Summary Of the Markets Today:

- The Dow closed up 520 points or 1.47%,

- Nasdaq closed down 0.23%,

- S&P 500 closed up 0.38%,

- Gold $2036 down $11,

- WTI crude oil settled at $76 down $2,

- 10-year U.S. Treasury 4.344% up 0.073 points,

- USD index $103.51 up $0.75,

- Bitcoin $37,740 down $85

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Disposable personal income (DPI) in October 2023, personal income less personal current taxes, increased to 3.9% year-over-year (from 3.8% in October 2022) and personal consumption expenditures (PCE) remained steady at 2.2% rise year-over-year [all percentages inflation adjusted]. Excluding food and energy, the PCE price index declined from 3.4% year-over-year last month to 3.0% in October 2023. In plain English, consumer spending and consumer income has essentially flatlined over the last 3 months which translates to a steady GDP growth. Inflation, on the other hand, had a significant improvement this month which may keep future federal funds increases at bay.

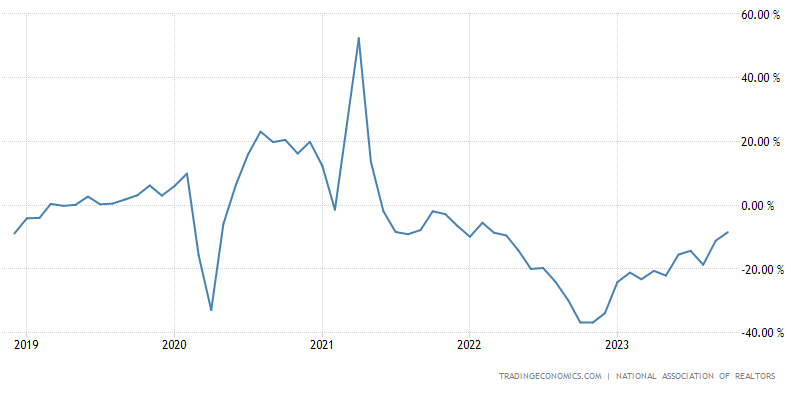

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – dropped 1.5% to 71.4 in October 2023, the lowest number since the index was originated in 2001. Year over year, pending transactions declined 8.5%. An index of 100 is equal to the level of contract activity in 2001. Lawrence Yun, NAR chief economist stated:

During October, mortgage rates were at their highest, and contract signings for existing homes were at their lowest in more than 20 years. Recent weeks’ successive declines in mortgage rates will help qualify more home buyers, but limited housing inventory is significantly preventing housing demand from fully being satisfied. Multiple offers, of course, yield only one winner, with the rest left to continue their search.

In the week ending November 25, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,000, a decrease of 500 from the previous week’s revised average. The previous week’s average was revised up by 500 from 220,000 to 220,500.

Here is a summary of headlines we are reading today:

- The Last 6 Months Have Been Devastating For U.S. Clean Energy Stocks

- Oil Prices Retreat As OPEC+ Cuts Another 684KBPD, Brazil Joins OPEC+

- The First-Ever Enhanced Geothermal Plant in the United States

- Russia’s Biggest Oil and Gas Exporters See Revenues Slump by 41%

- Consumer Reports: EVs Are Less Reliable Than Gasoline Cars

- Now at a new 2023 high, the Dow is approaching a record. These stocks could push it over the top

- Money Laundering Expert Raised Alarm Over “Unusual” Chinese Payments To Hunter Biden

- Tesla Hosts ‘Biggest Event On Earth This Year’ To Launch Cybertruck

- Bank of America, Wells Fargo lead gains in big-bank stocks to add to November’s win

