Summary Of the Markets Today:

- The Dow closed down 285 points or 0.76%,

- Nasdaq closed down 1.18%,

- S&P 500 closed down 0.80%,

- Gold $2049 down $24.00,

- WTI crude oil settled at $73 up $2.71,

- 10-year U.S. Treasury 3.903% down 0.037 points,

- USD index $102.45 up $0.27,

- Bitcoin $42,740 down $2,078 (4.64%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

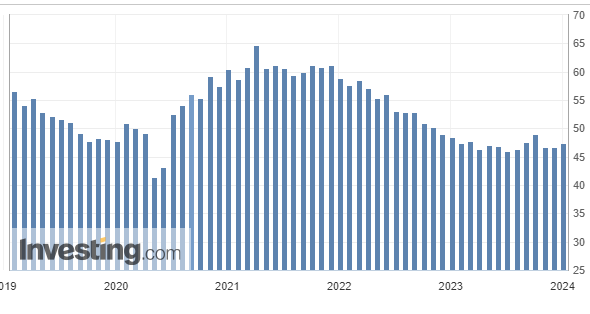

The ISM Manufacturing PMI registered 47.4% in December 2023, up 0.7 percentage points from the 46.7% recorded in November. The overall economy continued in contraction for a third month after one month of weak expansion preceded by nine months of contraction and 30 months of expansion before that. According to the ISM, a Manufacturing PMI above 48.7% over some time generally indicates an expansion of the overall economy. As the overall economy has been expanding whilst manufacturing is in a recession – one can assume that this rule is not applicable.

The number of job openings changed little at 8.8 million on the last business day of November 2023. Over the month, the number of hires and total separations decreased to 5.5 million and 5.3 million, respectively. Within separations, quits (3.5 million) edged down and layoffs and discharges (1.5 million) changed little. The general trend of job openings is falling which correlates to employment gains.

The highlights of the minutes of the Federal Open Market Committee for December 12–13, 2023 show: [note: that these minutes state that the Fed is likely done raising the federal funds rate. But I have a hard time reading into these minutes that the Fed will soon begin cutting rates.]

… Regarding the economic outlook, participants generally judged that, in 2024, real GDP growth would cool and that rebalancing of the labor market would continue, with the unemployment rate rising somewhat from its current level.

… participants noted the improvement in both headline and core inflation and discussed the developments in components of these aggregate measures. They observed that progress had been uneven across components, with energy and core goods prices falling or changing little recently, but core services prices still increasing at an elevated pace.

… Participants generally perceived a high degree of uncertainty surrounding the economic outlook. As an upside risk to both inflation and economic activity, participants noted that the momentum of economic activity may be stronger than currently assessed, possibly on account of the continued balance sheet strength of many households. Furthermore, participants observed that, after a sharp tightening since the summer, financial conditions had eased over the intermeeting period. Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal

… participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves. Participants pointed to the decline in inflation seen during 2023, noting the recent shift down in six-month inflation readings in particular, and to growing signs of demand and supply coming into better balance in product and labor markets as informing that view. Several participants remarked that the Committee’s past policy actions were having their intended effect of helping to slow the growth of aggregate demand and cool labor market conditions. They judged that, in combination with improvements in the supply situation, these developments were helping to bring inflation back to 2 percent over time. Most participants noted that, as indicated in their submissions to the SEP, they expected the Committee’s restrictive policy stance to continue to soften household and business spending, helping to promote further reductions in inflation over the next few years.

Here is a summary of headlines we are reading today:

- UK Manufacturing Sector Plunges Deeper Into Crisis

- Oil Gains Over 3% On Libya, OPEC and Middle East Escalation

- Argentina’s New President Is Looking To Shake Up Its Oil Industry

- BYD’s Record-Breaking Quarter Challenges Tesla’s EV Dominance

- MidEast Conflict Escalates with 2 Explosions in Iran Killing 100

- Dow tumbles nearly 300 points Wednesday, Nasdaq closes lower for a 2nd straight day in 2024: Live updates

- Xerox to cut 15% of its workforce

- Mortgages, auto loans, credit cards: Expert predictions for interest rates in 2024

