Summary Of the Markets Today:

- The Dow closed up 57 points or 0.15%,

- Nasdaq closed up 0.03%,

- S&P 500 closed up 0.25%, (Closed at 5,487, New Historic high 5,490)

- Gold $2,345 up $15.90,

- WTI crude oil settled at $82 up $1.17,

- 10-year U.S. Treasury 4.215 down 0.064 points,

- USD index $105.27 down $0.050,

- Bitcoin $64,363 down 2,135 or 3.21%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

For over two years, inflation adjusted retail sales has been soft – and May 2024 data continues soft retail sales up 2.9% year-0ver-year (up 0.8% inflation adjusted). I use unadjusted data as I only care about year-over-year growth which does not require seasonal adjustments. The economic weakness comes from the following sectors: furniture/home furnishing; building materials; health/personal care stores; and department stores. High growth sectors: miscellaneous stores; and non-store retailers.

Industrial Production increased 0.4% year-over-year with subindices manufacturing up 0.05% year-over-year; utilities up 3.9% year-over-year; and mining down 0.4% year-over-year. Nothing to write home about but manufacturing technically is not in a recession with 0.05% growth. Major weakness was in construction supplies.

Here are some of headlines we are reading today:

- New Report Highlights Rising Investments in Nuclear Arsenals

- Citgo Corpus Christi Oil Refinery Restarts

- Power Outage Could Reduce Norway’s Gas Supply to Europe Again

- Coal India Studies Argentina Lithium Asset Development With U.S. Company

- Oil Prices Bounced Back After Markets Overreacted to the OPEC Announcement

- Oil Prices Bounced Back After Markets Overreacted to the OPEC Announcement

- Nvidia passes Microsoft in market cap to become most valuable public company

- The Fed is ‘playing with fire’ by not cutting rates, says creator of ‘Sahm Rule’ recession indicator

- Major altcoins sink amid broader crypto pullback: CNBC Crypto World

- Treasury yields retreat as weak retail sales raise concerns about consumer

- May retail sales rise 0.1%, weaker than expected

- Boeing’s stock falls as lawmakers blast CEO Calhoun for ‘strip mining’ company for profits

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

This Key Component of Europe’s Wind Energy Boom Could Become a $20B MarketOffshore substations are vital in collecting and transmitting generated power to the electricity grid.Offshore wind installations are gathering pace worldwide leading to the need for reliable, accessible infrastructure to bring the generated power onshore and into the electricity grid. As a result, demand for offshore substations is booming, especially in Europe. Rystad Energy research and modeling shows that 137 substations will be installed offshore continental Europe this decade, requiring $20 billion in total investment. Over 120 of these facilities… Read more at: https://oilprice.com/Energy/Energy-General/This-Key-Component-of-Europes-Wind-Energy-Boom-Could-Become-a-20B-Market.html |

|

New Report Highlights Rising Investments in Nuclear ArsenalsThe nine nuclear-armed nations in the world continue to modernize their nuclear arsenals amid growing reliance on them as deterrence in 2023, a fresh report issued on June 17 by a Swedish think tank said. “While the global total of nuclear warheads continues to fall as cold war-era weapons are gradually dismantled, regrettably we continue to see year-on-year increases in the number of operational nuclear warheads,” said Dan Smith, director of the Stockholm International Peace Research Institute (SIPRI). “This trend seems likely to continue and… Read more at: https://oilprice.com/Geopolitics/International/New-Report-Highlights-Rising-Investments-in-Nuclear-Arsenals.html |

|

YPFB Considers Leasing Pipelines to Facilitate Vaca Muerta Gas ExportsBolivia’s state-owned oil and gas company, YPFB, is evaluating the possibility of leasing its pipeline infrastructure to Argentina for exporting natural gas from the Vaca Muerta shale play to Brazil. YPFB President Armin Dorgathen highlighted this potential move during a recent announcement, emphasizing the economic benefits for Bolivia. “Renting the pipelines will bring us more resources,” Dorgathen stated, noting that Bolivia’s infrastructure presents the most viable and cost-effective route for Argentine gas exports. The Vaca Muerta formation,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/YPFB-Considers-Leasing-Pipelines-to-Facilitate-Vaca-Muerta-Gas-Exports.html |

