Summary Of the Markets Today:

- The Dow closed up 185 points or 0.53%,

- Nasdaq closed up 0.46%,

- S&P 500 closed up 0.41%,

- Gold $1991 down $10,

- WTI crude oil settled at $77 down $0.98,

- 10-year U.S. Treasury 4.41% down 0.008 points,

- USD index $103.88 up $0.32,

- Bitcoin $37,676 up $1,925,

- Baker Hughes U.S. Rig Count up 4 to 622

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in October 2023 decreased from 2.5% year-over-year (YoY) the previous month to 0.3% YoY this month. Inflation-adjusted new orders declined 5.3% YoY. Durable goods new orders growth has been generally declining since mid-year.

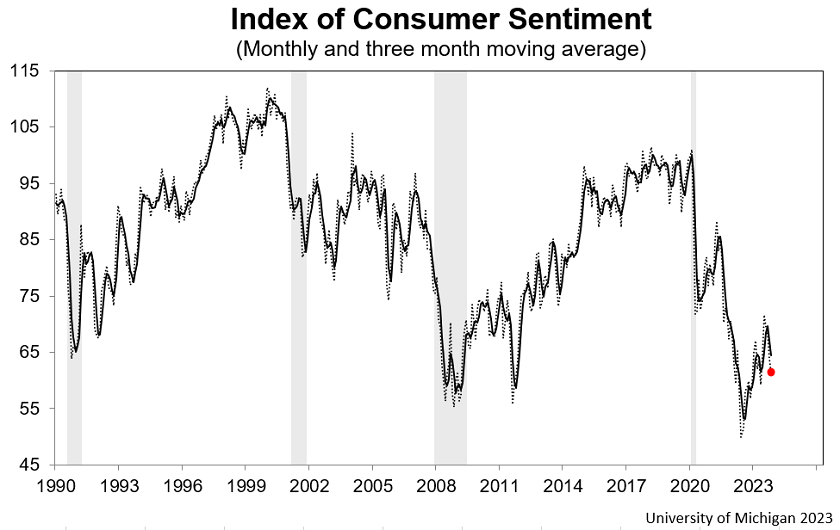

The University of Michigan Consumer sentiment fell a modest 2.5 index points, or 4%, from October. While this marks the fourth consecutive month of declines, November’s reading reflects a balance of factors, some of which improved while others worsened. More-favorable current assessments and expectations of personal finances were offset by a notable deterioration in expected business conditions. In particular, long-run business conditions plunged by 15% to its lowest since July 2022. Younger and middle-aged consumers exhibited strong declines in economic attitudes this month, while sentiment of those age 55 and older improved from October.

In the week ending November 18, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,000, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 220,250 to 220,750.

Here is a summary of headlines we are reading today:

- Venezuelan Output Rises to 850,000 Bpd Amid Sanctions Relaxation

- Precious Metals Prices Stagnate Amid Global Uncertainties

- Manufacturing in Major Economies Continues Downward Trend

- New Tungsten Oxide Coating Boosts Hydrogen Fuel Cell Life

- Andurand: OPEC+ May Need to Cut More as U.S. Oil Production Soars

- Bad news for Black Friday: Retailers cast doubt on holiday shopping with cautious guidance

- Israel-Hamas war live updates: Four-day pause in fighting to begin Thursday morning, Hamas says

- Bond Yields & Bitcoin Jump As Black Gold Dumps’n’Pumps

- For The First Time Since The Covid Crisis, There Are More Global Rate Cuts Than Hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Biden and Xi Chart a New Path in U.S.-China RelationsTo underscore its uniqueness, we have to go back to November 2022 for the last personal meeting between the leaders of the two most powerful countries at the moment, the US and China. Back then, Biden and Xi met each other on the sidelines of the G20 meeting in Bali, Indonesia. This meeting in Bali was preceded by a significant period of increased tensions between the US and China following Nancy Pelosi’s visit to Taiwan. Pelosi’s trip was regarded by China as a provocation and a departure from the one China policy. As such, Pelosi’s… Read more at: https://oilprice.com/Geopolitics/International/Biden-and-Xi-Chart-a-New-Path-in-US-China-Relations.html |

