Summary Of the Markets Today:

- The Dow closed up 391 points or 1.15%,

- Nasdaq closed up 2.05%,

- S&P 500 closed up 1.56%, High 4,319: 4,200 = critical resistance level)

- Gold $1,940 down $29.90,

- WTI crude oil settled at $77 up $1.55,

- 10-year U.S. Treasury 4.620% down 0.010 points,

- USD Index $105.80 down $0.110,

- Bitcoin $37,287 up 2.00%,

- Baker Hughes Rig Count: U.S. -2 to 616 Canada +3 to 199

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

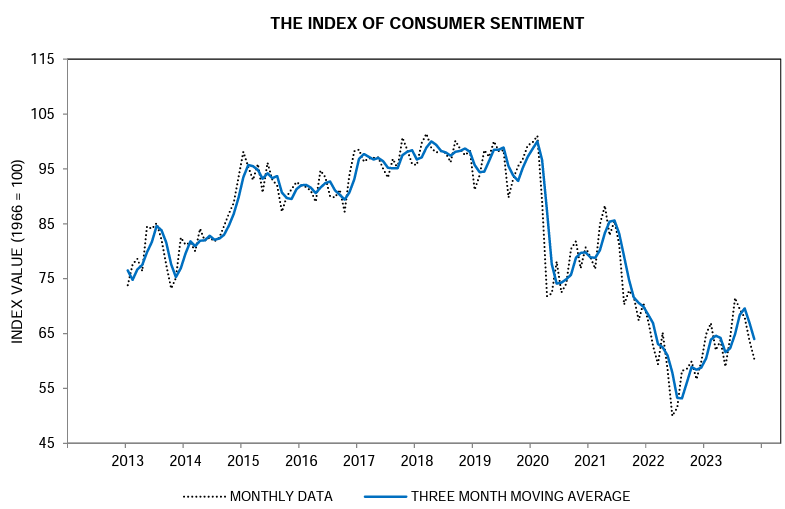

University of Michigan consumer sentiment slipped for the fourth straight month, falling 5% in November 2023. While current and expected personal finances both improved modestly this month, the long-run economic outlook slid 12%, in part due to growing concerns about the negative effects of high-interest rates. Ongoing wars in Gaza and Ukraine weighed on many consumers as well. Overall, lower-income consumers and younger consumers exhibited the strongest declines in sentiment. In contrast, the sentiment of the top tercile of stockholders improved 10%, reflecting the recent strengthening in equity markets.

Here is a summary of headlines we are reading today:

- Germany To Bail Out Siemens’ Struggling Wind Turbine Division

- Plug Power Crashes After ‘Going Concern’ Warning

- U.S. Oil Rigs Continue To Fall

- Maine Voters Reject State Takeover Of Private Utilities Companies

- U.S. Space Force Partners With Elon Musk To Launch Mysterious X-37B Space Plane

- Swedish Union Blocks Tesla Imports As Labor Dispute Escalates

- Dow leaps nearly 400 points Friday, major averages notch a second week of gains: Live updates

- Fed’s Mary Daly says it’s ‘too early to declare victory’ on inflation

- Patients are lining up for $2,500 full-body MRI scans that can detect cancer early

- Iran Warns Of ‘Inevitable Expansion’ Of War After IDF Conducts Flag-Raising Ceremony In Gaza

- Crypto: Bitcoin could reach $150,000 in 2025 during new bull cycle, says AllianceBernstein

- Futures Movers: Oil tallies a third straight weekly fall, pressured by demand worries and a potential supply surplus

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Germany To Bail Out Siemens’ Struggling Wind Turbine DivisionReuters reports the German government, Siemens AG, and other parties will provide billions of euros in project-related guarantees to support Siemens AG’s struggling wind turbine division. This financial assistance comes just weeks after the company warned about mounting losses amid a meltdown across wind and solar industries. Three people familiar with the talks said that Siemens Energy’s top shareholder, Siemens AG, with a 25.1% stake, is prepared to provide some guarantees. Details are still scant, and nothing has been decided, as an agreement… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Germany-To-Bail-Out-Siemens-Struggling-Wind-Turbine-Division.html |

|

Brazil’s State-Run Oil Co Could Splash $100B On Projects Over 5 YearsBrazil’s state-run oil company, Petrobras, could spend $100 billion on investments in projects it is currently analyzing and already committed to, a Reuters source suggested on Friday. Petrobras is set to issue its five-year plan that will cover 2024 through 2028. For now, the plan is still being discussed, but an anonymous Reuters source is suggesting that the plan could include $100 billion in investments. In August, Petrobras CEO Sergio Caetano Leite said that the company’s investments spelled out by its up-and-coming five-year plan… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-State-Run-Oil-Co-Could-Splash-100B-On-Projects-Over-5-Years.html |

