Summary Of the Markets Today:

- The Dow closed down 274 points or 0.71%,

- Nasdaq closed down 0.20%,

- S&P 500 closed down 0.32%,

- Gold $2,042 down $12.00,

- WTI crude oil settled at $73 up $0.55,

- 10-year U.S. Treasury 4.162% up 0.131 points,

- USD index $104.45 up $0.53,

- Bitcoin $42,374 down $477 (1.11%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

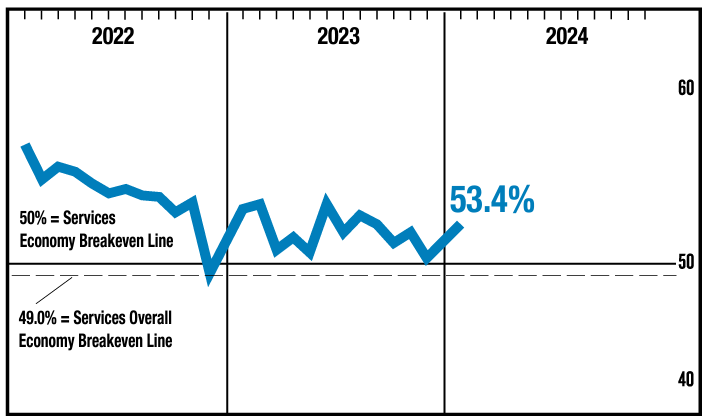

In January 2024, the ISM Services PMI registered 53.4%, 2.9 percentage points higher than December’s seasonally adjusted reading of 50.5 percent. The composite index indicated growth in January for the 13th consecutive month after a seasonally adjusted reading of 49 percent in December 2022, which was the first contraction since May 2020 (45.4 percent). The Business Activity sub-Index registered 55.8 percent in January, matching the seasonally adjusted reading of 55.8 percent in December. The New Orders sub-Index expanded in January for the 13th consecutive month . This index suggests modest growth.

Here is a summary of headlines we are reading today:

- Buffett-Backed Occidental CEO Says Oil Shortage by 2025

- 7 Killed in Drone Attack On Occupied Syrian Oil Field

- Kyrgyzstan Faces Heating Crisis After Power Plant Accident

- Brent Crude Holds at $77 on Strong Jobs Report, Potential Rate Cut Delay

- Hertz Halts EV Purchases from Polestar as Resale Value Crashes

- U.S. And Iranian Attacks In The Middle East Threaten Major Oil Price Rises

- Germany to Subsidize 10 GW of New Natural Gas Power Plant Capacity

- Dow closes more than 250 points lower, S&P 500 slips from record as bond yields surge: Live updates

- Mortgage rates jump back over 7% as stronger economic data rolls in

- Snap to lay off 10% of global workforce, around 500 employees

- Senate releases $118 billion bipartisan aid proposal for Israel, Ukraine, border security

- 10-, 30-year Treasurys post biggest 2-day losses in years on strong economic data, Powell interview

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Saudi Arabia Signals a Shift in Oil StrategyIn 1943 President Franklin Roosevelt declared that “the defense of Saudi Arabia is vital to the defense of the United States.” The reason: Ten years earlier the desert kingdom had granted a concession to Standard Oil of California to explore for oil. It turned out there was some, in fact, a lot. Roosevelt visited with the kingdom’s monarch, King Ibn Saud, early in 1945 to further cement relations between the two countries, paving the way for a mutual defense treaty in 1951. The idea was to provide protection for Saudi Arabia in exchange for access… Read more at: https://oilprice.com/Energy/Crude-Oil/Saudi-Arabia-Signals-a-Shift-in-Oil-Strategy.html |

|

Global Demand for Critical Minerals Spurs Recycling DebateThere are big plans for the production of critical minerals to meet the rapidly growing demand as the world undergoes a green transition. Governments are starting to work together to develop their sustainable mining capabilities and ensure that they produce enough metals and minerals to respond to global needs. To support these efforts, many are now questioning whether we should be recycling our electronics and batteries to contribute to the production of critical minerals. People worldwide are sitting on millions of batteries and electronic… Read more at: https://oilprice.com/Metals/Commodities/Global-Demand-for-Critical-Minerals-Spurs-Recycling-Debate.html |

