Summary Of the Markets Today:

- The Dow closed up 294 points or 0.82%,

- Nasdaq closed up 0.55%,

- S&P 500 closed up 0.59%,

- Gold $2,090 up $32.80,

- WTI crude oil settled at $74 down $1.72,

- 10-year U.S. Treasury 4.217% down 0.135 points,

- USD Index $103.22 down $0.280,

- Bitcoin $38,804 up $1,079 ( 2.86% ),

- Baker Hughes U.S. Rig Count up 3 to 625

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during October 2023 was 10.7% above October 2022 (10.0% inflation-adjusted). During the first ten months of this year, construction spending was 5.6% above the same period in 2022. Construction definitely is in a growth spurt.

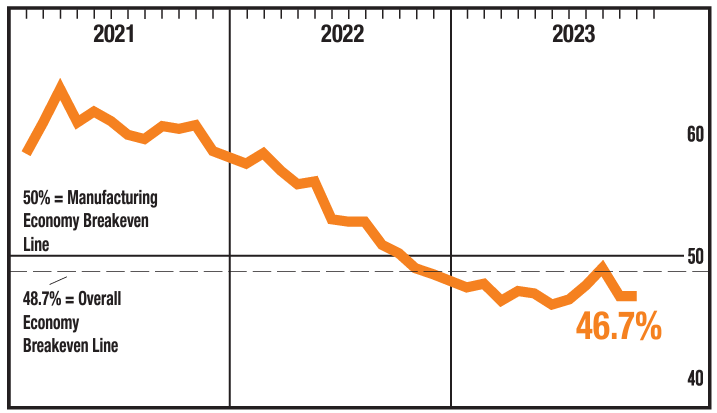

The ISM Manufacturing PMI® registered 46.7% in November 2021, unchanged from the 46.7% recorded in October. A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory at 48.3%.

Here is a summary of headlines we are reading today:

- U.S. Adds Three More Shippers to Russian Sanction List over Oil Price Cap

- U.S. Oil Drillers See More Gains As OPEC+ Agrees to Cut Production

- Guyana on Edge Amid Rumors of a Venezuelan Invasion

- Oil Markets Confused and Underwhelmed by OPEC+ Cuts

- Fed Chair Powell calls talk of cutting rates ‘premature’ and says more hikes could happen

- S&P 500 rises on Friday to close at 2023 high: Live updates

- Bitcoin hits highest level since May 2022 to kick off December: CNBC Crypto World

- Market Snapshot: Dow tops 36,000 after remarks by Fed’s Powell, S&P 500 heads for highest close of 2023

- Futures Movers: Oil prices settle at a 2-week low as OPEC+ decision disappoints

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

COP28: Policymakers Should Focus on Energy TechThe Cop28 climate summit has opened in Dubai, yet it is already clear that the world is not on track to meet the climate change targets that governments set themselves in Paris in 2015. In strictly numerical terms therefore, Cop28 will be a failure, like all the climate summits that came before it. The likely response will be much wringing of hands and pointing of fingers as people conclude, once again, that mankind lacks the moral and political will to save the planet and itself. This is the wrong approach to climate change. The energy transition… Read more at: https://oilprice.com/Energy/Energy-General/COP28-Policymakers-Should-Focus-on-Energy-Tech.html |

|

U.S. Adds Three More Shippers to Russian Sanction List over Oil Price CapThe United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) has added three additional companies and vessels to the sanctioned list for violations pertaining to the oil price cap set on Russian crude oil. Today’s inclusion marks the eighth action taken to enforce the crude oil price cap. Of the three entities sanctioned on Friday, two companies are based in the United Arab Emirates: Sterling Shipping Incorporated and Steymoy Shipping Limited. The third entity to find itself on the list is HS Atlantica Limited,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Adds-Three-More-Shippers-to-Russian-Sanction-List-over-Oil-Price-Cap.html |

