Summary Of the Markets Today:

- The Dow closed down 45 points or 0.12%,

- Nasdaq closed down 0.71%, (Closed at 17,733, New Historic high 18,035)

- S&P 500 closed down 0.41%,

- Gold $2,337 down $0.10,

- WTI crude oil settled at $81 down $0.29,

- 10-year U.S. Treasury 4.396 up 0.106 points,

- USD index $105.89 down $0.020,

- Bitcoin $59,943 down $1,665 or 2.70%,

- Baker Hughes Rig Count: U.S. -7 to 581 Canada +10 to 176

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real Disposable Personal Income increased 1.1% year-over-year in May 2024 – up marginally from last month’s 0.9% gain year-over-year. Real Personal Consumption Expenditures increased 2.4% year-over-year – up from 2.3% year-over-year last month. The inflation adjustment (price index) fell from 2.7% year-over-year last month to 2.6% in May 2024. The bottom line is that today’s data is a marginal improvement BUT this is not strong data – and I see no trend lines that scream that the data is slowly improving.

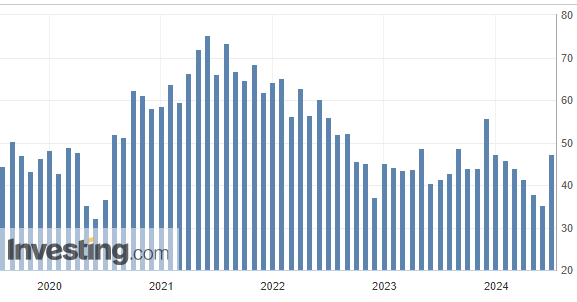

The Chicago PMI unexpectedly increased to 47.4 in June 2024 from last month’s 35.4. A reading above 50 would indicate a manufacturing expansion. Pundits use the Chicago PMI as an indicator of the direction of the National PMI which will be released next week. I am not a fan of surveys, and I see no data that would explain this improvement.

Here is a summary of headlines we are reading today:

- Bitcoin Stumbles as Germany Liquidates $150 Million in Seized Crypto

- Supreme Court Overturns Chevron Doctrine in Landmark Decision

- U.S. Oil, Gas Drilling Activity Plummets

- China Three Gorges Renewables to Invest $11 Billion in Integrated Power Project

- Markets Await Inflation Data as Oil Prices Continue to Rally

- Artificial Intelligence and Electric Vehicles Will Send U.S. Power Demand Soaring

- Nike CEO John Donahoe comes under fire from Wall Street after lackluster performance

- Key Fed measure shows inflation rose 2.6% in May from a year ago, as expected

- Bitcoin dips to $60,000 as the cryptocurrency heads for losing month: CNBC Crypto World

- Target Finally Gets Serious About Out-Of-Control Thefts, Lowers Intervention Threshold To Just $50

- Moody’s Predicts 24% Of Office Towers Will Be Vacant By 2026

- Treasury yields finish higher despite May’s PCE data, for two straight quarters of advances

- Bond market participants brace for bigger deficits under either Trump or Biden

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Bitcoin Stumbles as Germany Liquidates $150 Million in Seized CryptoThe German government has recently transferred a substantial amount of Bitcoin to centralized exchanges, fueling market discussions and speculations. According to data from blockchain analytics firm Arkham, the German Federal Criminal Police Office (BKA) moved another 250 BTC to exchanges such as Kraken and Coinbase. This Bitcoin is worth about $15.4 million. A transfer that follows a series of similar moves last week. In total, around $150 million worth of Bitcoin has been sent to various exchange addresses. The German authorities’ Bitcoin… Read more at: https://oilprice.com/Finance/the-Markets/Bitcoin-Stumbles-as-Germany-Liquidates-150-Million-in-Seized-Crypto.html |

