Summary Of the Markets Today:

- The Dow closed down 317 points or 0.82%,

- Nasdaq closed down 2.23%,

- S&P 500 closed down 1.61%,

- Gold $2,053 up $1.40,

- WTI crude oil settled at $76 down $2.03,

- 10-year U.S. Treasury 3.943% down 0.003 points,

- USD index $103.63 up $0.23,

- Bitcoin $42,501 down $1,100 (2.52%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

According to ADP, private employers added 107,000 jobs in January 2023 and annual pay was up 5.2 percent year-over-year.. The hiring slowdown of 2023 spilled into January, and pressure on wages continues to ease. The pay premium for job-switchers shrank to a new low last month. ADP has not been a great predictor of BLS jobs growth but honestly I would not bet the farm that any of the data is that accurate. 107,000 jobs growth is not excellent.

The Chicago Business Barometer unexpectedly contracted at an accelerated rate in the month of January 2023. The Chicago business barometer slipped to 46.0 in January from an upwardly revised 47.2 in December, with a reading below 50 indicating a contraction. Another confirmation that manufacturing continues in a recession.

The following statement was issued by the Federal Reserve’s FOMC regarding the Federal Funds Rate: [The bottom line is that the FOMC is saying they will not cut the federal funds rate until they are sure that the inflation rate will reach 2%. IMO, the data is currently showing upward inflation pressures.]

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

Here is a summary of headlines we are reading today:

- The U.S. and Europe Are Rushing To Boost Domestic Uranium Production

- Lithium Producer Sigma Hikes its Brazilian Resource Estimate by 27%

- Only 13 EVs Will Be Eligible for U.S. Tax Credits This Year

- Oil Ticks Lower on Crude Build

- Qatar Awards $6 Billion Worth of Deals to Boost Output from Its Top Oilfield

- Fed Chief Jerome Powell says a March rate cut is not likely

- Dow closes 300 points lower, Nasdaq drops 2% after Fed indicates March rate cut unlikely: Live updates

- Wall Street punishes Alphabet and Microsoft despite earnings beats after stocks hit record

- Meta’s continued rally could hinge on the fortunes of upstart retailers Temu and Shein

- 10-year Treasury yield hovers around 4% as traders evaluate Fed decision

- Boeing chief admits ‘serious challenge’ ahead

- Fed holds interest rates at a 23-year high

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The U.S. and Europe Are Rushing To Boost Domestic Uranium ProductionThere is great potential for several new uranium production markets as the U.S. and Europe look to diversify away from Russia for new nuclear energy pursuits. The U.S. and several European countries have announced ambitious nuclear power plans for the coming decades, in support of a green transition. However, the lack of uranium production outside of Russia is posing a threat to achieving these plans. Sanctions introduced on Russian energy and other products, following the 2022 Russian invasion of Ukraine, have led to global shortages of natural… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/The-US-and-Europe-Are-Racing-To-Boost-Domestic-Uranium-Production.html |

|

Lithium Producer Sigma Hikes its Brazilian Resource Estimate by 27%Lithium producer Sigma Lithium said on Wednesday that a new estimate of its mineral resource site in Brazil had shown lithium deposits were 27% higher than in a previous assessment from a year ago. Sigma Lithium now says that its Audited NI 43-101 Mineral Resource at its 100%-owned Grota do Cirilo operation at Vale do Jequitinhonha was raised to 109 million tons of measured, indicated, and inferred mineral resource. Grota do Cirilo now becomes the world’s fourth-largest operating industrial pre-chemical lithium beneficiation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lithium-Producer-Sigma-Hikes-its-Brazilian-Resource-Estimate-by-27.html |

|

Organic Cathode Batteries: A Leap Forward in Eco-Friendly Energy StorageMassachusetts Institute of Technology researchers announced a new organic battery material that could offer a more sustainable way to power electric cars. The lithium-ion battery includes a cathode based on organic materials to replace the cobalt or nickel. The reporting paper has been published in ACS Central Science. For now many electric vehicles are powered by batteries that contain cobalt – a metal that carries high financial, environmental, and social costs. In a new study, the researchers showed that the organic material, which could… Read more at: https://oilprice.com/Energy/Energy-General/Organic-Cathode-Batteries-A-Leap-Forward-in-Eco-Friendly-Energy-Storage.html |

