Summary Of the Markets Today:

- The Dow closed down 138 points or 0.35%,

- Nasdaq closed down 0.30%,

- S&P 500 closed down 0.29%,

- Gold $2,167 down $13.50,

- WTI crude oil settled at $81 up $1.40,

- 10-year U.S. Treasury 4.292% up 0.100 points,

- USD index $103.31 up $0.520,

- Bitcoin $69,710 down $3,4841 (4.75%), New Historic high 73,798.25

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Advance estimates of U.S. retail and food services sales for February 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were up 1.5% above February 2023 according to the US Census tables. However, using the St Louis Fed’s FRED database, retail sales are up 5.5% year-over-year in February 2024. Take your pick 🙂

In the week ending March 9, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 208,000, a decrease of 500 from the previous week’s revised average. The previous week’s average was revised down by 3,750 from 212,250 to 208,500.

The Producer Price Index for final demand (PPI) advanced 1.6% for the 12 months ended in February 2024, the largest rise since moving up 1.8 percent for the 12 months ended September 2023. The rise in the PPI can be traced to oil prices.

Here is a summary of headlines we are reading today:

- Brent Soars Past $85 As IEA Recalculates Supply, Demand

- Gold Prices Soar Past $2,150 After Bullish Rally

- Fourth Russian Lukoil Exec Found Dead by Apparent Suicide

- U.S. Drivers Warned to Brace For Jump in Gasoline Prices

- The U.S. Is Betting Big on Small Nuclear Reactors

- Dow closes more than 100 points lower, snaps 3-day win streak after hot inflation report: Live updates

- This week provided a reminder that inflation isn’t going away anytime soon

- Bitcoin and ether fall as investors press pause on rally: CNBC Crypto World

- ‘Bad News’ Is Bad News For Stocks, Bonds, Crypto, & Gold

- How Overpaid Are State And Local Government Workers Compared To Private

- Long-term Treasury yields jump by most in a month after hot producer-price report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Uzbekistan’s Black Shale Uranium Bonanza Draws International InterestA state-owned uranium producer in Uzbekistan is in talks with China Nuclear Uranium, also state-run, on the possibility of working together to develop a pair of mines. Navoiuran said in a statement on March 12 that the black shale uranium deposits under consideration — Jantuar and Madanli — are both in Uzbekistan’s Navoi region. Black shale uranium refers to uranium deposits found within black shale rock formations. Navoiuran has been operating since 2022, when it was hived off from the Navoi Mining and Metallurgical Plant. The… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Uzbekistans-Black-Shale-Uranaium-Bonanza-Draws-International-Interest.html |

|

Brent Soars Past $85 As IEA Recalculates Supply, DemandCrude oil prices hit a four-month high on Thursday, with the U.S. benchmark crossing over the $80 mark and Brent passing $85 per barrel after changes in supply and demand predictions that bring OPEC+ and International Energy Agency (IEA) forecasts into closer alignment. After gaining nearly $3 on Wednesday, at 3:43 p.m. ET on Thursday, Brent crude was trading at $85.23, up 1.43% on the day. West Texas Intermediate (WTI) was trading at $81.13, up 1.77% on the day. Earlier on Thursday, the IEA tweaked its forecasts for this year, predicting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Soars-Past-85-As-IEA-Recalculates-Supply-Demand.html |

|

Gold Prices Soar Past $2,150 After Bullish RallyVia Metal Miner Once again, the Global Precious Metals MMI (Monthly Metals Index) failed to exhibit strong bearish or bullish pressure. The index remained sideways throughout February, budging down a mere 0.65%. Despite this, some bullish pressure did seep into precious metal prices at the beginning of March, when numerous precious metals began to rally. Gold prices, in particular, shot up, likely due to the weakening of the DXY (U.S. dollar index). At this time, precious metal investors should remain cautious about purchasing precious metals,… Read more at: https://oilprice.com/Metals/Gold/Gold-Prices-Soar-Past-2150-After-Bullish-Rally.html |

|

Shell Focuses on Investor Returns as Climate Goals Take a BackseatThe head of Shell received nearly £8m last year as the petrol giant cut executive pay following a drop in energy prices. The firm handed chief executive Wael Sawan, who took over the role from longstanding predecessor Ben van Beurden in January of 2023, a total pay packet worth £7.94m. This comprised a base salary of £1.40m, an annual bonus of £2.71m and a £2.60m long-term incentive payment, among other payments. This figure ranks more than van Beurden’s 2021 pay packet, but less than the £9.7m the former… Read more at: https://oilprice.com/Energy/Energy-General/Shell-Focuses-on-Investor-Returns-as-Climate-Goals-Take-a-Backseat.html |