|

Venezuelan Output Rises to 850,000 Bpd Amid Sanctions RelaxationWorking towards production of 1 million barrels of oil per day in the wake of Washington’s easing of sanctions, Venezuelan Oil Ministry officials said on Wednesday that output had reached 850,000 bpd and the country was on its way to recovering market share, Reuters reports. The production volume reached as of the Venezuelan Oil Ministry’s statement on Wednesday is up from October output of 786,000 bpd. Speaking to journalists on the sidelines of a Caracas oil conference, Reuters cited Venezuela’s deputy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuelan-Output-Rises-to-850000-Bpd-Amid-Sanctions-Relaxation.html |

|

Precious Metals Prices Stagnate Amid Global UncertaintiesVia Metal Miner The Global Precious Metals MMI (Monthly Metals Index) maintained a sideways trend once again, this time moving up only 2.07%. That said, the overall future for precious metals prices brightened recently. For example, through October, gold increased around $150 per ounce. However, there were several variations in the prices of precious metals between October 1 and November 1. Numerous factors, including macroeconomic conditions, central bank policies, and geopolitical tensions, significantly impacted these variations. Palladium Prices… Read more at: https://oilprice.com/Metals/Gold/Precious-Metals-Prices-Stagnate-Amid-Global-Uncertainties.html |

|

European Utility Giant Turns More Selective On Renewables SpendingItalian utility giant Enel, one of Europe’s largest, is becoming more cautious in its investments in renewables and will be more selective in spending on clean energy amid high interest rates and rising costs. Enel unveiled on Wednesday a new strategic plan for 2024 through 2026, which new chief executive Flavio Cattaneo said would focus on profitability, flexibility, and resilience. In 2020, the previous CEO of the Italian utility giant said the group plans to invest as much as US$174 billion (160 billion euros) by 2030 in boosting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Utility-Giant-Turns-More-Selective-On-Renewables-Spending.html |

|

Manufacturing in Major Economies Continues Downward TrendOrder books for manufacturing firms fell to their weakest level since early 2021, quashing hopes of a recovery in the sector. According to the Confederation of British Industry’s (CBI) industrial trends survey, firms reported a sharp deterioration in order books in the three months to November. A weighted balance of -35 percent reported a downturn in order books, well below the long-run average of -13 percent and the weakest level since January 2021 – at the start of the second Covid lockdown. Anna Leach, CBI Deputy Chief Economist,… Read more at: https://oilprice.com/Metals/Commodities/Manufacturing-in-Major-Economies-Continues-Downward-Trend.html |

|

New DRC Copper Discoveries Boost Shares of Canadian MinerVia Metal Miner Canadian copper mining giant Ivanhoe Mines recently announced new “maiden” mineral resources for high-grade Makoko and Kiala deposits in its project in the Democratic Republic of Congo (DRC). The company said that Makoko contains indicated mineral resources of 16 million tons (MT) at 3.55% copper. They also reported inferred mineral resources of 154 million tons at 1.97% copper using a 1.5% copper cut-off.Kiala, on the other hand, contains an indicated mineral resource of 5 MT at 3.56% copper using a 1.5% copper… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-DRC-Copper-Discoveries-Boost-Shares-of-Canadian-Miner.html |

|

New Tungsten Oxide Coating Boosts Hydrogen Fuel Cell LifePohang University of Science & Technology engineers enhance hydrogen fuel cell durability via tungsten oxide coating that functions as a shield. The research has received recognition and was featured on the front cover of the international journal Science Advances. Fuel cells used in hydrogen vehicles has shown that when they are initiated or brought to a sudden halt (start-up/shut-down, SU/SD), external air is drawn into the vehicle. The oxygen present in this air triggers an unintended electrochemical reaction within the fuel cell,… Read more at: https://oilprice.com/Energy/Energy-General/New-Tungsten-Oxide-Coating-Boosts-Hydrogen-Fuel-Cell-Life.html |