|

Embattled Phillips 66 Close Oklahoma Pipeline After Fire, RuptureLess than a month after news that Phillips 66 was discussing the sale of some of its assets, the company has been forced to shut down a section of a natural gas pipeline due to a fire. The natural gas pipeline in the Oklahoma Panhandle ruptured after a fire on Tuesday, with Phillips 66 saying in a Wednesday statement that the fire had been extinguished and the cause of the incident was under investigation, Reuters reports. No injuries or threats to nearby residences have been reported, and the company said that multiple fire and law… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Embattled-Phillips-66-Close-Oklahoma-Pipeline-After-Fire-Rupture.html |

|

Australia Looks To Capitalize on China’s Insatiable Copper DemandVia Metal Miner The frosty relationship between China and Australia continues to thaw, as evidenced in the bi-lateral trade indices indicate. Now, thanks to China’s growing copper demand, the world possesses one more indicator. According to recently released data, Australia exported 27,500 metric tons of copper ores and concentrates to China in November last year. At U.S. $44.5 million, this represents the highest-ever recorded shipment for any month after 2020. That was the year China forced its unofficial ban on Australian exports. … Read more at: https://oilprice.com/Metals/Commodities/Australia-Looks-To-Capitalize-on-Chinas-Insatiable-Copper-Demand.html |

|

Reuters Survey Shows OPEC Output Down in JanuaryA Reuters survey shows OPEC’s oil production plunging for the month of January, registering the biggest drop in output since July last year. The survey lists new voluntary production cuts by some cartel members along with shut-in oil in Libya due to protests earlier in the month as the causes for the drop in output. OPEC produced 26.33 million barrels per day of oil in January, a drop of 410,000 bpd from the previous month, Reuters said, also noting that Angola’s barrels are missing as of December, when the country opted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Reuters-Survey-Shows-OPEC-Output-Down-in-January.html |

|

Chinese Automakers Eye Opportunity in Central AsiaAfter wrapping up the political section of his recent working trip to China, Uzbekistan’s President Shavkat Mirziyoyev took the long way home from Beijing by passing through the southern city of Shenzen. He traveled there to visit the headquarters of leading Chinese automaker BYD, which has just overtaken Elon Musk’s Tesla as the world’s best-seller of electric vehicles. And then, together with BYD chief executive Wang Chuanfu, he oversaw a remote launch ceremony for an assembly plant of hybrid and electric cars to be built in… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-Automakers-Eye-Opportunity-in-Central-Asia.html |

|

Germany Plans Large Share Sale of Nationalized Energy Major UniperGermany has started exploring options to sell a large stake in energy giant Uniper, which the government nationalized in 2022, with a possible share offering at the end of this year or next year, sources with knowledge of the plan told Bloomberg on Wednesday. The German government has launched initial talks with potential advisers, according to Bloomberg’s unnamed sources. Germany had to nationalize Uniper in 2022 to avoid its collapse amid soaring gas prices and a lack of Russian supply in the wake of the Ukraine invasion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Plans-Large-Share-Sale-of-Nationalized-Energy-Major-Uniper.html |

|

Only 13 EVs Will Be Eligible for U.S. Tax Credits This YearThis year, the list of qualified electric vehicles (EVs) for U.S. tax credits is relatively small. Many popular models like the Nissan Leaf, Ford Mustang Mach-E, and some Tesla Model 3s are missing – largely due to new battery sourcing rules. With stricter rules coming into effect, the number of models is dropping from 43 to 13. Visual Capitalist’s Marcus Lu created the following graphic to show the qualifying EV models in 2024, based on data from FuelEconomy.gov. Which EVs Made the List? Here are the EVs that are eligible for a U.S. tax credit… Read more at: https://oilprice.com/Energy/Energy-General/Only-13-EVs-Will-Be-Eligible-for-US-Tax-Credits-This-Year.html |