|

Fourth Russian Lukoil Exec Found Dead by Apparent SuicideThe vice president of Russian Lukoil, Vitaly Robertus, has been found dead in his office in Moscow, according to a Lukoil, making him the fourth top Lukoil executive to die since the Russian invasion of Ukraine in March 2022. “It is with deep regret that we inform you that at the age of 54, the vice-president of the company, Robertus Vitaly Vladimirovich, suddenly died,” Lukoil said in a March 13 press release, which did not disclose the cause of death. While the Lukoil press release avoided mentioning the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fourth-Russian-Lukoil-Exec-Found-Dead-by-Apparent-Suicide.html |

|

Australia’s Victoria State Fast-Tracks Renewable Energy ProjectsThe Victoria state government in Australia is accelerating planning approvals for renewable energy projects to ensure clean energy capacity gets built faster and easier, Victoria’s Premier Jacinta Allan said on Thursday. Under the new plan, renewable energy projects in Victoria will be eligible for an accelerated planning pathway under the Development Facilitation Program (DFP), which will treat these projects the same as other significant works. Since 2015, more than one in five renewable energy applications have ended… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australias-Victoria-State-Fast-Tracks-Renewable-Energy-Projects.html |

|

U.S. Drivers Warned to Brace For Jump in Gasoline PricesIt couldn’t have come at a worse time. Refinery outages in the United States are colliding with the beginning of driving season, and analysts are warning that drivers could see a spike in prices at the pump. The national average price for a gallon of gasoline in the United States is currently sitting at $3.412—up from $3.396 yesterday an up a hearty $0.156 per gallon (4.8%) from $3.256 per gallon just a month ago. Still, prices are down year over year, with the average price for a gallon of gasoline selling for $3.466 this time last… Read more at: https://oilprice.com/Energy/Energy-General/US-Drivers-Warned-to-Brace-For-Jump-in-Gasoline-Prices.html |

|

Brazil Boosts Clean Energy Beyond HydropowerSouth America’s top hydropower producer, Brazil, has been installing a lot of other clean energy sources over the past half-decade, with solar and wind power now accounting for nearly one fourth of its power generation mix. While Brazil boasts one of the biggest clean energy shares in power in the world, some of the previous market share held by hydro generation has been replaced by soaring wind and solar power generation. The share of hydropower in Brazil’s electricity production declined to 67% last year, from 74% in 2018, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazil-Boosts-Clean-Energy-Beyond-Hydropower.html |

|

Bullish Oil & Gas Producers Remain Under-hedgedOil prices edged up in Wednesday’s session supported by a decline in U.S. crude inventories, Ukrainian attacks on Russian refineries and signs of strong demand. According to weekly data by the U.S. Energy Information Administration (EIA), U.S. crude stockpiles fell by 1.5 million barrels to 446.99 million barrels in the week to March 8, marking the fourth consecutive week of draws, while U.S. crude processing rose by 1.9 percentage point to 86.8% utilization. The American Petroleum Institute (API) reported… Read more at: https://oilprice.com/Energy/Crude-Oil/Bullish-Oil-Gas-Producers-Remain-Under-hedged.html |

|

Vattenfall Ditches Project to Produce Hydrogen From Offshore WindSwedish utility Vattenfall is scrapping a project to explore the possibilities of hydrogen production on offshore wind farms and transportation to shore, nearly two years after it began.? The HT1 Project was designed around Vattenfall’s European Offshore Wind Development Centre off the coast of Aberdeen, Scotland, and was partly funded by the UK’s Department for Energy Security and Net Zero through the Low Carbon Hydrogen Supply 2 funding program.? “Having tested the development phase for decentralised offshore hydrogen… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vattenfall-Ditches-Project-to-Produce-Hydrogen-From-Offshore-Wind.html |

|

The U.S. Is Betting Big on Small Nuclear ReactorsThe U.S. is set to accelerate the rollout of new nuclear power plants and reactors following the passing of new legislation this month. This follows a movement away from nuclear power for several decades due to the poor political and public perception of nuclear power due to several notable nuclear disasters. Now, in line with plans for a green transition, the U.S. is once again turning to nuclear power to provide abundant low-carbon energy and help decarbonize its economy. This month, the House approved legislation aimed at developing U.S.… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/The-US-Is-Betting-Big-on-Small-Nuclear-Reactors.html |

