Summary Of the Markets Today:

- The Dow closed up 202 points or 0.54%,

- Nasdaq closed up 1.35%,

- S&P 500 closed up 0.88%,

- Gold $2,024 up $17.90,

- WTI crude oil settled at $74 up $1.51,

- 10-year U.S. Treasury 4.142% up 0.038 points,

- USD index $103.47 up $0.02,

- Bitcoin $41,083 down $1,628 (3.81%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

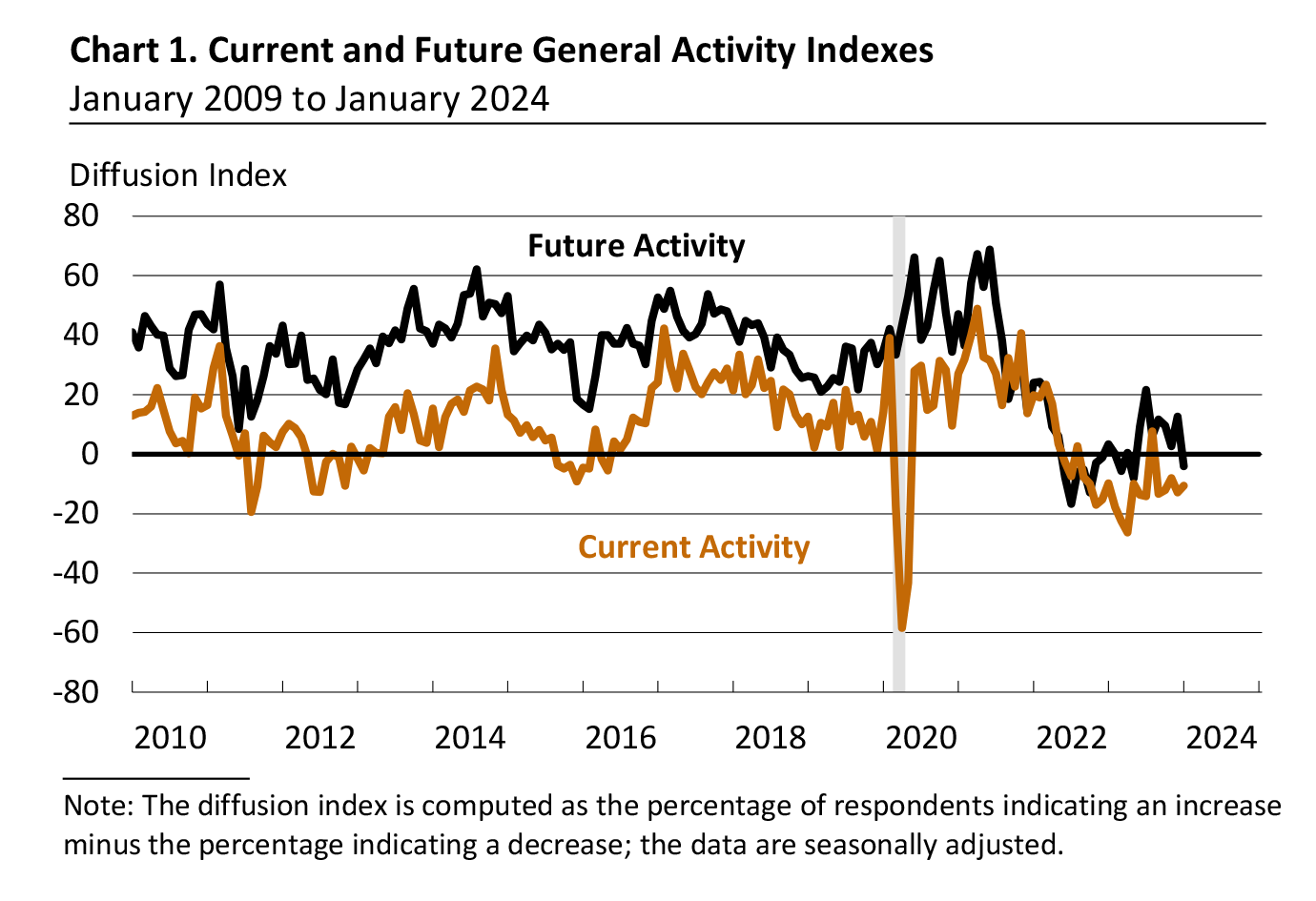

Philly Fed Manufacturing Business Outlook Survey in January 2024 continued to decline overall. The survey’s indicators for general activity, new orders, and shipments rose but remained negative. The survey’s broad indicators for future activity declined, suggesting less widespread expectations for overall growth over the next six months. The New York Feds manufacturing survey released earlier this week significantly declined.