|

Europe’s Largest LNG Terminal Signs 10-Year Deal for Algerian Natural GasThe UK’s Grain LNG, Europe’s largest liquefied natural gas terminal, signed on Wednesday a ten-year agreement that will extend the long-term storage and redelivery capacity of Algerian gas company Sonatrach at the Grain LNG terminal from January 2029. Grain LNG, located on the Isle of Grain in Kent, is the biggest such terminal in Europe and the eighth largest in the world by tank capacity with a site that spans more than 600 acres in total. National Grid’s Grain LNG is considered of strategic national… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Largest-LNG-Terminal-Signs-10-Year-Deal-for-Algerian-Natural-Gas.html |

|

Oil Ticks Lower on Crude BuildCrude oil prices went lower today after the U.S. Energy Information Administration reported an inventory build of 1.2 million barrels for the week to January 26. This compared with a substantial draw of 9.2 million barrels for the previous week. A day earlier, the American Petroleum Institute estimated another inventory draw, at 2.5 million barrels, for the week to January 26. This significantly exceeded analyst expectations for a much smaller draw, at 867,000 barrels. In fuels, the Energy Information Administration reported mixed inventory changes… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Ticks-Lower-on-Crude-Build.html |

|

Lackluster Economic Data Out of China Puts Oil Prices Under PressureChinese economic activity, a key barometer of oil demand, put some downward pressure on oil prices on Monday after data showed on Wednesday that manufacturing contracted in January for the fourth straight month. China’s official manufacturing purchasing managers’ index (PMI) rose slightly while remaining in contraction, dampening hopes for a rebound. China’s January PMI rose to 49.2, up from 49 in December, with levels below 50 considered to be a state of contraction and analysts concluding that China remains challenged… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lackluster-Economic-Data-Out-of-China-Puts-Oil-Prices-Under-Pressure.html |

|

January Has Been a Roller Coaster for CommoditiesVia Metal Miner January 2024 unfolded as a dynamic and volatile month for financial markets and commodity prices. The early weeks of January saw euphoria among investors fueled with hopes of receding inflation concerns and a dovish fed. However, a hawkish central bank and geopolitical tensions soon dampened that optimism. Meanwhile, falling oil prices and tightened investments drove bearish pressure on hopeful investors. Overall, financial markets resumed their December 2023 rally, mainly due to cooling inflation data and an eased U.S. CPI print.… Read more at: https://oilprice.com/Energy/Energy-General/January-Has-Been-a-Roller-Coaster-for-Commodities.html |

|

Even Tankers Carrying Russian Fuels Have Started Avoiding the Red SeaSome tankers transporting Russian fuels have started to avoid the Suez Canal route to Asia as ship-tracking data shows operators of vessels carrying Russian oil products may have reached the risk tolerance for passing close to Houthi missiles in the Red Sea and the Gulf of Aden. The Red Sea/Suez Canal route is the shortest route for tankers from Russia’s western ports to Asia. Until recently, traders and operators were relatively sure that cargoes of Russian origin wouldn’t be targeted. But last week’s attack on a U.S. and UK-linked… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Even-Tankers-Carrying-Russian-Fuels-Have-Started-Avoiding-the-Red-Sea.html |

|

Qatar Awards $6 Billion Worth of Deals to Boost Output from Its Top OilfieldQatar’s state firm QatarEnergy has awarded engineering and installation contracts worth a total of $6 billion to develop the next phase of its biggest oilfield, Al-Shaheen, which will boost production at the offshore field by around 100,000 barrels per day (bpd). The contract award is part of the third phase of Al-Shaheen’s development since North Oil Company took over the field’s operation in July 2017. The company is a joint venture between QatarEnergy, which has 70%, and French supermajor TotalEnergies, which holds… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Awards-6-Billion-Worth-of-Deals-to-Boost-Output-from-Its-Top-Oilfield.html |

