc (NYSE:BP) has predicted that global oil demand will peak next year while wind and solar capacity will continue to grow rapidly. In its latest edition of its annual Energy Outlook, BP has published a study of the evolution of the global energy system to 2050. BP has modeled its predictions on two key scenarios: The Current Trajectory and Net Zero. The Current Trajectory scenario is based on climate policies and carbon reduction pledges already in place while the Net Zero scenario… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Predicts-Global-Oil-Demand-Will-Peak-In-2025.html |

|

NATO Leaders Debate Multiyear Military Aid Package for UkraineNATO leaders gathered in Washington for a landmark summit are set to look into ways to bolster support for Ukraine in its war against Russia’s aggression as U.S. President Joe Biden strongly reaffirmed the 32-member alliance’s “full support” for Kyiv. NATO leaders on July 10 are to discuss a proposal by outgoing Secretary-General Jens Stoltenberg to provide Ukraine with 40 billion euros ($43 billion) in military aid for next year, after member states couldn’t agree on a multiyear military aid package for Ukraine that Stoltenberg had proposed.In… Read more at: https://oilprice.com/Geopolitics/International/NATO-Leaders-Debate-Multiyear-Military-Aid-Package-for-Ukraine.html |

|

Kpler Data: Saudi Arabia’s Oil Exports Fall to Lowest In DecadeRecent data from Kpler reveals a significant decline in crude oil exports from major OPEC+ producers in June, driven largely by weak demand in Asian markets and increased domestic consumption in the Middle East. This has resulted in Saudi Arabia’s exports plummeting to their lowest level in over a decade. OPEC+ production fell to its lowest point of the year as Saudi Arabia, Russia, and Iraq all implemented cuts to curb overproduction and respond to lower Asian demand. Saudi exports decreased dramatically by 930,000 barrels per day to 5.42 million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kpler-Data-Saudi-Arabias-Oil-Exports-Fall-to-Lowest-In-Decade.html |

|

OPEC Sticks To Strong Oil Demand Growth ForecastsOPEC has stuck to its forecast for relatively strong growth in global oil demand in 2024 and 2025, citing resilient economic growth and strong rebound in air travel in the summer months. In its latest Monthly Oil Market Report (MOMR), OPEC has predicted that global oil demand would rise by 2.25 million barrels per day (bpd) in 2024 and by 1.85 million bpd in 2025. Both figures remain unchanged from its first forecast in January 2024. Similarly, on the supply side, the group has kept its non-OPEC+ liquids supply growth estimate unchanged… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Sticks-To-Strong-Oil-Demand-Growth-Forecasts.html |

|

Hedge Funds Are Headhunting Successful Power TradersAttracted by market volatility and the prospect of handsome profits in the coming years, hedge funds are hiring power traders from utilities and investment banks. The hedge funds are offering big paydays, profit-share deals, signing bonuses, and perks such as chauffeurs for company cars to traders considering a move to power and natural gas trading, analysts and headhunters have told The Wall Street Journal. In pursuit of profits during heightened uncertainties in global energy markets, hedge funds are looking to attract top talent… Read more at: https://oilprice.com/Energy/Energy-General/Hedge-Funds-Are-Headhunting-Succesful-Power-Traders.html |

|

Honeywell to Buy Air Products’ LNG Technology for $1.8 BillionHoneywell has agreed to buy the LNG process technology and equipment business of Air Products in a $1.81 billion all-cash deal, as it looks to expand its energy transition capabilities, the industrial conglomerate said on Wednesday. The value of the deal represents approximately 13 times the estimated 2024 earnings before tax, depreciation, and amortization (EBITDA) of the business. Following the acquisition, Honeywell will have an end-to-end offering for customers worldwide. The transaction is expected to be accretive to Honeywell’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Honeywell-to-Buy-Air-Products-LNG-Technology-for-18-Billion.html |

