- The Dow closed up 204 points or 0.58%,

- Nasdaq closed up 1.13%,

- S&P 500 closed up 0.74%,

- Gold $1,980 down $5.00,

- WTI crude oil settled at $78 up $1.81,

- 10-year U.S. Treasury 4.422% down 0.019 points,

- USD Index $103.48 down $0.440,

- Bitcoin $37,494 up $566 ( 1.53% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

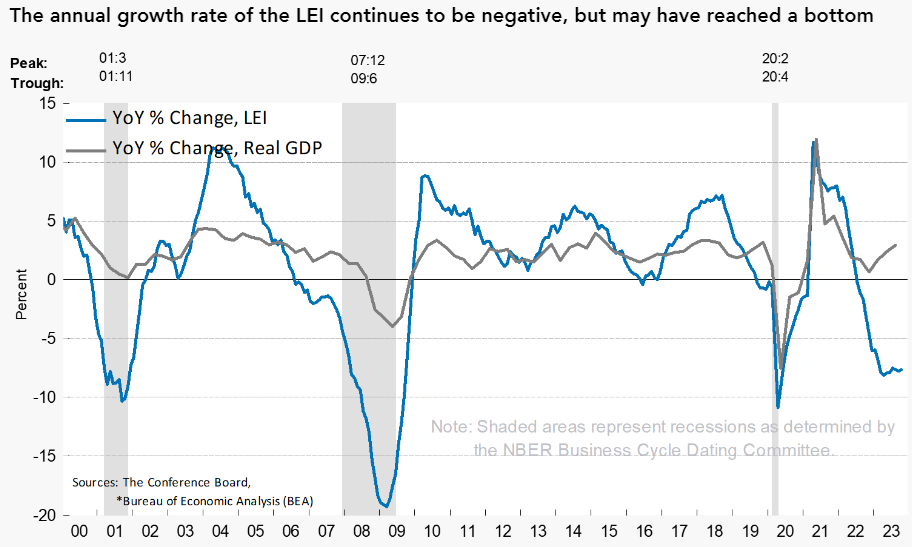

The Conference Board Leading Economic Index (LEI) for the U.S. fell by 0.8 percent in October 2023 to 103.9 (2016=100), following a decline of 0.7 percent in September. The Conference Board continues to see a recession in the near future. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board, adds:

The US LEI trajectory remained negative, and its six- and twelve-month growth rates also held in negative territory in October. Among the leading indicators, deteriorating consumers’ expectations for business conditions, lower ISM® Index of New Orders, falling equities, and tighter credit conditions drove the index’s most recent decline. After a pause in September, the LEI resumed signaling a recession in the near term. The Conference Board expects elevated inflation, high-interest rates, and contracting consumer spending—due to depleting pandemic saving and mandatory student loan repayments—to tip the US economy into a very short recession. We forecast that real GDP will expand by just 0.8 percent in 2024.

Here is a summary of headlines we are reading today:

- Clean Energy Start-ups Are Struggling As They Wait For Federal Aid

- Coast Guard Says Up to 26,000 Barrels May Have Leaked Into Gulf of Mexico

- Oil Giant YPF Surges 40% After Outsider Wins Argentinian Presidential Election

- Houthi Ship Seizure Threatens Oil Market Stability

- Nvidia stock closes at all-time high, a day before earnings

- U.S. gas prices are falling and could hit the cheapest Thanksgiving day price since 2020

- Hundreds of OpenAI employees threaten to follow Altman to Microsoft unless board resigns

- Most Americans tip 15% or less at a restaurant — and some tip nothing, poll finds

- Market Snapshot: Dow Jones climbs, S&P 500 aims to exit correction on hopes the Fed is finished raising rates