|

Citgo Corpus Christi Oil Refinery RestartsCitgo Petroleum Corporation has begun the process of restarting units at the West Plant of its 175,500 barrels per day (bpd) Corpus Christi, Texas, refinery. This follows the completion of planned maintenance activities, according to a community alert notification issued early Tuesday morning. “Citgo West Plant is starting up units following the completion of planned maintenance activities,” the alert stated. “During this time, flaring may occur. No community action is necessary.” The maintenance work, which commenced on April 29, was initially… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Citgo-Corpus-Christi-Oil-Refinery-Restarts.html |

|

Equinor Fights NIMBY Feelings in New York Battery Storage ProjectThe Not in My Back Yard (NIMBY) movement has targeted nuclear power plants, high voltage transmission lines, windmills and solar farms, demanding that builders just put them somewhere else. Now Equinor, the Norwegian energy company, wants to install New York’s largest grid battery storage facility in middle-class Mahopac, in Putnam County, about forty miles north of New York City. This proposed site is right next to posher Somers in Westchester County, on property owned by— as described by the local paper — members of two politically… Read more at: https://oilprice.com/Energy/Energy-General/Equinor-Fights-NIMBY-Feelings-in-New-York-Battery-Storage-Project.html |

|

Power Outage Could Reduce Norway’s Gas Supply to Europe AgainThe Nyhamna plant in Norway is unavailable for natural gas processing due to a power outage with an uncertain duration at the onshore facility, data from Norwegian gas system operator Gassco showed early on Tuesday afternoon local time. A total of 33.8 million cubic meters (mcm) out of the plant’s 79.8 mcm of technical capacity were not available as of 3 p.m. local time, with early Wednesday morning provisionally indicated as the end of the outage. The outage comes after the Nyhamna plant was offline for several days in early June… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Power-Outage-Could-Reduce-Norways-Gas-Supply-to-Europe-Again.html |

|

The Caribbean Energy Industry Is Undergoing a Major TransformationThe energy sector in the Caribbean is undergoing a huge transformation, from geothermal finds in Dominica to solar energy in Antigua and Barbuda. The long-overlooked region is now attracting high levels of investment, as energy companies see huge potential in its future. Massive investments from international organizations and private funders are expected to spur the development of a strong renewable energy sector across the region over the next decade. In December 2023, the World Bank announced it was partnering with governments across the… Read more at: https://oilprice.com/Energy/Energy-General/The-Caribbean-Energy-Industry-Is-Undergoing-a-Major-Transformation.html |

|

Coal India Studies Argentina Lithium Asset Development With U.S. CompanyState-held giant Coal India and a U.S. company are considering joint development of lithium assets in Argentina, under the U.S.-led pact for Minerals Security Partnership, Reuters reported on Tuesday, citing an Indian source with direct knowledge of the matter. Earlier this year, India signed an agreement with the state-owned enterprise of Catamarca province in northwest Argentina for a lithium exploration and mining project in the Argentinian province. To boost its energy transition efforts, India is also betting on acquiring… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Coal-India-Studies-Argentina-Lithium-Asset-Development-With-US-Company.html |

|

Oil Prices Bounced Back After Markets Overreacted to the OPEC AnnouncementTwo weeks ago, oil markets reacted negatively to OPEC+’s decision to unwind 2.2M bbl/day in voluntary production cuts later this year, with oil prices tumbling to multi-month lows. Standard Chartered pointed out that the selloff was an overreaction triggered by a combination of several factors including extreme macroeconomic pessimism, speculative shorts, and over-enthusiastic algorithmic trading that crowded out more fundamentally-based traders. Thankfully, oil prices have largely corrected to their previous levels before the OPEC+ announcement,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Bounced-Back-After-Markets-Overreacted-to-the-OPEC-Announcement.html |

|

Russia’s Crude Shipments Rise Despite Vow to Fix OverproductionRussia continued to raise its crude oil exports by sea for a second consecutive week despite promising to stick strictly to its OPEC+ output target in June, tanker-tracking data and port agent reports monitored by Bloomberg showed on Tuesday. In the four weeks to June 16, Russian crude oil shipments rose by some 80,000 barrels per day (bpd) to 3.42 million bpd, according to the data reported by Bloomberg’s Julian Lee. The week to June 16 was the second consecutive week in which the four-week average of Russia’s crude export… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Shipments-Rise-Despite-Vow-to-Fix-Overproduction.html |

|

Europe Aims to Reduce Reliance on China for Critical MineralsEurope has been looking for ways to accelerate its rare earth metals production to diversify its supply chain and reduce reliance on China as its main supplier. Several minerals will be crucial for the development of the global renewable energy industry, helping energy companies to produce batteries, solar and wind equipment and clean technologies. To date, the global reliance on China for these minerals has been significant and it continues to dominate worldwide production of lithium and several other critical minerals. However, recent developments… Read more at: https://oilprice.com/Metals/Commodities/Europe-Aims-to-Reduce-Reliance-on-China-for-Critical-Minerals.html |