|

Moldova Faces EU Pressure To Levy More Sanctions Against RussiaMoldova has to take further steps in aligning itself with the European Union’s punitive measures and sanctions against Russia, the bloc’s executive body recommended in its annual progress report that advocates the conditional opening of membership negotiations with Chisinau. Moldova and Ukraine obtained candidate status for EU membership in June last year, and the European Commission’s report published on November 8 commends the small southeastern European country for fulfilling six out of nine criteria needed to open membership negotiations. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Moldova-Faces-EU-Pressure-To-Levy-More-Sanctions-Against-Russia.html |

|

Oil Refiner Cosmo Energy Struggles To Fend Off Hostile Takeover BidCosmo Energy, Japan’s third-largest oil refiner, could find it difficult to gather shareholder support to block a hostile takeover bid from activist investors, Cosmo’s CEO Shigeru Yamada told Reuters in an interview published on Friday. Cosmo Energy has been fighting an activist investor group led by Yoshiaki Murakami for a year now and has voted on a “poison pill” tactic to dilute the stake of the activist investors if their group buys more shares without complying with all the procedures or without stating the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Refiner-Cosmo-Energy-Struggles-To-Fend-Off-Hostile-Takeover-Bid.html |

|

Plug Power Crashes After ‘Going Concern’ WarningShares of Plug Power, a company specializing in hydrogen and fuel-cell energy, plummeted by 30% in premarket trading in New York. This steep decline followed the company’s third-quarter earnings report on Thursday evening, which cited “unprecedented supply challenges in the hydrogen network in North America.” Plug Power reported third-quarter losses of $283.5 million, equivalent to 47 cents per share, widening from a loss of $170.8 million, or 30 cents per share, in the same quarter one year ago. The company’s revenue increased to $199 million… Read more at: https://oilprice.com/Energy/Energy-General/Plug-Power-Crashes-After-Going-Concern-Warning.html |

|

U.S. Oil Rigs Continue To FallThe total number of active drilling rigs in the United States fell by 2 this week after falling by 7 last week, according to new data that Baker Hughes published Friday, with the number of active oil rigs plunging to their lowest level since January 28 of last year. The total rig count fell to 616 this week. So far this year, Baker Hughes has estimated a loss of 163 active drilling rigs. This week’s count is 459 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs fell by 2 to 494, down by 127… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Rigs-Continue-To-Fall.html |

|

China To Compensate Coal Plants As It Seeks Power Supply StabilityChina will start guaranteeing payments to coal-fired power plants based on their installed capacity as of January 2024, as the world’s top coal consumer looks to ensure stability of electricity supply amid soaring renewable energy output. The National Development and Reform Commission (NDRC), the state planner, said on Friday that thermal power plants in most of China would be able to recover about 30% of their capital costs in the next two years, Reuters reported. The guaranteed payments will be a tariff collected from industrial and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-To-Compensate-Coal-Plants-As-It-Seeks-Power-Supply-Stability.html |

|

Maine Voters Reject State Takeover Of Private Utilities CompaniesMaine voters yesterday overwhelmingly rejected a ballot measure, Question 3, proposing a state takeover of its two investor-owned utilities, Central Maine Power and Versant. Public power advocates proposed a new state entity, Pine Tree Power, that would be authorized to issue debt for this utility takeover. Cost estimates for this plan cited in the local press varied from $8-13 billion and could take a decade to implement. The plan essentially would use the principles of eminent domain to establish a fair value for utility assets and then prosecute.… Read more at: https://oilprice.com/Energy/Energy-General/Maine-Voters-Reject-State-Takeover-Of-Private-Utilities-Companies.html |

|

Price Of Russian Oil Falls Back To Western-Capped LevelsThe price of a barrel of Urals grade crude oil shipping out of Russian ports has retreated to levels close to the G7 price cap after higher freight rates and falling Brent crude prices dragged it down, Reuters has calculated. The G7 imposed a price cap of $60 on Russian crude oil, with penalties for insurers and carriers who deal in Russian crude above that specified cap. For months, however, Russia has shipped much of its crude oil well above the cap—but the price that a barrel of Urals can fetch is now falling along with the price of Brent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Price-Of-Russian-Oil-Falls-Back-To-Western-Capped-Levels.html |