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Clean Energy Start-ups Are Struggling As They Wait For Federal AidSome American clean energy and technology startups are struggling to keep afloat while waiting for the U.S. Administration to disburse the pledged loans and funds under the landmark Inflation Reduction Act (IRA). Several startups have already filed for bankruptcy, others have flagged the ability to continue as a going concern or hired advisors to evaluate financing and strategic alternatives as soaring construction costs and high interest rates challenge their initial plans and timelines for having production sites up and running. … Read more at: https://oilprice.com/Energy/Energy-General/Clean-Energy-Start-ups-Are-Struggling-As-They-Wait-For-Federal-Aid.html |

|

UK Windfall Tax See Oil Giant Shell Pay First Net Taxes in YearsShell PLC recorded its first net corporate taxes paid in the UK in at least four years, following the implementation of an oil and gas windfall levy by the government, Bloomberg reported on Monday. From 2018 to 2021, Shell had received UK tax credits for North Sea investment expenses and the decommissioning of aging platforms. In 2022, Bloomberg reported that Shell paid $40.5 million in tax on $1.81 billion in UK profit as a result of the new Energy Profits Levy. Back in January this year, Shell had warned investors it would… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Windfall-Tax-See-Oil-Giant-Shell-Pay-First-Net-Taxes-in-Years.html |

|

Tensions Rise as Azerbaijan Snubs U.S.-Mediated Peace TalksAzerbaijan continues to refuse to attend peace talks with Armenia, citing what it calls the biased approach of Western mediating countries. This time it was the U.S. that displeased Azerbaijan. On November 16, Azerbaijan’s Foreign Ministry put out a statement announcing the country’s decision not to attend a meeting of the Armenian and Azerbaijani foreign ministers in Washington scheduled for four days later. The snub was in large part a response to U.S. Assistant Secretary of State James O’Brien’s testimony the previous day at a House Foreign… Read more at: https://oilprice.com/Geopolitics/International/Tensions-Rise-as-Azerbaijan-Snubs-US-Mediated-Peace-Talks.html |

|

Coast Guard Says Up to 26,000 Barrels May Have Leaked Into Gulf of MexicoThe U.S. Coast Guard says as much as 1.1 million gallons of oil, approximately 26,000 barrels, may have spilled into the Gulf of Mexico following a pipeline leak on Thursday off the coast of Louisiana. The source of the spill from the 67-mile-long underwater pipeline owned by Main Pass Oil Gathering and operated by Third Coast Infrastructure LLC remained unknown at the time of writing on Monday, with the Coast Guard continuing to investigate. The pipeline spill was confirmed by Main Pass Oil on Thursday, prompting immediate Coast Guard… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Coast-Guard-Says-Up-to-26000-Barrels-May-Have-Leaked-Into-Gulf-of-Mexico.html |

|

EU’s Energy Resilience Tested as Winter ApproachesTwo big questions loom over the Organization for Security and Cooperation in Europe (OSCE) ministerial meeting in Skopje on November 30-December 1, which will bring together the foreign ministers from the 57 members of the Vienna-based organization. Firstly, will one of them — Russia’s Sergei Lavrov — show up? And secondly, who will take over the one-year OSCE rotating chair for 2024 after North Macedonia? The two questions are somewhat linked. Lavrov was barred from attending the ministerial meeting in the Polish city of Lodz last December,… Read more at: https://oilprice.com/Energy/Energy-General/EUs-Energy-Resilience-Tested-as-Winter-Approaches.html |

|

UN Meets In Nairobi To Discuss Plastic ProductionThe international community has convened in Nairobi last week for a pivotal round of talks in an attempt to formulate the first global treaty against plastic pollution. The UN’s challenge of crafting such a treaty to stem the tide of plastic waste is underscored by the current annual production of about 400 million metric tons of plastic, with less than 10% being recycled. Key Points in Kenya The discussions are anchored around a “zero draft” document, presenting a range of policies and actions, as reported by Reuters. A key contention… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UN-Meets-In-Nairobi-To-Discuss-Plastic-Production.html |