|

Oil Prices Perk Up on Crude DrawCrude oil prices went higher today, after the U.S. Energy Information Administration reported an inventory draw of 3.4 million barrels for the week to July 5. This compared with a massive draw of 12.2 million barrels for the previous week. The American Petroleum Institute reported on Tuesday an estimated inventory draw of 1.9 million barrels for the week to July 5, strengthening the perception of a strong peak demand season in the world’s largest consumer of the commodity. The EIA, meanwhile, also reported mixed… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Perk-Up-on-Crude-Draw.html |

|

Russia’s Novatek Looks to Market LNG in ChinaRussia’s natural gas producer Novatek is offering liquefied natural gas to potential Chinese customers through a new marketing team, although it’s uncertain whether the Russian company would attract many clients with attractive prices, Chinese traders told Reuters on Wednesday. Novatek is now offering part of an LNG cargo from its majority-owned Yamal project in the Arctic. The cargo is set to arrive in China later in July, the China-based trading sources told Reuters. However, traders doubt the Russian company would… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Novatek-Looks-to-Market-LNG-in-China.html |

|

The Countries Increasing Their Coal Dependency Despite Climate PledgesAs many countries are battling to curb their coal production, some Asian powers continue to increase their dependency on the “dirtiest fossil fuel”, massively hindering a regional green transition. For years there have been big worries about China remaining heavily dependent on coal, but this trend has spread across Southeast Asia. Despite the development of climate pledges and energy strategies in favor of a green transition, with support from international donors, it looks like the region’s heavy reliance on coal could continue… Read more at: https://oilprice.com/Energy/Energy-General/The-Countries-Increasing-Their-Coal-Dependency-Despite-Climate-Pledges.html |

|

The Value of Norway’s Oil Fund Soars to New High of $1.7 TrillionFor the first time in its nearly three-decade history, Norway’s oil fund, the world’s largest sovereign wealth fund, has just exceeded the market value of 18 trillion Norwegian crowns, which equals $1.691 trillion as of Wednesday. Government Pension Fund Global, as the Norwegian fund is officially known, was created in the 1990s and the government started transferring revenues from Norway’s oil and gas industry into the fund in 1996. Since then, the fund has invested in equities and fixed income globally, raising its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Value-of-Norways-Oil-Fund-Soars-to-New-High-of-17-Trillion.html |

|

EU Clears Trafigura’s Acquisition of Biofuels Giant GreenergyThe European Commission has approved the proposed acquisition of the European business of UK-based biofuels producer Greenergy by commodities trading giant Trafigura. Following a review of the proposed transaction under the EU Merger Regulation, the Commission concluded that the deal would not raise competition concerns, because the companies would have a limited combined market position resulting from the deal. Trafigura announced it March that it had agreed to acquire Greenergy’s European business from Brookfield… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Clears-Trafiguras-Acquisition-of-Biofuels-Giant-Greenergy.html |

|

Saudi Arabia Nets $12.35 Billion From Aramco Share OfferingThe final proceeds for Saudi Arabia from the secondary sale of shares in its oil giant Aramco came in at $12.35 billion after the exercising of an over-allotment option, boosting the Kingdom’s total gain from the sale by $1 billion. Saudi Aramco sold last month a 0.64% stake in a secondary offering. Aramco priced 1.545 billion shares on offer in its latest share sale at $7.27 (27.25 Saudi riyals) apiece, based on the results of the book-building process. That was a discount of 6% compared to the closing price of Aramco’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Nets-1235-Billion-From-Aramco-Share-Offering.html |

|

HubSpot shares plunge 12% on report that Alphabet is shelving interest in acquiring software companyAlphabet has reportedly shelved its interest in acquiring HubSpot months after the companies were in talks. Read more at: https://www.cnbc.com/2024/07/10/hubspot-shares-plunge-16percent-on-report-that-alphabet-is-shelving-interest.html |

