Summary Of the Markets Today:

- The Dow closed down 58 points or 0.15%,

- Nasdaq closed up 0.12%, (Closed at 17,668,

- S&P 500 closed down 0.04%,

- Gold $2,349 up $30.40,

- WTI crude oil settled at $79 down $0.07,

- 10-year U.S. Treasury 4.211 down 0.029 points,

- USD index $105.51 up $0.31,

- Bitcoin $65,488 down 1,251 or 1.87%,

- Baker Hughes Rig Count: U.S. -4 to 590 Canada +17 to 160

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

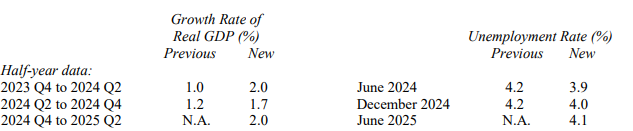

The Livingston Survey is the oldest continuous survey of economists’ expectations that summarizes the forecasts of economists from industry, government, banking, and academia. The Livingston Survey for June 2024 states:

The 23 participants in the June Livingston Survey predict higher output growth for the first half of 2024 than they predicted in the December 2023 survey. The forecasters, who are surveyed by the Federal Reserve Bank of Philadelphia twice a year, now project that the economy’s output (real GDP) will grow at an annual rate of 2.0 percent during the first half of 2024. They expect weaker conditions in the second half of 2024, when growth is expected to be at an annual rate of 1.7 percent. Both projections represent upward revisions from those of the December 2023 survey. Growth is expected to average an annual rate of 2.0 percent in the first half of 2025.

Prices for U.S. imports rose 1.1% for the year ended in May 2024, matching the over-the-year increase in April. The May and April 12-month advances are the largest over-the-year increases since December 2022. Prices for import fuel fell 2.0 percent in May or the gain in import prices would have been larger. Prices for U.S. exports rose 0.6% from May 2023 to May 2024, the first 12-month advance since January 2023. As 15%+ of US consumption is on imported products and services – I would expect an impact to inflation from imports.

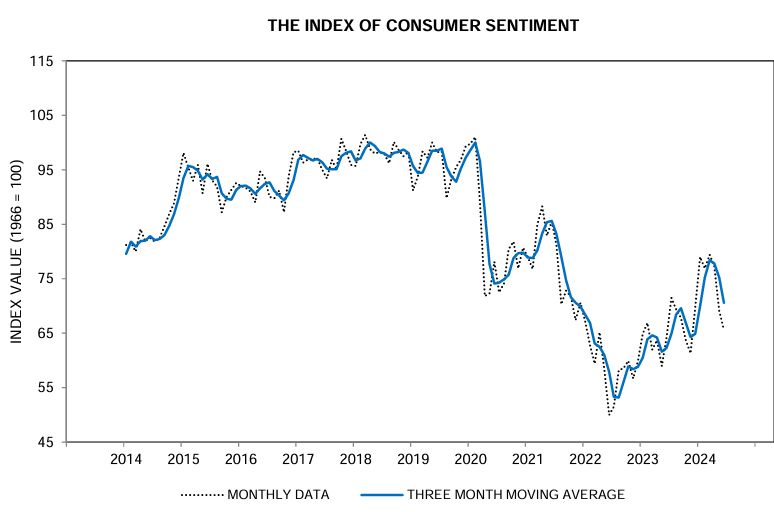

The University of Michigan consumer sentiment according to the authors was little changed in June 2024 saying “this month’s reading was a statistically insignificant 3.5 index points below May and within the margin of error. Sentiment is currently about 31% above the trough seen in June 2022 amid the escalation in inflation. Assessments of personal finances dipped, due to modestly rising concerns over high prices as well as weakening incomes. Overall, consumers perceive few changes in the economy from May.”

