Summary Of the Markets Today:

- The Dow closed up 26 points or 0.07%,

- Nasdaq closed up 0.09%,

- S&P 500 closed up 0.18%,

- Gold $2052 up $1.80,

- WTI crude oil settled at $74 up $1.68,

- 10-year U.S. Treasury 4.044% up 0.053 points,

- USD index $102.47 up $0.05,

- Bitcoin $43,747 down $707 (1.50%),

- Baker Hughes Rig Count: U.S. -1 to 621 Canada +39 to 125

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

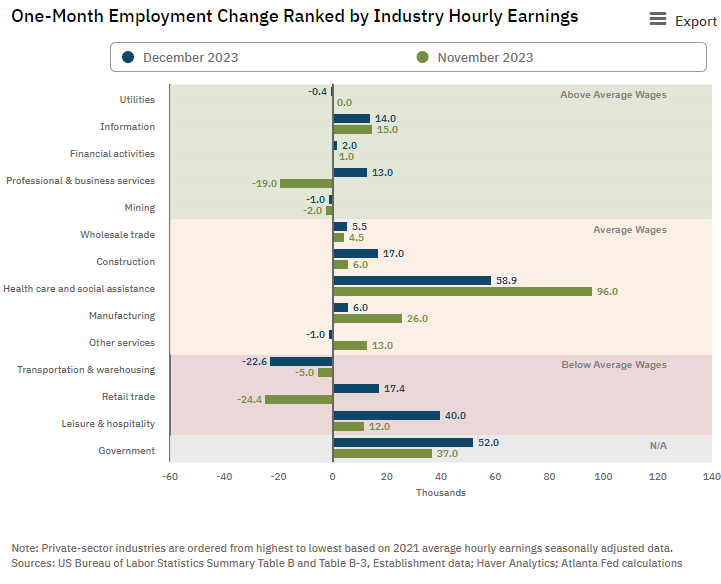

Total nonfarm payroll employment increased by 216,000 in December 2023, and the unemployment rate was unchanged at 3.7 percent. The headline numbers are stronger than expected and show decent growth. Employment continued to trend up in government, health care, social assistance, and construction, while transportation and warehousing lost jobs. Interestingly, the household survey showed a decline in the employed of 683,000 whilst the headline establishment survey increased 216,000 – this is a huge difference casting doubt on the validity of the headline numbers. In all events, the rate of growth year-over-year of employment continues to decline.

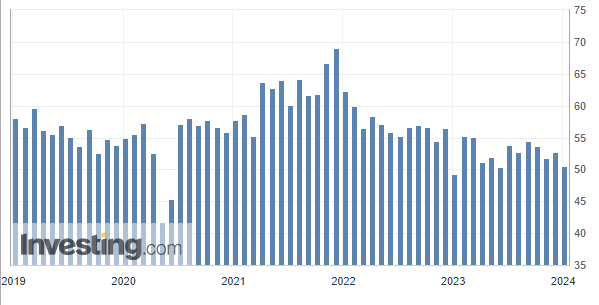

In December 2023, the ISM Services PMI registered 50.6 percent, 2.1 percentage points lower than November’s reading of 52.7 percent. A reading above 50 percent indicates the services sector economy is generally expanding; below 50 percent indicates it is generally contracting – the bottom line is that this index is saying the economy is barely growing.

Here is a summary of headlines we are reading today:

- Europe’s Natural Gas and Power Prices Jump as Cold Snap Begins

- U.S. Drilling Continues to Slow

- India Slashes Financial Support for State Oil Refiners’ Green Goals

- Retaliation Looms After Iran Bombings

- Eli Lilly’s direct drug sales alone may not upend the industry, but others could follow suit

- Apple shares slip on report U.S. government preparing antitrust lawsuit

- S&P 500 closes slightly higher Friday, but major averages end 9-week win streak: Live updates

- Wall Street heads into the week ahead on edge as inflation and earnings data loom

- Bitcoin dips 1.5% ahead of next week’s expected decision on spot ETF: CNBC Crypto World

