Summary Of the Markets Today:

- The Dow closed up 222 points or 0.67%,

- Nasdaq closed up 1.64%,

- S&P 500 closed up 1.05%, High 4,246: 4,200 = critical resistance level)

- Gold $1,989 down $5.90,

- WTI crude oil settled at $81 down $0.12,

- 10-year U.S. Treasury 4.761% down 0.114 points,

- USD Index $106.67 up $0.010,

- Bitcoin $34,523 up $40,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Another weak non-farm private employment gains by ADP in October 2021 that showed job growth at 113,000 (blue line on the graph below). We consider 150,000 the breakeven number of jobs growth to support the working population growth. Lately, there has been almost no correlation between ADP and the BLS monthly employment report (which will be issued this Friday).

Construction spending during September 2023 was 8.7% (red line on the graph below) above September 2022 – 4.8% inflation-adjusted (blue line on the graph below). Despite the higher rates for borrowing, construction spending is growing at a good clip.

The number of job openings changed little at 9.6 million on the last business day of September. Over the month, the number of hires and total separations changed little at 5.9 million and 5.5 million, respectively. Within separations, quits (3.7 million) and layoffs and discharges (1.5 million) changed little. Over the last 12 months, hires and separations have been trending down – but this decline cannot be correlated to either positive or negative employment gains. Job openings, on the other hand, historically have correlated with employment gains – and suggest a continued modest moderation of employment gains.

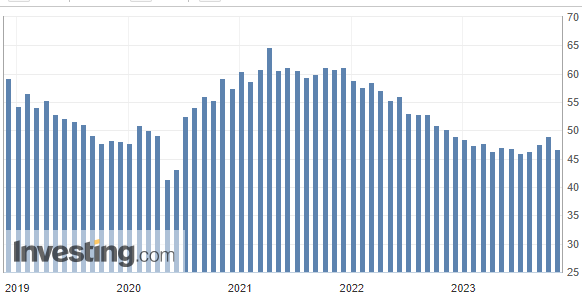

The ISM Manufacturing PMI registered 46.7% in October 2023, 2.3 percentage points lower than the 49% recorded in September. A Manufacturing PMI® above 48.7%, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory at 45.5%, 3.7 percentage points lower than the figure of 49.2% recorded in September. It is our position that manufacturing has been in a recession for at least a year.

The Federal Reserve FOMC concluded its scheduled meeting today stating that economic activity expanded at a strong pace but inflation remains elevated. They added that “Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.” Therefore, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.

Here is a summary of headlines we are reading today:

- UK Manufacturing Faces Worst Downturn Since 2008

- Europe’s Renewables Landscape Transforms With Rooftop Solar Adoption

- Researchers Unveil Catalyst To Convert CO2 Into Methane

- What’s Hezbollah’s Next Step?

- U.S. Gasoline Refining Profits Tumble As Demand Weakens

- Shares Of The World’s Top Offshore Wind Firm Drop 20% On Scrapped U.S. Projects

- Stocks rally to start November after Fed decision, Dow gains more than 200 points: Live updates

- Treasury details plans to step up size of bond sales to manage growing debt load and higher rates

- IRS announces 2024 retirement account contribution limits: $23,000 for 401(k) plans, $7,000 for IRAs

- Apple expected to post fourth consecutive quarterly sales decline Thursday

- The Federal Reserve leaves rates unchanged. Here’s what that means for your wallet

- Bond Report: 2-year Treasury yield slips below 5% after Fed delivers another pause in interest rate hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Kyrgyzstan’s $4.7 Billion Central Asian Railway Faces Major Funding SetbackDuring recent visits to the United States and Germany, Kyrgyz President Sadyr Japarov encouraged investors to participate in the China-Kyrgyzstan-Uzbekistan (CKU) railway project — a crucial component of Xi Jinping’s ambitious Belt and Road Initiative. Kyrgyzstan’s treasury is not bursting with money and Bishkek is in great need of cash to build its part of the monumental railway project — expected to cost a few billion dollars — that could bring big profits to its coffers. But despite assurances given by Kyrgyz authorities on the imminent start… Read more at: https://oilprice.com/Geopolitics/International/Kyrgyzstans-47-Billion-Central-Asian-Railway-Faces-Major-Funding-Setback.html |

