Summary Of the Markets Today:

- The Dow closed up 14 points or 0.04%,

- Nasdaq closed up 0.84%,

- S&P 500 closed up 0.54%,

- Gold $2,053 up $9.90,

- WTI crude oil settled at $78 down $0.26,

- 10-year U.S. Treasury 4.244% down 0.03 points,

- USD index $104.10 up $0.12,

- Bitcoin $62,225 up $1,773 (2.94%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

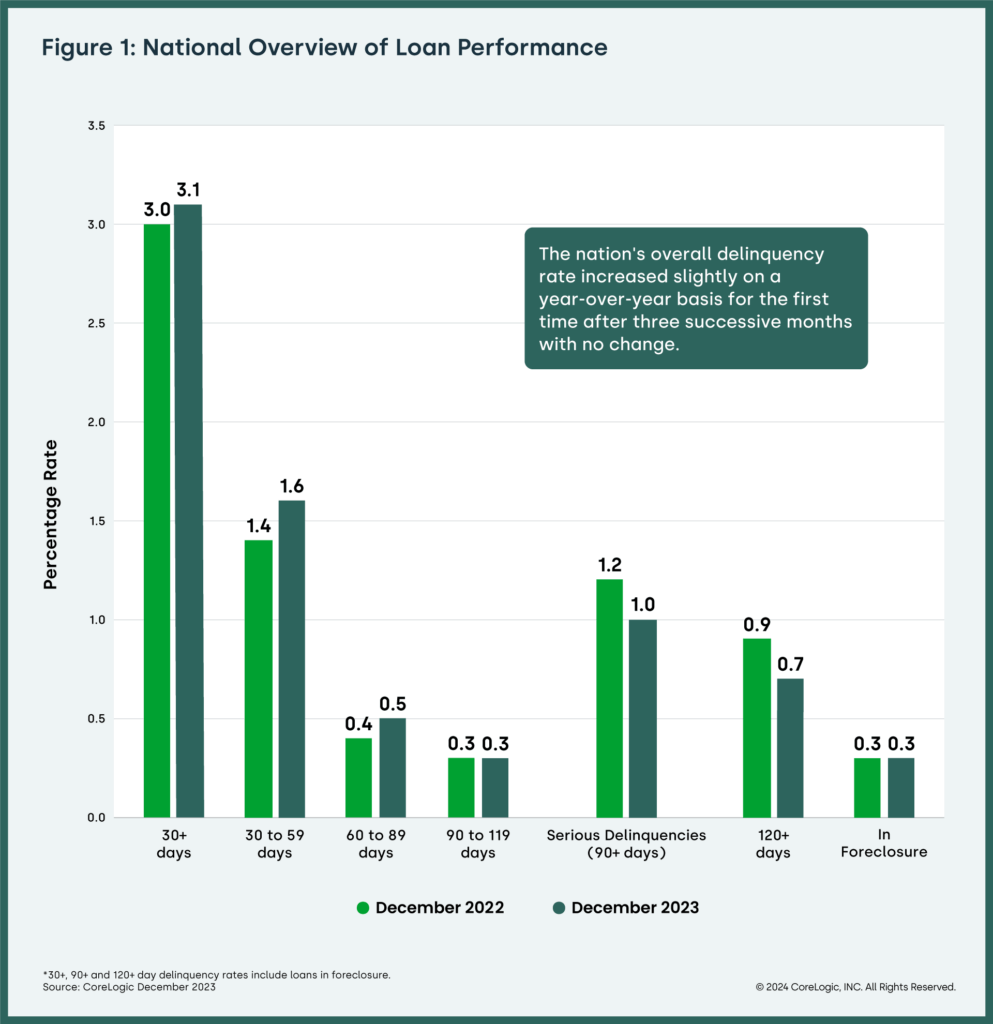

In December 2023, 3.1% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), up by 0.1 percentage points year-over-year from December 2022 and up by 0.2 percentage points month-over-month from November 2023 – according to CoreLogic’s Loan Performance Insights Report .

