Summary Of the Markets Today:

- The Dow closed up 49 points or 0.13%,

- Nasdaq closed up 0.24%,

- S&P 500 closed up 0.06%,

- Gold $2,048 down $3.30,

- WTI crude oil settled at $77 up $2.64,

- 10-year U.S. Treasury 4.158% up 0.006 points,

- USD index $104.15 up $0.09,

- Bitcoin $45,521 up $1,390 (3.15%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

December 2023 sales of merchant wholesalers were up 1.6% from December 2022 – down 3.8% inflation-adjusted. Total inventories of merchant wholesalers were down 2.7% from December 2022. The December inventories/sales ratio for merchant wholesalers was 1.34. The December 2022 ratio was 1.40. It is the inventory-to-sales ratio that provides the indication of a slowing economy and this ratio is currently improving.

In the week ending February 3, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,250, an increase of 3,750 from the previous week’s revised average. The previous week’s average was revised up by 750 from 207,750 to 208,500.

Here is a summary of headlines we are reading today:

- Skilled Worker Shortage Stalls U.S. Construction Boom in 2024

- Shipping Giants Warn of Worsening Red Sea Security Situation

- Duke Energy Misses Earnings Forecast as Higher Interest Rates Bite

- Oil Gains 2% as Israel Rejects Gaza Ceasefire Deal, US Gas Inventory Plummets

- Maersk Tumbles as Red Sea Crisis Stings

- BP’s Indiana Refinery to Remain Shut for Three Weeks

- Arm shares surge 60% after SoftBank-controlled chip designer issues strong forecast

- S&P 500 hits 5,000, but closes just under the milestone: Live updates

- PayPal plummets as Wall Street likens CEO’s strategy to ‘turning around the titanic’

- Bitcoin breaks above $45,000 to highest level since day after spot ETFs went live: CNBC Crypto World

- No Charges: Biden “Willfully” Retained Classified Documents; Special Counsel Says Biden “Elderly Man With Poor Memory”

- Investors see risk that inflation was hotter than reported for the end of 2023

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Evaluating Ammonia’s Role in Sustainable ShippingChalmers University of Technology researchers show in a study where the researchers carried out life cycle analyses for batteries and for three electrofuels including ammonia. The report has been published in Applied Energy. Switching to ammonia as a marine fuel, with the goal of decarbonization, can instead create entirely new problems. Eutrophication and acidification are some of the environmental problems that can be traced to the use of ammonia – as well as emissions of laughing gas, which is a very potent greenhouse gas. In the search… Read more at: https://oilprice.com/Energy/Energy-General/Evaluating-Ammonias-Role-in-Sustainable-Shipping.html |

|

Skilled Worker Shortage Stalls U.S. Construction Boom in 2024Via Metal Miner The Construction MMI (Monthly Metals Index) moved in a relatively sideways trend. Steel prices continuing to flatten out, along with bar fuel surcharges dipping in price, kept the index from breaking out of the sideways movement we’ve witnessed since December. As the index enters 2024, U.S. construction news continues to focus on high interest rates and when the hawkish Fed might consider dropping them. Along with this, the U.S. construction market still faces labor shortages, particularly for specialized skills. While predictions… Read more at: https://oilprice.com/Energy/Energy-General/Skilled-Worker-Shortage-Stalls-US-Construction-Boom-in-2024.html |

|

Corporate America Retreats from ESG RhetoricInvestors are pulling funds from sustainable investments as the ESG (Environmental, Social, and Governance) bubble deflates, triggered by high interest rates, poor returns, plummeting stocks in renewable energy, stricter SEC regulations, political backlash, and Elon Musk’s war on woke capitalism. At the same time, ESG mentions on earnings calls by corporate America have plunged. In 2021, during the pandemic boom, US ESG funds hit a record $358 billion in assets, up from $95 billion in 2017. But since then, investor interest has waned as higher… Read more at: https://oilprice.com/Finance/the-Markets/Corporate-America-Retreats-from-ESG-Rhetoric.html |