The number of CEO changes in December 2023 at U.S. companies jumped 13% from 180 November CEO exits to 204 in December. This marks a 104% increase from the 100 CEOs who left their posts in the same month one year prior. Andrew Challenger, workplace expert and Senior Vice President of Challenger, Gray & Christmas, Inc stated:

Historically, we’ve seen large economic shifts preceded by a surge in CEO exits. Companies must consider the implications of younger C-level leaders to their future success. How do they get diverse talent – diverse in age, ethnicity, and ability – into their pipelines? How do they ensure those future leadership teams are successful? These is absolutely the questions companies are asking themselves in 2024,

Privately owned housing units authorized by building permits in December 2023 were 6.1% above December 2022. An estimated 1,469,800 housing units were authorized by building permits in 2023. This is 11.7 percent below the

2022 figure of 1,665,100. Privately‐owned housing starts were up 7.6% year-over-year. An estimated 1,413,100 housing units were started in 2023. This is 9.0 percent (±2.5 percent) below the 2022 figure of 1,552,600. Privately owned housing completions were up 8.4% year-over-year. An estimated 1,452,500 housing units were completed in 2023. This is 4.5 percent (±3.8 percent) above the 2022 figure of 1,390,500. Overall, 2023 was a good year for the construction of residential housing.

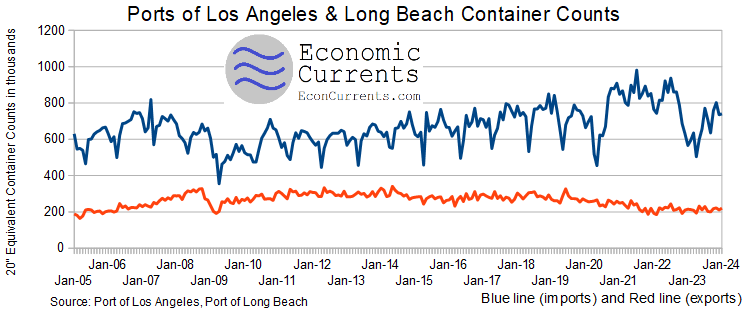

Accounting for 40% of containers entering and leaving the U.S., the container volumes in December 2023 through the Ports of Los Angeles and Long Beach were up 18% year-over-year for imports and up 6% for exports. The growing strength of imports suggests the U.S. economy is beginning to improve.

In the week ending January 13, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 203,250, a decrease of 4,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 207,750 to 208,000.

Here is a summary of headlines we are reading today:

- Protecting Coasts and Powering Homes: The Tidal Range Revolution

- Climate Groups Defeat Norwegian Government In Court Battle

- Red Sea Crisis Spurs Surge in Container Ship Rates

- The World’s Coal-Fired Power Generation Hit a Record High in 2023

- Tesla’s Aggressive Pricing Strategy Hits European Auto Stocks

- Top Oil and Financial Firms Made $424 Billion in Windfall Profits in Two Years

- Fed’s Raphael Bostic expects rate cuts to happen in the third quarter

- Dow closes 200 points higher Thursday to shake off 3-day slump as Apple shares pop: Live updates

- Red Sea attacks already bigger issue for supply chain than pandemic, maritime advisory warns

- Weekly jobless claims post lowest reading since September 2022

- Ballooning Credit & Rate Cuts: A Perfect Storm For Default

- The Dow claws back earlier losses as tech rally resumes despite rate-cut uncertainty