|

UK Manufacturing Faces Worst Downturn Since 2008The UK’s manufacturing sector is engulfed in the deepest downturn since the 2008 financial crisis as market uncertainty depresses activity, a closely watched survey suggests. According to the Chartered Institute of Procurement & Supply (CIPS) the UK manufacturing purchasing managers index (PMI) recorded 44.8 in October, with the 50 mark separating growth from contraction. Although this was an improvement on last month’s figure of 44.3, it was revised down from last week’s initial October estimate of 45.2. This meant production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Manufacturing-Faces-Worst-Downturn-Since-2008.html |

|

Armenia Faces Russia’s Economic Might As Tensions RiseArmenia’s relations with its strategic partner Russia are getting worse and worse and its leaders seem to desire a shift in geopolitical orientation towards the West. But a look at Russia’s powerful levers over the country makes that kind of thinking seem delusional. And Moscow has begun dropping hints of how much economic pain it can inflict on Armenians. Armenian officials offer assurances that all is fine on the economic front, but economists and businesspeople are increasingly worried about possible consequences of the political… Read more at: https://oilprice.com/Geopolitics/International/Armenia-Faces-Russias-Economic-Might-As-Tensions-Rise.html |

|

Putin Faces Election Challenge As Fuel Subsidies BackfireSubsidizing fuel is creating a budgetary crisis in Russia amid its ongoing war in Ukraine and soaring inflation, with the state budget now expected to take a multi-billion-dollar hit, according to Reuters calculations. In September, Moscow moved to slash by 50% a subsidy for oil refiners, which Reuters calculates will have to be offset by some $4.3 billion in subsidies to other industries, plus a one-off tax that equates to over $3.7 billion. When Russia moved to cut its damper subsidy for refiners just over a month ago, the knock-off… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Faces-Election-Challenge-As-Fuel-Subsidies-Backfire.html |

|

Europe’s Renewables Landscape Transforms With Rooftop Solar AdoptionEurope’s solar installation levels are exceeding expectations, with the amount installed in October 2023 already matching the total installed in all of last year. Rystad Energy modeling forecasts new solar capacity additions will grow 30% this year versus 2022, surpassing 58 gigawatts direct current (GWDC) of new panels by the end of the year. This year, rooftop solar installations have taken the lead, accounting for 70% of all newly installed solar in Europe. This underscores the continent’s commitment to clean energy and the adaptability of solar… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Europes-Renewables-Landscape-Transforms-With-Rooftop-Solar-Adoption.html |

|

India Swaps Russian Crude For Saudi Oil As Discount DwindlesIndia’s October imports of Russian crude oil were down 4% compared to the previous month, with increased imports from Saudi Arabia. According to IBC, citing Vortexa cargo data, India imported 1.55 million barrels per day of Russian crude in October, compared to 1.62 million bpd in September. The drop in October reflects a dwindling discount for Russian crude, which is frequently selling above the G7-imposed price cap of $60 per barrel, despite buying restrictions. The fall in India’s Russian crude imports for October was balanced out… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Swaps-Russian-Crude-For-Saudi-Oil-As-Discount-Dwindles.html |

|

Researchers Unveil Catalyst To Convert CO2 Into MethaneRice University materials scientists developed copper-based catalysts to help speed up the rate of carbon dioxide-to-methane conversion. Technologies for removing carbon from the atmosphere keep improving, but solutions for what to do with the carbon once it’s captured are harder to come by. The lab of Rice University materials scientist Pulickel Ajayan and collaborators developed a way to wrest the carbon from carbon dioxide and affix it to hydrogen atoms, forming methane – a valuable fuel and industrial feedstock. According to the… Read more at: https://oilprice.com/Energy/Energy-General/Researchers-Unveil-Catalyst-To-Convert-CO2-Into-Methane.html |