|

Another Merger Being Explored in the U.S. Shale SpaceAs mergers and acquisitions heat up in the U.S. shale industry, U.S. oil and gas producer Devon Energy is looking to purchase Enerplus, anonymous sources told Reuters on Thursday. The potential tie-up would see the $3 billion valued Enerplus acquired by $30 billion Devon Energy, adding to the string of other mergers and acquisitions in the North American oil and gas industry, including megadeals such as Exxon’s acquisition of Pioneer Natural Resources and Chevron’s acquisition of Hess, along with Occidental’s purchase of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Another-Merger-Being-Explored-in-the-US-Shale-Space.html |

|

The Costly Consequences of Britain’s Infrastructure Planning PitfallsPoorly defined objectives, an overzealous planning system and a disjointed supply chains are all reasons why the UK lags behind its peers on building major infrastructure, a report has found. Researchers at the Boston Consulting Group’s Centre for Growth dug into why exactly Britain’s infrastructure projects are often long-delayed and way over budget. The study comes after the i paper reported that the 14-mile Lower Thames Crossing – which is yet to see spades in the ground – has cost £297m in planning permission alone.… Read more at: https://oilprice.com/Energy/Energy-General/The-Costly-Consequences-of-Britains-Infrastructure-Planning-Pitfalls.html |

|

Shipping Giants Warn of Worsening Red Sea Security SituationSecurity threats to commercial shipping in the Red Sea are not abating, they are escalating instead, and disruptions to maritime trade are expected to last up to a year, according to some of the biggest shipping companies in the world. Many container and tanker operators have been avoiding the Red Sea/Suez Canal route and diverting vessels via the Cape of Good Hope in Africa since the Iran-backed Houthi militants in Yemen escalated early this year missile attacks on commercial ships in the Gulf of Aden, the Bab el-Mandeb Strait, and the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shipping-Giants-Warn-of-Worsening-Red-Sea-Security-Situation.html |

|

Duke Energy Misses Earnings Forecast as Higher Interest Rates BiteU.S. utility giant Duke Energy (NYSE: DUK) reported on Thursday underwhelming fourth-quarter earnings below analyst expectations as rising interest rates raised costs for utilities. Duke Energy booked adjusted earnings per share (EPS) of $1.51 for the fourth quarter, compared to $1.11 for the fourth quarter of 2022. Higher adjusted results for the quarter compared to last year were driven by lower O&M expense, favorable rate case impacts along with growth from riders and other retail margin, and lower tax expense and franchise tax… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Duke-Energy-Misses-Earnings-Forecast-as-Higher-Interest-Rates-Bite.html |

|

Oil Gains 2% as Israel Rejects Gaza Ceasefire Deal, US Gas Inventory PlummetsCrude oil prices have ticked up over 2% in the aftermath of the rejection of a ceasefire in Gaza, with Israeli forces launching new air strikes on Rafah city, and the Gaza Health Ministry saying that 130 people had been killed in the past 24 hours. U.S. Secretary of State Antony Blinken visited the Middle East this week, raising hopes of a ceasefire deal during his trip. However, Israeli Prime Minister Benjamin Netanyahu vowed to continue the war until “victory”. Earlier this week, Hamas offered a 4-½-month ceasefire… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Gains-2-as-Israel-Rejects-Gaza-Ceasefire-Deal-US-Gas-Inventory-Plummets.html |

|

Standard Chartered: Expect Very Little Growth In U.S. Oil Supply In 2024Last year, U.S. crude production surged to all-time high, blunting efforts by OPEC+ to keep global markets constrained, and Energy Intel has predicted that robust non-OPEC oil supply is likely to cap oil prices even in the event demand surprises to the upside. To wit, Energy Intel predicted that non-Opec-plus supply growth would clock in at 1.5 million b/d (crude 1 million b/d) in the current year, enough to offset demand growth in the 1.5 million-2 million b/d range. This leaves OPEC with little room to unwind its production cuts.… Read more at: https://oilprice.com/Energy/Crude-Oil/Standard-Chartered-Expect-Very-Little-Growth-In-US-Oil-Supply-In-2024.html |