|

Fisker Files for Bankruptcy as Troubles Mount for EV MakersElectric vehicle manufacturer Fisker Group Inc said on Tuesday it had filed for Chapter 11 protection in the District of Delaware, one year after launching its first model, as market and macroeconomic headwinds led to a lot of cash burned to take the Ocean SUV to the market. Fisker is the second EV start-up of automotive designer Henrik Fisker to go bankrupt after it badly missed forecasts for EV production and deliveries last year. “We are proud of our achievements, and we have put thousands of Fisker Ocean SUVs in customers’… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fisker-Files-for-Bankruptcy-as-Troubles-Mount-for-EV-Makers.html |

|

Oil Prices Climb as Sentiment Continues to ImproveOil prices have bounced back after the last OPEC+ announcement sent them crashing, and the U.S. Federal Reserve could send them higher still with optimistic messaging.- Oil markets were eagerly anticipating the start of peak driving season in the summer, but gasoline demand so far has been mostly disappointing, with US consumption some 2% lower year-over-year.- Asia has been the first continent where gasoline weakness led to refinery run cuts, as a glut of light distillate supply has pushed Singapore gasoline cracks below the $5 per barrel mark.-… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-as-Sentiment-Continues-to-Improve.html |

|

U.S. Judge Dismisses Exxon’s Lawsuit Against Activist InvestorA U.S. district judge has dismissed a lawsuit filed by ExxonMobil against shareholder Arjuna Capital after ruling that the case is now moot after the activist investor had withdrawn a climate proposal and promised not to file similar proposals in the future. The dispute between the U.S. supermajor and Arjuna Capital emerged early this year, when Exxon sued Arjuna and Follow This in a Texas district court, aiming to block their climate proposals from going to a vote at the annual shareholder meeting, in the first such… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Judge-Dismisses-Exxons-Lawsuit-Against-Activist-Investor.html |

|

Shell Boosts Its LNG Business by Buying Trader Pavilion EnergyShell, the world’s largest LNG trader, is doubling down on the sector and further boosting its liquefied natural gas business as it signed a deal to buy Singapore-based LNG trading firm Pavilion Energy. Shell said on Tuesday that its subsidiary Shell Eastern Trading Pte. Ltd. has reached an agreement with Carne Investments Pte. Ltd., an indirect wholly-owned subsidiary of Temasek, to acquire 100% of the shares in Pavilion Energy. Pavilion Energy has a global business encompassing LNG trading, shipping, natural gas supply,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Boosts-Its-LNG-Business-by-Buying-Trader-Pavilion-Energy.html |

|

Nvidia passes Microsoft in market cap to become most valuable public companyNvidia shares have multiplied by more than nine-fold since the end of 2022, and the chipmaker surpassed Microsoft to become the most valuable public company. Read more at: https://www.cnbc.com/2024/06/18/nvidia-passes-microsoft-in-market-cap-is-most-valuable-public-company.html |

|

The Fed is ‘playing with fire’ by not cutting rates, says creator of ‘Sahm Rule’ recession indicatorAs the jobless level has ticked up in recent months, the “Sahm Rule” has generated increasing talk on Wall Street. Read more at: https://www.cnbc.com/2024/06/18/economist-sahm-who-devised-recession-rule-says-the-fed-is-playing-with-fire-.html |

|

Top BofA auto analyst says Detroit automakers need to exit China as soon as possibleThe rise of local Chinese automakers, such as BYD and Geely, has put growing pressure on Detroit automakers. Read more at: https://www.cnbc.com/2024/06/18/detroit-automakers-need-to-exit-china-bofa-analyst-says-.html |

|

Boeing CEO blasted by Senate panel: ‘It’s a travesty that you are still in your job’Boeing is under fire after a door plug blew out of one of its nearly new 737 Max planes in January during an Alaska Airlines flight. Read more at: https://www.cnbc.com/2024/06/18/boeing-ceo-dave-calhoun-senate-hearing.html |

|

These are the most popular trades today — and the best contrarian trades to go against the crowdThe “Magnificent Seven” is the most crowded trade on Wall Street, but investors are looking for stocks that have more upside should sentiment go the other way. Read more at: https://www.cnbc.com/2024/06/18/these-are-the-best-contrarian-trades-to-go-against-the-crowd-bofa-says.html |

