Summary Of the Markets Today:

- The Dow closed up 349 points or 0.91%,

- Nasdaq closed up 0.30%,

- S&P 500 closed up 0.58%,

- Gold $2,016 up $12.10,

- WTI crude oil settled at $78 up $1.53,

- 10-year U.S. Treasury 4.234% down 0.031 points,

- USD index $104.28 down $0.44,

- Bitcoin $51,790 up $78 (0.15%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

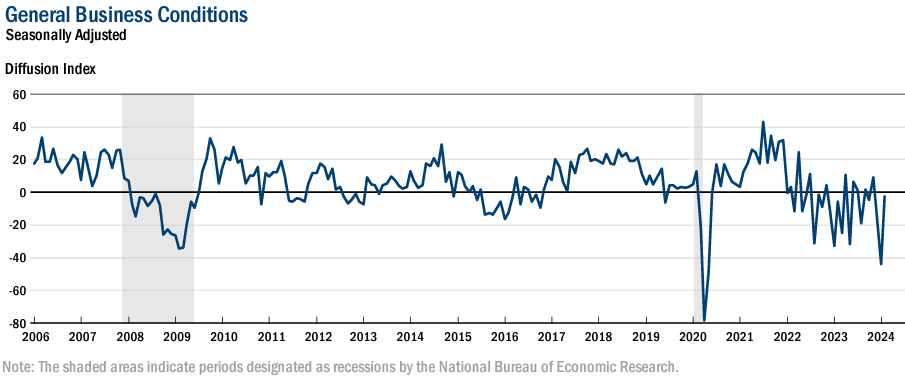

The Philly Fed February 2024 Manufacturing Business Outlook Survey shows manufacturing improved with the current general activity and shipments rose and turned positive. The indicator for new orders also rose but remained negative. I am not a fan of the Philly Fed survey as it has a lot of noise.

The New York Fed’s February 2024 Empire State Manufacturing Survey general business conditions index rose forty-one points but remained negative at -2.4. New orders declined modestly, while shipments edged higher. Unfilled orders continued to shrink, and delivery times continued to shorten.

The January 2024 Industrial Production from the Federal Reserve shows Industrial Production has no growth year-over-year with components manufacturing down 0.9% year-over-year, mining down 1.2% year-over-year, and utilities up 9.0% year-over-year. Manufacturing remains in a recession.

Retail trade sales in January 2024 were up 0.6% above January 2023 – and literally no growth inflation-adjusted. Inflation-adjusted retail sales have essentially not grown over the past year.

In the week ending February 10, the advance figure for seasonally adjusted unemployment initial claims 4-week moving average was 218,500, an increase of 5,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 212,250 to 212,750.

Import prices declined 1.3% year-over-year and export prices declined 2.4% year-over-year. The disinflation of export and import prices can be laid on the general weakness of the global economy.

Here is a summary of headlines we are reading today:

- U.S. House Passes Reversal Of Biden’s LNG Export Ban

- Hot off Nickel Fraud, Trafigura Faces Big Losses in Mongolia Oil

- Trump Vows to Block U.S. Steel Acquisition

- Buffett’s Berkshire Increases Stake in Chevron and Occidental

- BofA: Oil Demand Growth Has Peaked

- Banking Giant JP Morgan Exits Climate Action Group

- S&P 500 closes at record high, Dow gains 300 points in late-day rally: Live updates

- Shake Shack stock surges 20% on fourth-quarter profit, strong 2024 outlook

- Crypto venture funding climbs for first time in nearly 2 years after bitcoin’s stellar run

- Yield-Curve Bear-Steepening Spells Trouble For Markets

- Treasury yields drop for 2nd straight day after weaker-than-expected January retail sales