Real Disposable Personal income increased 2.1% year-over-year in January 2024 – significantly down from the 3.2% year-over-year last month. Real personal consumption expenditures (PCE), personal income less personal current taxes, increased likewise fell to 2.1% year-over-year from 3.2% last month. The PCE price index increased 2.4% year-over-year – down from 2.6% last month. The PCE price index excluding food and energy was little changed at 2.8% year-over-year (this is the Federal Reserve’s preferred metric for judging inflation).

In the week ending February 24, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,500, a decrease of 3,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 215,250 to 215,500.

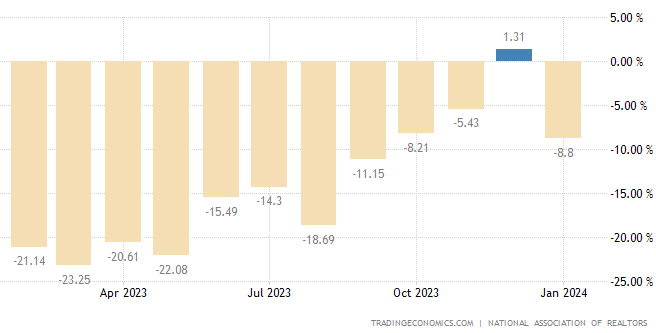

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – in January 2024 was down 8.8% year-over-year. NAR Chief Economist Lawrence Yun stated:

The job market is solid, and the country’s total wealth reached a record high due to stock market and home price gains. This combination of economic conditions is favorable for home buying. However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.

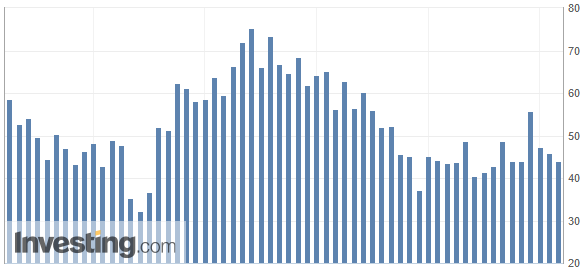

The latest Chicago Purchasing Manager’s Index (Chicago Business Barometer) fell to 44.0 in February 2024 from 46.0 in January. This index is used by the markets as a peak into the Purchasing Manager’s Index which will be released tomorrow.

Here is a summary of headlines we are reading today:

- Low-Cost Nickel from Indonesia is Flooding The Market

- New Tech Enhances Safety and Performance of Lithium Ion Batteries

- Utility Scale Solar Installations Saw Largest Jump Ever Last Year

- Can Anything Stop Bitcoin’s Bull Run?

- Analysts Expect Oil Prices to Remain Close to $80 This Year

- S&P 500 and Nasdaq rise Thursday as stocks head for a winning month: Live updates

- Key Fed inflation measure rose 0.4% in January as expected, up 2.8% from a year ago

- Ray Dalio says the U.S. stock market ‘doesn’t look very bubbly’

- Solana soars more than 12% amid broader crypto rally: CNBC Crypto World

- Feb Auto Sales: Here’s what to expect from Maruti, Tata Motors & other top automakers

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Asia’s Energy Dilemma: Can the Continent Kick Its Coal Habit?Countries worldwide are accelerating the closure of their coal plants, as governments and private companies plough money into growing the global renewable energy capacity, supporting a gradual transition away from fossil fuels. Coal is expected to be the first of the fossil fuels to go, having been deemed to be the world’s dirtiest energy resource. However, the move away from coal is not so easy for some countries in Asia that remain heavily dependent on it. Yet, several advanced and developing economies, such as China, India and Indonesia,… Read more at: https://oilprice.com/Energy/Coal/Asias-Energy-Dilemma-Can-the-Continent-Kick-Its-Coal-Habit.html |

