Summary Of the Markets Today:

- The Dow closed up 130 points or 0.36%,

- Nasdaq closed up 0.45%,

- S&P 500 closed up 0.41%,

- Gold $2,019 down $27.80,

- WTI crude oil settled at $71 up $1.86,

- 10-year U.S. Treasury 4.233% up 0.104 points,

- USD Index $103.98 up $0.440,

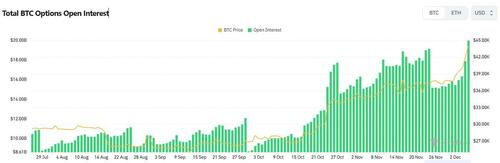

- Bitcoin $44,384 up $1,125 ( 2.60% )

- Baker Hughes Rig Count: U.S. +1 to 626 Canada +2 to 194

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

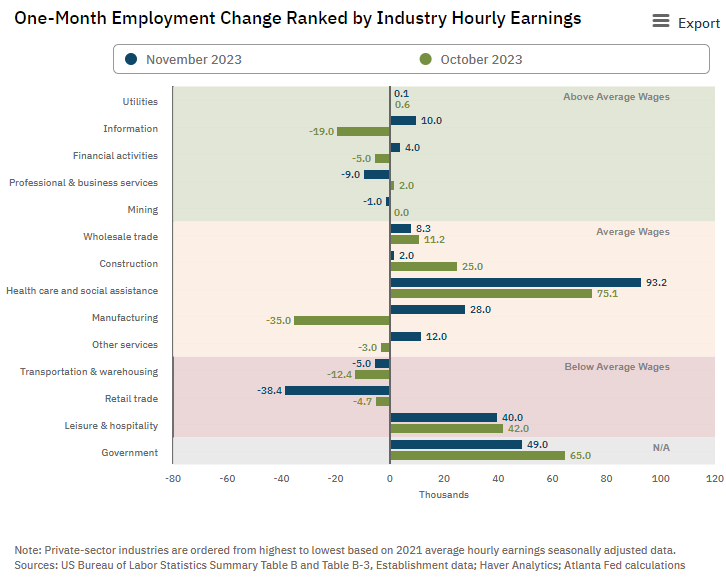

Total nonfarm payroll employment increased by 199,000 in November 2023, and the unemployment rate edged down to 3.7 percent. Job gains occurred in healthcare (almost half of the new jobs were in healthcare) and government (1/4 of new jobs were in government). Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined significantly. The household survey shows an additional 747,000 were employed in November than October – and this is well over 3 times more than the headline 199,000 in the establishment survey.

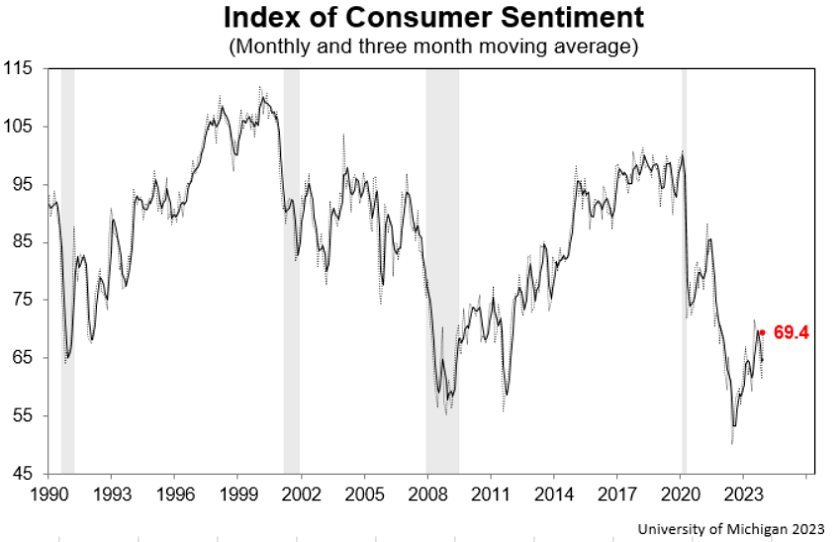

The University of Michigan Consumer sentiment soared 13% in December 2023, erasing all declines from the previous four months, primarily on the basis of improvements in the expected trajectory of inflation. Sentiment is now about 39% above the all-time low measured in June of 2022 but still well below pre-pandemic levels. All five index components rose this month, led by surges of over 24% for both the short and long-run outlook for business conditions. There was a broad consensus of improved sentiment across age, income, education, geography, and political identification. A growing share of consumers—about 14%—spontaneously mentioned the potential impact of next year’s elections. Sentiment for these consumers appears to incorporate expectations that the elections will likely yield results favorable to the economy.