|

Supreme Court Overturns Chevron Doctrine in Landmark DecisionIn a landmark decision, the U.S. Supreme Court has overturned the Chevron doctrine, a decades-old legal precedent that granted federal agencies the authority to interpret ambiguous laws. The 6-3 ruling marks a significant shift in the balance of power between federal agencies and the judiciary, with profound implications for the oil and gas industry, as well as other sectors reliant on regulatory frameworks. The Chevron doctrine, stemming from the 1984 case Chevron v. Natural Resources Defense Council, mandated that courts defer to federal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Supreme-Court-Overturns-Chevron-Doctrine-in-Landmark-Decision.html |

|

Biden Administration To Hold Offshore Wind Auction in Central AtlanticThe U.S. Department of the Interior will hold next month an offshore wind lease sale in the Central Atlantic as the Biden Administration continues to pursue advancing renewable energy installations, the Interior said on Friday. The areas, which will be auctioned on August 14, 2024, by the Bureau of Ocean Energy Management, could generate up to 6.3 gigawatts (GW) of clean, renewable energy and power up to 2.2 million American homes, the administration said. The Final Sale Notice includes one area offshore the states of Delaware and Maryland,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-To-Hold-Offshore-Wind-Auction-in-Central-Atlantic.html |

|

U.S. Oil, Gas Drilling Activity PlummetsThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 7 to 581 this week, compared to 674 rigs this same time last year. The number of oil rigs fell by 6 this week, after falling by 3 in the week prior. Oil rigs now stand at 479—down by 66 compared to this time last year. The number of gas rigs fell by 1 this week to 97, a loss of 27 active gas rigs from this time last year. Miscellaneous stayed the same at… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drilling-Activity-Plummets.html |

|

EU Pledges Continued Support for Ukraine with New Security AgreementUkrainian President Volodymyr Zelenskiy on June 27 signed security agreements with the European Union, Estonia, and Lithuania at the start of a two-day EU summit in Brussels. The security deal with the European Union reinforces the bloc’s support for Kyiv in nine areas of security and defense policy. A draft of the agreement obtained by RFE/RL reiterates the “resolute condemnation of Russia’s war of aggression against Ukraine” and reaffirms the EU’s “unwavering support for Ukraine’s independence, sovereignty,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Pledges-Continued-Support-for-Ukraine-with-New-Security-Agreement.html |

|

What the Supreme Court’s Latest Ruling Against the EPA Means for Oi & GasSupreme Court Halts EPA’s Good Neighbor Plan: Implications for the Oil and Gas Industry In a significant decision affecting environmental regulation and interstate pollution, the Supreme Court has temporarily halted the Environmental Protection Agency’s (EPA) “Good Neighbor Rule.” This rule aimed to restrict emissions from power plants and industrial sources that contribute to downwind pollution. The 5-4 decision, driven by the conservative majority, puts the rule on hold while ongoing legal challenges from industry groups and… Read more at: https://oilprice.com/Energy/Energy-General/What-the-Supreme-Courts-Latest-Ruling-Against-the-EPA-Means-for-Oi-Gas.html |

|

U.S. Targets Iranian Oil Exports with Latest SanctionsThe United States on June 27 issued fresh sanctions against Iran in response to Tehran further expanding its nuclear program, U.S. Secretary of State Antony Blinken said in a statement. “Over the past month, Iran has announced steps to further expand its nuclear program in ways that have no credible peaceful purpose,” Blinken said. “We remain committed to never letting Iran obtain a nuclear weapon, and we are prepared to use all elements of national power to ensure that outcome.” The new sanctions take aim at three companies based in the United… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Targets-Iranian-Oil-Exports-with-Latest-Sanctions.html |

|

China Three Gorges Renewables to Invest $11 Billion in Integrated Power ProjectChina Three Gorges Renewables plans to invest $11 billion (80 billion Chinese yuan) in a huge integrated power project in China with solar, wind, and coal power capacity plus a storage facility. China Three Gorges Renewables, a unit of the biggest hydropower producer in the country, China Three Gorges, plans the 16 gigawatt (GW) energy complex in the Inner Mongolia region in northern China, the company said in a stock filing cited by Reuters. The project in Ordos City has already been approved by the Chinese authorities as one of the new large… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Three-Gorges-Renewables-to-Invest-11-Billion-in-Integrated-Power-Project.html |