|

Buffett-Backed Occidental CEO Says Oil Shortage by 2025Warren Buffett-backed Occidental Petroleum is predicting an oil supply shortage by 2025 due to global failure to replace crude reserves at a fast enough pace. “We’re in a situation now where in a couple of years’ time we’re going to be very short on supply,” Occidental CEO Vicki Hollub told CNBC at the Smead Investor Oasis Conference in Phoenix, Arizona on Monday. Noting that some 97% of the oil the world is currently producing is from discoveries made in the 20th century; yet, globally less than 50% of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Buffett-Backed-Occidental-CEO-Says-Oil-Shortage-by-2025.html |

|

7 Killed in Drone Attack On Occupied Syrian Oil FieldA key and very evident theme out of the Red Sea is that the US has lost ‘deterrence’ and perhaps never had it to begin with. Despite over a dozen waves of large-scale Western coalition attacks on Houthi positions, the Yemeni Shia rebels are vowing more attacks on commercial shipping, as we’ve reported. It is the same with Iran-aligned groups in Syria and Iraq, even after the Pentagon on Friday hit 85 targets with 120 bombs. This marked the single biggest US attack on ‘Iranian proxies’ in the region since the Gaza war began, but it… Read more at: https://oilprice.com/Latest-Energy-News/World-News/7-Killed-in-Drone-Attack-On-Occupied-Syrian-Oil-Field.html |

|

Controversy Engulfs UK Banks Over Iranian Petrochemical ConnectionsUK banks have provided bank accounts to holding companies linked to a state-backed Iranian petrochemicals company which has been under western sanctions since 2018, according to reports. The Financial Times reported that both Lloyds and Santander provided accounts to British front companies owned by Petrochemical Commercial Company (PCC). PCC is a sanctioned Iranian petrochemicals company accused by the US of helping to raise hundreds of millions of dollars for the Iranian Revolutionary Guard and of working with Russian intelligence agencies. Both… Read more at: https://oilprice.com/Energy/Energy-General/Controversy-Engulfs-UK-Banks-Over-Iranian-Petrochemical-Connections.html |

|

LNG “Pause” Is Not A “Reversal”, Biden Admin Reassures AlliesAssistant U.S. Secretary for Energy Resources Geoffrey Pyatt has told reporters that U.S. allies have been reassured that the Biden Administration’s pause on LNG will not affect currently permitted exports. “I’ve found that our allies who raise these issues with me, tend to be quickly reassured when you explain to them what this is, which is a pause,” not a reversal, Pyatt told reporters in a call reported by Reuters. “This policy will have no impact on currently permitted LNG exports,” he continued. In the last week of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/LNG-Pause-Is-Not-A-Reversal-Biden-Admin-Reassures-Allies.html |

|

Kyrgyzstan Faces Heating Crisis After Power Plant AccidentHouseholds across Kyrgyzstan’s capital woke up on February 2 to find they had no running hot water or heating. The cause was an explosion that occurred overnight at the Bishkek TETs, Kyrgyzstan’s largest thermal power plant, which provides for around 15 percent of the country’s needs. The incident led to hot water to almost all Bishkek residents being turned off, while sections of the southern parts of the city were left without heating. Schoolchildren were ordered to remain home. Deputy Health Minister Mederbek Ismailov… Read more at: https://oilprice.com/Energy/Energy-General/Kyrgyzstan-Faces-Heating-Crisis-After-Power-Plant-Accident.html |

|

Brent Crude Holds at $77 on Strong Jobs Report, Potential Rate Cut DelayOil prices refrained from responding to geopolitical pressure on Monday, instead dropping slightly on solid numbers from the U.S. jobs report and a caution over interest rate cuts. The latest report from the U.S. Bureau of Labor Statistics showed accelerating job growth for January, with wages seeing a two-year-high increase. However, analysts now fear that the accelerated jobs growth could impact the Federal Reserve’s tentative timeline for interest rate cuts. The data “pushes the timeline for Fed’s highly anticipated cutting… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Crude-Holds-at-77-on-Strong-Jobs-Report-Potential-Rate-Cut-Delay.html |

