Summary Of the Markets Today:

- The Dow closed down 525 points or 1.35%,

- Nasdaq closed down 1.80%,

- S&P 500 closed down 1.37%,

- Gold $2,006 down $27.50,

- WTI crude oil settled at $78 up $0.83,

- 10-year U.S. Treasury 4.314% up 0.144 points,

- USD index $104.88 up $0.71,

- Bitcoin $49,393 down $552 (1.42%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Consumer Price Index for All Urban Consumers (CPI-U) in January 2024 increased 3.1% year-over-year – down from 3.3% in December 2023 but unchanged from 3.1% in November 2023. The all items less food and energy index rose 3.9% over the last 12 months, the same increase as for the 12 months ending December. The Federal Reserve uses the PCE inflation index to monitor inflation which the January data will be released at the end of February – and most likely it will be little changed. The market reaction to this release is surprising as I have been saying that inflation pressures are increasing – and the market mistakingly believed inflation has gone away.

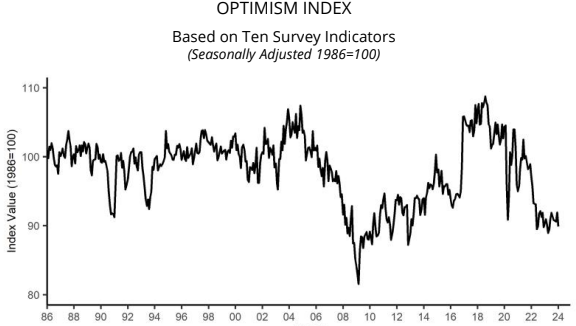

The NFIB Small Business Optimism Index decreased two points in January 2024 to 89.9, marking the 25th consecutive month below the 50-year average of 98. The net percent of owners who expect real sales to be higher declined 12 points from December to a net negative 16% (seasonally adjusted), a very negative shift in expectations. NFIB Chief Economist Bill Dunkelberg stated:

Small business owners continue to make appropriate business adjustments in response to the ongoing economic challenges they’re facing. In January, optimism among small business owners dropped as inflation remains a key obstacle on Main Street.

Here is a summary of headlines we are reading today:

- Why Are China’s Solar Panels So Cheap?

- Bearish Market Conditions Persist for Stainless Steel

- Oil Steady As Inflation Comes In Hotter Than Expected

- Mining Billionaire Slams Carbon Capture as ‘Falsehood’

- ETF Frenzy Pushes Bitcoin to Highest Levels Since 2021

- Diamondback Energy’s $26 Billion Endeavor Acquisition Shakes Up Permian Basin

- OPEC Sees Strong Long-Term Oil Demand

- Dow tumbles 500 points, posts worst day since March 2023 after hot inflation report: Live updates

- Here’s the inflation breakdown for January 2024 — in one chart

- Here’s what bitcoin’s chart says about its next moves after it breached $50,000 this week

- Prices rose more than expected in January as inflation won’t go away

- This stock-market predictor with a great record is even more bullish now than it was last year

- Treasury yields end at highest levels since at least December after hotter-than-expected CPI inflation report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why Are China’s Solar Panels So Cheap?Authored by Mike Shedlock via MishTalk.com, The US wants to break into the solar panel business. Doing so, if its possible at all, means costs of the solar panels and electricity will surge… China’s Grip on Solar The Wall Street Journal asks Can the U.S. Break China’s Grip on Solar? That’s a free link worth reading. The short answer is everything in China is cheaper from materials to electricity to labor. The process is worth a closer look, however, and the US trails significantly in every stage. Polysilicon The primary building… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Why-Are-Chinas-Solar-Panels-So-Cheap.html |

|

Trump Can’t Stop Energy Transition: KerryFormer President—and current Presidential candidate—Donald Trump—won’t be able to stand in the way of the Energy Transition, John Kerry said on Tuesday at the International Energy Agency ministerial meeting. The U.S. Special Presidential Envoy for Climate did warn, however, that President Trump could reverse the efforts made in anti-coal diplomacy. “Even when President Trump was there for those 4 years, 75% of our new electricity came from renewables because we had portfolio laws in the 37 states that required the deployment of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trump-Cant-Stop-Energy-Transition-Kerry.html |

