Summary Of the Markets Today:

- The Dow closed up 152 points or 0.40%,

- Nasdaq closed up 1.30%,

- S&P 500 closed up 0.96%,

- Gold $2,004 down $3.50,

- WTI crude oil settled at $77 down $1.26,

- 10-year U.S. Treasury 4.265% down 0.051 points,

- USD index $104.72 down $0.24,

- Bitcoin $51,412 up $2,355 (4.63%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

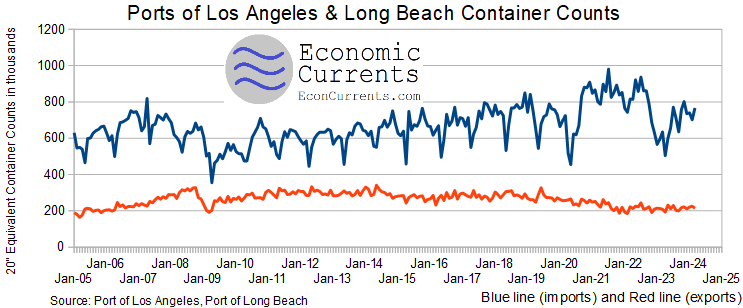

The Ports of Los Angeles and Long Beach handle 40% of the USA container traffic – and January 2024 was a good month with imports up 21% year-over-year and exports up 2% year-over-year. The steep improvement in imports strongly suggests the USA economy is stronger than realized.

Here is a summary of headlines we are reading today:

- New Electrode Revolutionizes Hydrogen Production from Seawater

- Canadian NDP Calls for Ban on Coal Exports

- Skyrocketing Battery Mineral Demand Set to Outpace Supply By 2023

- Oil Prices Steady as Middle East Conflict Intensifies on Lebanese Border

- Product Draws Not Enough to Offset Huge Crude Build

- Dow closes more than 100 points higher as stocks recoup some losses following big sell-off: Live updates

- Mortgage rates surge higher again, causing homebuyers to pull back

- Lyft CEO takes blame for ‘extra zero that slipped into’ earnings release

- Uber stock pops more than 10% on $7 billion share buyback

- Bitcoin briefly crosses $52,000 as it recaptures $1 trillion market cap: CNBC Crypto World

- Economists Are Sounding Alarm On ‘YOLO’ Credit Bubble

- MGM’s hotels charged $1,000 a night on average for the Super Bowl, but the stock suffers a hangover

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

New Electrode Revolutionizes Hydrogen Production from SeawaterUniversity of Tsukuba researchers have developed highly durable electrodes without precious metals to enable direct hydrogen production from seawater. Water electrolysis utilizing renewable energy sources is emerging as a promising clean method for hydrogen production. But the water electrolysis method, a promising avenue for hydrogen production, relies on substantial freshwater consumption, thereby limiting the regions available with water resources required for water electrolysis. Therefore, it is imperative to develop a new technology for water… Read more at: https://oilprice.com/Energy/Energy-General/New-Electrode-Revolutionizes-Hydrogen-Production-from-Seawater.html |

|

Novatek Resumes Fuel Processing After Ukrainian Drone AttackRussia’s Novatek restarted earlier this week fuel processing at its complex on the Baltic Sea damaged last month in a suspected Ukrainian drone attack, industry sources told Reuters on Wednesday. Novatek’s export terminal and processing site at Russia’s Ust-Luga port on the Baltic Sea was damaged in January by what Ukraine said was a drone attack on Russian energy infrastructure. While the Ust-Luga port on continued to ship crude and fuels for exports, terminal operated by Novatek was… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Novatek-Resumes-Fuel-Processing-After-Ukrainian-Drone-Attack.html |