|

U.S. Space Force Partners With Elon Musk To Launch Mysterious X-37B Space PlaneThe US Space Force’s Boeing X-37B unmanned, reusable space plane will be launched via a SpaceX Falcon Heavy rocket from Kennedy Space Center, Florida, for the first time in early December, the US military wrote in a press release. “The X-37B Mission 7 will launch on a SpaceX Falcon Heavy rocket for the first time, designated USSF-52, with a wide range of test and experimentation objectives,” Space Force said. The mysterious spaceplane is built by Boeing and operated by the Air Force Rapid Capabilities Office and the Space Force. Its last… Read more at: https://oilprice.com/Energy/Energy-General/US-Space-Force-Partners-With-Elon-Musk-To-Launch-Mysterious-X-37B-Space-Plane.html |

|

Swedish Union Blocks Tesla Imports As Labor Dispute EscalatesAs Tesla looks to navigate uncertain demand with price cuts heading into 2024, the company is now also encountering heightened tensions in Sweden as the local transport workers’ union intensifies its efforts by threatening to block the automaker’s imports at all Swedish ports beginning November 17. Tesla’s stake in the Swedish market, which ranks as its fifth-largest in Europe with over 16,000 new vehicle registrations in the first three quarters of the year, underscores the significance of this confrontation. The conflict in Sweden has escalated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Swedish-Union-Blocks-Tesla-Imports-As-Labor-Dispute-Escalates.html |

|

NRG Sells Billion-Dollar Stake In Texas Nuclear Power ProjectEarlier this week, NRG Energy announced the sale of its 44% ownership interest in the two-unit South Texas Nuclear Project outside of Houston to Constellation Resources. The purchase price for about 1100 mws of nuclear capacity was $1.75 billion, although both parties noted that the final transaction price was closer to $1.4 billion after tax considerations. The seller, NRG, stated in its press release that the proceeds would be used mainly for corporate purposes and common stock repurchase. NRG has been the target of an activist investor, Elliott… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/NRG-Sells-Stake-In-Texas-Nuclear-Power-Project-In-Billion-Dollar-Deal.html |

|

Europe Taps Record-High Natural Gas Storage As Temperatures DropTraders have begun withdrawing natural gas from Europe’s record-high inventories this week as the weather turned colder and heating demand rose. The gas storage sites in the EU were 99.57% full as of November 8, according to data from Gas Infrastructure Europe. In the past few days, most EU countries have made consecutive small net withdrawals of gas from their storage, the data showed. These were the first consecutive net withdrawals from Europe’s gas storage since April—the end of the previous winter heating season. Withdrawals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Taps-Record-High-Natural-Gas-Storage-As-Temperatures-Drop.html |

|

Oil Prices Under Pressure But Sentiment Could Soon ShiftOil prices continued to tumble this week as demand concerns and inventory build-ups added to bearish sentiment, but with an OPEC+ meeting at the end of the month and the potential of an escalation in the Gaza war things could change rapidly.Friday, November 10th, 2023Battered by inventory build-ups, weaker-than-expected Chinese economic data, and slackening physical demand coming from skyrocketing freight costs, oil prices have struggled this week and ICE Brent is set for a $5 per barrel week-on-week drop, settling around the $80 per barrel mark.… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-But-Sentiment-Could-Soon-Shift.html |

|

Japan And South Korea Look To Build Hydrogen Supply ChainJapan and South Korea are expected to announce next week a plan to build a hydrogen and ammonia supply chain together, which will include investment in production outside these countries, Nikkei reported on Friday. The leaders of the two countries, Japan’s Prime Minister Fumio Kishida and South Korea’s President Yoon Suk Yeol are set to announce the Hydrogen Ammonia Global Value Chain during an upcoming visit to Stanford University in the U.S. on November 17. Japan and South Korea will be cooperating in hydrogen and ammonia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Japan-And-South-Korea-Look-To-Build-Hydrogen-Supply-Chain.html |

|

Dow leaps nearly 400 points Friday, major averages notch a second week of gains: Live updatesStocks rallied Friday, making up the ground lost in the previous session as Treasury yields stabilized. Read more at: https://www.cnbc.com/2023/11/09/stock-market-today-live-updates.html |

|

Fed’s Mary Daly says it’s ‘too early to declare victory’ on inflationTighter policy is helping bring down inflation but not to where policymakers should feel too comfortable, the San Francisco Fed president said. Read more at: https://www.cnbc.com/2023/11/10/feds-mary-daly-says-its-too-early-to-declare-victory-on-inflation.html |

|

‘T-bill and chill’: Why Jack Bogle’s strategy of ‘lazy’ investing is making a comebackWith the meme-stock rally in the review mirror, individual investors are rediscovering a philosophy made famous by Vanguard’s founder, Jack Bogle. Read more at: https://www.cnbc.com/2023/11/10/t-bill-and-chill-why-jack-bogles-strategy-of-lazy-investing-is-making-a-comeback-.html |