|

Saipem First to Call Drop in Aramco Orders Over Oil Expansion Plan ScrappingItaly’s Saipem oilfield services company said on Thursday that it was anticipating a 20% fall in orders from Aramco as a result of the Saudi oil giant’s orders from on high in late January to scrap plans for expanding capacity, Reuters reported. In 2020, Saipem signed a 12-year-deal with Saudi Aramco, and has averaged over $1.6 billion in engineering and construction projects for Aramco between 2021 and 2023, according to Reuters. “(Saipem’s) new business plan already includes a 20% cut in orders from Saudi Arabia compared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saipem-First-to-Call-Drop-in-Aramco-Orders-Over-Oil-Expansion-Plan-Scrapping.html |

|

Low-Cost Nickel from Indonesia is Flooding The MarketVia Metal Miner The global nickel mining industry is under stress, and the primary reason is an oversupply of low-cost nickel from Indonesia. Moreover, this constant supply continues to support a major global surplus, placing downward pressure on the nickel price. At this point, the Southeast Asian nation has already cornered more than half of the world’s supply of this critical metal. Indonesia’s ascent as the leading player in the global nickel industry, leveraging Chinese capital and innovation, proved remarkable. In fact,… Read more at: https://oilprice.com/Metals/Commodities/Low-Cost-Nickel-from-Indonesia-is-Flooding-The-Market.html |

|

Wood Mac Shaves 1 Million BPD off Global Oil Demand ForecastWood Mackenzie has revised its global oil demand forecast downward by 1 million barrels per day to 1.9 million bpd for 2024, with the biggest increases in demand coming from China and India. Citing a Wood Mac briefing during an Energy Institute conference in London, Reuters reported on Thursday that Wood Mac’s VP of oils research, Alan Gelder, was largely in line with OPEC own estimates for this year. In January, Wood Mac said it expected global oil demand growth to continue to set records this year, up nearly 2 million bpd compared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Wood-Mac-Shaves-1-Million-BPD-off-Global-Oil-Demand-Forecast.html |

|

New Tech Enhances Safety and Performance of Lithium Ion BatteriesIncheon National University scientists have developed a method to improve the stability and properties of lithium ion battery separators with a layer of silicon dioxide and other functional molecules. The study published in Energy Storage Materials demonstrates successful graft polymerization on a polypropylene (PP) separator, incorporating a uniform layer of silicon dioxide (SiO2). Lithium-ion batteries face safety concerns as a result of internal separator issues which often lead to short circuits. Batteries employing the Incheon National separators… Read more at: https://oilprice.com/Energy/Energy-General/New-Tech-Enhances-Safety-and-Performance-of-Lithium-Ion-Batteries.html |

|

Crescent Point Energy Lifts Base Dividend as It Turns Profit for Q4Canadian oil and gas producer Crescent Point Energy (NYSE: CPG) is raising its quarterly base dividend by 15% as it reported on Thursday a net income for the fourth quarter, compared to a loss for the same period of 2022. Crescent Point booked US$701 million (C$951 million) in net income for Q4 2023, compared to a loss of US$367 million (C$498 million) for the fourth quarter of 2022. Adjusted net earnings from continuing operations fell by 8% in the quarter and by 3% for full-year 2023 compared to 2022. The company is increasing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Crescent-Point-Energy-Lifts-Base-Dividend-as-It-Turns-Profit-for-Q4.html |

|

Egypt Seals Historic $35 Billion Development Deal with UAEVia Middle East Eye Egypt has agreed to a $35 billion deal with the United Arab Emirates to develop the town of Ras el-Hekma town on its northwestern coast, Egyptian Prime Minister Mostafa Madbouly announced on Friday after weeks of speculations. Madbouly said at a news conference, which was attended by Egyptian and Emirati officials, that Egypt will receive an advance amount of $15bn in the coming week, and another $20bn within two months. The deal is the largest foreign direct investment in an urban development project in the country’s… Read more at: https://oilprice.com/Geopolitics/International/Egypt-Seals-Historic-35-Billion-Development-Deal-with-UAE.html |