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

BP Buys Up Full Control Of Solar Power Developer Lightsource BPBP has bought up full control of solar power developer Lightsource BP in a move demonstrating the former’s ambitions outside of fossil fuels. The oil major announced today that it has acquired 50.03 per cent of the business for an initial fee of £254m, adding to the 49.97 per cent it already owned. BP first took a stake in the company in 2017, expanding the operations to 19 countries from three, built a 61GW development pipeline, and grown to over 1,200 personnel. This was built to a near-50 per cent holding in December… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/BP-Buys-Up-Full-Control-Of-Solar-Power-Developer-Lightsource-BP.html |

|

The Last 6 Months Have Been Devastating For U.S. Clean Energy StocksWhile the U.S. government continues to try and micromanage markets and subsidize their virtue signaling preferences, 5% interest rates have been busy offering up a reality check to the Biden administration’s green energy pipe dream. That pipe dream is, of course, that green energy companies could survive in an environment where rates are high; also referred to as an environment where you actually have to turn a consistent profit and generate cash to survive. According to a new Bloomberg report, that’s just too much reality for some clean… Read more at: https://oilprice.com/Energy/Energy-General/The-Last-6-Months-Have-Been-Devastating-For-US-Clean-Energy-Stocks.html |

|

The Complexities of Clamping Down on Russian SanctionsAround a year after the U.S. and Europe introduced sanctions on Russian energy, following the Russian invasion of Ukraine early in 2022, some countries and actors are circumventing sanctions and continuing to buy Russian energy products. In recent months, Russia has appeared to shrug off the sanctions as it continues to sell energy to several major consumers, such as China and India, to keep its economy ticking over. But now, the EU is planning to introduce stricter measures that could hit Russia hard and make it more difficult to evade sanctions. … Read more at: https://oilprice.com/Energy/Energy-General/The-Complexities-of-Catching-Russian-Sanctions-Evaders.html |

|

ECB Rate-Cut Expectations Soar After EU Inflation Cools More Than ExpectedFollowing cooler than expected CPI from Germany and Spain yesterday, the aggregate euro-zone inflation cooled more than expected this morning with headline CPI tumbling from +2.9% in October to +2.4% in November. Core CPI – that excludes volatile components including fuel and food – also moderated for a fourth month, to 3.6%. Source: Bloomberg The decline in inflation was dominated by Energy deflation… And inflation is slowing across all of Europe… However, inflation is likely to tick higher before returning to target due to statistical… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ECB-Rate-Cut-Expectations-Soar-After-EU-Inflation-Cools-More-Than-Expected.html |

|

Oil Prices Retreat As OPEC+ Cuts Another 684KBPD, Brazil Joins OPEC+Oil prices began to retreat on Thursday afternoon as it became clear that OPEC+ members were agreeing to voluntary cuts beginning in the new year, and that those cuts would be announced only by each member country instead of by the group as a whole. OPEC+ announced during the full OPEC+ meeting on Thursday that because all the cuts agreed to today were voluntary, they would be announced not by the group, but by the individual member states. Immediately following the meeting’s kickoff, it was also announced that Brazil would join the OPEC+… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Retreat-As-OPEC-Cuts-Another-684KBPD-Brazil-Joins-OPEC.html |

|

The First-Ever Enhanced Geothermal Plant in the United StatesU.S. tech giant Google and geothermal startup Fervo Energy have launched the U.S.’ first-ever enhanced geothermal plant that will produce 100% carbon-free electricity round the clock. Dubbed Project Red, the 3.5-megawatt plant is now supplying power directly to the Las Vegas–based utility NV Energy with enough electricity to power roughly 2,600 U.S. homes. Whereas that amount of power might seem minuscule compared to the Gigawatt range typical of nuclear plants, Project Red is the most powerful among the world’s fleet of 40-plus enhanced… Read more at: https://oilprice.com/Alternative-Energy/Geothermal-Energy/The-First-Ever-Enhanced-Geothermal-Plant-in-the-United-States.html |

|

Court Rules Germany’s Climate Policy Falls Short of Legal RequirementsThe Berlin-Brandenburg Higher Administrative Court ruled on Thursday that Germany’s federal policies to fight climate change in the transport and housing sectors are falling short of a law that sets limits to emissions in the sectors. The regional court in Germany also required the government to take emergency action and bring the policies in transport and housing within the emissions limits set in the Climate Protection Act from 2024 to 2030, Reuters reports. The Berlin-Brandenburg Higher Administrative Court thus upheld legal challenges… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Rules-Germanys-Climate-Policy-Falls-Short-of-Legal-Requirements.html |

