Summary Of the Markets Today:

- The Dow closed up 130 points or 0.34%,

- Nasdaq closed up 1.51%,

- S&P 500 closed up 1.03%,

- Gold $2,167 up $8.50,

- WTI crude oil settled at $79 down $0.16,

- 10-year U.S. Treasury 4.092% down 0.012 points,

- USD index $102.82 down $0.550,

- Bitcoin $67,690 up $415 (0.62%), All time high 68,990.90

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

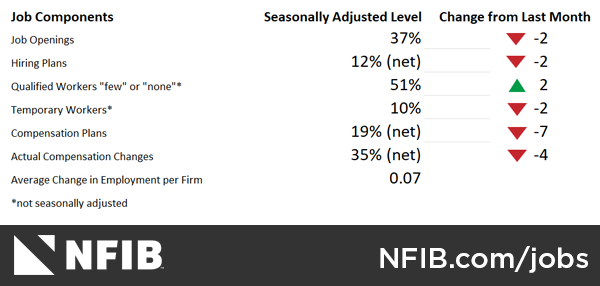

According to NFIB’s monthly jobs report, 37% (seasonally adjusted) of all owners reported jobs openings they could not fill in the current period, down two points from January and the lowest reading since January 2021. The percent of small business owners reporting labor quality as their top small business operating problem declined five points from January to 16%, the lowest reading since April 2020. NFIB Chief Economist Bill Dunkelberg stated:

Job openings among small businesses decreased in February to pre-pandemic levels. Employment activity has lessened somewhat as it becomes easier for owners to find qualified workers. Even with this slowdown, labor demand remains strong.

Nonfarm business sector labor productivity increased 2.6 percent year-over-year in the fourth quarter of 2023 whilst unit labor costs increased 2.5% year-over-year. So overall, there is no growth due to the unchanged productivity/cost relationship.

U.S.-based employers announced 84,638 job cuts in February, up 3% from the 82,307 cuts announced one month prior. It is 9% higher than the 77,770 cuts announced in the same month in 2023. Economically it means very little except a higher job cuts rate is usually indicative of a slowing economy.

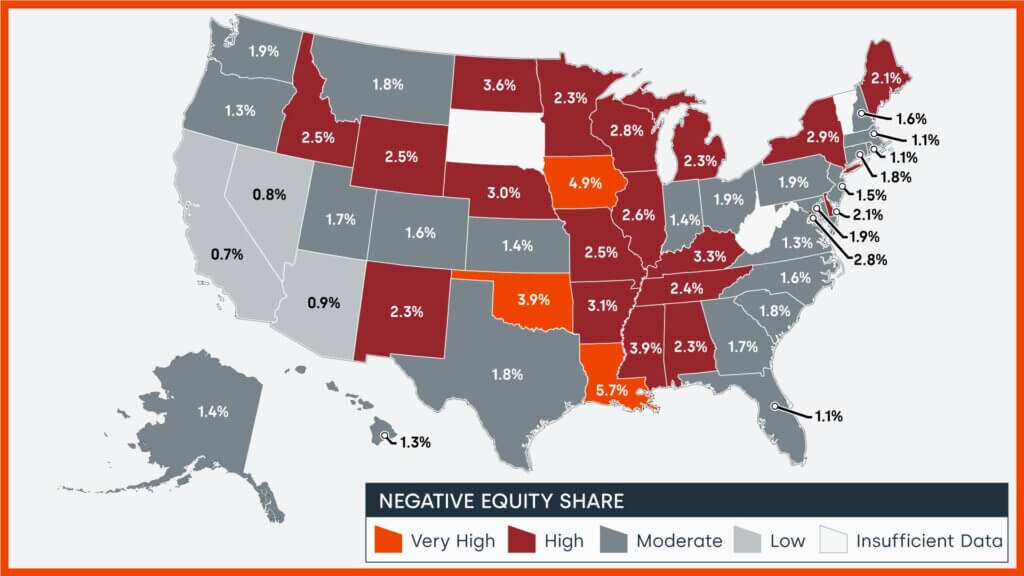

CoreLogic shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase by a total of $1.3 trillion since the fourth quarter of 2022, a gain of 8.6% year over year. In the fourth quarter of 2023, the total number of mortgaged residential properties with negative equity decreased by 1.1% from the third quarter of 2023, representing 1 million homes, or 1.8% of all mortgaged properties.