|

Why Is Azerbaijan Hosting the World’s Most Important Climate Change Conference?Oil rigs just off the coast of Azerbaijan’s capital, Baku, are a constant reminder of what drives this Caspian Sea nation’s economy. Later this year, though, the country’s reliance on fossil-fuel exports will come up against global-warming concerns as Baku plays host to the 29th iteration of the United Nations Climate Change Conference, COP29. The announcement that Azerbaijan will host COP29 has roiled many climate and human rights activists, who question the nation’s commitments to climate-friendly policies at a time when… Read more at: https://oilprice.com/The-Environment/Global-Warming/Why-Is-Azerbaijan-Hosting-the-Worlds-Most-Important-Climate-Change-Conference.html |

|

Canadian NDP Calls for Ban on Coal ExportsFrom 2021 to 2022, Canada’s coal exports jumped 60%, according to the NDP, as reported by the Global News, while coal exports have risen by more than eight times since 2018. In 2018, thermal coal exports from Canada reached one million tonnes, continuing to gain significant momentum, reaching 5.5 million tonnes in 2021 and 8.23 million tonnes in 2022. NDP’s Laurel Collins, a long-term environmental critic, has called Canada’s failure to address exports of the dirtiest fossil fuel as “shocking”. “It’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-NDP-Calls-for-Ban-on-Coal-Exports.html |

|

Market Woes Force Glencore to Unload Stake in Major Nickel MineMining giant Glencore is exiting its 49 percent stake in a major nickel mine, weeks after lowering expectations for its performance in a slumping global market for the commodity. The firm inherited its stake in the Koniambo nickel operation when it acquired Xstrata a decade ago and has since run it on behalf of the Societe Miniere du Sud Pacifique via the French government, which controls the territory. The Swiss mining group has shovelled around $4bn (£3.2bn) into the mine to date but said yesterday high operating costs and market conditions… Read more at: https://oilprice.com/Metals/Commodities/Market-Woes-Force-Glencore-to-Unload-Stake-in-Major-Nickel-Mine.html |

|

Skyrocketing Battery Mineral Demand Set to Outpace Supply By 2023Battery minerals are vital for the clean energy transition. They power cost-effective, on-demand energy systems and are at the core of decarbonizing transportation. In the following graphic from Visual Capitalist’s Tessa Di Grandi, Sprott examines the growth in demand for battery metals, as well as potential supply constraints. Exploring Mineral Growth to 2040 Demand for battery metals is set to skyrocket in the coming years. Let’s break down the expected growth between current usage and the projected demand in 2040, based on a Net Zero Emissions… Read more at: https://oilprice.com/Metals/Commodities/Skyrocketing-Battery-Mineral-Demand-Set-to-Outpace-Supply-By-2023.html |

|

Oil Prices Steady as Middle East Conflict Intensifies on Lebanese BorderOil prices were holding steady after initially gaining 1% on Wednesday as the Israel-Hamas conflict gained momentum in Lebanon, with Israel responding to a rocket barrage from Hezbollah by launching a series of strikes in southern Lebanon, sparking fears of an expanding war. Earlier on Wednesday, strikes launched from Lebanon into northern Israel reportedly wounded seven people. Israel responded shortly afterwards by unleashing its fighter jets in a series of strikes into Lebanon’s south, reportedly killing at least four people and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Steady-as-Middle-East-Conflict-Intensifies-on-Lebanese-Border.html |

|

Shell Expects Global LNG Demand To Jump by 50% by 2040Global demand for liquefied natural gas (LNG) is expected to surge by 50% by 2040, driven by higher demand from Asia, with coal-to-gas switching in China and a boost in LNG consumption to fuel economic growth in South and Southeast Asia, Shell said on Wednesday. Last year, global trade in LNG reached 404 million tons, slightly higher than the 397 million tons in 2022, with tight supplies of LNG constraining growth, Shell, the world’s largest LNG trader, said in its annual Shell LNG Outlook 2024. A milder winter in 2022/2023, high gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Expects-Global-LNG-Demand-To-Jump-by-50-by-2040.html |