|

2.8 Billion Tonnes of Metals Extracted Globally in 2022In 2022, 2.8 billion tonnes of metals were mined throughout the world – while major industries that directly consume processed mineral materials contribute 14% of the US economy. As Visual Capitalist’s Bruno Venditti details below, here’s each metal’s contribution to the total: More via Visual Capitalist: Iron Ore Dominance Iron ore dominates the metals mining landscape, comprising 93% of the total mined. In 2022, 2.6 billion tonnes of iron ore were mined, containing about 1.6 billion tonnes of iron. Percentages may not add up to 100 due… Read more at: https://oilprice.com/Metals/Commodities/28-Billion-Tonnes-of-Metals-Extracted-Globally-in-2022.html |

|

Oil Prices Extend Gains Further on OPEC+ Cut PredictionsCrude oil prices continued their climb on Monday with gains of over 2% heading into the next OPEC+ meeting on November 26, where the expanded cartel is expected to further bolster voluntary output cuts. At 10:50 a.m. ET on Monday, Brent crude was trading at $82.54, up 2.39%, for a $1.93 gain on the day. West Texas Intermediate (WTI) was trading up 2.17% at $77.54, for a $1.65 gain on the day. The jump in oil prices started on Friday, after four weeks of declining prices saw fundamentals overtake the war-risk premium prices had… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Extend-Gains-Further-on-OPEC-Cut-Predictions.html |

|

Oil Giant YPF Surges 40% After Outsider Wins Argentinian Presidential ElectionThe New York-listed shares of Argentinian oil and gas firm YPF SA (NYSE: YPF) jumped by 42% early on Monday after far-right outsider Javier Milei won the presidential election in Argentina in a victory over his left-wing rival, current economy minister Sergio Massa. Milei won the presidency in a runoff vote on Sunday amid a severe economic crisis in Argentina. Weeks before the election, Argentina was rocked by an unprecedented shortage of gasoline, with drivers running the gauntlet to find scarce supplies of gas to fill their tanks… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Giant-YPF-Surges-40-After-Outsider-Wins-Argentinian-Presidential-Election.html |

|

The UAE Could Raise Oil Production Regardless of OPEC+ DecisionOPEC’s third-largest producer, the United Arab Emirates (UAE), could raise its oil output next year as it has won a higher quota under the OPEC+ agreement. The UAE, OPEC’s third-biggest producer after Saudi Arabia and Iraq, said in the summer that it would not join the Saudis in making voluntary production cuts. The UAE has argued for years that it should be allowed to pump more than its current OPEC+ quota as it is raising its production capacity. At the June meeting, the UAE got a huge concession from OPEC+ in the form of an upward… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-UAE-Could-Raise-Oil-Production-Regardless-of-OPEC-Decision.html |

|

The Middle East Enjoys Last Month Of High Prices Before Cuts Kick InHaving enjoyed a strong third quarter with Brent prices averaging 86 per barrel, the oil producer countries of the Middle East are now facing a much direr outlook into the winter. Over the past month, oil prices have shed some $10 per barrel and WTI even started to see contango as market sentiment soured. The Asian market, traditionally accounting for the majority of Middle Eastern exports, has so far been immune to contango, nevertheless Dubai futures have started to react to weaker Chinese buying, higher inflows of US or Russian crudes, leading… Read more at: https://oilprice.com/Energy/Oil-Prices/The-Middle-East-Enjoys-Last-Month-Of-High-Prices-Before-Cuts-Kick-In.html |

|

Houthi Ship Seizure Threatens Oil Market StabilityThe Iran-aligned Houthi rebels of Yemen have seized a cargo ship linked to an Israeli company in the Red Sea in the latest flare-up in the Middle East that could roil the oil market ahead of the OPEC+ meeting next weekend. Houthi spokesperson Yahya Saree said in a statement that the rebels “carried out a military operation in the Red Sea, the results of which were the seizure of an Israeli ship and taking it to the Yemeni coast,” The Times of Israel reported. The vessel, Galaxy Leader, is owned by a company registered under Isle of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Houthi-Ship-Seizure-Threatens-Oil-Market-Stability.html |