|

DJT shares tumble 13% as Trump Media stock sell-off acceleratesTrump Media shares are down about 40% since a New York jury found Trump guilty of 34 felony counts of falsifying business records on May 30. Read more at: https://www.cnbc.com/2024/06/18/djt-shares-tumble-13percent-as-trump-media-stock-sell-off-accelerates.html |

|

Major altcoins sink amid broader crypto pullback: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Brian Dixon of Off The Chain Capital discusses the factors behind bitcoin and other cryptocurrencies’ recent pullback. Read more at: https://www.cnbc.com/video/2024/06/18/major-altcoins-sink-broader-crypto-pullback-crypto-world.html |

|

Warren Buffett buys Occidental shares for 9 straight days, pushes his stake to nearly 29%The Omaha, Nebraska-based conglomerate purchased Occidental shares every trading day from June 5 to Monday. Read more at: https://www.cnbc.com/2024/06/18/warren-buffett-buys-occidental-shares-for-9-straight-days-pushes-his-stake-to-nearly-29percent.html |

|

Fisker files for bankruptcy protection in wave of EV startups, moment of déjà vu for its founderConsumer adoption for EVs has grown slower than expected, costs have risen and investor interest in EVs other than Tesla has dried up. Read more at: https://www.cnbc.com/2024/06/18/fisker-ev-maker-bankruptcy.html |

|

Treasury yields retreat as weak retail sales raise concerns about consumerU.S. Treasury bond yields fell Tuesday following the release of May retail sales data. Read more at: https://www.cnbc.com/2024/06/18/treasury-yields-rise-ahead-of-may-retail-sales-data.html |

|

May retail sales rise 0.1%, weaker than expectedRetail sales were expected to rise 0.2% in May, according to the Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2024/06/18/retail-sales-report-may-2024-may-retail-sales-rise-0point1percent.html |

|

Couple spent ‘all of our money’ to open a New York cafe—their business brought in nearly $50 million last yearElisa Marshall and Benjamin Sormonte spent their life savings, plus money from family and friends, to open Maman in 2014. Now, the cafe chain brings in millions annually. Read more at: https://www.cnbc.com/2024/06/18/maman-owners-how-we-built-a-cafe-chain-that-brings-in-millions-a-year.html |

|

These new high yield bond funds are hitting the market as interest rates start to fallNew high yield funds are coming online even as the Federal Reserve is expected to cut rates and the economy is showing signs of slowing. Read more at: https://www.cnbc.com/2024/06/18/these-new-high-yield-bond-funds-are-hitting-the-market-as-interest-rates-start-to-fall.html |

|

Federal Judge Blocks Biden’s Rewrite Of Title IXAuthored by Eric Lundrum via American Greatness, On Monday, the Biden Administration’s attempt to rewrite federal Title IX regulations was temporarily blocked by a federal judge in Kentucky.

As ABC News reports, United States District Judge Danny Reeves described Biden’s new regulations as “arbitrary in the truest sense of the word.”

His ruli … Read more at: https://www.zerohedge.com/political/federal-judge-blocks-bidens-rewrite-title-ix |

|

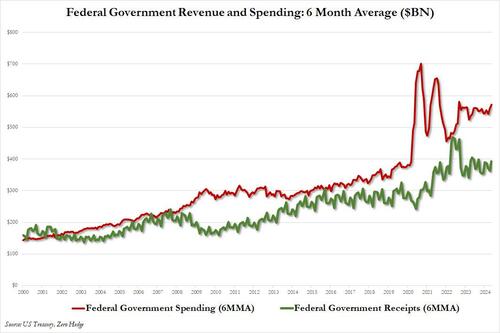

CBO Figures Out How To “Math”, Raises 2024 US Budget Deficit By $400BN To $1.9 TrillionThis should come as a shock to exactly nobody. Last week, the Treasury reported that in May, the US government collected $323.6 billion in tax receipts, it spent more than double that, or some $670 billion…

… resulting in a May budget deficit of $347 billion – about $100 billion more than consensus expected – and the second biggest May deficit on record, with only the Covid crisis peak of May 2020 higher. Read more at: https://www.zerohedge.com/markets/cbo-figures-out-how-math-raises-2024-us-budget-deficit-400bn-19-trillion |

|

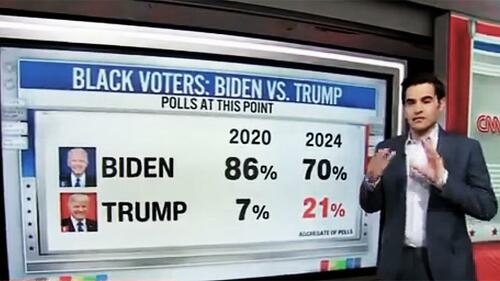

Watch: CNN Data Reporter “Speechless” At “Historic” Loss Of Black Support For BidenAuthored by Steve Watson via Modernity.news, CNN data reporter Harry Enten expressed shock at just how much support Joe Biden has lost among Black voters, admitting that Donald Trump’s polling numbers are “historic.”