|

S&P 500 closes above 5,600 for the first time, lifted by gains in Big Tech: Live updatesThe three major averages each rose more than 1% on Wednesday. Read more at: https://www.cnbc.com/2024/07/09/stock-market-today-live-updates.html |

|

Key inflation report looms on Thursday as traders grow more confident in Fed rate cutThe June consumer price index will be released on Thursday, with traders eyeing September for the Federal Reserve’s first rate cut. Read more at: https://www.cnbc.com/2024/07/10/june-cpi-inflation-report-preview.html |

|

Senators strike bipartisan deal for a ban on stock trading by members of CongressNancy Pelosi dropped her resistance to a proposed ban on stock trading by legislators in 2022, allowing the policy push to pick up steam on Capitol Hill. Read more at: https://www.cnbc.com/2024/07/10/senators-strike-bipartisan-deal-for-a-ban-on-stock-trading-by-members-of-congress.html |

|

Samsung launches the Galaxy Ring — a first-of-its-kind product for the tech giantThe Samsung Galaxy Ring has the ability to track various health metrics such as heart rate and sleep. Read more at: https://www.cnbc.com/2024/07/10/samsung-galaxy-ring-launch-price-specs-feature-availability.html |

|

Goldman says investors should start shifting out of cash. Here’s where it sees opportunityGoldman Sachs believes it is a “real probability” that the Fed will start to cut rates in September. Read more at: https://www.cnbc.com/2024/07/10/where-goldman-sees-opportunity-to-start-switching-out-of-cash-.html |

|

With Chevron reversal, Supreme Court paves way for a ‘legal earthquake’More than 19,000 past federal court cases cite the landmark 1984 Chevron ruling, which the Supreme Court just overturned. Read more at: https://www.cnbc.com/2024/07/10/supreme-court-post-chevron-legal-chaos.html |

|

Bitcoin hovers at $57,000 as Fed Chair Powell continues testimony on Capitol Hill: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Rennick Palley, founding partner of Stratos, breaks down how current prices and regulatory action is affecting crypto VC trends. Read more at: https://www.cnbc.com/video/2024/07/10/bitcoin-hovers-as-fed-chair-continues-testimony-crypto-world.html |

|

Bill Gross says Tesla is the new meme stockLongtime investor Bill Gross believes Elon Musk’s Tesla is behaving like a speculative play among retail investors. Read more at: https://www.cnbc.com/2024/07/10/bill-gross-says-tesla-is-the-new-meme-stock.html |

|

Ashley Biden diary thief arrested in Georgia on weed, other charges the day before jail surrender dateFlorida resident Aimee Harris had pleaded guilty to conspiring to steal and sell a diary belonging to Ashley Biden, daughter of President Joe Biden. Read more at: https://www.cnbc.com/2024/07/10/ashley-biden-diary-thief-arrested-jail-surrender.html |

|

George Clooney calls on Biden to drop out of the racePresident Joe Biden is under new pressure to step aside by longtime ally and Hollywood actor George Clooney. Read more at: https://www.cnbc.com/2024/07/10/george-clooney-calls-on-biden-to-drop-out-of-presidential-race.html |

|

The presidential election shouldn’t influence how you invest, financial experts sayU.S. presidential elections historically haven’t moved the stock market. Financial experts don’t expect this year to be any different. Read more at: https://www.cnbc.com/2024/07/10/dont-make-investing-moves-based-on-the-election-experts-say.html |

|

Walmart is opening five automated distribution centers as it tries to keep its grocery dominanceThe facilities are part of Walmart’s broader effort to modernize its supply chain and expand capacity to keep up with customers’ online orders. Read more at: https://www.cnbc.com/2024/07/10/walmart-to-open-five-automated-distribution-centers.html |

|

Elon Musk Defeats $500 Million Lawsuit Over Twitter Mass LayoffsAuthored by Tom Ozimek via The Epoch Times, A California judge handed Elon Musk a win in a lawsuit filed over the mass firing of staff at Twitter after he took over the social media platform in October 2022.

