Summary Of the Markets Today:

- The Dow closed up 269 points or 0.68%,

- Nasdaq closed up 0.20%,

- S&P 500 closed up 0.32%,

- Gold $2192 up $21.80,

- WTI crude oil settled at $81 down $0.24,

- 10-year U.S. Treasury 4.271% down 0.001 points,

- USD index $104.04 up $0.20,

- Bitcoin $65,220 down $2,633

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Philly Fed Manufacturing Business Outlook Survey edged down 2 points to 3.2 in March 2024. This is only the index’s fifth positive reading since May 2022. Nearly 24 percent of the firms reported increases in general activity this month, while 21 percent reported decreases; 52 percent reported no change. The index for new orders turned positive for the first time since October, rising from -5.2 in February to 5.4 in March. Historically, this index is an outlier versus other regional fed surveys in that its results are usually higher. I continue to state that manufacturing in the US remains in a recession.

In the week ending March 16, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 211,250, an increase of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 208,000 to 208,750.

Total existing-home sales slid 3.3% year-over-year. The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). NAR Chief Economist Lawrence Yun stated:

Additional housing supply is helping to satisfy market demand. Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.

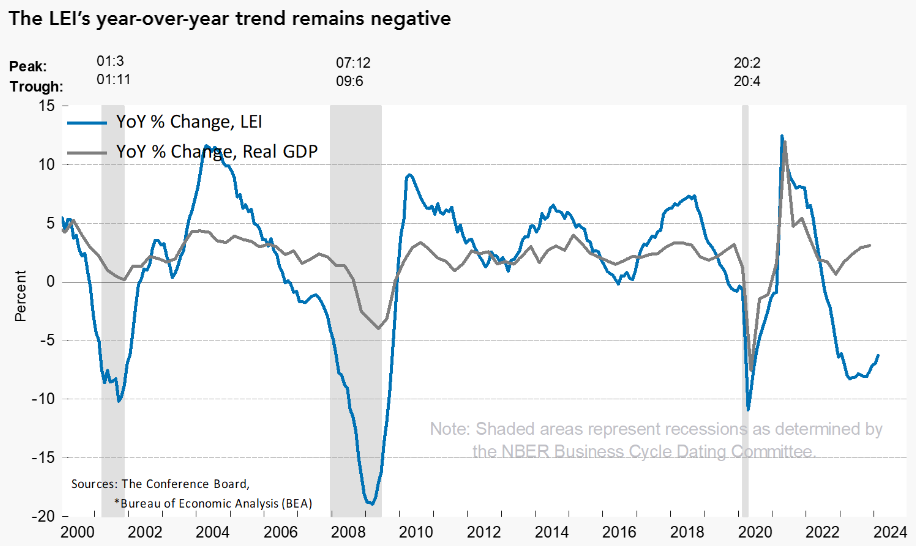

The Conference Board Leading Economic Index® (LEI) for the U.S. increased by 0.1 percent in February 2024 to 102.8 (2016=100), following a 0.4 percent decline in January. At least the Conference Board is no longer forecasting a recession. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The U.S. LEI rose in February 2024 for the first time since February 2022. Strength in weekly hours worked in manufacturing, stock prices, the Leading Credit Index™, and residential construction drove the LEI’s first monthly increase in two years. However, consumers’ expectations and the ISM® Index of New Orders have yet to recover, and the six- and twelve-month growth rates of the LEI remain negative. Despite February’s increase, the Index still suggests some headwinds to growth going forward. The Conference Board expects annualized US GDP growth to slow over the Q2 to Q3 2024 period, as rising consumer debt and elevated interest rates weigh on consumer spending.