Here is a summary of headlines we are reading today:

- More U.S. Diesel Headed To Europe In December

- Oil Rebounds as DOE Looks To Buy 3 Million Barrels For SPR In March

- Oil Rig Count Sees Small Loss As WTI Recovers To $70

- U.S. Gasoline Prices Continue Falling as Futures Hit Two-Year Low

- China’s Oil Demand Growth Is Set for a Significant Slowdown in 2024

- The runway is getting clearer, but the U.S. economy still isn’t assured of a soft landing

- S&P 500 notches new high for 2023 Friday, on six-week hot streak after solid economic data: Live updates

- 10-year Treasury yield jumps as unemployment rate unexpectedly declines

- U.S. payrolls rose 199,000 in November, unemployment rate falls to 3.7%

- Cryptos Jump, Commodities Dump, & Yield-Curve Slumps In ‘Goldilocks’ Week

- The Conversation: China is using internet warfare to disrupt U.S. and Western politics. Here’s what to watch for.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

More U.S. Diesel Headed To Europe In DecemberThe United States is on track to ship more diesel to Europe this month, with Europe’s diesel imports from Asia and the Middle East falling so far this month. While Europe’s desire to wean itself completely off Russian fuel supplies, Europe’s appetite for imported diesel and gasoil hasn’t diminished. In fact, it is estimated that it will increase this month to 290,000 bpd, preliminary estimates from Kpler and compiled by Bloomberg show. This is the highest level of diesel and gasoil imports since July of 2018. U.S.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/More-US-Diesel-Headed-To-Europe-In-December.html |

|

Oil Rebounds as DOE Looks To Buy 3 Million Barrels For SPR In MarchWith oil plunging an (almost) unprecedented 7 weeks in a row, the longest such stretch since 2018… … and many momentum chasing experts – the same ones who two months ago were calling for triple digit oil – already predicting that Saudi Arabia will soon be forced to do what it did in March 2020 when it flooded the market with oil to crush higher cost competitors, this morning we got a reminder of just why oil isn’t trading far, far higher. For those confused, the reason why oil is not in the triple digits is the drain of more than 300 million… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rebounds-as-DOE-Looks-To-Buy-3-Million-Barrels-For-SPR-In-March.html |

|

U.S. Plans 3 Million Barrel Purchase of Crude Oil for SPRThe United States Department of Energy said on Friday that it plans to buy 3 million barrels of crude oil for the Strategic Petroleum Reserve for March delivery as oil prices sink to levels below the stated threshold for the government’s refill plan. The Biden Administration saw the stockpiles of crude oil in the nation’s strategic reserve fall from 638 billion barrels at President Joe Biden’s inauguration to just 347 billion barrels by this summer as the Administration tried to bring down gasoline prices for consumers. The large… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Plans-3-Million-Barrel-Purchase-of-Crude-Oil-for-SPR.html |

|

Oil Rig Count Sees Small Loss As WTI Recovers To $70The total number of active drilling rigs in the United States rose by 1 this week after rising by 3 last week, according to new data that Baker Hughes published Friday. The total rig count rose to 626 this week. Since this time last year, Baker Hughes has estimated a loss of 158 active drilling rigs. This week’s count is 449 fewer rigs than the rig count at the beginning of 2019, before the pandemic. The number of oil rigs fell by 2 to 503. Oil rigs are now down by 122 compared to this time last year. The number of gas rigs rose by 3 this… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Rig-Count-Sees-Small-Loss-As-WTI-Recovers-To-70.html |

|

Ofgem Responds to UK Federation of Small Business: Expect Fair PricesOfgem and the Department for Energy Security and Net Zero have submitted proposals to expand protection for businesses in response to the Federation of Small Businesses’ (FSB) plea for more support as winter bills bite. The FSB had called on Ofgem and other energy suppliers alike late last month, signalling that changes in contracts and standing charges must be made as small businesses still battle high utility bills. The energy regulator launched a statutory consultation on proposals, ensuring businesses get the “highest… Read more at: https://oilprice.com/Energy/Energy-General/Ofgem-Responds-to-UK-Federation-of-Small-Business-Expect-Fair-Prices.html |

