Summary Of the Markets Today:

- The Dow closed down 31 points or 0.08%,

- Nasdaq closed down 0.42%,

- S&P 500 closed down 0.28%,

- Gold $2,200 up $1.70,

- WTI crude oil settled at $82 down $0.43,

- 10-year U.S. Treasury 4.232% down 0.021 points,

- USD index $104.33 down $0.150,

- Bitcoin $69,889 down $966 (1.33%), – Historic high 73,798.25

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in February 2024 improved and is up 2.6% year-over-year – but is down 1.6% year-over-year inflation-adjusted. Negative growth in durable goods is not a sign of a growing economy.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index 20-City Composite posted a year-over-year increase of 6.6% in January 2024, up from a 6.2% increase in the previous month. Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices stated:

We’ve commented on how consistent each market performed during 2023 and that continues to be the case. While there is a large disparity between leaders such as San Diego versus laggards such as with Portland, the broad market performance is tightly bunched up. This is also true of high and low tiers. The average annual gains between high and low tiers across cities tracked by the indices is just 1.1%. Low price tiered indices have outperformed high priced indices for 17 months. Homeowners most likely saw healthy gains in the last year, no matter what city you were in, or if it was in an expensive or inexpensive neighborhood. No matter which way you slice it, the index performance closely resembled the broad market.

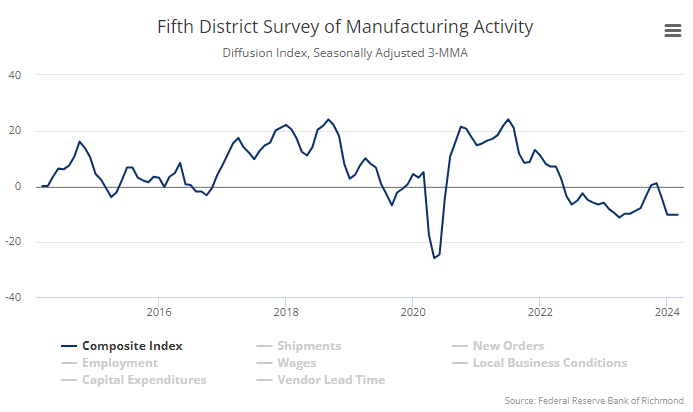

The Richmond Fed manufacturing activity slowed in March 2024. The composite manufacturing index decreased from −5 in February to −11. Of its three component indexes, shipments remained solidly negative at −14, new orders fell from −5 to −17, and employment fell from 7 to 0. Manufacturing remains in a recession in the U.S.

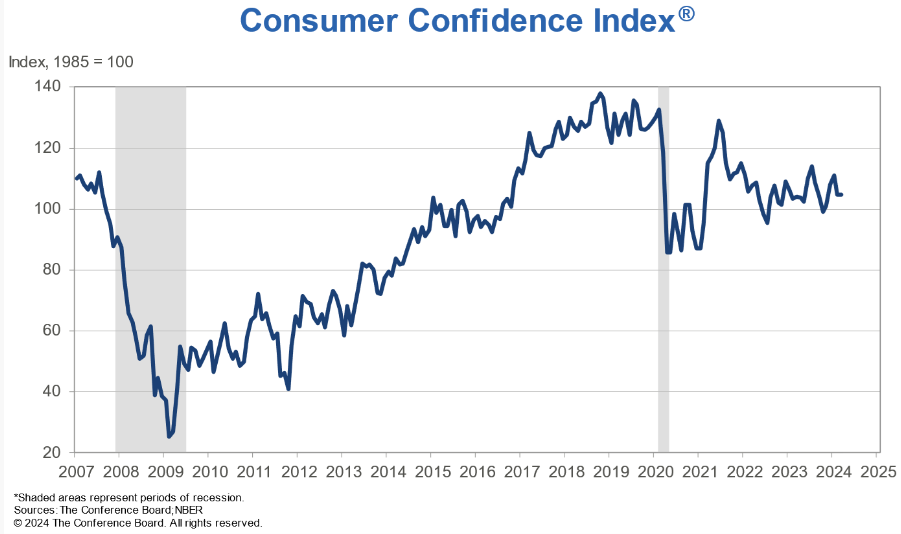

The Conference Board Consumer Confidence Index® was 104.7 (1985=100) in March, essentially unchanged from a downwardly revised 104.8 in February. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumers’ assessment of the present situation improved in March, but they also became more pessimistic about the future. Confidence rose among consumers aged 55 and over but deteriorated for those under 55. Separately, consumers in the $50,000-$99,999 income group reported lower confidence in March, while confidence improved slightly in all other income groups. However, over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.

