Summary Of the Markets Today:

- The Dow closed up 162 points or 0.41%,

- Nasdaq closed up 0.84%,

- S&P 500 closed up 0.62%,

- Gold $2,340 up $1.20,

- WTI crude oil settled at $83 down $0.39,

- 10-year U.S. Treasury 4.427 down 0.051 points,

- USD index $105.69 down $0.210,

- Bitcoin $61,827 down $1,003 or 1.60%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Home prices nationwide, including distressed sales, increased year over year by 4.9% in May 2024 compared with May 2023 according to CoreLogic. The CoreLogic HPI Forecast indicates that home prices will rise by 0.7% from May 2024 to June 2024 and increase by 3% on a year-over-year basis from May 2024 to May 2025.

The number of job openings changed little at 8.1 million on the last business day of May 2024, the U.S. Bureau of Labor Statistics reported today. Over the month, both the number of hires and total separations were little changed at 5.8 million and 5.4 million, respectively. I have a healthy disrespect for this particular dataset. Historically there was reasonable correlation between job openings and job growth. but something changed with the COVID recession. It is likely there are phantom job openings. Historically this dataset would suggest that there will be little change in job growth in the coming months.

Here is a summary of headlines we are reading today:

- Aramco Targets 60% Increase in Gas Production by 2030

- Nuclear Plants in High Demand as Tech Firms Scramble to Ramp Up AI Data Centers

- U.S. Drivers Could See The Lowest July 4 Gasoline Prices Since 2021

- Global Crude Oil Shipments Fall in June on Saudi Export Slump

- German Firms Install Solar Panels to Cut Electricity Costs

- S&P 500 closes above 5,500 for the first time as Powell highlights inflation progress, Tesla jumps: Live updates

- Powell says Fed has made ‘quite a bit of progress’ on inflation but needs more confidence before cutting

- Powell says Fed has made ‘quite a bit of progress’ on inflation but needs more confidence before cutting

- Silvergate Bank settles SEC claims it failed to monitor $1 trillion in crypto transactions: CNBC Crypto World

- Google’s carbon emissions surge nearly 50% due to AI energy demand

- Bonds & Stocks Bid As Government Job Openings Suddenly Surge

- Tesla surprises with better than expected car sales

- Treasury yields end lower for first time in three sessions as Fed chair cites improving pace of inflation

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Hidden Costs of Georgia’s Partnership With ChinaGeorgia’s strategic partnership with China may seem promising for Tbilisi on the surface, but the substance of the relationship conflicts with Georgia’s long-term ambitions. There are two drawbacks for Georgia. First, the partnership with China comes at the expense of Euro-Atlantic integration: the increasing rivalry between China and the West makes it difficult, if not impossible to walk the geostrategic tightrope dividing both sides. Second, Chinese engagement is unlikely to deter possible future Russian military aggression… Read more at: https://oilprice.com/Geopolitics/International/The-Hidden-Costs-of-Georgias-Partnership-With-China.html |

|

Aramco Targets 60% Increase in Gas Production by 2030The Saudi state-owned oil major Aramco has big plans for its future in fossil fuels, despite calls for a global green transition. The oil and gas firm is investing heavily in a future in LNG, solidifying its position in the international market as demand continues to grow. This year, it has announced several big LNG investments, in line with the company’s development plan. In addition, Aramco’s CEO Amin Nasser has been very vocal in his support for greater international investment in oil and gas, suggesting that demand will remain high… Read more at: https://oilprice.com/Energy/Natural-Gas/Aramco-Targets-60-Increase-in-Gas-Production-by-2030.html |

|

OPEC’s Oil Production Continues to Rise Despite OPEC+ PledgesHigher production in Nigeria and Iran boosted OPEC’s oil production in June for a second month in a row, according to the monthly Reuters survey published on Tuesday. OPEC’s all 12 producers pumped 26.7 million barrels per day (bpd) of crude oil in June, up by 70,000 bpd compared to May, found the survey, which tracks supply to the market and is based on information provided by industry sources and shipping data. Nigeria increased its oil production by an estimated 50,000 bpd last month, as Africa’s top oil producer… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Oil-Production-Continues-to-Rise-Despite-OPEC-Pledges.html |

|

Nuclear Plants in High Demand as Tech Firms Scramble to Ramp Up AI Data CentersBig tech firms like Amazon are actively speaking with utility companies to build artificial intelligence data centers powered by clean, reliable nuclear energy. This move aligns with the ‘Next AI Trade’ investing theme, which was introduced to pro-subs in early April. “The owners of roughly a third of US nuclear power plants are in talks with tech companies to provide electricity to new data centers needed to meet the demands of an artificial-intelligence boom,” the Wall Street Journal says. In particular, WSJ sources say Amazon Web… Read more at: https://oilprice.com/Energy/Energy-General/Nuclear-Plants-in-High-Demand-as-Tech-Firms-Scramble-to-Ramp-Up-AI-Data-Centers.html |