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Protecting Coasts and Powering Homes: The Tidal Range RevolutionLancaster University researchers David Vandercruyssen, Simon Baker, David Howard and George Aggidis from the School of Engineering have said that tidal range schemes are vital to protect habitats, housing and businesses from a rising sea level estimated to be over one meter within 80 years. The research report published in Energy (an open access paper), follows on from earlier Lancaster University research into a combined tidal range electricity generation and cost model demonstrating the viability of tidal range energy in the UK. This showed how… Read more at: https://oilprice.com/Alternative-Energy/Tidal-Energy/Protecting-Coasts-and-Powering-Homes-The-Tidal-Range-Revolution.html |

|

Beijing Navigates Shifting Sands in Middle East PoliticsRecent months of compounding crises in the Middle East have exposed China’s limited commitment and ability to play a leading role in the region, and as I explained here, Beijing isn’t necessarily well-positioned to benefit from the newfound chaos. Finding Perspective: Since the beginning of Israel’s ongoing war in Gaza, China has gradually taken a backseat toward the conflict. Beijing has used the large-scale humanitarian crisis and mounting civilian casualties in Gaza as an opportunity to blame the hostilities on the United States’s Middle East… Read more at: https://oilprice.com/Geopolitics/International/Beijing-Navigates-Shifting-Sands-in-Middle-East-Politics.html |

|

Climate Groups Defeat Norwegian Government In Court BattleThe Norwegian government has suffered a major setback in its bid to expand the country’s oil and gas production after the country’s Supreme Court ruled that three permits issued by the government to develop new offshore oil and gas fields are invalid because their environmental impact was not sufficiently assessed. Last year, Greenpeace Nordic and Natur og Ungdom filed a lawsuit with the Oslo District Court, seeking a temporary injunction for the three projects—Equinor ASA’s (NYSE:EQNR) Breidablikk… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Climate-Groups-Defeat-Norwegian-Government-In-Court-Battle.html |

|

Election Year Puts Climate Change at Forefront for BusinessesLast week we learnt that 2023 was the world’s hottest year on record. Concerns about the temperature data from both the Met Office and the EU’s Climate Change Service comes as we have faced worsening flooding in the UK, wildfires across North America and prolonged droughts in East Africa. This extreme weather poses a risk to lives and livelihoods in the UK and around the world. It presents business and the City with serious challenges, but also opportunities to shape the future for the better. In this General Election year, while there… Read more at: https://oilprice.com/The-Environment/Global-Warming/Election-Year-Puts-Climate-Change-at-Forefront-for-Businesses.html |

|

Philippines To Explore South China Sea For Oil Amid China DisputeThe Philippines says it will go ahead with plans to build defense alliances with the U.S. and its Western allies in a bid to make it possible for the Southeast Asian nation to explore oil-and-gas-rich South China Sea. “I really do think it’s quite urgent that we start now,” Philippine’s Defence Secretary Gilberto Teodoro Jnr told Bloomberg News in an interview on Wednesday in his office in Manila, adding that oil exploration is “part of the package” of the country’s strategy to protect its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Philippines-To-Explore-South-China-Sea-For-Oil-Amid-China-Dispute.html |

|

Red Sea Crisis Spurs Surge in Container Ship RatesRed Sea diversions mean container lines need more ships to carry the same amount of cargo. The security situation — which is even more precarious in the near term due to coalition air strikes in Yemen — has already driven spot container freight rates much higher. Now it is starting to push up the price container lines pay to rent ships. “This week saw a scramble for prompt tonnage,” said MB Shipbrokers (formerly Maersk Broker) in a market report on Friday, referring to ships that can be chartered immediately. “Owners… Read more at: https://oilprice.com/Geopolitics/International/Red-Sea-Crisis-Spurs-Surge-in-Container-Ship-Rates.html |

|

Shell Starts Layoffs in Search of EfficienciesShell has begun hundreds of layoffs, sources with knowledge of the matter told Bloomberg on Thursday, as the supermajor looks to create more value through simplification and discipline. Positions in the low-carbon business will be the first to be eliminated, followed by additional job cuts in the corporate affairs division and project and technology departments, Bloomberg’s sources said. Last year, Shell said it plans to cut 15% of the 1,300 jobs in its Low Carbon Solutions business as it scales back some green energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Starts-Layoffs-in-Search-of-Efficiencies.html |