|

Utility Scale Solar Installations Saw Largest Jump Ever Last YearUtility-scale solar installations in the United States rose by 60% last year, the highest level ever recorded, according to new data. U.S. solar projects grew by 15 GW last year—a 60% increase and the highest jump on record, environmental research group Kayrros said in a new report. Behind the large increase year over year was an uneventful 2022, which saw a rash of bottlenecks in solar supply chains, lack of solar workforce, and high import tariffs. Texas, under the oversight of the Electric Reliability Council of Texas (ERCOT), saw the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Utility-Scale-Solar-Installations-Saw-Largest-Jump-Ever-Last-Year.html |

|

Oil Workers Fired As Strike Rages On in KazakhstanAn oil services company in western Kazakhstan whose operations have been hampered by a strike that began in December has escalated the standoff by announcing that it will dismiss 50 employees involved in industrial action. The firings, announced by West Oil Software on February 27, represent the company’s largest mass dismissal since the strike started. The company has stated that the strike is costing it millions of dollars daily, with the financial damage to date around 1 billion tenge ($2.2 million). It cited a December court ruling, which… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Workers-Fired-As-Strike-Rages-On-in-Kazakhstan.html |

|

Kuwait’s Fuel Oil Exports Jump to Record as New Refinery Ramps UpFuel oil exports from one of OPEC’s top crude exporters, Kuwait, are estimated to have hit a record-high level in February, as the new Al-Zour Refinery has ramped up fuel processing to full capacity. In February, fuel oil exports from Kuwait reached a record high of around 720,000 metric tons, equal to 158,000 barrels per day (bpd), according to ship-tracking data from analytics firm Kpler cited by Reuters. According to data from LSEG, Kuwait’s fuel oil exports in February have been around 516,000 tons, which is the highest export… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kuwaits-Fuel-Oil-Exports-Jump-to-Record-as-New-Refinery-Ramps-Up.html |

|

Can Anything Stop Bitcoin’s Bull Run?Bitcoin surged beyond $63,000 on Wednesday, marking its highest level in over two years, fuelled by a wave of investment into new U.S. spot bitcoin exchange-traded products. This rally, witnessing a remarkable 42% increase this month, is shaping up to be its most significant monthly gain since December 2020. However, the excitement was short-lived as Bitcoin unexpectedly experienced a drop, stabilizing at $61,650 during Asia’s morning trading session. This upward momentum in the most traded cryptocurrency’s value also lifted Ether… Read more at: https://oilprice.com/Finance/the-Markets/Can-Anything-Stop-Bitcoins-Bull-Run.html |

|

India’s Coal Stocks Soar to Seasonal RecordAs coal mining soars, coal stocks at India’s power generators have hit their highest-ever level for this time of year despite record coal-fired power production to meet surging demand. Coal-fired power generators had amassed as many as 44 million tons of coal as of the end of February, nearly double the 26 million tons stockpiled at the same time in 2022, per data from India’s Ministry of Power analyzed by Reuters market analyst John Kemp. Currently, stocks at India’s coal-fired power generators are sufficient to cover more than… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Coal-Stocks-Soar-to-Seasonal-Record.html |

|

Offshore Oil Discoveries ThriveAnalysts and energy industry executives are sounding the alarm about underinvestments in oil and gas exploration. This has been going on for years, and it is a recipe for shortages down the road. But despite the industry as a whole spending less money on exploration and drilling only where it is virtually certain it would hit oil, exploration continues—especially offshore. In 2023, oil and gas companies operating in the Gulf of Mexico announced eight new discoveries in the deepwater section of the area, Offshore Magazine reported earlier… Read more at: https://oilprice.com/Energy/Crude-Oil/Offshore-Oil-Discoveries-Thrive.html |

|

Analysts Expect Oil Prices to Remain Close to $80 This YearSufficient supply and uninterrupted oil trade flows despite the Middle Eastern conflicts are set to keep oil prices close to the $80 per barrel threshold this year, the monthly Reuters poll of analysts showed on Thursday. For the fourth consecutive month, more than three dozen analysts and economists continued to revise down slightly their forecast for the average price of the two most traded benchmarks, Brent and WTI, the Reuters poll found. According to the experts, Brent Crude prices will average $81.13 a barrel this year,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Analysts-Expect-Oil-Prices-to-Remain-Close-to-80-This-Year.html |