Here is a summary of headlines we are reading today:

- South Africa Won’t Ditch Coal Anytime Soon

- OPEC: Oil Industry Needs $11 Trillion in Upstream Investment by 2045

- Subsidy Investigation Sent China’s EV Exports to the EU Plunging by 20%

- Bullish Sentiment Brings $90 Oil Within Reach

- Logistics companies scramble after bridge collapse closes Port of Baltimore until further notice

- S&P 500 closes lower for a third straight session as market rally cools: Live updates

- Stocks trade near records, but chances are your portfolio isn’t sufficiently protected from a fall

- Bitcoin maintains $70,000, and KuCoin charged with anti-money laundering violations: CNBC Crypto World

- Tesla Cooperates With CATL On Faster-Charging Battery Technology

- Donald Trump media firm soars in stock market debut

- Treasury yields hold steady as traders eye February inflation data at end of week

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Can We Find a Balance Between Economic Growth with Environmental Sustainability?The perils that threaten the continuity of human civilization are so obvious that it is puzzling that so little is being done to counter these perils. In fact, much is being done to hasten their arrival. Climate change, nuclear war, toxic pollution leading to complete loss of human fertility, solar storms and electromagnetic pulse weapons that could take down the entire electric grid, designer viruses against which none of us have defenses, and energy and resource depletion are just some of the extinction-level risks that we face. Now, none of… Read more at: https://oilprice.com/Energy/Energy-General/Can-We-Find-a-Balance-Between-Economic-Growth-with-Environmental-Sustainability.html |

|

Russia’s Offline Oil Refining Capacity Reaches 14%The amount of Russian oil refining capacity that has been taken offline due to Ukrainian drone strikes is 14% of Russia’s total refining capacity, according to Reuters calculations. Calculations show that 900,000 barrels per day of refining capacity has been taken offline by drone strikes, Reuters said on Tuesday. This includes Lukoil’s Norsi and Volgograd refineries, and Rosneft’s Kuibyshev and Ryazan refineries, among others. Ukraine has stepped up its drone attacks on Russian refineries in recent weeks, which have reduced Russia’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Offline-Oil-Refining-Capacity-Reaches-14.html |

|

The Long and Winding Road to EU AccessionEarlier in March, the European Commission sent over the so-called “negotiation framework” for Ukraine and Moldova to European Union member states for approval. The 19-page-document, seen by RFE/RL, covers both countries as they so far are paired in the EU enlargement process and outlines the basic principles of European Union accession talks. One Ukrainian official described it to me as “very broad,” adding that “as of now, it causes no concerns to us as there is nothing particularly good or bad in it.” That appears to be a fair description as… Read more at: https://oilprice.com/Geopolitics/International/The-Long-and-Winding-Road-to-EU-Accession.html |

|

South Africa Won’t Ditch Coal Anytime SoonIf you’re expecting South Africa will make a quick shift away from coal-fired power in favor of green energy, prepare to be disappointed. Expecting South Africa to quickly give up on coal-fired power would be “very wrong,” South Africa’s energy minister Gwede Mantashe told Bloomberg this week. Instead, South Africa will continue to rely on coal and other fossil fuel-generated power, even as richer nations push the country towards greener forms of energy, because it is less intermittent than green energy, Mantashe said, and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Wont-Ditch-Coal-Anytime-Soon.html |

|

UK Trade Union Prepares for Showdown with Tata SteelVia Metal Miner The latest steel news and sources from the UK indicate that the Community trade union plans to ballot its members at Tata Steel for strike action. The move comes amid the company’s plans to replace two blast furnaces at the Port Talbot site with electric arc furnaces. “Community representatives from all Tata Steel UK plants have unanimously agreed to serve notice on the company should Tata confirm their intention to close Blast Furnace Number 4,” the London-headquartered union quoted its national officer for steel,… Read more at: https://oilprice.com/Energy/Energy-General/UK-Trade-Union-Prepares-for-Showdown-with-Tata-Steel.html |