|

India Could Boost Russian Crude Imports As Prices FallAs the price of Russia’s flagship crude fell below the $60 per barrel price cap and international benchmarks slumped, India expects to increase its purchases of Russian oil, an anonymous senior government official in India told Reuters on Friday. The price of Russia’s flagship crude, Urals, has dropped below the $60 per barrel price cap for the first time in months amid plunging international benchmarks. The price of Urals crude loaded from Russia’s Baltic Sea port of Primorsk fell to $56.15 a barrel,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Could-Boost-Russian-Crude-Imports-As-Prices-Fall.html |

|

COP28 Draft Text Highlights Division Over a Fossil Fuel Phase-OutThe future of fossil fuels and possible language on the phase-out of fossil fuels in the final text of COP28 continues to be debated at the climate summit as the latest draft shows. The latest version of the draft text with “refined textual building blocks”, published on Friday, offers several options for language about the phase-out of fossil fuels, including an option not to include any text. The draft text published by the United Nations Framework Convention on Climate Change says that the countries will be called upon “to… Read more at: https://oilprice.com/Energy/Energy-General/COP28-Draft-Text-Highlights-Division-Over-a-Fossil-Fuel-Phase-Out.html |

|

U.S. Gasoline Prices Continue Falling as Futures Hit Two-Year LowU.S. gasoline futures slumped this week to the lowest level since 2021, suggesting that the average American pump price will continue to drop and end the year below $3 per gallon. On Thursday, the NYMEX RBOB gasoline futures contract dropped below the $2 per gallon mark, as demand is weakening and supply is building. The benchmark gasoline futures fell to below $2 a gallon for the first time since 2021. The latest inventory report from the EIA showed an inventory build of 5.4 million barrels of gasoline for last week. This compared with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Continue-Falling-as-Futures-Hit-Two-Year-Low.html |

|

Oil Prices Climb But Bearish Sentiment Remains StrongOil prices were rising early on Friday morning but remain on course for a seventh consecutive weekly loss as demand concerns continue to drive bearish sentiment.Friday, December 8th, 2023With Chinese oil demand slowing down into Q4, OPEC+ production cuts failing to impress the oil market, and non-OPEC supply continuing to grow – with Guyana starting its third FPSO this month – the immediate outlook for oil prices is far from rosy. Both WTI and Brent fell to their lowest readings since June, falling below $69 and $74 per barrel, respectively,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-But-Bearish-Sentiment-Remains-Strong.html |

|

Africa’s Largest Oil Refinery Moves Closer to Start-upThe Dangote Refinery in Nigeria, Africa’s biggest, is expected to receive on Friday its first of several cargoes of crude oil that would enable it to begin initial runs, the Dangote group said in a statement seen by Reuters. The refinery, which has been commissioned but has yet to begin producing any fuel, will receive 1 million barrels of Agbami crude from Shell’s trading unit. The cargo is one of 6 million barrels of crude which will enable the start-up of the refinery, according to the Dangote group of Africa’s richest man,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Largest-Oil-Refinery-Moves-Closer-to-Start-up.html |

|

Oil Trading Giant Trafigura Triples Dividends After Record-High ProfitCommodity trader Trafigura paid its highest-ever dividends for its 2022/2023 financial year, after posting another record-high profit amid volatile markets. Trafigura, one of the biggest independent oil and commodity traders in the world, said in its 2022/2023 fiscal year results on Friday that its net profit jumped to about $7.4 billion for the year to September 30, 2023, up from $7 billion for the previous fiscal year, which was the then-record-high profit for the privately owned trading group. Trafigura paid $5.9 billion in dividends to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Trading-Giant-Trafigura-Triples-Dividends-After-Record-High-Profit.html |

|

Mining Giant Anglo American to Cut Copper and Iron Ore ProductionAnglo American plans to reduce iron ore and copper output in the near term to lower costs, one of the world’s top mining companies said on Friday as it fights to boost its share price that has slumped by over 30% this year. After the production, capex, and costs guidance on Friday, shares of Anglo American – which produces copper, nickel, platinum group metals, and diamonds, among others – slumped by 6.5% on the London Stock Exchange in the early morning. Year to date, Anglo American’s stock… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mining-Giant-Anglo-American-to-Cut-Copper-and-Iron-Ore-Production.html |