|

Spain Enjoys Cheap Electricity Amid Record Renewable Energy OutputSpanish power prices have tumbled in February to a fraction of the price in neighboring France as record wind and solar power generation in Spain has triggered an extreme slump in prices. Day-ahead electricity prices for Thursday settled at just $5.20 (4.80 euros) per megawatt-hour (MWh) in Spain, compared to as much as $68.86 (63.59 euros) per MWh for France, according to data compiled by Bloomberg. France relies mostly on its vast domestic nuclear power generation for most of its electricity needs and is typically a net exporter of electricity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spain-Enjoys-Cheap-Electricity-Amid-Record-Renewable-Energy-Output.html |

|

S&P 500 and Nasdaq rise Thursday as stocks head for a winning month: Live updatesThe three major averages are headed for another winning month. Read more at: https://www.cnbc.com/2024/02/28/stock-market-today-live-updates.html |

|

Key Fed inflation measure rose 0.4% in January as expected, up 2.8% from a year agoThe core PCE price index was expected to increase 0.4% in January on a monthly basis and 2.8% from a year ago. Read more at: https://www.cnbc.com/2024/02/29/pce-inflation-january-2023-.html |

|

Ray Dalio says the U.S. stock market ‘doesn’t look very bubbly’The founder of Bridgewater, one of the world’s largest hedge funds, analyzed the market based on his bubble criteria. Read more at: https://www.cnbc.com/2024/02/29/ray-dalio-says-the-us-stock-market-doesnt-look-very-bubbly.html |

|

Microsoft introduces Copilot AI chatbot for finance workers in Excel and OutlookAfter going after sales and customer service, now Microsoft is focusing on finance, a corporate function where getting the numbers right is critical. Read more at: https://www.cnbc.com/2024/02/29/microsoft-introduces-copilot-ai-chatbot-for-finance-workers.html |

|

These were February’s biggest stock winners. Here’s where analysts see them going nextHere’s where analysts think some of the biggest winning and losing stocks in February are headed. Read more at: https://www.cnbc.com/2024/02/29/biggest-stock-winners-in-february-where-analysts-see-them-going-next.html |

|

Humanoid robot startup Figure AI valued at $2.6 billion as Bezos, OpenAI, Nvidia join fundingFounded in 2022, Figure AI has developed a general-purpose robot, called Figure 01, that looks and moves like a human. Read more at: https://www.cnbc.com/2024/02/29/robot-startup-figure-valued-at-2point6-billion-by-bezos-amazon-nvidia.html |

|

Trump Media sued by co-founders ahead of DWAC merger, potential setback for lucrative dealA merger by Trump’s social media company could net him billions of dollars, a potential lifeline as he faces more than $500 in civil legal judgments. Read more at: https://www.cnbc.com/2024/02/29/trump-media-sued-over-dwac-merger-share-dilution.html |

|

All of AMC’s revenue growth came from Taylor Swift and Beyoncé films, theater chain saysThe movie chain is one of many citing the two concert films’ positive effect on financials. Read more at: https://www.cnbc.com/2024/02/29/all-of-amcs-revenue-growth-came-from-taylor-swift-and-beyonc-films.html |

|

Solana soars more than 12% amid broader crypto rally: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Phil Harvey, CEO of Sabre56, a digital asset mining consultancy, breaks down how bitcoin’s rally impacts miners ahead of April’s halving event. He also explains what it will take for bitcoin miners to survive following that key technical event expected in April. Read more at: https://www.cnbc.com/video/2024/02/29/solana-soars-more-than-12percent-amid-broader-crypto-rally-cnbc-crypto-world.html |

|

Putin warns of nuclear war if NATO sends troops into UkraineRussian President Vladimir Putin warned NATO countries of the danger of a nuclear conflict with Russia if NATO troops were deployed on the ground in Ukraine. Read more at: https://www.cnbc.com/2024/02/29/putins-state-of-the-union-focuses-on-sovereignty-the-west-and-ukraine.html |