|

Enbridge To Bring Permian Gas To Gulf Coast To Tap LNG DemandEnbridge is forming a joint venture to build and operate natural gas pipelines connecting gas supply from the Permian Basin to the U.S. Gulf Coast to tap into growing LNG export demand, the Canadian-based pipeline giant said on Tuesday. Enbridge has entered into a definitive agreement with WhiteWater/I Squared Capital and MPLX LP to form a joint venture that will develop, construct, own, and operate natural gas pipeline and storage assets connecting Permian gas with the Gulf Coast. Enbridge will own 19% of the joint… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Enbridge-To-Bring-Permian-Gas-To-Gulf-Coast-To-Tap-LNG-Demand.html |

|

Price Cap Shakeup? Ofgem Considers Options for a Changing Energy MarketA “more dynamic” price cap could be introduced by Ofgem based on the time of day households use its energy, it has been revealed. The energy regulator has launched a consultation on a range of options for the future of the price cap including on with a “time-of-use dependent unit rates to encourage consumer flexibility”. Ofgem is also considering introducing a targeted cap which could be based on a variety of factors such as vulnerability, and more flexible, market-based price protections such as setting a limit between… Read more at: https://oilprice.com/Energy/Energy-General/Price-Cap-Shakeup-Ofgem-Considers-Options-for-a-Changing-Energy-Market.html |

|

OPEC: Oil Industry Needs $11 Trillion in Upstream Investment by 2045The oil industry will need cumulative investments of $11.1 trillion in exploration and production by 2045 to keep pace with growing energy demand and ensure stable supply, OPEC Secretary General Haitham Al Ghais has told Emirati news agency WAM in an interview. “Allocating more investments in the oil industry will contribute to promoting the sustainability of the global energy sector, securing sufficient and reliable supplies for the world as a whole, and ensuring secure supplies for future generations,” OPEC’s chief… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Oil-Industry-Needs-11-Trillion-in-Upstream-Investment-by-2045.html |

|

Goehring and Rozencwajg: EVs May Never Achieve Widespread Adoption“Electric vehicles (EVs) are pilling up on lots across the country as the green revolution hits a speed bump, data show.”~ USA Today, November 14, 2023 “Hertz Global Holdings announced Thursday it planned to cut one-third of its global EV fleet over the year. Following the announcement, Hertz CEO Stephen Scherr suggested the road to electrification could be bumpier than anticipated.”~ Bloomberg, January 11, 2024 Starting mid-point last decade, the investment community became convinced EV adoption would quickly surge. EV… Read more at: https://oilprice.com/Energy/Energy-General/Goehring-and-Rozencwajg-EVs-May-Never-Achieve-Widespread-Adoption.html |

|

Subsidy Investigation Sent China’s EV Exports to the EU Plunging by 20%Chinese EV exports to the European Union slumped by 19.6% in January and February 2024 compared to the same period last year as the EU continues its investigation into whether China’s subsidies are giving its auto manufacturers an unfair advantage over other EV makers. In the first two months of 2024, China exported around 75,600 EVs to the EU, according to official Chinese customs data reported by Bloomberg on Tuesday. In October, the EU launched anti-subsidy investigations into EU imports of battery electric vehicles… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Subsidy-Investigation-Sent-Chinas-EV-Exports-to-the-EU-Plunging-by-20.html |

|

Investors Brace for Impact as Crude Markets React to Rising War RisksA twin crisis is unfolding for the administration as the Ukrainian military bombs key crude refineries deep within Russian territory with suicide drones. The administration has pleaded with the Ukranians to halt strikes on Russian energy infrastructure as this will only contribute to tightening global supplies and push energy prices higher, as well as inflation in the US, hurting Biden’s re-election odds. Now for the other crisis that’s unfolding in the Middle East: US Vice President Kamala Harris told ABC’s “This Week” that a major attack… Read more at: https://oilprice.com/Energy/Crude-Oil/Investors-Brace-for-Impact-as-Crude-Markets-React-to-Rising-War-Risks.html |

|

The U.S. and EU Are at Odds Over Fossil Fuel FundingThe United States and the European Union are at odds over how far a ban on fossil fuel loans and guarantees would extend and haven’t reached an agreement at the latest round of talks within the OECD organization of the most developed nations, sources with knowledge of the discussions have told the Financial Times. OECD members, which include the U.S., the EU, Canada, the UK, Japan, and South Korea, among others, have recently held a round of talks in Paris, without reaching any compromise about the extent to ban export credit agencies… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-and-EU-Are-at-Odds-Over-Fossil-Fuel-Funding.html |

