Summary Of the Markets Today:

- The Dow closed up 224 points or 0.59%,

- Nasdaq closed up 1.12%,

- S&P 500 closed up 0.76%,

- Gold $2,032 up $13.10,

- WTI crude oil settled at $77 down $1.06,

- 10-year U.S. Treasury 4.080% down 0.008 points,

- USD index $103.50 up $0.06,

- Bitcoin $43,090 up $1,135 (2.70%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

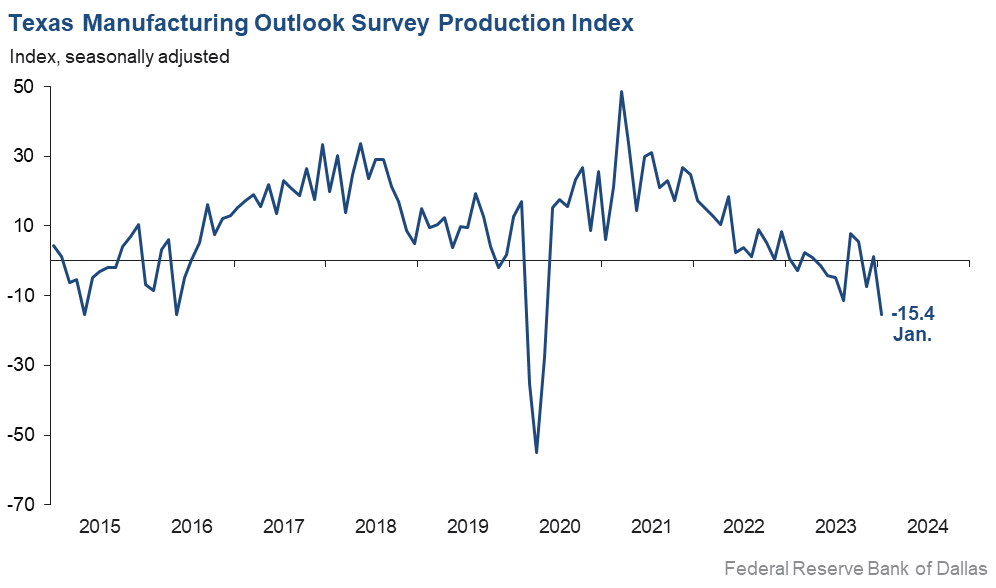

Dallas Fed Manufacturing activity contracted in January 2023 after stabilizing in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dropped 17 points to -15.4—its lowest reading since mid-2020. Manufacturing remains in a recession in the U.S. – and most Fed regional surveys show contraction in January.

Here is a summary of headlines we are reading today:

- New Sanctions on Venezuela Oil Likely As Maduro Bans Opposition

- Russia Throws Caution to the Wind to Boost Oil Exports

- U.S. Prices At the Pump Climb After Cold Spell Shutdowns

- Shale Boom Fuels Third Year of Record U.S. Gas Output

- Spending on Natural Gas to Top $1 Trillion Over the Next Decade

- etail return fraud is rising as key holiday deadline approaches

- S&P 500 rises to close at fresh record Monday as Big Tech earnings loom: Live updates

- Reed Hastings sells $1.1 billion in Netflix shares

- Bitcoin reclaims $43,000 as the cryptocurrency extends recent gains: CNBC Crypto World

- The 15 most expensive U.S. neighborhoods per square foot—No. 1 is 2,000% higher than average

- Ryanair cuts profit forecast after online travel agent row

- Dow scores 6th record close of 2024, bolstered by Treasury funding update in pivotal week for markets