|

Hertz Halts EV Purchases from Polestar as Resale Value CrashesCar rental giant Hertz has paused the purchase of electric vehicles from manufacturer Polestar as the resale value of the EVs has plummeted, Polestar’s chief executive officer Thomas Ingenlath told the Financial Times on Monday. Hertz, which was an early mover in buying EVs to rent to customers, signed in April 2022 an agreement with Polestar to buy 65,000 cars over five years. Polestar began delivering the first EVs to Hertz in June 2022. Hertz was initially receiving Polestar 2, which has established Polestar’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hertz-Halts-EV-Purchases-from-Polestar-as-Resale-Value-Crashes.html |

|

U.S. And Iranian Attacks In The Middle East Threaten Major Oil Price RisesUntil a few days ago, two key factors had kept oil prices down since the beginning of the Israel-Hamas War on 7 October 2023. The first was the exceptionally accomplished diplomacy of U.S. Secretary of State Antony Blinken and his team in preventing the direct involvement of more Middle Eastern states in the conflict. The second was that the White House has been choosing to disregard a dramatic rise in illegal oil exports from Iran to China since Russia invaded Ukraine on 24 February 2022. Irrespective of whether oil enters the global market legally… Read more at: https://oilprice.com/Energy/Crude-Oil/US-And-Iranian-Attacks-In-The-Middle-East-Threaten-Major-Oil-Price-Rises.html |

|

South Korea’s EV Sales Held Back by Drivers’ Fears of Battery FiresSouth Korea’s electric vehicle (EV) sales fell by 0.1% last year for the first annual decline since 2017, as drivers cite fears of batteries catching fire and insufficient number of chargers as key obstacles alongside higher interest rates and high prices. South Korean drivers are concerned that their future EVs could catch fire while charging or in a car crash, according to a November survey by the Korea Transportation Safety Authority quoted by Bloomberg on Monday. In 2020 and 2021, several high-profile cases of EVs catching… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Koreas-EV-Sales-Held-Back-by-Drivers-Fears-of-Battery-Fires.html |

|

Upcoming UK Power Capacity Auction Could Set Record PricesThis month’s capacity market auction in the UK – designed to pay power producers to provide additional capacity to the grid in times of high demand – could fetch record-high clearing prices for the 2027-2028 market when backup capacity looks tight. The four-year-ahead (T-4) capacity market auction, awarding contracts to generators to have power supply available at peak demand periods, could clear at $85.40 (£68) per kilowatt per year, Bloomberg reported on Monday, quoting estimates from commodity research… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Upcoming-UK-Power-Capacity-Auction-Could-Set-Record-Prices.html |

|

U.S. and Iran Locked in a Dangerous Game of BrinkmanshipIranian President Ebrahim Raisi has said during a trip to an impoverished southern region that Tehran is not looking for military conflict but would respond forcefully to any country that threatens the Islamic republic. “We will not start any war, but if anyone wants to bully us, they will receive a strong response,” Raisi said in a televised speech on February 2 in Hormozgan Province, located along the Gulf of Oman.Raisi’s comments were the latest from officials this week that signaled Iran’s openness to a diplomatic resolution to rising… Read more at: https://oilprice.com/Geopolitics/International/US-and-Iran-Locked-in-a-Dangerous-Game-of-Brinkmanship.html |

|

Germany to Subsidize 10 GW of New Natural Gas Power Plant CapacityGermany will tender 10 gigawatts (GW) of new natural gas-fired capacity from power plants that could be converted to hydrogen in the 2030s, as part of plans to ensure stable electricity supply as wind and solar power generation and installations grow. The plan for Germany’s power plants is in its early stages of development and today the Economy Ministry said that German Chancellor Olaf Scholz, Economy Minister Robert Habeck, and Finance Minister Christian Lindner had agreed a program with which the federal government… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-to-Subsidize-10-GW-of-New-Natural-Gas-Power-Plant-Capacity.html |