- Oil prices finish higher, back on track for gains for the week

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

European Commission Downgrades Growth Forecast for 2024Growth in the eurozone will be slower than previously expected as the bloc continues to struggle with inflationary pressures and high interest rates, according to new forecasts from the European Commission. The eurozone is now predicted to grow 0.8 per cent in 2024, downgraded from 1.2 percent in its previous round of forecasts in November. However, this is still an improvement on the 0.5 percent rise in 2023. Its post-pandemic rebound came to “an abrupt end” last year in the face of the European Central Bank’s rapid rise in interest… Read more at: https://oilprice.com/Finance/the-Economy/European-Commission-Downgrades-Growth-Forecast-for-2024.html |

|

EU Not Interested in Extending Russian Gas Transit Deal via UkraineThe European Union (EU) has “no interest” in extending the transit agreement for Russian natural gas supply to EU countries via Ukraine, EU Energy Commissioner Kadri Simson said on Thursday. The gas transit deal, with which EU members including Austria and Slovakia receive Russian gas via a route crossing Ukraine, expires at the end of 2024. “We have no interest to prolong the trilateral gas transit agreement with Russia, which will expire by the end of this year,” Commissioner Simson told a meeting of an EU Parliament… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Not-Interested-in-Extending-Russian-Gas-Transit-Deal-via-Ukraine.html |

|

U.S. House Passes Reversal Of Biden’s LNG Export BanThe U.S. House voted and passed a measure to take away the Biden Administration’s ability to pause the approval of new LNG exports to large markets. The vote, which took place on Thursday, is designed to grant only the Federal Energy Regulatory Commission the authority to approve new LNG exports within the United States—meaning that the Biden Administration’s Department of Energy would no longer have the authority to stand in the way of new approvals. But while the measure passed in the Republic-led House, it may run up against… Read more at: https://oilprice.com/Latest-Energy-News/World-News/House-Passes-Reversal-Of-Bidens-LNG-Export-Ban.html |

|

Uzbekistan Looks to Phase Out Polluting Gasoline ProductionIn an attempt to show that they are finally taking heed of the rapidly aggravating problem of air pollution, authorities in Uzbekistan have slapped fines on two major state-run power plants for causing harm to the environment. Tashkent thermal power plant, or TTP, and the Novo-Angren TPP will in aggregate be required to pay 2 billion sums (about $160,000) for flouting air quality standards, failure to comply with proper waste disposal protocols and oil spillages. The penalties levied earlier this month by the Ecology Ministry came amid growing… Read more at: https://oilprice.com/The-Environment/Global-Warming/Uzbekistan-Looks-to-Phase-Out-Polluting-Gasoline-Production.html |

|

Hot off Nickel Fraud, Trafigura Faces Big Losses in Mongolia OilOil trading giant Trafigura has agreed to debt repayment plans with its oil products customers in Mongolia, which will lead to significant losses for the trader in Mongolia, Bloomberg reported on Thursday, saying the losses could be in the hundreds of millions of dollars. “We have been trading oil and metals in Mongolia for a number of years. We have a good track record of successfully recovering debts from counterparts in emerging markets,” Bloomberg cited a Trafigura spokesperson as saying. The spokesperson refrained from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hot-off-Nickel-Fraud-Trafigura-Faces-Big-Losses-in-Mongolia-Oil.html |

|

Trump Vows to Block U.S. Steel AcquisitionVia Metal Miner The Raw Steels Monthly Metals Index (MMI) fell 11.17% from January to February as steel prices declined. U.S. flat rolled steel prices continued to slide after finding a peak at the close of 2023. Following a 2% decline throughout January, hot rolled coil prices fell over 5% during the first half of February. HRC prices now sit at the $1,000/st mark, as bearish momentum appeared to accelerate in recent weeks. Producer Q4 Results Show Lower Volume Despite Steel Prices Uptrend In their late January quarterly financial statement releases,… Read more at: https://oilprice.com/Metals/Commodities/Trump-Vows-to-Block-US-Steel-Acquisition.html |

|

Firms Hike Spending on Oil and Gas Activity Offshore Norway in 2024Total investments in oil and gas activity offshore Norway, including pipeline transportation, are estimated to hit $23 billion (244 billion Norwegian crowns) this year, up by 5% compared to last quarter’s assessment, Statistics Norway said on Thursday. The latest forecast for 2024 for the sectors oil and gas, manufacturing, mining and quarrying, and electricity supply now suggests investments in these sectors combined would jump by around 30% this year compared to 2023. Last year, total investments in oil and gas extraction… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Firms-Hike-Spending-on-Oil-and-Gas-Activity-Offshore-Norway-in-2024.html |