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

IEA Leads Summit on Secure, Responsible Critical Minerals SupplyThe need for international cooperation in developing a sustainable critical minerals industry is becoming increasingly evident, as several forecasts suggest that demand will likely outpace supply over the next decade. As governments worldwide push for a green transition and rapid innovations are being seen in renewable energy and clean technology, the dependency on critical minerals is growing. However, there are wide concerns about the impact of massive mining expansion on the environment. Countries must now work together to determine the best… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Leads-Summit-on-Secure-Responsible-Critical-Minerals-Supply.html |

|

New Sanctions on Venezuela Oil Likely As Maduro Bans OppositionThe Biden administration is set to potentially renew sanctions on Venezuelan oil in April after the banning of an opposition candidate for this year’s presidential elections, Bloomberg reports. The six-month suspension of sanctions on Venezuelan oil ends in April, and the Biden administration may renew all sanctions at that time due to failure to meet the conditions for their lifting. Last week, opposition leader Maria Corina Machado was blocked from running for president by a court ruling in a move she has referred to as “judicial… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Sanctions-on-Venezuela-Oil-Likely-As-Maduro-Bans-Opposition.html |

|

Investor Group Seeks to Steer BP Back to Oil and GasA leading London activist investor group is pressuring oil giant BP to ditch renewable energy and maintain its fossil fuel operations for shareholders, reports suggest. The Financial Times this morning reported that Bluebell Capital Partners wrote to BP chair Helge Lund in October after taking a small stake in the company. The letter decried BP’s commitment to reduce oil and gas production by 25 per cent by 2030 against 2019 levels as an “irrational strategy” that has depressed its share price. The target is a legacy commitment… Read more at: https://oilprice.com/Energy/Energy-General/Investor-Group-Seeks-to-Steer-BP-Back-to-Oil-and-Gas.html |

|

Russia Throws Caution to the Wind to Boost Oil ExportsWith severe weather and U.S. and European sanctions hitting Russian oil exports, Moscow has reportedly eased restrictions to allow ports to operate during major storms in order to maintain the pace of exports. According to a Reuters report, traders interviewed said that there were both technical and environmental risks to the easing of restrictions at Russian ports in order to maintain export revenues. Reuters cited three unnamed traders as saying that Russian ports had been given “unofficial recommendations” to load… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Throws-Caution-to-the-Wind-to-Boost-Oil-Exports.html |

|

China to Refill Oil Reserves Following 2023 DrawdownIt’s not just the US that is in desperate need of refilling its strategic oil reserve after Biden drained it to score some quick political points ahead of the 2022 midterms. China also needs to refill its oil tanks after steadily drawing on those stockpiles for much of 2023… but like in the US, don’t expect a massive buying spree that will send global prices rallying. According to data from Vortexa, onshore inventories in the world’s biggest crude importer fell to an eight-month low at the start of the year. That’s likely to… Read more at: https://oilprice.com/Energy/Crude-Oil/China-to-Refill-Oil-Reserves-Following-2023-Drawdown.html |

|

Naphtha Margins Jump To 2022 High as Ship with Russian Fuel AttackedRefining margins for naphtha in Asia jumped to their highest level in nearly two years on Monday, following an attack in the Gulf of Aden on a tanker transporting Russian fuel. The profit for making naphtha, a key feedstock for the petrochemicals industry, jumped in Asia on Monday to a premium of $0.25 over Dubai crude, according to data compiled by Bloomberg. Asian traders were spooked by the attack on the vessel carrying fuel from Russia, after the Iran-aligned Houthis had said earlier this month that Russian shipments were… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Naphtha-Margins-Jump-To-2022-High-as-Ship-with-Russian-Fuel-Attacked.html |

|

High-Impact Drilling to see Rebound in Africa and Latin America this YearThe upstream industry hopes 2024 can be a bounce-back year for high-impact oil and gas drilling after a lackluster 2023, with Africa and Latin America likely to spearhead activities. Rystad Energy has identified 36 potential high-impact wells to be drilled or spud in 2024, the highest annual total since we started tracking the market in 2015. This would be a sizeable jump from the 27 high-impact wells drilled last year, and operators will hope for a better success rate. Of these 36 potentially significant wells, 13 are in Africa and 10 in Latin… Read more at: https://oilprice.com/Energy/Energy-General/High-Impact-Drilling-to-see-Rebound-in-Africa-and-Latin-America-this-Year.html |