|

The U.S.’ Return To Its “Denial Oil” Strategy Is CriticalAmidst the growing influence of American rivals in the Middle East, the United States appears to be reassessing its ties with regional allies just as it nears completion of its pullout policy from the region. President Biden’s administration has initiated a re-evaluation of U.S. policy toward the Middle East, despite recent attacks on American sites in Iraq, Syria, and Jordan aiming to compel a full withdrawal of American forces. While returning to the Middle East presents challenges for the United States, a region that has profoundly shaped American… Read more at: https://oilprice.com/Geopolitics/Middle-East/The-US-Return-To-Its-Denial-Oil-Strategy-Is-Critical.html |

|

TotalEnergies: Debt Rules Hurt Africa’s Renewable InvestmentsTight rules on government debts by the IMF are hampering more investments in clean energy in Africa, where countries are not always available to guarantee loans due to said rules, according to the chief executive of French supermajor TotalEnergies. When companies look to develop a new renewable energy project in Africa, they ask governments for guarantees because the clean energy developers don’t want to run the risk of not being paid, Patrick Pouyanné said at an industry event on Wednesday, as carried by Reuters. “But… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Debt-Rules-Hurt-Africas-Renewable-Investments.html |

|

Product Draws Not Enough to Offset Huge Crude BuildCrude oil prices trended lower today after the U.S. Energy Information Administration reported an estimated inventory increase of 12 million barrels for the week to February 9. The change compared with a build of 5.5 million barrels for the previous week. The American Petroleum Institute had a day earlier estimated an inventory build of a sizeable 8.52 million barrels for the week to February 9. In fuels, the Energy Information Administration estimated draws. Gasoline stocks shed 3.7 million barrels in the reporting period,… Read more at: https://oilprice.com/Energy/Crude-Oil/Product-Draws-Not-Enough-to-Offset-Huge-Crude-Build.html |

|

Kazakhstan Vows to Comply With OPEC+ Cuts Despite January OverproductionOn Wednesday, non-OPEC oil producer Kazakhstan vowed to compensate over the coming months for a lack of compliance with the voluntary cuts in the OPEC+ deal in January. “Kazakhstan has always supported the initiatives of the OPEC+ member countries,” the country’s Energy Ministry said in a statement today. Kazakhstan, as well as several other non-OPEC and OPEC producers part of the OPEC+ pact, pledged in November additional voluntary cuts of a total of 2.2 million barrels per day… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Vows-to-Comply-With-OPEC-Cuts-Despite-January-Overproduction.html |

|

RBC Predicts Prolonged Challenges in EV MarketFor the better part of the last 6 months we have been documenting the slowdown in EV adoption, with major legacy automakers scaling back on investments, switching to hybrid plugin models and saturating the market with competition. And a new note from RBC this week seems to suggest that the slowdown isn’t close to being over. Analyst Tom Narayan wrote on Tuesday morning in a note to clients: “Key takeaways thus far from earnings season are that the EV slowdown is not showing any evidence of an inflection, Level 4 autonomy headwinds continue to persist,… Read more at: https://oilprice.com/Energy/Energy-General/RBC-Predicts-Prolonged-Challenges-in-EV-Market.html |

|

Oil Prices Set to Rise as Global Stock Refills Ramp UpChina’s rebuilding of oil inventories and higher crude purchases elsewhere for fear of escalating shipping disruptions in the Red Sea are set to support global oil demand and benchmark prices in the near term, traders and analysts tell Reuters. Global oil stocks have been depleted to lower than historical averages since the Russian invasion of Ukraine shifted oil trade flows and sent oil prices above $100 per barrel in 2022. At the end of last year, with oil sliding from the 2023 highs of over $95 per barrel in September,… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Set-to-Rise-as-Global-Stock-Refills-Ramp-Up.html |

