Summary Of the Markets Today:

- The Dow closed up 401 points or 1.03%,

- Nasdaq closed up 1.25%,

- S&P 500 closed up 0.89%,

- Gold $2186 up $26.30,

- WTI crude oil settled at $82 up $1.63,

- 10-year U.S. Treasury 4.279% down 0.018 points,

- USD index $103.42 down $0.39,

- Bitcoin $65,795 up $3,889

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Federal Reserve’s FOMC meeting concluded today with no adjustment to the federal funds rate as inflation remains above their 2.o% target although the economy and employment are strong. The Fed Chair Powell additionally communicated they expect up to 3 rate cuts this year. Not sure any of this makes sense as by their admission the economy is expanding which historically is coincident with raising (not cutting) the federal funds rate. Additionally, there are no signs yet that inflationary pressures have subsided. In any event, the market took the potential of rate cuts with gusto driving the markets to historical highs. The text of the meeting statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Here is a summary of headlines we are reading today:

- Saudi Aramco To Expand Natural Gas Output Capacity by 60%

- Israel’s Gas Exports to Egypt Soar Despite Political Tensions

- Chinese Fuel Oil Imports Jumped by 21% in the First Two Months of the Year

- EPA issues new auto rules aimed at cutting carbon emissions, boosting electric vehicles and hybrids

- Israel Furious After Canada Votes To Halt Arms Exports To Tel Aviv

- Only 30% Of New Yorkers Are Happy With City’s Quality Of Life, 50% Plan On Leaving Within Five Years

- Fed Chair Powell Explains Why The Dots ‘Are Not A Forecast’, But…

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Iran Losing Its Clout in the Caucasus?An emboldened Azerbaijan, backed by Turkey, has changed the balance of power in the South Caucasus in recent years. Baku reclaimed full control over Nagorno-Karabakh, a breakaway region that for three decades had been under ethnic-Armenian control, last year. A weakened Armenia, meanwhile, has distanced itself from its traditional ally, Russia, and looked to move closer to the West. The geopolitical changes in the region have raised concerns in Iran, which neighbors Armenia and Azerbaijan. Tehran fears it could lose its clout in a region that has… Read more at: https://oilprice.com/Geopolitics/International/Is-Iran-Losing-Its-Clout-in-the-Caucasus.html |

|

Saudi Aramco To Expand Natural Gas Output Capacity by 60%After scrapping oil capacity expansion plans earlier this year, Saudi state oil giant Aramco is now poised to boost natural gas output by 60% by 2030, Reuters reports, citing an Aramco executive on the sidelines of the Houston CERAWeek energy conference. In the third quarter of last year, Saudi Arabia made two significant natural gas discoveries in two fields in the Empty Quarter, along with the discovery of five reservoirs in previously discovered fields. At the Al-Hiran field, gas flowed at a rate of 30 million cubic feet… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-To-Expand-Natural-Gas-Output-Capacity-by-60.html |

|

Indonesia Aims to Cap Nickel Prices at $18,000Via Metal Miner Nickel prices inverted to the upside in February, with an 8.71% month-over-month rise. Following a 3.53% increase during the first weeks of March, prices appeared to stagnate after they found at least a short-term peak on March 13. Overall, the Stainless Monthly Metals Index (MMI) remained sideways, with a modest 1.95% rise from February to March. Distributors Note Slight Pick-Up in Q1 The stainless market saw a significant boost in recent weeks, although distributors stopped short of referring to it as a market turnaround. Bullish… Read more at: https://oilprice.com/Metals/Commodities/Indonesia-Aims-to-Cap-Nickel-Prices-at-18000.html |

|

Suriname in Talks with Exxon, TotalEnergies For Natural Gas DevelopmentSuriname’s state-owned Staatsolie has begun early talks with ExxonMobil and French TotalEnergies for the possible joint development of natural gas fields in the Guyana-Suriname basin, Staatsolie Managing Director Annand Jagesar told Reuters on the sidelines of the Houston CERAWEeek conference. With first oil production still several years in the future following initial discoveries offshore Suriname, the country is hoping to become both a major oil producer and a regional gas hub. “We’ve been talking to Total. They don’t see an… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Suriname-in-Talks-with-Exxon-TotalEnergies-For-Natural-Gas-Development.html |