Here are some of headlines we are reading today:

- China’s Small Banks Face Scrutiny Over Russian War Support at G7

- Canada Poised to Reclaim Top Spot as World’s Largest Uranium Producer

- U.S. Oil, Gas Drilling Activity Sees Further Declines

- “Bitcoin is Exponential Gold”, Says Fidelity’s Director Of Global Macro

- Tesla Shareholders Push Back Against ESG Proposals

- China’s Oil Demand Threatened by LNG Trucks

- Nasdaq Composite ekes out record close, notches a 3% weekly gain: Live updates

- Adobe shares surge 15% for sharpest rally since 2020

- Bitcoin dips into the $65,000 level to end the week: CNBC Crypto World

- Counterfeit Titanium Found In Some Boeing And Airbus Jets

- Treasury yields see biggest two- and three-week declines since December as bonds keep rallying

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Small Banks Face Scrutiny Over Russian War Support at G7With Western officials looking to hamper Beijing’s support for a Russian economy reoriented around the war in Ukraine, China’s smaller banks have emerged as a new target. How to deal with the small Chinese financial institutions that are helping Moscow evade Western sanctions will be a top agenda item at the Group of Seven (G7) summit in Italy on June 13-15. U.S. officials have said that going after booming Chinese-Russian trade — particularly the supply of nonlethal but militarily applicable dual-use products — is a priority. “We… Read more at: https://oilprice.com/Geopolitics/International/Chinas-Small-Banks-Face-Scrutiny-Over-Russian-War-Support-at-G7.html |

|

Sweden Rejects New Power Cable to Germany Over Market InefficienciesIn a significant move, the Swedish government has rejected the proposed 700 MW Hansa PowerBridge subsea power connection between Sweden and Germany. Energy Minister Ebba Busch cited inefficiencies in the German electricity market as the primary reason for the decision, emphasizing that connecting southern Sweden—already facing an electricity production deficit—with Germany could lead to higher prices and increased market instability. The Hansa PowerBridge project, a collaboration between grid operators Svenska Kraftnät and Germany’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sweden-Rejects-New-Power-Cable-to-Germany-Over-Market-Inefficiencies.html |

|

Canada Poised to Reclaim Top Spot as World’s Largest Uranium ProducerCanada was the world’s top uranium producer for years until Kazakhstan dethroned it in 2009. Fast forward to 2022, and Canada held the second spot, pumping out 15% of the global supply. By 2023, Canada became the top uranium supplier to the US, delivering 27% of total deliveries. With uranium prices soaring in the last several years, primarily because of the ‘Next AI Trade’ theme (laid out for pro subs), Canada’s uranium mining boom could lead it to reclaim the top spot. A new report from Bloomberg highlights that Canada’s Saskatchewan province… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Canada-Poised-to-Reclaim-Top-Spot-as-Worlds-Largest-Uranium-Producer.html |

|

Africa’s Biggest Refinery Delays First Gasoline Supply until mid-JulyThe Dangote Refinery in Nigeria, Africa’s biggest and newest crude processing facility, is delaying the start of gasoline deliveries after the middle of July, the Dangote group’s president Aliko Dangote told Nigerian media this week. “We had a bit of delay, but it will start coming out 10/15 of July,” said Dangote, Africa’s richest man, commenting on the beginning of gasoline production at the huge refinery which started operations in January. “By third week of July, we will be able to take it into… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Biggest-Refinery-Delays-First-Gasoline-Supply-until-mid-July.html |

|

U.S. Oil, Gas Drilling Activity Sees Further DeclinesThe total number of active drilling rigs for oil and gas in the United States fell this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 4 to 590 this week, compared to 687 rigs this same time last year. The number of oil rigs fell by 4 again this week, after falling by 4 in the week prior. Oil rigs now stand at 488–down by 64 compared to this time last year. The number of gas rigs stayed the same this week at 98, a loss of 32 active gas rigs from this time last year. Miscellaneous rigs stayed the… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drilling-Activity-Sees-Further-Declines.html |

|

Catan’s New Edition Challenges Players with Energy Crisis, Climate ChangeThe classic board game Catan, known for its emphasis on development and resource management, has been reimagined for the 21st century with a new edition that integrates modern energy challenges. “Catan: New Energies” tasks players with balancing fossil fuel production and clean energy development while averting climate catastrophe. In this updated version, players build towns, cities, and roads and must decide between investing in fossil fuels for quicker gains or opting for renewable energy, which is slower but sustainable. The game introduces… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Catans-New-Edition-Challenges-Players-with-Energy-Crisis-Climate-Change.html |