|

African Nations Ready For Output Fight as OPEC Delays Meet, Oil Prices TankCrude oil prices continued their downward spiral Wednesday morning, with Brent down 4.38% at 10:45 a.m. ET, shortly after it was announced that the planned OPEC+ meeting for Sunday would be delayed until November 30. Brent crude has lost $3.61 on the day, trading at $78.84, with West Texas Intermediate (WTI) down 4.54% at $74.24, for a $3.53 loss on the day. Oil prices initially started plunging earlier today following a Bloomberg report warning that the OPEC+ meeting may be delayed. Fears that OPEC+ will further deepen… Read more at: https://oilprice.com/Latest-Energy-News/World-News/African-Nations-Ready-For-Output-Fight-as-OPEC-Delays-Meet-Oil-Prices-Tank.html |

|

EU Gas Demand Remains Soft Amid Economic SlowdownEU countries continue to minimize the use of natural gas for electricity production. According to Ember, electricity generation from gas-fired power plants in the nine months of 2023 decreased by 14% (all data is compared with the same period of the previous year, unless otherwise indicated). From January to September 2022, electricity production from natural gas in the EU amounted to 380.4 terawatt-hours (TWh), but in the nine months of 2023 it only reached 325.8 TWh. Thus, in absolute terms, gas-fired electricity generation decreased by… Read more at: https://oilprice.com/Energy/Natural-Gas/EU-Gas-Demand-Remains-Soft-Amid-Economic-Slowdown.html |

|

Andurand: OPEC+ May Need to Cut More as U.S. Oil Production SoarsThe OPEC+ group may need to make additional oil production cuts to offset growing supply from the United States that has exceeded expectations, hedge fund manager Pierre Andurand told Bloomberg television in an interview on Wednesday. “Demand growth is very strong, despite all the fears of a really weak macroeconomic outlook,” Andurand told Bloomberg. “Supply has been the issue, a lot more supply than expected.” U.S. oil production has been breaking records in recent weeks, exceeding earlier forecasts. According to Andurand,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Andurand-OPEC-May-Need-to-Cut-More-as-US-Oil-Production-Soars.html |

|

Oil Inches Down On Inventory BuildCrude oil prices moved lower today, after the U.S. Energy Information Administration reported a sizeable inventory build of 8.7 million barrels for the week to November 17. This compared with an inventory build of 3.6 million barrels for the week to November 10. It also compared with an estimated inventory build of a substantial 9 million barrels, reported by the American Petroleum Institute for the week to November 17. In fuels, the EIA estimated inventory mixed inventory changes for the latest week. Gasoline stocks added 700,000 barrels in the… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Inches-Down-On-Inventory-Build.html |

|

Russia’s Fuel Exports Are Set to Hit a Four-Month High in NovemberHigher refining processing rates and continued easing of fuel export restrictions are set to boost Russia’s exports of refined petroleum products to a four-month high in November, according to estimates by Bloomberg. The higher fuel exports are led by a jump in diesel shipments after Russia partially lifted on October 6 a temporary ban on diesel exports that lasted just over two weeks. In October, Russia’s diesel exports by sea were estimated to have dropped by 11% compared to September, due to the export ban and heavy refinery maintenance.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Fuel-Exports-Are-Set-to-Hit-a-Four-Month-High-in-November.html |

|

Global Uranium Shortage Spurs Investment FrenzyThe price of yellowcake – uranium concentrate used in nuclear generation – has hit the highest level in more than 15 years, driven by soaring demand as a crucial energy source for a “green future.” Additionally, global supply disruptions are further pressuring prices higher. Nymex futures tracking physical-market contracts of uranium ore topped $80.25 per pound on Monday, the highest level since February 2008. Since we first recommended uranium stocks in December 2020, in a note titled “Buy Uranium: Is This The Beginning Of The Next ESG Craze,”… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Global-Uranium-Shortage-Spurs-Investment-Frenzy.html |

|

Oil Prices Plunge by 4% as OPEC+ Postpones MeetingOil prices plummeted by 4% on Wednesday after OPEC officially confirmed that the OPEC+ meeting scheduled for this weekend would be postponed to November 30. The U.S. benchmark, WTI Crude, crumbled by 4.37% to below $75 a barrel, to $74.55, while Brent Crude, the international benchmark, dived below the $80 a barrel threshold, at $79.12, down by 4.26% on the day. The plunge in oil prices followed a brief statement from OPEC, which said today that the OPEC+ meetings, originally planned for November 25 and 26, 2023, have been rescheduled to Thursday,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Plunge-by-4-as-OPEC-Postpones-Meeting.html |