|

EU Cracks Down on Air PollutionThe European Commission has ordered Hungary, Romania, and 10 other member states to comply with EU air pollution legislation and reduce their emissions of several pollutants to reduce air pollution. The EU executive sent a letter of formal notice to Luxembourg, Poland, and Romania, and a reasoned opinion to Bulgaria, Ireland, Cyprus, Latvia, Lithuania, Hungary, Austria, Portugal, and Sweden for failing to ensure the correct implementation of their commitments to reduce several air pollutants as required by Directive (EU) 2016/2284 on the national… Read more at: https://oilprice.com/The-Environment/Global-Warming/EU-Cracks-Down-on-Air-Pollution.html |

|

The White House Does Not Expect Arab States to Weaponize OilThe United States is confident that the Arab states will not use oil supply as a weapon as they have done in the past, White House energy security adviser Amos Hochstein told the Financial Times in an interview published this weekend. “Oil has been weaponised from time-to-time since it became a traded commodity, so we’re always worried about that, working against that, but I think so far it hasn’t,” Hochstein told FT. According to the Biden Administration’s top energy adviser, the U.S. and the global oil market are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-White-House-Does-Not-Expect-Arab-States-to-Weaponize-Oil.html |

|

Africa’s Oil Production Is Set to Decline Next YearAfrica’s oil production is set for a gradual decline in 2024, the African Energy Chamber said in a new report on the industry this weekend. The chamber forecasts “relative calm” in the global oil market for the remainder of 2023, NJ Ayuk, Executive Chairman of the African Energy Chamber, wrote. “For now, the wild extremes of the pandemic era appear to be behind us,” Ayuk said, but noted that declining oil production in Africa is not welcome news for the African oil-producing nations. “The State of African Energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Oil-Production-Is-Set-to-DeclineNextYear.html |

|

Nvidia stock closes at all-time high, a day before earningsNvidia’s earnings report on Tuesday may give investors their clearest picture yet of the demand for artificial intelligence technology heading into next year Read more at: https://www.cnbc.com/2023/11/20/nvidia-earnings-report-to-give-investors-peek-into-ai-demand-for-2024.html |

|

U.S. gas prices are falling and could hit the cheapest Thanksgiving day price since 2020Gas prices have fallen for nine weeks now on a seasonal weakening of demand and a drop in crude oil prices. Read more at: https://www.cnbc.com/2023/11/20/us-gas-prices-are-falling-and-could-hit-the-cheapest-thanksgiving-day-price-since-2020.html |

|

Amazon sued by three employees who allege gender discrimination and ‘chronic’ pay inequityThree staffers in Amazon’s corporate research and strategy division sued the company alleging gender discrimination and retaliation Read more at: https://www.cnbc.com/2023/11/20/amazon-sued-by-three-employees-who-allege-gender-discrimination.html |

|

Hundreds of OpenAI employees threaten to follow Altman to Microsoft unless board resignsHundreds of OpenAI employees have signed a letter demanding the board resign or face an employee exodus to Altman’s new venture at Microsoft. Read more at: https://www.cnbc.com/2023/11/20/hundreds-of-openai-employees-threaten-to-follow-altman-to-microsoft-unless-board-resigns-reports-say.html |

|

Federal court guts the Voting Rights Act, denying citizens and groups the right to sueIf upheld nationally, the ruling would decimate the landmark voting rights law. Read more at: https://www.cnbc.com/2023/11/20/federal-court-guts-the-voting-rights-act-denying-citizens-and-groups-the-right-to-sue.html |

