Summary Of the Markets Today:

- The Dow closed down 299 points or 0.76%,

- Nasdaq closed up 1.26%,

- S&P 500 closed up 0.39%,

- Gold $2,332 down $12.80,

- WTI crude oil settled at $81 down $0.86,

- 10-year U.S. Treasury 4.230 down 0.018 points,

- USD index $105.61 up $0.140,

- Bitcoin $61,991 up $1,728 or 2.87%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, decreased to –0.09 in May 2024 from –0.05 in April. The CFNAI-MA3 is used for economic forecasting. Even with this month’s decline, the CFNAI-MA3 is trending up – A value below zero has been associated with the national economy expanding with below-average growth. An increasing likelihood of a recession has historically been associated with a CFNAI-MA3 value below –0.70. The CFNAI is the best coincident index out there.

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 7.2% in May 2024, dropping from a 7.5% increase in the previous month. Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices gave this analysis:

For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high. 2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year. Thirteen markets are currently at all-time highs and San Diego reigns supreme once again, topping annual returns for the last six months. The Northeast is the best performing market for the previous nine months, with New York rising 9.4% annually. Sustained outperformance of the Northeast market was last observed in 2011. For the decade that followed, the West and the South held the top posts for performance. It’s now been over a year since we’ve seen the top region come from the South or the West. Last month’s all-time high came with all 20 markets accelerating price gains. This month, just over half of our markets are seeing prices accelerate on a monthly basis. At 6.3% annual gains, the index has decelerated from the start of the year, with only two markets rising on an annual basis.

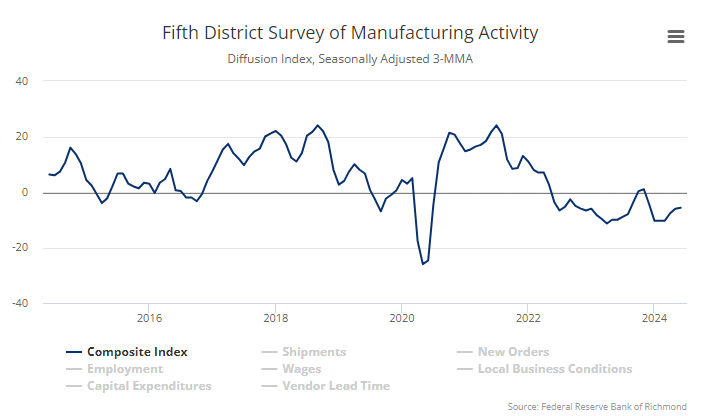

The Richmond Fed’s manufacturing activity slowed in June 2024. The composite manufacturing index decreased from 0 in May to −10 in June. Of its three component indexes, shipments fell notably from 13 to −9, new orders decreased from −6 to −17, and employment rose from −6 to −2. Manufacturing remains a soft spot in the current USA economy.

