Summary Of the Markets Today:

- The Dow closed up 51 points or 0.13%,

- Nasdaq closed up 0.83%,

- S&P 500 closed up 0.27%,

- Gold $2,341 up $1.40,

- WTI crude oil settled at $84 up $1.96,

- 10-year U.S. Treasury 4.469 up 0.126 points,

- USD index $105.82 down $0.04,

- Bitcoin $63,205 up $537 or 0.86%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Total Construction spending is up 6.4% year-over-year in May 2024 – down from 7.6% year-over-year last month. Private construction was up 5.4% year-over-year whilst public construction was up 9.7% year-over-year. As one can see from the graph below, construction spending is on a slowing trendline – but still remains a bright spot in the economy.

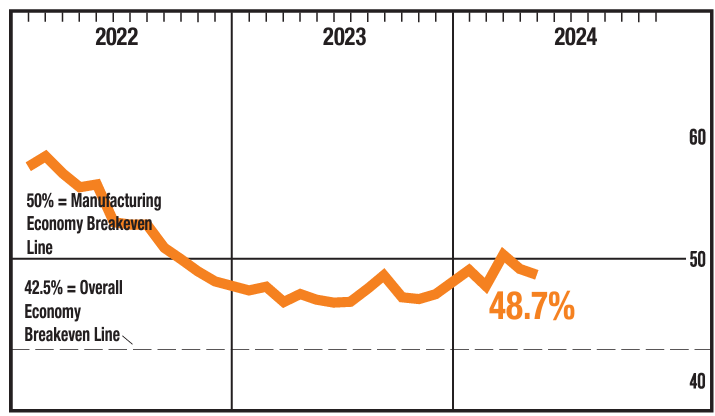

The Manufacturing PMI® registered 48.5 percent in June 2024, down 0.2 percentage point from the 48.7 percent recorded in May. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory, registering 49.3 percent, 3.9 percentage points higher than the 45.4 percent recorded in May. The Backlog of Orders Index registered 41.7 percent, down 0.7 percentage point compared to the 42.4 percent recorded in May. The bottom line is that for the last 18 months, manufacturing has remained a weak spot in the economy with no evidence of growing strength.

Here is a summary of headlines we are reading today:

- Transatlantic Energy Highway: Is a Global Power Grid on the Horizon?

- Heatwave Drives Record Electricity Demand in Eastern U.S.

- Italian Oil Giant Eni to Divest Over $4B in Upstream Assets

- Trans Mountain Oil Pipeline Off to a Solid Start

- OPEC: The World Cannot Run on Renewable Energy and EVs

- China Stops Reporting Renewable Energy Utilization Data

- EU Hits Record 74% Zero-Emission Power Generation

- S&P 500, Nasdaq close higher to kick off second half’s trading: Live updates

- Chewy shares fall nearly 7% as the boost from Roaring Kitty’s new stake diminishes

- Bitcoin jumps back above $63,000 to kick off second half of 2024: CNBC Crypto World

- Collapsed bitcoin exchange Mt. Gox is about to unload $9 billion of coins onto the market. Here’s what it means

- Cocoa Prices Fall To Critical Technical Support Level On Improving Ivory Coast Outlook

- Maersk shares jump on decision to scrap plans for DB Schenker takeover

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

| Here are the headlines moving the markets. | |

|

Steel Industry Reacts to Import Caps and Tariffs with Cautious ApproachVia Metal Miner Sources said that steel manufacturing entities in northern Europe are unlikely to seek price increases on hot rolled coil until July, despite events since May that could create conditions to raise them. “If you do that, you seem very opportunistic,” one source told MetalMiner. Mills were seeking €630-650 ($675-695) per metric ton EXW in late May, up from earlier quotes of €620-630 ($665-675) that month, though there are currently few takers. On May 31, the European Commission, the executive body of the European… Read more at: https://oilprice.com/Metals/Commodities/Steel-Industry-Reacts-to-Import-Caps-and-Tariffs-with-Cautious-Approach.html |

|

Transatlantic Energy Highway: Is a Global Power Grid on the Horizon?There are a great number of challenges standing between the current global energy landscape and decarbonization. Even though the installation of renewable energy production capacity is picking up speed, experts say that the growth rate is insufficient to achieve the goals set forth by the Paris Climate Agreement. However, in some places, the amount of renewable energy currently being produced is already too much for the grid to handle in some locations, with prices even going negative when supply and demand are severely mismatched. The problem… Read more at: https://oilprice.com/Energy/Energy-General/Transatlantic-Energy-Highway-Is-a-Global-Power-Grid-on-the-Horizon.html |