- U.S. recession still a threat; China growth stalls, and other 2024 investing risks

- 10-year Treasury yield slips after December Fed minutes show officials didn’t rule out further rate hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UK Manufacturing Sector Plunges Deeper Into CrisisThe UK’s manufacturing sector fell deeper into contraction in December, while business optimism fell to its lowest level in a year, a closely watched survey suggested. S&P’s global UK manufacturing Purchasing Managers’ Index (PMI) slipped back to 46.2 in December, lower than the 46.4 recorded in the ‘flash’ estimate in mid-December. December’s reading also marked a downturn from November’s reading of 47.2, which was a seven-month high. The 50-mark separates growth from contraction. The deterioration… Read more at: https://oilprice.com/Finance/the-Economy/UK-Manufacturing-Sector-Plunges-Deeper-Into-Crisis.html |

|

Beijing’s Bid For Influence in the Global SouthFor Chinese Ambassador to the EU Fu Cong, the Israel-Hamas war laid bare the West’s double standards and how Beijing sees it falling out of touch with the rest of the world. Speaking in Brussels in mid-November, shortly after the October 7 outbreak of hostilities in Israel and Gaza, Fu railed against the bloc’s labeling of China as a “rival” on the global stage, saying that if having different foreign policy views makes Beijing a rival then Brussels will find it has many other competitors. “From the Middle East to… Read more at: https://oilprice.com/Geopolitics/International/Beijings-Bid-For-Influence-in-the-Global-South.html |

|

Biden Administration To Purchase More Oil For SPRThe Department of Energy’s Office of Petroleum Reserves has announced a solicitation for the purchase of up to 3 million barrels of crude oil for the nation’s Strategic Petroleum Reserves (SPR), the agency said in a Wednesday press release. The solicitation is for as many as 3 million barrels of crude for delivery into the SPR in April 2024, and will go towards replenishing the nearly 300 million barrels of crude oil sold off during the current administration, ostensibly to lower retail gasoline prices for U.S. drivers. After selling… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-To-Purchase-More-Oil-For-SPR.html |

|

Oil Gains Over 3% On Libya, OPEC and Middle East EscalationCrude oil prices rose more than 3% Wednesday driven by escalating tensions in the Middle East, an OPEC pledge of unity and the shut-in of Libya’s biggest oilfield over protests. At 14:13 p.m. ET on Wednesday, Brent crude was trading up 3.07% at $78.22, while West Texas Intermediate (WTI) was trading up 3.25% at $72.69. Up until now, weak fundamentals had been counterbalancing any impact on oil prices from escalating tensions in the MIddle East. “We haven’t seen prices react much in part because fundamentals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Gains-Over-3-On-Libya-OPEC-and-Middle-East-Escalation.html |

|

New Tech Transforms Greenhouse Gases into Industrial ResourcesRuhr-University Bochum researchers are constantly pushing the limits of technology by breaking new ground in CO2 conversion. The goal is to turn the harmful greenhouse gas into a valuable resource. A novel catalyst system could help reach the CO2 recycling goal. Research groups around the world are developing technologies to convert carbon dioxide (CO2) into raw materials for industrial applications. Most experiments under industrially relevant conditions have been carried out with heterogeneous electrocatalysts, i.e. catalysts that are in a different… Read more at: https://oilprice.com/Energy/Energy-General/New-Tech-Transforms-Greenhouse-Gases-into-Industrial-Resources.html |

|

India’s Largest Natural Gas Importer to Extend LNG Deal with QatarPetronet LNG, the largest natural gas importer in India, expects to sign later this month an agreement to extend its LNG supply deal with Qatar beyond 2028, India’s Oil Secretary Pankaj Jain said on Wednesday. “We are pretty close to signing the deal,” the secretary told reporters in New Delhi, as carried by Reuters. Qatar, one of the world’s top LNG exporters, prefers to sign long-term agreements with its buyers, and had given its Indian customers until the end of 2023 to negotiate possible extension and/or renewal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Largest-Natural-Gas-Importer-to-Extend-LNG-Deal-with-Qatar.html |