- U.S. payrolls increased by 216,000 in December, much better than expected

- US Bankruptcies Jump 18% In 2023 Amid High Interest Rates

- The S&P 500’s first five trading days may indicate full-year performance. That doesn’t bode well for stocks in 2024.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Europe’s Natural Gas and Power Prices Jump as Cold Snap BeginsPower prices in Finland jumped to record-high levels as a deep freeze in Europe began in the Arctic parts of the Nordic countries and is set to move south to northwest Europe in the weekend and next week, creating additional energy demand and leading to higher electricity and natural gas prices. In Finland and Sweden, heavy snow and freezing temperatures have prompted cancelations of some train services on Friday and during the weekend. Day-ahead power prices in Finland hit a record-high and grid operator Fingrid warned on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Natural-Gas-and-Power-Prices-Jump-as-Cold-Snap-Begins.html |

|

New UK Carbon Tax Aims to Encourage Sustainable Metal ProductionVia Metal Miner HM Treasury recently announced that the UK plans to enact a carbon tax on certain metals and natural resource imports into the country by 2027. The December 19 announcement said that steel, aluminum, and iron ore will be subject to the tax. This tax is currently known as the Carbon Border Adjustment Mechanism (CBAM). “Goods imported into the UK from countries with a lower or no carbon price will have to pay a levy by 2027, ensuring products from overseas face a comparable carbon price to those produced in the UK,”… Read more at: https://oilprice.com/Metals/Commodities/New-UK-Carbon-Tax-Aims-to-Encourage-Sustainable-Metal-Production.html |

|

India-Guyana Ink Landmark Oil & Gas Cooperation DealThe world’s third-largest oil importer, India, has approved the signing of a cooperation agreement with the world’s newest oil exporter, Guyana, covering the entire value chain from crude supply to exploration offshore the South American country. India’s government approved on Friday the signing of a Memorandum of Understanding (MoU) between India’s Ministry of Petroleum & Natural Gas and the Ministry of Natural Resources of Guyana on cooperation in the hydrocarbon sector. “The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Guyana-Ink-Landmark-Oil-Gas-Cooperation-Deal.html |

|

U.S. Drilling Continues to SlowThe total number of active drilling rigs for oil and gas in the United States fell this week by 1, according to new data that Baker Hughes published on Friday—the first weekly data of the new year. The total rig count fell by 1 to 621 this week. Throughout 2023, the United States has seen the active rig count for oil and gas fall by 157, while achieving record-breaking production. The end-of-year rig count was also 452 fewer rigs than the pre-pandemic era—again, all while beating pre-pandemic production rates by 1.377 million… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Continues-to-Slow.html |

|

Falling Spot Prices Trigger Surge in Asian LNG ImportsAsia’s LNG imports jumped in December to a record-high for any month in history as China regained the top importer spot from Japan and lower spot prices incentivized purchases. Last month, imports of LNG into Asia rose to 26.61 million metric tons, per data from commodity analysts Kpler cited by Reuters columnist Clyde Russell. Imports increased from the November level of 23.35 million tons and were also higher than the previous Asian LNG import record of 26.15 million tons set in January 2021, according to the data… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Falling-Spot-Prices-Trigger-Surge-in-Asian-LNG-Imports.html |

|

ChAI’s 2024 Forecast For 5 Key Commodities2023 has marked a significant shift in the commodities market compared to the tumultuous years of 2021 and 2022, which were characterised by extreme price volatility due to pandemic-induced supply and demand uncertainties. This year, we’ve witnessed unique trends across various commodities, and in this article, we’ll explore the developments and driving factors of five key commodities—Brent Crude Oil, Natural Gas, Copper, Wheat, and Coffee—along with ChAI’s forecasts for 2024. Brent Crude Oil The story of crude oil in 2023 has… Read more at: https://oilprice.com/Metals/Commodities/ChAIs-2024-Forecast-For-5-Key-Commodities.html |

|

Iran Withholds Oil Deliveries As It Seeks Higher Prices from ChinaIran seeks higher prices for its crude going to its top customer, China, and has been withholding some supply, Reuters reported on Friday, citing trading and refinery sources. China has continued to buy cheaper crude from Iran even after the U.S. re-imposed sanctions on Iranian oil in 2018. But now Iran is reportedly seeking narrower discounts to Brent for its crude supply to China, which has led to a “stalemate” between Iran and its Chinese customers. Iran has sought discounts of $5 to $6 per barrel for its light crude for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Withholds-Oil-Deliveries-As-It-Seeks-Higher-Prices-from-China.html |

