Summary Of the Markets Today:

- The Dow closed down 220 points or 0.65%,

- Nasdaq closed down 0.94%,

- S&P 500 closed down 0.81%, High 4,319: 4,200 = critical resistance level)

- Gold $1,964 up $5.70,

- WTI crude oil settled at $76 up $0.26,

- 10-year U.S. Treasury 4.634% up 0.126 points,

- USD Index $105.95 up $0.350,

- Bitcoin $36,560 up 2.64%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In the week ending November 4, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,250, an increase of 1,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 210,000 to 210,750.

Here is a summary of headlines we are reading today:

- Still On The Auction Block, Citgo Sees 19% Jump In Q3 Net Profit

- Egypt Can’t Ramp Up LNG Supply To Europe Due To The Hamas-Israel War

- Saudi Arabia’s Energy Minister Blames Speculators For Oil Price Plunge

- Shell Sues Greenpeace For Boarding Oil Production Vessel

- Powell says Fed is ‘not confident’ it has done enough to bring inflation down

- S&P 500 snaps 8-day winning streak, Dow closes 200 points lower as bond yields rise: Live updates

- IRS announces new income tax brackets for 2024

- SEC chair Gary Gensler says an FTX reboot could happen if it follows the law: CNBC Crypto World

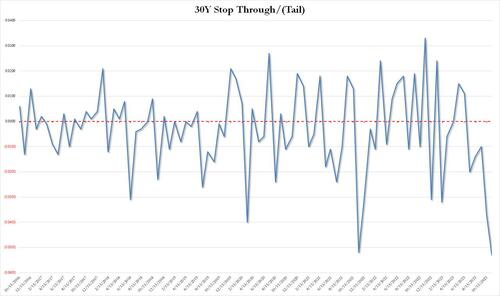

- Stocks Tumble, Yield Surge After Catastrophic 30Y Auction Stops With Biggest Tail On Record As Foreign Demand Craters

- TaxWatch: Standard deductions for 2024 taxes will jump 5.4% due to inflation, IRS numbers show

- Futures Movers: Oil ends higher after 2-day drop to nearly 4-month lows

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Groundbreaking Research Promises Greener Rare Earth Element PurificationCornell University scientists have characterized the genome of a metal-loving bacteria with an affinity for rare earth elements. The research paves the way towards replacing the harsh chemical processing of these elements with a benign practice called biosorption. Rare earth elements are critical materials in electric cars, wind turbines and smartphones. Today, retrieving these metals from raw ore requires processing with acids and solvents. But a new technology, envisioned by the scientists and powered by a microbe, could make processing rare… Read more at: https://oilprice.com/Energy/Energy-General/Groundbreaking-Research-Promises-Greener-Rare-Earth-Element-Purification.html |

|

Still On The Auction Block, Citgo Sees 19% Jump In Q3 Net ProfitU.S.-based Venezuelan-owned oil refiner Citgo Petroleum has posted Q3 earnings showing a 19% jump in net profit, year-on-year, on strong margins and after a significant hike in utilization rates. Citgo’s Q3 net profit hit $567 million, up from $477 million in Q3 2022. The refiner’s total throughput for the quarter was 802,000 barrels per day, with crude runs accounting for 765,000 bpd, according to a Citgo press release on Thursday, putting the utilization rate at 95%. This compares to Q2 2023 total throughput… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Still-On-The-Auction-Block-Citgo-Sees-19-Jump-In-Q3-Net-Profit.html |

|

Report: Russian Military-Linked Hackers Responsible For 2022 Ukraine Grid OutageHackers affiliated with Russia’s military intelligence agency penetrated and disrupted parts of Ukraine’s electricity grid late last year using sophisticated new hacking tools, a new report said. The findings, by the U.S. cybersecurity firm Mandiant, add further evidence about the tools used by, as well as the sophistication of, the agency known as the GRU in targeting not only Ukraine, but other places around the globe as well. “This attack represents the latest evolution in Russia’s cyber physical attack capability, which… Read more at: https://oilprice.com/Geopolitics/International/Report-Russian-Military-Linked-Hackers-Responsible-For-2022-Ukraine-Grid-Outage.html |

|

Russia Won’t Abandon Grand LNG PlansRussia is adamant that it will press on with its grand scheme of increasing LNG production despite U.S. sanctions on a major project, Russian Foreign Ministry spokeswoman Maria Zakharova said on Thursday. While the United States moved to squeeze Moscow further by adding another package of sanctions that targeted a company heavily involved in the $25 billion Arctic LNG-2 project, Russia has no intention of relaxing its plans to boost LNG production to 100 million tons per day. Referring to Novatek-led Arctic LNG-2, Zakharova said on Thursday that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Wont-Abandon-Grand-LNG-Plans.html |