|

Maersk Tumbles as Red Sea Crisis StingsShares of A.P. Moller-Maersk A/S in Copenhagen plunged on Thursday. This decline occurred after the world’s second-largest shipping company announced fourth-quarter earnings and guidance that fell short of analysts’ forecasts, alongside the cancellation of its stock repurchase program. Vincent Clerc, chief executive of Maersk, wrote in a statement, “While the Red Sea crisis has caused immediate capacity constraints and a temporary increase in rates, eventually, the oversupply in shipping capacity will lead to price pressure and impact our results.”… Read more at: https://oilprice.com/Finance/the-Markets/Maersk-Tumbles-as-Red-Sea-Crisis-Stings.html |

|

ConocoPhillips Beats Profit Forecast as Production Hits Record HighConocoPhillips (NYSE: COP) reported on Thursday consensus-beating earnings for the fourth quarter of 2023, driven by record oil and gas production. The U.S. oil and gas company booked fourth-quarter 2023 adjusted earnings of $2.9 billion, or $2.40 per share. This, although lower than in Q4 2022, easily beat the analyst consensus estimate of $2.09 per share. Full-year 2023 adjusted earnings were $10.6 billion or $8.77 per share, compared with full-year 2022 adjusted earnings of $17.3 billion, or $13.52 per share. ConocoPhillips,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-Beats-Profit-Forecast-as-Production-Hits-Record-High.html |

|

Russia’s New LNG Project Can’t Begin Shipments Before MarchRussia’s newest LNG export project, Arctic 2 LNG developed by Novatek, will not be able to start shipments before March as it is still waiting for at least one ice-breaker tanker that’s still in South Korea, Russian daily Kommersant reported on Thursday. Earlier indications were that Arctic 2 LNG of Russia’s top LNG producer and exporter, Novatek, could begin its first cargo shipments to customers this month. The U.S. sanctions, however, are holding the project’s start-up and are slowing progress as buyers refuse… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-New-LNG-Project-Cant-Begin-Shipments-Before-March.html |

|

World’s Top Sovereign Fund Slams Exxon’s Lawsuit Over Climate ProposalsExxon’s lawsuit against two activist investor groups over climate resolutions is “very aggressive,” according to the world’s biggest sovereign wealth fund, which is a top ten shareholder in the U.S. supermajor. Last month, ExxonMobil sued two activist investor groups in a Texas district court, aiming to block their climate proposals from going to a vote at the annual shareholder meeting later this year in the first such direct complaint to court instead of to the SEC. Exxon sued U.S. activist investor Arjuna… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Top-Sovereign-Fund-Slams-Exxons-Lawsuit-Over-Climate-Proposals.html |

|

BP’s Indiana Refinery to Remain Shut for Three WeeksBP’s refinery in Whiting, Indiana, will remain shut for at least three weeks following a facility-wide power outage a week ago. Speaking to Reuters, unnamed sources familiar with developments said the following weeks will see a series of inspections carried out at the facility to ensure it is fit to return to operation. In case the inspectors uncover any damage, the shutdown will be extended until the damage is fixed. In case of ho damage, the refinery could reopen in two weeks, the Reuters sources said. The Whiting refinery has the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BPs-Indiana-Refinery-to-Remain-Shut-for-Three-Weeks.html |

|

EU Pushes Back Deadline for ESG Reporting to 2026The European Parliament and the Council of Europe this week agreed to postpone the entry into effect of sustainability reporting requirements by two years for certain industries and non-EU companies. This will give companies more time to prepare for the EU’s sustainability reporting rules, the two institutions said in a statement. “Boosting European competitiveness is a core pillar of the Belgian Presidency, and one way to achieve this objective is to reduce the administrative burden on companies,” Belgium’s Deputy Prime… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Pushes-Back-Deadline-for-ESG-Reporting-to-2026.html |