|

“Bitcoin is Exponential Gold”, Says Fidelity’s Director Of Global MacroJurrien Timmer, Fidelity’s Director of Global Macro, recently made a notable statement about Bitcoin, describing it as “exponential gold” and an emerging player on the “store of value” team. Timmer’s comments were shared through a series of posts, where he elaborated on Bitcoin’s evolving role in the financial ecosystem. In my view, bitcoin is exponential gold and an aspiring player on the store of value team. My work suggests that the price of bitcoin is driven primarily by the growth in its network, which is in turn driven by bitcoin’s… Read more at: https://oilprice.com/Energy/Energy-General/Bitcoin-is-Exponential-Gold-Says-Fidelitys-Director-Of-Global-Macro.html |

|

European Diesel Market Shows Signs of TighteningMarket spreads and futures prices signaled at the end of this week a tightening in the European diesel market, on the back of closed or restricted arbitrage opportunities for supply from both the United States and the Middle East. The prompt gasoil futures on the ICE exchange jumped to a premium over the next-month futures contract intraday on Friday, from a discount at Thursday’s close, according to data compiled by Bloomberg. This market structure, backwardation, suggests increased immediate demand for a commodity compared to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Diesel-Market-Shows-Signs-of-Tightening.html |

|

Tesla Shareholders Push Back Against ESG ProposalsShareholders also voted against several proposals aimed at improving Tesla’s ESG standards, opting instead to re-incorporate the company in Texas. Tesla chief Elon Musk has won shareholder approval over his controversial 2018 stock option compensation package, potentially worth up to $56bn (£44bn), at Tesla’s annual meeting held at its Texas gigafactory. Shareholders also greenlit Tesla’s decision to re-incorporate in Texas, moving away from Delaware, where Musk’s pay package had previously been rescinded. “Hot… Read more at: https://oilprice.com/Energy/Energy-General/Tesla-Shareholders-Push-Back-Against-ESG-Proposals.html |

|

Fitch: EU Tariffs on China’s EVs Will Not Affect European MarketThe European Commission’s provisional tariffs on imports of Chinese electric vehicles in the EU are not expected to materially impact the European market, due to the slow uptake of EVs, Fitch Ratings said on Friday. However, a potential Chinese retaliation would be key to the fortunes of European carmakers, especially of the German auto manufacturers, according to the rating agency. Earlier this week, the European Commission announced provisional tariffs on Chinese EVs in Europe, ranging from 17.4% for BYD to 38.1% for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fitch-EU-Tariffs-on-Chinas-EVs-Will-Not-Affect-European-Market.html |

|

Debate Rages Over Global Oil DemandSigns that inflation may be easing in the U.S. have given oil markets a bullish hue this week, but uncertainty over demand remains.Friday, June 14, 2024After several weeks of unpredictable see-sawing, oil markets are back to their usual self. The IEA and OPEC are publicly arguing about the future of oil demand, U.S. interest rate cuts are still not happening, and questions remain about the strength of summer gasoline demand. That said, a positive outlook in U.S. inflation data might have helped to tilt the balances slightly in favor of… Read more at: https://oilprice.com/Energy/Energy-General/Debate-Rages-Over-Global-Oil-Demand.html |

|

Russia’s Oil Product Shipments Jumped by 10.4% in MayRussia’s fuel exports by sea increased by 10.4% in May compared to April as Moscow lifted a gasoline export ban and some refineries returned from maintenance, according to Reuters estimates and data from industry sources. Last month, Russia shipped 9.595 million metric tons of oil products to international markets, as the authorities lifted on May 20 a temporary ban on gasoline exports and as more refineries completed planned seasonal maintenance or emergency repairs after Ukrainian drone hits. Exports via the Black… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Product-Shipments-Jumped-by-104-in-May.html |

|

OPEC Demand Forecast Boosts Bullish Sentiment in Oil MarketsOil Prices Rise on OPEC Demand Forecast and Easing U.S. Inflation Oil prices are sharply higher as we end the week, driven by an optimistic demand forecast from OPEC and signs of easing U.S. labor market and inflation pressures. These factors have bolstered expectations for potential Federal Reserve rate cuts despite recent cautious statements from Fed officials. Consequently, oil prices have posted a near 3% weekly gain. US Economic Indicators and Federal Reserve Actions The U.S. Labor Department reported a 0.2% drop in the Producer Price Index… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Demand-Forecast-Boosts-Bullish-Sentiment-in-Oil-Markets.html |