|

U.S. Prices At the Pump Climb After Cold Spell ShutdownsPrices for a gallon of gasoline in the United States rose 4.5 cents from a week ago, hitting an average of $3.07 on Sunday, GasBuddy reports, after refinery shutdowns due to cold weather pushed wholesale prices up. The national average price of gasoline in the U.S. is still 41.2 cents lower than a year ago, while diesel prices, which have fallen 0.5 cents in the past week, remain 79 cents lower than a year ago. “We’ve seen the national average price of gasoline bounce back up after cold-weather-related refinery shutdowns… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Prices-At-the-Pump-Climb-After-Cold-Spell-Shutdowns.html |

|

Activist Investor Urges BP to Abandon RenewablesOne activist investor is taking on supermajor BP. But instead of what all other activist investors have pursued with oil and gas giants in recent years, Bluebell Capital Partners is calling on the UK-based group to renege on its goal to reduce oil and gas production and scale back its ambitions in renewable energy. Bluebell Capital Partners sent at the end of last year a letter to BP chair Helge Lund, a letter which the Financial Times has seen, urging the supermajor not to reduce its oil and gas output, as it is destroying shareholder… Read more at: https://oilprice.com/Energy/Energy-General/Activist-Investor-Urges-BP-to-Abandon-Renewables.html |

|

Italy Pursues Closer Energy Ties With Africa Through $6 Billion FundItaly is creating a $5.95 billion (5.5 billion euro) fund to boost its energy ties with Africa and support healthcare and education there in a bid to stem migrant flows from North Africa to Italian shores, Italy’s right-wing Prime Minister Giorgia Meloni said on Monday. Meloni unveiled the funding plan, dubbed ‘Mattei plan’ – named after the founder of Italian energy major Eni, Enrico Mattei, – during a summit with dozens of African heads of state and government and EU officials, including Ursula von der Leyen, the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italy-Pursues-Closer-Energy-Ties-With-Africa-Through-6-Billion-Fund.html |

|

Shale Boom Fuels Third Year of Record U.S. Gas OutputI previously reported that the U.S. set a new oil production record in 2023 and became the world’s top liquefied natural gas exporter. I also noted that it was likely that the U.S. set a natural gas production record in 2023, but that it wouldn’t be certain until the Energy Information Administration released the final numbers sometime in 2024. The EIA has now released those numbers. December 2023 marked a new all-time monthly high for natural gas production, and overall production for the year beat the previous record by 3.7%. Following… Read more at: https://oilprice.com/Energy/Natural-Gas/Shale-Boom-Fuels-Third-Year-of-Record-US-Gas-Output.html |

|

Drought Hits Canada’s Hydropower SectorCanada’s western provinces have been hit by the worst drought in years and provincial utilities are getting into losses as their hydropower generating capacities are lower amid low reservoir levels. In British Columbia, drought in the past year has forced BC Hydro to draw water for hydropower generation from the least affected areas and to import electricity, executives have told Bloomberg. British Columbia’s utility corporation has been importing more electricity from neighboring Alberta and from some western U.S. states. No blackouts… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drought-Hits-Canadas-Hydropower-Sector.html |

|

Saudi Oil Flow Continues Through Red Sea Despite Regional ConflictChina and Russia aren’t the only countries being given a “pass” from Yemen’s Houthi rebels, but Saudi Arabia is also exporting crude oil through the Red Sea as if in perfectly normal times (well, almost). At a moment that especially Western and any and all Israeli-linked vessels are being targeted by rocket and drone attacks out of Yemen, the head of Aramco’s refining, oil trading and marketing division Mohammed Al Qahtani has confirmed to Bloomberg, “We’re moving in the Red Sea with our oil and products cargoes.” He added that the… Read more at: https://oilprice.com/Energy/Crude-Oil/Saudi-Oil-Flow-Continues-Through-Red-Sea-Despite-Regional-Conflict.html |