|

Arm shares surge 60% after SoftBank-controlled chip designer issues strong forecastShares of Arm climbed more than 60% on Thursday after the company reported better-than-expected earnings and a strong forecast. Read more at: https://www.cnbc.com/2024/02/08/arm-shares-soar-after-reporting-strong-earnings-and-forecast.html |

|

Disney shares notch best day in more than three years after earnings bonanzaWalt Disney shares climbed more than 11% Thursday after a jam-packed earnings report. Read more at: https://www.cnbc.com/2024/02/08/disney-pops-6percent-in-premarket-after-epic-games-eras-tour-announcements.html |

|

S&P 500 hits 5,000, but closes just under the milestone: Live updatesThe S&P 500 is on the brink of breaching the 5,000 milestone for the first time ever. Read more at: https://www.cnbc.com/2024/02/07/stock-market-today-live-updates.html |

|

Senate advances $95 billion Ukraine, Israel funding bill, faces uphill battle as budget talks loomThe Senate originally proposed a $118 funding bill that included aid for Israel, Ukraine, Taiwan and the U.S. border, which did not pass Wednesday. Read more at: https://www.cnbc.com/2024/02/08/senate-advances-95-billion-ukraine-israel-aid-package.html |

|

PayPal plummets as Wall Street likens CEO’s strategy to ‘turning around the titanic’PayPal shares plunged by double digits Thursday after a disappointing forecast added to uncertainty around the payments giant. Read more at: https://www.cnbc.com/2024/02/08/paypal-plummets-as-wall-street-likens-ceos-strategy-to-turning-around-the-titanic.html |

|

Biden ‘willfully’ kept classified materials, had ‘poor memory’: Special counselSpecial counsel Robert Hur declined to prosecute President Joe Biden in the probe. Donald Trump is being prosecuted for retaining classified documents. Read more at: https://www.cnbc.com/2024/02/08/biden-docs-probe-final-report-issued-by-special-counsel-robert-hur-.html |

|

J&J, Merck and Bristol Myers CEOs defend high drug prices in Senate hearing, as Biden tries to cut costsThe push to cut drug prices is one of those rare hot-button issues that unites the two major political parties. Read more at: https://www.cnbc.com/2024/02/08/jj-merck-bristol-myers-squibb-ceos-senate-drug-price-hearing.html |

|

Supreme Court skeptical of Trump ballot disqualification by ColoradoThe Supreme Court, despite having a conservative supermajority of justices, has not always voted in favor of former President Donald Trump. Read more at: https://www.cnbc.com/2024/02/08/supreme-court-trump-challenge-to-colorado-ballot-ban.html |

|

Google rebrands Bard AI to Gemini and launches a new app and subscriptionGoogle Bard, a chief competitor to OpenAI’s ChatGPT, is now called Gemini, the same name as the suite of AI models that power it. Read more at: https://www.cnbc.com/2024/02/08/google-gemini-ai-launches-in-new-app-subscription.html |

|

Bitcoin breaks above $45,000 to highest level since day after spot ETFs went live: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Tal Cohen, Kraken USA managing director, explains how the introduction of spot bitcoin ETFs in the U.S. impacts the crypto exchange. Read more at: https://www.cnbc.com/video/2024/02/08/bitcoin-breaks-above-45000-highest-level-since-day-after-spot-etfs-went-live-cnbc-crypto-world.html |

|

Snoop Dogg, Master P allege Walmart, Post Foods hid their cereal in sabotage plotThe musicians say in a lawsuit that Post Foods and Walmart undermined Snoop Cereal after the rappers initially declined to sell the brand but then entered into a contract in late 2022. Read more at: https://www.cnbc.com/2024/02/08/snoop-dogg-master-p-allege-walmart-post-foods-hid-their-cereal-in-sabotage-plot.html |