|

Bullish Sentiment Brings $90 Oil Within ReachIn what feels like an increasingly bullish oil market, $90 Brent is now a real possibility. While demand uncertainty persists, geopolitical risk, a weakening U.S. dollar, and OPEC+ supply cuts have moved prices higher.- Long positions held by hedge funds and other money managers have seen the strongest influx of bullish interest since September 2023, indicating the market believes geopolitical pressures will keep on pushing oil prices higher.- Net long positions held in Nymex WTI rose by 50 million barrels in the week ending March 19, whilst ICE… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Brings-90-Oil-Within-Reach.html |

|

Russia Sells Shell Stake in Sakhalin LNG Project to Gazprom for $1 BillionThe Russian government has decided to sell Shell’s minority stake in the Sakhalin LNG project to state-controlled giant Gazprom for $1 billion, reversing a previous decision to have LNG producer and exporter Novatek have the stake which Shell abandoned after the invasion of Ukraine. In 2022, a decree from Vladimir Putin stipulated that a newly set up state Russian company would take over the rights and obligations of Sakhalin Energy Investment Co., the joint venture running the Sakhalin-2 oil and gas project. Shell and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Sells-Shell-Stake-in-Sakhalin-LNG-Project-to-Gazprom-for-1-Billion.html |

|

India Pauses Venezuela Oil Purchases Fearing U.S. Sanctions ReturnIndian state and private refiners have suspended purchases of crude from Venezuela as the U.S. sanctions waiver on Venezuela’s oil exports expires on April 18 and could lead to complications if not renewed, sources familiar with the purchases have told Bloomberg. Private refiner Reliance Industries, which is India’s largest buyer of Venezuelan crude grade Merey, looks to avoid complications with cargoes if the U.S. were to re-impose the sanctions that were temporarily lifted for six months in the middle of October 2023. As the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Pauses-Venezuela-Oil-Purchases-Fearing-US-Sanctions-Return.html |

|

Logistics companies scramble after bridge collapse closes Port of Baltimore until further noticeBaltimore’s Francis Scott Key Bridge collapsed after the 10,000 container-capacity vessel Dali collided with a bridge pillar. Rescue efforts are underway. Read more at: https://www.cnbc.com/2024/03/26/logistics-companies-scramble-after-bridge-collapse-closes-port-of-baltimore.html |

|

Cocoa prices are soaring to record levels. What it means for consumers and why ‘the worst is still yet to come’Cocoa has more than tripled in cost over the past year and is up 129% in 2024. Read more at: https://www.cnbc.com/2024/03/26/cocoa-prices-are-soaring-to-record-levels-what-it-means-for-consumers.html |

|

S&P 500 closes lower for a third straight session as market rally cools: Live updatesThe S&P 500 slid for a third day on Tuesday. Read more at: https://www.cnbc.com/2024/03/25/stock-market-today-live-updates.html |

|

Reddit investors shrug off hold rating, bid up stock another 15% as post-IPO rally continuesReddit’s post-IPO rally continues, despite the company receiving a hold rating from a prominent analyst. Read more at: https://www.cnbc.com/2024/03/26/reddit-stock-jumps-15percent-as-post-ipo-rally-continues.html |

|

Stocks trade near records, but chances are your portfolio isn’t sufficiently protected from a fallDiversification is an uncomfortable – but necessary – topic for investors, even with stocks near highs. Read more at: https://www.cnbc.com/2024/03/26/stocks-trade-near-records-but-chances-are-your-portfolio-isnt-sufficiently-protected-from-a-fall.html |

|

Trump Media stock jumps as much as 50% after DJT ticker debutDonald Trump last used the DJT stock ticker for a casino and hotel operator. He is hoping his social media company does better than the last firm did. Read more at: https://www.cnbc.com/2024/03/26/trump-media-stock-ticker-djt-debuts-after-dwac-merger.html |

|

Apple announces its big annual conference, where it could reveal its AI strategyApple typically reveals the latest versions of its iPhone, iPad, Mac and Apple TV software at WWDC via a “keynote” video on the first day, led by CEO Tim Cook. Read more at: https://www.cnbc.com/2024/03/26/apple-announces-wwdc-2024-ai-announcements-expected.html |