|

Southeast Europe’s “Vertical Corridor” to Reshape Gas TransitCountries in southeastern and central Europe have begun working together to create a new gas transit route to help compensate for the loss of Russian gas exports to Europe following Russia’s invasion of Ukraine. If realized, the “Vertical Corridor” would offer Azerbaijan a new route to export its gas to east and central European markets and, as such, could help Baku to meet its pledge to the European Union to double its gas exports to Europe to 20 billion cubic meters a year by 2027. The planned new route would mainly utilize existing pipelines… Read more at: https://oilprice.com/Energy/Natural-Gas/Southeast-Europes-Vertical-Corridor-to-Reshape-Gas-Transit.html |

|

Bearish Market Conditions Persist for Stainless SteelVia Metal Miner The downtrend for nickel prices showed signs of exhaustion, with significant potential to impact stainless steel prices. Nickel moved sideways throughout January with a modest 1.60% decline. While directional momentum remained slow, prices continued to edge lower during the first weeks of February and now sit at their lowest level since April 2021. Overall, the Stainless Monthly Metals Index (MMI) moved sideways, falling 0.5% from January to February. Outokumpu’s Q4 Reports Show Weaker 2023 Market Outokumpu noted a… Read more at: https://oilprice.com/Metals/Commodities/Bearish-Market-Conditions-Persist-for-Stainless-Steel.html |

|

OPEC Sees World Oil Demand Increasing by 1.8 Million Bpd in 2025World oil demand next year is expected to increase by 1.8 million barrels per day, OPEC said in its latest Monthly Oil Market Report released on Tuesday. OPEC sees the demand for crude oil rising by 1.8 million bpd to 106.2 million barrels per day next year, with the OECD region expecting to see 0.1 million bpd of that 1.8 million bpd growth, and non-OECD realizing the lion’s share at 1.7 million bpd growth. OPEC’s outlook on 2024 oil demand was unchanged for this month, eyeing a 2.2 million bpd growth rate, to 104.36 million bpd, the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Sees-World-Oil-Demand-Increasing-by-18-Million-Bpd-in-2025.html |

|

Oil Steady As Inflation Comes In Hotter Than ExpectedEquity markets got caught off guard by higher-than-expected U.S. inflation figures, but crude prices have shown resilience. US Natural Gas Prices Collapse on Milder Weather and Robust Output – US natural gas prices hit a 40-month low last week at just $1.91 per mmBtu as the combined effect of mild weather, strongly rebounding production and sizable inventories continue to weigh on prices. – February to date, US population-weighted temperature has averaged 46 Fahrenheit, some 5 degrees above normal, whilst nationwide gas production… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Steady-As-Inflation-Comes-In-Hotter-Than-Expected.html |

|

Not All OPEC Producers Are Delivering On Their Pledged CutsOPEC’s crude oil production slumped by 350,000 barrels per day (bpd) in January as the latest voluntary output cuts kicked in, but not all those who had pledged reductions delivered on their promises. As OPEC’s crude oil production from all 12 members fell by 350,000 bpd to 26.342 million bpd in January, the country with the biggest contribution to the cuts was Libya, one of the three OPEC members exempted from the cuts alongside Iran and Venezuela, according to the secondary sources in OPEC’s Monthly Oil Market Report (MOMR)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Not-All-OPEC-Producers-Are-Delivering-On-Their-Pledged-Cuts.html |

|

Refinery Outage Delays Next Oil Price RallyThe power outage that took BP’s refinery in Whiting, Indiana, offline for at least three weeks has delayed a potential price jump by dampening demand expectations in the immediate term. The 400,000-bpd facility is the largest refinery in the Midwest—and its temporary shutdown will lead to an increase in crude inventories, traders expect—and they are acting accordingly. Reuters’ John Kemp reported that in the week that followed the February 1 outage at Whiting, traders sold some 62 million barrels of West Texas… Read more at: https://oilprice.com/Energy/Energy-General/Refinery-Outage-Delays-Next-Oil-Price-Rally.html |