|

Redox Flow Desalination Offers Potable Water and Energy StorageResearchers at NYU Tandon School of Engineering achieved a major breakthrough in Redox Flow Desalination (RFD), an emerging electrochemical technique that can turn seawater into potable drinking water and also store affordable renewable energy. In a paper published in Cell Reports Physical Science, the NYU Tandon team led by Dr. André Taylor, professor of chemical and biomolecular engineering and director of DC-MUSE (Decarbonizing Chemical Manufacturing Using Sustainable Electrification), increased the RFD system’s salt removal rate… Read more at: https://oilprice.com/Energy/Energy-General/Redox-Flow-Desalination-Offers-Potable-Water-and-Energy-Storage.html |

|

Buffett’s Berkshire Increases Stake in Chevron and OccidentalIn what was a rather uneventful quarter for Warren Buffett’s Berkshire Hathaway, the massive hedge fund made only a few modest changes to its portfolio in Q4 2023, which as of Dec 31, 2023 was valued as $347.4 billion (at least the long book, short positions don’t have to be disclosed). Among the notable changes, Berkshire sold out of its entire stake in homebuilder DR Horton (valued at $641MM in Q3), Markel ($234MM), StoneCo ($114MM) and Globe Life ($90MM). The fund also reduced its holdings in its top position Apple, by 10 million shares, cutting… Read more at: https://oilprice.com/Finance/the-Markets/Buffetts-Berkshire-Increases-Stake-in-Chevron-and-Occidental.html |

|

U.S. and EU Discuss New “Robust Anniversary” Sanctions on RussiaThe United States and the EU, together with partners, discussed this week the potential of slapping “robust” new sanctions on Russia ahead of the second anniversary of the Russian invasion of Ukraine, a senior U.S. official told Reuters. The partners met in Brussels and “Many of us are prepared to roll out quite robust anniversary packages,” the official told Reuters, as the anniversary of the February 24, 2022 invasion approaches. At the Brussels meeting, the U.S., the EU, the UK, and other partners took stock… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-and-EU-Discuss-New-Robust-Anniversary-Sanctions-on-Russia.html |

|

Eni Drills New Well Offshore Cyprus As It Looks To Fast-Track Gas DiscoveryEni has completed the drilling of a second appraisal well at the Cronos natural gas discovery offshore Cyprus, estimating additional production capacity as it looks to fast-track development of the field, the Italian energy major said on Thursday. The production test at the Cronos-2 well showed an estimate of production capacity in excess of 150 million standard cubic feet per day (MMSCFD), which “is instrumental in progressing with the studies to select the best fast-track development option,” Eni said. “Together… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Eni-Drills-New-Well-Offshore-Cyprus-As-It-Looks-To-Fast-Track-Gas-Discovery.html |

|

BofA: Oil Demand Growth Has PeakedGlobal oil demand continues to rise and will keep increasing for years, but the annual rate growth may have already peaked, according to Bank of America. Electrification of transport, energy efficiency, and slower economic growth would all combine to cap the growth rate in the coming years as demand growth is returning to more moderate levels from before the Covid slump. In the three years following the pandemic hit to demand, global oil consumption saw a strong rebound as economies reopened and people returned to their typical ways of travel and… Read more at: https://oilprice.com/Energy/Crude-Oil/BofA-Oil-Demand-Growth-Has-Peaked.html |

|

Europe’s Battery Storage Boom Is An $84 Billion Investment OpportunityEurope is set for a boom in battery storage installations with grid-scale capacity expected to jump sevenfold by the end of this decade and represent $84 billion (78 billion euros) in total investment opportunities through 2050, Aurora Energy Research said in a new report this week. As a key enabler of renewables rollout, battery storage is set for a massive acceleration by 2030, according to Aurora Energy Research’s European Battery Markets Attractiveness Report, which examines 24 countries to determine which offer the most attractive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Battery-Storage-Boom-Is-An-84-Billion-Investment-Opportunity.html |

|

Banking Giant JP Morgan Exits Climate Action GroupJP Morgan Asset Management has left the Climate Action 100+ group that was set up to pressure companies into becoming greener. The reason for the move, per the Financial Times, is that the bank’s asset management arm believes it has accumulated the expertise to push companies into climate action on its own. “The firm has built a team of 40 dedicated sustainable investing professionals,” a spokeswoman for JP Morgan Asset Management told the FT. “Given these strengths and the evolution of its own stewardship capabilities,… Read more at: https://oilprice.com/The-Environment/Global-Warming/Banking-Giant-JP-Morgan-Exits-Climate-Action-Group.html |