|

COP28 Commences Amid Both Controversy and OptimismThe twenty-eight Conference of the Parties to the UN Framework Convention on Climate Change opened on Thursday. Some 70 thousand diplomats, political and business leaders from almost 200 countries will attend the 2-week summit in Dubai. They are gathering at Expo City, a special district built in an effort to create a low-carbon, sustainable city for the Dubai World Expo 2020. Heads of state will appear during the next two days, addressing plenary sessions in what’s called the World Climate Action Summit. Vice-president Kamala… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/COP28-Commences-Amid-Both-Controversy-and-Optimism.html |

|

Russia’s Biggest Oil and Gas Exporters See Revenues Slump by 41%Total revenues for Russia’s largest oil and gas exporters plunged by 41% between January and September compared to the same period last year, due to lower commodity prices and lower exports, Russia’s central bank said on Thursday. Oil and gas production and exports have dropped this year, the Bank of Russia said in a financial stability review on Thursday. Re-directing oil and gas exports requires significant investment, and changes in the nature of transactions are raising the lead times for receipt of payments. “The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Biggest-Oil-and-Gas-Exporters-See-Revenues-Slump-by-41.html |

|

Germany’s Uniper Says Europe Needs More LNGEurope needs additional volumes of liquefied natural gas (LNG) to ease the tight market and alleviate supply concerns, Michael Lewis, CEO of Germany’s energy giant Uniper, told Bloomberg Television in an interview published on Thursday. “Until significantly more LNG volumes come onto the market, there is going to be a tight situation,” said the chief executive of the energy group, which the German government bailed out last year at the peak of the energy crisis. Germany nationalized Uniper in September 2022 as it was… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Uniper-Says-Europe-Needs-More-LNG.html |

|

OPEC+ Reaches Deal “In Principle” on Oil Output CutsOPEC+ reached a deal on Thursday that would see the group’s oil production cuts spill over into the new year—and at a level that is a deeper cut than is currently in place, delegates said following today’s JMMC meeting. The group agreed to cut production by an additional 1 million bpd starting in 2024, sources suggested—and this is in addition to the 1 million bpd Saudi Arabia has been cutting since the summer. This has been agreed to “in principle” and will be voted on at the full OPEC+ meeting. For the specifics… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Reaches-Deal-In-Principle-on-Oil-Output-Cuts.html |

|

Consumer Reports: EVs Are Less Reliable Than Gasoline CarsU.S. owners of electric vehicles have been experiencing on average more problems with their cars than the owners of vehicles with the traditional internal combustion engines, Consumer Reports said in its annual ranking of brand reliability. This year, Lexus, Toyota, and Mini are found to be the three most reliable brands in CR’s auto reliability brand rankings, with the two Japanese brands swapping spaces from last year. This year Consumer Reports addressed the rapidly growing number of electrified offerings that automakers are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Consumer-Reports-EVs-Are-Less-Reliable-Than-Gasoline-Cars.html |

|

OPEC+ Headed for 2 Million Bpd Oil Output Cut in 2024As the meeting of the Joint Ministerial Monitoring Committee (JMMC) began on Thursday, delegates are telling media that OPEC+ could be discussing deeper oil production cuts for the first quarter of 2024 and that total cuts could be close to 2 million barrels per day (bpd). Total OPEC+ cuts could approach 2 million bpd, depending on the willingness of the countries to contribute, according to delegates, commodity analyst Giovanni Staunovo reported as the JMMC meeting began. The figure includes a rollover of the Saudi and Russian cuts… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Headed-for-2-Million-Bpd-Oil-Output-Cut-in-2024.html |