|

Will Orban’s Government Cause Turmoil in the EU?The European Union is bracing for Hungary to take over the EU’s rotating presidency, which starts on July 1. It could be an awkward six months for the EU leadership given that Hungarian Prime Minister Viktor Orban has been on a collision course with Brussels, watering down EU sanctions on Russia, preventing military and financial aid for Ukraine, and questioning Kyiv’s EU aspirations. Hungary, a self-styled “illiberal democracy,” has been penalized for what officials in Brussels see as backsliding on democracy, with the EU freezing 6 billion euros… Read more at: https://oilprice.com/Geopolitics/International/Will-Orbans-Government-Cause-Turmoil-in-the-EU.html |

|

Heatwave Drives Record Electricity Demand in Eastern U.S.Electricity demand soared across the eastern and midwestern United States in June as an intense heatwave gripped the region. The Eastern Interconnection, which covers the mainland U.S. east of the Rockies excluding Texas, experienced unprecedented electricity consumption, according to the EIA. On June 21, peak demand reached 502,670 megawatts (MW) in a single hour, surpassing the 2023 June peak of 467,609 MW. The heatwave brought record-breaking temperatures to several areas. Bangor, Maine, hit 96 degrees on June 20, a record not seen since 1931.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Heatwave-Drives-Record-Electricity-Demand-in-Eastern-US.html |

|

Courts Take Charge: Implications of SCOTUS Dismantling Chevron DeferenceThe U.S. Supreme Court overturned two staples of the regulatory system. the so-called Chevron deference, which calls upon the courts to defer to the expertise of specialized federal agencies and the use of administrative law judge opinions (Jarkesy decision.) Junking the Chevron deference would affect the work of a large swath of the federal regulatory bureaucracy. (We wrote about this case and its implications for OilPrice readers several months ago.) The court found that the considerable subject matter expertise of federal agencies would no longer… Read more at: https://oilprice.com/Energy/Energy-General/Courts-Take-Charge-Implications-of-SCOTUS-Dismantling-Chevron-Deference.html |

|

Italian Oil Giant Eni to Divest Over $4B in Upstream AssetsItalian oil giant Eni is planning to divest over $4 billion in upstream assets, with Indonesia and Cyprus among those potentially targeted, Bloomberg reported on Monday, citing unnamed sources. Eni is seeking to divest a total of 8 billion euros, or over $4 billion in upstream assets over the next three years, Bloomberg reported, with divestments potentially including both smaller projects that could be scooped up by local buyers, or stakes in larger projects. Eni did not comment on the report for Bloomberg. The Bloomberg report… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italian-Oil-Giant-Eni-to-Divest-Over-4B-in-Upstream-Assets.html |

|

Biden’s De Facto EV Mandate At Risk after Supreme Court ‘Chevron’ RulingThe Biden Administration’s new strict tailpipe emission standards have just become particularly vulnerable after the Supreme Court overturned last week a 40-year-old landmark ruling, known as the ‘Chevron deference’, which granted federal agencies the authority to interpret ambiguous laws. The precedent, set in 1984 in a case involving the oil giant, gave federal agencies more power to interpret ambiguous laws. But last Friday’s Supreme Court ruling will strip federal agencies, including the Environmental Protection… Read more at: https://oilprice.com/Energy/Energy-General/Bidens-De-Facto-EV-Mandate-At-Risk-after-Supreme-Court-Chevron-Ruling.html |

|

Trans Mountain Oil Pipeline Off to a Solid StartThe Trans Mountain pipeline delivered enough crude oil to load 20 tankers from Canada’s Pacific Coast in the first full month of operations of the expanded link, just below the company’s expectations, Reuters reported on Monday, citing data from tanker-tracking providers LSEG, Vortexa, and Kpler. The expanded Trans Mountain pipeline has tripled the capacity of the original pipeline to 890,000 barrels per day (bpd) from 300,000 bpd to carry crude from Alberta’s oil sands to British Columbia on the Pacific Coast. The higher… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trans-Mountain-Oil-Pipeline-Off-to-a-Solid-Start.html |

|

Consolidation Wave in U.S. Oil and Gas is Big Boon for Private EquityA couple of years ago, private equity funds were having trouble convincing investors that there was still money to be made in oil and gas. At that time, everyone wanted in on the ESG game. Fast forward two years—private equity funds that stayed exposed to the oil and gas industry are making billions from their exits. At the end of last month, EnCap Investments sold its portfolio company XCL Resources to SM Energy and Northern Oil and Gas. The total price tag was about $2.5 billion. Also in June, EnCap sold assets of another… Read more at: https://oilprice.com/Energy/Energy-General/Consolidation-Wave-in-US-Oil-and-Gas-is-Big-Boon-for-Private-Equity.html |