|

Asia, Europe LNG Imports Likely To Survive Red Sea ChaosDespite the continued escalation of tensions and conflicts in the Middle East and the diversion of LNG cargoes away from the Red Sea, natural gas prices in Europe and spot LNG prices in Asia have dropped to the lowest levels in years and months, respectively, even during peak winter season. Asian demand for LNG has rebounded this winter season, following weaker-than-expected import demand in the 2022/2023 season, while gas inventories in the region are relatively high. This would help the biggest Asian buyers, China, Japan, and South… Read more at: https://oilprice.com/Energy/Natural-Gas/Asia-Europe-LNG-Imports-Likely-To-Survive-Red-Sea-Chaos.html |

|

The World’s Coal-Fired Power Generation Hit a Record High in 2023Global coal-fired power generation reached a record-high level in 2023, per data from environmental think tank Ember reported by Reuters columnist Gavin Maguire. As countries, especially in Asia, looked to meet growing electricity demand and ensure their energy security, coal use in power generation hit record highs. Per Ember data, global electricity generation from coal was 8,295 terawatt hours (TWh) between January and October, up by 1% compared to the same period in 2022. Meanwhile, global coal exports also rose last year to more than 1 billion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Worlds-Coal-Fired-Power-Generation-Hit-a-Record-High-in-2023.html |

|

Oil Moves Up on Inventory DrawCrude oil prices inched higher today after the U.S. Energy Information Administration reported an estimated inventory decline of 2.5 million barrels for the week to January 12. This compared with a moderate inventory build of 1.3 million barrels for the previous week, which also saw another round of massive increases in fuel inventories that drove prices lower at the time. For last week, the EIA also reported more inventory builds in gasoline and middle distillate stocks. In gasoline, the authority estimated an inventory increase… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Up-on-Inventory-Draw.html |

|

Russia’s Oil Revenues Slump To Six-Month LowWidening discounts for Russian grades and lower international benchmark prices dragged Russia’s oil export revenues down to a six-month low in December, despite higher export volumes, the International Energy Agency (IEA) said on Thursday. All Russian oil exports, including crude and fuels, jumped by 500,000 barrels per day (bpd) to 7.8 million bpd in the last month of 2023, compared to November, the IEA said in its Oil Market Report for January. This was the highest export level in nine months, with crude oil shipments jumping… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Revenues-Slump-To-Six-Month-Low.html |

|

Tesla’s Aggressive Pricing Strategy Hits European Auto StocksNew year, same strategy to move metal. Tesla is reportedly slashing prices across Europe, following similar moves the company made in China and also continuing the strategy the company used successful throughout 2023 to stoke demand at the cost of margins. Multiple sources, citing Tesla’s website, reported on Wednesday morning that Tesla has reduced prices for two variants of its Model Y in Germany by 5,000 euros ($5,439). The Performance version of the Model Y is now available to German buyers at EUR55,990, and the Long Range version is… Read more at: https://oilprice.com/Energy/Energy-General/Teslas-Aggressive-Pricing-Strategy-Hits-European-Auto-Stocks.html |

|

IEA Raises Oil Demand Outlook for 2024 for Third Consecutive MonthGlobal oil demand is set to rise by 1.2 million barrels per day (bpd) this year compared to 2023, the International Energy Agency (IEA) said on Thursday, raising its 2024 demand growth outlook for a third consecutive month. Although the IEA flagged today in its monthly report a significantly slower growth rate this year, due to “macroeconomic headwinds, tighter efficiency standards and an expanding EV fleet”, the Paris-based agency lifted its forecast for global oil demand growth by 180,000 bpd compared to the estimate from the previous… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Raises-Oil-Demand-Outlook-for-2024-for-Third-Consecutive-Month.html |

|

Top Oil and Financial Firms Made $424 Billion in Windfall Profits in Two YearsThe biggest oil companies and the top financial institutions generated combined windfall profits of as much as $424 billion in the two years to June 2023, a report by ActionAid and Oxfam showed this week. ActionAid and Oxfam have looked at the 200 largest companies in the world by market capitalization to estimate their windfall profits, comparing the earnings in the two years up to June 2023 with profits in the four preceding years. Of these 200 companies, 14 were in fossil fuels and 22 in the banking sector, bringing the total to 36 companies… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-Oil-and-Financial-Firms-Made-424-Billion-in-Windfall-Profits-in-Two-Years.html |

