Summary Of the Markets Today:

- The Dow closed up 48 points or 0.13%,

- Nasdaq closed down 0.32%,

- S&P 500 closed up 0.13%,

- Gold $2,036 down $4.10,

- WTI crude oil settled at $78 up $0.95,

- 10-year U.S. Treasury 4.319% up 0.044 points,

- USD index $103.99 down $0.09,

- Bitcoin $50,915 down $1,020 (2.27%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Minutes of the Federal Open Market Committee for January 30–31, 2024 were issued today, and the highlights are summarized below:

Participants observed that the unexpected strength in real GDP growth in the fourth quarter reflected stronger-than-expected net exports and inventory investment, which tend to be volatile and may carry little signal for future growth. Still, consumption continued to grow at a solid pace. In addition to strong demand, many participants attributed the recent expansion in economic activity to favorable supply developments. Participants noted that the pace of job gains had moderated since early last year but remained strong and that the unemployment rate had remained low. Inflation had eased over the past year but remained elevated.

… Regarding the economic outlook, participants judged that the current stance of monetary policy was restrictive and would continue to put downward pressure on economic activity and inflation. Accordingly, they expected that supply and demand in product and labor markets would continue to move into better balance. In light of the policy restraint in place, along with more favorable inflation data amid ongoing improvements in supply conditions, participants viewed the risks to achieving the Committee’s employment and inflation goals as moving into better balance.

… Participants judged that some of the recent improvement in inflation reflected idiosyncratic movements in a few series. Nevertheless, they viewed that there had been significant progress recently on inflation returning to the Committee’s longer-run goal. Many participants indicated that they expected core nonhousing services inflation to gradually decline further as the labor market continued to move into better balance and wage growth moderated further. Various participants noted that housing services inflation was likely to fall further as the deceleration in rents on new leases continued to pass through to measures of such inflation.

… some participants noted signs that the finances of some households—especially those in the low- and moderate-income categories—were increasingly coming under pressure, which these participants saw as a downside risk to the outlook for consumption. In particular, they pointed to increased usage of credit card revolving balances and buy-now-pay-later services, as well as increased delinquency rates for some types of consumer loans.

… Participants discussed the uncertainty surrounding the economic outlook. As an upside risk to both inflation and economic activity, participants noted that momentum in aggregate demand may be stronger than currently assessed, especially in light of surprisingly resilient consumer spending last year. Furthermore, several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall. Participants also noted some other sources of upside risks to inflation, including possible disruptions to supply chains from geopolitical developments, a potential rebound in core goods prices as the effects of supply-side improvements dissipate, or the possibility that wage growth remains elevated.

… Participants viewed maintaining the current stance of policy as appropriate given the incoming data, which indicated that inflation had continued to move toward the Committee’s 2 percent objective and that demand and supply in the labor market had continued to move into better balance.

… participants judged that the policy rate was likely at its peak for this tightening cycle. They pointed to the decline in inflation seen during 2023 and to growing signs of demand and supply coming into better balance in product and labor markets as informing that view. Participants generally noted that they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainably toward 2 percent.

Here is a summary of headlines we are reading today:

- Geologists Are Predicting a Natural Hydrogen “Gold Rush”

- U.S. Court Ruling Sends Venezuela’s Oil-Backed Bonds into Collapse

- Saudi Arabia Can No Longer Raise Oil Output For Cash

- Canadian Oil and Gas Companies Relinquish All Pacific Coast Permits

- Fed officials expressed caution about lowering rates too quickly at last meeting, minutes show

- Nasdaq Composite closes lower for a 3rd day as investors brace for Nvidia earnings: Live updates

- Stocks making the biggest moves midday: Nvidia, SolarEdge, Teladoc, Wingstop and more

- Mortgage demand takes a massive hit as interest rates cross back over 7%

- FOMC Minutes Show ‘Most Officials Fear Risk Of Cutting Too Quickly’, Staff Mention Financial Stability Issues