|

Shell Sees LNG Replacing Coal in AsiaUK energy supermajor Shell has projected that liquefied natural gas (LNG) will replace coal as a leading driver of Chinese and other Asian economies. According to the firm’s LNG Outlook published today, demand will rise by 50 percent by 2040 and global LNG trade will grow to around 625-685m tonnes per year, up from the 404m tonnes traded in 2023. “China is likely to dominate LNG demand growth this decade as its industry seeks to cut carbon emissions by switching from coal to gas,” said Steve Hill, executive vice president for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Sees-LNG-Replacing-Coal-in-Asia.html |

|

Dow closes more than 100 points higher as stocks recoup some losses following big sell-off: Live updatesThe S&P 500 rose on Wednesday following a substantial day of losses for all three major indexes. Read more at: https://www.cnbc.com/2024/02/13/stock-market-today-live-updates.html |

|

Mortgage rates surge higher again, causing homebuyers to pull backMortgage rates are rising sharply again, causing mortgage demand to drop. Read more at: https://www.cnbc.com/2024/02/14/mortgage-rates-surge-higher-again-causing-homebuyers-to-pull-back.html |

|

Lyft CEO takes blame for ‘extra zero that slipped into’ earnings releaseLyft CEO David Risher took responsibility for the major error that appeared in the company’s earnings release late Tuesday. Read more at: https://www.cnbc.com/2024/02/14/lyft-ceo-takes-blame-for-extra-zero-in-q4-earnings-release.html |

|

Here’s what Meta CEO Mark Zuckerberg has to say about the Apple Vision ProMeta CEO Mark Zuckerberg shared his opinions on Apple’s new Vision Pro headset. Read more at: https://www.cnbc.com/2024/02/14/mark-zuckerberg-comments-on-apples-vision-pro-.html |

|

Here’s what you should know about adding emerging markets bond exposure to your portfolioVanguard and BlackRock think emerging markets debt looks attractive right now. Read more at: https://www.cnbc.com/2024/02/14/should-you-consider-emerging-markets-bonds-what-you-need-to-know.html |

|

Biden administration examining role of supply chain middlemen in generic drug shortagesThe FTC and HHS are seeking public comment on the contracting practices and market concentration of group purchasing organizations and drug wholesalers. Read more at: https://www.cnbc.com/2024/02/14/ftc-hhs-examining-cause-of-generic-drug-shortages.html |

|

Uber stock pops more than 10% on $7 billion share buybackUber’s stock spiked more than 10% on Wednesday after the ride-hailing company announced it will buy back up to $7 billion worth of company shares. Read more at: https://www.cnbc.com/2024/02/14/uber-stock-pops-more-than-10percent-on-7-billion-share-buyback.html |

|

Dan Niles is long 4 and short 3 of the Magnificent 7 stocksThe Satori Fund’s Dan Niles is offering up his strategy for playing the Magnificent 7 stocks. Read more at: https://www.cnbc.com/2024/02/14/dan-niles-is-long-4-and-short-3-of-the-magnificent-7-stocks.html |

|

Bitcoin briefly crosses $52,000 as it recaptures $1 trillion market cap: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Andy Baehr of CoinDesk Indices discusses what’s driving bitcoin’s rally to multi-year highs. Read more at: https://www.cnbc.com/video/2024/02/14/bitcoin-briefly-crosses-52000-recaptures-1-trillion-market-cap-crypto-world.html |

|

How Elon Musk’s war on Delaware could change the way corporations make some of their biggest decisionsDelaware is home to more than 60% of the Fortune 500. After the decision to void Elon Musk’s pay package, the Tesla CEO is aiming to lead a corporate exodus. Read more at: https://www.cnbc.com/2024/02/14/elon-musk-war-on-delaware-may-change-how-companies-make-big-decisions.html |

|

‘Anyone But You’ could spark a rom-com renaissance in Hollywood“Anyone But You” proves that romantic comedies still have a space in theaters and audiences will turn up for them. Read more at: https://www.cnbc.com/2024/02/14/anyone-but-you-could-spark-a-rom-com-renaissance-in-hollywood.html |