Here is a summary of headlines we are reading today:

- Tokyo Tech Scientists Crack Hydrogen Storage Conundrum

- Taxpayer Money Funds EV Infrastructure Push Despite Slow Adoption

- Restored Import Tax Hits Russian Coal Sales to China

- EPA’s New Car Emission Standards Doom the Gasoline Car

- IEA Chief: No Chance of Hitting Climate Goals Without Nuclear Power

- European Power Giant Bets on U.S. Despite Possible Trump Presidency

- Republican Lawmakers Blame IEA for Straying From Energy Security Mission

- Auto prices are cooling, but ‘we’re never going back to the old normal,’ expert says. Here’s what car shoppers can expect

- “Freedom Bonds”: US Wants $50BN Bond For Ukraine Backed By Frozen Russian Assets

- Stock market’s post-Fed rally hides some worry about officials’ commitment to 2% inflation

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Tokyo Tech Scientists Crack Hydrogen Storage ConundrumTokyo Institute of Technology scientists have reported hydrogen stored in hydrogen boride sheets can be efficiently released electrochemically. Through a series of experiments, they demonstrated that dispersing these sheets in an organic solvent and applying a small voltage is enough to release all the stored hydrogen efficiently. The results suggest hydrogen boride sheets could soon become a safe and convenient way to store and transport hydrogen, which is a cleaner and more sustainable fuel. The research paper, published in the journal Small,… Read more at: https://oilprice.com/Energy/Energy-General/Tokyo-Tech-Scientists-Crack-Hydrogen-Storage-Conundrum.html |

|

US Senators Look to Strengthen Ban on Selling Off Oil Stockpiles to ChinaU.S. senators introduced a bill on Thursday designed to expand the ban on selling off the nation’s oil held in the Strategic Petroleum Reserves to China. U.S. President Joe Biden signed a funding bill earlier this month that blocked Chinese companies from purchasing U.S. crude oil held in the nation’s SPR, but the bill still allowed oil sales to Chinese companies, provided the oil wasn’t actually being exported to China. A next-level bill was introduced on Thursday that would expand the earlier funding bill to include all Chinese companies—whether… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Senators-Look-to-Strengthen-Ban-on-Selling-Off-Oil-Stockpiles-to-China.html |

|

China’s Stimulus Snub Sinks Metals MarketsVia Metal Miner Investors, traders, and the metals community continue to anticipate fresh stimulus measures from China’s top leaders, which could potentially kickstart economic growth, increase metals consumption, and affect metal prices. However, they remain rather disappointed with Beijing’s target 5% growth for 2024. Moreover, demand has remained subdued since the Lunar New Year holiday. Almost everyone was awaiting the annual, week-long session of China’s parliament, which ended on March 11, 2024, as well as the decisions… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Stimulus-Snub-Sinks-Metals-Markets.html |

|

Taxpayer Money Funds EV Infrastructure Push Despite Slow AdoptionIt will take a mighty big change of fortune for the electric vehicle (EV) industry to meet Illinois’ goal of one million EVs on the road in Illinois by 2030. Gov. JB Pritzker repeated that target last week, but trends are pointing somewhere else. The hard numbers are EV registrations in Illinois, published by the Illinois Secretary of State. For the most recent 12-month period, Illinois added just 32,478 vehicles to its EV registration rolls. That’s 8,120 per quarter. But to reach the target of one million by 2030, that number would… Read more at: https://oilprice.com/Energy/Energy-General/Taxpayer-Money-Funds-EV-Infrastructure-Push-Despite-Slow-Adoption.html |

|

Restored Import Tax Hits Russian Coal Sales to ChinaRussia’s coal sales to China plunged by 22% in January and February compared to the same months last year after China re-imposed an import tax, which makes Russian coal more expensive. The reintroduced import tax on coal doesn’t affect either Australia or Indonesia, two major coal exporters and direct competitors of Russia, because they have free trade agreements with China. Despite the jump in total Chinese coal imports in the first two months of 2024, Russian sales plunged, according to official customs data from China cited by Bloomberg.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Restored-Import-Tax-Hits-Russian-Coal-Sales-to-China.html |

|

EPA’s New Car Emission Standards Doom the Gasoline CarThis week, the Environmental Protection Agency announced the finalization of new tailpipe emission standards. The agency boasted that these were the strictest standards ever, adding that they would save money, create jobs, and eliminate billions of tons of CO2 emissions. The American Petroleum Institute, along with the American Fuel & Petrochemical Manufacturers, issued an immediate reaction, warning that the new standards would make all gasoline and diesel-powered light vehicles illegal in less than 10 years. And that will not… Read more at: https://oilprice.com/Energy/Energy-General/EPAs-New-Car-Emission-Standards-Doom-the-Gasoline-Car.html |