|

OPEC+ Reaches Preliminary Agreement to Deepen Oil Production CutsAs OPEC+ is holding its meeting on Thursday, delegates and sources in the cartel and the wider group are telling media sources that there could be further cuts to the alliance’s production early next year. A preliminary agreement has been reached that OPEC+ could cut more than 1 million barrels per day (bpd) next year, including Saudi Arabia extending its voluntary cuts and additional cuts from other members of the group, two sources at OPEC+ told Reuters. Saudi Arabia, the leader of OPEC and its top producer, has won provisional approval… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Reaches-Preliminary-Agreement-to-Deepen-Oil-Production-Cuts.html |

|

U.S. Investment Firm EIG Closes In on a Multi-Billion-Dollar LNG AcquisitionEIG Global Energy Partners expects to announce soon a deal of several billion U.S. dollars to buy an LNG asset in addition to a stake in an Australian project, EIG chief executive officer R. Blair Thomas said in an interview with The Wall Street Journal. U.S.-based institutional investor in the global energy and infrastructure sectors, EIG, via its unit MidOcean Energy, is currently looking to buy a 27.5% stake in the Australia Pacific LNG project in eastern Australia. The project is currently owned by ConocoPhillips with a 47.5% stake,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Investment-Firm-EIG-Closes-In-on-a-Multi-Billion-Dollar-LNG-Acquisition.html |

|

Dow jumps 500 points to new 2023 high Thursday, capping 8% November rally: Live updatesStocks rose Thursday, buoyed by inflation data that increased hopes the Federal Reserve could begin cutting rates next year. Read more at: https://www.cnbc.com/2023/11/29/stock-market-today-live-updates.html |

|

Activist investor Nelson Peltz launches Disney proxy fight, seeks multiple board seatsNelson Peltz and his firm, Trian, are seeking multiple seats on Disney’s board, triggering a proxy fight. Read more at: https://www.cnbc.com/2023/11/30/nelson-peltz-seeks-two-seats-on-disney-board.html |

|

Elon Musk hypes Tesla Cybertruck at deliveries event in AustinThe event, to be held in Austin at 2 p.m. local time Thursday, will be livestreamed and marks the company’s first deliveries of the Cybertruck to customers. Read more at: https://www.cnbc.com/2023/11/30/tesla-set-to-reveal-cybertruck-details-at-austin-deliveries-event.html |

|

X CEO Linda Yaccarino addresses Musk’s ‘go f— yourself’ comment to advertisersLinda Yaccarino addressed the explicit comments Elon Musk hurled at advertisers Wednesday. Read more at: https://www.cnbc.com/2023/11/30/x-ceo-addresses-musks-go-f-yourself-comment-to-advertisers.html |

|

Cathie Wood’s Innovation ETF is up 31% in November, notching its best month everThe fund rebounded drastically from three straight months of losses, pushing 2023 gains to 47%. Read more at: https://www.cnbc.com/2023/11/30/cathie-woods-flagship-etf-is-up-30percent-on-pace-for-its-best-month-ever.html |

|

November’s rally has set the 60/40 portfolio on track for its best month since 2020Keeping diversified and staying the course can pay off. Read more at: https://www.cnbc.com/2023/11/30/november-rally-sets-60/40-portfolio-on-track-for-best-month-since-2020.html |

|

Pending home sales drop to a record low, even worse than during the financial crisisMortgage rates in October rose sharply, with the average on the 30-year fixed loan briefly eclipsing 8%. Read more at: https://www.cnbc.com/2023/11/30/pending-home-sales-drop-to-record-low.html |

|

U.S. crude declines as skepticism mounts over OPEC+ cutsTraders are concerned the cuts are only voluntary, raising the question of whether OPEC+ can follow through and curtail output, an analyst said. Read more at: https://www.cnbc.com/2023/11/30/us-crude-oil-falls-more-than-2percent-as-skepticism-mounts-over-opec-cuts.html |