|

Bitcoin maintains $70,000, and KuCoin charged with anti-money laundering violations: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Paul Brody, global blockchain leader for EY, discusses the recent resurgence of crypto adoption and what to expect from Ethereum in the near future. Read more at: https://www.cnbc.com/video/2024/03/26/bitcoin-maintains-70000-kucoin-charged-anti-money-laundering-violations-cnbc-crypto-world.html |

|

Trump hit with gag order in New York hush money case after slamming judgeJudge Juan Merchan imposed a limited gag order on Donald Trump in his criminal hush money case in New York. Read more at: https://www.cnbc.com/2024/03/26/trump-hit-with-gag-order-in-new-york-hush-money-case-after-slamming-judge.html |

|

SEC settles insider trading charges against Andy Bechtolsheim, co-founder of Arista, Sun MicrosystemsAndy Bechtolsheim, the co-founder of Sun Microsystems and Arista Networks, reached a settlement with the SEC on insider trading charges. Read more at: https://www.cnbc.com/2024/03/26/sec-charges-arista-co-founder-andy-bechtolsheim-with-insider-trading.html |

|

Trump is selling $60 Bibles with ‘God Bless the U.S.A.’ singer Lee GreenwoodThe Donald Trump and Lee Greenwood partnership comes as the GOP presidential nominee has seen his net worth explode by billions of dollars on paper. Read more at: https://www.cnbc.com/2024/03/26/trump-selling-60-god-bless-the-usa-bibles-with-lee-greenwood.html |

|

McDonald’s to sell Krispy Kreme nationwide; doughnut maker’s shares jumpKrispy Kreme will more than double its distribution to reach McDonald’s restaurants nationwide. Read more at: https://www.cnbc.com/2024/03/26/mcdonalds-to-sell-krispy-kreme-doughnuts-nationwide-by-end-of-2026.html |

|

Canada Goose to cut 17% of its corporate workforce, following string of retail layoffsCanada Goose said Tuesday that it will cut about 17% of its corporate workforce as consumers continue to pull back on discretionary spending. Read more at: https://www.cnbc.com/2024/03/26/canada-goose-to-cut-17percent-of-its-corporate-workforce.html |

|

The Canaries In America’s Coal MineAuthored by J.Peder Zane via RealClearPolitics.com, Joe Biden vs. Donald Trump is not the race America needs, but it is the one we deserve.

A political system that has spit out a race few voters want is the perfect symbol of a nation – and a people – bent to the point of breaking. Biden vs. Trump appears to be a welcome diversion in a country whose government seems unequipped to face its biggest challenges and whose people are increasingly unwilling to take responsibility for their own problems. Eight months arguing about two angry old men – hearing our own side praise us to the hilt while blaming every woe on the other – is time we don’t have to spe … Read more at: https://www.zerohedge.com/political/canaries-americas-coal-mine |

|

A “Black Swan Event” – General Flynn Raises Questions About Baltimore Bridge CollapseHere’s a live broadcast of the disaster area in Baltimore, Maryland. Update (1508ET): “Can we take the idea that this [Baltimore bridge collapse] was a terrorist attack off the table … and absolutely we cannot do that,” President Trump’s former national security adviser (and retired lieutenant general) Michael Flynn told Alex Jones in an online interview. Flynn called the container ship ramming the 1.6-mile-long bridge mile bridge at the Port of Baltimore a “black swan” event.

Meanwhile, the White House and federal government agencies have been quick to declare this was not a terror attack. * * * Update (1423ET): Maritime job placement company Read more at: https://www.zerohedge.com/markets/watch-huge-bridge-baltimore-collapses-after-container-ship-strike |

|

‘Haven For Illicit Money-Laundering’ – DoJ Charges Crypto Exchange KuCoin Over Billions In Criminal FundsUnited States Justice Department (DoJ) officials unsealed an indictment against cryptocurrency exchange KuCoin and two of its founders for “conspiring to operate an unlicensed money transmitting business” and violations of the Bank Secrecy Act.