|

Germany and Morocco Sign Hydrogen and Renewables PactGermany and Morocco signed on Friday in Berlin an alliance on climate and energy to boost cooperation in renewable energy installations and hydrogen production in the North African country. Morocco has excellent conditions to host solar and wind power generation capacity and to produce green hydrogen, Germany’s Development and Economy Ministries said in a joint statement today. Germany, which is betting on future green hydrogen imports to meet its climate goals, hopes that Morocco could become an exporter of the fuel to Europe’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-and-Morocco-Sign-Hydrogen-and-Renewables-Pact.html |

|

Markets Await Inflation Data as Oil Prices Continue to RallyOil prices have surged over the last three weeks as geopolitical tensions climbed, although concerning economic data in the U.S. could drag prices back down.Friday, June 28, 2024All eyes are fixed on US inflation data as crude oil prices have maintained their hot streak and are set to end this week with a third weekly gain. Surging geopolitical tensions around Israel and Lebanon have overshadowed slackening economic data from the US in May, with every single day this week posting a day-on-day increase and Brent set to finish the week at $87 per… Read more at: https://oilprice.com/Energy/Energy-General/Markets-Await-Inflation-Data-as-Oil-Prices-Continue-to-Rally.html |

|

Repsol Discusses Merging UK North Sea Business With NEO EnergyRepsol has been in discussions to merge its UK North Sea operations with NEO Energy in what could be another consolidation offshore the UK, where operators struggle with a high windfall tax. The Spanish energy major has been holding extensive talks with private equity-backed NEO Energy and could announce a deal in the coming weeks, anonymous industry sources told Reuters on Friday. If Repsol and NEO reach a deal, they would create one of the largest producers in the UK North Sea with production exceeding 110,000 barrels of oil equivalent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Repsol-Discusses-Merging-UK-North-Sea-Business-With-NEO-Energy.html |

|

Repsol Considers Selling Minority Stake in Eagle Ford AssetsSpanish energy major Repsol could be the next company involved in the mergers and acquisitions wave in the U.S. shale patch as it considers selling up to a 49% interest in its assets in the Eagle Ford play in South Texas, Reuters reported on Friday, citing anonymous sources with knowledge of the talks. Repsol, which has acquired Eagle Ford assets from Equinor and Inpex in recent years, operates wells that produce around 50,000 barrels of oil equivalent a day (boed) in the shale play. Now the company is looking to divest a minority… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Repsol-Considers-Selling-Minority-Stake-in-Eagle-Ford-Assets.html |

|

Artificial Intelligence and Electric Vehicles Will Send U.S. Power Demand Soarin1. Brazil Fails to Bring the Oil Bonanza into 2024 – Brazil has been one of the fastest-growing oil producers of the 2020s, reaching a crude production all-time high of 3.73 million b/d in early 2024, but production woes have hampered its performance since. – Oil production has plunged almost 25% since the beginning of this year, mostly caused by unnamed technical problems encountered at the Mero and Tupi pre-salt fields. – Simultaneously to the string of technical issues, the environmental agency that should approve new production equipment… Read more at: https://oilprice.com/Energy/Energy-General/Artificial-Intelligence-and-Electric-Vehicles-Will-Send-US-Power-Demand-Soarin.html |

|

The Geopolitical Risk Premium Is Back as Oil Prices ClimbGeopolitical Tensions Drive Oil Higher Crude oil futures are set to close over 2% higher this week, primarily driven by escalating tensions between Israel and Hezbollah. The market has largely shrugged off soft U.S. gasoline demand, focusing instead on potential supply disruptions in the Middle East. This price movement underscores the oil market’s sensitivity to geopolitical risks, especially in key producing regions. Middle East Conflict Risks Israel has deployed troops to its northern border as attacks from Lebanon have surged. RBC Capital Markets… Read more at: https://oilprice.com/Energy/Energy-General/The-Geopolitical-Risk-Premium-Is-Back-as-Oil-Prices-Climb.html |