- 10-, 30-year Treasury yields end at highest levels since November following ugly 20-year bond auction, Fed minutes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Geologists Are Predicting a Natural Hydrogen “Gold Rush”Speaking this weekend at a Denver meeting of the American Association for the Advancement of Science, geologists heralded a coming, game-changing surge in mankind’s harvesting of a resource long thought impractical to collect: naturally-occurring or “geologic hydrogen.” The scientists provided a first look at the findings of an as-yet-unpublished study performed by the US Geological Survey (USGS). The key takeaway: naturally-occurring hydrogen is far more abundant near the Earth’s surface than previously known. Researchers say the planet… Read more at: https://oilprice.com/Energy/Energy-General/Geologists-Are-Predicting-a-Natural-Hydrogen-Gold-Rush.html |

|

The Armenia-Azerbaijan Diplomatic Dance ContinuesArmenian Prime Minister Nikol Pashinyan and Azerbaijani President Ilham Aliyev met in Munich on February 17 with the mediation of German Chancellor Olaf Scholz. According to Azerbaijan’s APA news agency, Scholz left the room at some point and the meeting continued in bilateral format. Afterwards, the sides expressed satisfaction with the meeting but offered few specifics on a way forward. It was the first meeting between the two leaders since last July, though they did have a brief encounter at a CIS summit in December. … Read more at: https://oilprice.com/Geopolitics/International/The-Armenia-Azerbaijan-Diplomatic-Dance-Continues.html |

|

U.S. Court Ruling Sends Venezuela’s Oil-Backed Bonds into CollapseA day after a New York court ruling that Venezuelan law would determine the validity of bonds issued by state-run PDVSA oil company, Bloomberg reports that bonds have “collapsed”, slumping on questions over their validity. At stake is $2 billion in PDVSA bonds, and PDVSA notes dropped 17 cents following Tuesday’s ruling, according to Bloomberg. On Tuesday, the New York State Court of Appeals ruled on the matter after Venezuelan opposition, which controls the state-run oil company’s U.S. assets, said the bonds set to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Court-Ruling-Sends-Venezuelas-Oil-Backed-Bonds-into-Collapse.html |

|

Supply Chain Challenges Could Boost Air Cargo DemandBy Eric Kulisch of FreightWaves Air Canada expects the slow recovery in cargo volume that began in the fourth quarter to quicken in 2024, aided by the addition of two more freighter aircraft, but doesn’t anticipate gains in pricing power, Mark Galardo, executive vice president for network planning and revenue management, said Friday. The cargo division within Air Canada (TSX: AC) currently operates five converted and two factory-built Boeing 767-300 freighters. It is scheduled this year to receive two cargo jets converted from passenger configuration,… Read more at: https://oilprice.com/Finance/the-Economy/Supply-Chain-Challenges-Could-Boost-Air-Cargo-Demand.html |

|

Armed Group Shuts Down Libya’s Zawiya RefineryAn armed group has taken control of and shut down Libya’s Al-Zawiya refinery and two oil complexes, demanding unpaid salaries and other benefits, Libya media report. The armed group, the Petroleum Facilities Guard (PFG), said in a Tuesday video statement that the refinery operators have five days to comply with their requests or face more closures from other PFG members at key facilities around Libya. The Mellitah and Misrata oil complexes have also been shut down by the PFG. This latest shutdown comes only a month after… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Armed-Group-Shuts-Down-Libyas-Zawiya-Refinery.html |

|

U.S. Aluminum Market Roiled by Closure of Major SmelterFollowing a 4.7% month-over-month decline during January, aluminum prices fell an additional 1.9% throughout the first half of February. Despite these declines, aluminum prices continued to trade in their long-term sideways range. Meanwhile, the Midwest Premium also remains consolidated, with prices retracing to the downside following a short-lived bounce at the end of January. Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, with a modest 1.8% decline from January to February. Aluminum Prices, Premium Market Shakes Off Smelter… Read more at: https://oilprice.com/Metals/Commodities/US-Aluminum-Market-Roiled-by-Closure-of-Major-Smelter.html |