January 2024 exports were up 2.0% year-over-year, imports were up 0.1%, whilst the trade balance improved (which means it decreased) 4.1% year-over-year. As the import and export prices have declined year-over-year – the growth in trade was larger than it appears (meaning the US and world economies are growing).

In the week ending March 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,250, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 212,500 to 213,000.

Here is a summary of headlines we are reading today:

- Venezuela’s State-Run Refiner Sees Profit Tumble 81%

- SpaceX-Backed Flying Car Startup Gets FAA Nod

- Central Banks Boost Gold Reserves to Diversify from the Dollar

- Texas Wildfires Underscore Increasing Risk for Utilities

- Standard Chartered: OPEC’s Latest Move Is Bullish

- EU to Quit Treaty That Allows Oil Firms to Sue Governments Over Climate Policies

- S&P 500 jumps 1% for fresh closing record, Nasdaq pops 1.5% to touch all-time high: Live updates

- Powell says the Fed is ‘not far’ from the point of cutting interest rates

- The stock market tailwind Goldman sees growing to $1 trillion in 2025 and how to play it

- Leaked Hacking Files Spur Concerns Of China Weakening US For War

- U.S. oil prices end lower on talk of adequate global supplies

- Bitcoin’s fair value is $35,000 — but who’s counting?

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Korea and Kazakhstan Partner to Probe Potential Lithium GoldmineKazakhstan is positioning itself as an important potential global supplier of high-quality lithium just as demand surges for the mineral, which is indispensable for the booming power-storage technology industry. The auspices are good, although few firm investment commitments have materialized. Speaking at a conference in Seoul on March 5, researchers from the Korea Institute of Geoscience and Mineral Resources announced that they had discovered sizable lithium reserves in an area of eastern Kazakhstan. Experts from the Korea Institute of Geoscience… Read more at: https://oilprice.com/Energy/Energy-General/Korea-and-Kazakhstan-Partner-to-Probe-Potential-Lithium-Goldmine.html |

|

Venezuela’s State-Run Refiner Sees Profit Tumble 81%Venezuela’s state-owned refiner Citgo Petroleum’s net profits fell 81% in the fourth quarter of 2023, according to its most recent regulatory filing on Thursday. The state-run refinery, which operates three refineries in the United States, saw its net profits plunge to $1.54 million for the fourth quarter, down from $806 million in the fourth quarter of the previous year. The dip in profits was largely attributed to refinery outages and weaker margins—with its crude utilization rate falling to 89% in Q4. Its Q3 2023 utilization… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuelas-State-Run-Refiner-Sees-Profit-Tumble-81.html |

|

SpaceX-Backed Flying Car Startup Gets FAA NodPre-orders for a “flying car” have soared in recent months leading industry experts to question how close we are to small passenger vehicle flight. Alef Aeronautics, a company backed by Space-X, specialising in the production of flying cars, has achieved 2,850 pre-orders for its electric vertical take-off and landing (eVTOL) vehicle. The firm is backed by Tesla investor and venture capitalist Tim Draper, which has helped draw attention. Based in San Mateo, California, Alef Aeronautics is allowing customers to pre-order its two-seater… Read more at: https://oilprice.com/Energy/Energy-General/SpaceX-Backed-Flying-Car-Startup-Gets-FAA-Nod.html |

|

Germany Extends Rosneft Trusteeship, Avoiding NationalizationFollowing Russian Rosneft’s move to sell its refinery assets in Germany last week, Berlin on Thursday announced it would extend its trusteeship over the local Rosneft subsidiaries until mid-September to avoid nationalization. This is the third time Germany has extended the trusteeship of Rosneft PJSC, with the new extension set to expire on September 10, giving Moscow time to divest its assets. The current trusteeship period was set to expire on March 10. Last week, Rosneft launched a sales process seeking to divest its German… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Extends-Rosneft-Trusteeship-Avoiding-Nationalization.html |

|

Central Banks Boost Gold Reserves to Diversify from the DollarAuthored by Simon White, Bloomberg macro strategist, Powell might not be overly worried about inflation – with his recent comments reiterating the Federal Reserve is on track to cut rates this year – but other central banks are not so relaxed. Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation. Gold’s move in recent days has been broad as well as… Read more at: https://oilprice.com/Energy/Energy-General/Central-Banks-Boost-Gold-Reserves-to-Diversify-from-the-Dollar.html |