|

U.S. Plan for Central Asian Integration Gets Thumbs Up From Key PlayersA US-led effort to help Central Asian states reshape the region’s business landscape is achieving some of its initial objectives, putting the initiative on a more solid foundation for potential success. Key Central Asian governments are reacting favorably to the plan. Heading into the inaugural meeting of what is called the B5+1 process, a primary aim was to institutionalize an annual gathering bringing together private and public sector leaders from all five Central Asian states for discussions aimed at breaking down trade barriers that… Read more at: https://oilprice.com/Geopolitics/International/US-Plan-for-Central-Asian-Integration-Gets-Thumbs-Up-From-Key-Players.html |

|

ING Sees Oil Prices Rising Further on Supply RiskOil markets will continue to tighten in the second and third quarters amid growing supply risks including the rollover of voluntary supply cuts from OPEC+ into Q2 2024, Ukraine’s recent attacks on Russia’s refineries as well as constant disruptions to oil flows through the Red Sea, ING Global Market Research has predicted. ING Global has hiked its oil price forecast from US$80/bbl to US$87/bbl for the second quarter and from US$82/bbl to US$88/bbl for the third quarter. Several other analysts share a similar sentiment. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/ING-Sees-Oil-Prices-Rising-Further-on-Supply-Risk.html |

|

Why Do we Still Have Investor-Owned Utilities?The electricity and water utility industries are mirror images in a way. Government agencies service roughly 85% of water consumers and investor-owned companies the rest. Investor-owned utilities serve roughly 85% of the electricity market and government agencies serve the balance. Government agencies provide both essential commodities at a lower cost in both markets. This is not because they are operationally more efficient but for two other reasons: very low tax rates and significantly lower capital costs. Regarding capital costs, financial theory… Read more at: https://oilprice.com/Energy/Energy-General/Why-Do-we-Still-Have-Investor-Owned-Utilities.html |

|

IEA Chief: No Chance of Hitting Climate Goals Without Nuclear PowerThe world will need nuclear power generation to reach its emission reduction and net-zero targets, according to Fatih Birol, the executive director of the International Energy Agency (IEA). “Without the support of nuclear power, we have no chance to reach our climate targets on time,” Birol said ahead of a nuclear energy summit in Brussels on Thursday, as carried by Reuters. “Renewables will play a major role in terms of electricity, especially solar, supported by wind and hydro power,” the head of the Paris-based agency… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Chief-No-Chance-of-Hitting-Climate-Goals-Without-Nuclear-Power.html |

|

Kremlin Claims Western Powers Are Attempting to Undermine Its Trade With ChinaThe United States and the EU continue to exert “unprecedented pressure” on China to reject trade payments from Russia, Kremlin spokesman Dmitry Peskov said on Thursday. China and Russia have forged closer trade ties in recent years, especially in oil trade, after the West banned imports of Russian crude and fuels, and imposed a price cap on Russia’s petroleum products if they use Western transportation, insurance, and financing. “Of course, unprecedented pressure from the United States and the European Union… Read more at: https://oilprice.com/Energy/Energy-General/Kremlin-Claims-Western-Powers-Are-Attempting-to-Undermine-Its-Trade-With-China.html |

|

European Power Giant Bets on U.S. Despite Possible Trump PresidencySpanish utility giant Iberdrola will focus the largest part of its multi-billion investments for 2024-2026 on the United States as its capex plans don’t hinge on the Inflation Reduction Act and a possible repeal of the IRA by a second Trump presidency, Iberdrola’s executive chairman Ignacio Galán told the Financial Times in an interview on Thursday. Iberdrola said today it would invest $44.7 billion (41 billion euros) and hire 10,000 people by 2026 to accelerate electrification in its key markets. A… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Power-Giant-Bets-on-US-Despite-Possible-Trump-Presidency.html |

|

Trouble in the North Sea? Wood Group Announces Job CutsUK oil major Wood Group is set to cut hundreds of jobs as it prepares to release its 2023 annual results, reports suggest. According to Sky News, the London-listed oil major is eyeing up the axeing of 200 positions from its 36,000-strong employee base. The firm employs roughly 6,500 in the UK, the majority of whom are based in Aberdeen. The news comes nearly a year after a rumoured £1.7bn takeover by private equity giant Apollo Management was culled, with the investment group saying that it would make no further offers. The news wiped 35… Read more at: https://oilprice.com/Energy/Crude-Oil/Trouble-in-the-North-Sea-Wood-Group-Announces-Job-Cuts.html |