|

ArcelorMittal Takes Legal Action Against Liberty Steel Over Unpaid DebtVia Metal Miner ArcelorMittal recently obtained a freeze order from a Singaporean court against Liberty Steel. The order totals €140 million ($150 million) and relates to the prospective sale of Liberty Steel assets. According to reports, the Luxembourg-headquartered group acquired a court injunction from a Singapore court on Nov. 1. That injunction prohibits Liberty from removing any assets from the city-state up to the stipulated amount. However, GFG played down the Singapore court order, stating, “We have applied to overturn the order,… Read more at: https://oilprice.com/Metals/Commodities/ArcelorMittal-Takes-Legal-Action-Against-Liberty-Steel-Over-Unpaid-Debt.html |

|

China’s Central Bank Says Economy On Track To Achieve 5% Growth TargetChina is anticipated to achieve its annual gross domestic product (GDP) growth target this year, with a focus on transitioning to a high-quality and sustainable expansion model, according to People’s Bank of China Governor Pan Gongsheng, as stated in a speech posted on the central bank’s website. Beijing had set a growth target of around 5 percent for the current year. However, some economists have expressed concerns that the government’s growth objective might be challenging to meet, given that the incremental policy stimulus… Read more at: https://oilprice.com/Finance/the-Economy/Chinas-Central-Bank-Says-Economy-On-Track-To-Achieve-5-Growth-Target.html |

|

Serbian Firms Caught Exporting Sanctioned Goods To RussiaSerbian companies are exporting dual-use goods to Russia that have been targeted by Western sanctions due to their use in Russian armaments deployed in Ukraine — despite a pledge by President Aleksandar Vucic that his country would not serve as a conduit for circumventing U.S. and EU sanctions. Dual-use goods can be used for both military and civilian purposes and, among the recipients of these exports from Serbia to Russia is an IT supplier hit with U.S. sanctions in September in what Washington described as an effort to deprive Russian President… Read more at: https://oilprice.com/Geopolitics/International/Serbian-Firms-Caught-Exporting-Sanctioned-Goods-To-Russia.html |

|

Egypt Can’t Ramp Up LNG Supply To Europe Due To The Hamas-Israel WarEurope shouldn’t count on Egypt for more LNG in the short to medium term amid tight natural gas balances in the Eastern Mediterranean after the Hamas-Israel war erupted, the Oxford Institute for Energy Studies (OIES) said in a new report. Following the Hamas attack on Israel in early October, Chevron, the operator of the Tamar gas field offshore southern Israel, shut down production at the field per instructions from the Israeli energy ministry. Subsequently, export flows of gas from southern Israel to Egypt through the offshore… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Egypt-Cant-Ramp-Up-LNG-Supply-To-Europe-Due-To-The-Hamas-Israel-War.html |

|

G7 Countries Back EU Ban On Russian DiamondsAlthough Russia’s economy has not collapsed under Western sanctions, the European Union is preparing to unveil another round of sanctions, focusing on Moscow’s diamond exports, potentially as early as next week. At the G7 foreign ministers’ meeting in Japan, EU’s top diplomat, Josep Borrell, told the Financial Times that the EU has secured enough backing from G7 countries on the new ban, as well as support from Belgium – one of the world’s leading diamond traders. “In order for [EU] member states to be unanimous for the ban on diamond… Read more at: https://oilprice.com/Geopolitics/International/G7-Countries-Back-EU-Ban-On-Russian-Diamonds.html |

|

Africa’s Biggest Refinery Is Still Months Away From Full ProductionThe Dangote Refinery in Nigeria, Africa’s biggest, with a capacity of 650,000 barrels per day (bpd), has been commissioned, but full-scale production, including production of gasoline for Europe, is not expected to begin until the second half of 2024, analysts have told Bloomberg. After years of delays and massive cost overruns, Nigeria finally saw the giant oil refinery commissioned in May. The Dangote Refinery, built by the group of the same name of Africa’s richest person, Aliko Dangote, was inaugurated by Nigeria’s former… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Biggest-Refinery-Is-Still-Months-Away-From-Full-Production.html |

|

Saudi Arabia’s Energy Minister Blames Speculators For Oil Price PlungeOil demand is robust—it’s oil speculators that are behind the most recent drop in global crude oil prices, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman has said. Of demand, bin Salman said definitively, “It’s not weak. People are pretending it’s weak. It’s all a ploy.” The Saudi Energy Minister has lashed out repeatedly at traders and oil speculators, warning them earlier this year that anyone betting against crude oil would be “ouching like hell”. It is just one of many… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabias-Energy-Minister-Blames-Speculators-For-Oil-Price-Plunge.html |