|

Europe to Face Cold Weather in January after Mild DecemberThe Lower 48 and Europe enjoyed a mild start to winter but will be transitioning into a period of colder and possibly even snowier conditions through at least the mid-point of January. This will lead to a surge in heating demand on both sides of the Atlantic. ECMWF and GFS models forecast that after an unusually warm December driven by El Nino, lower 48 temperatures from Thursday through Jan. 15 will trend around a 30-year seasonal average of about 37 Fahrenheit. After the mid-point of the month, the latest GFS Operational model shows a cold… Read more at: https://oilprice.com/Energy/Energy-General/Europe-to-Face-Cold-Weather-in-January-after-Mild-December.html |

|

India Slashes Financial Support for State Oil Refiners’ Green GoalsIn a bid to reduce government deficit, India plans to halve the equity support to three state-held oil refiners to help them fund measures to meet their net-zero operations targets, Reuters reported exclusively on Friday, quoting industry and government sources. The three state-owned refiners, Indian Oil Corp, Bharat Petroleum Corporation, and Hindustan Petroleum Corporation, were set to receive the equivalent of $3.6 billion, or 300 billion Indian rupees, in equity support for the fiscal year 2023/2024 to reach their goals to have… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Slashes-Financial-Support-for-State-Oil-Refiners-Green-Goals.html |

|

Mid-East Tensions Continue To Support OilCrude prices are set to close out the first week of the new year with a small gain as tensions in the Middle East continue to provide support. Friday, January 5, 2024Oil prices are set to finish this week with a slight gain after Middle Eastern tensions helped recoup losses after US inventory data. Despite a hefty 5.5-million crude stock draw, believed to be the usual year-end clearing of inventory to minimize ad valorem inventory taxes, the immediate reaction was a slight downward correction after both gasoline and diesel posted huge stock… Read more at: https://oilprice.com/Energy/Energy-General/Mid-East-Tensions-Continue-To-Support-Oil.html |

|

Oil May Not Go Higher Unless Supply Gets DisruptedWeekly Performance Summary This week witnessed varied movements in the crude oil market, driven by multiple factors. Oil prices dropped lower on Thursday, impacted by significant increases in gasoline and distillate stocks, which overshadowed a larger-than-expected crude stock decline. However, overall, the market is slightly higher for the week as we head into Friday’s action, supported by supply issues in Libya, escalating tensions in the Middle East, and encouraging remarks from the Federal Reserve’s December meeting minutes. Additionally,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-May-Not-Go-Higher-Unless-Supply-Gets-Disrupted.html |

|

2024 Could be a Better Year for Canadian Oil ProducersNumbers Report – January 05, 2024In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers. Let’s take a look.1. 2024 Should Have Been Canada’s Year, Might Still Be – The long-anticipated launch of the Trans Mountain Expansion (TMX) pipeline has been a rallying call for Canadian upstream producers to ramp up operations, benefitting… Read more at: https://oilprice.com/Energy/Energy-General/2024-Could-be-a-Better-Year-for-Canadian-Oil-Producers.html |

|

My Top Energy Stock Pick for 2024Before I started my holiday season vacation a couple of weeks ago, I wrote a couple of pieces looking forward to 2024. Those pieces focused on oil, which is only natural given its importance in the energy space, but as I did my research while on break, I came to the conclusion that my number one pick for 2024 was not in oil, but in an area that was somewhat uninspiring for traders and investors…natural gas. Let’s get one thing out of the way early; I am not saying that natty will necessarily break out above the $2-$3.50 range that… Read more at: https://oilprice.com/Energy/Gas-Prices/My-Top-Energy-Stock-Pick-for-2024.html |