|

Usher’s pre-show routine: The Super Bowl 58 halftime performer uses affirmations and exercise to start his dayThe 45-year-old starts to prepare ready hours before he ever takes the stage. Read more at: https://www.cnbc.com/2024/02/08/super-bowl-2024-halftime-performer-ushers-pre-show-routine.html |

|

New Kia Carnival minivan will be offered as a hybrid and maintain its SUV designKia is adding a hybrid model to its Carnival minivan to meet increasing consumer demand for the technology and assist in meeting federal fuel economy standards. Read more at: https://www.cnbc.com/2024/02/08/kia-carnival-hybrid-minivan-coming-this-summer.html |

|

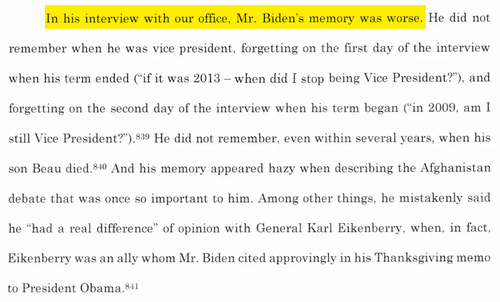

No Charges: Biden “Willfully” Retained Classified Documents; Special Counsel Says Biden “Elderly Man With Poor Memory”The latest evidence of a two-tiered justice system and Democrats apparently above the law comes in a report released Thursday afternoon by the special counsel investigating President Biden’s mismanagement of classified documents, which decided against charging the president. “Our investigation uncovered evidence that President Biden willfully retained and disclosed classified materials after his vice presidency when he was a private citizen,” according to a special counsel’s final report. In the report, special counsel Robert Hur wrote, “Biden will likely present himself to the jury, as he did during his interview with our office, as a sympathetic, well-meaning, elderly man with a poor memory.”

|

|

70 NYCHA Employees Charged In Biggest Bribery Raid In Justice Department HistoryAuthored by Tom Ozimek via The Epoch Times, Prosecutors said Tuesday that 70 current and former employees of the New York City Housing Authority (NYCHA) face bribery and extortion charges in what officials say is the biggest number of such charges issued in a single day in the history of the U.S. Justice Department.

The defendants are accused of demanding over $2 million in corrupt payments from contractors in exchange for awarding over $13 million worth of no-bid contracts, according to the Department of Justice (DOJ). Sixty-six of the 70 defendants were arrested on Tuesday morning in New York, Connecticut, and North Carolina. All of the accused were NYCHA employees at the time of the charged conduct, which took place at nearly a third of all NYCHA buildings in New York City. Read more at: https://www.zerohedge.com/political/70-nycha-employees-charged-biggest-bribery-raid-justice-department-history |

|

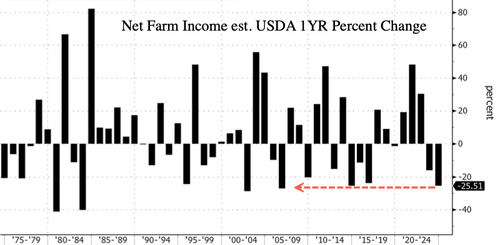

Bidenomics Failing Farmers As Expected Incomes Crash The Most Since 2006Bidenomics Failing Farmers As Expected Incomes Crash The Most Since 2006A new report from the US Department of Agriculture forecasts that US farmers are poised for another year of financial misery, facing the most significant decline in incomes in almost two decades as crop prices slide and US dominance in ag exports wanes. USDA forecasts net farm income, a broad measure of profits, to plunge $39.8 billion, or 25.5%, to $116.1 billion in 2024. This follows a forecasted decrease of $29.7 billion, or 16%, from 2022 to $155.9 billion in 2023. If the estimate holds, farmers face the largest income drop since 2006 and back-to-back years of financial pain.