|

COP28 Presidency No Red Lines on Fossil FuelsThe COP28 UAE-led presidency doesn’t have any “red lines” for language about fossil fuels in the negotiated text, COP28 Director General Majid al-Suwaidi said on Friday. “Our job as a COP presidency is not to have red lines. We don’t have red lines.” The question was in response to comments by UN Secretary General Antonio Guterres about what he called the urgent need to phase out fossil fuels to avoid climate catastrophe and meet Paris goals. “We cannot save a burning planet with a firehose of fossil fuels,” Guterres said earlier in the day. “The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/COP28-Presidency-No-Red-Lines-on-Fossil-Fuels.html |

|

U.S. Oil Drillers See More Gains As OPEC+ Agrees to Cut ProductionThe total number of active drilling rigs in the United States rose by 3 this week after rising by 4 last week, according to new data that Baker Hughes published Friday. The total rig count rose to 625 this week. Since this time last year, Baker Hughes has estimated a loss of 159 active drilling rigs. This week’s count is 450 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs rose by 5 to 505. Oil rigs are now down by 122 compared to this time last year. The number of gas rigs fell… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Drillers-See-More-Gains-As-OPEC-Agrees-to-Cut-Production.html |

|

Orban Says Ukraine’s EU Accession Not Currently In Hungary’s InterestHungarian Prime Minister Viktor Orban said opening European Union accession negotiations with Ukraine is not currently in Budapest’s interest and that the 27-member bloc should opt instead for a “strategic partnership” with the war-wracked country. In a progress report last month, the European Commission — the bloc’s executive body — recommended opening EU accession negotiations with Ukraine once it meets the required conditions after gaining candidate status together with much smaller Moldova in June last year.Orban, a right-wing populist… Read more at: https://oilprice.com/Energy/Energy-General/Orban-Says-Ukraines-EU-Accession-Not-Currently-In-Hungarys-Interest.html |

|

Dutch Fund Keeps Shell, BP in Portfolio as it Dumps 40 Other Oil FirmsDutch pension fund Pensioenfonds Metaal & Techniek (PMT) is divesting from 40 oil and gas companies, but will keep its investments in Shell and BP and seven other energy firms as it sees the nine companies as “the most promising” for PMT in the sector. PMT will continue to invest in Aker BP, BP, Enbridge, Eni, Equinor, Galp Energia, Neste Oyj, OMV, and Shell as it “bid goodbye” to 40 other oil and gas firms, the pension fund said on Friday. Those nine companies meet PMT’s requirements—to have publicly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Dutch-Fund-Keeps-Shell-BP-in-Portfolio-as-it-Dumps-40-Other-Oil-Firms.html |

|

Russia Set To Boost Diesel Shipments By 28% in DecemberRussia will be ramping up its diesel exports from its Black Sea and Baltic Sea ports by 28% in December from November, as Moscow relaxed further its fuel export curbs and Black Sea storms delayed some November loadings into this month, industry data seen by Bloomberg showed on Friday. This month, Russia is set to ship an average of around 681,000 barrels per day (bpd) of diesel from its key Western ports, up by 28% from last month, per estimates based on historical data from intelligence firm Kpler. According to the data compiled by Bloomberg,… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Set-To-Boost-Diesel-Shipments-By-28-in-December.html |

|

German Grid Regulator Plans to Spread Clean Energy Costs Across All RegionsConsumers in Germany’s states with lower clean energy production may end up paying higher grid fees as the regulator plans to spread out evenly among regions the higher costs of adding renewables to the system. The Federal Network Agency, Bundesnetzagentur, proposed on Friday a plan to evenly distribute the higher costs of adding a lot of renewable energy generation to the grid. This essentially means that German states in the north of the country, where most of the onshore wind power is generated, would pay lower grid fees. But the large… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Grid-Regulator-Plans-to-Spread-Clean-Energy-Costs-Across-All-Regions.html |