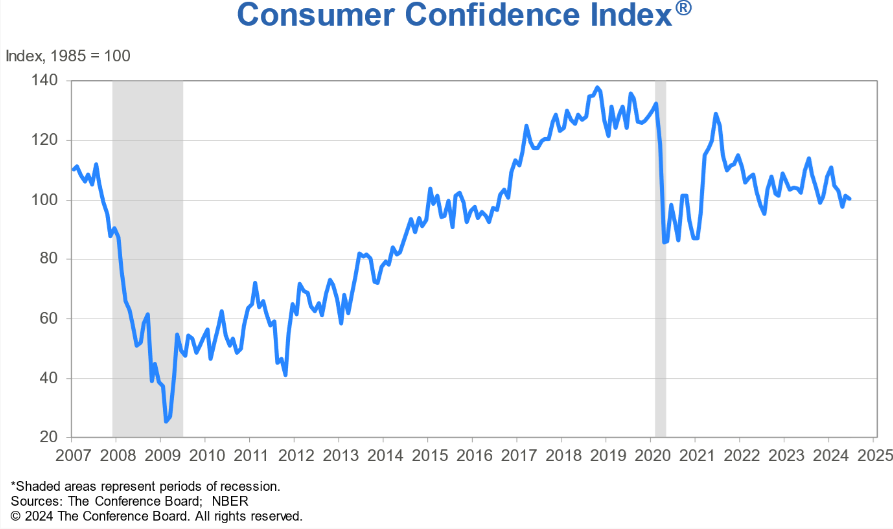

The Conference Board Consumer Confidence Index® dipped in June 2024 to 100.4 (1985=100), down from 101.3 in May. Dana M. Peterson, Chief Economist at The Conference Board had this to say:

Confidence pulled back in June but remained within the same narrow range that’s held throughout the past two years, as strength in current labor market views continued to outweigh concerns about the future. However, if material weaknesses in the labor market appear, Confidence could weaken as the year progresses. Consumers expressed mixed feelings this month: their view of the present situation improved slightly overall, driven by an uptick in sentiment about the current labor market, but their assessment of current business conditions cooled. Meanwhile, for the second month in a row, consumers were a bit less pessimistic about future labor market conditions. However, their expectations for both future income and business conditions weakened, weighing down the overall Expectations Index. The decline in confidence between May and June was centered on consumers aged 35-54. By contrast, those under 35 and those 55 and older saw confidence improve this month. No clear pattern emerged in terms of income groups. On a six-month moving average basis, confidence continued to be highest among the youngest (under 35) and wealthiest (making over $100K) consumers.

Here is a summary of headlines we are reading today:

- Copper and Nickel Face Cooling Demand

- Texas Natural Gas Prices Turn Negative Even Amid Heat Wave

- Brazil’s Oil Surge Set to Challenge OPEC’s Market Strategy

- Renewable Energy Growth Fails To Offset Fossil Fuel Dominance

- Europe’s Top Airline to Introduce Surcharge to Cover Cost of Clean Fuel

- Here’s how bad housing affordability is now

- How Delta made itself America’s luxury airline — and what United wants to do about it

- S&P 500, Nasdaq snap three-session losing streak Tuesday as Nvidia shares rebound: Live updates

- Bitcoin miner Hut 8 soars more than 15% after announcing $150 million AI investment: CNBC Crypto World

- U.S. auto sales are expected to slow during the second half of 2024

- Bitcoin bounces above $62,000, Solana leads cryptocurrencies higher

- Why GameStop’s $2.1 billion stock sale taxes its shareholders and hurts the economy

- 2-year Treasury yield ends lower for first time in four sessions as traders await Friday’s inflation data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Mega Projects in Central Asia Are Back in FashionFor most of the last two decades, China has been the most obvious source of foreign direct investment for the countries of Central Asia. But for the two poorest countries of the region — Kyrgyzstan and Tajikistan — truly strategic investment from Beijing appeared to peak in the middle of that period. That was when Chinese companies agreed on deals to overhaul the transport and energy infrastructure in the two mountainous countries, build or modernize power plants in their respective capitals, and acquire lucrative mineral deposits along the way.… Read more at: https://oilprice.com/Geopolitics/International/Chinas-Mega-Projects-in-Central-Asia-Are-Back-in-Fashion.html |

|

Copper and Nickel Face Cooling DemandVia Metal Miner Overall, the Stainless Monthly Metals Index (MMI) rose 3.89% from May to June. The nickel price mirrored other base metals, finding a peak on May 20 before inverting to the downside. By the close of June 20, nickel prices had fallen over 19%, returning to their lowest level since early April. That said, they remain 4.24% above their Q1 close. Stainless Market Rolls into Summer with Slow Demand Market sources showed little optimism about the current state of the stainless market as demand for 304 cold rolled stainless steel reportedly… Read more at: https://oilprice.com/Metals/Commodities/Copper-and-Nickel-Face-Cooling-Demand.html |