|

Another Major Announces Conversion of European Oil RefineryItaly’s Eni said on Monday it would convert its refinery in Livorno into a biofuels-making facility in a second announcement of an upcoming closure of a European oil refinery in less than a week. The Italian energy major confirmed today its decision to build Italy’s third bio-refinery in Livorno. The project was first announced in October 2022 and was followed by an application for Environmental Impact Assessment (EIA) in November 2022. The plan to make hydrogenated biofuels awaits official authorization and includes the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Another-Major-Announces-Conversion-of-European-Oil-Refinery.html |

|

Spending on Natural Gas to Top $1 Trillion Over the Next DecadeThe oil and gas industry is expected to spend more than $1 trillion on natural gas supply, driven by demand for gas in Europe, climate campaign group Global Witness said on Monday in a new analysis of Rystad Energy data. The industry is set to invest $223 billion of the projected spending in the supply of natural gas for Europe… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spending-on-Natural-Gas-to-Top-1-Trillion-Over-the-Next-Decade.html |

|

Retail return fraud is rising as key holiday deadline approachesRetail return fraud is rising, and companies face a tough balance of trying to keep customers loyal while cracking down on abuse of return policies. Read more at: https://www.cnbc.com/2024/01/29/retail-return-fraud-is-rising-as-key-holiday-deadline-approaches.html |

|

S&P 500 rises to close at fresh record Monday as Big Tech earnings loom: Live updatesThe benchmark S&P 500 closed at a record for the sixth time on Monday. Read more at: https://www.cnbc.com/2024/01/28/stock-futures-fall-ahead-of-big-tech-earnings-and-fed-meeting-decision-live-updates.html |

|

Sen. Elizabeth Warren pushes Fed Chair Powell to cut ‘astronomical’ rates, ease housing pressurePresident Joe Biden’s 2024 reelection campaign has struggled to earn points with voters on the economy, in part due to expensive housing costs. Read more at: https://www.cnbc.com/2024/01/29/warren-pushes-fed-chair-powell-to-cut-rates-ease-housing-pressure-.html |

|

Amazon terminates iRobot deal, Roomba maker to lay off 31% of staffAmazon and iRobot said regulatory concerns made it impossible for the deal to move forward, sending the Roomba makers’ shares plummeting. Read more at: https://www.cnbc.com/2024/01/29/amazon-terminates-irobot-deal-vacuum-maker-to-lay-off-31percent-of-staff.html |

|

How to get the biggest bang for your buck while investing in dividend-paying stocksNominal yields on your dividend payers only tell part of the story when you pick out your stocks. Read more at: https://www.cnbc.com/2024/01/29/how-to-get-the-biggest-bang-for-your-buck-while-investing-in-dividend-paying-stocks.html |

|

Starbucks olive oil-infused Oleato drinks to launch across the U.S.Starbucks’ olive oil-infused coffee beverages will be available across all U.S. stores starting Tuesday, the company announced. Read more at: https://www.cnbc.com/2024/01/29/starbucks-oleato-olive-oil-drinks-launch-across-the-us.html |

|

Reed Hastings sells $1.1 billion in Netflix sharesNetflix co-founder and executive chairman Reed Hastings has gifted two million shares of the streaming giant, according to a regulatory filing. Read more at: https://www.cnbc.com/2024/01/29/reed-hastings-sells-1point1-billion-in-netflix-shares.html |

|

Haley hits Trump on tariffs ahead of her Wall Street fundraisers“This is a man who now wants to go and put 10% tariffs across the board,” Haley said of Trump on CNBC’s Squawk Box. Read more at: https://www.cnbc.com/2024/01/29/haley-hits-trump-on-tariffs-ahead-of-her-wall-street-fundraisers.html |

|

FanDuel parent Flutter lists on the NYSE, challenging DraftKings as sports-betting pure playFanDuel parent company Flutter listed on the New York Stock Exchange, giving U.S. investors more choice in sports betting. Read more at: https://www.cnbc.com/2024/01/29/fanduel-parent-flutter-lists-on-the-nyse.html |