|

U.S. Export Bank to Vote on Backing Bahrain Oil Project Despite Climate PledgeU.S. Export-Import Bank (EXIM), the official export credit agency of the United States, is voting on Thursday whether to underwrite a loan backing an oil and gas project in Bahrain despite a U.S. pledge to stop supporting the expansion of fossil fuel projects. Last month, Exim voted to notify Congress that it plans to underwrite a loan of more than $100 million to the borrower, Bahrain’s state company Bapco Energies, which would help it drill more than 400 oil and gas wells in the Middle Eastern country. The project will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Export-Bank-to-Vote-on-Backing-Bahrain-Oil-Project-Despite-Climate-Pledge.html |

|

IEA Sees OPEC+ Cuts Pushing Oil Markets Into a Supply DeficitThe oil market is shifting from a surplus to a supply deficit that will last for all of 2024 if OPEC+ further extends its production cuts until the end of the year, the International Energy Agency (IEA) said on Thursday. Early this month, the members of the OPEC+ alliance that had pledged the Q1 cuts announced they would roll over the supply reductions until the end of the second quarter. In its Oil Market Report for March, the IEA now assumes that OPEC+ would continue with the voluntary cuts through 2024, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Sees-OPEC-Cuts-Pushing-Oil-Markets-Into-a-Supply-Deficit.html |

|

Shell Eases 2030 Emissions TargetShell reaffirmed on Thursday its ambitions to be a net-zero energy business by 2050 but eased its carbon intensity target for 2030 as it has shifted away from clean power sales to retail customers. The UK-based supermajor said in its updated Energy Transition Strategy 2024 that it would aim for a 15-20% reduction in its net carbon intensity target by 2030, compared to 2016 levels, against a previous target of a 20% cut. The eased emissions target is the result of Shell prioritizing value over volume in power, with a focus on select… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Eases-2030-Emissions-Target.html |

|

U.S. Wants Venture Global to Explain Confidentiality of Its LNG ProjectThe Federal Energy Regulatory Commission (FERC) has asked U.S. liquefied natural gas exporter Venture Global LNG to justify why it keeps details of its Calcasieu Pass LNG facility confidential, weeks after customers including BP complained that the U.S. LNG seller had not been transparent about the status of its Louisiana plant. BP, along with Shell, Repsol, Eni, and Edison, became foundational buyers of Venture Global’s LNG even before it started producing. They paid for the construction of the Calcasieu Pass facility and secured… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Wants-Venture-Global-to-Explain-Confidentiality-of-Its-LNG-Project.html |

|

Dow closes more than 100 points lower, snaps 3-day win streak after hot inflation report: Live updatesStocks slipped Thursday as traders weighed a hotter-than-expected wholesale inflation reading and a decline in market leader Nvidia. Read more at: https://www.cnbc.com/2024/03/13/stock-market-today-live-updates.html |

|

Refund fraud schemes promoted on TikTok, Telegram are costing Amazon and other retailers billions of dollarsAmazon suffered more than $700,000 in losses at the hands of one refund fraud ring indicted last year, according to court documents. Read more at: https://www.cnbc.com/2024/03/14/amazon-and-other-retailers-hit-by-refund-fraud-costing-them-billions.html |

|

This week provided a reminder that inflation isn’t going away anytime soonPrice pressures increasing at a faster-than-expected pace raised concern that inflation could be more durable than anticipated. Read more at: https://www.cnbc.com/2024/03/14/this-week-provided-a-reminder-that-inflation-isnt-going-away-anytime-soon.html |

|

Morgan Stanley names a head of artificial intelligence as Wall Street leans into AIThe move shows the rising importance of AI in financial services, sparked by the rise of generative AI tools that create human-like responses to queries. Read more at: https://www.cnbc.com/2024/03/14/morgan-stanley-names-head-of-artificial-intelligence-jeff-mcmillan.html |

|

The move in this AI momentum ‘poster child’ is so astounding that it’s time to fade, Wolfe Research saysShares of this computer server manufacturer have soared 300% year to date. Over the past 12 months, they are up a whopping 1,100%. Read more at: https://www.cnbc.com/2024/03/14/the-move-in-this-ai-momentum-play-is-astounding-its-time-to-fade-wolfe-says.html |

|

Wall Street isn’t pleased that Kevin Plank is returning as Under Armour’s CEO, shares plunge 12%Stephanie Linnartz, a former Marriott executive who took over at Under Armour in February 2023, is the second CEO UAA has cycled through in less than two years. Read more at: https://www.cnbc.com/2024/03/14/wall-street-not-happy-that-kevin-plank-returning-as-under-armours-ceo.html |