|

Top Oil Fund Books Largest Outflows Since 2016 on OPEC+ UncertaintyThe world’s top oil fund, United States Oil ETF (NYSEARCA: USO), booked on Tuesday its biggest daily outflows since December 2016 amid heightened volatility ahead of the OPEC+ meeting which was scheduled for the coming weekend but has since been delayed. USO saw daily withdrawals of nearly $225 million, according to estimates by Bloomberg. United States Oil ETF has been the biggest and most closely watched oil-linked exchange-traded product on the market for years. USO seeks to reflect the performance of the spot price of West Texas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-Oil-Fund-Books-Largest-Outflows-Since-2016-on-OPEC-Uncertainty.html |

|

Sam Altman’s back. Here’s who’s on the new OpenAI board and who’s outAfter several days of crisis and tumult, Sam Altman has returned as the CEO of OpenAI. Three new board members have replaced the leadership that fired Altman. Read more at: https://www.cnbc.com/2023/11/22/sam-altmans-back-heres-whos-on-the-new-openai-board-and-whos-out.html |

|

Dow closes nearly 200 points higher Wednesday as markets head into Thanksgiving: Live updatesStocks rose Wednesday as yields fell to their lowest level in two months and traders tried to go into the Thanksgiving holiday on a high note. Read more at: https://www.cnbc.com/2023/11/21/stock-market-today-live-updates.html |

|

Goldman Sachs paid pro golfer Patrick Cantlay more than $1 million annually, sources sayGoldman opted not to renew Cantlay’s sponsorship this year in the latest example of the bank’s retrenchment from its retail banking push. Read more at: https://www.cnbc.com/2023/11/22/goldman-sachs-patrick-cantlay-pay.html |

|

Bad news for Black Friday: Retailers cast doubt on holiday shopping with cautious guidanceRetailers have been cautious headed into the holidays, spelling trouble for the crucial shopping season and raising questions about the health of the economy. Read more at: https://www.cnbc.com/2023/11/22/retailers-outlook-black-friday-holiday-2023-spending.html |

|

What the Binance settlement means for crypto investors—and why it could clear the path for a bitcoin ETFIndustry insiders are cheering the end of a CZ-led Binance as a necessary path forward for crypto. Read more at: https://www.cnbc.com/2023/11/22/what-the-binance-settlement-means-for-crypto-investorsand-why-it-could-clear-the-path-for-a-bitcoin-etf.html |

|

2 dead after vehicle crashes into Rainbow Bridge checkpoint and explodes at U.S.-Canada border in Niagara Falls“I’ve been briefed on the incident on the Rainbow Bridge in Niagara Falls and we are closely monitoring the situation.” Gov. Kathy Hochul said. Read more at: https://www.cnbc.com/2023/11/22/rainbow-bridge-in-niagara-falls-closed-after-explosion-of-vehicle-reportedly-entering-us-from-canada.html |

|

Binance users pull more than $1 billion from the exchange after CEO leaves, pleads guiltyBinance has seen outflows amounting to more than $1 billion in the past 24 hours, not including bitcoin, according to data from blockchain analysis firm Nansen. Read more at: https://www.cnbc.com/2023/11/22/whats-next-for-binance-after-doj-settlement-departure-of-changpeng-zhao.html |

|

What’s next for Binance after its CEO stepped down and pleaded guilty: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Steven Lubka, Swan Bitcoin’s head of private clients & family offices, weighs in on the multi-billion dollar Binance settlement with U.S. government officials. Read more at: https://www.cnbc.com/video/2023/11/22/whats-next-binance-ceo-stepped-down-pleaded-guilty-crypto-world.html |

|

U.S. crude oil declines after OPEC delays meetingThe OPEC talks have run into trouble due to Saudi dissatisfaction with other members’ production levels, delegates told Bloomberg. Read more at: https://www.cnbc.com/2023/11/22/us-crude-oil-tumbles-below-75-a-barrel-after-opec-delays-meeting.html |