|

Fed Chief Jerome Powell says a March rate cut is not likelyFed Chairman Jerome Powell said the central bank is unlikely to have enough confidence about inflation to cut rates as soon as March. Read more at: https://www.cnbc.com/2024/01/31/fed-chief-jerome-powell-says-a-march-rate-cut-is-not-likely.html |

|

Dow closes 300 points lower, Nasdaq drops 2% after Fed indicates March rate cut unlikely: Live updatesStocks fell to their session lows Wednesday after Federal Reserve chair Jerome Powell pushed back against a March rate cut. Read more at: https://www.cnbc.com/2024/01/30/stock-market-today-live-updates.html |

|

Wall Street punishes Alphabet and Microsoft despite earnings beats after stocks hit recordInvestors were left wanting more from Microsoft and Alphabet after recent rallies lifted their stock prices to all-time highs. Read more at: https://www.cnbc.com/2024/01/30/wall-street-punishes-alphabet-and-microsoft-despite-earnings-beats-.html |

|

Meta’s continued rally could hinge on the fortunes of upstart retailers Temu and SheinOnline retailers Temu and Shein, which are both based in the China region, helped contribute to Meta’s ad rebound in 2023. Read more at: https://www.cnbc.com/2024/01/31/metas-continued-rally-could-hinge-on-fortunes-of-temu-and-shein.html |

|

A look at how stocks perform before and after the Fed’s first rate cut — and how it may be different this timeHistory shows that stocks typically rally after the Federal Reserve starts to lower rates, but the way that plays out exactly can get more complicated. Read more at: https://www.cnbc.com/2024/01/31/a-look-at-how-stocks-perform-before-and-after-the-feds-first-rate-cutand-how-it-may-be-different-this-time.html |

|

Byron Allen, offering $14 billion for Paramount, has a long history of media bids that haven’t materializedAllen previously explored deals to buy ABC, television station operator Tegna and the National Football League’s Washington Commanders. Read more at: https://www.cnbc.com/2024/01/31/paramount-bidder-byron-allen-has-long-history-of-failed-media-bids-.html |

|

QAnon-linked legal fund spent $400,000 defending Trump allies, new filing showsA fund intended to pay the legal bills of allies of Donald Trump has raised more than $1.5 million and spent just under $400,000, new records show. Read more at: https://www.cnbc.com/2024/01/31/qanon-linked-legal-fund-spent-400000-defending-trump-allies-filing-shows.html |

|

Biden administration looks to forgive student debt of borrowers in hardshipThe Biden administration announced on Wednesday that it will try to deliver student loan forgiveness to borrowers experiencing financial hardship. Read more at: https://www.cnbc.com/2024/01/31/biden-administration-may-expand-student-loan-forgiveness-plan-.html |

|

XRP drops after Ripple co-founder’s crypto wallets hacked: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Chuck Mounts, chief DeFi officer at S&P Global Ratings, discusses the agency’s recent ranking of stablecoin stability and his outlook for digital assets. Read more at: https://www.cnbc.com/video/2024/01/31/xrp-drops-after-co-founders-crypto-wallets-hacked-cnbc-crypto-world.html |

|

10-year Treasury yield hovers around 4% as traders evaluate Fed decisionThe 10-year U.S. Treasury yield flickered around the 4% level. Read more at: https://www.cnbc.com/2024/01/31/us-treasury-yields-ahead-of-fed-interest-rate-decision.html |

|

Federal Reserve holds interest rates steady, sets the stage for cuts. What that means for your moneyAs the Federal Reserve sets the stage for rate cuts later this year, here’s what that means for your credit card, mortgage rate, auto loan and savings account. Read more at: https://www.cnbc.com/2024/01/31/what-the-federal-reserves-next-move-means-for-the-rates-you-pay.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting in December. Read more at: https://www.cnbc.com/2024/01/31/heres-what-changed-in-the-new-fed-statement.html |

|

Ether takes center stage as bitcoin heads into one of its strongest monthsEther is ready to take the limelight in the month ahead after bitcoin and newly launched bitcoin ETFs dominated crypto investor attention in January. Read more at: https://www.cnbc.com/2024/01/31/ether-takes-center-stage-as-bitcoin-finds-footing-heading-into-one-of-strongest-months.html |

|

Four States Consider Lifting Taxes On Precious MetalsVia SchiffGold.com, Citizens of Georgia, Kentucky, Wisconsin, and Kansas may soon enjoy lower taxes on precious metals if recently introduced pro-metal bills are made law in 2024.