|

Mining Billionaire Slams Carbon Capture as ‘Falsehood’Carbon capture has failed for decades and policymakers need real solutions to emissions reductions, not a “complete falsehood” such as CCS, according to Andrew Forrest, the Australian billionaire who is the founder of iron ore producer Fortescue Metals Group. “We’re going to keep burning fossil fuels and somehow magically get rid of the carbon down into the ground where there is no proof that it will stay there, but heaps of proof that it fails,” Forrest said on Tuesday at a conference in Paris for the 50th anniversary… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mining-Billionaire-Slams-Carbon-Capture-as-Falsehood.html |

|

ETF Frenzy Pushes Bitcoin to Highest Levels Since 2021Bitcoin has surged past the $50,000 mark, marking its highest level since 2021. This surge highlights a significant shift in investor interest, largely attributed to the introduction of mainstream bitcoin investment funds. The cryptocurrency market has experienced significant growth, with Bitcoin gaining nearly 15% since the start of the year. This growth is largely attributed to the US Securities and Exchange Commission’s approval of several spot bitcoin exchange-traded funds (ETFs), which offer investors regulated exposure to bitcoin’s… Read more at: https://oilprice.com/Finance/the-Markets/ETF-Frenzy-Pushes-Bitcoin-to-Highest-Levels-Since-2021.html |

|

France Cuts EV Incentives for Wealthy HouseholdsFrance is reducing bonuses for electric vehicle (EV) purchases for the wealthier half of households as it looks to rein in spending and keep incentives for the lower-income buyers. In a decree on Tuesday, France cuts the so-called ecological bonus for EV purchases for the wealthier 50% of households by $1,073 (1,000 euros). “There are two types of aid – for the poorest 50% of French people the bonus remains at 7,000 euros. For the richest 50% of French people, the bonus is now reduced from 5,000 euros to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/France-Cuts-EV-Incentives-for-Wealthy-Households.html |

|

Diamondback Energy’s $26 Billion Endeavor Acquisition Shakes Up Permian BasinLast year, when the full extent of the unprecedented consolidation wave in the shale sector gradually became apparent, we speculated that when it’s all said and done, US energy companies would have more production discipline than the OPEC+ cartel, and sure enough, today we got the latest confirmation when Diamondback Energy agreed to buy fellow Texas oil-and-gas producer, the closely privately-held Endeavor Energy, in a $26 billion cash-and-stock deal that will create the third-largest oil producer in the Permian, behind only Exxon and Chevron.… Read more at: https://oilprice.com/Energy/Crude-Oil/Diamondback-Energys-26-Billion-Endeavor-Acquisition-Shakes-Up-Permian-Basin.html |

|

IEA: Oil Supply Increase More Than Enough to Meet Demand Growth in 2024Oil supply increases from the Americas will be more than enough to meet demand growth this year, putting downward pressure on oil prices this year in the absence of a major geopolitical escalation in the Middle East, the International Energy Agency’s (IEA) Executive Director Fatih Birol told Bloomberg on Tuesday. The IEA sees global oil demand growth significantly weakening in 2024 from 2023, Birol said, adding that the agency sees consumption growing by 1.2 million barrels per day (bpd) to 1.3 million bpd this… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Oil-Supply-Increase-More-Than-Enough-to-Meet-Demand-Growth-in-2024.html |

|

OPEC Sees Strong Long-Term Oil DemandGlobal oil demand is expected to remain robust in the long term and the recent Saudi reversal of production capacity expansion shouldn’t be read as a view of falling demand, OPEC Secretary General Haitham Al Ghais told Reuters on Tuesday. “First of all I want to be clear I cannot comment on a Saudi decision … but this is in no way to be misconstrued as a view that demand is falling,” Al Ghais told the newswire on the sidelines of a summit in Dubai. At the end of last month, Saudi Arabia surprised the oil market by… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Sees-Strong-Long-Term-Oil-Demand.html |