|

Fed’s favorite gauge shows inflation rose 0.2% in October and 3.5% from a year ago, as expectedThe personal consumption expenditures price index was expected to increase 0.2% in October on a monthly basis and 3.5% from a year ago. Read more at: https://www.cnbc.com/2023/11/30/pce-inflation-report-october-2023-.html |

|

U.S. Treasury lobbies for more power to chase crypto crime outside America: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kraken’s chief legal officer, Marco Santori, discusses the SEC’s latest enforcement action against the crypto exchange. Read more at: https://www.cnbc.com/video/2023/11/30/us-treasury-lobbies-for-more-power-to-chase-crypto-crime-outside-america-cnbc-crypto-world.html |

|

Nashville added nearly 100 new residents per day in 2022. Here’s why people are moving to Music CityIn 2022, Nashville grew by roughly 100 people per day. Here’s why transplants are still moving to Music City. Read more at: https://www.cnbc.com/2023/11/30/nashville-added-nearly-100-new-residents-per-day-in-2022-.html |

|

See inside Tennessee’s most expensive home at $65 million, just outside NashvilleThere has been a shift in interest toward Middle Tennessee as wealthy buyers look for the large acreage and rural lifestyle of a farm. Read more at: https://www.cnbc.com/2023/11/30/inside-tennessees-most-expensive-home-near-nashville.html |

|

Now at a new 2023 high, the Dow is approaching a record. These stocks could push it over the topAnalysts expect some members to see big upsides ahead. Read more at: https://www.cnbc.com/2023/11/30/the-dow-is-approaching-an-all-time-high-the-stocks-that-can-help.html |

|

Money Laundering Expert Raised Alarm Over “Unusual” Chinese Payments To Hunter BidenA bank investigator hired to monitor Hunter Biden’s company, Owasco P.C. raised the alarm over an influx of Chinese money while despite the company providing zero services.

In a June 26, 2018 email from the investigator, concerns were raised over wire transfers from a Chinese company, and Biden’s joint Chinese venture, Hudson West III. Specifically, $5 million initially sent to Hudson West was described as a business loan, however “there was no loan agreement document submitted,” wrote the investigator, whose name and which bank he was working for was redacted. Most of the funds were sent to Owasco via 16 wire transfers labeled as management fees and reimbursements. “We find it unusual that approximately 58 percent of the funds were transferred to the law firm in a few months and the frequency of the payments appear erratic,” said the investigator. “It was also previously indicated that Hudson West III LLC does not currently … Read more at: https://www.zerohedge.com/political/money-laundering-expert-raised-alarm-over-unusual-chinese-payments-hunter-biden |

|

The Rise Of Ordinals And NFTs On The Medium Of BitcoinAuthored by Danny Yang via BitcoinMagazine.com, The Ordinals protocol was introduced to Bitcoin in early 2023 at a most opportune time. Bitcoin had nearly two years of low transaction fees from the lack of demand to actually send Bitcoin transactions. Bitcoin is considered to be the most secure blockchain in the world, but that security depends on miners who receive their revenue from transaction fees and block rewards. As part of the predetermined supply schedule, the block rewards are expected to be halved around April 2024 which would further drastically cut the miner revenue. To support the miners, Bitcoin needed something new to spur growth, and that was Ordinals. Ordinals drove huge demand to send Bitcoin transactions. Over $100 million (USD) worth of transaction fees have been spent so far this year just to create inscriptions, one type of transaction attributed to Ordinals. Read more at: https://www.zerohedge.com/crypto/rise-ordinals-and-nfts-medium-bitcoin |

|

Watch Live: Tesla Hosts ‘Biggest Event On Earth This Year’ To Launch CybertruckUpdate (1545ET): Musk begins to personally hand deliver Cybertrucks to owners.

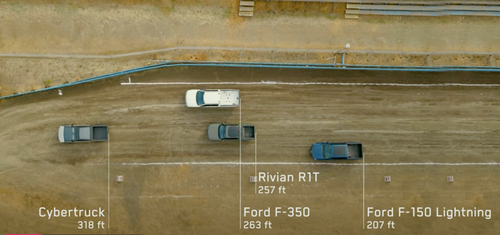

* * * Update (1540ET): Elon Musk said the Cybertruck can outperform the Ford F-350 in a ‘truck and tractor pulling’ competition.