|

Woodside Energy’s $1.5 Billion Impairment Stirs ConcernsWoodside Energy expects to book non-cash post-tax asset impairment charges of $1.5 billion for its 2023 fiscal year, mostly due to impairment for the Shenzi field in the Gulf of Mexico, which Australia’s top energy company bought as part of the merger with BHP’s petroleum assets in 2022. Of the expected $1.5 billion impairments, about $1.2 billion is related to the Shenzi oil and gas field offshore Louisiana, which accounted for around 5% of Woodside’s production in 2023, the company said in a statement on Thursday. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Woodside-Energys-15-Billion-Impairment-Stirs-Concerns.html |

|

S&P 500 closes at record high, Dow gains 300 points in late-day rally: Live updatesStocks rose Thursday as Wall Street rebounded from Tuesday’s big sell-off, although weaker-than-expected retail sales figures dampened sentiment. Read more at: https://www.cnbc.com/2024/02/14/stock-market-today-live-updates.html |

|

Ford CEO tells Wall Street to forget Tesla, says ‘Pro’ business is the future of the auto industryFord Pro is made up of the automaker’s traditional fleet and commercial businesses as well as emerging telematics, logistics and other connective operations. Read more at: https://www.cnbc.com/2024/02/15/ford-ceo-forget-tesla-pro-unit-is-auto-industrys-future.html |

|

Nvidia holdings disclosure pumps up shares of small AI companiesA filing from Nvidia late Wednesday shows the chipmaker has stakes in a handful of public companies. Read more at: https://www.cnbc.com/2024/02/15/nvidia-holdings-disclosure-pumps-up-shares-of-small-ai-companies.html |

|

Shake Shack stock surges 20% on fourth-quarter profit, strong 2024 outlookFor 2024, Shake Shack expects to grow total revenue by 11% to 15% and open 80 new restaurants. Read more at: https://www.cnbc.com/2024/02/15/shake-shack-shak-earnings-q4-2023.html |

|

This type of ETF offers portfolio income along with some complexity. How to determine if it’s right for youSo-called derivative income funds gathered $22 billion in flows last year, according to Morningstar. Read more at: https://www.cnbc.com/2024/02/15/this-type-of-etf-offers-portfolio-income-along-with-some-complexity.html |

|

Microsoft will bring four Xbox games to other companies’ consolesMicrosoft said Thursday that it will release four of its video games on competing consoles, signaling a shift in strategy. Read more at: https://www.cnbc.com/2024/02/15/microsoft-will-bring-four-xbox-games-to-other-companies-consoles.html |

|

Wells Fargo says regulator has lifted a key penalty tied to its 2016 fake accounts scandalThe Office of the Comptroller of the Currency terminated a consent order that forced Wells Fargo to revamp how it sells its retail products and services. Read more at: https://www.cnbc.com/2024/02/15/wells-fargo-says-consent-order-tied-to-2016-scandal-lifted.html |

|

After ChatGPT’s viral success, OpenAI is now getting into videoOpenAI announced Thursday it has expanded beyond text and images to offer video-generation AI for the first time. Read more at: https://www.cnbc.com/2024/02/15/after-chatgpts-viral-success-openai-is-now-getting-into-video.html |

|

Crypto venture funding climbs for first time in nearly 2 years after bitcoin’s stellar runIt marks the first time that venture VC investments in crypto startups have risen since the March quarter of 2022. Read more at: https://www.cnbc.com/2024/02/15/crypto-vc-funding-climbs-for-first-time-in-2-years-after-bitcoin-rally.html |

|

Ether trades above $2,800 for the first time since May 2022: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Robert Le, a crypto analyst with PitchBook, breaks down the findings of the data firm’s Q4 crypto report, which revealed a slight uptick in venture capital funding, marking a modest recovery after six quarters of decline. Read more at: https://www.cnbc.com/video/2024/02/15/ether-trades-above-2800-first-time-since-may-2022-cnbc-crypto-world.html |