|

Xcel Energy May Have Triggered Wildfires in TexasXcel Energy’s facilities in Texas may have been the cause of a spree of wildfires that ripped through the state. Excel, based in Minneapolis, an electric utility and natural gas delivery company, said it very well may be responsible for igniting the recent Smokehouse Creek fire—the largest wildfire in the state’s history. The Smokehouse Creek wildfire began February 26, incinerating over a million acres, destroying more than 500 homes, and killing two before spilling into neighboring Oklahoma. The wildfires quickly spread after… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Xcel-Energy-May-Have-Triggered-Wildfires-in-Texas.html |

|

Turkmenistan Eyes Gas Export Breakthrough with TurkeyWith Turkmenistan and its gas export dreams, intentions are strong, but implementation is faltering. On March 1, Turkmen National Leader Gurbanguly Berdymukhamedov, the father of the president, traveled to Turkey to attend the Antalya Diplomatic Forum. During the visit, he met with Turkish President Recep Tayyip Erdogan — an encounter celebrated with generous niceties. To mark his host’s recent 70th birthday, Berdymukhamedov arrived with the gift of an ichmek, a Turkmen sheepskin gown traditionally bestowed upon wise elders. A few days… Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistan-Eyes-Gas-Export-Breakthrough-with-Turkey.html |

|

Saudis Complete Transfer of 8% in Aramco to the Sovereign Wealth FundSaudi Arabia has completed the transfer of an 8% stake in its state oil giant Aramco from state ownership to the Kingdom’s sovereign wealth fund, Saudi Crown Prince Mohammed bin Salman said on Thursday. The transfer of the stake to fully owned companies of the Public Investment Fund (PIF) of Saudi Arabia is expected to solidify PIF’s strong financial position and credit rating, said the sovereign wealth fund, whose chairman of the board of directors is the Crown Prince. The 8% stake in Saudi Aramco is currently worth… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudis-Complete-Transfer-of-8-in-Aramco-to-the-Sovereign-Wealth-Fund.html |

|

Texas Wildfires Underscore Increasing Risk for UtilitiesWarren Buffett fretted, in his annual report, that wildfires threatened his electric utility investments. He specifically cited the stock price carnage experienced by two US utilities, Pacific Gas & Electric and Hawaiian Electric, as the basis for his concern. Barely a week later, the Smokehouse fire in the Texas Panhandle has burned over a million acres of brush and timber in the heart of cattle country. This time it is Minneapolis-based Xcel Energy and its utility subsidiary, Southwestern Public Service that is at risk. The company… Read more at: https://oilprice.com/Energy/Energy-General/Texas-Wildfires-Underscore-Increasing-Risk-for-Utilities.html |

|

China’s Crude Oil Imports Increased by 5% in January and FebruaryChinese crude oil imports jumped by 5.1% in January and February compared to the same two months last year, government data showed on Thursday, as fuel demand rose during the Lunar New Year holiday last month. China, the world’s largest crude importer, saw oil cargo arrivals rise to a total of 10.74 million barrels per day (bpd) in the first two months of 2024, compared to about 10.4 million bpd in January-February 2023, according to Reuters’ calculations based on data in tons reported today by the Chinese General Administration… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Crude-Oil-Imports-Increased-by-5-in-January-and-February.html |

|

Kuwait Sees Solid Oil Demand In A Fairly Balanced MarketGlobal oil demand looks robust in a balanced market this year, Shaikh Nawaf Al-Sabah, chief executive of Kuwait’s state oil firm Kuwait Petroleum Corporation (KPC), told Bloomberg in an interview published on Thursday. “From my perspective I think it remains a healthy market on the demand side,” the executive said, noting that rising U.S. shale production has helped meet part of the recent growth in world oil consumption. Kuwait, one of the biggest producers in the Middle East and OPEC, is part of the several OPEC+… Read more at: https://oilprice.com/Energy/Crude-Oil/Kuwait-Sees-Solid-Oil-Demand-In-A-Fairly-Balanced-Market.html |

|

Chinese Copper Producers to Discuss Output Curbs Amid Low FeesMore than a dozen Chinese copper smelters are expected to discuss next week potential production cuts due to unsustainably low fees for processing the semi-processed ore, or concentrate, into finished metal, sources with knowledge of the matter told Bloomberg on Thursday. The China Nonferrous Metals Industry Association will host a meeting of copper smelters next week, at which at least 15 copper processing firms have been invited, according to Bloomberg’s sources. Executives from Chinese copper smelters are expected to discuss… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Copper-Producers-to-Discuss-Output-Curbs-Amid-Low-Fees.html |