Mr. Musk and X Corp. (Twitter was rebranded as X in July 2023) were accused of violating provisions of the federal Employee Retirement Income Security Act (ERISA) by allegedly misleading employees about whether he’d honor a severance plan “at least as favorable” as one developed by prior Twitter management, leading some staff to stay at the company longer than they otherwise would have and getting less severance pay than they expected when they were let go. The class-action lawsuit, which was brought by Courtney McMillian, who oversaw Twitter’s benefits programs, sought at least $500 million in allege … Read more at: https://www.zerohedge.com/personal-finance/elon-musk-defeats-500-million-lawsuit-over-twitter-mass-layoffs |

|

Still In The “First Or Second Innings” Of CRE Tower StormWhile politics and geopolitics dominate the headlines—whether it’s Joe Bien’s mumbling and stumbling or the risks of World War III in Eastern Europe, the Middle East, or the South China Sea—many seem to overlook the ongoing commercial real estate crash in the US. This CRE downturn is set to worsen as remote and hybrid work models drastically reduce demand for traditional office towers. Bloomberg cited data from the Mortgage Bankers Association, reminding us that banks will face a $1 trillion maturity wall of CRE loans at the end of this year. This only means more bank failures are ahead because of the bad property debt held on balance sheets. “Compared with the Savings & Loans crisis and 2008, we’re still in the first or second innings” when it comes to distressed CRE assets, said Rebel Cole, a finance professor at Florida Atlantic University who advises Oaktree Capital Management, adding, “There’s a tsunami coming and the waters are pulling out from the beach.” In a recent note, John Brady, global head of real estate at Oaktree, explained, “We could be on the precipice of one of the most significant real estate distressed investment cycles of the last 40 years.” Brady said that “unloved” CRE space will present opportunities for bottom fishing: “Few asset classes are as unloved as commercial real estate and thus we believe there are few better places to fin … Read more at: https://www.zerohedge.com/markets/still-first-or-second-innings-cre-tower-storm |

|

The Pennsylvania County That Just Might Be 2024’s ‘Ground Zero’Authored by Salena Zito via RealClearPolitics, ERIE, Pennsylvania — Despite 40,000 people leaving this city since 1970 (10,000 of them between 2000 and 2016) and having the unfortunate distinction of being the home of the poorest zip code in the state – “ride or die” Erie residents, especially young people who have left for better opportunities only to come back to raise their families here, are a real thing.

They are reshaping the way the city moves and shakes as well as its politics, in what is perhaps not just the most important county in Pennsylvania in determining who will be the next president – but arguably the most important county in the country. It is a city and county in economic flux, situated halfway between New York City and Chicago along one of the Great Lakes. It has two major interstates, a massive port, and access to robust freight and … Read more at: https://www.zerohedge.com/political/pennsylvania-county-just-might-be-2024s-ground-zero |

|

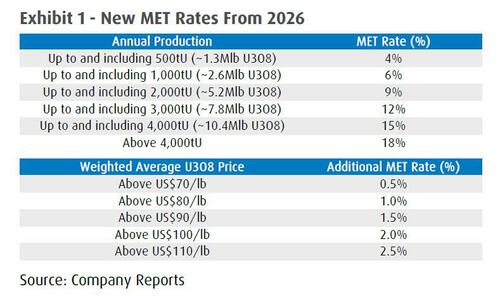

Uranium Stocks Soar As New Mineral Tax In Kazakhstan Will Drive Higher Uranium PricesUranium mining stocks soared on Wednesday after a surprise hike in extraction taxes in Kazakhstan, the world’s largest uranium-producing country, which BMO Capital Markets said will limit future supply growth. As Interfax first reported, the government in Kazakhstan introduced a new Mineral Extraction Tax (MET) for uranium, replacing the existing 6% flat rate MET introduced in 2023. Per the new code, the new MET rate is to increase to 9% from 6% in 2025. However, the biggest change is from 2026 onwards where the Government has introduced a two-tier MET, calculated based on production output and spot uranium prices (see the table below).