|

Digesting the OPEC+ Production CutsOPEC+ Agrees on Significant Output Cuts Amid Market Uncertainty In a decisive move, OPEC+ members, led by Saudi Arabia, have agreed to substantial voluntary output cuts totaling about 2.2 million barrels per day (bpd) for early next year. This announcement, which emerged from the group’s online meeting, has sent ripples through the global oil markets. Market Reaction to Voluntary Supply Cuts Despite the sizeable cut, benchmark global oil prices settled down by around 2%. This subdued reaction is attributed to the voluntary nature of the reductions… Read more at: https://oilprice.com/Energy/Energy-General/Digesting-the-OPEC-Production-Cuts.html |

|

Europe’s Insatiable Hunger for LNG1. OPEC+ Confronts Quota Imperfections, Weak Sentiment- Saudi Arabia and Russia, the two heavyweights of OPEC+, have managed to coordinate a wider response to weakening market sentiment and agree on voluntary cuts of 2.2 million b/d in their latest November 30 summit. – Saudi Arabia is rolling over its voluntary 1 million b/d production cut into Q1 2024, joined by Russia which promised to curb the supply of crude by 300,000 b/d and of oil products by another 200,000 b/d. – Six other OPEC+ members chipped in with their voluntary cuts, spearheaded… Read more at: https://oilprice.com/Energy/Energy-General/Europes-Insatiable-Hunger-for-LNG.html |

|

Oil Markets Unimpressed By OPEC+ CutsMarkets Oil markets balked at the OPEC+ news this week that saw the organization extend cuts from Saudi Arabia and Russia and deepen the group’s overall cuts with other member states beginning in the first quarter of next year. The distinction–and likely a large factor in sending prices downward on Thursday–is the fact that the additional cuts (those beyond Russia and Saudi Arabia’s rollover cuts) are voluntary cuts. On one hand, this could be seen as a large win for Saudi Arabia, which has been shouldering much of the market… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Unimpressed-By-OPEC-Cuts.html |

|

Guyana on Edge Amid Rumors of a Venezuelan InvasionFor newly oil-rich Guyana, this weekend will be a fateful one, with rumors that Venezuela is gathering forces to invade at the close of a referendum on the ownership of Essequibo, a disputed region that represents two-thirds of Guyana’s total territory. Residents of Essequibo are frozen in a state of uncertainty. Rumors have not been verified, and those circulating in the media claim to be based on Brazilian intelligence. What is clear is that Guyana has become a point of political capital for the Maduro regime, and the question now is whether… Read more at: https://oilprice.com/Energy/Energy-General/Guyana-on-Edge-Amid-Rumors-of-a-Venezuelan-Invasion.html |

|

Why Did Oil Drop on an OPEC+ Output Cut and Will the Selling Continue?Over the last twenty years or so, I have spent a lot of time teaching and mentoring aspiring traders. During that time, I have heard a lot of questions, but the most common one by far is why markets move in a counterintuitive direction after news. Normally, those questions are about stocks after earnings releases and the answer is often quite obvious. It may be that an EPS beat was achieved on lower than expected earnings, or that the numbers were boosted by a one off item and the adjusted number is actually lower than forecast. Or it could be… Read more at: https://oilprice.com/Energy/Oil-Prices/Why-Did-Oil-Drop-on-an-OPEC-Output-Cut-and-Will-the-Selling-Continue.html |

|

Oil Markets Confused and Underwhelmed by OPEC+ CutsOil markets were left both confused and underwhelmed by the OPEC+ decision to cut 2.2 million bpd in the first quarter of 2024, with oil prices falling toward a weekly loss.Friday, December 1st, 2023Oil markets welcomed the new OPEC+ deal that pledged 2.2 million b/d in voluntary cuts for the first quarter of 2024 in a very lukewarm manner, with Brent erasing all its earlier gains and dropping back to $81 per barrel. With even the most seasoned industry watchers starting to lose track of which country will be cutting what amount against which reference… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Confused-and-Underwhelmed-by-OPEC-Cuts.html |