“With this expected decline, net farm income in 2024 would be 1.7 percent below its 20-year average (2003–22) of $118.2 billion and 40.9 percent below the record high in 2022 in inflation-adjusted dollars,” USDA wrote in the report. … Read more at: https://www.zerohedge.com/commodities/bidenomics-failing-farmers-incomes-crash-most-2006 |

|

The Great Reset Is Dead, Long Live The Great ResetAuthored by Tom Luongo via Gold, Goats, ‘n Guns blog,

When the World Economic Forum rolled out their advertising campaign for The Great Reset it was supposed to be the victory lap for Globalism. Coupled with the COVID-19 pandemic, the subsequent global financial crisis unleashed a flood of government funny money that was supposed to buy our way to their perpetual prosperity.

It failed. Don’t take my word for it. Take the word of one of the chief architects of the Great Reset, Klaus von Commie Schnitzel’s right hand man, Yuval Noah Harari.

|

|

Yodel in final stages of talks amid concern over its futureThe parcel delivery firm, which employs 10,000 staff, is in discussions with “interested parties”. Read more at: https://www.bbc.co.uk/news/business-68238101?at_medium=RSS&at_campaign=KARANGA |

|

Uber Eats’ Super Bowl ad slammed for food allergy jokeThe Super Bowl advert faces a backlash for appearing to make light of a man with a peanut allergy. Read more at: https://www.bbc.co.uk/news/business-68239844?at_medium=RSS&at_campaign=KARANGA |

|

Amazon staff target Valentine’s Day with strikeA walkout of more than 1,000 staff is set to take place at the Coventry site from 13 to 15 February. Read more at: https://www.bbc.co.uk/news/uk-england-coventry-warwickshire-68239721?at_medium=RSS&at_campaign=KARANGA |

|

Entero Healthcare’s Rs 1,600-cr IPO to open on Friday. 10 things to knowThe IPO comprises a fresh equity issue of Rs 1,000 crore and an offer for sale of up to 47.69 lakh shares. Under the OFS, Prabhat Agrawal, Prem Sethi, Orbimed Asia Iii Mauritius, Chethan MP, Deepesh T Gala, among others, will offload shares. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/entero-healthcares-rs-1600-cr-ipo-biggest-so-far-in-2024-10-things-to-know-before-subscribing-to-the-issue/articleshow/107530291.cms |

|

Tech View: Nifty forms long red candle on daily chart. What traders should do on FridayThe short-term trend of Nifty seems to have turned down and one may expect some more weakness in the short term. The near-term uptrend of the market remains intact and further weakness down to the immediate support of 21,550-21,500 levels could be a buying opportunity, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-red-candle-on-daily-chart-what-traders-should-do-on-friday/articleshow/107528267.cms |

|

Technical Stock Pick: Breakout from a ‘Flag’ pattern could take Gabriel India to fresh highs; time to buy?A clear breakout from the pattern could take the stock to fresh record highs above 440 in the short to medium term, suggest experts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-stock-pick-breakout-from-a-flag-pattern-could-take-gabriel-india-to-fresh-highs-time-to-buy/articleshow/107516917.cms |

|

New York Community Bancorp’s stock ‘untethered from fundamentals,’ analyst saysD.A. Davidson downgraded New York Community Bancorp to neutral and reduced its target price for the stock to $5 from $8.50. Read more at: https://www.marketwatch.com/story/new-york-community-bancorps-stock-untethered-from-fundamentals-analyst-says-in-downgrade-ea68cb65?mod=mw_rss_topstories |

|

Investors see risk that inflation was hotter than reported for the end of 2023Inflation revisions don’t generally make waves. But they did last year and it’s for this reason that investors are preparing for what Friday’s updated data might show. Read more at: https://www.marketwatch.com/story/investors-brace-for-risk-of-upside-revisions-to-2023-inflation-figures-196f0319?mod=mw_rss_topstories |

|

Why one of Wall Street’s most reliable recession indicators may have misfiredA recession hasn’t followed last year’s inversion of the yield curve. The economy may not be out of the woods. Read more at: https://www.marketwatch.com/story/why-one-of-wall-streets-most-reliable-recession-indicators-may-have-misfired-81c905a5?mod=mw_rss_topstories |