According to BMO analyst Alexander Pearce, the new mineral extraction tax “is a surprise given it was increased in 2023.” He also notes that “the new rates are not marginal, thus the new MET penalizes large mining assets with potential MET of up to 20.5% (18% for anything o … Read more at: https://www.zerohedge.com/markets/uranium-stocks-soar-new-mineral-tax-kazakhstan-will-drive-higher-uranium-prices |

|

Musk defeats ex-Twitter staff seeking $500m in severanceA US judge dismissed the case, one of several filed in the aftermath of Mr Musk’s takeover of the site. Read more at: https://www.bbc.com/news/articles/c72vr64el8yo |

|

Passengers could get compensation after BA court rulingThe ruling against British Airways has the potential to affect thousands of airline claims every year. Read more at: https://www.bbc.com/news/articles/c9x8w4r26nko |

|

Staff allowed to choose working hours in new trialThe project will build on the original 2022 trial looking at a four-day working week. Read more at: https://www.bbc.com/news/articles/c3g08e70819o |

|

Breakout Stocks: How to trade Maruti Suzuki, CAMS and BritanniaThe Indian market witnessed selling pressure at higher levels as traders preferred to book profits. The S&P BSE Sensex fell over 400 points to close below 80,000 while the Nifty50 also closed with a loss of over 100 points at 24,324. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-maruti-suzuki-cams-and-britannia-industries-on-thursday/market-roundup/slideshow/111637790.cms |

|

Moody’s upgrades YES Bank outlook to positive, affirms ratingsMoody’s expects YES Bank’s profitability to improve over the next 12-18 months as its depositor base and lending franchise grow. This growth, combined with meeting central bank lending targets through new branch loans, will reduce operating costs and boost overall profitability. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/moodys-upgrades-yes-bank-outlook-to-positive-affirms-ratings/articleshow/111639771.cms |

|

Fed would not wait for 2% inflation to consider rate cut: PowellThe US central bank will not want to wait for inflation to cool to its two percent target before considering a rate cut, Federal Reserve Chair Jerome Powell told lawmakers Wednesday. On Wednesday, Powell told lawmakers that he is not yet prepared to express confidence that inflation is moving sustainably down to two percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fed-would-not-wait-for-2-inflation-to-consider-rate-cut-powell/articleshow/111641913.cms |

|

Is my boss a narcissist? ‘Once you take a company public, you are more likely to be in the psychopathic zone.’“Narcissism is a personality style, not a disorder. It shows up and puts a person at odds with other people,” says psychologist Ramani Durvasula. Read more at: https://www.marketwatch.com/story/its-like-an-infection-is-your-boss-a-narcissist-here-are-the-warning-signs-of-a-toxic-workplace-culture-e6a09048?mod=mw_rss_topstories |

|

Wall Street is becoming more skeptical of artificial-intelligence hype helping to power stocksAfter 18 months of hyping up artificial intelligence and its potentially transformative impact on both corporate profits and human productivity, Wall Street appears to be turning more skeptical. Read more at: https://www.marketwatch.com/story/wall-street-is-becoming-more-skeptical-of-artificial-intelligence-hype-helping-to-power-stocks-983aa5ca?mod=mw_rss_topstories |

|

‘I’m not jealous — just genuinely curious’: How can a woman work from home and mind her 3-year-old child at the same time?“What do you all think about employees who work from home and have little kids to watch at the same time?” Read more at: https://www.marketwatch.com/story/im-not-jealous-just-genuinely-curious-how-can-a-woman-work-from-home-and-mind-her-3-year-old-child-at-the-same-time-14a9c311?mod=mw_rss_topstories |