|

Standard Chartered: OPEC’s Latest Move Is BullishOil markets have managed to reverse their early week losses, inching up higher in Wednesday’s session after the Energy Information Administration reported significant inventory draws across various fuels. The EIA has reported a smaller crude build of 1.4 million barrels for the week ending March 1 compared with a build of 4.2 million barrels for the previous week, while the American Petroleum Institute has pegged the crude build at just 423,000 barrels. The EIA has also estimated inventory draws of 4.5 million barrels of gasoline… Read more at: https://oilprice.com/Energy/Crude-Oil/Standard-Chartered-OPECs-Latest-Move-Is-Bullish.html |

|

India’s Fuel Demand Jumps As Its Economy RoarsIndia’s fuel consumption jumped by 5.7% in February compared to the same month of 2023, data from the Ministry of Petroleum and Natural Gas showed on Thursday. Total fuel consumption in the world’s third-largest crude oil importer rose to nearly 5 million barrels per day (bpd), or over 19.7 million metric tons, last month, per data from the ministry’s Petroleum Planning and Analysis Cell (PPAC) published today. That’s a 5.7% yearly increase and a rise of 5.1% on a per-day basis compared to January, when consumption… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Fuel-Demand-Jumps-As-Its-Economy-Roars.html |

|

EU to Quit Treaty That Allows Oil Firms to Sue Governments Over Climate PoliciesEuropean Union member states agreed on Thursday to jointly leave a 1990s energy treaty that allows oil companies to sue governments over their climate policies, EU officials told Reuters. The Energy Charter Treaty (ECT), signed in 1994 and in force since 1998, was originally designed to promote international investment in the energy sector and has historically provided protections for investors in fossil fuels. The treaty basically allows oil firms to sue governments for compensation for lost profits if they think energy policies have… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-to-Quit-Treaty-That-Allows-Oil-Firms-to-Sue-Governments-Over-Climate-Policies.html |

|

S&P 500 jumps 1% for fresh closing record, Nasdaq pops 1.5% to touch all-time high: Live updatesStocks rose Thursday, as hope over easing inflation and gains in tech helped Wall Street claw back more of this week’s losses. Read more at: https://www.cnbc.com/2024/03/06/stock-market-today-live-updates.html |

|

Rivian shares surge as company reveals new EV models, $2.25 billion in cost savingsThe announcements come at a crucial time for Rivian as it attempts to expand its customer base amid slower-than-expected EV sales in the U.S. Read more at: https://www.cnbc.com/2024/03/07/rivian-r2-electric-suv-starting-price-performance.html |

|

Powell says the Fed is ‘not far’ from the point of cutting interest ratesPowell on Thursday indicated that interest rate cuts may not be too far off, if inflation signals cooperate. Read more at: https://www.cnbc.com/2024/03/07/powell-says-fed-is-not-far-from-the-point-of-cutting-interest-rates.html |

|

Layoffs rise to the highest for any February since 2009, Challenger saysThe total of 84,638 planned cuts showed an increase of 3% from January and 9% from a year ago. Read more at: https://www.cnbc.com/2024/03/07/layoffs-rise-to-the-highest-for-any-february-since-2009-challenger-says.html |

|

The stock market tailwind Goldman sees growing to $1 trillion in 2025 and how to play itHere are some of the names in Goldman’s stock buybacks basket, which has outperformed the S&P 500. Read more at: https://www.cnbc.com/2024/03/07/goldman-sees-this-stock-market-tailwind-growing-to-1-trillion-in-2025.html |

|

NYCB says it lost 7% of deposits in the past month, slashes dividend to 1 centNYCB had $77.2 billion in deposits as of March 5, NYCB said in an investor presentation tied to the capital raise, down from $83 billion it had as of Feb. 5. Read more at: https://www.cnbc.com/2024/03/07/nycb-lost-7percent-of-deposits-in-past-month-slashes-dividend-to-1-cent.html |