|

Why Russia Is Arming General Haftar in LibyaPolitics, Geopolitics & Conflict Libya continues to unravel, quietly, with indications mounting that rival governments are regrouping for something big. Earlier this week, aided by US intelligence, Italian authorities intercepted a cargo ship suspected of bringing Russian weapons to General Khalifa Haftar in eastern Libya. It is not without reason that his rival, interim prime minister Dbeibah in Tripoli has been growing increasingly nervous–quite publicly. Russia is arming Haftar in return for allowing Moscow to build a port on the Mediterranean… Read more at: https://oilprice.com/Energy/Energy-General/Why-Russia-Is-Arming-General-Haftar-in-Libya.html |

|

Nike CEO John Donahoe comes under fire from Wall Street after lackluster performanceNike’s CEO John Donahoe has helmed the sneaker giant for nearly five years, but under his watch, its stock has underperformed and its lost market share. Read more at: https://www.cnbc.com/2024/06/28/nike-ceo-john-donahoe-under-fire-from-wall-street.html |

|

Biden debate flop leads Democrats to call for new nominee — but replacing him is tough to doPresident Joe Biden emerged bruised from his first presidential debate with Donald Trump, raising fears about his age and ability to serve another term. Read more at: https://www.cnbc.com/2024/06/28/biden-debate-trump-democrats-new-nominee-heres-how.html |

|

Chevron doctrine overturned: Republicans, big business praise Supreme Court decisionThe Supreme Court ruling overturned the case known as Chevron v. Natural Resources Defense Council, reducing the authority of federal regulatory agencies. Read more at: https://www.cnbc.com/2024/06/28/chevron-doctrine-supreme-court-republicans-business.html |

|

Supreme Court rejects bid by former Trump aide Steve Bannon to avoid jail in contempt caseFormer Trump White House aide Steve Bannon was sentenced to four months in jail for defying a congressional subpoena related to the Jan. 6 Capitol riot. Read more at: https://www.cnbc.com/2024/06/28/supreme-court-trump-steve-bannon-jail-contempt-case.html |

|

Key Fed measure shows inflation rose 2.6% in May from a year ago, as expectedThe core personal consumption expenditures price index was expected to increase 0.1% in May and 2.6% from a year ago. Read more at: https://www.cnbc.com/2024/06/28/may-pce-inflation-report.html |

|

Wall Street kicks off the second half of 2024 with key jobs report in the week aheadStocks have a lot to live up to in the second half of the year. Read more at: https://www.cnbc.com/2024/06/28/jobs-report-in-the-week-ahead-will-kick-off-second-half-of-2024.html |

|

Boeing delays Starliner return by ‘weeks’ for testing, NASA says astronauts aren’t strandedBoeing’s crew flight test represents the first time Starliner is carrying people, flying NASA astronauts Butch Wilmore and Suni Williams. Read more at: https://www.cnbc.com/2024/06/28/boeing-nasa-delays-starliner-further.html |

|

Bitcoin dips to $60,000 as the cryptocurrency heads for losing month: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. Ben McMillan, IDX Digital Assets CIO and founder, the state of crypto markets and the future of crypto ETFs. Plus, Chris King of Eaglebrook Advisors weighs in on adoption of spot crypto ETFs by investment advisors. Read more at: https://www.cnbc.com/video/2024/06/28/bitcoin-dips-cryptocurrency-heads-for-losing-month-crypto-world.html |

|

Crypto company Consensys sued by SEC as regulator continues industrywide crackdownThe SEC on Friday filed sued against blockchain software company Consensys, alleging the improper sale of securities. Read more at: https://www.cnbc.com/2024/06/28/sec-sues-ethereum-company-consensys-expanding-industrywide-crackdown.html |

|

DJT shares pull back after sharp rise following Biden stumble in Trump debateSome Democrats said President Joe Biden needs to exit the White House race against Donald Trump after his debate performance. DJT stock may benefit. Read more at: https://www.cnbc.com/2024/06/28/djt-shares-soar-trump-biden-debate.html |