|

Israel-Hamas war live updates: Four-day pause in fighting to begin Thursday morning, Hamas saysU.S. Secretary of State Antony Blinken hailed the deal as “significant progress.” Read more at: https://www.cnbc.com/2023/11/22/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Diageo cites Diddy rape claims in renewed push to keep him out of tequila adsSean Combs, who denied and promptly settled the allegations, faces criticism from various corners of his commercial empire, from his liquor partnership to his media brand. Read more at: https://www.cnbc.com/2023/11/22/diageo-cites-diddy-rape-claims-in-renewed-push-to-keep-him-out-of-tequila-ads.html |

|

‘Napoleon’ is Apple’s latest bid to seize cinematic prestige – and OscarsApple is making another push for Academy Award glory with acclaimed director Ridley Scott’s “Napoleon,” opening just ahead of the Thanksgiving holiday. Read more at: https://www.cnbc.com/2023/11/22/napoleon-apple-oscars-ridley-scott.html |

|

This is ‘the most attractive feature of an ETF,’ advisor says — and it can help cut your tax billAs mutual fund investors brace for year-end distributions, experts have tips to lessen the tax burden in future years. Here’s what investors need to know. Read more at: https://www.cnbc.com/2023/11/22/how-to-save-on-future-taxes-for-mutual-fund-capital-gains-distributions.html |

|

Bond Yields & Bitcoin Jump As Black Gold Dumps’n’PumpsJobless claims surged on an un-adjusted basis, durable goods orders dumped, consumer sentiment slumped, and inflation expectations jumped… US macro data is not signaling a ‘soft landing…

Source: Bloomberg …but apart from that “the consumer is resilient and look over there at NVDA’s earnings”. But, despite smashing it on earnings, NVDA actually traded lower (as anxiety over Biden’s China crackdown weigh a smidge)…

Read more at: https://www.zerohedge.com/markets/bond-yields-bitcoin-jump-black-gold-dumpsnpumps |

|

Quinn: The Crash Will Be SpectacularAuthored by Jim Quinn via The Burning Platform blog,

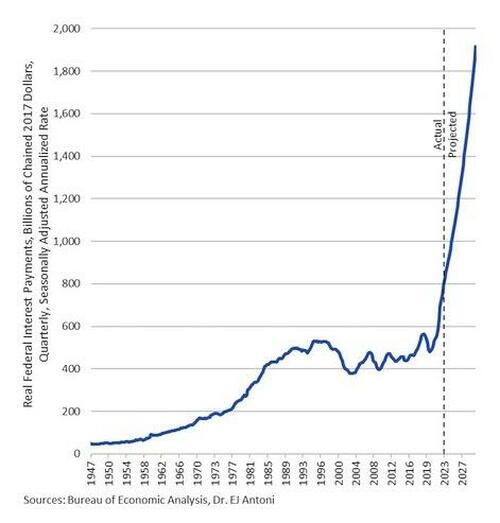

The government collects $2.6 trillion of individual taxes at the point of a gun and threat of prison. Meanwhile they still operate at an annual deficit of $2 trillion. And this is before interest on the national debt starts to really skyrocket. Our Troll Secretary of the Treasury Yellen had the opportunity to lock in trillions of our national debt for 30 years at 2% rates, but purposely kept rolling it on a short-term basis.

Interest on the debt will surpass $1 trillion annually within the next year, and, as you can see, will be approaching $2 trillion per year in a few more years. Read more at: https://www.zerohedge.com/geopolitical/quinn-crash-will-be-spectacular |

|

For The First Time Since The Covid Crisis, There Are More Global Rate Cuts Than HikesTwo weeks ago, after Powell essentially admitted the Fed would not hike any more and that the July rate hike was the last one, we reminded readers that it takes on average 8 months between the last Fed hike and the first rate cut, suggesting that the Fed would begin cutting rates in March, something the market quickly started pricing in and to which it currently assigns about a 30% probability (and, as recently as a few days ago, 87% odds of a May rate cut).