|

Sri Lanka Pays Partial Oil Debt to Iran with $20M in Ceylon TeaSri Lanka has repaid $20 million in oil debt to Iran with tea in a move that Sri Lanka officials say do not violate U.S. sanctions on Iran, Agence France Presse reports. In April 2022, Sri Lanka defaulted on $46 billion in foreign debt, earning a $2.9-billion bailout from the International Monetary Fund (IMF), and leaving it bereft of cash to pay its oil debt to Iran. Sri Lanka owes a total of $251 million in oil debt to Iran, of which $20 million has now been paid in the form of tea. “So far US$20 million worth of tea has… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sri-Lanka-Pays-Partial-Oil-Debt-to-Iran-with-20M-in-Ceylon-Tea.html |

|

Saudi Arabia Can No Longer Raise Oil Output For CashLast year, Saudi Arabia’s sovereign wealth fund became the world’s top spender, accounting for a quarter of the $124 billion that sovereign wealth funds invested in total. Saudi Arabia has been spending heavily both abroad and at home—the home of the world’s megaprojects, such as the $500-billion futuristic Neom project and a whole new airline, among others. As a result, last year, the Public Investment Fund’s cash and treasury assets slimmed from over $105 billion in 2022 to some $37 billion as of September,… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Can-No-Longer-Raise-Oil-Output-For-Cash.html |

|

Turkish Firm Signs 1 GWh Energy Storage Deal With China’s HarbinTurkey’s engineering group Kontrolmatik signed on Wednesday an agreement with a Chinese firm to build a wind farm and a 1 GWh energy storage facility in western Turkey, worth more than $600 million. Kontrolmatik’s unit Progresiva Enerji Yatirimlari Ticaret signed the deal with electric power plant equipment manufacturer Harbin Electric International (HEI), a unit of China’s Harbin Electric Co Ltd, at a ceremony in Ankara today. The investment for the 1 GWh energy storage facility is estimated in the range between $350… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkish-Firm-Signs-1-GWh-Energy-Storage-Deal-With-Chinas-Harbin.html |

|

Venezuela’s Oil Output Could See Moderate BoostEconomic history dictates that the last leg of any battle against high inflation is the hardest, and so it is proving in the United States. Consumer price inflation remains sticky, increasing the likelihood that the Federal Reserve will have to engineer a so-called ‘hard landing’ (read recession) to bring inflation back to within its target range. Persistent high inflation or a recession – or both – are bad news for President Biden as he seeks reelection later this year against a resurgent Donald Trump. Increasingly bleak geopolitics… Read more at: https://oilprice.com/Energy/Crude-Oil/Venezuelas-Oil-Output-Could-See-Moderate-Boost.html |

|

Deutsche Bank Sees Brent Oil Price at $88 by the End of 2024A nearly balanced market in the first half of the year and seasonal strengthening of demand in the second half are set to push the price of Brent Crude to $88 per barrel by the end of 2024, according to analysts at Deutsche Bank. “We look for continued OPEC+ discipline in a nearly balanced market for H1, and seasonal strength in H2,” the bank’s strategists wrote in a note on Wednesday carried by FXStreet. With the OPEC+ cuts in the first half of 2024, Deutsche Bank sees little upside to its H1 forecast of $83 per… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Deutsche-Bank-Sees-Brent-Oil-Price-at-88-by-the-End-of-2024.html |

|

China’s EV Growth Set To Explode in 2024The electric vehicle (EV) market is on track for a watershed year in 2024 as emissions reduction targets clash with falling consumer spending amid enduring economic uncertainty. Rystad Energy research forecasts 17.5 million EV sales this year, an 18.5% annual increase. As a result, the share of new car sales that are either battery electric (BEV) or plug-in hybrid electric vehicles (PHEV) will increase from 19.2% in 2023 to around 21.8% at the end of 2024. China will play a significant role in the market’s continued expansion thanks to sizeable… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-EV-Growth-Set-To-Explode-in-2024.html |