* * * Tesla’s long-awa … Read more at: https://www.zerohedge.com/markets/watch-tesla-hosts-event-deliver-first-batch-cybertrucks-customers |

|

Trump Gag Order Reinstated By NY Appeals CourtColor us less than surprised; but a New York appeals court reinstated Thursday the gag order imposed on former President Donald Trump by the judge overseeing his civil fraud trial.

The gag order was initially imposed by Judge Engeron on Oct. 3 (after President Trump accused the judge’s top clerk of political bias in a post on social media). An appeals court judge temporarily paused the gag order on Nov. 16 while the former president appealed the order. But now, in an order issued on Nov. 30, a four-judge panel of the Supreme Court of the State of New York, Appellate Division, overturned the temporary suspension of the gag order:

|

|

Government intervenes in Abu Dhabi’s bid to buy TelegraphThe UK will take a closer look at the sale of the Telegraph to Gulf investors. Read more at: https://www.bbc.co.uk/news/business-67583166?at_medium=RSS&at_campaign=KARANGA |

|

Train strikes: RMT vote ends industrial action until at least springRail workers have voted to accept a pay deal, ending their involvement in a long-running series of strikes. Read more at: https://www.bbc.co.uk/news/business-67577683?at_medium=RSS&at_campaign=KARANGA |

|

Will Tesla’s truck recover from its shattering start?Tesla is due to host an event promoting the first deliveries of its new “cybertruck”. Read more at: https://www.bbc.co.uk/news/business-67580991?at_medium=RSS&at_campaign=KARANGA |

|

Ashwini Agarwal on why Buffett Indicator of market cap to GDP may not apply to India“We are pretty much at a peak but this market cap to GDP is a misnomer in my view because large parts of the GDP are not listed. So, how do you correlate market cap to GDP? Our agriculture, which is a large part of the GDP, does not trade ; a large part of the SME sector does not trade; a large part of government services which make up the GDP do not trade.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/ashwini-agarwal-on-why-buffett-indicator-of-market-cap-to-gdp-may-not-apply-to-india/articleshow/105615687.cms |

|

Tech View: Nifty bulls await triggers for a fresh peak. What traders should do on FridayOI Data showed that on the call side, the highest OI was observed at 20,400 followed by 20,300 strike prices while on the put side, the highest OI was at 20,000 strike price. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-await-triggers-for-a-fresh-peak-what-traders-should-do-on-friday/articleshow/105627622.cms |

|

Tata Tech IPO investors make 180% return on Day 1. Should you buy, sell or hold?At a 140% premium over the issue price of Rs 500, Tata Technologies’ listing price of Rs 1,200 beat Street’s estimates. While the stock was expected to double on the listing, it went far beyond, hitting the day’s high of Rs 1,400 on the NSE or a 180% uptick over the upper IPO price band. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tata-tech-ipo-investors-make-180-return-on-day-1-should-you-buy-sell-or-hold/articleshow/105617742.cms |

|

The Tesla Cybertruck is finally here; prices start around $61,000Tesla delivers the first of its Cybertrucks at an event Thursday in Texas. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A4-7E6B93112332%7D&siteid=rss&rss=1 |

|

Banking: Bank of America, Wells Fargo lead gains in big-bank stocks to add to November’s winSome bank stocks saw their best monthly performance since October 2022, as talk of potential rate cuts lured cash off the sidelines. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A5-31BE26915404%7D&siteid=rss&rss=1 |

|

Bond Report: 10-, 30-year Treasury yields see biggest monthly declines since 2019 on signs of easing inflationTreasury yields rose on Thursday, yet ended November with their biggest monthly declines in four years on signs of easing inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A5-121557C05E93%7D&siteid=rss&rss=1 |