|

China’s Oil Demand Threatened by LNG Trucks1. IEA Angers Oil Market With 2029 Demand Peak Call – This week has seen a fierce standoff between OPEC and the IEA, with the latter predicting a peak to oil demand in 2029 at 105.6 million b/d, following which consumption would decline amidst higher penetration of EVs and improved fuel efficiency. – From a total spare production capacity of 6.7 million b/d this year, the IEA sees the supply surplus ballooning to 8.2 million b/d, albeit 45% of this increase would come from natural gas liquids, not oil. – OPEC has countered by stating… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Oil-Demand-Threatened-by-LNG-Trucks.html |

|

Oil and Gas M&A Momentum Continues to BuildDeals, Mergers & Acquisitions Matador Resources Company has announced the acquisition of Permian Basin oil and gas properties from Ameredev II Parent, LLC for $1.9 billion. This deal includes a 19% stake in Piñon Midstream and enhances Matador’s existing portfolio with high-quality assets in Lea County, New Mexico, and Loving and Winkler Counties, Texas. With this acquisition, Matador’s Delaware basin acreage will exceed 190,000 net acres, producing over 180,000 boed with proved reserves surpassing 580 MMboe. The acquisition is strategically… Read more at: https://oilprice.com/Energy/Energy-General/Oil-and-Gas-MA-Momentum-Continues-to-Build.html |

|

Nasdaq Composite ekes out record close, notches a 3% weekly gain: Live updatesThe S&P 500 is coming off a fresh record high on Thursday. Read more at: https://www.cnbc.com/2024/06/13/stock-market-today-live-updates.html |

|

Friday’s trading could trigger a $10 billion rush of demand for Nvidia shares. Here’s howNvidia’s market cap race with Apple and Microsoft could have a big impact on a $70 billion fund. Read more at: https://www.cnbc.com/2024/06/14/fridays-trading-could-trigger-a-10-billion-rush-of-demand-for-nvidia-shares-heres-how.html |

|

‘Inside Out 2’ arrives in theaters and could hit a 100-day run. Here’s why that’s increasingly rareBoth Walt Disney Animation and Pixar struggled to regain a foothold at the box office after pandemic restrictions lessened and audiences returned to theaters. Read more at: https://www.cnbc.com/2024/06/14/inside-out-2-opening-theatrical-window.html |

|

CEOs at Trump meeting: Ex-president ‘meandering’ and ‘doesn’t know what he’s talking about’Trump offered scant details on how he would reduce taxes and cut back on business regulations, according to two people in the room. Read more at: https://www.cnbc.com/2024/06/14/ceos-at-trump-meeting-not-impressed.html |

|

This sector is loved by Wall Street for its attractive yields and relative valueAgency mortgage-backed securities are providing a coupon yield of about 5.7%, according to UBS. Read more at: https://www.cnbc.com/2024/06/14/mortgage-backed-securities-are-loved-by-wall-street-for-their-attractive-yields-and-relative-value.html |

|

Adobe shares surge 15% for sharpest rally since 2020Adobe reported better-than-expected earnings and revenue, lifting the stock to its biggest gain in more than four years. Read more at: https://www.cnbc.com/2024/06/14/adobe-shares-surge-and-head-for-sharpest-rally-since-2020-.html |

|

Jared Kushner’s post-White House deal-making included badly timed bet on Amazon aggregatorShortly after leaving the Trump White House, Jared Kushner was putting Saudi money to work across a host of businesses, including Amazon aggregator Unybrands. Read more at: https://www.cnbc.com/2024/06/14/jared-kushner-investments-included-bet-on-amazon-aggregator-unybrands.html |

|

Bitcoin dips into the $65,000 level to end the week: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Matthew Hougan, chief investment officer at Bitwise Asset Management, discusses regulatory advancements in crypto, spot ether ETFs and more from Coinbase’s State of Crypto Summit in New York City. Read more at: https://www.cnbc.com/video/2024/06/14/bitcoin-dips-into-the-65000-level-to-end-the-week-cnbc-crypto-world.html |