|

Texas Natural Gas Prices Turn Negative Even Amid Heat WaveIn an unexpected turn of events, U.S. spot natural gas prices in Texas dropped below zero on Tuesday despite soaring demand driven by a severe heat wave. This phenomenon, typically seen in the low-demand seasons of spring and autumn, was primarily caused by pipeline maintenance that stranded gas in the Permian Basin. Kinder Morgan’s Permian Highway gas pipeline, operating at reduced capacity due to necessary repairs, contributed to this price plunge. The Permian Basin, a significant oil-producing region, also produces substantial gas volumes.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Natural-Gas-Prices-Turn-Negative-Even-Amid-Heat-Wave.html |

|

French Weapon Sales Stir Controversy in the CaucasusA cold conflict is escalating between France and Azerbaijan. And the latest twist in the tit-for-tat spat is heightening the prospect of renewed conflict in the Caucasus. On June 18, French Defense Minister Sebastien Lecornu announced the sale of 36 Caesar self-propelled howitzers to Armenia. The move immediately sparked vitriolic responses from Azerbaijan and Russia. The Azerbaijani Defense Ministry called the sale as a “provocative” step that could revive the region as a “hotbed of war.” Russian Foreign Ministry spokeswoman… Read more at: https://oilprice.com/Geopolitics/International/French-Weapon-Sales-Stir-Controversy-in-Caucasus.html |

|

Russian Oil and Gas Revenues Surge by 50% in JuneIn a significant rebound, Russia’s oil and gas revenues for June are projected to increase by over 50% year-on-year, reaching $9.4 billion, according to new Reuters calculations. This surge comes after a reduction in refinery subsidies, highlighting Russia’s resilience in the face of Western sanctions aimed at its energy sector. The redirection of oil exports to India and China has played a crucial role in maintaining financial inflows, essential for a budget under pressure from increased defense spending. Despite the ongoing conflict in Ukraine… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-and-Gas-Revenues-Surge-by-50-in-June.html |

|

Brazil’s Oil Surge Set to Challenge OPEC’s Market StrategyBrazil Could Frustrate OPEC’s Oil Market Management Policy Brazil’s oil production has started to recover following a plunge earlier this year as many offshore platforms underwent planned repairs and maintenance work. After a 25% drop in Brazilian output at the beginning of the year, platforms are returning from maintenance and producing more oil. Earlier-than-expected starts to some projects are also set to help Brazil recover its oil output later this year, and production could exceed forecasts, some analysts say.… Read more at: https://oilprice.com/Energy/Crude-Oil/Brazils-Oil-Surge-Set-to-Challenge-OPECs-Market-Strategy.html |

|

Barclays: It’s Unrealistic for Banks to Ditch Oil and Gas ClientsCalls from campaigners and activist investors for banks to abandon financing for the oil and gas industry are unrealistic, according to the top executive of banking giant Barclays. Banks “cannot go cold turkey” on financing the oil and gas sector, Barclays chief executive officer C.S. Venkatakrishnan told Bloomberg during the Bloomberg Sustainable Finance Forum in London on Tuesday. Environmental campaigners and shareholder activists have been calling for a halt to financing for coal, oil, and gas, and have been accusing the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Barclays-Its-Unrealistic-for-Banks-to-Ditch-Oil-and-Gas-Clients.html |

|

Renewable Energy Growth Fails To Offset Fossil Fuel DominanceAt a time when the peak of “green” virtue signaling has come and gone, we regret to inform you that all that jawboning and posturing has achieved… absolutely nothing because according to the Statistical Review of World Energy report released on Thursday, global fossil fuel consumption and energy emissions hit all-time highs in 2023 (even as fossil fuels’ share of the global energy mix decreased slightly on the year). Growing demand for fossil fuel despite the scaling up of renewables could be a sticking point for the transition to lower carbon… Read more at: https://oilprice.com/Energy/Energy-General/Renewable-Energy-Growth-Fails-To-Offset-Fossil-Fuel-Dominance.html |