|

Shell Sees $6 Billion Investment Opportunity in NigeriaShell sees $6 billion worth of oil and gas investment opportunities in Nigeria, the country’s presidency said following a meeting of senior executives of the supermajor with Nigerian officials. Zoë Yujnovich, Shell’s Integrated Gas and Upstream Director, and the top executives of Shell’s Nigerian unit, Shell Nigeria PLC, held talks on Thursday with Nigerian President Bola Ahmed Tinubu in Abuja. According to presidential spokesperson Ajuri Ngelale, Shell has identified a $5 billion investment opportunity in Nigeria’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Sees-6-Billion-Investment-Opportunity-in-Nigeria.html |

|

China’s Oil Demand Growth Is Set for a Significant Slowdown in 2024Crude oil demand in China is set to slow down sharply next year, a survey among 12 industry analysts and consultants carried out by Bloomberg has suggested. According to the results of the survey, oil demand in the world’s biggest importer will decline to 500,000 barrels daily in 2024 as post-pandemic recovery loses steam. This is just a third of the demand growth rate recorded this year. “Next year, growth will be returning to the normal trajectory with pandemic factors fading. The outlook isn’t so encouraging,” Sinopec… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Oil-Demand-Growth-Is-Set-for-a-Significant-Slowdown-in-2024.html |

|

EU to Allow Members to Ban Russian Pipeline GasThe European Union has drafted a legislative proposal to authorize member states to ban Russian and Belarusian companies from booking capacity on gas pipelines in the bloc in a bid to reduce further the EU’s intake of Russian gas. According to a Financial Times report, the proposal will also include access to EU LNG terminals. The proposal comes amid calls to ban Russian LNG imports even as these hit a record this year. Another aspect of the raft legislation is letting European companies that have existing contracts with Russian or Belarusian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-to-Allow-Members-to-Ban-Russian-Pipeline-Gas.html |

|

The runway is getting clearer, but the U.S. economy still isn’t assured of a soft landingThere’s nothing about a 3.7% unemployment rate and another 199,000 jobs that even whispers “recession,” let alone screams it. Read more at: https://www.cnbc.com/2023/12/08/the-runway-is-getting-clearer-but-the-us-economy-still-isnt-assured-of-a-soft-landing.html |

|

S&P 500 notches new high for 2023 Friday, on six-week hot streak after solid economic data: Live updatesStocks rose on Friday after the November jobs report and University of Michigan consumer survey data signaled a resilient economy and cooling inflation. Read more at: https://www.cnbc.com/2023/12/07/stock-market-today-live-updates.html |

|

U.S. approves first gene-editing treatment, Casgevy, for sickle cell diseaseCasgevy uses the Nobel Prize-winning technology CRISPR to treat sickle cell disease, a blood disorder that affects about 100,000 Americans. Read more at: https://www.cnbc.com/2023/12/08/casgevy-first-crispr-gene-editing-treatment-approved-in-us.html |

|

10-year Treasury yield jumps as unemployment rate unexpectedly declinesInvestors assessed the latest U.S. jobs report on Friday. Read more at: https://www.cnbc.com/2023/12/08/us-treasury-yields-investors-look-to-us-jobs-report.html |

|

Google weighs Gemini AI project to tell people their life story using phone data, photosA team at Google has proposed using AI technology to create a “bird’s-eye” view of users’ lives using mobile phone data such as photographs and searches. Read more at: https://www.cnbc.com/2023/12/08/google-weighing-project-ellmann-uses-gemini-ai-to-tell-life-stories.html |

|

Exxon Mobil is one of the most oversold names and could be primed for a bounce. Here are the othersInvestors broadly sold off energy shares as oil prices tumbled for the seventh straight week. Read more at: https://www.cnbc.com/2023/12/08/exxon-mobil-is-one-of-the-most-oversold-names-and-could-be-primed-for-a-bounce-here-are-the-others.html |

|

Trump PAC paid part of nearly $900,000 fee to fraud trial expert witnessAn expert witness retained by the defense in the civil fraud trial of former President Donald Trump said he has been paid nearly $900,000 for his work. Read more at: https://www.cnbc.com/2023/12/08/trump-pac-paid-part-of-nearly-900000-fee-to-fraud-trial-expert-witness.html |