|

Argentina’s New President Is Looking To Shake Up Its Oil IndustryWhen Argentine libertarian Javier Milei made his debut into politics in 2020 with a mission to”blow up” the system, few predicted that he would have a chance to do the shake-up from the highest office in the land and, not certainly, just three years later. However, that’s exactly what the economist and former TV pundit is now doing. Last week, Milei sent a wide-ranging omnibus reform package to congress, part of his shock therapy approach he has adopted to transform Argentina’s economic policy into myriad aspects of government.… Read more at: https://oilprice.com/Energy/Crude-Oil/Argentinas-New-President-Is-Looking-To-Shake-Up-Its-Oil-Industry.html |

|

India Denies Sanctions Hold Back Imports of Russian Crude OilIndia’s lower imports of Russian crude oil in recent weeks were the result of unattractive discounts, not because of payment issues amid tougher U.S. sanctions on Russia’s exports, Indian Oil Minister Hardeep Singh Puri said on Wednesday. “There is no payment problem,” Puri told a briefing in New Delhi on Wednesday, as quoted by Bloomberg. “It is a pure function of price at which our refiners will buy,” he said, adding that India’s priority is to ensure the cheapest price possible for its consumers.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Denies-Sanctions-Hold-Back-Imports-of-Russian-Crude-Oil.html |

|

Turkey’s Steel Powerhouse Expands with High-Tech MillVia Metal Miner Turkish longs and flats producer Haba? recently announced plans to build a downstream cold rolling and tinplate mill. The growing Turkish steel industry brand estimates that the plant will have an annual capacity of 900,000 metric tons. Current plans place the new plant on a greenfield site close to Haba?’ main production facilities at Alia?a. This sits roughly 50 kilometers north of the Western Turkish city of Izmir. In a December 22 announcement, Italian equipment provider and contractor Danieli stated that commissioning… Read more at: https://oilprice.com/Metals/Commodities/Turkeys-Steel-Powerhouse-Expands-with-High-Tech-Mill.html |

|

Italy Considers $1-Billion Incentive Plan to Boost EV SalesItaly’s government is discussing a plan worth $1 billion (930 million euros) to incentivize purchases of electric vehicles as part of efforts to renew one of Europe’s oldest auto fleets, Bloomberg reported on Wednesday, quoting a draft document it has seen. The Italian industry ministry is currently discussing the package of incentives, which are set to include financial stimulus of as much as $15,030 (13,750 euros) to allow citizens with an annual income lower than $32,780 (30,000 euros) to scrap their Euro 2 conventional… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italy-Considers-1-Billion-Incentive-Plan-to-Boost-EV-Sales.html |

|

BYD’s Record-Breaking Quarter Challenges Tesla’s EV DominanceFor the first time ever, BYD has passed Tesla as the world’s most popular electric vehicle. As we noted moments ago, Tesla announced this morning it had “produced approximately 495,000 vehicles and delivered over 484,000 vehicles” for Q4. The company noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for the year. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period. … Read more at: https://oilprice.com/Energy/Energy-General/BYDs-Record-Breaking-Quarter-Challenges-Teslas-EV-Dominance.html |

|

MidEast Conflict Escalates with 2 Explosions in Iran Killing 100At least 100 people have been killed in two explosions in Iran on Wednesday during a ceremony to mark the 2020 assassination of Iran’s Quds Force commander Qassem Soleimani. Various Iranian media have reported the death toll as ranging from 73 to over 100, with scores of others injured by two explosive devices planted along the road to Iran’s Keman’s Martyrs’ Cemetery. No one has claimed responsibility for the attack–the deadliest in Iran since the late 70s. The attack comes as tensions… Read more at: https://oilprice.com/Latest-Energy-News/World-News/MidEast-Conflict-Escalates-with-2-Explosion-in-Iran-Killing-100.html |

|

China Looks to Capitalize on Low Oil PricesLower crude oil prices will likely prompt Chinese refiners to buy more crude and send more of those volumes to build up stockpiles, after purchases and estimated inventory builds slowed significantly in October and November in response to the 2023-high oil prices hit at the end of September. As oil prices eased in November and December, Chinese refiners are estimated to have purchased higher volumes of crude oil, and China’s crude oil imports could be on track to rebound in early 2024 if prices continue to remain subdued at below $80… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Looks-to-Capitalize-on-Low-Oil-Prices.html |