|

‘Dune: Part Two’ looks to end box office drought with $80 million openingWhile Warner Bros. is projecting a conservative $65 million debut for “Dune: Part Two,” box office analysts foresee a haul between $70 million and $80 million. Read more at: https://www.cnbc.com/2024/02/29/dune-part-two-hits-theaters-friday-amid-box-office-drought.html |

|

These 3 stocks have outperformed Nvidia over the past 5 years—they’re not Apple or TeslaStocks in midsize companies tend to outperform their larger and smaller counterparts over time. Three have outperformed Nvidia over the past 5 years. Read more at: https://www.cnbc.com/2024/02/29/mid-cap-stocks-that-have-outperformed-nvidia-over-past-5-years.html |

|

Biden Now Says No Gaza Ceasefire Soon, Contradicting His “By Monday” RemarksThe sitting US Commander-in-Chief seems to sometimes just make stuff up on the fly, based on apparently no real information, but just because it sounds good in the moment. Here’s what he said at the start of the week… Biden while in an ice cream shop Tuesday in New York with Seth Meyers was asked by a reporter when he thought a ceasefire could begin, to which he answered he hoped a truce would be implemented within days. “Well, I hope by the beginning of the weekend, by the end of the weekend,” he said. And that’s when offered Monday as the day the warring sides will reach a ceasefire. “My national security adviser tells me that we’re close. We’re close. We’re not done yet. My hope is, by next Monday, we’ll have a ceasefire.” As we reported earlier, Israeli officials and even Hamas seemed to have no idea what he was talking about. Both sides issued statements concerning the Qatar-mediated negotiations process saying they are a long way away from achieving any kind of truce. Biden’s somewhat off the cuff remarks likely even raised eyebrows among his own officials, given the totality of reporting over the last several days has been negative on the prospect of an imminent peace deal and hostage/prisoner swap. And now by week’s end, on Thursday Biden issued the opposite assessment, and even pinpointed his own prio … Read more at: https://www.zerohedge.com/political/biden-now-says-no-gaza-ceasefire-soon-after-his-own-monday-remarks |

|

“I Wrote What!?” – Matt Taibbi Unloads On Google’s ‘AI-Powered Libel Machine’Authored by Matt Taibbi via Racket News, Last night, after seeing chatter about Google/Alphabet’s much-ballyhooed new AI tool, Gemini, I checked for myself. Any product rollout disastrous enough to cause a one-day share drop of 4.4% for a firm with a $1.73 trillion market capitalization must be quite a spectacle, I thought. Matt Walsh’s recap was worth it just for the look on his face. Chuckling to start, by the end of the night I wasn’t laughing, unprepared as I was for certain horrifying if lesser-publicized quirks of “the Gemini era.” Most of Gemini’s initial bad press surrounded the machine’ … Read more at: https://www.zerohedge.com/political/i-wrote-what-matt-taibbi-unloads-googles-ai-powered-libel-machine |

|

Wendy’s Walks Back ‘Surge Pricing’ Report After CEO CommentsFast food giant Wendy’s has refuted reports that they’re going to use ‘surge pricing’ – the practice of raising prices when demand is the highest, after comments by CEO Kirk Tanner, who told market analysts earlier this month that the company would use “dynamic pricing” as part of a $20 million investment in digital menu boards for all restaurants, which will be in operation by the end of 2025.

“Wendy’s will not implement surge pricing, which is the practice of raising prices when demand is highest,” a company spokesperson told Fox News Digital. “We didn’t use that phrase, nor do we plan to implement that practice.” On Tuesday, the company issued a statement following backlash against ‘surge pricing.’ “We didn’t use that phrase, nor do we plan to implement that practice,” the company said. “This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restau … Read more at: https://www.zerohedge.com/economics/wendys-walks-back-surge-pricing-report-after-ceo-comments |

|

Trump Rages After Mainstream Media Follow ‘McCaskill Rule’ On “Mental Midget” Biden’s Use Of False ‘Melania’ StoryAuthored by Jonathan Turley, We recently discussed the call by MSNBC contributor and former Democratic Senator Claire McCaskill for the media to stop fact checking Joe Biden before the election. Some in the media appear to have gotten the McCaskill memo in running the false story repeated by Biden in his interview this week on NBC.