|

Oil Companies Want Kurdistan Payment Issue Settled Before Resuming ExportsThe international oil companies operating in Iraq’s semi-autonomous region of Kurdistan will not be producing oil for exports until they have clarity about overdue and future payments and sales terms, Norwegian firm DNO, one of the six members of the Association of the Petroleum Industry of Kurdistan (APIKUR), said on Thursday. Currently, Iraqi federal government officials and the Kurdistan region’s petroleum association are discussing the resumption of crude flows through the Iraq-Turkey pipeline to the Turkish Mediterranean… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Companies-Want-Kurdistan-Payment-Issue-Settled-Before-Resuming-Exports.html |

|

China’s Independent Refiners Look To Boost OutputAuthorities in the province home to most of China’s independent refiners have asked the central government to allocate additional quotas for fuel oil imports as the refiners look to boost processing this month and next, but lack enough crude oil import quotas, traders and analysts have told Reuters. The independent refiners, the so-called teapots based in the Chinese coastal province of Shandong, have received lower quotas to import crude oil this year. So now they are seeking, through the provincial government of Shandong, to be allowed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Independent-Refiners-Look-To-Boost-Output.html |

|

Shell Sues Greenpeace For Boarding Oil Production VesselShell is suing Greenpeace for millions of dollars in damages after the environmentalists boarded early this year a vessel in the Atlantic en route to a future oilfield in the UK North Sea. Shell has filed the lawsuit in London’s High Court, demanding $2.1 million in damages, including legal costs, additional expenses for security, and costs incurred by shipping delays, a document seen by Reuters showed on Thursday. Greenpeace claims Shell has hit the climate campaign group with an “intimidation lawsuit,” threatening an $8.6-million… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Sues-Greenpeace-For-Boarding-Oil-Production-Vessel.html |

|

Insurers Continue To Back Oil And Gas Projects Despite Climate RiskDespite soaring payouts for climate-related disasters, the global insurance industry continues to back projects to increase oil and gas production, the Insure Our Future campaign said in a new report on Wednesday. Fossil fuel insurance earned the industry around $21.25 billion in 2022, according to research commissioned for the report from market intelligence firm Insuramore. The top ten individual fossil fuels insurers include AEGIS, Chubb, Allianz, AXA, Fairfax Financial, Zurich, W. R. Berkley, and AIG, the report found. “Although some… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Insurers-Continue-To-Back-Oil-And-Gas-Projects-Despite-Climate-Risk.html |

|

Powell says Fed is ‘not confident’ it has done enough to bring inflation downPowell said in remarks for an International Monetary Fund audience that more work could be ahead in the battle against high prices. Read more at: https://www.cnbc.com/2023/11/09/powell-says-fed-is-not-confident-it-has-done-enough-to-bring-inflation-down.html |

|

Democratic Sen. Joe Manchin says he is not running for reelectionSen. Joe Manchin, D-W.V., said he will not seek reelection to the Senate, but will explore whether to create a “movement to mobilize the middle.” Read more at: https://www.cnbc.com/2023/11/09/democratic-sen-joe-manchin-says-he-is-not-running-for-reelection.html |

|

S&P 500 snaps 8-day winning streak, Dow closes 200 points lower as bond yields rise: Live updatesThe S&P 500 broke its longest streak of positive sessions since 2021. Read more at: https://www.cnbc.com/2023/11/08/stock-market-today-live-updates.html |

|

IRS announces new income tax brackets for 2024The IRS on Thursday announced higher federal income tax brackets and standard deductions for 2024. Here’s what taxpayers need to know. Read more at: https://www.cnbc.com/2023/11/09/irs-here-are-the-new-income-tax-brackets-for-2024.html |

|

There’s a new entry into the weight loss drug boom. Here’s the outlook for the stockAstraZeneca is the latest player to enter the weight loss drug market, which analysts predict could reach $100 billion by 2030. Read more at: https://www.cnbc.com/2023/11/09/theres-a-new-entry-into-the-weight-loss-drug-boom-heres-the-outlook-for-the-stock.html |

|

What’s Warner Bros. Discovery’s next move? David Zaslav and John Malone offer cluesWarner Bros. Discovery CEO David Zaslav and board member John Malone both suggested buying distressed assets in the next two years. Read more at: https://www.cnbc.com/2023/11/09/zaslav-malone-wbd-next-move.html |