|

Google-backed Tempus AI pops by as much as 15% in Nasdaq stock market debutTempus AI rose by as much as 15% in trading on Friday after the health-care diagnostics company priced its Nasdaq IPO at $37, the high-end of offering range. Read more at: https://www.cnbc.com/2024/06/14/google-backed-tempus-ai-pops-by-as-much-as-15percent-in-nasdaq-debut.html |

|

Supreme Court rules gun ‘bump stocks’ ban is unlawfulThe ban was imposed by the Trump administration after the accessory was used during the 2017 mass shooting in Las Vegas. Read more at: https://www.cnbc.com/2024/06/14/supreme-court-rules-gun-bump-stocks-ban-is-unlawful.html |

|

Competition in the housing market is cooling off. Here’s whyHomes are not selling as fast as they once were. This is causing supply to grow in some areas. Here’s what that means for you as a homebuyer or seller. Read more at: https://www.cnbc.com/2024/06/14/why-competition-in-the-housing-market-is-cooling-off.html |

|

Luxury homes on these beaches are losing value fast, as effects of climate change hit hardAs sea levels rise and storms intensify, coastal real estate is seeing flooding and erosion like never before, and it’s impacting home values. Read more at: https://www.cnbc.com/2024/06/14/luxury-homes-on-these-beaches-are-losing-value-fast-as-effects-of-climate-change-hit-hard.html |

|

Infowars host Alex Jones’ personal assets to be sold to help pay Sandy Hook debt, judge rulesConspiracy theorist Alex Jones owes $1.5 billion for his false claims that the Sandy Hook Elementary School shooting was a hoax. Read more at: https://www.cnbc.com/2024/06/14/alex-jones-infowars-bankruptcy-sandy-hook-debt.html |

|

Grant: Rates Are Going Much Higher. Is He Right?Authored by Lance Roberts via RealInvestmentAdvice.com, Recently, James Grant, editor of the Interest Rate Observer, was asked about his outlook for interest rates. He sees interest rates moving in a cyclical pattern, potentially rising for another multi-decade period. Grant bases his view on historical observations rather than a mystical belief in cycles. He states that finance has shown a cyclical nature, moving from extremes of euphoria to revulsion in various asset classes. Therefore, he proposes that persistent inflation, increased military spending, and significant fiscal deficits could drive rates higher. The Fed’s target of a 2% inflation rate and the electorate’s preference for policies that lead to inflation also contribute to this trend. Let me state that I have a tremendous amount of respect for Grant and his work. However, I can’t entirely agree with his view. I will focus today’s discussion on the outlook for interest rates based on the two bolded sentences above. The chart below shows the long-term view of short and long-bond interest rates, inflation, and GDP. As Grant notes, there is a cycle to interest rates previously. Read more at: https://www.zerohedge.com/markets/grant-rates-are-going-much-higher-he-right |

|

Counterfeit Titanium Found In Some Boeing And Airbus JetsBoeing is no longer the pride of American aviation. The plane manufacturer is riddled with so many problems it’s impossible to keep track. Yesterday, the FAA announced an investigation (yet another…) into a 737 Max 8 jet that encountered a dangerous mid-flight ‘Dutch roll’ several weeks ago. Now, a report from the New York Times reveals that some Boeing jets are built with ‘counterfeit titanium.’

The report continued:

|

|

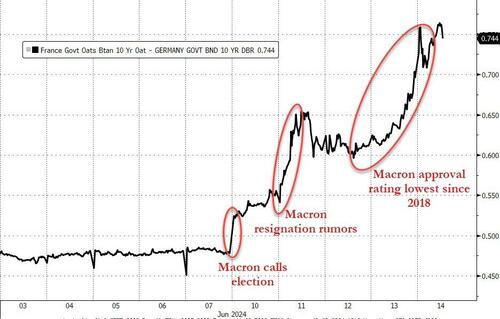

Macron Has Gambled… And LostBy Elwin de Groot, Head of Macro Strategy at Rabobank We still have one more day to go in the European session before the weekend, but the week in review is already showing to be one of quick decisions, where the bond market was ‘saved’ by the US inflation data and where Macron may have asked for a Papal blessing. But whether that turns out to be sufficient remains to be seen. Macron has gambled… and lost? According to the latest polls, only 40% of Macron’s MPs would gather enough support to even qualify for a second round of run-off votes. In a surprise move, the French president announced elections last Sunday. Macron may have acted quickly after the results of the European Parliament elections in the hope that he could ride a fear-inspired wave of solidarity that could stop Marine Le Pen’s National Rally in its tracks. However, that move could backfire pretty badly.