|

Retaliation Looms After Iran BombingsWhile Israel is now withdrawing forces from Gaza under pressure to pursue lower-level combat operations, external incidents continue to escalate from Lebanon and Iraq to the Red Sea shipping lanes and inside Iran. With respect to Iran, two explosions presumed to be by suicide bombers along the road to the cemetery to mark the 2020 assassination of prominent Iranian general Qassem Soleimani killed as many as 100 people earlier this week. While initially no one claimed responsibility, the Islamic State claimed the attack just a day later, with Iran… Read more at: https://oilprice.com/Geopolitics/International/Retaliation-Looms-After-Iran-Bombings.html |

|

OPEC’s December Production Up, Not Down: SurveyThe Organization of the Petroleum Exporting Countries (OPEC) increased its crude oil production in December, collectively pumping 27.88 million barrels per day, according to a new Reuters survey published on Friday. OPEC’s production rose by an average of 70,000 barrels per day (bpd), the survey showed, with production increases seen in OPEC’s 2nd largest producer, Iraq, as well as Angola—accounting for 60,000 bpd of the overage. Nigeria also saw a production increase. The group’s most prolific producer, Saudi Arabia, on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-December-Production-Up-Not-Down-Survey.html |

|

Eli Lilly’s direct drug sales alone may not upend the industry, but others could follow suitLillyDirect is the latest attempt to simplify what critics call a complex system for distributing, pricing and prescribing prescription drugs. Read more at: https://www.cnbc.com/2024/01/05/eli-lilly-weight-loss-drug-site-may-not-upend-industry.html |

|

Apple shares slip on report U.S. government preparing antitrust lawsuitThe agency’s lawsuit could target how the Apple Watch works exclusively with the iPhone, as well as the company’s iMessage service. Read more at: https://www.cnbc.com/2024/01/05/apple-shares-slip-on-report-us-government-preparing-antitrust-lawsuit.html |

|

Microsoft, OpenAI sued for copyright infringement by nonfiction book authors in class action claimThe new copyright infringement lawsuit against Microsoft and OpenAI comes a week after The New York Times filed a similar complaint in New York. Read more at: https://www.cnbc.com/2024/01/05/microsoft-openai-sued-over-copyright-infringement-by-authors.html |

|

S&P 500 closes slightly higher Friday, but major averages end 9-week win streak: Live updatesThe three major averages closed out the first week of the new year in negative territory. Read more at: https://www.cnbc.com/2024/01/04/stock-market-today-live-updates.html |

|

Coinbase is planning a pivotal acquisition that will allow it to launch crypto derivatives in the EUCoinbase told CNBC exclusively that it entered into an agreement to buy an unnamed holding company which holds a Mifid II license. Read more at: https://www.cnbc.com/2024/01/05/coinbase-to-expand-crypto-derivatives-in-eu-with-license-acquisition-.html |

|

Wall Street heads into the week ahead on edge as inflation and earnings data loomA hot consumer inflation reading next week, after this week’s better-than-expected payrolls number, could dampen investor sentiment. Read more at: https://www.cnbc.com/2024/01/05/wall-street-heads-into-the-week-ahead-on-edge-as-inflation-and-earnings-data-loom.html |

|

AG wants Trump banned from New York real estate business for life, fined $370 million in fraud caseDonald Trump denies committing fraud in valuing real estate assets owned by the Trump Organization. New York Attorney General Letitia James is suing him. Read more at: https://www.cnbc.com/2024/01/05/ag-wants-trump-banned-from-new-york-real-estate-business-for-life.html |

|

Wayne LaPierre resigns as NRA leader, days before start of his civil trialLaPierre and three other current and former NRA leaders are facing a lawsuit that alleges they violated nonprofit laws and misused NRA funds to finance their lavish lifestyles. Read more at: https://www.cnbc.com/2024/01/05/wayne-lapierre-resigns-as-nra-leader-days-before-start-of-his-civil-trial.html |

|

Bitcoin dips 1.5% ahead of next week’s expected decision on spot ETF: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Noelle Acheson, author of the Crypto is Macro Now newsletter, discusses what was behind crypto’s turbulent start to 2024. Read more at: https://www.cnbc.com/video/2024/01/05/bitcoin-dips-of-next-weeks-expected-decision-on-spot-etf-cnbc-crypto-world.html |

|

Blank Street Coffee relied on low costs to grow — now it’s betting on subscriptionsBlank Street CEO Vinay Menda estimates that the chain’s new subscription program could eventually account for 30% to 40% of its customers. Read more at: https://www.cnbc.com/2024/01/05/blank-street-coffee-bets-on-subscription-program.html |