|

Court Hearing on Citgo Auction Could Be Delayed Until SeptemberThe court officer who oversees the auction of Venezuela’s PDV Holding, the parent company of refiner Citgo Petroleum, has asked a Delaware court to postpone the hearing on the winning bids by two months until September 19, to have more time to evaluate the bids and negotiate a sales agreement. The deadline for submitting binding bids for Citgo’s parent company expired last month, while the deadline for completing the court-appointed auction and the awarding of the winners is currently July 15. But Robert Pincus, the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Hearing-on-Citgo-Auction-Could-Be-Delayed-Until-September.html |

|

How to Ensure Oil Workers Get Access to Clean Energy JobsAs the world transitions away from fossil fuels to renewable alternatives, we are inevitably seeing cuts in oil and gas jobs around the globe. Meanwhile, the number of renewable energy jobs is increasing in line with capacity expansion. Many of those who have worked in oil and gas are ideal candidates for the clean energy sector as they have extensive experience working in energy, as well as the skills needed to support operations. Therefore, governments and the private energy sector must introduce mechanisms to make it easier for workers to switch… Read more at: https://oilprice.com/Energy/Energy-General/How-to-Ensure-Oil-Workers-Get-Access-to-Clean-Energy-Jobs.html |

|

OPEC: The World Cannot Run on Renewable Energy and EVsProponents of critical minerals as the way to have a world running solely on renewables and electric vehicles are not providing the full picture as their assessments of necessary investments and the speed of the energy transition sound unrealistic, according to OPEC Secretary General Haitham Al Ghais. Policymakers and forecasters, as well as advocates of a fast energy transition, need to carefully consider if the needed investments and volumes of critical minerals supply are feasible in their net-zero scenarios, Al Ghais wrote in an article published… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-The-World-Cannot-Run-on-Renewable-Energy-and-EVs.html |

|

China Stops Reporting Renewable Energy Utilization DataChina didn’t include figures on utilization rates at power plants by source in its May monthly data series, following the previous month’s data that showed utilization at renewable energy generators had dropped, Reuters reported on Monday, citing China’s latest data release. In the data series through April 2024, China had given a breakdown of utilization rates at thermal, hydro, nuclear, solar, and wind power plants. The last such data has found that the average operating hours of wind and solar power generators fell, while… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Stops-Reporting-Renewable-Energy-Utilization-Data.html |

|

Trader Sumitomo Seeks U.S. Shale Service Business Despite Exiting ProductionJapanese trading firm Sumitomo will look to increase its services and related business in the U.S. shale patch, three years after quitting shale production operations, Sumitomo president Shingo Ueno told Bloomberg in an interview published on Monday. In early 2021, Sumitomo sold the last of its production assets in the U.S. shale patch, divesting its oil-producing operations in the Eagle Ford. Prior to that deal, Sumitomo sold its Marcellus Shale Gas development project and its relevant assets in Pennsylvania. The Japanese trading… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trader-Sumitomo-Seeks-US-Shale-Service-Business-Despite-Exiting-Production.html |

|

EU Hits Record 74% Zero-Emission Power GenerationThe European Union has seen its largest share of zero-emission electricity generation so far this year, with 74% of power generated by renewables and nuclear, according to data from industry association Eurelectric. Year to date, renewables have generated 50.39% of the EU’s electricity and nuclear accounted for 23.5% of power generation, while fossil fuels made up 26.1% of the bloc’s electricity output, the data showed. “The electricity generation of Europe has never had such a low-carbon profile before,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Hits-Record-74-Zero-Emission-Power-Generation.html |

|

Supreme Court rules Trump has immunity for ‘official acts,’ limits evidence and reach of special counsel’s election caseFormer President Donald Trump is charged with illegally conspiring to overturn his loss to President Joe Biden in the 2020 presidential election. Read more at: https://www.cnbc.com/2024/07/01/donald-trump-immunity-supreme-court-ruling.html |

|

S&P 500, Nasdaq close higher to kick off second half’s trading: Live updatesStocks gyrated but turned higher in afternoon trading on Monday as the second half of 2024 began. Read more at: https://www.cnbc.com/2024/06/30/stock-market-today-live-updates.html |

|

Boston Celtics’ majority owner puts team up for sale weeks after NBA championshipThe ownership group behind the Boston Celtics has put the team up for sale, weeks after it won the NBA championship. Read more at: https://www.cnbc.com/2024/07/01/boston-celtics-for-sale-after-nba-championship.html |