As CoinDesk reports, the DoJ said in an indictment that KuCoin and founders Chun Gan and Ke Tang operated KuCoin as a money-transmitting business with over 30 million customers but did not implement a know-your-customer (KYC) or AML program until 2023 – and even then, its KYC program did not apply to existing customers. Neither Gan nor Tang were arrested, the DOJ said in a press release. Read more at: https://www.zerohedge.com/crypto/haven-illicit-money-laundering-doj-charges-crypto-exchange-kucoin-over-billions-criminal |

|

Tesla Cooperates With CATL On Faster-Charging Battery TechnologyAuthored by Charles Kennedy via OilPrice.com, Tesla and battery manufacturer CATL are working together on the development of new battery technologies that could lead to faster-charging electric vehicle batteries, the founder of the Chinese battery manufacturer, the world’s biggest, told Bloomberg in an interview published on Monday.

Contemporary Amperex Technology Co. Ltd., as CATL is officially known, has a large supply deal with the U.S. EV manufacturer, and is also a battery supplier to big automakers including BMW and the Mercedes-Benz Group AG. Amid the U.S.-China trade and technology spats and U.S. restrictions on Chinese technology used in America-made products, CATL is effectively banned from s … Read more at: https://www.zerohedge.com/technology/tesla-cooperates-catl-faster-charging-battery-technology |

|

British Gas chief’s pay package jumps to £8.2mCentrica chief executive Chris O’Shea gets £4m more in 2023, up from £4.5m the year before. Read more at: https://www.bbc.co.uk/news/business-68669446 |

|

Donald Trump media firm soars in stock market debutThe long awaited moment hands the former president a stake worth more than $5bn. Read more at: https://www.bbc.co.uk/news/business-68667664 |

|

Papa Johns pizza to shut nearly a tenth of UK sitesThe chain has confirmed it will shut 43 of its 450 restaurants by the middle of May. Read more at: https://www.bbc.co.uk/news/business-68663844 |

|

Companies flock to public markets as IPO fundraising jumps 19% to nearly Rs 62,000 cr in FY24While FY24 saw firms from varied sectors tapping the IPO market, BFSI had a limited presence, with just Rs 9,655 crore being raised by companies from this sector. This accounts for about 18% of the total IPO fundraising, compared with 51% in FY23. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/companies-flock-to-public-markets-as-ipo-fundraising-jumps-19-to-nearly-rs-62000-cr-in-fy24/articleshow/108792828.cms |

|

NSE Rejig: $94 million cumulative passive inflows seen in NTPC, 2 other PSU stocks, says NuvamaNTPC’s weight on the Nifty CPSE is expected to go up 20% versus the current weight of 17.9%. As for NHPC and NLC, the new weights post the readjustment will likely be 4.6% and 1.2%, respectively, versus 4.2% and 0.9%, now. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-rejig-94-million-cumulative-passive-inflows-seen-in-ntpc-2-other-psu-stocks-says-nuvama/articleshow/108789141.cms |

|

Nuvama bullish on SMIDs, lists top 6 midcap stock picks“The current scenario has reached an oversold condition at key support levels and we recommend taking long positions. The broader market, which was overheated, has seen a healthy decline and it appears that the price correction phase is over and will likely lead to a bottoming and a resumption of the bull phase,” it added. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nuvama-bullish-on-smids-lists-top-6-midcap-stock-picks/slideshow/108790047.cms |

|

Trump merges MAGA and Wall Street with ‘super-charged meme stock’For a business with little revenue and a relatively small audience, Donald Trump’s social-media company is proving to be one of the biggest things on Wall Street on its first day of trading. Read more at: https://www.marketwatch.com/story/trump-merges-maga-and-wall-street-with-super-charged-meme-stock-90e9ff6e?mod=mw_rss_topstories |

|

Commercial real estate is itching for a rebound two years after start of Fed rate hikesDemand for office leases is picking up, but interest rates are still a wild card. Read more at: https://www.marketwatch.com/story/commercial-real-estate-is-itching-for-a-rebound-two-years-after-start-of-fed-rate-hikes-5b13253d?mod=mw_rss_topstories |

|

Treasury yields hold steady as traders eye February inflation data at end of weekYields on U.S. government debt finished little changed on Tuesday in cautious trading, as investors looked ahead to February’s PCE inflation data at the end of the week. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-as-traders-eye-critical-inflation-data-at-end-of-week-a9313f5b?mod=mw_rss_topstories |