|

Shares of ed-tech company 2U plummet almost 60%, falling below $1 on NasdaqOnline education company 2U saw its stock fall to below $1 Friday after a concerning revenue forecast. Read more at: https://www.cnbc.com/2023/11/10/shares-of-ed-tech-company-2u-plummet-almost-60percent-falling-below-1.html |

|

These luxury stocks won’t lose their luster even as sales growth slows to pre-pandemic levelsLuxury stocks are seeing growth normalize from their pandemic-era highs, but analysts believe there are still promising investment opportunities in the sector. Read more at: https://www.cnbc.com/2023/11/10/these-luxury-stocks-wont-lose-their-luster-even-as-sales-growth-slows.html |

|

Patients are lining up for $2,500 full-body MRI scans that can detect cancer earlyThousands of people have paid $2,500 for full-body MRI scans from Prenuvo, whose technology can detect more than 500 health conditions Read more at: https://www.cnbc.com/2023/11/10/prenuvo-offers-2500-full-body-mri-scans-that-can-detect-cancer-early.html |

|

Trump admits ‘various people’ saw ‘papers and boxes’ brought from White HouseFormer President Donald Trump faces the prospect of multiple, separate criminal trials in 2024, as he seeks the GOP presidential nomination. Read more at: https://www.cnbc.com/2023/11/10/trump-judge-rejects-classified-documents-trial-delay.html |

|

Ron Baron expects SpaceX’s Starlink to go public around 2027Baron is a major backer of Elon Musk’s companies. Tesla and SpaceX rank as two of Baron Capital’s largest holdings. Read more at: https://www.cnbc.com/2023/11/10/ron-baron-expects-spacexs-starlink-to-go-public-around-2027.html |

|

‘Far too many Palestinians have been killed,’ Blinken says; Gaza health ministry says hospitals hit in strikes“Simultaneous raids” were launched on Gaza City hospitals overnight, including Al-Shifa, a Gaza Ministry of Health spokesman said. Read more at: https://www.cnbc.com/2023/11/10/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Australia offers refuge to Pacific island nation threatened by rising sea levelsThe Australia-Tuvalu Falepili Union is a bilateral treaty focused on migration, security and climate change. Read more at: https://www.cnbc.com/2023/11/10/australia-offers-refuge-to-tuvalu-residents-threatened-by-rising-sea-levels.html |

|

COVID-19 fraudsters bought fancy cars, a Pokemon card – even a private islandThieves may have stolen more than $280 billion in federal COVID-19 aid, the greatest grift in U.S. history. About $1.2 billion has been seized by authorities. Read more at: https://www.cnbc.com/2023/11/10/covid-19-aid-grift-thieves.html |

|

Health savings accounts, with a triple tax advantage, are ‘perfect,’ advisor says — but only if used the right wayHealth savings accounts offer unique tax benefits. But most people are using them like a piggy bank. Read more at: https://www.cnbc.com/2023/11/10/most-people-are-short-changing-themselves-with-health-savings-accounts-hsa.html |

|

Top US General: Israel Killing Civilians Will Help Hamas RecruitAuthored by Dave DeCamp via AntiWar.com, Chairman of the Joint Chiefs of Staff Gen. Charles Q. Brown has expressed concern that Israel’s killing of Palestinian civilians will help Hamas recruit more militants and cautioned against a long war in Gaza. Asked by reporters if the high civilian casualty rate will create more Hamas fighters, Brown said, “Yes, very much so. And I think that’s something we have to pay attention to.”

Read more at: https://www.zerohedge.com/military/top-us-general-israel-killing-civilians-will-help-hamas-recruit |

|

Iran Warns Of ‘Inevitable Expansion’ Of War After IDF Conducts Flag-Raising Ceremony In GazaUpdate(1515ET): On Friday Israeli media produced this headline hailing that “Israeli flags wave proudly along the shores of Gaza”. Starting on Thursday footage began widely circulating online showing IDF troops holding an Israeli flag raising ceremony, laying stake to conquered areas of the Strip. In a short speech during the ceremony on a Gaza beach, just prior to leading troops in the national anthem, an IDF soldier said “this is our land” and told his forces they are leading the way for Jews “to return to our lands.”