|

Brookfield Plans to Raise $25 Billion for New Clean Energy FundsBrookfield Asset Management aims to raise upwards of $25 billion for two new private funds that would invest in clean energy, The Wall Street Journal reported on Monday. Brookfield Asset Management – which has recently raised a record $28-billion infrastructure fund, the world’s largest closed-ended private infrastructure fund, and the largest fund ever raised by Brookfield – expects to raise billions of U.S. dollars in a clean energy-focused fund in the emerging markets. “The demand, particularly from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brookfield-Plans-to-Raise-25-Billion-for-New-Clean-Energy-Funds.html |

|

Dow closes more than 250 points lower, S&P 500 slips from record as bond yields surge: Live updatesStocks fell Monday as Treasury yields spiked higher on concerns the Federal Reserve may not cut rates as much as expected. Read more at: https://www.cnbc.com/2024/02/04/stock-market-live-updates.html |

|

Mortgage rates jump back over 7% as stronger economic data rolls inMortgage rates crossed over 7% for the first time since December, making homes less affordable just ahead of the spring housing market. Read more at: https://www.cnbc.com/2024/02/05/mortgage-rates-back-over-7percent-as-stronger-economic-data-rolls-in.html |

|

Oil market will face supply shortage by end of 2025, Occidental CEO says“We’re in a situation now where in a couple of years time we’re going to be very short on supply,” Occidental CEO Vicki Hollub said. Read more at: https://www.cnbc.com/2024/02/05/oil-market-will-face-supply-shortage-by-end-of-2025-occidental-ceo-says.html |

|

Snap to lay off 10% of global workforce, around 500 employeesThe Snapchat owner said it will cut 10% of its staff, the latest round of big tech layoffs even as stocks soar. Read more at: https://www.cnbc.com/2024/02/05/snap-to-lay-off-10percent-of-global-workforce-around-500-employees.html |

|

Retirees are about to shift money into equity income, boosting these stocks, says Bank of AmericaStocks with big dividend yields could be more attractive to income-hungry investors as interest rates on cash fall. Read more at: https://www.cnbc.com/2024/02/05/retirees-are-about-to-shift-money-into-equity-income-boosting-these-stocks-says-bank-of-america.html |

|

King Charles diagnosed with cancerThe news comes a week after both Princess Kate and King Charles III were discharged from a private London clinic after individual procedures. Read more at: https://www.cnbc.com/2024/02/05/king-charles-diagnosed-with-cancer.html |

|

Fed’s Kashkari backs sentiment that policymakers can take their time cutting interest ratesKashkari said economic developments have shown that Fed policy is not as restrictive on growth as it appears on the surface. Read more at: https://www.cnbc.com/2024/02/05/kashkari-backs-sentiment-that-the-fed-can-take-its-time-cutting-interest-rates.html |

|

Gemini says crypto lender Genesis moves to sell Grayscale Bitcoin Trust assets: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Trevor Filter, the co-founder of Flexa, breaks down what’s driving prices right now amid a historically strong month for the crypto market. Read more at: https://www.cnbc.com/video/2024/02/05/gemini-says-crypto-lender-genesis-moves-sell-grayscale-bitcoin-trust-assets-cnbc-crypto-world.html |

|

Senate releases $118 billion bipartisan aid proposal for Israel, Ukraine, border securitySpeaker Mike Johnson announced a House counterproposal to fund Israel alone, which the White House has deemed a political stunt. Read more at: https://www.cnbc.com/2024/02/04/senate-emergency-aid-proposal-israel-ukraine-border-.html |

|

Student loan crisis is just as big as climate change, Rep. Clyburn says. Here’s whyRep. James Clyburn says the student loan crisis is his biggest issue. Here’s why. Read more at: https://www.cnbc.com/2024/02/05/rep-clyburn-student-loan-crisis-is-just-as-big-as-climate-change.html |

|

A giant reborn: Satya Nadella’s decade as Microsoft CEOTen years after he was introduced to the world as Microsoft’s next CEO, Satya Nadella has overseen a 10x increase in the stock price and a cultural transformation. Microsoft in 2024 reigns as the world’s most valuable company, and its sights are set on continuing to win in the age of artificial intelligence. How did Nadella pull it off? CNBC’s Jon Fortt uncovers the history of a leader’s unlikely rise with an eye on the challenges ahead. Read more at: https://www.cnbc.com/video/2024/02/04/satya-nadellas-decade-as-ceo-of-microsoft.html |