|

Israel-Hamas war live updates: White House says Israel will implement 4-hour pauses in fighting in areas of north Gaza every dayIsrael has agreed to put in place four-hour daily humanitarian pauses in fighting, according to the White House, focusing on areas in northern Gaza. Read more at: https://www.cnbc.com/2023/11/09/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Biden says all autoworkers deserve deals like those the UAW won from Detroit automakersPresident Joe Biden said the deals won by UAW negotiators are “game changers” that set a “new standard” for blue-collar workers. Read more at: https://www.cnbc.com/2023/11/09/biden-uaw-contracts-all-autoworkers.html |

|

Meta lets Amazon shoppers buy products on Facebook and Instagram without leaving the appsMeta debuted a new advertising feature that lets users link their Facebook and Instagram accounts to Amazon for easier purchasing Read more at: https://www.cnbc.com/2023/11/09/meta-lets-amazon-users-buy-on-facebook-instagram-without-leaving-apps.html |

|

Flutter shares fall after disappointing earnings — but it insists FanDuel is No. 1 in sports bettingA disappointing earnings report sent shares of FanDuel parent Flutter falling, as it defends its first place position in the U.S. sports betting market. Read more at: https://www.cnbc.com/2023/11/09/fanduel-parent-flutter-stock-falls-after-disappointing-earnings.html |

|

The ‘dupe’ trend hit travel in 2023. It’s a good way to save on your next trip, experts sayTravelers sought out alternatives to popular hot spots as a way to save money in 2023. The strategy can help when planning your next trip. Read more at: https://www.cnbc.com/2023/11/09/try-a-travel-dupe-to-save-money-on-your-2024-trip-experts-say.html |

|

Barbie who? Gen Alpha kids ‘obsessed’ with skin care could fuel holiday spendingYoung children are adopting skin-care routines like never before and this holiday, they’re set to drive beauty sales. Read more at: https://www.cnbc.com/2023/11/09/gen-alpha-kids-to-fuel-holiday-skincare-spending.html |

|

SEC chair Gary Gensler says an FTX reboot could happen if it follows the law: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, SEC chair Gary Gensler reacts to the conviction of Sam Bankman-Fried, the potential for spot bitcoin ETFs, and calls for U.S. crypto regulation. Read more at: https://www.cnbc.com/video/2023/11/09/sec-chair-gary-gensler-ftx-reboot-if-it-follows-the-law-crypto-world.html |

|

How Affluent Homebuyers Are Keeping Luxury Real Estate Market AfloatSubmitted by Sam Bourgi of CreditNews

Undaunted by rapidly rising mortgage rates, many rich Americans haven’t given up on their poolside pads and high-end condos just yet. Luxury home prices climbed 9% to hit $1.1 million, the highest third-quarter level ever recorded, reports Redfin. That’s almost three times faster than the price growth of non-luxury homes, which made it to a median $340,000 in the third quarter. Read more at: https://www.zerohedge.com/markets/how-affluent-homebuyers-are-keeping-luxury-real-estate-market-afloat |

|

One Hit Wonder Masa Son Continues To Incinerate Capital, Loses Another $6.2 Billion After WeWork BankruptcySeveral years ago, roughly around the time Masa Son’s SoftBank launched a truly unprecedented, historic capital misallocation campaign (which will one day be a case study in how to vaporize tens of billions), which was nothing more than a levered bet on easy monetary policy and central banks reflating markets, and also around the time we first asked if “SoftBank was the Bubble Era’s “Short Of The Century”, his earnings presentations were filled with jolly-if-ridiculous, unicorn-riddlged slides such as these pitching the financial conglomerates ill-fated foray into “AI”:

Read more at: https://www.zerohedge.com/markets/one-hit-wonder-masa-son-continues-incinerate-capital-loses-another-17-billion-wework |

|

Stocks Tumble, Yield Surge After Catastrophic 30Y Auction Stops With Biggest Tail On Record As Foreign Demand CratersComplete disaster. That’s the only way one can describe today’s 30Y auction, which many expected could be challenging after a mediocre 3Y and a subpar 10Y auction earlier this year, but nobody expected… this. The bond priced at a high yield of 4.769%, which was below last month’s 4.837%, and just shy of the April 2010 high. But more importantly, it tailed the When Issued by a whopping 5.3bps, which was… well… terrible, because as shown in the chart below, this was the biggest tail on record (going back to 2016).