|

U.S. Drivers Could See The Lowest July 4 Gasoline Prices Since 2021The U.S. national average price of gasoline on July 4 is expected at $3.49 per gallon, which would be the lowest price on Independence Day since 2021, fuel-savings platform GasBuddy said on Tuesday. Gasoline prices have risen in recent days amid higher crude oil prices, but the national average is still set to be lower on July 4 compared to 2023 and 2022. GasBuddy expects the national average price of gas on July 4 to be just a penny lower than it was a year ago – when it was $3.50 a gallon. But this year’s Independence… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Drivers-Could-See-The-Lowest-July-4-Gasoline-Prices-Since-2021.html |

|

Ineos Energy CEO: UK Making Oil and Gas Investment DifficultThe chief executive of Ineos Energy has said the business will prioritise expansion in the US and Denmark over Britain, arguing that the country’s politicians have put “pain” on the oil and gas sector. David Bucknall told The Times that the US and Denmark, the other two regions the company operates in, were “much easier to invest in at the moment”. “If you look at the US, you have different rhetoric at the top level from different sides of the political spectrum, but the reality is that the people in the Department… Read more at: https://oilprice.com/Energy/Crude-Oil/Ineos-Energy-CEO-UK-Making-Oil-and-Gas-Investment-Difficult.html |

|

Russian Pipeline Gas Exports to Europe Soared by 23% Y/Y in JuneRussia’s gas giant Gazprom shipped 23% higher volumes of natural gas via pipeline to Europe in June compared to the same month last year, according to estimates by Reuters. Gazprom’s pipeline gas deliveries averaged a daily volume of 81.8 million cubic meters (mcm) in June, up from 66.8 mcm in June last year, per the Reuters calculations based on data from European gas transmission group Entsog and Gazprom’s daily reports on gas transit via Ukraine. Gazprom’s export volumes in June 2024 declined from the 89.5 mcm daily… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Pipeline-Gas-Exports-to-Europe-Soared-by-23-YY-in-June.html |

|

Saudi Aramco Bets on Unconventional Field in $25-Billion Gas ExpansionThe world’s biggest oil company and crude oil exporter, Saudi Aramco, is betting big on its unconventional natural gas reserves to strategically grow its domestic and international gas and LNG business. Aramco has been seeking a greater role in the global LNG market as it plans to ramp up its natural gas production and trading business. The oil giant is looking to boost its domestic natural gas supply, to replace direct crude burn for its power generation and free up more crude for exports. As part of its strategic… Read more at: https://oilprice.com/Energy/Natural-Gas/Saudi-Aramco-Bets-on-Unconventional-Field-in-25-Billion-Gas-Expansion.html |

|

Global Crude Oil Shipments Fall in June on Saudi Export SlumpFalling crude oil exports from Saudi Arabia accounted for half of the 1 million barrels per day (bpd) drop in global seaborne shipments in June compared to May, tanker-tracking data compiled by Bloomberg showed on Tuesday. The estimated decline of about 1.08 million bpd in global crude oil shipments was the biggest monthly drop in seaborne crude supply so far this year, according to the data. Saudi Arabia, the world’s top crude oil exporter, led the decline, likely because of burning more oil domestically for power generation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Global-Crude-Oil-Shipments-Fall-in-June-on-Saudi-Export-Slump.html |

|

WTI Crude Soars to Highest Level Since April on Demand Optimism, Hurricane BerylHurricane Beryl strengthened overnight to a powerful Category 5 storm as it churned in the Caribbean Sea. The Cat. 5 storm is the earliest on record in the Atlantic hurricane season and has caused concern among energy traders about potential Gulf Coast disruptions. On Monday morning, Beryl made landfall on Grenada’s Carriacou Island in the Caribbean Sea with winds around 150 mph. According to NOAA data dating back to 1851, this is the strongest known storm to traverse the Grenadines area. Beryl’s arrival marks… Read more at: https://oilprice.com/Energy/Crude-Oil/WTI-Crude-Soars-to-Highest-Level-Since-April.html |