|

Insurers such as State Farm and Allstate are leaving fire- and flood-prone areas. Home values could take a hitInsurance companies are reducing coverage in climate-dangerous markets, leaving many homeowners without affordable property insurance options. Read more at: https://www.cnbc.com/2024/02/05/what-homeowners-need-to-know-as-insurers-leave-high-risk-climate-areas.html |

|

Most Americans can file federal taxes for free — but only about 3% used this option last seasonIf you’re eager to save on filing your taxes, you likely qualify for IRS Free File for federal returns. Here’s what taxpayers need to know. Read more at: https://www.cnbc.com/2024/02/05/heres-how-to-qualify-for-irs-free-file-for-federal-tax-returns.html |

|

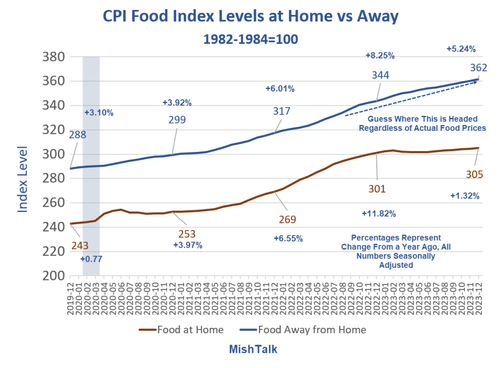

Cost Of Running A McDonalds Jumps $250,000 In CA Due To Minimum Wage HikesBy Mish Shedlock of MishTalk Prices at fast food restaurants in California are set to jump in April as huge minimum wage hikes kick in. Escalating restaurant prices won’t be limited to California.

Expect to Pay More California already has some of the highest fast food prices in the nation. Expect to pay still more, and not just in California. The Wall Street Journal notes Burritos and Big Macs to Cost More in California as Pay Rises

|

|

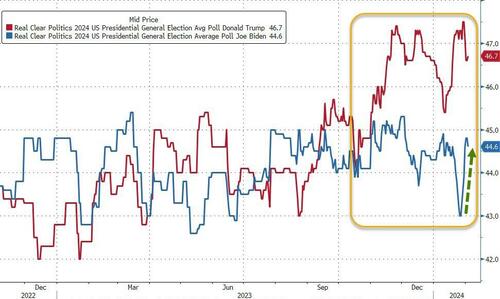

‘Markets Are Now Anchoring On Potential Trump Victory’ – Ex-Soros CIO Says “All Pullbacks Should Be Bought”“We are expecting an upward trajectory in the US equity markets,” wrote Scott Bessent, a former Soros Fund Management investing chief as he bets on a “Trump rally”.

Bessent’s bet appears well based as the polls (averaged by Real Clear Politics), Trump has a solid lead over Biden (although Biden – for some reason – saw a surge in the last few days?)…

Source: Bloomberg

|

|

Trans Crowd Angry At Chappelle Winning Yet Another GrammyAuthored by Steve Watson via Modernity.news, Comedian Dave Chappelle won Best Comedy Album for a second year running at the Grammy Awards Sunday, prompting the transgender crowd to go into a meltdown on social media.

The award is Chappelle’s fifth overall, yet drew anger from fans of trans because his special “What’s in a Name,” taken from a portion of a speech he gave at Duke Ellington School of the Arts contained references to so called ‘transphobic’ jokes he has made in the past. “The more you say I can’t say something, the more urgent it is for me to say it,” Chappelle noted in the speech, adding “It has nothing to do with what you are saying I can’t say. It has everything to do with my freedom of artistic expression.”