The bid to cover was just as bad: at 2.236 it was the lowest since Dec 2021. The internals were even worse as foreign bidders (Indirects) tumbled from 65.1% to 60.1%, the lowest since Nov 2021, and with Directs taking down only 15.2%, banks (Dealers) were forced to step up and take the balance, or a whopping 24.7%, double the recent average of 12.7%, and the highest since Nov 2021. Thi … Read more at: https://www.zerohedge.com/markets/stocks-tumble-yield-surge-after-catastrophic-30y-auction-stops-biggest-tail-record-foreign |

|

Rubino: Are There Too Many People Or Too Few?Via John Rubino’s Substack, With financial collapse and global war inching closer every day, you’d have to be an anxiety junkie to worry about distant things like demographic trends. Still, the population debate is interesting, with economists, statisticians, and techies disagreeing over whether the world of 2100 will have too many people, too few, or just the right number. To summarize the three scenarios: Too many people. We already exceed the Earth’s carrying capacity and developing country populations will continue to increase for at least the next half-century, leading to mass extinctions, degradation of farmland and aquifers, and widespread famine. Meanwhile, automation will eliminate millions of jobs, causing mass unemployment, civil unrest, and bankrupt governments. This is “negative feedback loop” all the way down. Too few people. Birth rates are plunging and by mid-century there won’t be enough young workers to support a growing number of retirees, resulting in a global inflationary depression and/or massive cuts in social programs that leave millions of retirees destitute. Just the right number. The workforce shrinks while automation eliminates jobs, keeping labor markets more or less in balance. Productive capacity expands, retirees are supported, and the environment starts to heal. It really does matter which of these actually happens. How we got hereThe human population has exploded thanks to industrialization, fo … Read more at: https://www.zerohedge.com/geopolitical/rubino-are-there-too-many-people-or-too-few |

|

McDonald’s: ‘There’s disgusting behavior at my branch’The claim comes after a BBC investigation exposed a toxic workplace culture at the fast food chain. Read more at: https://www.bbc.co.uk/news/business-67093982?at_medium=RSS&at_campaign=KARANGA |

|

Jezebel: Feminist media site shuts down after 16 yearsA downturn in advertising led to the “excruciating” decision, its owner said. Read more at: https://www.bbc.co.uk/news/business-67372543?at_medium=RSS&at_campaign=KARANGA |

|

Fuel prices still cause for concern, warns watchdogA new report has found while wholesale prices have dropped, petrol and diesel is more expensive. Read more at: https://www.bbc.co.uk/news/business-67368097?at_medium=RSS&at_campaign=KARANGA |

|

ESAF SFB shares to debut on Friday. What GMP signals ahead of listingThe public offer was subscribed by a massive 73 times at close on strong demand from institutional investors. The QIB category was booked 173 times.ESAF Small Finance Bank has a focus on unbanked and under-banked customer segments, especially in rural and semi-urban areas. The AUM grew from Rs 8,426 crore to Rs 16,320 crore from FY21-23, registering a CAGR of 39.22%, the highest CAGR among peers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/esaf-small-finance-bank-shares-to-debut-on-friday-what-gmp-signals-ahead-of-listing/articleshow/105099387.cms |

|

Diwali Muhurat Picks: 10 smallcap stocks to make your portfolio glowETMarkets picks 10 stocks that have strong return potential till the next Diwali. These stocks have been picked from a pool of investment bets from different brokerages. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/diwali-muhurat-picks-10-smallcap-stocks-to-make-your-portfolio-grow-and-glow/slideshow/105101014.cms |

|

Tech View: Market sentiment favours bearish bets. Here’s what traders should do on FridayThe smaller degree of higher tops and bottoms is intact on the daily chart and the recent unfilled opening upside gap around 19,250 levels could offer support for the market during the present consolidation to form a higher bottom, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-market-sentiment-favours-bearish-bets-heres-what-traders-should-do-on-friday/articleshow/105098430.cms |

|

Earnings Results: Coach parent’s stock rises as analysts say revenue softness is less grim than fearedTapestry Inc.’s stock reversed early losses to trade up about 4% Thursday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7295-B00D2A727D0D%7D&siteid=rss&rss=1 |

|

TaxWatch: Standard deductions for 2024 taxes will jump 5.4% due to inflation, IRS numbers show90% of people use the standard deduction to lower their taxable income, IRS stats say. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7287-3C43823FDF3F%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil ends higher after 2-day drop to nearly 4-month lowsOil futures climbed Thursday, shaking off data that pointed to weak Chinese consumer demand to finish higher after a two-day drop that left crude at its lowest since mid-July. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7295-67D7B256357B%7D&siteid=rss&rss=1 |