|

Rural retailer Tractor Supply eliminates DEI roles, Pride support and carbon emissions goalsRetailer Tractor Supply announced that it will eliminate DEI roles, withdraw carbon emissions goals and stop sponsoring Pride festivals. Read more at: https://www.cnbc.com/2024/06/28/tractor-supply-ends-dei-pride-support-carbon-goals.html |

|

Warren Buffett gives away another $5.3 billion, says his children will manage his estateWarren Buffett on Friday made his biggest annual donation to date, giving $5.3 billion worth of Berkshire Hathaway shares to five charities. Read more at: https://www.cnbc.com/2024/06/28/buffett-donates-another-5point3-billion-says-his-children-will-run-estate-.html |

|

Analysts love these cheap dividend-paying stocks heading into the second halfCNBC Pro screened for dividend-paying names that are trading at a discount and are rated buy or overweight by at least 60% of the analysts covering the stock. Read more at: https://www.cnbc.com/2024/06/28/cheap-dividend-paying-stocks-that-are-beloved-by-wall-street.html |

|

California Doctor Who Drove Family Off Cliff Avoids Trial Due To Mental IllnessAuthored by Rachel Acenas via The Epoch Times, A southern California doctor who purposely drove his car with his family off a cliff won’t face trial due to his mental illness, prosecutors announced.

Dharmesh Patel, 42, was granted a mental health diversion by a court due to evidence that shows the radiologist suffers from major depressive disorder, according to the San Mateo District Attorney’s office in a statement on Thursday. The completion of a mental health diversion program in California allows a defendant to seek treatment and have charges against them dismissed. “Weighing all factors, the court determined the defendant was suitable and granted the defense request for mental health diversion,’ Judge Susan … Read more at: https://www.zerohedge.com/medical/california-doctor-who-drove-family-cliff-avoids-trial-due-mental-illness |

|

Target Finally Gets Serious About Out-Of-Control Thefts, Lowers Intervention Threshold To Just $50A new Bloomberg report reveals that retailer Target is finally cracking down on thieves by lowering the staff intervention threshold from $100 to $50. Target management has complained on earnings calls about ‘shrink’ in recent quarters and surging thefts that have squeezed margins. People familiar with the new policy say employees will soon be able to intervene and halt criminals from leaving the store with as little as $50 in stolen goods. The previous threshold was $100. They say the new policy will be enforced this summer.

Target operates nearly 2,000 stores in the US and has warned investors countless times about damaging shrink—inventory loss due to theft, damage, and other factors—which has squeezed profit margins. In March, Target Executive Vice President Michael Fiddelke said the company lost $500 million more in shrink in … Read more at: https://www.zerohedge.com/markets/target-finally-gets-serious-about-out-control-thefts-lowers-intervention-threshold-just-50 |

|

China’s Credit Impulse Loses Its MojoBy Dhaval Joshi of BCA Research Many economists and strategists emphasize the importance of China’s credit impulse as the driver of China’s – and the world’s – economic growth. A key question for them is: what is happening to China’s credit impulse – is it increasing, decreasing, stabilizing, or destabilizing? For many years, this was indeed the key question to ask. Not anymore. After the global financial crisis of 2008-09, China unleashed a stimulus bazooka. A stimulus so big that China’s credit impulse peaked at a massive and unprecedented 25% of China’s GDP. In the subsequent stimuluses of 2013 and 2017, China’s credit impulse peaked at a sizable, albeit lower, 15% of GDP. Then in 2020 came the global pandemic. Yet even after this once-in- In the so-called ‘stimulus’ that has come more recently, the impact has truly dwindled. China’s credit impulse has peaked at little more than 3 percent of GDP, equating to barely a tenth of the post-GFC impact (Chart 1). Read more at: https://www.zerohedge.com/markets/chinas-credit-impulse-loses-its-mojo |

|

Moody’s Predicts 24% Of Office Towers Will Be Vacant By 2026A new report from Moody’s offers yet another grim outlook that the commercial real estate downturn is nowhere near the bottom. Elevated interest rates and persistent remote and hybrid working trends could result in around 24% of all office towers standing vacant within the next two years. The office tower apocalypse will result in more depressed values that will only pressure landlords. “Combining these insights, with our more than 40 years of historic office performance data, as well as future employment projections, our model indicates that the impact on office demand from work from home will be around 14% on average across a 63- month period, resulting in vacancy rates that peak in early 2026 at approximately 24% nationally,” Moody’s analysts Todd Metcalfe, Anthony Spinelli, and Thomas LaSalvia wrote in the report.