|

Pakistan Hits Militant Targets in Iran in Retaliatory StrikePakistan carried out early on Thursday a series of military strikes against terrorist hideouts in Iran’s southeastern province Sistan-Baluchestan, in the latest conflict escalation in the Middle East, two days after Iran targeted with missiles sites linked to militant group Jaysh al-Adlin in western Pakistan. Pakistan’s Ministry of Foreign Affairs said that “a number of terrorists were killed” during the operation based on intelligence. According to Iranian state TV and news agencies, three women and four children were killed.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pakistan-Hits-Militant-Targets-in-Iran-in-Retaliatory-Strike.html |

|

Nelson Peltz is launching a blitz on Disney. Here’s what he says is next in his proxy fightTrian Fund Management will amp up its case to get Nelson Peltz and Jay Rasulo elected to the Disney board in the coming months. Read more at: https://www.cnbc.com/2024/01/18/nelson-peltz-outlines-plans-for-disney-proxy-battle.html |

|

Fed’s Raphael Bostic expects rate cuts to happen in the third quarterThe Atlanta Fed president said a “golden path” economic scenario is getting closer than many Fed officials had expected. Read more at: https://www.cnbc.com/2024/01/18/feds-raphael-bostic-expects-rate-cuts-to-happen-in-the-third-quarter.html |

|

Dow closes 200 points higher Thursday to shake off 3-day slump as Apple shares pop: Live updatesThe tech-heavy Nasdaq Composite rose Thursday and turned positive for the year, boosted by tech gains. Read more at: https://www.cnbc.com/2024/01/17/stock-market-today-live-updates.html |

|

Passive investing rules Wall Street now, topping actively managed assets in stock, bond and other fundsAs 2023 came to a close passive held more assets under management than active. Read more at: https://www.cnbc.com/2024/01/18/passive-investing-rules-wall-street-now-topping-actively-managed-assets-in-stock-bond-and-other-funds.html |

|

These stocks that are reporting earnings next week have momentum going for themWatch these stocks that may be poised for a breakout alongside quarterly results next week. Read more at: https://www.cnbc.com/2024/01/18/these-stocks-reporting-earnings-next-week-have-momentum-at-their-back.html |

|

Red Sea attacks already bigger issue for supply chain than pandemic, maritime advisory warnsHouthi attacks on ships in the Red Sea are already having a bigger impact on the supply chain than Covid, according to data coming in on cargo vessel delays. Read more at: https://www.cnbc.com/2024/01/18/red-sea-crisis-already-bigger-issue-for-shipping-than-covid-data-show.html |

|

Amazon’s latest layoffs hit its Buy with Prime unitSince the new year began, Amazon has laid off employees in its Prime Video, MGM Studios, Twitch and Audible divisions. Read more at: https://www.cnbc.com/2024/01/18/-amazon-layoffs-hit-its-buy-with-prime-unit.html |

|

Judge loses patience with Trump lawyer in E. Jean Carroll sex assault defamation trialDonald Trump clashed with the judge and complained about E. Jean Carroll’s testimony during her first day on the stand in his sex assault defamation trial. Read more at: https://www.cnbc.com/2024/01/18/trump-trial-e-jean-carroll-testimony-ex-president-judge-clash.html |

|

Weekly jobless claims post lowest reading since September 2022Initial filings for unemployment insurance totaled 187,000 for the week ended Jan. 13. Read more at: https://www.cnbc.com/2024/01/18/weekly-jobless-claims-post-lowest-reading-since-september-2022.html |

|

Senate passes stopgap bill to prevent a shutdown, sending it to the HouseThe bill would keep the government open on a short-term basis until March 1, when the first of two funding deadlines will hit. The second will be on March 8. Read more at: https://www.cnbc.com/2024/01/18/senate-passes-stopgap-bill-to-prevent-a-shutdown-sending-it-to-the-house.html |