|

China’s CNOOC Saw Profits Plunge in 2023 Due to Lower Oil PricesChina’s state-held oil and gas giant CNOOC said on Thursday that its net profit for 2023 slipped by 12.6% from a record-high level in 2022, due to the decline in international oil prices. CNOOC, which specializes in offshore oil and gas developments in China and internationally, reported a net profit attributable to shareholders of the company of $17.2 billion (123.8 billion Chinese yuan) for 2023, down from the all-time high of $19.7 billion (141.7 billion yuan) booked for 2022, when oil prices exceeded $100 per barrel after… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-CNOOC-Saw-Profits-Plunge-in-2023-Due-to-Lower-Oil-Prices.html |

|

Republican Lawmakers Blame IEA for Straying From Energy Security MissionCongress leaders from the Republican Party have sent a letter to Fatih Birol, the executive director of the International Energy Agency, expressing concern that the IEA has strayed from its core mission of promoting energy security. Senate Energy and Natural Resources Committee ranking member John Barrasso (Wyo) and House Energy and Commerce Committee Chair Cathy McMorris Rodgers (Wash) wrote in the letter that the agency has been undermining energy security by discouraging enough investment in oil, natural gas, and coal. “Until… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Republican-Lawmakers-Blame-IEA-for-Straying-From-Energy-Security-Mission.html |

|

Reddit pops 48% in NYSE debut after selling shares at top of rangeReddit entered the public market on Thursday, betting that a wider swath of investors will buy into the 19-year-old social media company. Read more at: https://www.cnbc.com/2024/03/21/reddit-ipo-rddt-starts-trading-on-nyse.html |

|

DOJ sues Apple over iPhone monopoly in landmark antitrust caseApple and its iPhone and App Store business have been eyed by the Department of Justice, which previously filed antitrust suits against Google. Read more at: https://www.cnbc.com/2024/03/21/doj-sues-apple-over-iphone-monopoly.html |

|

ESPN’s model is eroding. Past and present execs are split on how it can protect its dominanceCNBC spoke with ESPN chief Jimmy Pitaro, former Disney CEO Bob Chapek, and former ESPN President John Skipper as part of a digital documentary on ESPN’s future. Read more at: https://www.cnbc.com/2024/03/21/espn-executives-talk-streaming-plans-in-cnbc-documentary.html |

|

Dow closes more than 250 points higher as major averages surge to fresh records: Live updatesStocks climbed Thursday and technology shares outperformed as the major averages built on new record highs. Read more at: https://www.cnbc.com/2024/03/20/stock-market-today-live-updates.html |

|

Retail traders are bailing on 3 of the hottest AI plays in the stock market todayThe everyday investor appeared to take profit on some of these rallying names. Read more at: https://www.cnbc.com/2024/03/21/retail-traders-are-bailing-on-3-of-the-hottest-ai-plays-in-the-market-today.html |

|

February home sales spike 9.5%, the largest monthly gain in a year, as supply improvesInventory rose 5.9% year over year to 1.07 million homes for sale at the end of February. Read more at: https://www.cnbc.com/2024/03/21/february-2024-home-sales-spike.html |

|

Bitcoin rebounds to $67,000 as Fed leaves rate cuts in 2024 roadmap: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, David Mercer, CEO of LMAX Group, weighs in on what’s driving crypto markets and institutional appetite for digital assets. Read more at: https://www.cnbc.com/video/2024/03/21/bitcoin-rebounds-to-67000-fed-rate-cuts-2024-roadmap-crypto-world.html |

|

Judge orders Trump company to tell financial watchdog about efforts to get appeal bondsDonald Trump is trying to avoid paying a $454 million business fraud judgment stemming from a lawsuit by New York Attorney General Letitia James. Read more at: https://www.cnbc.com/2024/03/21/judge-orders-trump-company-to-tell-watchdog-about-appeal-bonds.html |