|

Canadian Oil and Gas Companies Relinquish All Pacific Coast PermitsCanada is celebrating a milestone as oil and gas companies have now voluntarily relinquished the last remaining permits for oil and gas exploration and development off its Pacific Coast. Canada has a federal moratorium on all offshore oil and gas activities on its West Coast in place since 1972, following a provincial moratorium by British Columbia on oil and gas drilling from 1959. However, permits issued before 1972 were still valid. Now that Chevron relinquished the last remaining oil and gas development permits offshore Western Canada, the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-Oil-and-Gas-Companies-Relinquish-All-Pacific-Coast-Permits.html |

|

German Natural Gas Giant to Invest Heavily in Hydrogen InfrastructureGermany’s state-controlled firm Securing Energy for Europe (Sefe) plans to invest around $540 million (500 million euros) in repurposing some of its underground gas storage sites and gas pipelines into infrastructure fit for storing and transporting green hydrogen, Sefe’s CEO Egbert Laege told Reuters in an interview published on Wednesday. “The exact investment calculation is not yet available, but we are talking about sums in the mid-three-digit million-euro range for converting some of our gas storage sites… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Natural-Gas-Giant-to-Invest-Heavily-in-Hydrogen-Infrastructure.html |

|

EU Okays Additional Sanctions on Russia After Navalny’s DeathThe European Union on Wednesday agreed in principle on a new, 13th, package of sanctions against Russia for its invasion of Ukraine, days after the death of opposition leader Alexey Navalny in a Russian prison. The EU aims to vote on the package in time for February 24, which marks the second anniversary of the war, Belgium, which holds the rotating EU presidency, said today. “This package is one of the broadest approved by the EU. It will undergo a written procedure and be formally approved for the 24 February,” the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Okays-Additional-Sanctions-on-Russia-After-Navalnys-Death.html |

|

Fed officials expressed caution about lowering rates too quickly at last meeting, minutes showThe Federal Reserve on Wednesday released minutes from its Jan. 30-31 meeting. Read more at: https://www.cnbc.com/2024/02/21/fed-minutes-january-2024.html |

|

Nvidia set to report fourth-quarter earnings after the bellNvidia has been the primary beneficiary of the obsession with large AI models, which are developed on the company’s pricey graphics processors for servers. Read more at: https://www.cnbc.com/2024/02/21/nvidia-nvda-earnings-report-q4-2024.html |

|

Palo Alto Networks shares drop most since 2012 IPOWhile the demand picture hasn’t changed, Palo Alto Networks will take a hit as it tries to get clients using multiple products to combat “spending fatigue.” Read more at: https://www.cnbc.com/2024/02/21/palo-alto-networks-stock-on-pace-for-worst-day-since-2012-ipo.html |

|

Nasdaq Composite closes lower for a 3rd day as investors brace for Nvidia earnings: Live updatesInvestors await the release of Nvidia’s latest quarterly results, due Wednesday after the bell. Read more at: https://www.cnbc.com/2024/02/20/stock-market-today-live-updates.html |

|

The Nvidia trade looks crowded ahead of the chipmaker’s earnings report, according to the chartsNvidia has been awarded the flagship status of companies leading the artificial intelligence revolution, and all eyes turn to fourth-quarter earnings. Read more at: https://www.cnbc.com/2024/02/21/the-nvidia-trade-looks-crowded-ahead-of-the-chipmakers-earnings-report-according-to-the-charts.html |

|

Here’s why Capital One is buying Discover in the biggest proposed merger of 2024Capital One is betting that owning a global payments network protects it against a rising tide of fintech and regulatory threats. Read more at: https://www.cnbc.com/2024/02/21/why-capital-one-is-buying-discover-in-the-biggest-merger-yet-of-2024.html |

|

Biden administration to forgive $1.2 billion in student debt for over 150,000 borrowersThe Biden administration said on Wednesday that it would forgive $1.2 billion in student debt for 150,000 borrowers enrolled its new repayment plan. Read more at: https://www.cnbc.com/2024/02/21/biden-to-forgive-1point2-billion-in-student-debt-for-150000-borrowers.html |