|

Israel’s Gas Exports to Egypt Soar Despite Political TensionsVia The Cradle Israel’s NewMed Energy reported on Tuesday that natural gas exports from the Leviathan field to Egypt increased by 28 percent in 2023. The company reports that the exports jumped from 4.9 billion cubic meters (BCM) in 2022 to 6.3 BCM in 2023. Israel Katz, former energy minister, approved the increase in exports to Egypt last year. For 2026, he projected an annual production increase of six BCM – about 60 percent over the current volume. “3.5 BCM of which will be directed in favor of Egypt,” the report stated. … Read more at: https://oilprice.com/Energy/Natural-Gas/Israels-Gas-Exports-to-Egypt-Soar-Despite-Political-Tensions.html |

|

The Golden Age of Miner Dividends Might Be Coming to an EndAccording to a new report, after years of bumper dividends, investors will have to get used to lower cash returns from mining giants such as BHP, Rio Tinto, Anglo American, and Glencore. Analysis from Morningstar published today said that after “many years of returning excess cash to shareholders” at the expense of expanding portfolios through mergers and acquisitions, heightened prices are now forcing a strategic rethink. Geological deposits are finite and deplete; be it precious metals such as gold and silver, energy fuel such as… Read more at: https://oilprice.com/Metals/Commodities/The-Golden-Age-of-Miner-Dividends-Might-Be-Coming-to-an-End.html |

|

Oil Falls 2% As Markets Await Fed Rate Cut SignalAfter rallying significantly earlier this week, oil prices plummeted by around 2% on Wednesday as markets awaited an interest rate policy announcement from the Federal Reserve before the closing bell. At 12:55 p.m. ET on Wednesday, Brent crude was trading down 1.68% at $85.91, while WTI, the U.S. crude benchmark, was trading down 2.17% at $81.66. Later on Wednesday, the Federal Reserve will close out its two-day meeting, with analysts widely anticipating that interest rates will be held steady. Those rates have been maintained… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Falls-2-As-Markets-Await-Fed-Rate-Cut-Signal.html |

|

Sudan Oil Exports under Force Majeure As Pipeline Ruptures in War ZoneSudan has declared force majeure on crude oil exports from landlocked neighbor South Sudan, following a major rupture in the pipeline carrying crude from South Sudan to a port in Sudan in an area with active military activity. The latest conflict in Sudan erupted in April last year, when the Rapid Support Forces (RSF), a paramilitary group, took up arms against the Sudanese army in the capital Khartoum. Sudan is the only conduit for crude oil exports out of landlocked South Sudan. South Sudan broke from Sudan in 2011 and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sudan-Oil-Exports-under-Force-Majeure-As-Pipeline-Ruptures-in-War-Zone.html |

|

Private Equity Cashes In After $30 Billion Shale Exit DealsPrivate equity firms have rewarded investors handsomely in recent months after divesting more than $30 billion worth of oil and gas assets in the U.S. shale patch in a blockbuster year for American upstream mergers and acquisitions. Buyout firms with oil and gas assets sold an estimated $30.55 billion worth of these last year, and consequently, they paid billions of dollars to the investors of their oil and gas-focused funds, The Wall Street Journal reports. As oil and gas producers, flush with cash from the 2022 record profits, started scouring… Read more at: https://oilprice.com/Energy/Energy-General/Private-Equity-Cashes-In-After-30-Billion-Shale-Exit-Deals.html |

|

Chinese Fuel Oil Imports Jumped by 21% in the First Two Months of the YearChina’s imports of fuel oil surged by 21% in January and February compared to the same months in 2023, according to data from the Chinese General Administration of Customs released on Wednesday and reported by Reuters. Fuel oil imports have been rising in the world’s top crude oil importer in recent months as the independent refiners, the so-called teapots based in the coastal province of Shandong, have ramped up the use of fuel oil as a cheaper feedstock. At the end of last year, the teapots had lower quotas to import… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Fuel-Oil-Imports-Jumped-by-21-in-the-First-Two-Months-of-the-Year.html |

|

Oil Supported By Crude, Gasoline DrawsCrude oil prices were trading lower today after the Energy Information Administration reported that U.S. crude oil inventories had shed 2 million barrels in the week to March 15, with gasoline stocks also declining. The crude oil inventory change compared with a draw of 1.5 million barrels for the previous week, which also featured a substantial inventory decline in gasoline inventories. Gasoline inventories fell by 3.3 million barrels in the week to March 15, with production averaging 9.6 barrels daily. This compared with a draw… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Supported-By-Crude-Gasoline-Draws.html |

|

Italy’s Grid Operator to Invest $18 Billion to Support the Rise of RenewablesItaly’s power grid operator Terna SpA plans a record-high five-year investment of $18 billion (16.5 billion euros) by 2028 to support and accelerate the country’s decarbonization, the company said in the details of its new industrial plan 2024-2028. Most of Terna’s capital expenditure (capex) through 2028 will go to strengthening and expanding the transmission grid and developing cross-border interconnection capacity, “to guarantee increased security, resilience and efficiency of the system enabling it to handle… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italys-Grid-Operator-to-Invest-18-Billion-to-Support-the-Rise-of-Renewables.html |