|

Elon Musk companies are gobbling up Nvidia hardware even as Tesla aims to build rival supercomputerWhile Elon Musk says Tesla is trying to build an AI supercomputer, his companies are spending billions of dollars on Nvidia hardware. Read more at: https://www.cnbc.com/2024/03/21/elon-musk-buying-nvidia-hardware-even-as-tesla-aims-to-build-ai-rival.html |

|

House Speaker Johnson says he will invite Israel leader Netanyahu to address Congress, slams SchumerHouse Speaker Mike Johnson blasted Senate Majority Leader Chuck Schumer for criticism of Israeli Prime Minister Benjamin Netanyahu over the Gaza war. Read more at: https://www.cnbc.com/2024/03/21/house-speaker-to-invite-israel-leader-netanyahu-to-address-congress.html |

|

Auto prices are cooling, but ‘we’re never going back to the old normal,’ expert says. Here’s what car shoppers can expectWhile car prices are beginning to come down from peak highs for both new and used cars, drivers might never again see pre-pandemic norms, experts say. Read more at: https://www.cnbc.com/2024/03/21/new-used-car-prices-are-cooling-heres-what-auto-shoppers-can-expect.html |

|

Landmark $418 million settlement could slash homebuying costs by tens of thousands of dollars—here’s how it worksHome transaction costs could decrease by as much as 2% based on a recent change in how commission fees are charged. Read more at: https://www.cnbc.com/2024/03/21/landmark-settlement-could-slash-homebuying-costs.html |

|

U.S. energy secretary tells skeptical executives natural gas export pause will be short-livedOil and gas executives strongly pushed back against the U.S. pause on new LNG exports during the CERAWeek energy conference in Houston. Read more at: https://www.cnbc.com/2024/03/21/us-energy-secretary-tells-skeptical-executives-natural-gas-export-pause-will-be-short-lived.html |

|

“Freedom Bonds”: US Wants $50BN Bond For Ukraine Backed By Frozen Russian AssetsLeery of outright seizing all of the some $280 billion in Russian central bank assets mostly held in Europe, the Group of Seven’s alternative ‘Plan B’ is quickly taking shape. There’s been greater consensus of support for instead using the windfall profits gained from reinvesting Russian assets frozen in Europe to support the purchase of weapons for Ukraine. Days ago the The Wall Street Journal detailed that “Two-thirds of the roughly $300 billion in reserves were sitting in European banks and clearinghouses. As those assets mature and are reinvested, they have generated profits that EU officials say could reach 15 billion euros, equivalent to more than $16 billion, over the next four years.” The blocked assets currently generate an estimated $3.6 billion of net profits per year. On Thursday the United States unveiled a new plan to allies centered on what are being dubbed “freedom bonds”. The initiative would create a special purpose vehicle to issue at least $50 billion of bonds generated by the frozen assets, Bloomberg reports. Read more at: https://www.zerohedge.com/geopolitical/freedom-bonds-us-wants-50bn-bond-ukraine-backed-frozen-russian-assets |

|

24 States Oppose Proposed Labor Department DEI Rule For ApprenticeshipsAuthored by Chase Smith via The Epoch Times, A coalition of 24 states led by Tennessee is opposing a new rule proposed by the Department of Labor (DOL) aimed at integrating diversity, equity, and inclusion (DEI) principles into the National Apprenticeship System.

Led by Tennessee Attorney General Jonathan Skrmetti, the attorneys general in a March 18 letter contend that the rule fosters racial discrimination. “The Proposed Rule deviates from the statutory purpose of safeguarding the welfare of apprentices and builds on existing regulations to further entrench an apprenticeship regime dedicated to picking winners and losers based on the color of apprentices’ skin,” the letter states. … Read more at: https://www.zerohedge.com/political/24-states-oppose-proposed-labor-department-dei-rule-apprenticeships |

|

“What Are We Doing?” Ana Kasparian Flips Out After Suspects In Murder, Dismemberment Case Released In New York‘You know it’s bad when…’ A shocking, under-reported story about the absolute state of New York’s bail reform laws has now gone viral, after left-wing journalist Ana Kasparian went on an epic rant against policies that her fellow Democrats absolutely voted for. It appears that it took New York releasing suspects in a double-murder / dismemberment case to start red-pilling the wine grannies on The View – a story which made its way to Kasparian. Earlier this month, three roomates were charged with hiding pieces of two dismembered bodies, which were hacked up with meat cleavers and then scattered around Long Island. Read more at: https://www.zerohedge.com/political/what-are-we-doing-ana-kasparian-flips-out-after-suspects-murder-dismemberment-case |