|

Winklevoss twins donate nearly $5 million to crypto super PAC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ryan Jones, senior director of product management at Consensys, the developer of the self-custodial crypto wallet MetaMask, discusses a new feature focused on enhancing security for wallet users. Read more at: https://www.cnbc.com/video/2024/02/21/winklevoss-twins-donate-nearly-5-million-crypto-super-pac-cnbc-crypto-world.html |

|

Boeing replaces head of troubled 737 Max programBoeing replaced the head of its troubled 737 program after a fuselage panel blew midair during an Alaska Airlines flight last month. Read more at: https://www.cnbc.com/2024/02/21/boeing-replaces-head-of-troubled-737-max-program.html |

|

Stocks making the biggest moves midday: Nvidia, SolarEdge, Teladoc, Wingstop and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/02/21/stocks-making-the-biggest-moves-midday-nvda-sedg-tdoc-wing-and-more.html |

|

Mortgage demand takes a massive hit as interest rates cross back over 7%Applications for a mortgage to purchase a home fell 10% last week as interest rates surged to the highest level since early December. Read more at: https://www.cnbc.com/2024/02/21/mortgage-demand-takes-a-massive-hit-as-interest-rates-cross-back-over-7percent.html |

|

52% of Black Americans say homeownership is a mark of success, report finds. But it can conflict with other goalsWhile homeownership is a path to build wealth, a mortgage payment and other housing-related expenses can cause financial strain. Read more at: https://www.cnbc.com/2024/02/21/homeownership-is-a-hallmark-of-success-for-many-black-adults.html |

|

IRS to begin ‘dozens of new audits’ of corporate jets in crackdown of corporations, higher earnersThe IRS plans “dozens of new audits” of corporate jet usage as part of its increased scrutiny of large corporations, complex partnerships and top earners. Read more at: https://www.cnbc.com/2024/02/21/irs-to-crack-down-on-corporate-jets-used-for-personal-travel.html |

|

The Pitfalls Of Central PlanningAuthored by Charles Hugh Smith via OfTwoMinds blog, If Central Planning can’t expand its power, it expands its budget, at the expense of its programs.

Central Planning has an ominous totalitarian undertone, but there is a place for it in the social toolbox. The federal Interstate highway system was central planning, and so is Social Security. Many view America’s patchwork electrical grid as not serving the national interest or its citizenry, and a dose of central planning to expand the grid’s resilience and capacity might be the best way forward. But like all tools, central planning has intrinsic limits and flaws. In The U.S. Housing Market: Rent-Serfs and Artificial Scarcity and my weekend Musings Report for subscribers, I laid out the fatal flaws intrinsic to unfe … Read more at: https://www.zerohedge.com/political/pitfalls-central-planning |

|

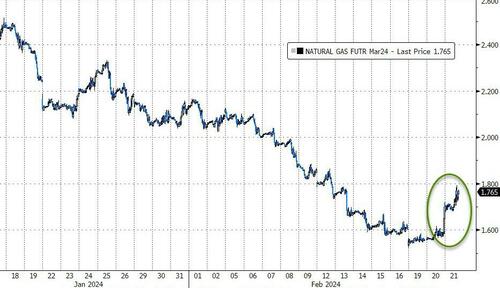

NatGas Soars After Chesapeake Cuts Production Outlook Amid Vicious Bear MarketWith US natural gas prices crashing to lows not seen since early Covid in recent days, around $1.60 per million British thermal units, major shale producer Chesapeake Energy announced in a Tuesday earnings report that it would decrease the number of drilling rigs to reduce production this year. As a result, NatGas futures soared. Futures for next-month delivery jumped more than 12% to $1.77 in early afternoon trading on Wednesday.

This followed news from Chesapeake:

|

|

ChatGPT Had A Public Meltdown But OpenAI Says It’s Fine NowAuthored by Tristan Greene via Cointelegraph, OpenAI’s popular ChatGPT artificial intelligence (AI) system suffered a bit of a public meltdown between Feb. 20 and 21 that had it confusing and confounding users by spouting gibberish and other strangeness including unprompted pseudo-Shakespeare.