What is particularly striking is that the President is again being accused of spreading disinformation, the very basis used by his Administration to censor critics and groups. His Administration Read more at: https://www.zerohedge.com/political/trump-rages-after-mainstream-media-follow-mccaskill-rule-mental-midget-bidens-use-false |

|

Sainsbury’s cuts 1,500 jobs in bid to reduce costsThe roles will go at its contact centre in Cheshire, in-store bakeries, and some local fulfilment centres. Read more at: https://www.bbc.co.uk/news/business-68434837 |

|

Body Shop to shut 75 stores and cut hundreds of jobsThe retailer will close the sites over the next four to six weeks, but will keep 116 UK shops open. Read more at: https://www.bbc.co.uk/news/business-68433638 |

|

Ocado warns M&S of legal action over food dealThe grocery technology firm claims the retailer owes it a final payment of nearly £191m. Read more at: https://www.bbc.co.uk/news/business-68433637 |

|

Feb Auto Sales: Here’s what to expect from Maruti, Tata Motors & other top automakersStrong double-digit year-on-year (YoY) growth in Feb 2024 is likely for 2W wholesale volumes due to good demand (retails up ~10%) and a favourable base. PV volumes are likely to have grown at a healthy pace led by positive retail trends (retails up ~4%) and inventory build. CVs, though, are likely to have slid in single digits due to weak LCV volumes and a high base. Tractors are likely to have declined by low double digits due to the festival timing and challenges in the west/south. In the near term, the high base would lead to muted CV and tractor growth. Here’s a look at auto sales expectations for top automakers in February. (Data Source: Anand Rathi) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/feb-auto-sales-heres-what-to-expect-from-maruti-tata-motors-amp-other-top-automakers/in-focus/slideshow/108104143.cms |

|

Tech View: Nifty giving non-directional signs. What should traders do on FridayNifty 50 held on to the crucial support zone of 21,900 – 21,850, which coincided with the 20-day moving average and the 50% Fibonacci retracement level of the rise from 21530 – 22249. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-giving-non-directional-signs-what-should-traders-do-on-friday/articleshow/108109745.cms |

|

How Nifty and Bank Nifty performed on leap days over the yearsWith the leap year day on Thursday, here’s a track record of how Nifty and Nifty Bank have moved during these sessions Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-nifty-and-bank-nifty-performed-on-leap-days-over-the-years/slideshow/108109523.cms |

|

Shares of GSI Technology, which sparked meme-like buzz, set for longest winning streak since JulyGSI Technology Inc. shares climbed 11.05% Thursday, putting the memory specialist on pace to extend its winning streak to four days — its longest such streak since July 13, 2023, when it rose for four straight trading days, Dow Jones Market Data show. Read more at: https://www.marketwatch.com/story/shares-of-gsi-technology-which-sparked-meme-like-buzz-set-for-longest-winning-streak-since-july-6edfc10e?mod=mw_rss_topstories |

|

Chemours’s stock plunges on news that accounting issues are much worse than first thoughtChemours’s stock plummeted Thursday as investors learned that the accounting issues they were made aware of two weeks ago were much worse than they had realized. Read more at: https://www.marketwatch.com/story/chemourss-stock-plunges-on-news-that-accounting-issues-are-much-worse-than-first-thought-905aed1b?mod=mw_rss_topstories |

|

Oil prices score back-to-back monthly gainsOil futures failed to shake off weakness during Thursday’s session after a fifth straight monthly rise in U.S. crude inventories, but managed to score back-to-back monthly gains on lingering risks to global supplies. Read more at: https://www.marketwatch.com/story/oil-prices-nudge-higher-attempting-to-shake-off-rise-in-u-s-crude-inventories-d6da729b?mod=mw_rss_topstories |