Earlier this month, all four states introduced or reintroduced bills that would exempt precious metals from either state sales tax (in Kentucky and Wisconsin) or state income tax (in Georgia and Kansas). Kentucky lawmakers will vote on House Bill 101 and Senate Bill 105 in this year’s legislative session. If passed, the bills would end state sales tax on gold, silver, platinum, and palladium bullion starting in August of this year. Wisconsin’s Assembly Bill 29 and Senate Bill 33 would both enact similar provisions while also lifting sales tax on the purchase of copper bullion. Proponents of these bills point out that gold and silver are one of the only asset classes that have sale … Read more at: https://www.zerohedge.com/personal-finance/four-states-consider-lifting-taxes-precious-metals |

|

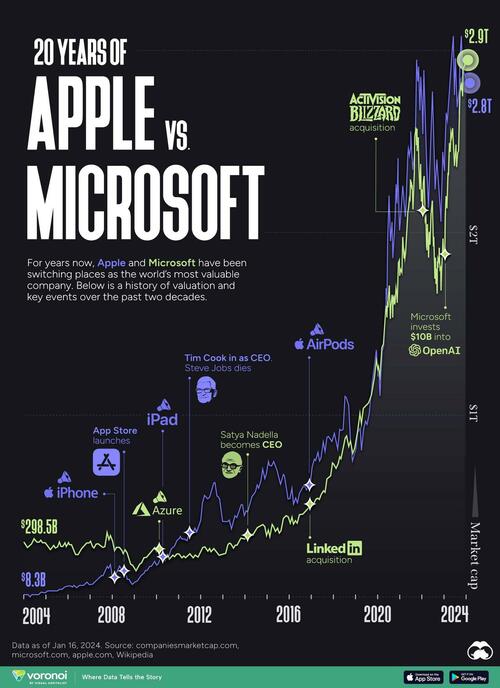

Visualizing 20 Years Of Apple Vs MicrosoftFor years, Apple and Microsoft have been switching places as the world’s most valuable company, in terms of market capitalization. In today’s chart, Visual Capitalist’s Nick Routley explores this history, as well as key events over the past two decades, based on data from CompaniesMarketCap and both companies. Data is from January 16, 2024.

A History of the Battle for Market Cap DominanceDuring the 1990s, Microsoft capitalized on the success of Windows, supplanting General Electric as the most valuable company in the U.S. in the process. Around the same time, Apple was on the brink of bankruptcy due to intense competition in the personal computer market, high product pricing, and a lack of innovation. The company also suffered from numerous failed attempts to modernize the Macintos … Read more at: https://www.zerohedge.com/markets/visualizing-20-years-apple-vs-microsoft |

|

Washington’s Planned Theft Of Credit Card BenefitsAuthored by Kevin van Elswyk via The Mises Institute, Our vacation airline tickets in September were funded by accumulated miles on our Alaska Airlines credit card. While on vacation this summer, my brother-in-law graciously hosted eight of us for dinner. He tried to downplay the generous hospitality by saying he had just gotten his “cash back” award from his credit card company. The “cash back” credit card had accumulated a tidy sum of money, paying for a very nice dinner.

At home in Brookfield, a takeout restaurant advised a 3.5 percent surcharge if paying by credit or debit card. Shopping later, our favorite farm market added a dollar to all card transactions. It is not unusual in Brookfield to see two prices for gas: one price is for cash, and the slightly higher gallon cost is for credit. These actions offset the cost of interchange fees, the costs from the processing bank. These Read more at: https://www.zerohedge.com/personal-finance/washingtons-planned-theft-credit-card-benefits |

|

Watch Live: Fed Chair Powell Walk Hawkish-Dove Tight-RopeGiven today’s dovish surge in March rate-cut odds (and 2024 rate-cut expectations) after NYCB’s results, one can’t help but think Powell will use the press conference to push back further against the market’s attitude, building on the very hawkish Fed statement.