|

Paramount shares jump after reports of takeover interestParamount shares surged Friday following reports that RedBird and Skydance were exploring a potential takeover. Read more at: https://www.cnbc.com/2023/12/08/paramount-para-takeover-interest-reports.html |

|

Binance founder Changpeng Zhao is too rich to leave the U.S. before criminal sentencing, judge saysThe ruling reverses a previous decision allowing Zhao, the crypto also known as CZ, to travel to his home in the United Arab Emirates before he is sentenced on Feb. 23. Read more at: https://www.cnbc.com/2023/12/08/binance-founder-cz-too-rich-to-leave-us-before-sentencing-judge.html |

|

U.S. issues strongest criticism of Israel yet as civilian deaths in Gaza surgeSecretary of State Blinken stressed the U.S. concern for the protection of civilians in Gaza, where authorities say that over 16,000 people have been killed. Read more at: https://www.cnbc.com/2023/12/08/us-issues-strongest-criticism-of-israel-yet-as-civilian-deaths-in-gaza-surge.html |

|

U.S. payrolls rose 199,000 in November, unemployment rate falls to 3.7%Nonfarm payrolls were expected to increase by 190,000 in November, according to the Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2023/12/08/jobs-report-november-2023-us-payrolls-rose-199000-in-november-unemployment-rate-falls-to-3point7percent.html |

|

Why experts say falling EV prices could actually hinder widespread adoptionThe lower prices might bode well for buyers, but they raise concerns that low resale values could hurt EV adoption among mainstream consumers. Read more at: https://www.cnbc.com/2023/12/08/falling-ev-prices-could-hinder-adoption-experts-say.html |

|

Ron Insana: The Fed’s dream scenario of an economic soft landing has arrived. Here’s whyThe soft landing we’ve all been waiting for is already here, says Ron Insana. Read more at: https://www.cnbc.com/2023/12/08/ron-insana-the-feds-dream-scenario-of-an-economic-soft-landing-has-arrived-heres-why.html |

|

Cryptos Jump, Commodities Dump, & Yield-Curve Slumps In ‘Goldilocks’ WeekReality set in this week that the ‘goldilocks’ narrative is not compatible with the massive rate cuts priced in for next year. As Goldman warned:

Stocks mixed-ish, Bonds mixed-ish, Commodities down, Crypto up, & Dollar up as Rate-Cut hopes faded this week (from 140bps in 2024 to 112bps)…

Source: Bloomberg On the macro side – it was all ‘soft’ with a little firming in ‘hard’ data: Inflation expectati … Read more at: https://www.zerohedge.com/markets/cryptos-jump-commodities-dump-yield-curve-slumps-goldilocks-week |

|

Record Bitcoin Call Volumes Target $50,000 By JanuarySomething unexpected is happening in the world of cryptos: yes, prices have soared, but unlike so many occasions in the past two years, they have not been followed by a brutal slams even as the space continues to hit multi-year highs, as if the shorts’ enthusiasm to self the fucking rip is evaporating. Meanwhile, the lack of painful reversal has emboldened bulls, who have pushed bitcoin as high as $45,000 earlier this week (the largest token was trading just shy of $44,000 on Friday), with an influx of capital leading to an uptick in activity from crypto derivatives traders and options open interest hitting an all-time high of around $20 billion according to data from Coinglass. An increase in open interest signals higher liquidity and more market participants. What’s just as notable, is that the majority of the options traded in the past 24 hours have been calls, with a breakdown of 60% calls and only 40% puts.

It’s not just the most recent option trades that are bullishly biased: when The Block exami … Read more at: https://www.zerohedge.com/markets/record-bitcoin-call-volumes-target-50000-january |

|

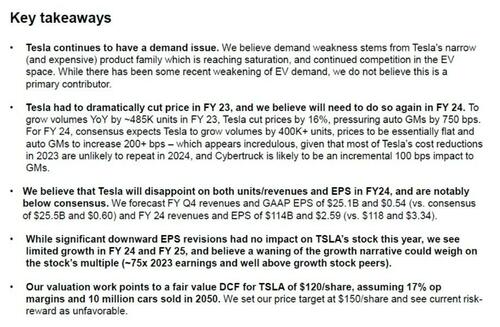

Tesla Best Short Idea For 2024, Bernstein’s Toni Sacconaghi SaysThere haven’t been too many semi-reputable sell side names that have thrown in the towel on Tesla publicly, but that’s exactly what Bernstein is doing. Analyst Toni Sacconaghi, instead of just cutting his price target on the name and giving it an underweight rating – which he’s done – also has the firm convinced that Tesla is the best short recommendation for 2024.