|

U.S. payrolls increased by 216,000 in December, much better than expectedNonfarm payrolls were expected to increase by 170,000 in December, according to a Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2024/01/05/jobs-report-december-2023-payrolls-increased-by-216000-in-december.html |

|

Here’s where the jobs are for December 2023 — in one chartHiring for government jobs and health care led the gains to close out 2023. Read more at: https://www.cnbc.com/2024/01/05/heres-where-the-jobs-are-for-december-2023-in-one-chart.html |

|

Florida wins first FDA approval to import cheaper drugs from CanadaFlorida’s plan to import drugs from Canada will likely face hurdles before it takes effect, including potential lawsuits from the pharmaceutical industry. Read more at: https://www.cnbc.com/2024/01/05/florida-wins-first-fda-approval-to-import-drugs-from-canada.html |

|

Blue States Saw Highest Rates Of Homelessness In 2023Authored by Eric Lundrum via American Greatness, In the year 2023, the highest recorded rates of homelessness on average were found in states that lean Democratic, as well as the District of Columbia.

As the Daily Caller reports, the data from the Department of Housing and Urban Development (HUD) was released in December. Although not actually a state, Washington D.C. had the highest rate of homelessness in the country, at 73.3 for every 10,000 residents, which amounts to roughly 4,922 total homeless. New York came in second with 52.4 homeless people for every 10,000, or 103,200 total. Vermont came in third with 50.9 per 10,000, or about 3,295. Rounding out the top five was Oregon, in fourth place, with 50 per 10,000, equating to about 20,000 people; and California, with … Read more at: https://www.zerohedge.com/political/blue-states-saw-highest-rates-homelessness-2023 |

|

Watch Live: President Biden Marks Jan-6 Anniversary (By Calling Trump A Threat To Democracy & Freedom)President Biden’s first major campaign event of 2024 is set to take place in the key battleground state of Pennsylvania. The president intends to persuade the American people – in a speech – that former President Trump, his most likely presidential election opponent, is a threat to democracy. Biden is expected to speak at Montgomery County Community College, about 15 miles from the Revolutionary War encampment of Valley Forge, on Friday afternoon, one day before the third anniversary of the January 6 Capitol riot. Biden’s aides told Reuters that the speech’s theme will be about “preserving democracy.” Another aide told ABC News Chief White House Correspondent Mary Bruce that the president worked very hard crafting his speech after meeting with historians and scholars at the White House this week. The president is expected to call Trump and MAGA Americans ‘far-right extremists’ and a genuine threat to the freedoms on which the country was founded. The Biden-Harris campaign said Montgomery County Community College is a “stone’s throw” away from the Revolutionary War encampment of Valley Forge. This is where then-General George Washington, leading the Continental Army, “transformed a disorganized alliance of colonial militias into a cohesive coalition united in their fight for our democracy” 250 years ago. “This Saturday will mark the three-year anniversary of when … Read more at: https://www.zerohedge.com/political/watch-live-biden-marks-jan-6-anniversary-calling-trump-threat-democracy-freedom |

|

US Bankruptcies Jump 18% In 2023 Amid High Interest RatesAuthored by Naveen Athrappully via The Epoch Times, Overall bankruptcies in the United States jumped by almost a fifth in 2023 as both businesses and households struggled with high-interest rates and the end of pandemic stimulus.

Total U.S. bankruptcy filings rose by 18 percent to 445,186 last year, up from 378,390 filings in 2022, according to data from Epiq AACER, a provider of U.S. bankruptcy filing data. This includes both commercial and personal bankruptcy filings until the month of November. “As anticipated, we saw new filings in 2023 increase momentum over 2022 with a significant number of commercial filers leading the expected increase and normalization back to pre-pandemic bankruptcy volumes,” said Michael Hunter, vice president of Epiq AACER.