|

Bitcoin reclaims $43,000 as the cryptocurrency extends recent gains: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Coinbase security chief Philip Martin explains the company’s role in many of the spot bitcoin ETFs now trading in the United States. Read more at: https://www.cnbc.com/video/2024/01/29/bitcoin-extends-recent-gains-cross-43000-cnbc-crypto-world.html |

|

‘Biggest, baddest ship on the planet’: World’s largest cruise ship stokes environmental concernsThe world’s largest cruise ship set sail from Miami, Florida over the weekend, stoking concerns about the environmental impact of cruise tourism. Read more at: https://www.cnbc.com/2024/01/29/icon-of-the-seas-worlds-largest-cruise-ship-sets-sail-from-miami.html |

|

The 15 most expensive U.S. neighborhoods per square foot—No. 1 is 2,000% higher than averageThe average U.S. home costs an average of $244 per square foot, but in some cities they cost thousands of dollars more. Read more at: https://www.cnbc.com/2024/01/29/most-expensive-us-neighborhoods-based-on-cost-per-square-foot.html |

|

These companies reporting earnings this week have a history of beating expectations, Bespoke saysThese stocks can also pop on the back of their strong reports, history shows. Read more at: https://www.cnbc.com/2024/01/29/these-companies-reporting-earnings-this-week-have-a-history-of-beating-expectations-bespoke-says.html |

|

The Blowoff!Via Praetorian Capital, Last summer, I was having lunch with a friend at a plain vanilla shop, who kept checking his phone and muttering, “this NVIDIA is killing me.” After the third time in five minutes, I had to ask:

The whole experience was surreal. I miss all sorts of trades. I don’t let them bother me. If something is killing me, it’s because I’m losing money. I’ve never worried about making less. It’s just not an emotion that I’ve experienced. Besides, my friend was trailing his benchmark by a few hundred basis points. To me, that’s a bad day, a rounding error—certainly not a crisis. However, I don’ … Read more at: https://www.zerohedge.com/markets/blowoff |

|

Mess In The West: ‘Army Of God’ Convoy Heads To US Border While EU Farmers Block CitiesIn the US, a convoy of truckers, calling themselves “God’s Army,” is preparing to embark on a journey from several locations across the Lower 48 to the southern border as tensions soar between Texas and the Biden administration. Meanwhile across the Atlantic, farmers are bearing down on Europe’s capitals – from Bucharest to Warsaw to Brussels – venting frustrations about climate policies. These social instabilities are breaking out ahead of key European and US elections this year.

The organizers of the “Take Our Border Back” convoy are “calling all active & retired law enforcement and military, Veterans, Mama Bears, elected officials, business owners, ranchers, truckers, bikers, media and LAW ABIDING, freedom-loving Americans” to “assemble in honor of our US Constitution and Bill of Rights” at the southern border, in protest against the federal government’s inability to secure the border, according to the Read more at: https://www.zerohedge.com/geopolitical/mess-west-army-god-convoy-heads-us-border-while-eu-farmers-block-cities |

|

Incentives Are EverythingAuthored by Mark Jeftovic via BombThrower.com, How it started / How it’s going…

Yet, elites think that individual incentives are irrelevant.One of the holy writs of the Bitcoin and crypto-currency space is The Sovereign Individual, written over twenty years ago, before the Global Financial Crisis, before the Satoshi white paper, before clown world and before “The Jackpot” (COVID-19). Written by James Dale Davidson (still active and writing), and the late Lord Rees-Mogg (whose son is a prominent figure in the UK Tory party), the book predicted a future wherein the centralized, hierarchical, top-down model of nation state governance would break down and be forced to yield to a type of free market competition for citizens, producers and tax revenues. The reason why was simple: asymmetric … Read more at: https://www.zerohedge.com/crypto/incentives-are-everything |