|

Has America Run Out Of Time?Authored by Michael Snyder via TheMostImportantNews.com, For those that love America, these are very trying times. We have watched our beloved country go steadily downhill for decades, and in recent years that process has greatly accelerated. Now we have reached a point where our entire culture is absolutely saturated with evil, and large media corporations make billions of dollars exporting that culture to the rest of the world. In the end, we will truly reap what we have sown. If our nation had chosen to reverse course, things could have worked out much differently. But that has not happened. Yes, there are individuals and small groups that have chosen to change direction, but the nation as a whole just continues to run the wrong direction as fast as it possibly can. In this article, I am going to share some numbers with you that are just staggering. We have been given opportunity after opportunity to choose a different direction, and we just keep making the wrong choices. At some point we will be out of opportunities. In fact, could it be possible that America has already run out of time? Read more at: https://www.zerohedge.com/personal-finance/has-america-run-out-time |

|

Bank boss says UK interest rate cut ‘on the way’The Bank of England has kept the cost of borrowing at 5.25% for the fifth time in a row. Read more at: https://www.bbc.co.uk/news/business-68618436 |

|

GMB staff to strike over sex harassment claimsEmployees claim reforms recommended by an independent lawyer-led review are yet to take place. Read more at: https://www.bbc.co.uk/news/uk-politics-68631376 |

|

‘I want the £45,000 state pension that was stolen from me’Women born in the 1950s hit by the rise in state pension age react to a report recommending compensation. Read more at: https://www.bbc.co.uk/news/business-68610680 |

|

Tech View: Nifty faces key hurdle at 20-EMA. What traders should do on FridayNifty on Thursday ended 173 points higher to test the immediate hurdle of short-term moving average i.e. 20-EMA, but it couldn’t surpass it amid weekly expiry. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-faces-key-hurdle-at-20-ema-what-traders-should-do-on-friday/articleshow/108682155.cms |

|

Best quarter in 14 years: Block trades raise $7.1 bn as Tata, BAT cash inShareholders have raised $7.1 billion selling their holdings in India so far this year, with the quarter on track to have raised the most from block trades since the January to March period in 2010, data compiled by Bloomberg show. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/indian-block-trades-are-headed-toward-best-quarter-in-14-years/articleshow/108664277.cms |

|

ETMarkets Smart Talk: Global semiconductor sector likely to reach a trillion-dollar industry by 2030: Anil RegoAnil Rego foresees the semiconductor industry becoming a trillion-dollar sector by 2030, driven by automotive, data storage, and wireless industries. He recommends focusing on high-quality stocks in banking, auto & ancillaries, and building materials segments for incremental earnings. He also says risks are currently exogenous such as global slowdown and geopolitical uncertainty.. Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-smart-talk-global-semiconductor-sector-likely-to-reach-a-trillion-dollar-industry-by-2030-anil-rego/articleshow/108649042.cms |

|

Stock market’s post-Fed rally hides some worry about officials’ commitment to 2% inflationA growing sense of worry is unfolding against the backdrop of a U.S. stock-market rally that sent all three major indexes to new heights on Thursday. Read more at: https://www.marketwatch.com/story/stock-markets-post-fed-rally-hides-some-worry-about-officials-commitment-to-2-inflation-570f2bfd?mod=mw_rss_topstories |

|

Stock market momentum and S&P 500 strength look solidVolatility is low and market signals are still flashing green. Read more at: https://www.marketwatch.com/story/stock-market-momentum-and-s-p-500-strength-look-solid-f6420c1d?mod=mw_rss_topstories |

|

2-year Treasury yield ends higher for 7th time in past 9 sessions after batch of U.S. dataTreasury yields finished little changed on Thursday, though the policy-sensitive two-year rate advanced as data showed U.S. business activity continues to rise. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-after-powell-comments-bolster-hopes-for-june-rate-cut-161b2809?mod=mw_rss_topstories |