|

|

North Korea Fires Hundreds Of Artillery Rounds Toward South’s Border IslandsTensions are once again ratcheting on the Korean peninsula, after North Korea fired over 200 artillery rounds off its West coast which landed near the South’s Yeonpyeong and Baengnyeong Islands on Friday. Seoul condemned the “provocative act” while the North responded by saying the islands weren’t in danger due to these drills. There have been no casualties, and the shells appear to have fallen harmlessly into the sea, but there are fears of a repeat of a 2010 incident which saw North Korean artillery fire killing four people on Yeonpyeong island. South Korea’s military responded by launching live-fire drills of its own in the same area. Drills were initiated on Yeonpyeong in particular by marines stationed there, with alerts telling civilians to stay sheltered during the exercises. South Korea’s Joint Chiefs issued a statement warning the Kim Jong Un government that it is “solely responsible for this escalating crisis” and urged his regime “to stop immediately.”

North Korea’s artillery fire … Read more at: https://www.zerohedge.com/geopolitical/north-korea-fires-hundreds-artillery-rounds-near-souths-border-islands |

|

Not that difficult to buy a home, says NatWest chairSir Howard Davies faced backlash online and has since rowed back on his comments on home ownership. Read more at: https://www.bbc.co.uk/news/business-67890334?at_medium=RSS&at_campaign=KARANGA |

|

Post Office scandal: Dozens more seek legal help after TV dramaFifty new potential victims of the scandal have contacted lawyers after the airing of a related TV drama. Read more at: https://www.bbc.co.uk/news/business-67894818?at_medium=RSS&at_campaign=KARANGA |

|

National Insurance calculator: What will I pay and how is tax changing?National Insurance rates are falling, but other changes mean many people are paying more tax. Read more at: https://www.bbc.co.uk/news/explainers-63635185?at_medium=RSS&at_campaign=KARANGA |

|

Marico Q3 Update: Revenue drops even as volumes grow in low single-digitTowards the end of the December quarter, Marico initiated significant steps towards improving the ROI of its general trade channel partners while structurally re-igniting growth in the channel. This included a primary stock correction for its channel partners. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/marico-q3-update-revenue-drops-even-as-volumes-grow-in-low-single-digits/articleshow/106576228.cms |

|

Tech View: Nifty may find resistance around 21,800-21,850 next week. What should traders do?The short-term uptrend status of Nifty remains intact, but the market is likely to find resistance around 21,800-21,850 levels in the coming sessions. A decisive move only above 21,850-21,900 levels could open the next upside target of 22,200 levels. Any dips from here could find support around 21,500, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-may-find-resistance-around-21800-21850-next-week-what-should-traders-do/articleshow/106576671.cms |

|

Demat account openings at record high, total accounts near 14 crore markThe number of new Demat account openings is directly proportional to the surge in stock prices. Typically, a bull market attracts more number of new investors and whenever the market hits a rough patch the number of active traders and investors also tends to decrease. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/demat-account-openings-at-record-high-total-accounts-near-14-crore-mark/articleshow/106566664.cms |

|

What this key stock-market gauge is telling investors amid a rough start to 2024The stock market has stumbled into the new year, but a closely watched measure of expected volatility remains subdued — cheering up investors looking for renewed equity gains but worrying those who fear market participants are complacent. Read more at: https://www.marketwatch.com/story/what-this-key-stock-market-gauge-is-telling-investors-amid-rough-start-to-2024-c8078abb?mod=mw_rss_topstories |

|

Who is Bill Ackman, the hedge funder who used corporate-raiding tactics to push out Harvard’s president?The Harvard grad and donor used well-honed activist-investor moves to get what he wanted at the nation’s premier Ivy League school Read more at: https://www.marketwatch.com/story/who-is-bill-ackman-the-hedge-funder-who-used-corporate-raiding-tactics-to-push-out-harvards-president-4f548027?mod=mw_rss_topstories |

|

The S&P 500’s first five trading days may indicate full-year performance. That doesn’t bode well for stocks in 2024.The S&P 500’s movement over the first five days of the trading year often provides a good indicator of how it will perform over the rest of the year, according to historical data. But if so, that doesn’t bode well for stocks in 2024. Read more at: https://www.marketwatch.com/story/the-s-p-500s-first-five-trading-days-may-indicate-full-year-performance-that-doesnt-bode-well-for-stocks-in-2024-5d5d7cf6?mod=mw_rss_topstories |