|

As more Americans reach 65 than ever, here’s what to know about your Social Security retirement ageTo get the biggest Social Security retirement benefit checks, it pays to wait. Read more at: https://www.cnbc.com/2024/02/14/social-security-retirement-age-how-to-know-when-to-claim-benefits.html |

|

At least 10 people shot during Kansas City Chiefs Super Bowl celebrationTwo people have been detained, officials said. Read more at: https://www.cnbc.com/2024/02/14/multiple-people-injured-after-shooting-at-kansas-city-chiefs-super-bowl-celebration.html |

|

“Shots Have Been Fired”: Chaos Erupts At Kansas City Super Bowl ParadeChaos erupted at the Kansas City Chiefs Superbowl parade on the streets of Kansas City, Missouri, on Wednesday afternoon after reports of a shooting. “Shots have been fired around Union Station. Please leave the area,” Kansas City Police posted to X.

Daily Mail states, “Two gunmen have been detained after shots rang out at the Kansas City Chiefs Superbowl parade, sending thousands fleeing as the celebration descended into chaos.” Other reports state that “several people were struck by gunfire.” According to X user Breaking 911, here’s what is known so far:

|

|

The “Phantom Legion” ProblemAuthored by Charles Hugh Smith via OfTwoMinds blog, Everything is presented as rock-solid until it falls apart. Of the many signs of systemic decay in the late Roman Empire, one of particular relevance to our era is the Phantom Legion, military units that on paper were at full strength–and paid accordingly–but which were in reality no longer there: the paymaster collected the silver wages and recorded the unit’s roll of officers and soldiers, but it was all make-believe. When the Empire’s wealth seems limitless, graft, embezzlement and fraud all seem harmless to those skimming the wealth. Look, the Empire is forever, what harm is there in my little self-interested skim? This rot starts at the top, of course, and then seeps into every nook and cranny of the system. When those at the top are getting fabulously wealthy on modest salaries while claiming to serve the public, the signal is clear: go ahead and maximize your own private gain at the expense of the public and the state. Civic virtue–the backbone of the Empire–decayed into self-interest, incompetence and indulgence. The “Phantom Legion” Problem has another wrinkle: the legion is reported at full strength, but the actual number of soldiers is far lower than the reported number, and the competence of the officers is so low that the legion is incapable of performing its duties. In other words, the numbers don’t reflect the actual utility-value of the legion as a combat unit: the so … Read more at: https://www.zerohedge.com/personal-finance/phantom-legion-problem |

|

ZeroHedge ‘Dollar’ Debate Recap: BRICs Bust, CBDCs Crushed, & No “Non-Painful Way” Out Of ThisLast night, ZeroHedge kicked off our third live debate to discuss the fate of the U.S. Dollar and whether it will continue to dominate global trade. Our esteemed economic experts vigorously debated the question: Will the Dollar remain the global reserve currency in 2030? Intros Making the negative case, Austrian economist Bob Murphy put forth a succinct case why foreigners will continue to ditch the dollar. In simple terms, an abysmal fiscal situation and poor customer service. “These numbers are astronomical,” said Murphy, adding “It’s happening right now.” “So yes, I don’t see a non-painful way to change this trajectory. And other things equal, you’re a foreigner and you keep seeing them pile up the debt – you’re going to conclude ‘this is unsustainable, we need to start weaning ourselves off of reliance on this currency.” Read more at: https://www.zerohedge.com/economics/zerohedge-debate-recap-global-reserve-brics-cbdcs-and-more |

|

Economists Are Sounding Alarm On ‘YOLO’ Credit BubbleAuthored by Sam Bourgi via CreditNews.com, A growing percentage of Americans are becoming reckless with their spending, fueling what one economist calls a “super duper” credit bubble.

In a note to clients, economist David Rosenberg of Rosenberg Research warned that Americans are taking on too much debt to buy things they really don’t need. He calls these people “YOLO spenders,” which refers to the catchphrase, “You only live once.”