|

Why Do Gasoline Prices Rise in Spring?Gasoline prices are on the rise, climbing nearly $0.30/gallon since the beginning of the year. What you may not realize is that this price rise happens nearly every year. In fact, if we look back to 2000, the only time gasoline prices didn’t climb between January and May was in 2020 — when the COVID-19 pandemic collapsed oil prices. In the fall, the reverse happens. Nearly every year between August and December gasoline prices decline. People tend to notice this during election years, convinced that politicians are manipulating gasoline… Read more at: https://oilprice.com/Energy/Energy-General/Why-Do-Gasoline-Prices-Rise-in-Spring.html |

|

The U.S. Solar Industry Needs Government Support to Compete With Cheap ImportsU.S. solar component manufacturers need more government support and stricter enforcement of trade laws if America wants to create its own solar supply chain and cut dependence on cheap imports from China and Southeast Asia, a new report commissioned by the Solar Energy Manufacturers for America (SEMA) Coalition showed on Wednesday. While demand for solar power in the United States is soaring, the industry relies too heavily on imported goods, with serious gaps for U.S. ingots, wafers, and cells, according to the report authored by Guidehouse… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Solar-Industry-Needs-Government-Support-to-Compete-With-Cheap-Imports.html |

|

India’s Biggest Battery Factory to Start Operating by OctoberIndian battery manufacturer Good Enough Energy plans to have its biggest battery gigafactory operational in October with an initial capacity of 7 gigawatt-hours (GWh), the company’s founder Akash Kaushik told Bloomberg in an interview published on Wednesday. The initial 7-GWh capacity is set to expand to 20 GWh by 2026, Kaushik told Bloomberg on the sidelines of an event in Delhi. Good Enough Energy will invest $54 million (4.5 billion Indian rupees) in the factory in the Indian state of Jammu and Kashmir,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Biggest-Battery-Factory-to-Start-Operating-by-October.html |

|

Dow rises 400 points to record close after Fed says 3 rate cuts are on the way: Live updatesThe S&P 500 topped the 5,200 level and hit a new intraday high after the Federal Reserve held rates steady and said it would ease three times in 2024. Read more at: https://www.cnbc.com/2024/03/19/stock-market-today-live-updates.html |

|

Fed meeting recap: Everything Powell said during Wednesday’s market-moving news conferenceThe Federal Reserve stood pat on interest rates, but it’s also sticking with its forecast for three rate cuts before the year is out. Read more at: https://www.cnbc.com/2024/03/20/fed-meeting-today-live-updates-on-march-fed-rate-decision.html |

|

Reddit power users balk at chance to participate in IPO as Wall Street debut nearsReddit is inviting some users to participate in its IPO this week, but moderators told CNBC that they’re not taking the company up on its offer. Read more at: https://www.cnbc.com/2024/03/20/reddit-power-users-balk-at-chance-to-participate-in-ipo-as-debut-nears.html |

|

Bitcoin reverses higher after Fed meeting, reclaiming $65,000Bitcoin reversed higher on Wednesday as investors took a pause from the recent pullback and weighed the Federal Reserve’s latest policy decision. Read more at: https://www.cnbc.com/2024/03/20/bitcoin-btc-price-falls-as-cryptocurrencies-lose-400-billion-value.html |

|

10 growth stocks to buy from an investor who caught the big rallies in Nvidia and MicrosoftThe Harbor Capital Appreciation fund holds stocks with traits of “self reinforcing” growth. Read more at: https://www.cnbc.com/2024/03/20/how-this-long-time-holder-of-microsoft-and-nvidia-picks-growth-stocks.html |

|

Intel awarded up to $8.5 billion in CHIPS Act grants, with billions more in loans availableThe White House said on Wednesday that Intel has been awarded up to $8.5 billion as part of the CHIPS Act. Read more at: https://www.cnbc.com/2024/03/20/intel-awarded-up-to-8point5-billion-from-chips-act-with-loans-available.html |

|

Ether recovers losses after report that Ethereum Foundation faces SEC probe: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Austin Federa of Solana Foundation discusses the latest market moves and what developers are building on the platform. Read more at: https://www.cnbc.com/video/2024/03/20/ethereum-foundation-sec-probe-report-crypto-world.html |

|

Don’t trust Trump’s ‘impossible’ appeal bond claims, attorney general tells judgesTrump’s lawyers “supply no documentary evidence that demonstrates precisely what real property they offered,” to potential bond insurers, the AG’s office wrote. Read more at: https://www.cnbc.com/2024/03/20/dont-trust-trump-impossible-appeal-bond-claims-attorney-general-tells-judges.html |