|

Finland’s Energy Firm Gasum to Halt Russian LNG Imports amid EU SanctionsFinland’s energy company Gasum will stop buying or importing Russian liquefied natural gas from July 26, in line with a clause with the fresh EU sanctions on Russia, which includes sanctions targeting LNG. The European Union adopted on Monday a new sanctions package against Russia, targeting Russian LNG projects and shipments for the first time and looking to curb Moscow’s use of the so-called dark fleet to circumvent the price caps on Russian crude and oil products. The EU member states approved this week the 14th… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Finlands-Energy-Firm-Gasum-to-Halt-Russian-LNG-Imports-amid-EU-Sanctions.html |

|

Bullish Sentiment Is Building in Oil Markets as Demand Concerns FadeOil prices are set to post an impressive gain this month as bullish sentiment has been building and demand concerns fading.- As Brent futures have moved above $85 per barrel again, geopolitics have started to come to the forefront of market concerns as Houthi militias are intensifying strikes on commercial tankers and Israel-Lebanon tensions fly high. – Oil prices remain in expansionary mode as Brent remains above the 50-day average of $83.75 per barrel, with expected inventory draws in the summer providing fundamental support for a move higher.-… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Is-Building-in-Oil-Markets-as-Demand-Concerns-Fade.html |

|

Port Maintenance Drags Russia’s Oil Shipments Down to Three-Month LowMaintenance works at Russia’s busiest oil ports dragged down weekly crude oil shipments to the lowest level in over three months as the ports of Primorsk on the Baltic Sea and Kozmino in the Far East halted vessel departures for four days each in the week to June 23. Last week, Russian crude oil exports by sea fell by 660,000 barrels per day (bpd) from the previous week, to the lowest level in more than three months – 3.04 million bpd, vessel-tracking data monitored by Bloomberg showed on Tuesday. The four-week average exports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Port-Maintenance-Drags-Russias-Oil-Shipments-Down-to-Three-Month-Low.html |

|

Exxon and Partners’ Net Profit From Guyana’s Oil Soared in 2023ExxonMobil, Hess, and CNOOC of China booked a combined $6.33 billion in net profit for their joint oil operations offshore Guyana last year, with net profit margins topping that of chip maker Nvidia, according to Guyanese government data cited by Reuters. The Exxon-led consortium secured a lucrative contract with the government of Guyana when it began exploration offshore the South American country in the 2010s. Since discovering first oil in what turned out to be a very prolific Stabroek block, the partners in the consortium – Exxon,… Read more at: https://oilprice.com/Energy/Energy-General/Exxon-and-Partners-Net-Profit-From-Guyanas-Oil-Soared-in-2023.html |

|

Europe’s Top Airline to Introduce Surcharge to Cover Cost of Clean FuelThe Lufthansa Group, the biggest airline group in Europe, is introducing a so-called Environmental Cost Surcharge of up to $77.20 (72 euros) per flight to cover part of the costs for using additional volumes of sustainable aviation fuel (SAF), the Germany-based airline said on Tuesday. The surcharge of between $1.07 (1 euro) and $77.20 (72 euros) will apply to all tickets issued from June 26, 2024 with departure from January 1, 2025 from the 27 EU countries as well as the UK, Norway, and Switzerland. “The surcharge is intended to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Top-Airline-to-Introduce-Surcharge-to-Cover-Cost-of-Clean-Fuel.html |

|

Australian Fund: Coal Exclusions Won’t Make a Difference to Net Zero EffortsPension and investment funds dropping coal companies from their portfolios will not make a difference for the world’s efforts to get to net zero, the chief investment officer of a large Australian pension fund told Bloomberg on Tuesday. “We don’t think exclusions make any difference in practice to getting to net zero,” Michael Wyrsch, Chief Investment Officer at Australia’s Vision Super Pty, told Bloomberg in an interview. “We don’t see it as a victory, us holding a net zero portfolio while… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australian-Fund-Coal-Exclusions-Wont-Make-a-Difference-to-Net-Zero-Efforts.html |