|

Paramount is hunting for a streaming partner, could kick off a wave of dealsWarner Bros. Discovery has interest in merging Max and Paramount+, as Paramount looks to strike a deal for its money-losing streaming service. Read more at: https://www.cnbc.com/2024/07/01/paramount-streaming-merger-talks.html |

|

Citadel’s Ken Griffin says he’s not convinced that AI will replace human jobs in the near futureGriffin, whose firm has been at the forefront of automation, said machine-learning tools have their limits when it comes to adapting to changes. Read more at: https://www.cnbc.com/2024/07/01/ken-griffin-says-hes-not-convinced-ai-will-replace-human-jobs-in-near-future.html |

|

Chewy shares fall nearly 7% as the boost from Roaring Kitty’s new stake diminishesThe filing showed Roaring Kitty, whose legal name is Keith Gill, bought just over 9 million shares — amounting to a 6.6% stake in the company. Read more at: https://www.cnbc.com/2024/07/01/chewy-shares-rally-20percent-after-sec-filing-reveals-roaring-kitty-keith-gill-has-6point6percent-stake.html |

|

Here are JPMorgan’s top stock picks heading into JulyJPMorgan’s newest additions to its list of top stock picks include AT&T and First Citizens BancShares. Read more at: https://www.cnbc.com/2024/07/01/here-are-jpmorgans-top-stock-picks-heading-into-july.html |

|

Inside Starbucks’ plans to improve stores for customers and baristasStarbucks is rolling out changes to barista workflows as it tries to reduce customer wait times. Read more at: https://www.cnbc.com/2024/07/01/inside-starbucks-plans-to-improve-stores.html |

|

Bitcoin jumps back above $63,000 to kick off second half of 2024: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Thomas Perfumo, head of business operations & strategy at Kraken, weighs in on what’s driving the crypto market the second half of 2024 kicks off. Read more at: https://www.cnbc.com/video/2024/07/01/bitcoin-jumps-back-above-63000-second-half-of-2024-cnbc-crypto-world.html |

|

Millennials are ‘very ill-prepared’ to be the richest generation in history, wealth manager saysMillennials are purportedly poised to be the wealthiest generation in history, but are they ready to handle the vast inflow of money? Read more at: https://www.cnbc.com/2024/07/01/millennials-are-ill-prepared-to-be-the-wealthiest-generation.html |

|

Collapsed bitcoin exchange Mt. Gox is about to unload $9 billion of coins onto the market. Here’s what it meansBitcoin investors are spooked by anticipation of an imminent Mt. Gox payout to victims of a 2014 hack on the exchange that led to its collapse. Read more at: https://www.cnbc.com/2024/07/01/mt-gox-about-to-unload-9-billion-of-bitcoin-what-it-means-for-btc.html |

|

‘NEETS’ and ‘new unemployables’ — why some young adults aren’t workingAlthough the overall unemployment rate is just 4%, there is a growing share of young adults not working — by choice or by force. Read more at: https://www.cnbc.com/2024/07/01/neets-and-new-unemployables-why-fewer-young-adults-are-working.html |

|

Cocoa Prices Fall To Critical Technical Support Level On Improving Ivory Coast OutlookCommodity traders are closely watching a triangle pattern forming in New York cocoa prices.

According to Bloomberg, top grower Ivory Coast’s cocoa production is forecasted to rise in the next growing season. This news pressured prices to the lower support level of the triangle, around the mid-$7,500 per ton mark, and down from the near $12,000 level achieved in mid-April when traders were spooked by adverse weather conditions denting global supplies in Ivory Coast and Ghana.

|

|

OPEC: The World Cannot Run On Renewable Energy And EVsBy Tsvetana Paraskova of OilPrice.com Proponents of critical minerals as the way to have a world running solely on renewables and electric vehicles are not providing the full picture as their assessments of necessary investments and the speed of the energy transition sound unrealistic, according to OPEC Secretary General Haitham Al Ghais.

Policymakers and forecasters, as well as advocates of a fast energy transition, need to carefully consider if the needed investments and volumes of critical minerals supply are feasible in their net-zero scenarios, Al Ghais wrote in an article published on OPEC’s website on Monday. Mining projects to extract critical minerals have long lead times from discovery to first production.

|

|

GOP Operatives Working To Put Cornel West On Swing-State BallotsAt a time when leftists across America are increasingly disenchanted with President Biden, Republican operatives are quietly working to give them an alternative — by gathering signatures necessary to ensure that firebrand independent candidate Cornel West is on the ballot in swing states, according to reporting by NBC News.