|

Ireland’s Prime Minister Leo Varadkar unexpectedly resignsIrish Prime Minister Leo Varadkar on Wednesday announced he will step down as soon as his Fine Gael party names a new leader. Read more at: https://www.cnbc.com/2024/03/20/irelands-prime-minister-leo-varadkar-resigns.html |

|

EPA issues new auto rules aimed at cutting carbon emissions, boosting electric vehicles and hybridsThe rules relax initial tailpipe limits proposed last year but eventually get close to the same strict standards set out by the Environmental Protection Agency. Read more at: https://www.cnbc.com/2024/03/20/epa-issues-new-auto-rules-aimed-at-cutting-carbon-emissions-boosting-electric-vehicles-and-hybrids.html |

|

The Federal Reserve holds interest rates steady, with no immediate relief for consumers from sky-high borrowing costsAs the Federal Reserve postpones rate cutting, here’s what that means for your credit card, mortgage rate, auto loan and savings account. Read more at: https://www.cnbc.com/2024/03/20/the-fed-holds-interest-rates-steady-what-that-means-for-your-money.html |

|

The Fed hasn’t touched interest rates since July, but they’re still moving. What that looks like for credit cards, mortgages and savings accountsAs markets look toward potential interest rate cuts in 2024 from the Federal Reserve, these five charts show how rates have fluctuated over the past 12 months. Read more at: https://www.cnbc.com/2024/03/20/how-interest-rates-have-changed-even-as-the-fed-holds-steady.html |

|

Social Security commissioner vows to end ‘clawback cruelty’ with new plan for benefit overpaymentsNew Social Security Commissioner Martin O’Malley has unveiled a four-step plan to tackle overpayment issues that vex beneficiaries. Read more at: https://www.cnbc.com/2024/03/20/social-security-commissioner-vows-to-end-overpayment-clawback-cruelty.html |

|

Israel Furious After Canada Votes To Halt Arms Exports To Tel AvivVia The Cradle Canada will impose a ban on arms sales to Israel, the country’s Foreign Minister Melanie Joly announced on Tuesday. “It’s a real thing,” Joly told Canadian newspaper The Toronto Star on Tuesday. The decision follows a vote of 204-117 in the Canadian parliament on Monday in favor of ending the sales. While it originally called for a suspension, it was later changed into a full ban. “There are a number of existing contracts that are already in place, but this was on a going-forward basis, I think that’s how the minister’s looking at it. There has been a lot of concern expressed with respect to … lethal military sales to Israel during the conflict,” Canadian Defense Minister Bill Blair said Tuesday. Read more at: https://www.zerohedge.com/geopolitical/israel-furious-after-canada-votes-halt-arms-exports-tel-aviv |

|

Only 30% Of New Yorkers Are Happy With City’s Quality Of Life, 50% Plan On Leaving Within Five YearsBelieve it or not, high prices combined with massive taxation and out of control crime aren’t the keys to keeping the citizens of major American cities happy. Such was reflected in the results of a new poll, reported on by the NY Post, which revealed this week that only half of New Yorkers plan on staying in the city over the next five years. A mere 30% said they were happy with the quality of life in the city, the poll – run by The Citizens Budget Commission – also revealed. Additionally, the poll also found merely 37% of New Yorkers now rate public safety in their local area as excellent or good. This marks a significant decline from six years prior, when 50% of residents felt positively about their neighborhood’s safety. Queens Councilman Robert Holden said to the Post: “People are fed up with the quality of life. There’s a general sense of lawlessness. You go in … Read more at: https://www.zerohedge.com/markets/only-30-new-yorkers-are-happy-citys-quality-life-50-plan-leaving-within-five-years |

|

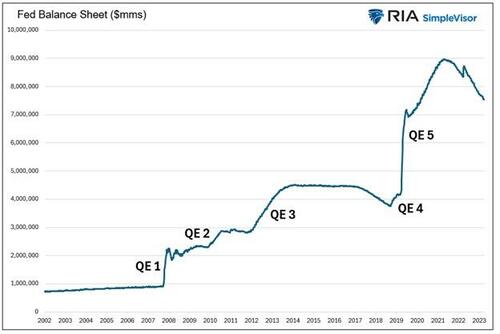

QE By A Different Name Is Still QEAuthored by Michael Lebowitz via RealInvestmentAdvice.com, The Fed added Quantitative Easing (QE) to its monetary policy toolbox in 2008. At the time, the financial system was imploding. Fed Chair Ben Bernanke bought $1.5 trillion U.S. Treasury and mortgage-backed securities to staunch a financial disaster. The drastic action was sold to the public as a one-time, emergency operation to stabilize the banking system and economy. Since the initial round of QE, there have been four additional rounds, culminating with the mind-boggling $5 trillion operation in 2020 and 2021.