|

EU, US, UAE Pressure Other Govts To Join Deal To Triple Renewable EnergyThe United States, the European Union, and the United Arab Emirates are looking to drum up new recruits in the form of other governments to sign onto a global deal that seeks to triple renewable energy investment, according to new documents seen by Reuters. The COP28 climate summit hosts are working with other governments to sign onto a pledge in the runup to the UN climate negotiations later this month in Dubai that would agree to triple renewable energy yet this decade. A launch event could take place at the beginning of the summit, a US State… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-US-UAE-Pressure-Other-Govts-To-Join-Deal-To-Triple-Renewable-Energy.html |

|

What’s Hezbollah’s Next Step?The ongoing conflict between Israel and the Palestinian group Hamas is currently viewed by oil and gas markets as a contained regional issue. However, concerns persist regarding the potential for escalation, particularly if other parties like Hezbollah in Lebanon or Iran become directly involved. Recent missile and drone attacks by Houthi rebels in Yemen, believed to be backed by Iran, have placed regional armed forces on high alert. Simultaneously, Iranian-supported militias in Iraq and Syria have been targeting American forces, adding to the… Read more at: https://oilprice.com/Energy/Energy-General/Whats-Hezbollahs-Next-Step.html |

|

U.S. Gasoline Refining Profits Tumble As Demand WeakensThe U.S. gasoline crack spread – a leading refining profitability indicator – slumped in October to the lowest level in nearly three years amid seasonally weaker American gasoline demand and the switch to the cheaper winter-grade gasoline, the Energy Information Administration said on Wednesday. In October, the crack spread, or the difference between the price of a wholesale petroleum product and the crude oil price, averaged 16 cents per gallon, the lowest monthly average since December 2020. The crack spread between New York Harbor… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Refining-Profits-Tumble-As-Demand-Weakens.html |

|

Oil Unchanged After Minor Inventory BuildCrude oil prices remained largely unchanged today after the Energy Information Administration reported an inventory build of a modest 800,000 barrels for the week to October 27. A day earlier, the American Petroleum Institute had estimated an inventory increase of 1.35 million barrels for the period, also reporting declines in gasoline and distillate stocks. The EIA’s latest weekly estimate compares with a crude oil inventory build of 1.4 million barrels for the third week of October. In fuels, meanwhile, the EIA reported mixed changes in… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Unchanged-After-Minor-Inventory-Build.html |

|

Russia And China Look To Speed Up Development Of New Natural Gas RouteRussia’s gas giant Gazprom is working with China to further raise Russian pipeline deliveries to the Chinese market and is discussing speeding up the start of supply via the Far Eastern route, Xie Jun, vice president at China National Petroleum Corporation (CNPC), said at a gas forum in Russia on Wednesday. “Our company and PJSC Gazprom are striving to build a closer energy partnership, and are systematically accelerating implementation of the gas supply project along the Far Eastern route,” Xie Jun said, as quoted by Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-And-China-Look-To-Speed-Up-Development-Of-New-Natural-Gas-Route.html |

|

Gold Nears $2,000 Amid Global TensionsVia Metal Miner For decades, gold has remained the best-performing asset class, providing double-digit returns for investors. True to form, gold demand this quarter remains above the long-term average as precious metal prices continue to move in response to global events. According to the World Gold Council (WGC), gold buying by central banks also continues at a scorching pace. And while jewelry demand declined a wee bit due to high prices, it was a mixed bag on the investment front. According to Council data, demand for the yellow… Read more at: https://oilprice.com/Metals/Gold/Gold-Nears-2000-Amid-Global-Tensions.html |

|

BP Executive Describes The U.S. Offshore Wind Industry As “Fundamentally Broken”The U.S. offshore wind industry is “fundamentally broken” and needs a reset, a clean energy executive at supermajor BP said at the FT Energy Transition summit on Wednesday. But the regulatory and permitting environment for the industry can be fixed, Anja-Isabel Dotzenrath, head of Gas and Low Carbon Energy at BP, said on the conference, as carried by Reuters. Currently, the U.S. regulatory environment is challenging for developers due to a lack of mechanisms to adjust for inflation, permitting issues, and a lag between… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Executive-Describes-The-US-Offshore-Wind-Industry-As-Fundamentally-Broken.html |