|

Soaring Costs Put New U.S. LNG Export Projects at Risk of DelaysSurging labor and construction costs are plaguing some major U.S. LNG export projects, threatening to delay new LNG supply to international markets. Wage growth since 2021, a shortage of skilled workers, and rising costs of materials with the inflation over the past three years have increased overall contractor costs for U.S. LNG export projects, analysts tell Reuters. Wages for skilled workers have jumped by 20% since 2021, and in some cases contractors have had to pay a per diem rate to retain these workers, Travis Woods, president… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Soaring-Costs-Put-New-US-LNG-Export-Projects-at-Risk-of-Delays.html |

|

Here’s how bad housing affordability is nowHome prices are now 47% higher than they were in early 2020, with the median sale price now five times the median household income. Read more at: https://www.cnbc.com/2024/06/25/housing-affordability-price-mortgage-rates.html |

|

Sixteen Nobel Prize-winning economists warn a second Trump term would ‘reignite’ inflationTrump says he would make his first-term tax cuts permanent, impose universal tariffs on all imports and pressure the Federal Reserve to cut interest rates. Read more at: https://www.cnbc.com/2024/06/25/nobel-prize-economists-warn-trump-inflation.html |

|

How Delta made itself America’s luxury airline — and what United wants to do about itDelta is the most profitable U.S. airline and says it continues to beat rivals as more travelers pay up for premium cabins. Read more at: https://www.cnbc.com/2024/06/25/delta-air-lines-americas-luxury-airline-and-what-united-wants-to-do-about-it.html |

|

S&P 500, Nasdaq snap three-session losing streak Tuesday as Nvidia shares rebound: Live updatesThe S&P 500 and Nasdaq Composite rose Tuesday, led by a rebound in Nvidia shares after a sharp downturn in the stock a day prior. Read more at: https://www.cnbc.com/2024/06/24/stock-market-today-live-updates.html |

|

Bitcoin miner Hut 8 soars more than 15% after announcing $150 million AI investment: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Phil Harvey, founder and CEO of Sabre56, a hosting provider and crypto mining consultant, weighs in on the recent surge in partnerships between miners and AI firms. Read more at: https://www.cnbc.com/video/2024/06/25/bitcoin-miner-hut-8-soars-more-than-15percent-after-announcing-150-million-ai-investment-cnbc-crypto-world.html |

|

Here are Oppenheimer’s top stock picks heading into JulyOppenheimer’s top stock ideas heading into the new trading month include a large retailer and a chipmaker. Read more at: https://www.cnbc.com/2024/06/25/here-are-oppenheimers-top-stock-picks-heading-into-july.html |

|

Trump gag order partially lifted in hush money case ahead of Biden debateA New York judge lifted parts of a gag order imposed on former President Donald Trump in his criminal hush money case. Read more at: https://www.cnbc.com/2024/06/25/trump-gag-order-partly-lifted-in-hush-money-case-ahead-of-first-presidential-debate.html |

|

U.S. auto sales are expected to slow during the second half of 2024Vehicle inventory levels are growing, incentives are increasing and there’s growing uncertainty surrounding the economy, interest rates and U.S. election. Read more at: https://www.cnbc.com/2024/06/25/us-auto-sales-are-expected-to-slow-during-the-second-half-of-2024.html |

|

Tesla recalls Cybertruck to fix faulty windshield wipers, loose trimTesla has issued its third and fourth recalls on its Cybertruck, which hit the market late last year. Read more at: https://www.cnbc.com/2024/06/25/tesla-recalls-cybertruck-to-fix-faulty-windshield-wipers-loose-trim.html |

|

Bitcoin bounces above $62,000, Solana leads cryptocurrencies higherBitcoin’s move coincided with a rebound in Nvidia and the Nasdaq Composite. Read more at: https://www.cnbc.com/2024/06/25/bitcoin-bounces-above-61000-solana-leads-cryptocurrencies-higher.html |