|

Surging American Exports Keep Oil and Gas Prices in CheckOil prices started the new year trading 2% higher in Asia amid increased tensions in the Red Sea after Iran said it had deployed a warship in the Red Sea. Yet, oil and natural gas prices have been subdued for most of the time since the Hamas-Israel war began in early October and ended 2023 with an annual loss—the first annual decline since 2020 when Covid crushed demand. With the OPEC+ production cuts, including a large voluntary cut from Saudi Arabia, one would think that another war apart from the Russian invasion of Ukraine… Read more at: https://oilprice.com/Energy/Energy-General/Surging-American-Exports-Keep-Oil-and-Gas-Prices-in-Check.html |

|

Frosty Forecast Sends European Natural Gas Prices SoaringEurope’s natural gas prices jumped by 5% mid-day on Wednesday as the latest forecasts showed most of Europe would see below-average freezing temperatures next week in a cold snap that would last at least until the middle of January. The February Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, had surged by 4.99% at $35.06 (32.10 euros) per megawatt-hour (MWh) as of 12:27 p.m. in Amsterdam today. The benchmark gas prices ended on Wednesday three consecutive trading days in which prices had dropped… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Frosty-Forecast-Sends-European-Natural-Gas-Prices-Soaring.html |

|

Fed officials in December saw rate cuts likely, but path highly uncertain, minutes showThe Federal Reserve on Wednesday released minutes from its Dec. 12-13 policy meeting. Read more at: https://www.cnbc.com/2024/01/03/fed-minutes-december-2023-.html |

|

Dow tumbles nearly 300 points Wednesday, Nasdaq closes lower for a 2nd straight day in 2024: Live updatesStocks fell Wednesday after the Nasdaq Composite registered its worst daily decline in nearly three months. Read more at: https://www.cnbc.com/2024/01/02/stock-market-today-live-updates.html |

|

Xerox to cut 15% of its workforceXerox will cut 15% of workforce as part of a new restructuring plan. Read more at: https://www.cnbc.com/2024/01/03/xerox-layoffs-company-to-cut-15percent-of-workforce.html |

|

GM’s 2023 U.S. vehicle sales were its best since 2019General Motors’ U.S. vehicle sales increased 14.1% last year to represent the automaker’s best year since 2019. Read more at: https://www.cnbc.com/2024/01/03/gm-2023-us-vehicle-sales.html |

|

There’s one stock Wall Street loves so much for 2024 that five analysts in one day picked it as their favoriteOne major technology giant is getting a ton of love on Wall Street three days into the new year. Read more at: https://www.cnbc.com/2024/01/03/wall-street-loves-this-stock-so-much-that-5-analysts-named-it-a-top-pick-in-one-day.html |

|

Names in Jeffrey Epstein court documents to be unsealed in New York on WednesdayMore than 150 names of people connected to sex offender Jeffrey Epstein are contained in New York federal court documents set to be made public. Read more at: https://www.cnbc.com/2024/01/03/jeffrey-epstein-court-document-names-unsealed-wednesday-.html |

|

Red Sea crisis boosts shipping costs, delays – and inflation worriesTo avoid attacks by Iran-backed Houthi militants based in Yemen, carriers have already diverted more than $200 billion in trade from the Red Sea. Read more at: https://www.cnbc.com/2024/01/03/red-sea-crisis-shipping-costs-delays-inflation.html |

|

Job openings nudged down in November, down to lowest in more than two yearsThe JOLTS report showed employment listings nudged lower to 8.79 million, about in line with the Dow Jones estimate for 8.8 million. Read more at: https://www.cnbc.com/2024/01/03/jolts-november-2023-job-openings-nudged-lower-down-to-1point4-per-available-worker.html |