|

Shares Of The World’s Top Offshore Wind Firm Drop 20% On Scrapped U.S. ProjectsØrsted is ceasing the development of two offshore wind projects in the United States due to supply chain delays and higher interest rates, the world’s biggest offshore wind developer said on Wednesday, which sent its shares plummeting by nearly 20% in Copenhagen. Orsted warned in August that it could face up to $2.3 billion (16 billion Danish crowns) of impairments on its U.S. project portfolio due to supply chain delays, higher interest rates, and the possible inability to qualify for additional tax credits beyond 30%. Now Ørsted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shares-Of-The-Worlds-Top-Offshore-Wind-Firm-Drop-20-On-Scrapped-US-Projects.html |

|

Fed holds rates steady, upgrades assessment of economic growthThe Federal Reserve on Wednesday again held benchmark interest rates steady amid a backdrop of a growing economy and labor market. Read more at: https://www.cnbc.com/2023/11/01/fed-meeting-november-2023-.html |

|

Stocks rally to start November after Fed decision, Dow gains more than 200 points: Live updatesThe Federal Reserve left rates unchanged in November. Read more at: https://www.cnbc.com/2023/10/31/stock-market-today-live-updates.html |

|

Treasury details plans to step up size of bond sales to manage growing debt load and higher ratesThe Treasury Department announced plans to accelerate the size of its auctions as it looks to handle its heavy debt load and with financing costs rising. Read more at: https://www.cnbc.com/2023/11/01/treasury-details-plans-to-step-up-size-of-bond-sales-to-manage-growing-debt-load-and-higher-rates.html |

|

IRS announces 2024 retirement account contribution limits: $23,000 for 401(k) plans, $7,000 for IRAsThe IRS has increased the 401(k) plan contribution limits for 2024, allowing employees to defer up to $23,000 into workplace plans, up from $22,500 in 2023. Read more at: https://www.cnbc.com/2023/11/01/irs-401k-ira-contribution-limits-for-2024.html |

|

Here are Wall Street’s favorite stocks into November — all expected to rise more than 20%CNBC Pro screened for stocks that are holding up well, have a consensus rating of buy and are estimated to have at least 20% upside. Read more at: https://www.cnbc.com/2023/11/01/here-are-wall-streets-favorite-stocks-into-november-all-expected-to-rise-more-than-20percent.html |

|

DoubleLine’s Gundlach says interest rates are going to fall as recession arrives early 2024“I do think rates are going to fall as we move into a recession in the first part of next year,” Gundlach said on CNBC’s “Closing Bell” Wednesday. Read more at: https://www.cnbc.com/2023/11/01/gundlach-says-rates-are-going-to-fall-as-recession-lands-in-early-2024.html |

|

Sam Bankman-Fried built crypto empire on ‘pyramid of deceit,’ prosecutors say in closingClosing arguments kicked off on Wednesday in Sam Bankman-Fried’s criminal fraud trial, with prosecutors walking the jury through four weeks of evidence Read more at: https://www.cnbc.com/2023/11/01/sbf-crypto-empire-built-on-pyramid-of-deceit-prosecutors-argue.html |

|

Donald Trump Jr. begins testifying at $250 million New York fraud trialDonald Trump Jr., Eric Trump, former President Donald Trump and Ivanka Trump are all set to testify in New York Attorney General Letitia James’ fraud trial. Read more at: https://www.cnbc.com/2023/11/01/trump-fraud-trial-donald-trump-jr-to-testify.html |

|

Apple expected to post fourth consecutive quarterly sales decline ThursdayAnalysts haven’t missed Apple’s lack of growth this year and want to see the company thriving again. Read more at: https://www.cnbc.com/2023/11/01/apple-q4-2023-earnings-preview-fourth-consecutive-sales-decline-expected.html |