|

This under-the-radar biopharma stock could more than double, Goldman Sachs saysThis biotech stock could see 138% upside as its lead asset reaches regulatory approval, Goldman Sachs said. Read more at: https://www.cnbc.com/2023/11/20/this-under-the-radar-biopharma-stock-could-more-than-double-goldman-sachs-says.html |

|

Ousted OpenAI head Sam Altman to lead Microsoft’s new AI teamFormer OpenAI CEO Sam Altman will be joining Microsoft to lead a new advanced AI research team, according to Microsoft CEO Satya Nadella. Read more at: https://www.cnbc.com/2023/11/20/ousted-openai-head-sam-altman-to-lead-microsofts-new-ai-team-ceo-nadella-says.html |

|

Crypto company led by former NYSE president acquires news outlet CoinDesk: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Chris Janczewski, head of global investigations at blockchain intelligence company TRM Labs, explains which crypto crimes were most popular in 2023. Read more at: https://www.cnbc.com/video/2023/11/20/crypto-company-led-by-former-nyse-president-acquires-news-outlet-coindesk-cnbc-crypto-world.html |

|

Exchange-traded funds ‘have come a long way,’ advisor says. How to use them in your portfolioExchange-traded funds are one option for your investment portfolio. Here’s how experts from CNBC’s Advisor Council are using them with clients. Read more at: https://www.cnbc.com/2023/11/20/heres-how-to-use-exchange-traded-funds-in-your-portfolio-experts-say.html |

|

Israel-Hamas war live updates: 31 babies evacuated from Gaza’s Al-Shifa; Biden says he believes a hostage deal will come soonIn an operational update, the IDF showed a clip of what appears to be a tunnel it said spans over 50 meters, beneath the largest medical facility in Gaza. Read more at: https://www.cnbc.com/2023/11/20/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Look inside this startup’s self-propelled RV, as camping goes electricCalifornia-based startup Pebble has invented a self-propelled, self-powered, remote-controlled trailer. Read more at: https://www.cnbc.com/2023/11/20/look-inside-this-startups-self-propelled-rv-as-camping-goes-electric.html |

|

Most Americans tip 15% or less at a restaurant — and some tip nothing, poll findsTraditional etiquette is to tip 15% to 20% for a sit-down meal. Many Americans seem to disagree. Read more at: https://www.cnbc.com/2023/11/20/most-americans-tip-15percent-or-less-at-a-restaurant-and-some-tip-nothing.html |

|

Tiger Woods’ new golf league delays start of season by a year after venue collapseTGL, the tech-driven indoor golf league led by Tiger Woods and Rory McIlroy delayed its start until 2025. Read more at: https://www.cnbc.com/2023/11/20/tiger-woods-tgl-golf-league-delayed-until-2025-after-dome-collapse.html |

|

Good (Auction), Bad (LEIs), & Ugly (AI) Sustain ‘Goldilocks’ Gains In Stocks & BondsLeading Economic Indicators continued their worst-since-Lehman path to recession but somehow ‘goldilocks’ economic narratives dominate of barely-any-landing-at-all & slowing inflation, and financial conditions continue to loosen, erasing more and more of “The Fed’s work” prompting the FCI-Doom-Loop to return…

Source: Bloomberg Of course, the day was dominated by the utter shambles surrounding OpenAI and its ‘get woke, go broke’ board which sent MSFT shares to a new record high (as they scooped up Altman along with the option basically the entire brain of OpenAI)… Read more at: https://www.zerohedge.com/markets/good-auction-bad-leis-ugly-ai-sustain-goldilocks-gains-stocks-bonds |

|

Most OpenAI Staff Threaten To Quit, Join Microsoft Unless ‘Incompetent, Incapable’ Board ResignsUpdate (1545ET): In a post on X, Salesforce CEO Marc Benioff stated that his company “will match any OpenAI researcher who has tendered their resignation full cash & equity OTE to immediately join our Salesforce Einstein Trusted AI research team under Silvio Savarese.”