|

Shell to Temporarily Halt European Biofuels ProjectShell will pause on-site construction work at a biofuels plant in Rotterdam amid weak market conditions, the supermajor said on Tuesday, as international oil firms continue to re-evaluate their low-carbon energy projects. Shell’s subsidiary Shell Nederland Raffinaderij will temporarily pause on-site construction work at its 820,000 tons-a-year biofuels facility at the Shell Energy and Chemicals Park Rotterdam in the Netherlands “to address project delivery and ensure future competitiveness given current market conditions,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-to-Temporarily-Halt-European-Biofuels-Project.html |

|

Oil Markets Are on Edge as Hurricane Beryl Barrels Towards JamaicaHurricane season is back, and oil markets are on edge as the earliest category 5 hurricane to form at this time of the year moves toward Jamaica.- As commodity markets started to talk politics following last week’s Biden-Trump debate, analysts seek to gauge the impact of US gasoline prices on voter satisfaction.- Nationwide gasoline prices are 3-4% lower year-on-year, with US gasoline consumption trending lower this year, gasoline cracks being a hefty $10 per barrel lower than in 2023 and inventories some 12 million barrels higher.- However,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Are-on-Edge-as-Hurricane-Beryl-Barrels-Towards-Jamaica.html |

|

Cathay Pacific: China Could Accelerate Sustainable Jet Fuel AdoptionChina could become a major catalyst for the widespread adoption of sustainable aviation fuel (SAF), considering its success in solar power development and electric vehicles rollout, senior executives at Cathay Pacific Airways have told Bloomberg. Cathay Pacific is collaborating with the Chinese authorities, state-owned utility State Power Investment Corp, and academics to look into ways of producing sustainable fuels at viable costs, the airline’s CEO Ronald Lam told Bloomberg in an interview published on Tuesday. According to Grace Cheung,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cathay-Pacific-China-Could-Accelerate-Sustainable-Jet-Fuel-Adoption.html |

|

German Firms Install Solar Panels to Cut Electricity CostsGermany’s small and medium-sized companies are increasingly turning to solar power to cover their electricity consumption as energy prices in Europe’s biggest economy haven’t dropped much despite the fall in natural gas prices compared to the peak energy crisis. “As electricity prices in Germany show no signs of decreasing as previously anticipated, companies are increasingly recognising the economic viability of installing solar panels,” Marie-Theres Husken, an energy expert for the BVMW association for small- and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Firms-Install-Solar-Panels-to-Cut-Electricity-Costs.html |

|

Venezuela Signals Willingness for New Round of Talks With U.S.Venezuela’s president, Nicolas, Maduro, has accepted a U.S. proposal for a new round of talks on local policies and the future of U.S. oil sanctions on Caracas. “I have received the proposal during two continuous months from the United States government to reestablish talks and direct dialogue,” Maduro said on Venezuelan television, as quoted by the Associated Press “After thinking about it for two months, I have accepted, and next Wednesday, talks will restart with the United States government to comply… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuela-Signals-Willingness-for-New-Round-of-Talks-With-US.html |

|

S&P 500 closes above 5,500 for the first time as Powell highlights inflation progress, Tesla jumps: Live updatesThe S&P 500 was pulled in different directions on Tuesday as Tesla shares jumped and Nvidia shares declined. Read more at: https://www.cnbc.com/2024/07/01/stock-market-today-live-updates.html |

|

How thousands of Americans got caught in fintech’s false promise and lost access to bank accountsThe Synapse collapse has revealed fintech’s promise of safety as a mirage. More than 100,000 Americans with $265 million in deposits were locked from accounts. Read more at: https://www.cnbc.com/2024/07/02/synapse-fintech-fdic-false-promise.html |

|

Powell says Fed has made ‘quite a bit of progress’ on inflation but needs more confidence before cutting“We’ve made quite a bit of progress and in bringing inflation back down to our target,” Powell said at a central banking forum in Sintra, Portugal. Read more at: https://www.cnbc.com/2024/07/02/powell-says-fed-has-made-quite-a-bit-of-progress-on-inflation-but-needs-more-confidence-before-cutting.html |

|

First House Democrat urges Biden to withdraw from presidential raceRep. Lloyd Doggett is the first sitting House Democrat to formally call on President Joe Biden to drop his reelection bid against former President Donald Trump. Read more at: https://www.cnbc.com/2024/07/02/doggett-first-house-democrat-urges-biden-to-withdraw-from-presidential-race.html |

|

This bank just boosted its 1-year CD yield to more than 5%, even as traders await Fed rate cutsTraders are expecting rate cuts from the Federal Reserve in the fall, and yields on interest-bearing deposit products will likely slide then. Read more at: https://www.cnbc.com/2024/07/02/this-bank-just-boosted-its-1-year-cd-yield-to-more-than-5percent.html |