At a minimum, The Fed wants to maintain some optionality into the next two meetings and not suggest he is being bullied by the market itself. Of course, today’s shitshow at NYCB will likely be mentioned (and an imminent start to tapering QT) as we note that The Fed removed the following sentence from the statement:

So, once again, Powell will be walking the tight-rope – this time as the hawkish-dove. Read more at: https://www.zerohedge.com/markets/watch-live-fed-chair-powell-walk-hawkish-dove-tight-rope |

|

Boeing chief admits ‘serious challenge’ aheadThe firm updates investors for the first time since the Alaska Airlines blowout. Read more at: https://www.bbc.co.uk/news/business-68157266?at_medium=RSS&at_campaign=KARANGA |

|

Fed holds interest rates at a 23-year highThe bank says it wants “greater confidence” about inflation cooling before it starts cutting rates. Read more at: https://www.bbc.co.uk/news/business-68157267?at_medium=RSS&at_campaign=KARANGA |

|

Halifax: First-time buyers are joining forces to buy propertiesNew research by Halifax also shows that first-time buyers put an average deposit of £53,414 down last year. Read more at: https://www.bbc.co.uk/news/business-68152877?at_medium=RSS&at_campaign=KARANGA |

|

Jan Auto Sales: What to expect from M&M, Maruti, TaMo & top automakersThe January auto sales figures will start to trickle in from February 1 onwards. Here’s a look at what to expect from auto sales numbers. (Source: ET NOW) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/january-auto-sales-what-to-expect-from-mampm-maruti-tata-motors-amp-other-top-automakers/in-spotlight/slideshow/107291857.cms |

|

Tech View: Nifty forms Piercing Line ahead of expiry. What traders should do on Budget dayThe trend may continue to be volatile on Thursday, especially as the Interim Budget will be delivered. Support on the lower end is situated at 21,500, while a decisive move above 21,750 might trigger a rally towards 22,100 and beyond. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-piercing-line-ahead-of-expiry-what-traders-should-do-on-budget-day/articleshow/107294527.cms |

|

NTPC gets DIPAM nod to list arm NTPC Green Energy to raise Rs 10,000 crThe NTPC’s proposal for NGEL listing was approved by the Department of Investment and Public Asset Management (DIPAM), as per the source. The company is planning to utilise the funds towards energy transition and setting up green energy projects, including solar and green hydrogen. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ntpc-gets-dipam-nod-to-list-arm-ntpc-green-energy-to-raise-rs-10000-cr/articleshow/107290264.cms |

|

Judge dismisses Disney’s free-speech lawsuit against DeSantisWalt Disney Co.’s lawsuit against Florida’s Republican Gov. Ron DeSantis and others, alleging they retaliated against the company for publicly criticizing a controversial parents-rights education law backed by DeSantis, was dismissed by a federal judge on Wednesday. Read more at: https://www.marketwatch.com/story/judge-dismisses-disney-lawsuit-against-desantis-7f5d1803?mod=mw_rss_topstories |

|

Biden administration proposes banning ‘junk fees’ on college students’ bank accountsThe CFPB and advocates have warned for years about deals between schools and financial institutions to pitch products to students. Read more at: https://www.marketwatch.com/story/biden-administration-proposes-banning-junk-fees-on-college-students-bank-accounts-377688ab?mod=mw_rss_topstories |

|

Your home office may have helped China attack critical U.S. infrastructure — here’s howInvestigators say they have broken up a network of hacked routers that China used to hide its infrastructure attacks Read more at: https://www.marketwatch.com/story/your-home-office-may-have-helped-china-attack-critical-u-s-infrastructure-heres-how-6e62f001?mod=mw_rss_topstories |