|

Trump Georgia DA Fani Willis takes the stand as judge considers whether to disqualify herA Georgia judge presiding over criminal charges against Donald Trump is hearing arguments about whether to disqualify District Attorney Fani Willis. Read more at: https://www.cnbc.com/2024/02/15/trump-georgia-case-judge-considers-whether-to-disqualify-da-fani-willis.html |

|

IRS weighing ‘audit selection algorithm’ changes for low-income taxpayer creditThe IRS is addressing issues that have led to a higher audit rate for filers claiming the earned income tax credit. Here’s what to know. Read more at: https://www.cnbc.com/2024/02/15/irs-weighing-audit-selection-algorithm-changes-for-low-income-credit.html |

|

Starboard Value’s Jeffrey Smith firms up activist bet on GoDaddy, trims winning Salesforce stakeStarboard Value’s Jeff Smith added to his GoDaddy holding last quarter while continuing to trim his lucrative bet in Salesforce, according to a filing. Read more at: https://www.cnbc.com/2024/02/15/starboard-values-jeffrey-smith-firms-up-activist-bet-on-godaddy-trims-winning-salesforce-stake.html |

|

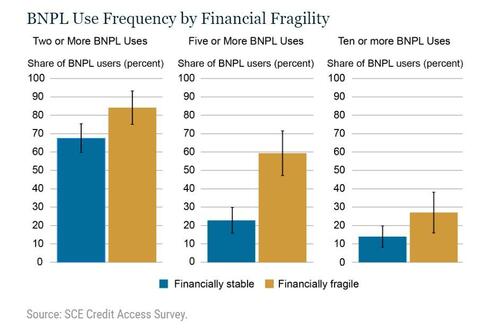

Many Are Addicted To “Buy Now, Pay Later” Plans, It’s A Big TrapAuthored by Mike Shedlock via MishTalk.com, Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

The office of the Comptroller of the Currency defines BNPL as “loans that are payable in four or fewer installments and carry no finance charges.” They are generally offered to online shoppers at checkout. The New York Fed discusses How and Why Do Consumers Use “Buy Now, Pay Later”?

|

|

Israel Kills Elite Hezbollah Commander, But Unleashes Single Deadliest Day For Lebanese CiviliansIsrael on Thursday announced that it killed a senior commander of Hezbollah’s elite Radwan Force, identified as Ali al-Debs, along with at least two other fighters in his group. The Israel Defense Forces (IDF) said the commander was taken out “in a precise air strike carried out by an IDF (Israeli army) aircraft on a Hezbollah military structure in Nabatiyeh,” in southern Lebanon on Wednesday. By Wednesday’s end it became clear it was the single deadliest day for Lebanese civilians since the start of border fighting after Oct.7.

“The dead were from the same … Read more at: https://www.zerohedge.com/geopolitical/israel-kills-elite-hezbollah-commander-unleashes-single-deadliest-day-lebanese |

|

Yield-Curve Bear-Steepening Spells Trouble For MarketsAuthored by Simon White , Bloomberg macro strategist, The yield curve has proven a poor (or very early) recession indicator in this cycle. This year, though, it will be far more useful in describing the evolution of liquidity and of funding markets, both critical to highlighting when the stock rally might be about to flounder. Specifically a bear steepening – longer-term yields rising more than shorter-term ones – will indicate that liquidity and money velocity are in jeopardy from rising government interest payments, and that funding markets are approaching the point where reserves could shift from abundant to scarce abruptly. Both will imperil risk assets. Stocks and other risk assets face the perfect storm if longer-term yields continue to outpace their shorter-term counterparts in a bear steepening of the yield curve. An increasingly plausible re-acceleration in inflation makes this outcome more likely. This year, jettison the yield curve as a recession predictor. With ever more blurring of fiscal and monetary policy, 2024 will be a liquidity battle between government interest payments and funding markets. Rather than anticipating a downturn, the yield curve will have enormous utility as a barometer of liquidity and funding conditions, and thus will act as a leading indicator for when risk assets are about to run into trouble. Read more at: https://www.zerohedge.com/markets/yield-curve-bear-steepening-spells-trouble-markets |

|

The Incoming Gold Shortage Nobody Is Talking AboutAuthored by Peter Reagan via Birch Gold Group, When private money follows central banks, will there be enough gold to go around?