|

Bill Martin, who called SVB’s collapse, adds to his NYCB short and says it will end up a ‘zombie bank’Bill Martin, who foresaw the collapse of Silicon Valley Bank in 2023, found his next big short in the troubled New York Community Bancorp. Read more at: https://www.cnbc.com/2024/03/07/bill-martin-who-called-svbs-collapse-says-nycb-will-end-up-a-zombie-bank.html |

|

Sweden formally joins NATO military alliance, ending centuries of neutralitySwedish Prime Minister Ulf Kristersson traveled to Washington, D.C., this week to hand over the final documents. Read more at: https://www.cnbc.com/2024/03/07/sweden-formally-joins-nato-military-alliance-ending-decades-of-neutrality.html |

|

Concerns about union strikes at East Coast, Gulf ports rise, leading to trade diversionsContract talks have started between the union for port workers on the East Coast and Gulf Coast, and maritime owners, with major consequences for US trade. Read more at: https://www.cnbc.com/2024/03/07/countdown-clock-for-strike-at-east-coast-gulf-ports-has-begun.html |

|

House Democrats probe SpaceX over alleged illegal export and use of Starlink by RussiaRead the letter House Democrats sent SpaceX about possible illegal use of Starlink by Russia in occupied Ukraine. Read more at: https://www.cnbc.com/2024/03/07/democrats-probe-russias-alleged-use-of-spacex-starlink-in-ukraine.html |

|

Trump vs. Biden: What a presidential election rematch could mean for your taxesWith looming tax law changes slated for after 2025, President Joe Biden or former President Donald Trump would face several expiring tax provisions. Read more at: https://www.cnbc.com/2024/03/07/trump-vs-biden-what-presidential-election-rematch-may-mean-for-taxes.html |

|

Jake Paul to fight Mike Tyson in boxing match streamed live on NetflixThe event marks one of Netflix’s most ambitious forays into both sports programming and live entertainment. Read more at: https://www.cnbc.com/2024/03/07/jake-paul-to-fight-mike-tyson-in-boxing-match-streamed-live-on-netflix.html |

|

Grocers are trying to get orders to your door faster than ever — here’s whyWalmart, Target and Kroger are trying to stand out on grocery convenience, not just price. Read more at: https://www.cnbc.com/2024/03/07/walmart-target-and-kroger-compete-on-grocery-delivery.html |

|

Leaked Hacking Files Spur Concerns Of China Weakening US For WarAuthored by Andrew Thornebrooke via The Epoch Times (emphasis ours), China’s communist regime is engaged in a worldwide campaign of cybercrime and leading experts believe that the United States is failing to respond swiftly enough to counter the threat. “In the current era of cyber, it’s all about speed,” retired Army Col. John Mills told The Epoch Times. “You have to presume a breach, and that the threat is inside. Looking at it from that perspective, it’s all about speed of identification, speed of ejection. The U.S. government is not good at that.”

Read more at: https://www.zerohedge.com/political/leaked-hacking-files-spur-concerns-china-weakening-us-war |

|

“Anytime, Anywhere”: Trump Taunts Biden To Debate, White House Wigs, And ‘View’ Crones Tell Wine-Moms He’s “Illegitimate”While Biden brags about forcing the President of Mexico (or Egypt), to allow humanitarian aid into Gaza, his administration, top Democrats, and their media tentacles insist he’s a well-oiled galaxy brain behind closed doors – to the point where even SNL has thrown in the towel.

|

|

Ron Paul: Fed’s “Dollar Destruction” And Moral CrisisVia SchiffGold.com, Ron Paul’s recent op-ed from the Ron Paul Institute for Peace and Prosperity, reprinted in the Orange County Register, breaks down the profound damage caused by central bank money printing: it pits savers against speculators, encouraging consumers to use debt to fund basic needs since their savings are constantly evaporating due to monetary debasement.

The result? Ballooning consumer debt and over-dependence on credit cards, while saving for the future becomes a zero-sum game:

The Fed’s “dollar destruction,” as Paul calls it, is something that Americans are so accustomed to, that we’re addicted to it even as it hurts us. Without endless money printing, the welfare state and foreve … Read more at: https://www.zerohedge.com/political/ron-paul-feds-dollar-destruction-and-moral-crisis |

|

Secretive China-Linked Socialist Groups Had Fingerprints All Over BLM-Adjacent Riots: SchweizerWhile most people know that BLM was largely behind the 2020 riots that followed the death of George Floyd, author Peter Schweizer has uncovered an angle we did not see coming.