|

U.S. Firms Slow Hiring for ESG RolesThe American bubble of hiring managers in environmental, social, and governance roles is starting to bust amid pressures for firms to cut costs and backlash from investors against ESG. The number of departures in ESG roles exceeded arrivals in six of last year’s 12 months, per data from employment data provider Live Data Technologies cited by The Wall Street Journal. Tech giants Amazon, Meta, and Google saw the biggest outflows as the sector began job cuts. Consulting companies have also shrunk ESG roles, according to the data reported… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Firms-Slow-Hiring-for-ESG-Roles.html |

|

Dow tumbles 500 points, posts worst day since March 2023 after hot inflation report: Live updatesStocks dropped on Tuesday after hotter-than-expected inflation data for January spiked Treasury yields. Read more at: https://www.cnbc.com/2024/02/12/stock-market-today-live-updates.html |

|

Here’s the inflation breakdown for January 2024 — in one chartThe consumer price index rose by 3.1% in January 2024, a smaller annual increase than in December. Read more at: https://www.cnbc.com/2024/02/13/heres-the-inflation-breakdown-for-january-2024-in-one-chart.html |

|

Airfare is down, but here’s why that may not last for longAirfare fell 6.4% in January from a year earlier, according to the latest inflation report. Read more at: https://www.cnbc.com/2024/02/13/airfare-is-down-but-heres-why-that-may-not-last-for-long.html |

|

Lael Brainard slams food companies for ‘shrinkflation’ as White House attacks price gougingConsumer brands like Coca-Cola, PepsiCo, Procter & Gamble and more have raised prices over the past year to keep profits afloat. Read more at: https://www.cnbc.com/2024/02/13/feds-lael-brainard-shrinkflation-white-house-battle.html |

|

Here’s what bitcoin’s chart says about its next moves after it breached $50,000 this weekBitcoin broke through $50,000 to start the week, although a stubbornly high inflation reading has pulled it lower since. Read more at: https://www.cnbc.com/2024/02/13/heres-what-bitcoins-chart-says-about-its-next-moves-after-it-breached-50000-this-week.html |

|

Bitcoin money launderer Ian Freeman ordered to pay $3.5 million to romance scam victimsIan Freeman has promoted the Bitcoin cryptocurrency for years, while hosting a radio show in New Hampshire with a libertarian theme. Read more at: https://www.cnbc.com/2024/02/13/bitcoin-money-launderer-ian-freeman-ordered-to-pay-3point5-million.html |

|

Paramount Global lays off about 800 employees, a day after announcing record Super Bowl ratingsParamount Global CEO Bob Bakish announced the company will lay off hundreds of employees Tuesday, just a day after CBS announced Super Bowl viewing records. Read more at: https://www.cnbc.com/2024/02/13/paramount-global-lays-off-about-800-employees-after-super-bowl.html |

|

Pilots got their payday. Now flight attendants are pushing airlines for higher wagesFlight attendants picketed around the U.S. Tuesday to demand higher pay and better working conditions. Read more at: https://www.cnbc.com/2024/02/13/flights-attendants-push-airlines-for-higher-wages.html |

|

Bitcoin retreats from $50,000 after hotter-than-expected inflation data: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Matt Hougan, CIO at Bitwise Asset Management, and Ric Edelman, founder of the Digital Assets Council of Financial Professionals, discuss the growing adoption of spot bitcoin ETFs among investment advisors. Read more at: https://www.cnbc.com/video/2024/02/13/bitcoin-retreats-after-hotter-than-expected-inflation-data-crypto-world.html |

|

Supreme Court gives Trump prosecutor a week to respond to delay request in election caseDonald Trump wants the Supreme Court to overturn a ruling that he lacks presidential immunity in his federal criminal elections interference case. Read more at: https://www.cnbc.com/2024/02/13/supreme-court-tells-trump-prosecutor-to-answer-immunity-challenge.html |

|

Prices rose more than expected in January as inflation won’t go awayThe consumer price index was expected to show a 0.2% increase in January, according to economists surveyed by Dow Jones. Read more at: https://www.cnbc.com/2024/02/13/cpi-inflation-january-2024-consumer-prices-rose-0point3percent-in-january-more-than-expected-as-the-annual-rate-moved-to-3point1percent.html |