|

Bitcoin prices retreat, MicroStrategy’s Saylor sells $216 million in stock: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kain Warwick of Synthetix discusses his outlook for the Ethereum network in 2024. Read more at: https://www.cnbc.com/video/2024/01/03/michael-saylor-selling-nearly-216-million-microstrategy-shares-cnbc-crypto-world.html |

|

More than 100 killed in blasts at memorial for top Iranian general SoleimaniGen. Qassem Soleimani was killed by a U.S. drone strike in January 2020, sparking angry protests in Iran and across the region. Read more at: https://www.cnbc.com/2024/01/03/over-70-killed-in-terrorist-attacks-near-soleimanis-tomb-during-ceremony.html |

|

Dry January may help improve your finances. One woman has already saved $48,000 by giving up alcoholIf you’re on the fence about partaking in Dry January, there’s an incentive to consider: the financial savings. Read more at: https://www.cnbc.com/2024/01/03/how-dry-january-can-help-you-save-money-improve-health.html |

|

Mortgages, auto loans, credit cards: Expert predictions for interest rates in 2024The Federal Reserve’s period of policy tightening appears to be over, opening the door to lower borrowing costs in the year ahead. Read more at: https://www.cnbc.com/2024/01/03/mortgages-auto-loans-credit-cards-2024-interest-rate-predictions.html |

|

Oil prices rise more than 3% as U.S. warns Houthis against Red Sea attacks, OPEC pledges unityTensions in the Middle East are mounting as militants attack vessels in the Red Sea and protest in Libya shut an oilfield. Read more at: https://www.cnbc.com/2024/01/03/oil-prices-rise-3percent-on-libya-disruption-opec-unity-pledge.html |

|

Equities Eye January Pause As Risk-On Mood FadesBy Michael Msika, BLoomberg Markets Live reporter and strateigst After partying frenziedly for two months before the New Year, stock markets might well need to take a breather in January. On the face of it, momentum still looks robust. But a closer look shows investors gravitating toward last year’s laggards, an oft-observed January pattern. On the first trading day of 2024, telecoms and energy, alongside value stocks such as banks and autos, benefited from the rotation, while tech slid. There are also reasons to be cautious on markets as a whole. Technically, global stocks have started the year in overbought territory, while Europe’s Stoxx 600 has been overbought for a record 20 sessions in a row, based on its 14-day RSI. And as our chart below shows, it’s repeatedly come up against resistance, failing yet again yesterday to breach a level that’s been unchallenged for two years. The index last broke above that barrier in January 2022, but the subsequent record high proved short-lived. Read more at: https://www.zerohedge.com/markets/equities-eye-january-pause-risk-mood-fades |

|

Houthis Claim Another Container Ship Attack As Middle East Turmoil WorsensTurmoil in the Middle East today has been marked by twin explosions near the burial site of the late Iranian commander Qasem Soleimani in Kerman, resulting in at least 73 fatalities and injuring 170 others. Additionally, there are new reports of another attack on a commercial vessel in the Red Sea by the Iran-backed Houthi rebels. According to Bloomberg, the Houthis’ armed forces’ spokesman claimed rebel forces attacked the container ship “CMA CGM TAGE” after the vessel’s captain ignored multiple warnings. The United Kingdom Maritime Trade Operations (UKMTO) organization reported a vessel that would’ve been in the same proximity of CMA CGM TAGE came under attack.

|

|

NYC Mayor Eric Adams Warns Immigrants Will Soon Be Sleeping On StreetsAuthored by Katabella Roberts via The Epoch Times, New York City Mayor Eric Adams has warned that illegal immigrants will soon be forced to sleep on streets as the city struggles to find space to house them amid an ongoing surge in new arrivals.