|

Israel-Hamas war live updates: Evacuations begin in Gaza; White House says no plans to put troops on the groundUntil now, the Rafah crossing has primarily facilitated deliveries of humanitarian aid to resource-deprived Gaza, where fighting continues. Read more at: https://www.cnbc.com/2023/11/01/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Why dealers say EV sales have slowedEV inventories have been piling up at dealerships in 2023, and are selling far more slowly than their gasoline counterparts. Read more at: https://www.cnbc.com/2023/11/01/why-dealers-say-ev-sales-have-slowed.html |

|

The Federal Reserve leaves rates unchanged. Here’s what that means for your walletThe Federal Reserve said it would leave rates unchanged in November. For consumers, however, it won’t get any less expensive to borrow. Read more at: https://www.cnbc.com/2023/11/01/the-federal-reserve-leaves-rates-unchanged-how-it-impacts-your-money.html |

|

Spirit Halloween lives on, even when the holiday ends and stores closeSpirit Halloween locations may close after Halloween, but the business remains hard at work year-round. Read more at: https://www.cnbc.com/2023/11/01/spirit-halloween-lives-on-when-holiday-ends.html |

|

Why Target Date Funds Fail Investors: A $3 Trillion DelusionAuthored by Michael Lebowitz via RealInvestmentAdvice.com, Morningstar estimates that as of 2022, there is nearly $3 trillion invested in target date mutual funds. Per Morningstar: Target date strategies remain the investment vehicle of choice for retirement savers. Whether retirement savers in target date funds know it or not, and we presume most don’t, they are mindlessly investing their wealth. The allocations between stocks and bonds in these funds are not based on risk or reward but solely on the calendar. Managing target date funds requires zero investment expertise, yet mutual fund and ETF managers rake in hundreds of millions of dollars a year in management fees. The volatile market environment helps us appreciate why target date funds are foolish. What Are Target Date Funds?

Target Funds are passive mutual funds run by simple algorithms. To be frank, the word algorithm makes their investment process seem more complicate … Read more at: https://www.zerohedge.com/personal-finance/why-target-date-funds-fail-investors-3-trillion-delusion |

|

Joe Biden Snagged Another $40K In ‘Laundered’ Chinese Money From Brother’s CEFC Payment: ComerRemember when Democrats insisted that Trump was compromised by Russia because of some alleged loan he had in the early 90’s according to ‘several sources with knowledge’ (who never materialized)? The same Democrats – and the same media, are of course dead silent over what’s now grown to $240,000 in laundered Chinese that ended up in Joe Biden’s pocket via his brother. We know, we know – huge shock.

On Wednesday, the House Oversight Committee revealed that President Biden received $40,000 in Chinese funds which were “laundered” through his brother, James Biden, in a “complicated financial transaction” marked as a ‘loan,’ which took place just weeks after Hunter Biden threatened the Chinese with his father’s wrath in a July 30, 2017 text message to a CEFC China Energy empl … Read more at: https://www.zerohedge.com/political/joe-biden-snagged-another-40k-laundered-chinese-money-brothers-cefc-payment-comer |

|

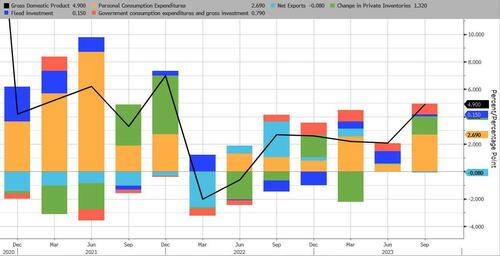

The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%Remember when we mocked the BEA’s recent report that Q3 GDP had hit a scorching 4.9% (well above estimates) on the back of such laughably “growth” factors as surging inventories and government consumption…

… and said prepare for Bidenomics to collapse in Q4? Well it just did, and not once but twice. First, it was the ISM Chair Tim Fiore who earlier today said that “the past relationship between the Manufacturing PMI and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis.” Translation: the econo … Read more at: https://www.zerohedge.com/markets/partys-over-atlanta-fed-slashes-q4-gdp-estimate-23-12 |

|

Watch Live: Fed Chair Powell Tries Not To Break AnythingNo change in policy rates… as expected; and a barely-changed statement, mean all eyes will be on Fed Chair Powell for the nuance leaning hawkish or dovish.