|

Great savers could face a ‘tax time bomb’ in retirement, advisor says — here’s how to avoid itIf you have a large pretax 401(k) or individual retirement account balance, you could face a future ‘tax time bomb,’ advisor says. Here’s how to avoid it. Read more at: https://www.cnbc.com/2024/06/25/reduce-taxes-on-retirement-income.html |

|

Retirement ‘super savers’ tend to have the biggest 401(k) balances. Here’s what they do differentlyEven as a retirement savings crisis looms, some investors are working to rack up large balances. Read more at: https://www.cnbc.com/2024/06/25/heres-how-to-be-a-retirement-super-saver.html |

|

Wednesday could be a big day for AI chip stocks as their market-leading rally stallsTwo key events Wednesday could provide a much-needed catalyst for the recently troubled semiconductor sector. Read more at: https://www.cnbc.com/2024/06/25/wednesday-could-be-big-for-ai-chip-stocks-as-their-huge-rally-stalls.html |

|

Trudeau In Trouble After Conservative Upset In Toronto “Must-Win” Special ElectionTwo years ago, Canadian Prime Minister Justin Trudeau declared war on conservatives – invoking the Emergencies Act to punish protesting truckers in a move that was ruled flatly unconstitutional in January.

Now, his political future is on the line after the ruling liberal party lost a key ‘safe seat’ in the Toronto-St. Paul’s special election. In an upset victory, Conservative candidate Don Stewart beat Liberal Leslie Church by a slim, but hugely significant 590 votes, dislodging a seat that the governing Liberals have held for more than 30 years. In response to the win, Conservative leader Pierre Poilivere demanded Trudeau call a snap election following what he called a “shocking upset” on social media Tuesday morn … Read more at: https://www.zerohedge.com/geopolitical/trudeau-trouble-after-conservative-upset-toronto-must-win-special-election |

|

Soaring Costs Put New U.S. LNG Export Projects At Risk of DelaysBy Tsvetana Paraskova of OilPrice.com Surging labor and construction costs are plaguing some major U.S. LNG export projects, threatening to delay new LNG supply to international markets.

Wage growth since 2021, a shortage of skilled workers, and rising costs of materials with the inflation over the past three years have increased overall contractor costs for U.S. LNG export projects, analysts tell Reuters. Wages for skilled workers have jumped by 20% since 2021, and in some cases contractors have had to pay a per diem rate to retain these workers, Travis Woods, president of Gulf Coast Industrial Group representing more than 1,500 contractors in Texas and Louisiana, told Reuters. In addition, e … Read more at: https://www.zerohedge.com/energy/soaring-costs-put-new-us-lng-export-projects-risk-delays |

|

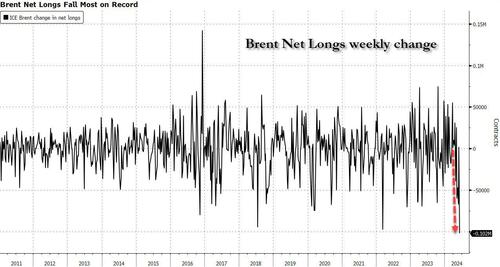

Biggest Short Squeeze In Brent Since 2016 Sparks Flood Of Bullish Oil CommentaryTwo weeks ago we observed that with oil prices tumbling, a full-blown capitulation was taking place in the market as the weekly bullish bets on Brent had just plunged the most on record…

… which we said a was “a clear sign of the surge in bearish sentiment and the extent of the technical selling that pressured crude” and which we concluded signaled that “a price rebound was imminent.” We were right: oil proceeded to rip higher in the past two weeks, pushing Brent to $86, the highest since the fake Iran-Israel confrontation in April which ended with a whimper and quickly eliminated the fear of any geopolitical crisis from the oil market. And as the price rose, so did the number of shorts who got steamrolled, and as shown in the next chart, two weeks after the biggest weekly drop in Brent net longs on recor … Read more at: https://www.zerohedge.com/markets/biggest-short-squeeze-brent-2016-sparks-flood-bullish-oil-commentary |