|

Bitcoin and ether fall as investors press pause on rally: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Andrew O’Neill, managing director and co-chair of S&P Global’s Digital Assets Research Lab, explains the significance of Ethereum’s Dencun upgrade and the impact of the upcoming bitcoin halving event on miners. Read more at: https://www.cnbc.com/video/2024/03/14/bitcoin-and-ether-fall-as-investors-press-pause-on-rally-cnbc-crypto-world.html |

|

Democrats cite AI gains and automation in Senate bill calling for 32-hour workweekThe Senate bill comes as JPMorgan Chase CEO Jamie Dimon and Microsoft co-founder Bill Gates say artificial intelligence could justify a shorter workweek. Read more at: https://www.cnbc.com/2024/03/14/ai-and-automation-justify-shorter-work-week-democrats-argue.html |

|

Shares of Dick’s Sporting Goods soar 15% on holiday earnings beat, dividend raiseDick’s Sporting Goods said its holiday quarter was the strongest sales period in the company’s history, leading it to raise its dividend by 10%. Read more at: https://www.cnbc.com/2024/03/14/dicks-sporting-goods-dks-earnings-q4-2023.html |

|

‘Dollars up, donors down’: More charity money is coming from the ultra-wealthyCharitable donations are becoming hyper-concentrated among a small group of ultra-wealthy mega-donors. Read more at: https://www.cnbc.com/2024/03/14/dollars-up-donors-down-more-charity-money-comes-from-ultra-wealthy.html |

|

SpaceX’s Starship notches major flight test milestones, breaks up over Indian Ocean in final momentsSpaceX launched the third test flight of its Starship rocket on Thursday, as the company pushed development of the mammoth vehicle past new milestones. Read more at: https://www.cnbc.com/2024/03/14/spacex-starship-rocket-third-test-flight-launch.html |

|

Here’s when the Fed is likely to start cutting interest rates, according to investment strategistsThe U.S. central bank will likely reduce its benchmark interest rate by 0.75 percentage points to 1 point this year and achieve a “soft landing,” experts said. Read more at: https://www.cnbc.com/2024/03/14/heres-when-the-fed-may-start-cutting-rates-investment-strategists-say.html |

|

The U.S. wants ByteDance to sell TikTok. China is almost certainly going to refuseChina is expected to block a sale of TikTok if Washington passes a law to force the Chinese-owned social media app to divest its U.S. business. Read more at: https://www.cnbc.com/2024/03/14/tiktok-ban-china-would-block-sale-of-short-video-app.html |

|

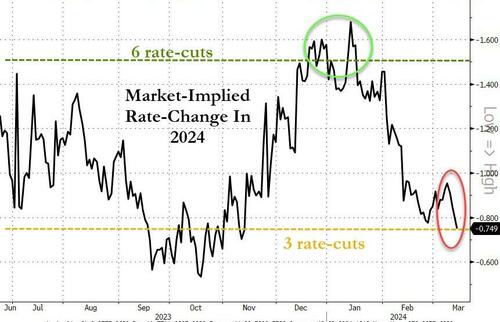

‘Bad News’ Is Bad News For Stocks, Bonds, Crypto, & GoldA lof of macro bad news… Softer-than-expected Retail Sales, hotter-than-expected Producer Prices, Jobless Claims up (from dramatically revised-down levels)… sending rate-cut expectations lower…

Source: Bloomberg …and tomorrow’s big OpEx gamma unclenching left the ‘bad news is good news’ narrative in the dust, wiping the smiles off many faces…

Bond yields were higher – notably higher – with the long-end significantly underpe … Read more at: https://www.zerohedge.com/markets/bad-news-bad-news-stocks-bonds-crypto-gold |

|

While Joe Was VP, Hunter And Pals Aided Chinese Bid To ‘Control’ Global Nuclear Power Market With US Tech: ReportDemocrats just can’t stop trying to sell US nuclear assets. According to a new report, while his father was Vice President, Hunter Biden and his business partners attempted to help Chinese energy firm CEFC purchase Westinghouse, a premier US-based nuclear technology firm, in an attempt to “control” the global market and provide “significant lobbying power in Congress.” “In summary, utilising the U.S. face of Westinghouse, combined with the economic power of CEFC (China) is the perfect solution to control this global sector,” wrote Hunter’s partner, James Gilliar, in a 2016 CEFC strategy memo, Just the News reports. … Read more at: https://www.zerohedge.com/energy/while-joe-was-vp-hunter-and-pals-aided-chinese-bid-control-global-nuclear-power-market-us |

|

How Overpaid Are State And Local Government Workers Compared To PrivateTwo weeks ago we observed that as private sector wage growth was slowing sharply, government worker wage growth had just hit a new all time high and was gingerly moving ever higher.