To be sure, this wouldn’t be the first time the market has gotten ahead of itself in pricing in Fed rate cuts, and as DB’s Jim Reid calculated last week, this would be at least the 7th time in this cycle that markets have seen a clear reaction to a potential dovish pivot. On the previous 6 occasions, those hopes were dashed since inflation remained too high for the Fed to be comfortable cutting rates (assuming, of course, that the Fed hasn’t quietly agreed to raise its inflation target to 3% or more). Indeed, core CPI has been above their 2% target since early 2021, and the Fed’s dot plot is still pointi … Read more at: https://www.zerohedge.com/markets/first-time-covid-crisis-there-are-more-global-rate-cuts-hikes |

|

Thoughts On The Big Bad Binance SettlementAuthored by Omid Malekan, First, I think companies that don’t like certain laws should still comply with them while campaigning for change. That said, one interpretation of the government’s suit and the resulting mammoth settlement is that by refusing to implement compliance schemes like AML & CFT, Binance failed to stop money laundering and the financing of terrorism.

The problem with this interpretation is that vast sums of illicit flows still move through the companies who do comply. Banks, brokers and other types of (mostly non-crypto) intermediaries are the preferred route for tax and sanctions evaders, to the tune of over a trillion dollars a year. A more accurate interpretation is that Binance refused to participate in the pretense of stopping illicit finance. They didn’t kick out the occasional bad actor or file endless suspicious … Read more at: https://www.zerohedge.com/crypto/thoughts-big-bad-binance-settlement |

|

What the Autumn Statement means for you and your moneyNow the speech has been delivered, what does it mean for your finances in the months ahead? Read more at: https://www.bbc.co.uk/news/business-67484095?at_medium=RSS&at_campaign=KARANGA |

|

UK economy growth forecasts slashed for next two yearsThe economy will grow much more slowly than previously thought until 2025, the government’s forecaster says. Read more at: https://www.bbc.co.uk/news/uk-67498305?at_medium=RSS&at_campaign=KARANGA |

|

Tax break for businesses made permanentA policy allowing firms to deduct machinery and equipment costs from their tax bill has been made permanent. Read more at: https://www.bbc.co.uk/news/business-67498039?at_medium=RSS&at_campaign=KARANGA |

|

Should you buy Tata Tech in case of a gap-up listing? SAMCO Securities explains“Tata Tech is the only Indian firm and among a handful globally that serves automotive clients in every stage of product’s life cycle from the drawing board to the showroom floor. Now as the firm is expanding into aerospace to anchor clients, the long-term perspective looks attractive for Tata Technologies also.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/if-you-have-long-term-outlook-okay-to-invest-in-tata-tech-after-a-gap-up-listing-samco-securities/articleshow/105410302.cms |

|

CDSL becomes first depository to register 10 crore Demat accountsCDSL is India’s leading and only listed depository, with an objective of providing convenient, dependable and secure depository services at affordable cost to all market participants. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/cdsl-becomes-first-depository-to-register-10-crore-demat-accounts/articleshow/105423893.cms |

|

Tech View: 19,850 proving big hurdle for Nifty bulls. What traders should do on Thursday expiryWhile 19850 is proving to be a tough resistance to break, the short- term trend of Nifty remains range- bound with a positive bias. A decisive move above 19850-19900 levels is expected to open a sharp upside towards new all-time highs Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-19850-proving-big-hurdle-for-nifty-bulls-what-traders-should-do-on-thursday-expiry/articleshow/105418954.cms |

|

Futures Movers: Oil prices settle lower as OPEC+ delays meeting amid reported infightingOil futures end lower Wednesday, but off the session’s worst levels, after OPEC+ delays a meeting that had been set for Sunday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A0-602DFADDEB1F%7D&siteid=rss&rss=1 |

|

Commodities Corner: OPEC+ meeting postponement raises talk of a ‘rift’ among oil producersThe Organization of the Petroleum Exporting Countries and the allies said Wednesday that they would delay their ministerial meeting by four days, raising speculation that the oil producers will face a much more challenging path to an agreement on output levels. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A0-9F20343C7653%7D&siteid=rss&rss=1 |

|

Commodities Corner: There may be investment opportunities in the water sector despite its less-than-stellar 2023 performanceWater is essential to human life, but trading in the market for the commodity has failed to show it, with a key global water index barely higher for the year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-72A0-DBBD0C14F4C1%7D&siteid=rss&rss=1 |

…

…