|

Trump sentencing date in hush money case postponed more than two months to Sept. 18Trump’s lawyers sought to challenge the hush money verdict after the Supreme Court ruled that ex-presidents have “presumptive immunity” for their official acts. Read more at: https://www.cnbc.com/2024/07/02/donald-trump-hush-money-delay-sentencing.html |

|

FDA approves Eli Lilly Alzheimer’s drug, expanding treatment options in the U.S.It’s a long-awaited win for Eli Lilly after donanemab faced several delays in its path to the market, including an initial rejection from the FDA last year. Read more at: https://www.cnbc.com/2024/07/02/fda-approves-eli-lilly-alzheimers-drug-donanemab.html |

|

Silvergate Bank settles SEC claims it failed to monitor $1 trillion in crypto transactions: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Elliot Chun of Architect Partners discusses the firm’s Q2 crypto M&A and financing report. Read more at: https://www.cnbc.com/video/2024/07/02/silvergate-settles-sec-claims-failed-to-monitor-1-trillion-crypto-transactions-crypto-world.html |

|

Google’s carbon emissions surge nearly 50% due to AI energy demandThe increase marks a setback in Google’s goal to achieve net-zero emissions by 2030. Read more at: https://www.cnbc.com/2024/07/02/googles-carbon-emissions-surge-nearly-50percent-due-to-ai-energy-demand.html |

|

Peloton staved off the cash crunch that threatened its business. Where does it go now?Peloton’s looming debt pile raised concerns that the company could be pushed into bankruptcy. Now that Peloton has refinanced, it still has to fix its strategy. Read more at: https://www.cnbc.com/2024/07/02/peloton-staves-off-liquidity-crunch-in-global-refinance.html |

|

Top Democrats Pelosi, Clyburn say Biden age concerns are ‘legitimate’ after debatePresident Biden stumbled through his first debate against Donald Trump, setting off alarm bells among Democrats about his ability to win November’s election. Read more at: https://www.cnbc.com/2024/07/02/nancy-pelosi-jim-clyburn-say-biden-age-concerns-are-legitimate.html |

|

Biden campaign reports raising $127 million in June, over $30 million since debateHigh fundraising totals for the Biden campaign reflect steady grassroots contributions despite the president’s sluggish debate performance. Read more at: https://www.cnbc.com/2024/07/02/biden-campaign-reports-raising-127-million-in-june.html |

|

Fed to cut rates three times by year-end, Lazard market strategist Temple saysLazard’s chief market strategist sees a more accommodative Federal Reserve than the market is currently priced for. Read more at: https://www.cnbc.com/2024/07/02/fed-to-cut-rates-three-times-by-year-end-lazard-strategist-says.html |

|

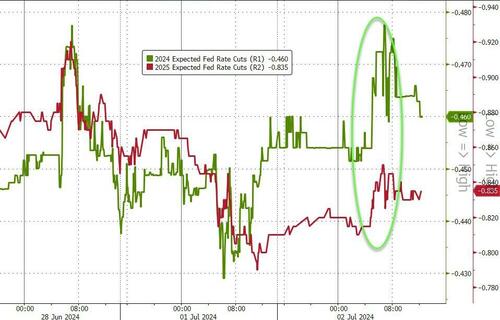

Bonds & Stocks Bid As Government Job Openings Suddenly SurgeDespite the near-perfect track record of downward revisions over the last 17 months, the market seemed buoyed today by a better than expected JOLTS print – which was juiced almost entirely by government jobs

Source: Bloomberg And that was enough to send rate-cut expectations (dovishly) higher

Source: Bloomberg Which pulled stocks and bonds higher in price… Read more at: https://www.zerohedge.com/markets/bonds-stocks-bid-government-job-openings-suddenly-surge |

|

Blackstone Sees AI Revolution Growing Private Credit Market To Staggering $25 TrillionSeveral years ago we calculated that the cost to implement the “Green new deal”, and to fund the liberal crusade against “climate change” would cost no less than $150 trillion over 30 years, or about $5 trillion per year, a staggering amount, and one which would require constant QE by central banks in the trillions each and every year to have any chance of ever getting funded, a process which just incidentally would spark double (if not triple) digit inflation. Which of course was the whole point: the bullshit “green” narrative was spewed by the top echelons of power not because these private jetsetters give a rat’s ass about the environment – if that was the case the CO2 footprint of the top 1% would not be greater than the bottom 90% – but because they always needed a palatable and “virtuous” justification to spend like drunken sailors, be it to destroy ideological enemy X in noble war Y (where the deep state is the biggest beneficiary of the flood in defense spending), or to destroy evil climate change. Read more at: https://www.zerohedge.com/markets/blackstone-sees-ai-revolution-growing-private-credit-market-staggering-25-trillion |