The fight for OpenAI talent is underway. * * * Update (1401ET): The number of OpenAI employees considering resignation has surged to 700, with some estimates suggesting it is about 90% of all staff.

Read more at: https://www.zerohedge.com/technology/wild-times-sam-altman-joins-microsoft-openai-taps-ex-twitch-ceo |

|

Peter Schiff: A Soft Landing Is ImpossibleThe latest buzzword in the mainstream financial media is “soft landing.” Everybody seems convinced the Fed has beaten inflation, and that it has completely avoided pushing the economy into a recession. According to the mainstream narrative, we may see a bit of an economic slowdown in the months ahead, but a recession is pretty much off the table. In his podcast, Peter Schiff explains why a soft landing is impossible.

Wall Street is booming with the growing belief that the inflation war is over, and not only is the Federal Reserve finished hiking interest rates, but it will begin to cut them in 2024.

|

|

Americans Still ‘Trust’ Their Savings Account MostThe low-risk, low-reward nature of the savings account keeps appealing to Americans – 48 percent of whom said they had such an account in the latest installment of Statista’s Consumer Insights survey.

As Statista’s Kathariuna Buchholz shows in the infographic below, other types of investment or money saving setups were far less popular.

You will find more infographics at Read more at: https://www.zerohedge.com/personal-finance/americans-still-trust-their-savings-account |

|

Sam Altman: What on earth is happening at OpenAI?The BBC’s technology editor Zoe Kleinman reflects on a whirlwind few days for the ChatGPT creator. Read more at: https://www.bbc.co.uk/news/technology-67474879?at_medium=RSS&at_campaign=KARANGA |

|

OpenAI staff demand board resign over Sam Altman sackingSenior staff are among the hundreds of people who have signed a letter calling on board members to go. Read more at: https://www.bbc.co.uk/news/business-67470876?at_medium=RSS&at_campaign=KARANGA |

|

Abu Dhabi-backed fund poised to take over TelegraphThe fund, run by former CNN boss Jeff Zucker, says it has the money it needs to rescue the newspaper. Read more at: https://www.bbc.co.uk/news/technology-67479946?at_medium=RSS&at_campaign=KARANGA |

|

How to trade Tata Investment, Mankind Pharma and ITI on TuesdaySectorally, buying was seen in IT, telecom, healthcare and public sector stocks while selling was seen in auto, utilities, capital goods, and FMCG stocks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-to-trade-tata-investment-mankind-pharma-and-iti-on-tuesday/articleshow/105364171.cms |

|

Underinvesting in new-age stocks an injustice to your portfolio: Ajay Srivastava“The old companies need to be given out of your portfolio. It is like your old wardrobe, you need to take out your old clothes out of your wardrobe, do not take out your old men out of their homes, but at least the wardrobe out of the homes and substitute with the new latest ones, that is what the portfolio is all about.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/if-you-dont-have-over-50-of-your-investment-in-new-age-stocks-you-are-doing-injustice-to-your-portfolio-ajay-srivastava/articleshow/105350105.cms |

|

4 realty stocks hit a 52-week high and rallied up to 20% in a monthFor more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/4-realty-stocks-hit-a-52-week-high-and-rallied-up-to-20-in-a-month/slideshow/105359820.cms |

|

White House tackles age concerns on Biden’s 81st birthday: ‘It’s about the president’s experience’The White House on President Joe Biden’s 81st birthday continued to push back against the view that he is too old for another term. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729E-A777565670CF%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices post back-to-back session gains as traders await next move by OPEC+Oil futures finish higher Monday, with traders turning their attention to OPEC+ and the prospect for an extended production cut. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729D-F7DAFEDA91A0%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow Jones climbs, S&P 500 aims to exit correction on hopes the Fed is finished raising ratesS&P 500 aims to exit correction territory to kick off Thanksgiving week Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-729E-19D955AEAEC7%7D&siteid=rss&rss=1 |