|

Brazil Won’t Cap Its Oil Production Despite Joining OPEC+ GroupBrazil, which is set to join the OPEC+ alliance in January, will not have any quota and will not participate in oil production cuts, Jean Paul Prates, the chief executive of Brazilian state-controlled oil giant Petrobras, told Reuters in an interview published on Friday. After the much-anticipated OPEC+ meeting on Thursday, the group surprisingly announced that Brazil would join the alliance in 2024. “The Meeting welcomed HE Alexandre Silveira de Oliveira, Minister of Mines and Energy of the Federative Republic of Brazil,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazil-Wont-Cap-Its-Oil-Production-Despite-Joining-OPEC-Group.html |

|

Fed Chair Powell calls talk of cutting rates ‘premature’ and says more hikes could happenFederal Reserve Chairman Jerome Powell on Friday pushed back on market expectations for aggressive interest rate cuts ahead. Read more at: https://www.cnbc.com/2023/12/01/fed-chair-powell-calls-talk-of-cutting-rates-premature-and-says-more-hikes-could-happen.html |

|

Media stocks jump after report says Apple, Paramount are discussing streaming bundleWarner Bros. Discovery and Paramount Global shares jumped Friday. Read more at: https://www.cnbc.com/2023/12/01/apple-paramount-streaming-bundle-report-boosts-media-stocks.html |

|

Inside Apple’s chip lab, home to the most ‘profound change’ at the company in decadesApple is upending much of the chip industry, designing custom silicon for every new iPhone and Mac. CNBC got a rare, exclusive look inside the lab. Read more at: https://www.cnbc.com/2023/12/01/how-apple-makes-its-own-chips-for-iphone-and-mac-edging-out-intel.html |

|

S&P 500 rises on Friday to close at 2023 high: Live updatesThe Dow Jones Industrial Average notched a 2023 high and capped off its best month in over a year. Read more at: https://www.cnbc.com/2023/11/30/stock-market-today-live-update.html |

|

These stocks are overbought following November’s big market surgeCNBC Pro screened for the most overbought and oversold names in the S&P 500 based on FactSet data. Read more at: https://www.cnbc.com/2023/12/01/these-stocks-are-overbought-following-novembers-big-market-surge.html |

|

Rep. George Santos expelled from Congress for corruption, cutting GOP majorityRep. George Santos, R-N.Y., has been charged with federal crimes related to his campaign finances. Read more at: https://www.cnbc.com/2023/12/01/gop-rep-george-santos-faces-expulsion-vote-in-house.html |

|

Amazon buys SpaceX rocket launches for Kuiper satellite internet projectThe move is a surprise from Amazon, given the company’s Kuiper system aims to compete with Elon Musk’s Starlink in the satellite broadband market. Read more at: https://www.cnbc.com/2023/12/01/amazon-buys-spacex-rocket-launches-for-kuiper-satellite-internet-project.html |

|

Bitcoin hits highest level since May 2022 to kick off December: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Grayscale Chief Legal Officer Craig Salm discusses what he believes will happen with the asset manager’s plans to convert its bitcoin and ethereum trusts into ETFs. Read more at: https://www.cnbc.com/video/2023/12/01/bitcoin-hits-highest-level-since-may-2022-to-kick-off-december-cnbc-crypto-world.html |

|

Zelenskyy says ‘new phase of war’ has begun, Hungary to back EU ‘strategic partnership’Ukrainian President Volodymyr Zelenskyy on Thursday called for quicker fortifications in key battlegrounds in eastern Ukraine. Read more at: https://www.cnbc.com/2023/12/01/russia-ukraine-war-updates-for-decpoint1-2023.html |