Read more at: https://www.zerohedge.com/geopolitical/secretive-china-linked-socialist-groups-had-fingerprints-all-over-blm-riots-schweizer |

|

Labour and Tories accused of silence over cutsTough decisions will need to be made following the next election, the Institute for Fiscal Studies said. Read more at: https://www.bbc.co.uk/news/business-68498937 |

|

How are the child benefit rules changing?Changes announced in the Budget mean people earning up to £80,000 will be able to claim the benefit. Read more at: https://www.bbc.co.uk/news/business-68500022 |

|

‘I earn £70,000 and can now get child benefit payments’The BBC spoke to people with a range of earnings and household set-ups about how the Budget affects them. Read more at: https://www.bbc.co.uk/news/business-68448107 |

|

Sebi issues administrative warning to VedantaVedanta has been warned by the markets regulator to strengthen its internal control for corporate announcements and press releases. Sebi found violation of Sections 12A (a), (b), (c) of SEBI Act, 1992 r/w Regulations 3 (b), (c),(d), 4(1) & 4(2) (k) & (r) of SEBI (PFUTP) Regulations, 2013 in respect of Vedanta publishing information related to its unlisted ultimate holding company. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-issues-administrative-warning-to-vedanta/articleshow/108301640.cms |

|

12 equity MFs crossed Rs 1K NAV. Here’s how they faredAround 12 equity mutual funds have crossed Rs 1,000 NAV, according to the data by ACE MF. Three flexi cap and mid cap, two ELSS, one aggressive hybrid, large & mid cap, large cap, and a thematic fund featured on the list. Here is how these equity mutual funds have fared since their inception. Read more at: https://economictimes.indiatimes.com/mf/analysis/12-equity-mutual-funds-crossed-rs-1000-nav-here-is-the-performance/funds-in-focus/slideshow/108294485.cms |

|

Tech View: Nifty call writers increase positions at 22,500 strike. What should traders do next weekNifty stayed below the psychological 22,500 mark, with call writers at the 22,500 strikes significantly increasing their positions. On the downside, support is expected to hold at 22,400. The buy-on-dips strategy is likely to persist as long as it remains above 22,400. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-call-writers-increase-positions-at-22500-strike-what-should-traders-do-next-week/articleshow/108302292.cms |

|

Treasury yields edge lower ahead of February jobs reportTreasury yields ended mostly lower as investors looked ahead to Friday’s jobs report. Read more at: https://www.marketwatch.com/story/treasury-yields-inch-higher-ahead-of-more-powell-testimony-looming-jobs-data-1697bdab?mod=mw_rss_topstories |

|

U.S. oil prices end lower on talk of adequate global suppliesU.S. oil futures ended Thursday’s session lower, as reported comments from the International Energy Agency suggest the world’s oil supplies will be enough to meet demand. Read more at: https://www.marketwatch.com/story/oil-prices-pull-back-after-boost-from-u-s-inventory-data-71599c92?mod=mw_rss_topstories |

|

Bitcoin’s fair value is $35,000 — but who’s counting?Bitcoin ETF demand and the cryptocurrency’s volatility disregard a fundamental valuation model. Read more at: https://www.marketwatch.com/story/bitcoins-fair-value-is-35-000-but-whos-counting-0c5d0523?mod=mw_rss_topstories |

(Illustration by The Epoch Times, Getty Images, Shutterstock)All signs indicate that the Chinese Communist Party (CCP) and its …

(Illustration by The Epoch Times, Getty Images, Shutterstock)All signs indicate that the Chinese Communist Party (CCP) and its …

BLM protesters throw objects into a fire outside a Target store near the Third Police Precinct on May 28, 2020, in Minneapolis, Minnesota, during protests over the death of George Floyd. (KEREM YUCEL/AFP via Getty Images)According to Schweizer’s book, Blood Money: Why the Powerful Turn a Blind Eye While China Kills Americans, many of the seemingly spontaneous riots were actually organized by members of little-known radical organizations back …

BLM protesters throw objects into a fire outside a Target store near the Third Police Precinct on May 28, 2020, in Minneapolis, Minnesota, during protests over the death of George Floyd. (KEREM YUCEL/AFP via Getty Images)According to Schweizer’s book, Blood Money: Why the Powerful Turn a Blind Eye While China Kills Americans, many of the seemingly spontaneous riots were actually organized by members of little-known radical organizations back …