QE is no longer a tool for handling a crisis. It has morphed into a policy to ensure the government can fund itself. However, as we are learning today, QE has its faults. For example, it’s not an appropriate policy in times of high inflation like we have. That doesn’t mean the Fed can’t provide liquidity to help the Treasury fund the government’s deficits. They just need to b … Read more at: https://www.zerohedge.com/markets/qe-different-name-still-qe |

|

Watch Live: Fed Chair Powell Explains Why The Dots ‘Are Not A Forecast’, But…Having jawboned the market down from over 6 rate-cuts to only 3 rate-cuts (and confirmed in today’s dot-plot), we suspect Fed Chair Powell will take a small victory lap over the exuberant wishful-thinkers that hoped an ‘easy’ Fed will come rushing back…

The question is – will Powell talk down the hawkish ‘projections’ of the ‘dots’ as he usually does… offering hope to the uber-doves once again?

Maybe the fact that financial conditions are as ‘loose’ now as they were before The Fed … Read more at: https://www.zerohedge.com/markets/watch-live-fed-chair-powell-explains-why-dots-are-not-forecast |

|

UK economy to ‘bounce back’ in 2024, says SunakThe prime minister tells the BBC the economy has “turned a corner” as he challenged on rising bills. Read more at: https://www.bbc.co.uk/news/business-68617291 |

|

US holds interest rates steady but signals cuts aheadForecasts from the Federal Reserve show officials still expect cuts by the end of the year. Read more at: https://www.bbc.co.uk/news/business-68619144 |

|

Train drivers set to strike again in AprilDrivers at 16 train companies will take part in rolling one-day strikes between 5 and 8 April. Read more at: https://www.bbc.co.uk/news/business-68617288 |

|

Tech View: Nifty RSI gives bearish crossover. What should traders do on Thursday?Nifty on Wednesday ended 22 points lower to form a Doji candle on the daily charts which indicates chances of a minor pullback rally. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-rsi-gives-bearish-crossover-what-should-traders-do-on-thursday/articleshow/108651684.cms |

|

Best equity mutual funds deliver up to 84% return in FY24. Do you own any?We considered all equity categories such as large cap, mid cap, small cap, large & mid cap, flexi cap, focused fund, ELSS, multi cap, value, contra fund, and sectoral/thematic fund categories. We considered regular and growth option schemes. We calculated returns offered by equity mutual fund schemes during the financial year 2023-24. We calculated returns starting from April 1, 2023 to March 18, 2024. Read more at: https://economictimes.indiatimes.com/mf/analysis/best-equity-mutual-funds-deliver-up-to-84-return-in-fy24-do-you-own-any/articleshow/108637771.cms |

|

Saurabh Mukherjea picks 3 new stocks for HNI investors in his PMS fundMukherjea said City Union Bank’s valuations are attractive at 1.1x FY25E P/B. Marcellus said that considering the bank’s stability and strong track record in the management team and its conservatism through multiple cycles in the past, the trend of consistent growth can continue in the future as well. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/saurabh-mukherjea-picks-3-new-stocks-for-hni-investors-in-his-pms-fund/articleshow/108642262.cms |

|

Bitcoin’s halving poses risks for miners. Who are the potential winners and losers?A weekly look at the most important news and moves in crypto, and what’s on the horizon in digital assets. Read more at: https://www.marketwatch.com/story/bitcoins-halving-poses-risks-for-miners-who-are-the-potential-winners-and-losers-27c76c0d?mod=mw_rss_topstories |

|

Gold prices climb back toward record highs in the Fed decision’s wakeGold showed little reaction in the immediate aftermath of the Federal Reserve’s decision Wednesday, then rallied toward record highs. Read more at: https://www.marketwatch.com/story/gold-prices-climb-back-toward-record-highs-in-the-fed-decisions-wake-84ce25bf?mod=mw_rss_topstories |

|

DWAC stock soars as vote on deal to buy Trump Media nearsShares of Digital World Acquisition, the special-purpose acquisition corporation looking to buy former President Donald Trump’s social-media company, soared in active trading Wednesday, two days before a shareholder vote on the proposed merger. Read more at: https://www.marketwatch.com/story/dwac-stock-soars-as-vote-on-deal-to-buy-trump-media-nears-ada5c825?mod=mw_rss_topstories |