Picking up on this topic, Mish Shedlock writes that the BLS released its employer costs report for the 4th quarter of 2023. He investigates how much state and local government workers make compared to private industry workers. Read more at: https://www.zerohedge.com/markets/how-overpaid-are-state-and-local-government-workers-compared-private |

|

US Steel Plunges After Biden Opposes Acquisition Of “Vital, Iconic” Company By Nippon SteelAs leaked yesterday, Joe Biden has come out against Nippon Steel’s proposed purchase of US Steel, saying it is “vital” for the “iconic American steel company” to remain “domestically owned and operated”.

In a statement on Thursday, Biden said that “it is important that we maintain strong American steel companies powered by American steel workers.”

Biden’s statement marks a rare presidential intervention in a transaction that outside an election year would have drawn less public scrutiny. Despite its storied history, US Steel’s role in the economy has diminished over several decades, a period during which producers in Asia … Read more at: https://www.zerohedge.com/markets/us-steel-plunges-after-biden-opposes-acquisition-vital-iconic-company-nippon-steel |

|

Flight chaos made worse by engineer delayAugust bank holiday disruption was made worse by engineers’ inability to fix the issue from home, a report says. Read more at: https://www.bbc.co.uk/news/business-68563068 |

|

Heat pump grant rules to be relaxedInsulation rule changes make it easier for households to qualify for £7,500 grant, government says. Read more at: https://www.bbc.co.uk/news/business-68563074 |

|

Post Office victim’s child: ‘Scandal left me mute’Katie Downey and other postmasters’ children want redress for the impact the scandal had on their lives. Read more at: https://www.bbc.co.uk/news/business-68543963 |

|

Railway multibaggers tank up to 33% since Interim Budget. Here’s how much IRFC, RVNL shedStocks like Texmaco and BEML have shed around 30% or more while IRFC, RailTel, and RVNL have dropped over 25% since the Interim Budget on February 1. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/railway-multibaggers-tank-up-to-33-since-interim-budget-heres-how-much-irfc-rvnl-shed/slideshow/108500495.cms |

|

Tech View: Nifty forms Inside Bar candle in pullback rally. What traders should do on FridayNifty’s Inside Bar candle signals a potential trend reversal, with key support at 21,860. Analysts predict resistance at 22,200-22,250 levels. Open Interest data reveals highest OI at 22,400 and 22,500 strike price, shaping trading strategies for the upcoming sessions. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-inside-bar-candle-in-pullback-rally-what-traders-should-do-on-friday/articleshow/108498100.cms |

|

43 lakh new demat accounts added in February, total count now stands at 14.80 croreCentral Depository Services (India) Limited continued its market dominance gaining market share in February 2024 in terms of the total number of demat accounts added. It has also seen an increase in market share on a month-on-month basis. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/43-lakh-new-demat-accounts-added-in-february-total-count-now-stands-at-14-80-crore/articleshow/108491471.cms |

|

Wholesale-price increases add to picture of persistent inflationThe biggest increase in wholesale costs since last summer is the latest in a string of readings that suggest inflation might not slow quickly toward the Federal Reserve’s 2% goal. Read more at: https://www.marketwatch.com/story/wholesale-price-increases-add-to-picture-of-persistent-inflation-1fdf2a4c?mod=mw_rss_topstories |

|

‘Perpetually optimistic’ investors worry Fed won’t cut rates three times this yearTraders are growing increasingly anxious about the possibility that they, along with Federal Reserve policy makers, have underestimated the longevity of U.S. inflation — potentially putting calls for three quarter-point interest-rate cuts this year in jeopardy. Read more at: https://www.marketwatch.com/story/perpetually-optimistic-investors-worry-fed-wont-cut-rates-three-times-this-year-fd1919ef?mod=mw_rss_topstories |

|

Long-term Treasury yields jump by most in a month after hot producer-price reportTreasury yields jumped on Thursday after data showed a bigger-than-expected rise in producer prices during February and prompted traders to pull back slightly on expectations for a June rate cut. Read more at: https://www.marketwatch.com/story/treasury-yields-nudge-higher-as-traders-await-producer-prices-report-757c90d1?mod=mw_rss_topstories |