|

|

Zelensky Confirms He’s Poised To Fire Military Chief, Amid Reports General Held ‘Secret Talks’ On Achieving PeaceUkrainian President Volodymyr Zelensky has finally given public confirmation that he is currently considering firing this top military general in charge of the armed forces, after a week of denials by Kiev officials amid an avalanche of reporting and leaks to the press. It has also been widely reported that Gen. Valerii Zaluzhny has rejected Zelensky’s attempts to dismiss him, leading to speculation that this could be the start of a mutiny, given also Zalushny is very popular and has a loyal following among military ranks. The Hill has cited a Sunday Italian news interview wherein Zelensky was asked whether he’s going to fire his military commander. Zelensky then said the Ukrainian populace want “a reset” and “a new beginning is necessary” given things haven’t gone well on the battlefield over the past year. Read more at: https://www.zerohedge.com/geopolitical/zelensky-confirms-he-might-fire-military-chief-after-reports-general-held-secret-talks |

|

CBI settles legal action brought by sacked boss Tony DankerThe business group agrees a settlement with Tony Danker after he was dismissed following complaints. Read more at: https://www.bbc.co.uk/news/business-68202969?at_medium=RSS&at_campaign=KARANGA |

|

Russian oil getting into UK via refinery loophole, reports claimRussian oil is refined in other countries and sold into the UK as jet fuel and diesel, research claims. Read more at: https://www.bbc.co.uk/news/business-68018660?at_medium=RSS&at_campaign=KARANGA |

|

Revolution Beauty: Ex-boss to pay £3m after scandalAdam Minto will pay more than £400,000 every March until 2029 after financial questions emerged. Read more at: https://www.bbc.co.uk/news/business-68204356?at_medium=RSS&at_campaign=KARANGA |

|

Top sectors where D-Street superstars invested big bucksMany investors closely track the investments of superstar investors like Rekha Jhunjhunwala, Ashish Kacholia, Sunil Singhania, and Vijay Kedia for valuable market insights. Each investor’s public portfolio reflects their unique investing style and their preferred approaches. Rare Enterprises leans towards textiles, apparel and accessories stocks, while Sunil Singhania and Porinju Veliyath favour software and services. Here’s a breakdown of the dominant sectors in each investor’s portfolio. (Source: Trendlyne) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ashish-kacholia-dolly-khanna-amp-other-d-st-superstars-are-most-invested-in-these-sectors-take-a-look/portfolio-tracker/slideshow/107420671.cms |

|

Britannia Q3 Results Preview: PAT may fall YoY on muted revenue, profitability; demand outlook eyedBritannia Q3 Results Preview: The company is seen reporting a moderate 1.2% year-on-year (YoY) growth in consolidated revenue for the December quarter due to flat growth in volumes, according to the average of estimates given by 10 brokerage firms. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/britannia-q3-results-preview-pat-may-fall-yoy-on-muted-revenue-profitability-demand-outlook-eyed/articleshow/107417765.cms |

|

Tech View: Nifty charts hint at sideways movement ahead. What traders should do on TuesdayPresent weakness is unlikely to damage the near-term uptrend status of the market and one may expect chances of an upside bounce from the lower levels. Immediate support is to be watched around 21,600-21,500 levels, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-sideways-movement-ahead-what-traders-should-do-on-tuesday/articleshow/107430593.cms |

|

10-, 30-year Treasurys post biggest 2-day losses in years on strong economic data, Powell interviewLong-dated Treasurys finished Monday with their biggest two-day losses since 2020 and 2022, after a batch of strong U.S. economic data and Federal Reserve Chair Jerome Powell’s weekend comments about the need to “carefully” approach the timing of interest-rate cuts. Read more at: https://www.marketwatch.com/story/bond-yields-continue-to-back-up-after-hot-jobs-data-e82ab082?mod=mw_rss_topstories |

|

‘A life and death scenario’: Small businesses say they’re paying more than 100% of profits to Uncle Sam after tax-law changeSmall businesses in sectors like software and manufacturing are panicking over the expiration of a critical tax deduction that they say could lead to mass layoffs and business closures, unless Congress acts quickly to amend the law. Read more at: https://www.marketwatch.com/story/a-life-and-death-scenario-small-businesses-say-theyre-paying-more-than-100-of-profits-to-uncle-sam-after-tax-law-change-e8d86910?mod=mw_rss_topstories |

|

This bond-market reality could crush investors’ hopes for a soft landingThe spread between high-yield bonds and Treasurys elevates U.S. recession risk. Read more at: https://www.marketwatch.com/story/this-bond-market-reality-could-crush-investors-hopes-for-a-soft-landing-a4df6c1e?mod=mw_rss_topstories |