A stylized image of Cornel West from his campaign websiteIn an election year in which non-major-party candidates — led by independent Robert F. Kennedy, Jr — are poised to take the largest share of the presidential vote in years, the effort is clearly intended to siphon off some leftists who might otherwise reluctantly vote for Biden — or his replacement. In a close race, even a nominally-m … Read more at: https://www.zerohedge.com/political/gop-operatives-working-put-cornel-west-swing-state-ballots |

|

Supreme Court Punts On Florida & Texas Social Media Laws, Sends Cases Back To Lower CourtsAuthored by Matthew Vadum via The Epoch Times, The Supreme Court on July 1 sent legal challenges to laws in Florida and Texas that regulate how social media platforms moderate content back to lower courts, finding that they failed to carry out proper analyses of the two cases. The court’s unanimous decision was written by Justice Elena Kagan.

Despite the 9-0 vote on the judgment, not all justices agreed with the reasoning behind it. This was the first time the nation’s highest court had reviewed state laws that deem social media companies “common carriers,” a status that might allow states to impose utility-style regulations on platforms and forbid them from discriminating agains … Read more at: https://www.zerohedge.com/political/supreme-court-punts-florida-texas-social-media-laws-sends-cases-back-lower-courts |

|

Union calls off Port Talbot steel workers’ strike“Essential” talks will now take place over the future of the UK’s largest steel plant. Read more at: https://www.bbc.com/news/articles/cv2g5j8vv5wo |

|

High mortgage rates pricing out buyers, says NationwideThe building society’s comments come as it says house prices rose by 0.2% in June. Read more at: https://www.bbc.com/news/articles/cp081z9vre4o |

|

Harland and Wolff posts £43m lossThe firm has reiterated its need for a £200m government loan guarantee to help stabilise its finances. Read more at: https://www.bbc.com/news/articles/czrj71l8z17o |

|

Vodafone Idea, 5 other stocks expected to enter MSCI indexIndia’s weighting in MSCI EM currently stands at 19.2% and is anticipated to surpass the 20% threshold gradually. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vodafone-idea-5-other-stocks-expected-to-enter-msci-index/slideshow/111401659.cms |

|

Tata Equity P/E Fund turned Rs 10,000 monthly SIP into Rs 1.82 crore in 20 yearsLaunched in June 2004, the scheme has consistently outperformed its benchmark, the Nifty 500 – TRI, delivering impressive returns. Over a decade, the scheme provided a 17.04% return compared to the benchmark’s 15.27%. In the past five years, it yielded 21.14%, surpassing the benchmark’s 19.76%. The scheme achieved a remarkable 25.78% return over three years, whereas the benchmark returned 19.81%. Read more at: https://economictimes.indiatimes.com/mf/analysis/tata-equity-p/e-fund-turned-rs-10000-monthly-sip-into-rs-1-82-crore-in-20-years/articleshow/111406896.cms |

|

Tech View: Nifty bulls using intraday dips to go long. Here’s how to trade on TuesdayPositive chart pattern like higher tops and bottoms is intact. The underlying trend of Nifty remains positive. The market is racing towards the next upside target of 24,400 levels in the near term. Immediate support is placed at 23,980 levels, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-using-intraday-dips-to-go-long-heres-how-to-trade-on-tuesday/articleshow/111407251.cms |

|

Maersk shares jump on decision to scrap plans for DB Schenker takeoverThe Danish shipping giant’s CEO said Maersk had decided to withdraw from the sales process after identifying challenges with integrating the German logistics company. Read more at: https://www.marketwatch.com/story/maersk-shares-jump-on-decision-to-scrap-plans-for-db-schenker-takeover-767323f7?mod=mw_rss_topstories |

|

French stocks rally after first round of electionsFrench stocks surged on Monday after the first round of parliamentary elections was interpreted to mean the far-right National Rally party was unlikely to form a majority. Read more at: https://www.marketwatch.com/story/french-stocks-see-strongest-rise-in-nearly-two-years-after-first-round-of-elections-9e5e21ff?mod=mw_rss_topstories |

|

‘He thinks I’m too materialistic’: My husband and I are in our 40s with two kids. He takes zero interest in our finances. He doesn’t even know the name of our mortgage company.“I am really worried that if I’m not around, he will not be able to manage the basics of everyday life for himself and our children.” Read more at: https://www.marketwatch.com/story/he-thinks-im-too-materialistic-my-husband-and-i-are-in-our-40s-with-two-kids-he-takes-zero-interest-in-our-finances-he-doesnt-even-know-the-name-of-our-mortgage-company-98f4d0d7?mod=mw_rss_topstories |