The Democrat issued the warning in an interview with FOX5 New York on Jan. 2. Mr. Adams said that New York City is “being inundated” with illegal immigrants, with roughly 2,5000 arriving every week, although that number can top 4,000 on some weeks, he said. “We’re not just saying we’re out of room as a sound bite, we’re out of room literally. People are going to be eventually sleeping on the streets,” Mr. Adams said. He stressed that … Read more at: https://www.zerohedge.com/political/nyc-mayor-eric-adams-warns-immigrants-will-soon-be-sleeping-streets |

|

Biden Admin Says US, Israel Not Behind Iran Blast As Death Toll Surpasses 100Update(1405ET): The death toll in Kerman city has risen to at least 103 killed, and over 141 injured, with new details being revealed in state-backed IRNA news as follows: “The first blast took place 700 meters away from Martyr General Qassem Soleimani’s tomb and the second explosion happened one kilometer away from it.” Other sources are saying there were well over 170 injuries in the aftermath. “The explosions dispersed mourners from Kerman’s cemetery and ambulances rushed to deliver the injured to hospitals in the city,” the report continues. This was among the single deadliest attacks in all of Iranian history. Iranian President Ebrahim Raisi didn’t single out any country of its intelligence services for being behind the attack, but said, “the perpetrators and criminals who were involved in this terrorist crime will soon be identified and punished for their actions.” However, some top Iranian officials did quickly point the finger at Israel and the US. This prompted a quick rejection of the allegation by the Biden administration, which also sought to distance Israel from the mass casualty event too:

|

|

Borrowers’ pain eased as lenders cut mortgage ratesAfter the UK’s biggest lender reduces rates on new fixed deals, other providers are expected to follow suit. Read more at: https://www.bbc.co.uk/news/business-67873017?at_medium=RSS&at_campaign=KARANGA |

|

Ryanair hits out at Booking.com over flight cutsThe airline says sites including Booking.com, Kiwi and Kayak suddenly removed its flights in December. Read more at: https://www.bbc.co.uk/news/business-67873695?at_medium=RSS&at_campaign=KARANGA |

|

Supermarkets’ busy Christmas boosted by promotions, says KantarResearch suggests £13.7bn was spent at supermarkets last month, with an average household parting with £477. Read more at: https://www.bbc.co.uk/news/business-67865065?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: As a sell-on-rise strategy is in play, what Nifty traders should do on Thursday expiryNifty on Wednesday ended 148 points lower to form a long negative candle on the daily chart placed at the edge of breaking below the immediate support of 10-day EMA. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-as-a-sell-on-rise-strategy-is-in-play-what-nifty-traders-should-do-on-thursday-expiry/articleshow/106519294.cms |

|

20% rally in 3 months! Breakout from multi-year swing high makes Exide Industries an attractive buyShort-term traders can look to buy the stock on dips for a possible target of Rs 372 in the next 3-4 weeks, suggest experts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-stock-pick-20-rally-in-3-months-breakout-from-multi-year-swing-high-makes-exide-industries-an-attractive-buy/articleshow/106504861.cms |

|

Top picks! Bank of Baroda, Varun Beverages among 8 largecap stocks that can rally up to 27%Axis Securities maintained its Buy rating on SBI with a target price of Rs 800, showing an upside potential of 25% from the current market prices. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/top-picks-bank-of-baroda-varun-beverages-among-8-largecap-stocks-that-can-rally-up-to-27/slideshow/106502713.cms |

|

U.S. recession still a threat; China growth stalls, and other 2024 investing risksThe global economy is not out of the woods. Read more at: https://www.marketwatch.com/story/u-s-recession-still-a-threat-china-growth-stalls-and-other-2024-growth-risks-7b50c8a6?mod=mw_rss_topstories |

|

10-year Treasury yield slips after December Fed minutes show officials didn’t rule out further rate hikesThe 10-year U.S. government-debt yield finished lower on Wednesday, after briefly topping the 4% mark in morning trading, as minutes from the Federal Reserve’s December meeting raised uncertainty about the path of monetary policy in 2024. Read more at: https://www.marketwatch.com/story/treasury-yields-move-higher-as-traders-rein-back-rate-cut-optimism-ahead-of-fed-minutes-fdc37806?mod=mw_rss_topstories |

|

Trying to get rid of your credit-card debt in 2024? Here’s your action plan.There’s new urgency for this common New Year’s resolution, as Americans struggle with over $1 trillion in credit card debt Read more at: https://www.marketwatch.com/story/trying-to-get-rid-of-your-credit-card-debt-in-2024-heres-your-action-plan-be78018a?mod=mw_rss_topstories |