|

Politics Mean Strategists Are In Wait-And-See ModeBy Michael Msika, Bloomberg Markets Live reporter and strategist European stocks don’t have any upside left in the tank, according to strategists, who are adopting a wait-and-see stance ahead of elections in France that could bring big changes for economic policy. The Stoxx Europe 600 will end the year at 517 points — around where it closed on Friday — according to the average estimate in a poll of 16 strategists. After an advance of about 8% this year, they’re wary of predicting more gains in a second half that includes the potential for political instability in France, a possible change in power in the UK and a US election where trade is a hot-button issue. The average estimate has moved up a little from last month’s forecast of 503 points, with some strategists — including those at Pictet and UniCredit — raising their targets because of cheap valuations, better economic prospects in the region and rising earnings forecasts. A big hike from UBS’s Gerry Fowler has also helped push the poll’s median forecast to 533. Read more at: https://www.zerohedge.com/markets/politics-mean-strategists-are-wait-and-see-mode |

|

Wrongly jailed sub-postmistress rejects apologyEx-Fujitsu engineer Gareth Jenkins says sorry to Seema Misra but she says it is “too little, too late”. Read more at: https://www.bbc.com/news/articles/c1ee540jypyo |

|

HSBC joins UK banks in cutting mortgage ratesSome lenders are trimming rates after the Bank of England hinted about a drop in borrowing costs. Read more at: https://www.bbc.com/news/articles/c2jj3vg1k0ro |

|

Vauxhall-owner may halt UK production over EV plansStellantis says UK rules on electric vehicles are too tough and it may have to close plants. Read more at: https://www.bbc.com/news/articles/cn44v3e7nggo |

|

Akme Fintrade shares to list tomorrow. What GMP signals ahead of listing?With a strong financial performance and growth trajectory, our upcoming listing is poised for success. The oversubscribed IPO reflects investor confidence in our business model and potential for further expansion. Partnering with industry experts like Gretex Corporate Services ensures a solid foundation for future growth. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/akme-fintrade-shares-to-list-tomorrow-what-gmp-signals-ahead-of-listing/articleshow/111256306.cms |

|

India central bank policymakers divided over rate-growth debateInternal members maintain hawkish stance on inflation, with Governor Das cautioning against hasty actions for fear of worsening the situation Read more at: https://economictimes.indiatimes.com/markets/stocks/news/india-central-bank-policymakers-divided-over-rate-growth-debate/articleshow/111245238.cms |

|

India’s new finance hub in Gujarat eyes real-time dollar settlement by 2025Real-time dollar settlement in India’s newest financial hub in Gujarat, GIFT City, is set to begin later this year. The service aims to attract foreign investors by streamlining transactions and reducing delays. Read more at: https://economictimes.indiatimes.com/markets/forex/indias-new-finance-hub-in-gujarat-eyes-real-time-dollar-settlement-by-2025/articleshow/111245197.cms |

|

Inflation is slowing and we’ve dodged a recession. Stocks are set for a summer stunner.Ed Yardeni: Ignore the inverted yield curve — this “Roaring 2020s” market is alive and well. Read more at: https://www.marketwatch.com/story/inflation-is-slowing-and-weve-dodged-a-recession-stocks-are-set-for-a-summer-stunner-621762ab?mod=mw_rss_topstories |

|

Why GameStop’s $2.1 billion stock sale taxes its shareholders and hurts the economyFoolish traders are indirectly funding GameStop’s balance sheet. Read more at: https://www.marketwatch.com/story/why-gamestops-2-1-billion-stock-sale-taxes-its-shareholders-and-hurts-the-economy-8dbf0575?mod=mw_rss_topstories |

|

2-year Treasury yield ends lower for first time in four sessions as traders await Friday’s inflation dataRates on U.S. government debt finished lower Tuesday as investors parsed comments from Federal Reserve officials and looked ahead to May inflation data later in the week. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-in-tight-range-as-traders-await-data-b82f3970?mod=mw_rss_topstories |