|

4 red flags for an IRS tax audit — and how to avoid the ‘audit lottery,’ according to tax prosSome taxpayers worry about IRS audits as the agency ramps up service, technology and enforcement. Here are four red flags filers need to know. Read more at: https://www.cnbc.com/2024/02/13/here-are-some-of-the-top-red-flags-for-an-irs-audit-tax-pros-say.html |

|

Molson Coors looks to lock in market share gains as consumers shift away from Bud LightMolson Coors gained market share after the Bud Light boycott last year. Now executives believe they can maintain the growth they’ve seen in the past year. Read more at: https://www.cnbc.com/2024/02/13/molson-coors-gains-market-share-as-consumers-shift-away-from-bud-light.html |

|

The EV Slowdown Isn’t Over Yet, RBC SaysFor the better part of the last 6 months we have been documenting the slowdown in EV adoption, with major legacy automakers scaling back on investments, switching to hybrid plugin models and saturating the market with competition. And a new note from RBC this week seems to suggest that the slowdown isn’t close to being over. Analyst Tom Narayan wrote on Tuesday morning in a note to clients: “Key takeaways thus far from earnings season are that the EV slowdown is not showing any evidence of an inflection, Level 4 autonomy headwinds continue to persist, and fears over supplier inventory overbuild are likely overblown.”

He also suggested that he would “prefer owning Stellantis into Thursday’s print, Ferrari on conservative 2024 guidance and demand strength and Mobileye/Tesla on successes with SuperVision and FSD.” Citing his reasoning for the EV slowdown not bottoming out, Narayan wrote that “Ford’s EV losses worsened sequentially again in Q4/23 (-$1.57B in Q4 vs -$1.329B in Q3). EV loss guidance for 2024 came in worse than consensus … Read more at: https://www.zerohedge.com/markets/ev-slowdown-isnt-over-yet-rbc-says |

|

Holding PatternsBy Jane Foley, Head of FX Strategy at Rabobank Right from the very first week of the year, Fed officials and other G10 central bankers have had reasonable success in pushing back against market expectations for early rate cuts. Following the blow-out January US labour report and candid remarks from Fed Chair Powell in the same week, the market has all but lost interest in the chances of a move by the FOMC as soon as next month. No central banker wants to be remembered as the policymaker that cut rates too soon and threw disinflationary pressures off course. That said, while Rabobank retains the forecast that the Fed’s first move is unlikely to be before June, there is still considerable market interest in a potential rate cut as soon as May. Today’s release of the US January CPI inflation data will provide the next test of how close the Fed is to achieving its goal of returning price pressures back to the 2% level and of reducing rates this spring. The market consensus stands at 2.9% y/y for the headline number, down from 3.4% y/y previously. The market median for the core CPI inflation number is 3.7% y/y down from 3.9% y/y. (ZH: The final number came in superhot compared to estimates and slammed shut the door on any early rate cuts). Read more at: https://www.zerohedge.com/markets/holding-patterns |

|

Rickards: Why Gold? Why Now?Authored by James Rickards via DailyReckoning.com, Despite the Wall Street happy talk about the Federal Reserve winning the battle against inflation, that battle has not been won.

Headline CPI (the kind Americans actually pay) was 3.1% in January – lower than December but notably above expectations. However, ‘core’ and ‘supercore’ were more problematic – up 3.9% YoY (flat from December) and up 4.4% YoY (highest since May 2023) respectively. In other words, inflation is not gone and may even be on the rise with higher oil prices lately due to geopolitical concerns. The Fed will not raise rates, but they will not be quick to cut them given continued inflation. Inflation has a way of sneaking up on investors in small increments and can do a lot of damage before investors see it for what it is. Sure, 3.4% inflation is a lot better than 9% inflation. But a 3.4% inflation rate cuts the value … Read more at: https://www.zerohedge.com/markets/rickards-why-gold-why-now |

|

Watch: Iranian Drills Simulate Attack On One Of Israel’s Largest AirbasesOn Tuesday Iranian state media published footage of what was described as part of a simulated military attack on a major Israeli airbase by the elite Islamic Revolutionary Guard Corps (IRGC). The IRGC utilized naval assets to fire a range of munitions, including from ships and submarines in what is clearly a threatening message aimed at Israel amid its ongoing onslaught in Gaza, in the context of the planned Shahid Mahdavi exercises.