According to an Elabe/Les Echos survey, Macro … Read more at: https://www.zerohedge.com/economics/macron-has-gambled-and-lost |

|

French Development Banks Pulls Bond Sale As Macron Sparks EU Market MeltdownSacre bleu!! The implications of French President Macron’s shock announcement of snap legislative elections after sustaining a hammering from the far-right Rassemblement National in European elections are starting to show up in some much more worrying systemic signals for the EU overall. The OATS Spread (the gap between the yields of 10-year bonds issued by France, known as OATS for obligations assimilables du Trésor, and German bunds) is back at the center of discussion …

Complicating the situation further is the news that left-leaning political parties in France sealed an alliance to join forces in the upcoming legislative election, with polls showing it can win the second-biggest bloc behind Marine Le Pen’s National Rally. Read more at: https://www.zerohedge.com/markets/french-development-banks-pulls-bond-sale-macron-sparks-eu-market-meltdown |

|

Supermarket sandwiches linked to E. coli outbreakRetailers are removing at least 56 types of sandwiches, wraps and salad from UK supermarket shelves. Read more at: https://www.bbc.com/news/articles/cz448dj4x8xo |

|

Barclays suspends festival funding after protestsThere had been protests over the bank’s links to Download, Latitude and the Isle of Wight festivals. Read more at: https://www.bbc.com/news/articles/crgg13nn0kgo |

|

Boeing plane investigated after ‘Dutch roll’Air regulators are investigating new issues with Boeing planes. Read more at: https://www.bbc.com/news/articles/c722j0rryrxo |

|

S&P Ratings places 6 Tata group companies on ‘CreditWatch Positive’The review is reportedly done to review whether the potential of support for the group entities from Tata Sons is greater than what the ratings agency had previously thought of. This is due to increasing operational and management linkages within the group. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sp-ratings-places-6-tata-group-companies-on-creditwatch-positive/articleshow/111002396.cms |

|

Infosys to announce Q1 results on July 18Infosys will flag off the first quarter earnings for FY25. It expects its constant currency revenue growth for FY25 to be around 1-3%. The operating margins are predicted to be anywhere between 20-22% in the current fiscal. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/infosys-to-announce-q1-results-on-july-18/articleshow/111003297.cms |

|

Can ChatGPT beat humans in picking stocks? Study says ‘Yes’A study by scholars from the University of Chicago found that ChatGPT can outperform human analysts in predicting stock earnings, as reported by The Financial Times. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-chatgpt-beat-humans-in-picking-stocks-study-says-yes/articleshow/110987460.cms |

|

These sectors have fallen enough to start looking attractive, chart watcher saysThe sharp selloffs some sectors have been seeing relative to the broader market could be a sign of underlying weakness, but Janney analyst Dan Wantrobski says they are actually presenting near-term buying opportunities. Read more at: https://www.marketwatch.com/story/these-sectors-have-fallen-enough-to-start-looking-attractive-chart-watcher-says-410aeed2?mod=mw_rss_topstories |

|

Treasury yields see biggest two- and three-week declines since December as bonds keep rallyingTreasury yields finished lower for a fourth straight session on Friday, touching the lowest levels in more than two months, after softer-than-expected U.S. inflation readings for May boosted expectations for a Federal Reserve interest-rate cut as soon as September. Read more at: https://www.marketwatch.com/story/treasury-yields-continue-to-fall-on-rate-cut-hopes-a4fee3a1?mod=mw_rss_topstories |

|

This underrated Hasbro business is gaining traction amid weaker toy demand, analysts sayBofA analysts said Wall Street hasn’t appreciated the potential of the toy maker’s digital-gaming business, which they believe could help drive a rebound for the company next year. Read more at: https://www.marketwatch.com/story/this-underrated-hasbro-business-is-gaining-traction-amid-weaker-toy-demand-analysts-say-04599815?mod=mw_rss_topstories |