|

The US Is A “Runaway Train”Submitted by QTR’s Fringe Finance I had the wonderful pleasure of interviewing my friend Chris Martenson from Peak Prosperity this week. Martenson, PhD (Duke), MBA (Cornell) is an economic researcher and futurist specializing in energy and resource depletion, and founder of PeakProsperity.com. He is one of a small list of favorites of mine that I am constantly reading and following on Twitter and on his site. He was also one of the first to sound the alarm about Covid in the U.S. while the mainstream media (and the rest of the nation) hadn’t figured out the obvious yet. In our 75 minute audio interview, we discussed a wide range of topics, including the potential for World War 3, the immigration crisis, the state of the economy in the U.S., our nation’s response to Covid and looking back on the events of 9/11 more than 20 years later. Chris told me right off the bat that he has significant concerns about the Russia/Ukraine war escalating due to the U.S. war machine making unilateral decisions: “So here’s the event that bothers me the most right now. A month ago, we hear that Ukraine has used some of their first long-range capabilities to attack Russia’s over-the-horizon nuclear early detection radar system. One of them, right?” “A couple of weeks later, a second one. All right. Do you think anybody listening to this really believes that we voted for somebody who made that decision to target those things?” He cont … Read more at: https://www.zerohedge.com/markets/us-runaway-train |

|

Trump Sentencing Delayed Two Months, ‘If Such Is Still Necessary’Update (1505ET): Donald Trump’s sentencing date has been kicked down the road more than two months – from July 11th to September 18th, ‘if such is still necessary.’

Donald J. Trump faces probation or prison time after being convicted of 34 felony counts of falsifying business records. Credit…Dave Sanders for The New York Times

Read more at: https://www.zerohedge.com/political/trump-moves-overturn-manhattan-conviction-after-supreme-court-immunity-decision |

|

Sainsbury’s hit as wet weather dampens Argos salesFood sales rise but the soggy spring hits demand for garden equipment and outdoor furniture Read more at: https://www.bbc.com/news/articles/cv2g0w81e45o |

|

Tesla surprises with better than expected car salesThe electric car maker sold more cars than expected this spring, raising hopes of a revival. Read more at: https://www.bbc.com/news/articles/c0dmvrxnk4jo |

|

The election issues you care about that manifestos barely mentionBBC audiences have asked for more detail on issues such as fly-tipping, income tax thresholds and assisted dying Read more at: https://www.bbc.com/news/articles/c1wepgxzqxqo |

|

Tech View: Nifty bulls getting tired at peaks. Here’s how to trade on WednesdayNifty ended Tuesday’s session with a small loss of 18 points to form a small red candle on the daily chart which indicated that bulls are getting tired at peaks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-getting-tired-at-peaks-heres-how-to-trade-on-wednesday/articleshow/111432347.cms |

|

Hindenburg claims it hardly made money by shorting Adani stocks & bondsHindenburg admits revenue from Adani shorts, may barely break even. Responds to Sebi’s show cause notice, highlights fraud risks, and calls out regulators for neglecting investor protection. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hindenburg-claims-it-hardly-made-money-by-shorting-adani-stocks-bonds/articleshow/111420459.cms |

|

Oil prices end lower as concern over Hurricane Beryl’s impact on U.S. output easesOil futures settled with a loss on Tuesday, with prices giving up early gains as concerns that powerful Hurricane Beryl could cause disruptions to offshore crude production in the Gulf of Mexico eased, for now. Read more at: https://www.marketwatch.com/story/oil-prices-extend-gains-on-july-4-travel-expectations-hurricane-beryl-worries-b1b87a80?mod=mw_rss_topstories |

|

Treasury yields end lower for first time in three sessions as Fed chair cites improving pace of inflationYields on U.S. government debt finished lower on Tuesday after Federal Reserve Chair Jerome Powell said the U.S. might be back on a disinflationary path, but that officials need greater confidence before they can lower interest rates. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yields-edge-lower-as-traders-await-powell-comments-b71e855a?mod=mw_rss_topstories |

|

Intuitive Machines’ stock rockets as next moon mission approachesShares of Intuitive Machines Inc. surged 12% Tuesday as the space-exploration company edges closer to its next mission to the moon. Read more at: https://www.marketwatch.com/story/intuitive-machines-shares-rocket-ahead-of-next-moon-mission-in-late-2024-dcb39da1?mod=mw_rss_topstories |