Following this highly provocative scene, on Friday Iran issued a new warning, saying that Israel’s expansion of its operations and attacks on Gaza hospitals and other provocative acts make an < … Read more at: https://www.zerohedge.com/geopolitical/israeli-tanks-have-gaza-hospitals-surrounded-un-decries-hell-earth |

|

Rising Inflation Expectations Heap More Risks To Treasury MarketAuthored by Simon White, Bloomberg macro strategist, The market’s point of focus in the UMich data is the higher-than-expected inflation expectations figure, which potentially brings more risks to bonds. One-year inflation expectations rose to 4.4% from 4.2%. But more saliently for the bond market, the long-term median of inflation expectations rose to 3.2%, its highest since 2011. As we saw yesterday with the weak 30-year auction, the Treasury market is facing mounting challenges with oversupply and poor liquidity. Rising consumer inflation expectations compound the issue as the household sector has become the marginal buyer of USTs as other sectors retreat.

Household’s rising inflation expectations therefore point to higher term premium (chart above), i.e. the US government will likely have to accept a bigger discount on its issuance to compensate for the household sector’s inflation outlook. … Read more at: https://www.zerohedge.com/markets/rising-inflation-expectations-heap-more-risks-treasury-market |

|

PBoC In A Hurry To Buy Gold: Covertly Bought 593 Tonnes Of Gold YTDBy Jan Nieuwenhuijs of Gainesville Coins The PBoC is in a hurry to buy enormous amounts of gold, indicating it’s preparing for substantial changes in the dollar-centric international monetary system. Based on information from industry sources and my personal calculations, total gold purchases by the Chinese central bank (reported and unreported) in Q3 accounted for 179 tonnes. Year-to-date the PBoC bought 593 tonnes, which is 80% more than what it bought in the first three quarters last year. Its total estimated gold holdings are 5,220 tonnes, more than twice what’s officially disclosed at 2,192 tonnes.

The movement towards gold by central banks is showing no sign of slowing down. Mainly the Chinese central bank is on a voracious buying spree since 2022, and it’s obtaining way more metal than what is officially reported. The People’s Bank of China (PBoC) buys gold off the rada … Read more at: https://www.zerohedge.com/markets/pboc-hurry-buy-gold-covertly-bought-593-tonnes-gold-ytd |

|

Ex-NatWest boss Alison Rose loses out on £7.6m after Nigel Farage rowDame Alison Rose resigned after admitting to discussing details about Nigel Farage’s bank account. Read more at: https://www.bbc.co.uk/news/business-67377140?at_medium=RSS&at_campaign=KARANGA |

|

UK economy flatlines as higher interest rates biteForecasters suggest that the economy is set to remain stagnant for several months yet. Read more at: https://www.bbc.co.uk/news/business-67370315?at_medium=RSS&at_campaign=KARANGA |

|

Microsoft says Teams and Xbox fixed in UK and EuropeThe firm has dealt with issues that emerged on the same day as it released a new Call of Duty game. Read more at: https://www.bbc.co.uk/news/technology-67379533?at_medium=RSS&at_campaign=KARANGA |

|

2024 will be a year of double-digit gains in the market: Sandip Sabharwal“We will see continuous possible improvement in margins and profitability for many of the auto companies. I would be positive on Tata Motors, we own Mahindra & Mahindra and we own Maruti also. Bajaj Auto, I would have liked to own but we could never buy and then it never corrected but I think that will also do well.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/2024-will-be-a-year-of-good-double-digit-gains-in-the-market-sandip-sabharwal/articleshow/105102323.cms |

|

My portfolio not a zoo with all animal species: Rajeev Thakkar on missing multibaggersAttractive investment opportunities, according to the value investor, happen when capable and competent managers/promoters work steadily toward creating long term wealth for shareholders. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/my-portfolio-not-a-zoo-with-all-animal-species-rajeev-thakkar-on-missing-multibaggers/articleshow/105115178.cms |

|

Crypto: Bitcoin could reach $150,000 in 2025 during new bull cycle, says AllianceBernsteinBitcoin could reach a cycle high of as much as $150,000 in 2025 Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7297-AE54B1BA0B05%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil tallies a third straight weekly fall, pressured by demand worries and a potential supply surplusOil futures rise Friday, but remain on track for a third straight weekly decline. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7296-8474416CFF85%7D&siteid=rss&rss=1 |

|

Outside the Box: Why a prenup could be the right prescription to keep a blended family healthyThese proactive steps help ensure the well-being of both partners and their children. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7296-B5BFDD6A5A9F%7D&siteid=rss&rss=1 |

New Chairman of the Joint Chiefs of Staff Gen. Charles Q. Brown, via USAF”That’s why when we talk about time — the faster you can get to a point where you stop the hostilities, you have less strife for the civilian popul …

New Chairman of the Joint Chiefs of Staff Gen. Charles Q. Brown, via USAF”That’s why when we talk about time — the faster you can get to a point where you stop the hostilities, you have less strife for the civilian popul …