Sacconaghi highlighted in a recent client memo that 2023 has been notably challenging for Tesla, reminding his readers that the EV company finished the year with its 2023 EPS about 50% below estimates for the year. Despite this, the stock has doubled, he points out. Read more at: https://www.zerohedge.com/markets/tesla-best-short-idea-2024-bernsteins-toni-sacconaghi-says |

|

The Media Is Hyping Up “Carbon Passports” To Restrict TravelAuthored by Steve Watson via Modernity.news, A talking point that is now everywhere in the media is the notion that in the near future travel is highly likely to be restricted through the introduction of so called ‘carbon passports’.

Last week, CNN ran a piece created by something called ‘The Conversation,’ which had the headline “It’s time to limit how often we can travel abroad – ‘carbon passports’ may be the answer” Within this “analysis,” readers were told that record-breaking heatwaves, wildfires and extreme weather events are being driven in part by people going on holiday. “Tourism is part of the problem,” the piece asserts, adding “The tourism sector generates around one-tenth of the greenhouse … Read more at: https://www.zerohedge.com/political/media-hyping-carbon-passports-restrict-travel |

|

Average two-year mortgage rate falls below 6%Mortgage providers have been cutting rates, but many homeowners still face a payment shock. Read more at: https://www.bbc.co.uk/news/business-67636575?at_medium=RSS&at_campaign=KARANGA |

|

US jobless rate falls to lowest level since JulyEmployers added a better-than-expected 199,000 jobs in November, despite efforts to cool the economy. Read more at: https://www.bbc.co.uk/news/business-67662809?at_medium=RSS&at_campaign=KARANGA |

|

Edinburgh Reforms: City shake-up branded ‘damp squib’ by MPsThe Treasury Committee says much of what was promised by the chancellor has not materialised. Read more at: https://www.bbc.co.uk/news/business-67657894?at_medium=RSS&at_campaign=KARANGA |

|

Retail investors ‘gambling’ in stocks? Nithin Kamath’s take on popular viewMost of Zerodha’s AUM was added post-2020, which is one of the biggest bull markets India has seen. While equity funds saw a slowdown in the pace of inflows, investments through the systematic investment plan route hit record high in November. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/retail-investors-gambling-in-stocks-nithin-kamaths-take-on-popular-view/articleshow/105848076.cms |

|

Tech View: Nifty 50 forms a long bullish candle on weekly charts. What traders should do next weekOn a week-on-week basis, the 50-stock index has gained 3.5% and has formed a long bullish candle, while holding higher bottom formation on daily and intraday charts, which is largely positive, says Amol Athawale, Vice President – Technical Research, Kotak Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-50-forms-a-long-bullish-candle-on-weekly-charts-what-traders-should-do-next-week/articleshow/105843067.cms |

|

3 global funds sell 7.8% stake in Five-Star Business for Rs 1,656 crore via open marketTPG Capital, through one of its affiliates TPG Asia Vii Sf Pte, sold 89,07,493 shares of Five-Star Business or 3.05% stake at Rs 730 apiece, aggregating around Rs 650 crore, according to bulk deals data on the National Stock Exchange. As of September end, the global private equity fund held 14.29% stake in the NBFC. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/3-global-funds-sell-7-8-stake-in-five-star-business-for-rs-1656-crore-via-open-market/articleshow/105846618.cms |

|

The Moneyist: ‘Low-paying jobs are the economy’s way of saying you should get a better job’: I’ve decided to stop tipping, except at restaurants. Am I wrong?“I’m a tradesman, and we pay for our tools, vehicles and years of training while earning zip.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A8-CDC503FB4F02%7D&siteid=rss&rss=1 |

|

The Conversation: China is using internet warfare to disrupt U.S. and Western politics. Here’s what to watch for.Disinformation is rampant on social media — a social psychologist explains the tactics used against you. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72AB-CEBDE9BC9888%7D&siteid=rss&rss=1 |