Illustrative: prior Iranian Navy drills, via APTop commander of the IRGC, Gen. Hossein Salami, claimed that his forces for the first time successfully launched a long-range ballistic missiles from a warship. “The IRGC for the first time has fired ballistic missiles in the Gulf of Oman,” state television cited. “The firing of a long-range ba … Read more at: https://www.zerohedge.com/geopolitical/watch-iranian-drills-simulate-attack-one-israels-largest-airbases |

|

Body Shop UK jobs and stores at risk in race to save firmThe retailer’s shops will remain open as usual while the administrators try to save the UK firm. Read more at: https://www.bbc.co.uk/news/business-68273424?at_medium=RSS&at_campaign=KARANGA |

|

Tetley monitoring its tea supplies on daily basisThe UK’s second biggest tea brand says it expects to be able to continue to meet normal demand. Read more at: https://www.bbc.co.uk/news/business-68284391?at_medium=RSS&at_campaign=KARANGA |

|

The Body Shop: What went wrong for the trailblazing chain?As the UK business enters administration, we look at what has gone wrong for the chain. Read more at: https://www.bbc.co.uk/news/business-68273425?at_medium=RSS&at_campaign=KARANGA |

|

Rashi Peripherals shares to list tomorrow. What GMP signals ahead of debut?The IPO of Rashi Peripherals was subscribed nearly 60 times at close, driven by heavy bidding from non-institutional investors. Most analysts were positive on the issue as the company has a good financial track record and robust distribution network. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rashi-peripherals-shares-to-list-tomorrow-what-gmp-signals-ahead-of-debut/articleshow/107663050.cms |

|

Tech View: Nifty trend remains choppy in short term. What traders should do on WednesdayThe short-term trend of Nifty remains choppy with alternative candle formations like bull and bear. A sustainable move above the immediate resistance of 21,800-21,850 levels can open a sharp upside towards another resistance of 22,000-22,100 levels in the near term, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-trend-remains-choppy-in-short-term-what-traders-should-do-on-wednesday/articleshow/107663289.cms |

|

Technical Stock Pick: 20% rally in 3 months! This PSU stock retest consolidation 1-year breakout zoneShort-term traders can look to buy the stock for a possible target of Rs 841 in the next 1-2 months, suggest experts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-stock-pick-20-rally-in-3-months-this-psu-stock-retest-consolidation-1-year-breakout-zone/articleshow/107648537.cms |

|

Dow drops more than 500 points after ‘ugly’ inflation report upsets market’s rate-cut expectationsJanuary’s hotter-than-expected inflation report threw financial markets into a tailspin on Tuesday and upended investors’ expectations about how soon and by how much the Federal Reserve might start cutting interest rates. Read more at: https://www.marketwatch.com/story/hotter-than-expected-inflation-upends-markets-thinking-on-when-fed-will-cut-rates-cfa49c41?mod=mw_rss_topstories |

|

This stock-market predictor with a great record is even more bullish now than it was last yearStocks typically enjoy a winning year when consumer sentiment jumps in January. Read more at: https://www.marketwatch.com/story/this-stock-market-predictor-with-a-great-record-is-even-more-bullish-now-than-it-was-last-year-9bd3f0b9?mod=mw_rss_topstories |

|

Treasury yields end at highest levels since at least December after hotter-than-expected CPI inflation reportTreasury yields soared on Tuesday, with the policy-sensitive 2-year rate jumping its most in nine months, after January’s U.S. consumer-price index report threw financial markets into a tailspin. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-ahead-of-report-expected-to-show-lowest-cpi-inflation-in-nearly-two-years-bbb785f8?mod=mw_rss_topstories |