In a separate report, Tom LaSalvia, Moody’s head of … Read more at: https://www.zerohedge.com/markets/moodys-predicts-office-towers-will-be-vacant-2026 |

|

Major UK high street banks say payment issues fixedSeveral people have told the BBC they are still facing issues, with some saying they have little cash left. Read more at: https://www.bbc.com/news/articles/c3g03ejjl1yo |

|

Asda and Tesco face legal action over E. coli casesLawyers acting for two people who fell ill in the outbreak have started legal proceedings. Read more at: https://www.bbc.com/news/articles/c880rekylxxo |

|

Fujitsu expert: I didn’t think Horizon was a monsterFormer Fujitsu Horizon expert tells an inquiry he did not think the software was “a monster”. Read more at: https://www.bbc.com/news/articles/c035j4vegvvo |

|

Sebi proposes mandatory disclosure of ‘risk-adjusted return’ by mutual fundsRisk-adjusted return offers a comprehensive view of a mutual fund’s performance by measuring the return earned per unit of risk taken. Currently, regulations do not require disclosure of RAR alongside standard returns for mutual funds. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-proposes-mandatory-disclosure-of-risk-adjusted-return-by-mutual-funds/articleshow/111347953.cms |

|

IPOs won’t be a no-exit entry, say experts after Sebi makes delisting easierDescribing the new rule as a potential game changer that could enhance merger and acquisition (M&A) deal activity, Abhishek Dadoo of Khaitan & Co. pointed out that the old regime allowed delisting through a reverse book build process, which sometimes led to excessively high prices. This often made delisting financially impractical for companies. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/ipos-wont-be-a-no-exit-entry-say-experts-after-sebi-makes-delisting-easier/articleshow/111338110.cms |

|

UltraTech’s India Cements stake buy a win-win for both. Here’s what analyst said on industry consolidationUltraTech Cement’s Rs 1,885 crore stake purchase in India Cements is expected to be mutually beneficial for both companies and would consolidate its position in South India at a time when the Adani Group’s acquisitive spree is intensifying competition between the two players. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ultratechs-india-cements-stake-buy-a-win-win-for-both-heres-what-analyst-said-on-industry-consolidation/articleshow/111340763.cms |

|

Trump and Biden play blame game on inflation. Here’s what prices did under their watch.The biggest surge in inflation in 40 years could end up deciding the 2024 presidential election — and President Joe Biden and former President Donald Trump each sought to outflank each other on the topic in Thursday’s debate. Read more at: https://www.marketwatch.com/story/trump-and-biden-play-blame-game-on-inflation-heres-what-prices-did-under-their-watch-401a10dd?mod=mw_rss_topstories |

|

Treasury yields finish higher despite May’s PCE data, for two straight quarters of advancesYields on long-term U.S. government debt finished at more than two-week highs on Friday amid a round of selling that may have been driven by traders moving to close out month- and quarter-end positions. Read more at: https://www.marketwatch.com/story/treasury-yields-a-touch-higher-as-traders-await-pce-inflation-data-4e711deb?mod=mw_rss_topstories |

|

Bond market participants brace for bigger deficits under either Trump or BidenOne of the top takeaways from Thursday night’s televised debate between President Joe Biden and his Republican challenger Donald Trump is that the U.S. faces little prospect of any fiscal restraint in the years ahead no matter who wins the Nov. 5 election. Read more at: https://www.marketwatch.com/story/bond-market-participants-brace-for-bigger-deficits-under-either-trump-or-biden-242ef112?mod=mw_rss_topstories |