Enten detailed how Trump is on course to win around 20 percent of Black voters, around DOUBLE what Republican candidates usually achieve. In the demographic of Black voters under 50, Biden’s support has halved in just four years. “I keep looking for this to change, to go back to a historical norm, and it, simply put, has not yet,” Enten declared.

|

|

Watch Live: Boeing’s Outgoing CEO Massacred In Senate TestimonyUpdate (1536ET): CEO Dave Calhoun says Boeing is ‘changing course’ on outsourcing. Essentially, this means the planemaker will bring more of the production in-house. * * * Update (1528ET): Sen. Richard Blumenthal (D-Conn.) tells CEO Dave Calhoun, “This hearing is a moment of reckoning … and about a company, a once iconic company, that somehow lost its way.” * * * Update (1501ET): Sen. Josh Hawley, R-Mo. tells CEO Dave Calhoun:

|

|

Faisal Islam: Voters are being taken for fools on the economyDo promises to leave various tax rates alone have any credibility, asks the BBC’s economics editor. Read more at: https://www.bbc.com/news/articles/crgg4ze1edpo |

|

Post Office sabotaged Horizon probe, says investigatorIndependent investigator says Post Office tried to obstruct probe into IT flaws. Read more at: https://www.bbc.com/news/articles/cyddlynqlryo |

|

Low investment blocking UK growth, says think tankBoth Conservative and Labour plan to reduce government investment over the next parliamentary term Read more at: https://www.bbc.com/news/articles/cl44edly2ryo |

|

Goldman Sachs sells 44.20 lakh shares worth Rs 183 crore in Paytm via block dealAs per the shareholding data of One 97 Communications, Goldman Sachs Singapore held 84,01,067 shares or 1.32% stake in the fintech payment platform. Paytm shares on Tuesday settled in the red, breaking their two-sessions winning streak. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/goldman-sachs-sells-44-20-lakh-shares-worth-rs-183-crore-in-paytm-via-block-deal/articleshow/111090910.cms |

|

Tech View: 23,500 key support for trend-following traders. Here’s how to trade on WednesdayAs it has sustained above the hurdle of 23,515 levels, it is expected that Nifty would move towards the next resistance of 1.786% Fib extension at 23,950 levels in the near term. The immediate support is placed at 23,450. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-23500-key-support-for-trend-following-traders-heres-how-to-trade-on-wednesday/articleshow/111089318.cms |

|

10 equity mutual funds that lost the most in MayAround 491 equity mutual fund schemes were active in May. Read more at: https://economictimes.indiatimes.com/mf/analysis/10-equity-mutual-funds-that-lost-the-most-in-may/slideshow/111089660.cms |

|

CBO raises U.S. budget-deficit forecast to close to $2 trillionThe U.S. budget deficit is projected to hit $1.92 trillion this year, up from $1.69 trillion in 2023, according to updated projections from the Congressional Budget Office released Tuesday. Read more at: https://www.marketwatch.com/story/cbo-raises-u-s-budget-deficit-forecast-to-close-to-2-trillion-019d2816?mod=mw_rss_topstories |

|

Boeing’s stock falls as lawmakers blast CEO Calhoun for ‘strip mining’ company for profitsBoeing employee Sam Mohawk is alleging that the company is improperly tracking airplane parts that for safety reasons should not be installed on airplanes. Read more at: https://www.marketwatch.com/story/new-boeing-whistleblowers-come-forward-ahead-of-senate-safety-hearing-5e85523f?mod=mw_rss_topstories |

|

Citi’s investment-banking revenue tracking 50% above year-ago levelCitigroup’s investment banking unit is being driven by better mergers and acquisitions activity as well as capital-raising. Read more at: https://www.marketwatch.com/story/citis-investment-banking-revenue-tracking-50-above-year-ago-level-978d9ba9?mod=mw_rss_topstories |