|

Funding Cut Off For UN Agency Aiding Gaza As Israel Publishes ‘Intelligence Dossier’ Alleging Oct.7 LinksThe main United Nations agency in Gaza has had its funding gutted, given that countries responsible for the bulk of funds have cut them off (especially the US and UK), following Israel’s allegations that at least a dozen of the UN agency’s employees were involved in the Hamas attack on Israel on October 7. The organization which goes by the formal name of the United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) has already reportedly fired several employees amid the allegations, and the controversy has resulted in the United States leading the way in pausing all donations. The UNRWA has long faced these accusations, and all the way back in 2018 the Trump administration cut US funding, but it was restored under the Biden administration in 2021. Read more at: https://www.zerohedge.com/geopolitical/funding-cut-un-agency-supporting-gaza-israel-publishes-intelligence-dossier-alleging |

|

Amazon-iRobot deal scrapped after EU challengeThe maker of the Roomba vacuum maker announces job cuts as the planned takeover collapses. Read more at: https://www.bbc.co.uk/news/business-68131819?at_medium=RSS&at_campaign=KARANGA |

|

Ryanair cuts profit forecast after online travel agent rowThe airline reduced its fares in December after sites including Booking.com suddenly removed its flights. Read more at: https://www.bbc.co.uk/news/business-68126413?at_medium=RSS&at_campaign=KARANGA |

|

Britishvolt buyer David Collard charged with assault in New YorkDavid Collard was arrested after an alleged altercation on Madison Avenue in November. Read more at: https://www.bbc.co.uk/news/business-68129123?at_medium=RSS&at_campaign=KARANGA |

|

Epack Durables shares to debut tomorrow. What GMP signals ahead of listing?The shares of Epack Durables will debut on the bourses on Tuesday following a successful IPO, which was subscribed 16 times at close. Ahead of the listing, the company’s shares are trading with a marginal premium of Rs 6 as against an issue price of Rs 230. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/epack-durables-shares-to-list-tomorrow-what-gmp-signals-ahead-of-listing/articleshow/107231990.cms |

|

Tech View: Nifty looks poised for another breakout. What traders should do on TuesdayNifty on Tuesday ended 385 points higher to form a long bull candle on the daily chart, indicating chances of an upside breakout of the hurdle at 21750 in the short term. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-looks-poised-for-another-breakout-what-traders-should-do-on-tuesday/articleshow/107234741.cms |

|

Softer growth in central & state capex seen; construction to support rural incomes next couple of years: Pranjul Bhandari, HSBCPranjul Bhandari of HSBC predicts that in FY25, both central and state government capex will grow at a slower clip. However, this slowdown may not be negative for growth as the central bank is expected to implement looser monetary conditions. Bhandari suggests that the central bank will ease liquidity, which can effectively act as a rate cut of about 40 to 50 basis points. While the rural economy has faced challenges, the construction sector has provided an alternate source of income for rural Indians Read more at: https://economictimes.indiatimes.com/markets/expert-view/softer-growth-in-central-state-capex-seen-construction-to-support-rural-incomes-next-couple-of-years-pranjul-bhandari-hsbc/articleshow/107235725.cms |

|

Dow scores 6th record close of 2024, bolstered by Treasury funding update in pivotal week for marketsU.S. stocks are higher Monday to start what may be the most pivotal week of 2024 so far. Read more at: https://www.marketwatch.com/story/s-p-500-futures-hover-near-record-ahead-of-pivotal-week-of-tech-earnings-d5e40a87?mod=mw_rss_topstories |

|

Bank complaints about higher capital requirements may be overblown, finance professor saysColumbia’s Tomasz Piskorski agrees with regulators that higher capital requirements could help protect smaller and mid-sized banks Read more at: https://www.marketwatch.com/story/bank-complaints-about-higher-capital-requirements-may-be-overblown-finance-professor-says-1b65860d?mod=mw_rss_topstories |

|

Small-caps continue to lag. That may be good news for the overall stock market.Small-cap stocks have been underperforming their large-cap peers over the past 12 months. However, it may bode well for stock market’s future performance, based on historical data. Read more at: https://www.marketwatch.com/story/small-caps-continue-to-lag-that-may-be-good-news-for-the-overall-stock-market-3e935dfc?mod=mw_rss_topstories |