Having been a bank director, Alasdair MacLeod knows a thing or two about the health of the banking system, and how to spot one that’s contracted something. Talking to Liberty and Finance, MacLeod explained that the banking crisis we’ve been seeing is very much a top-down issue starting from central banks. Watch here, or read on for my summary and analysis:

It’s a tale as old as bailouts: if the average … Read more at: https://www.zerohedge.com/markets/incoming-gold-shortage-nobody-talking-about |

|

UK economy fell into recession after people cut spendingPeople spending less helped drive the UK economy to shrink by more than expected at the end of last year. Read more at: https://www.bbc.co.uk/news/business-68285833?at_medium=RSS&at_campaign=KARANGA |

|

Jeremy Hunt considers reducing spending to fund tax cutsJeremy Hunt is looking at cutting billions in public spending to fund tax cuts in his Spring Budget. Read more at: https://www.bbc.co.uk/news/business-68303653?at_medium=RSS&at_campaign=KARANGA |

|

What is a recession and how could it affect me?A recession means the UK economy has shrunk for two three-month periods – or quarters – in a row. Read more at: https://www.bbc.co.uk/news/business-52986863?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty ends above 20-DMA for 3rd day. What traders should do on FridayNifty is currently placed at the edge of moving above the minor down- trend line resistance around 21,900-21,950 levels. A decisive break above this hurdle could open the doors for new all-time highs around 22,150 levels. Immediate support is at 21,800, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-ends-above-20-dma-for-3rd-day-what-traders-should-do-on-friday/articleshow/107725389.cms |

|

Betting Big! MFs raise stake in 30 stocks for 3 straight quarters, 11 turn multibaggersBarring two companies – Balrampur Chini Mills and Shree Cement – rest of the stocks have given atleast double-digit returns so far in the current financial year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/betting-big-mfs-raise-stake-in-30-stocks-for-3-straight-quarters-11-turn-multibaggers/articleshow/107710335.cms |

|

Big block deal in Vedanta. Is GQG buying stake from promoter?US-based GQG Partners is in talks to buy a stake in Vedanta. A big block deal worth over Rs 2,600 crore took place in Vedanta. The stake sale could be part of the Anil Agarwal-led mining company’s efforts to raise capital to repay debt. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/big-block-deal-in-vedanta-is-gqg-buying-stake-from-promoter/articleshow/107709370.cms |

|

Wendy’s is going all-in on breakfast ads, believing that, if you try it, you’ll be backShares of Wendy’s Co. slumped Thursday, after the fast-food burger chain reported fourth-quarter profit that disappointed Wall Street, amid higher cloud-computing costs, and provided a 2024 outlook that was below forecasts. Read more at: https://www.marketwatch.com/story/wendys-stock-falls-toward-a-3-month-low-after-earnings-miss-downbeat-outlook-4339bfa8?mod=mw_rss_topstories |

|

Treasury yields drop for 2nd straight day after weaker-than-expected January retail salesU.S. government debt rallied on Thursday after data showed a decline in January’s retail sales, sending yields down for a second straight session. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-ahead-of-big-data-dump-that-includes-january-retail-sales-jobless-claims-7b58a3ca?mod=mw_rss_topstories |

|

Oil prices finish higher, back on track for gains for the weekOil futures ended higher on Thursday, with U.S. and global prices back on track to score gains for the week, as supply uncertainty tied to the Middle East helped to offset pressure from rising U.S. crude inventories and production. Read more at: https://www.marketwatch.com/story/oil-prices-on-track-for-back-to-back-declines-after-jump-in-crude-inventories-7cfbf64f?mod=mw_rss_topstories |

Via APAl Jazeera reports that at least ten civilians and fighters were killed, and that five among the civilians were children. “Seven of the civilians were killed in Nabatieh late on Wednesday when a rare Israeli attack on the city hit a multistorey building, sources in Lebanon said.”

Via APAl Jazeera reports that at least ten civilians and fighters were killed, and that five among the civilians were children. “Seven of the civilians were killed in Nabatieh late on Wednesday when a rare Israeli attack on the city hit a multistorey building, sources in Lebanon said.”