|

U.S. executives in Davos see a Trump victory in 2024, and no cause for concernBoth publicly and privately, many U.S. executives at Davos expressed calm and readiness for a potential Donald Trump return to the White House. Read more at: https://www.cnbc.com/2024/01/18/davos-us-executives-see-a-trump-victory-in-2024.html |

|

The No. 1 challenge Fortune 500 execs say they’re facing with employees right now, according to new researchBosses are still struggling to trust that their employees are working without constant in-office supervision, says Atlassian co-CEO Scott Farquhar. Read more at: https://www.cnbc.com/2024/01/18/no-1-challenge-fortune-500-execs-say-theyre-facing-with-employees-new-research.html |

|

The early winner in the bitcoin ETF race has raked in $1 billionBlackRock’s iShares Bitcoin Trust looks to be an early winner among the bitcoin funds that were approved by regulators last week. Read more at: https://www.cnbc.com/2024/01/18/the-early-winner-in-the-bitcoin-etf-race-has-raked-in-1-billion.html |

|

Figuring It All OutSubmitted by QTR’s Fringe Finance For two years, the question has been the same: when is something going to give, and when are we going to see some real volatility in some market — any market — thanks to 5% interest rates? The answer, it turns out, may be simpler than I thought. I gave up a long time ago trying to figure out whether the market is going to flash crash or melt up as a result of aggressive further easing. If I had to handicap the situation today, I’d predict both are going to happen: we will see a sharp decline in the market, as a result of either a black swan event, disappearing liquidity, an unexpected blowoff valve (more on this in a bit) or all of the above, which would trigger margin calls and a deleveraging. Then, from there, I would predict an unprecedented response from the Fed, who would flood the system with money and easing in a way that was larger by any factor than how they have done it in the past. Whatever outcome occurs should be irrelevant thanks to the way that I positioned myself heading into the year. I’m hedged and short the indexes and a couple of specific names that I believe would plunge in the event of a market pullback. At the same time, I will be ready to use any profit from a sharp downturn to purchase sound money assets – namely, gold and silver, miners, first and foremost, and maybe some real estate and bitcoin – should they also wind up selling off in any type of panic that encompasses all assets. Read more at: https://www.zerohedge.com/markets/figuring-it-all-out |

|

Ballooning Credit & Rate Cuts: A Perfect Storm For DefaultVia SchiffGold.com, With consumer debt reaching record levels, the Federal Reserve contemplating rate cuts in 2024, and post-Covid inflation still yet to reach its peak, a storm is indeed brewing.

Price increases on essential goods like food, housing, and fuel are hitting hard for Average Americans. But in its policy to avoid economic reality as much as possible, the Fed’s CPI numbers don’t account for factors such as consumers buying cheap alternatives instead of the name brands that they used to easily afford. Acting as de facto PR agencies for Federal Reserve monetary policy, some media outlets are claiming that Americans are making headway on their debts, it’s just that higher inflation is obscuring all their great progress. Read more at: https://www.zerohedge.com/personal-finance/ballooning-credit-rate-cuts-perfect-storm-default |

|

Senate Passes Stopgap, But House Freedom Caucus Insists On Border MeasuresThe Senate on Thursday passed a stopgap government funding bill by a vote of 77-18 that will extend a two-tiered shutdown from Jan. 19 and Feb 2, to March 1, and March 8.

The bill, which still has to pass the House, may be held up by demands from the House Freedom Caucus – which has made a last-minute appeal to Speaker Mike Johnson (R-LA) to add an amendment vote on border and migration policy measures. The move could throw a wrench into plans to avoid the first phase of the shutdown on Friday, however a spokesperson for Johnson suggested there’s nothing to worry about (unless you care about unchecked illegal immigration). “The plan has not changed. The House is voting on the stop gap measure tonight to keep the government open,” wrote Johnson spox Raj Shah on X in response to the Freedom Caucus’ demands.

|

|

Hunter Biden Not Protected From Gun Charges By 2nd Amendment: Federal ProsecutorsAuthored by Zachary Stieber via The Epoch Times (emphasis ours), The U.S. Constitution’s Second Amendment does not protect President Joe Biden’s son from felony gun charges, federal prosecutors said in a new brief. “Anglo-American law has long recognized that the government may disarm those who, by their conduct or characteristics, present an increased risk to public safety if they possess firearms,” prosecutors said in the Jan. 16 filing. That means a U.S. law against gun ownership by people who use or are addicted to drugs can still stand under the U.S. Supreme Court’s 2022 decision that struck down restrictions in New York, they added.