With money markets and many Fed officials believing that the Fed is done with rate-hikes, Powell will not want to rock the boat of the central bank “proceeding carefully” to let cumulative tightening continue to work through as inflation trends lower and the labor market rebalances. His recent comments at The Economic Club of New York suggested ‘satisfaction’ with current policy settings… with the ubiquitous caveat that they are ‘data dependent’. Powell will be treading very carefully as, given the addition of the term “financial conditions” means anything less than the right amount of hawkishness will prompt the kind of reflexive gains in bonds and stocks that will reverse the tightening of financial conditions that he has been quietly comfortably allowing. < … Read more at: https://www.zerohedge.com/markets/watchlive-fed-chair-powell-tries-not-break-anything |

|

US Federal Reserve holds interest rates at 22-year highThe world’s biggest economy keeps borrowing costs higher in a bid to control price rises. Read more at: https://www.bbc.co.uk/news/business-67290817?at_medium=RSS&at_campaign=KARANGA |

|

FTX: Prosecutors accuse Crypto King Sam Bankman-Fried of ‘deceit’Sam Bankman-Fried is facing charges of fraud and money laundering, which he denies. Read more at: https://www.bbc.co.uk/news/business-67289430?at_medium=RSS&at_campaign=KARANGA |

|

Rishi Sunak: AI firms cannot ‘mark their own homework’Governments must act to protect citizens from potential AI risks, prime minister tells the BBC. Read more at: https://www.bbc.co.uk/news/technology-67285315?at_medium=RSS&at_campaign=KARANGA |

|

Musk & Tesla see combined $100 bn wealth erosion since Twitter takeoverElon Musk’s net worth and Tesla’s market cap have seen a combined loss of about $100 billion since he took over Twitter in October-end last year. This is in addition to X’s (formerly Twitter) valuation markdown to $19 billion. Musk spent $44 billion on Twitter a year ago to allow more free speech and turn it into an ‘everything app’. (Source: NYT News Service, finitiv, Bloomberg, TOI) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/musk-tesla-see-combined-100-bn-wealth-erosion-since-twitter-takeover/deep-cuts/slideshow/104893548.cms |

|

7 consumer discretionary stks hit 52-week high on WednesdayDuring Wednesday’s trading session, the benchmark index Sensex dropped around 284 points, ending the day at 63,591. Despite this decline, 7 stocks from the BSE Consumer Discretionary index reached their highest prices in the last 52 weeks. The 52-week high holds significant importance for traders and investors as it serves as a crucial technical indicator for assessing a stock’s present value and anticipating potential price fluctuations. This figure represents the highest price at which a stock has traded over the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/7-consumer-discretionary-stocks-hit-52-week-high-rally-up-to-25-in-a-month/stoke-ideas/slideshow/104893898.cms |

|

Tata Steel to issue 7.58 crore shares to Tata Steel Long Products shareholders under merger planShareholders of Tata Steel Long Products will get 67 shares of Tata Steel for every 10 shares held by them in the former. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tata-steel-to-issue-7-58-crore-shares-to-tata-steel-long-products-shareholders-under-merger-plan/articleshow/104894601.cms |

|

Bond Report: 2-year Treasury yield slips below 5% after Fed delivers another pause in interest rate hikesYields on U.S. government debt remain lower after Federal Reserve officials took no action on interest rates. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728D-F87AB98A8E70%7D&siteid=rss&rss=1 |

|

The Tell: Wall Street analysts are souring on stocks. That could mean the S&P 500 is poised for a 15% rally.Wall Street analysts are souring on U.S. stocks. Historically, that has meant that the market is likely to climb during the coming months, with gains sometimes breaking into double-digit percentage territory. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728E-C40BDFD475E3%7D&siteid=rss&rss=1 |