As of 8:14 Pacific Standard Time Feb. 21, the problem has apparently been solved. The latest update on OpenAI’s Status page indicates that “ChatGPT is operating normally.” This indicates that the problem was solved 18 hours after OpenAI first reported it.

|

|

FOMC Minutes Show ‘Most Officials Fear Risk Of Cutting Too Quickly’, Staff Mention Financial Stability IssuesThe Fed is worried about cutting too soon more than waiting too long…

And the higher stocks go, and lower crediot spreads go, the less urgency the need for a rate-cut:

So, be careful what you wish for. * * * Since the last FOMC meeting, on January 31st, Bitcoin has been the outstanding performer. Bonds have traded lower in price since then while stocks have outperformed with the dollar and gold BOTH UP modestly. Read more at: https://www.zerohedge.com/markets/fomc-minutes-7 |

|

Sarah Munby: Top civil servant hits out in Post Office compensation rowSarah Munby has claimed she never told the former Post Office chairman to delay compensation. Read more at: https://www.bbc.co.uk/news/uk-politics-68357074?at_medium=RSS&at_campaign=KARANGA |

|

Starmer demands answers about BBC Horizon storyRishi Sunak was asked at PMQs about axed 2016 investigation which might have cleared postmasters sooner. Read more at: https://www.bbc.co.uk/news/business-68362392?at_medium=RSS&at_campaign=KARANGA |

|

Google to fix AI picture bot after ‘woke’ criticismUsers fault Gemini for generating diverse images in inappropriate historical contexts. Read more at: https://www.bbc.co.uk/news/business-68364690?at_medium=RSS&at_campaign=KARANGA |

|

These 5 Nifty500 stocks saw highest increase in promoter pledge in Q3Here is a look at companies from the Nifty500 pack where pledged shares by promoters have increased on a sequential basis. (Data Source: Trendlyne) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-nifty500-stocks-saw-highest-increase-in-promoter-pledge-in-q3/red-flag/slideshow/107881427.cms |

|

China tightens grip on stocks with net sale ban at open, closeThe China Securities Regulatory Commission, led by newly appointed Chairman Wu Qing, has also created a task force with the nation’s stock exchanges to monitor short selling and issue warnings to firms that profit from the wagers, sources said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/china-tightens-grip-on-stocks-with-net-sale-ban-at-open-close/articleshow/107890418.cms |

|

Tech View: Nifty forms bearish engulfing pattern ahead of expiry. What traders should do on ThursdayThe bullish chart pattern like higher tops and bottoms continued as the per daily timeframe chart and Wednesday’s swing high of 22,249 could now be considered as a new higher top of the sequence. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-engulfing-pattern-ahead-of-expiry-what-traders-should-do-on-thursday/articleshow/107887557.cms |

|

Forget the billions. How much will climate change really cost your family?More than half of U.S. adults say they have incurred costs due to an extreme weather event over the past 10 years. Read more at: https://www.marketwatch.com/story/forget-the-billions-how-much-will-climate-change-really-cost-your-family-8490e0e5?mod=mw_rss_topstories |

|

10-, 30-year Treasury yields end at highest levels since November following ugly 20-year bond auction, Fed minutesTreasurys sold off on Wednesday, pushing long-term rates to their highest levels in almost three months, following a weak $16 billion sale of 20-year bonds and the release of minutes from the Federal Reserve’s January policy meeting. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-as-traders-await-fed-minutes-d6d3651b?mod=mw_rss_topstories |

|

Palo Alto Networks’ stock sinks toward worst day on record upon ‘abrupt pivot’Palo Alto Networks will give some product away for free for the time being in an attempt to grow long-term adoption of its “platform.” Read more at: https://www.marketwatch.com/story/palo-alto-networks-stock-sinks-toward-worst-day-on-record-upon-abrupt-pivot-ba459b02?mod=mw_rss_topstories |