|

Investors piled cash into money market mutual funds in 2023 and now could see a higher tax billIf you funneled cash into money market mutual funds in 2023 amid rising interest rates, you may have a surprise tax bill in April, experts say. Read more at: https://www.cnbc.com/2023/12/01/money-market-funds-may-deliver-a-surprise-tax-bill-amid-higher-yields.html |

|

Charlie Munger lived in the same home for 70 years: Rich people who build ‘really fancy houses’ become ‘less happy’Billionaire Charlie Munger intentionally lived in the same California home for seven decades — making him “happier” and benefitting his children, he said. Read more at: https://www.cnbc.com/2023/12/01/charlie-munger-living-in-the-same-home-for-70-years-made-me-happier.html |

|

Sandra Day O’Connor, first woman on Supreme Court, dies at 93Sandra Day O’Connor, who died from complications of advanced dementia, was the first of six women to serve on the Supreme Court. Read more at: https://www.cnbc.com/2023/12/01/sandra-day-oconnor-first-woman-on-supreme-court-dies-at-93.html |

|

Saudi Arabia is struggling to boost oil prices, raising possibility of supply war with U.S.In the end, Saudi Arabia may have only one option: Launch a supply war by flooding the market with oil. Read more at: https://www.cnbc.com/2023/12/01/saudi-arabia-is-struggling-to-boost-oil-prices-raising-possibility-of-supply-war-with-us-.html |

|

New Video Reveals McDonald’s Secret Spinoff Restaurant Called “CosMc’s”McDonald’s has maintained a high level of secrecy about its new spinoff restaurant chain called “CosMc’s.” This small-format concept restaurant was first announced in July with very few details. However, fast-food-obsessed internet sleuths have revealed they found a CosMc’s under construction in Illinois. TikToker snackolator, who posts only about junk food, recently shared a video showcasing what seems to be the construction of one of the first CosMc’s stores in Bolingbrook, Illinois.

“The kind of conventional thinking is that this is going to be something of a competitor to like Starbucks, where it’s going to focus on the McCafe stuff and the coffee and the drinks as opposed to serving burgers and fries, which makes even more sense when you realize that this CosMc’s is being built directly next to an existing McDonald’s,” snackolator said, who was quoted by Read more at: https://www.zerohedge.com/markets/new-video-reveals-mcdonalds-secret-spinoff-restaurant-called-cosmcs |

|

Latin America On Edge As Venezuela’s Maduro Holds Referendum Whether To Invade Oil-Rich Neighbor GuyanaIn a move that has prompted many to wonder which is the bigger banana republic, Venezuela or the US, Joe Biden’s new BFF, Venezuelan dictator Nicolas Maduro (who has promised to export a few barrels of oil to the US president – now that draining the SPR is no longer an option – to keep gas prices low ahead of the 2024 presidential election in exchange for sanction relaxation and defacto recognition by the White House that Maduro is the dictatorially “democratically” elected president of Venezuela, making a mockery of a decade of Western virtue-signaling sanctions), on Sunday Caracas is set to hold a referendum among Venezuelans on annexing (i.e., invading and taking over) a whopping 160,000 sq km of extremely oil-rich land in neighbouring Guyana.

Why now? Why only now when Caracas has for more than 200 years claimed rights over Essequibo, a vast swath of the territory Guyana? Simple: because as we said several days ago, … Read more at: https://www.zerohedge.com/markets/latin-america-edge-venezuelas-maduro-holds-referendum-whether-invade-oil-rich-neighbor |

|

Blackstone’s Flagship BREIT Gates Redemption Requests For 13 Consecutive MonthsBlackstone has limited investor redemption requests from its $64 billion commercial real estate trust for high-net wealth investors for the thirteenth consecutive month. However, the good news: the “backlog is easing,” according to Bloomberg. According to a shareholder letter, Blackstone Real Estate Income Trust (BREIT) recorded investor outflows of $1.8 billion in November. The fund fulfilled 67% of its requests, and demand redemptions fell to the lowest since September 2022. BREIT limits redemptions to 2% of net asset value monthly and 5% quarterly to curb sudden runs. This process of gating investors has been ongoing for 13 months due to surging fears of high interest rates and deteriorating conditions for commercial real estate markets. Recall:

The fund is heavily invested in housing, such as multi-family and student housing, as well as industrial properties and data centers. Read more at: https://www.zerohedge.com/markets/blackstones-flagship-breit-gates-redemption-requests-13-consecutive-months |

|

Politics Is Never Having To Say You’re Sorry: Mayorkas Refuses To Apologize To Del Rio AgentsAuthored by Jonathan Turley, Over two years later, Homeland Security Secretary Alejandro Mayorkas finally held a private meeting with the Border Patrol agents that he threw under the bus after they were falsely accused of whipping Haitain migrants near Del Rio, Texas.

There was reportedly no apology from Mayorkas. We have Read more at: https://www.zerohedge.com/political/politics-never-having-say-youre-sorry-mayorkas-refuses-apologize-del-rio-agents |

|

Three network down for tens of thousands across UKThe network says its working on the issue now to fix it as soon as possible. Read more at: https://www.bbc.co.uk/news/technology-67595457?at_medium=RSS&at_campaign=KARANGA |

|

Train strikes: Drivers vote to continue walkoutsAslef members back walkouts for the next six months, as the union begins nine days of action. Read more at: https://www.bbc.co.uk/news/business-67591258?at_medium=RSS&at_campaign=KARANGA |

|

Bank branch closures hits Prime Minister Rishi Sunak’s constituencyThe last bank in Richmond, North Yorkshire, is one of 18 branch closures announced by Barclays. Read more at: https://www.bbc.co.uk/news/business-67583574?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms long bull candle to end in uncharted zone. What traders should do next weekThe short-term trend of Nifty continues to be positive, and one may expect further upside in the coming week. The next upside levels to be watched are around 20,510 (50% Fibonacci projection, taken from March 23 bottom-Sept 23 top-Oct 23 bottom). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bull-candle-to-end-in-uncharted-zone-what-traders-should-do-next-week/articleshow/105658227.cms |

|

Trent becomes 5th Tata Group company to breach Rs 1 lakh-crore market capTrent has given multibagger returns of 109% in 2023, outperforming Nifty50 which has returned over 11% during this period. The last 12-month gains by this counter stand at 92%. Trent is trading above its 50-day and 200-day simple moving averages (SMAs), according to Trendlyne. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trent-becomes-5th-tata-group-company-to-breach-rs-1-lakh-crore-market-cap/articleshow/105654705.cms |

|

Early Christmas party? What exit poll results, GDP data mean for stock investorsWhile the Q2 GDP growth rate at 7.6% surpassed all expectations, Street favourite BJP is seen winning the key Hindi belts of Rajasthan and Madhya Pradesh. Historically, too, December has been dominated by bulls as in the last 12 years, Nifty has ended in the green on seven occasions. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/early-christmas-party-what-exit-poll-results-gdp-data-mean-for-stock-investors/articleshow/105646550.cms |

|

Market Snapshot: Dow tops 36,000 after remarks by Fed’s Powell, S&P 500 heads for highest close of 2023U.S. stocks advance after remarks by Fed Chair Jerome Powell. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A6-3C9339A141F8%7D&siteid=rss&rss=1 |

|

Outside the Box: Leaders at COP28 already have this strong weapon to fight climate change. They should use it.Carbon markets are politically and economically positioned to reduce emisssions worldwide. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A3-C24EF359524C%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices settle at a 2-week low as OPEC+ decision disappointsOil futures fall for a second straight session, erasing a gain for the week following the outcome of an eagerly awaited OPEC+ meeting. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A6-5061A1553EE5%7D&siteid=rss&rss=1 |