Hunter Biden in Washington on Dec. 19, 2023. (Drew Angerer/Getty Images) Read more at: https://www.zerohedge.com/political/hunter-biden-not-protected-gun-charges-2nd-amendment-federal-prosecutors |

|

Post Office scandal: 91-year-old victim ‘disgusted’ with compensation delayNinety-one-year-old Betty Brown says she had to give up her business as she was caring for her ill husband. Read more at: https://www.bbc.co.uk/news/business-68009767?at_medium=RSS&at_campaign=KARANGA |

|

Tata Steel: Port Talbot blast furnaces to close with 3,000 expected job lossesPlans to cut jobs in a move to greener steelmaking a “crushing blow” for Port Talbot, unions say. Read more at: https://www.bbc.co.uk/news/uk-wales-68022901?at_medium=RSS&at_campaign=KARANGA |

|

LNER train drivers to strike for five more daysAslef members are taking action after LNER told the union to provide minimum service levels. Read more at: https://www.bbc.co.uk/news/business-68017576?at_medium=RSS&at_campaign=KARANGA |

|

Epack Durables IPO opens tomorrow. What GMP signals ahead of subscriptionEpack Durables IPO will open for subscription on Friday. The company’s shares are currently trading at a premium of Rs 15 in the unlisted market. The IPO consists of a fresh equity issue of up to Rs 400 crore and an offer for sale of up to 10,437,047 shares by selling shareholders. Epack Durables is the second-largest room air conditioner original design manufacturer in India, with a 24% market share in domestically manufactured units in FY23. The IPO proceeds will be used for capacity expansion. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/epack-durables-ipo-opens-tomorrow-what-gmp-signals-ahead-of-subscription/articleshow/106957781.cms |

|

Paytm Q3 result preview: Losses to narrow on improved operating performance; solid revenue growth eyedPaytm Q3 result preview: Paytm is expected to post solid revenue growth for Q3. Revenue from operations may grow 32% YoY and rise 8% sequentially. Losses are expected to narrow to Rs 280 crore. Analysts expect operating profit to increase, driven by improved contribution margin. In Q2, Paytm’s revenue from operations improved 32%. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/paytm-q3-result-preview-losses-to-narrow-on-improved-operating-performance-solid-revenue-growth-eyed/articleshow/106945569.cms |

|

Budget may disappoint stocks related to government capex: JefferiesJefferies said it is not expecting an immediate tax hike, considering elections, some post-election measures such as higher capital gains tax are possible during the year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/budget-may-disappoint-stocks-related-to-government-capex-jefferies/articleshow/106948405.cms |

|

The Dow claws back earlier losses as tech rally resumes despite rate-cut uncertaintyU.S. stocks were higher on Thursday, with technology stocks extending their gains in the final hour of trade, as optimism on artificial intelligence continued to drive semiconductor shares higher despite rising uncertainty about whether the Federal Reserve will cut interest rates as early as markets have expected. Read more at: https://www.marketwatch.com/story/s-p-500-futures-rise-as-treasury-yields-dip-tsmc-results-support-nasdaq-d7d721b9?mod=mw_rss_topstories |

|

Long-term Treasury yields hit new 2024 highs after drop in U.S. jobless claimsTen- and 30-year Treasury yields finished at their highest levels of the year for a third straight session on Thursday after the release of lower-than-expected initial jobless claims. Read more at: https://www.marketwatch.com/story/treasury-yields-dip-ahead-of-jobless-claims-and-housing-data-306f0cbe?mod=mw_rss_topstories |

|

Oil prices finish higher as traders weigh demand outlook, Middle East supply threatsOil futures finished higher on Thursday as traders weighed the outlook for demand, as well as risks to supply caused by strife in the Middle East. Read more at: https://www.marketwatch.com/story/oil-prices-struggle-for-direction-as-traders-weigh-demand-worries-middle-east-supply-threats-4d09b1dc?mod=mw_rss_topstories |