That credit bubble has created < … Read more at: https://www.zerohedge.com/personal-finance/economists-are-sounding-alarm-yolo-credit-bubble |

|

Interest rates won’t fall due to 4% inflation, says Bank bossBank of England boss says the latest inflation figure “pretty much leaves us where we were”. Read more at: https://www.bbc.co.uk/news/business-68285819?at_medium=RSS&at_campaign=KARANGA |

|

Deliveroo and Uber Eats riders strike on Valentine’s DayThe action affecting Deliveroo, Stuart.com, Just Eat and Uber Eats, is a dispute over pay and conditions. Read more at: https://www.bbc.co.uk/news/business-68274158?at_medium=RSS&at_campaign=KARANGA |

|

Train strikes: All you need to know about action in February and MarchMore than 300 London Overground workers will go on strike from midnight on Monday 19 February. Read more at: https://www.bbc.co.uk/news/business-61634959?at_medium=RSS&at_campaign=KARANGA |

|

Alpex Solar shares to debut on NSE SME on Thursday. Is multibagger listing in the offing?Considering the upper price band of Rs 115, the stock is expected to list at a premium of 130%. The public offer of Alpex Solar was subscribed 300 times at close. The category reserved for retail investors was booked 350 times and that of NII investors was subscribed 500 times. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/alpex-solar-shares-to-debut-on-nse-sme-on-thursday-is-multibagger-listing-in-the-offing/articleshow/107698805.cms |

|

ETMarkets Fund Manager Talk: Why is this asset manager cautious on markets and recommends staggered buying?The market is pricing in a BJP victory with a majority in the upcoming general elections, but any disappointments could lead to a big setback for markets. Kedar Kadam says prefers largecaps over smallcap/microcaps and value stocks trading at reasonable valuations. In terms of sectors, we remain constructive on themes of capex (engineering/Infra/building materials), pharmaceuticals, 2-wheeler auto, and select specialty. chemical companies. Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-fund-manager-talk-why-is-this-asset-manager-cautious-on-markets-and-recommends-staggered-buying/articleshow/107666795.cms |

|

Tech View: Nifty forms bullish engulfing candle. What traders should do on ThursdayThe index is currently placed at the edge of breaking above the immediate hurdle of 21,850 level and a decisive move above this resistance is likely to pull Nifty towards 22,000-22,100 levels in the short term. Immediate support is at 21,720 level, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bullish-engulfing-candle-what-traders-should-do-on-thursday/articleshow/107695279.cms |

|

Big Lots, Express and Children’s Place could spell more trouble for commercial real estate, Barclays saysCorporate bankruptcies in January touched their highest level since 2020, according to Epiq Bankruptcy and Barclays. Read more at: https://www.marketwatch.com/story/big-lots-express-and-childrens-place-could-spell-more-trouble-for-commercial-real-estate-barclays-says-324f73cb?mod=mw_rss_topstories |

|

Michael Burry’s Scion Asset Management scoops up shares of Alphabet, AmazonMichael Burry’s Scion Asset Management scooped up shares of Alphabet Inc. and Amazon.com Inc. during the fourth quarter of 2023 Read more at: https://www.marketwatch.com/story/michael-burrys-scion-asset-management-scoops-up-shares-of-alphabet-amazon-fc546adc?mod=mw_rss_topstories |

|

MGM’s hotels charged $1,000 a night on average for the Super Bowl, but the stock suffers a hangoverMGM Resorts beat fourth-quarter earnings expectations, and said the Super Bowl effect was surprisingly “amazing,” but the casino and hotel operator’s stock continued to suffer from a post-game hangover. Read more at: https://www.marketwatch.com/story/mgms-hotels-charged-1-000-a-night-on-average-for-the-super-bowl-but-the-stock-suffers-a-hangover-c67b1373?mod=mw_rss_topstories |