Summary Of the Markets Today:

- The Dow closed up 124 points or 0.38%,

- Nasdaq closed up 0.48%,

- S&P 500 closed up 0.65%, High 4,196: 4,200 = critical resistance level)

- Gold $1,994 down $12.00,

- WTI crude oil settled at $81 down $1.10,

- 10-year U.S. Treasury 4.901% up 0.024 points,

- USD Index $106.65 up $0.530,

- Bitcoin $34,478 down $59,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In August 2023, the CoreLogic S&P Case-Shiller Index increased by 2.6% year over year, the second month of annual increases following two months of annual declines. With the rebound in prices this year, home prices are now up 0.4% compared with the June 2022 peak, but up by 6.4% from the January 2023 bottom. A quote from the Corelogic report:

Persistent mortgage rate increases have put the U.S. housing market in a quagmire, driving home sales activity to the lowest level in 15 years. As of September, year-to-date home sales are trending 22% below last year’s levels and 23% below 2019, according to CoreLogic MLS PIN data. Nevertheless, sales volume may further deteriorate in the coming months as mortgage rates continue to rise. Currently, mortgage rates moving from 3% to 8% wiped out about 36% of homebuyers’ purchasing power. Nevertheless, while existing home sales have slumped, prices have remained remarkably steady.

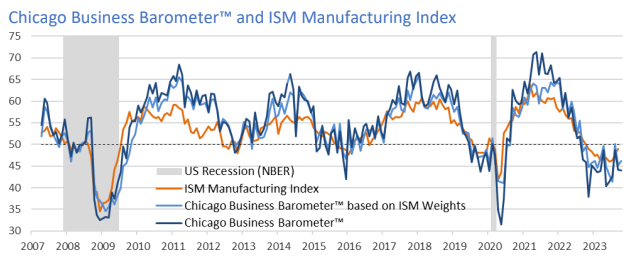

The Chicago Business Barometer fell -0.1 points to 44.0 from 44.1 in September. It remains below the 48.7 level seen in August but broadly in line with the 2023 average of 44.2. The markets consider the Chicago Business Barometer a peak into the soon-to-be-released ISM manufacturing survey. The current numbers suggest that manufacturing is in a recession in the U.S.

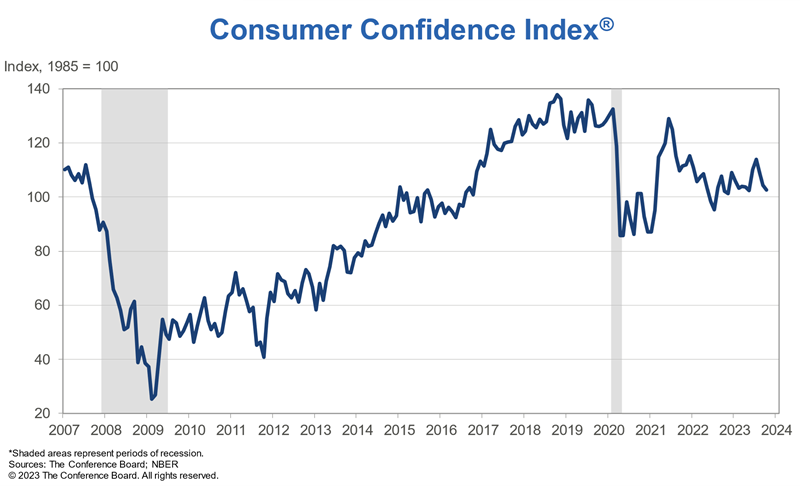

The Conference Board Consumer Confidence Index declined moderately in October to 102.6 (1985=100), down from an upwardly revised 104.3 in September. Dana Peterson, Chief Economist at The Conference Board summarized the reasons for the low confidence:

Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular. Consumers also expressed concerns about the political situation and higher interest rates. Worries around war/conflicts also rose, amid the recent turmoil in the Middle East. The decline in consumer confidence was evident across householders aged 35 and up, and not limited to any one income group.

Here is a summary of headlines we are reading today:

- Hedge Funds Bet Big On Uranium Stocks

- U.S. Crude Production Breaks Records

- Gold And Silver Shine As Global Safe Havens

- China’s Economic Woes Weigh On Oil Prices

- Oil Prices Could Test $115 If Hamas-Israel War Escalates Into Regional Conflict

- S&P 500 closes higher Tuesday, but logs first 3-month losing streak since 2020: Live updates

- November is typically the best month of the year for these 4 Dow stocks

- Israel-Hamas war live updates: Dozens of deaths reported in Gaza refugee camp airstrike; Hamas says it clashed with Israeli forces

- Treasury Department announces new Series I bond rate of 5.27% for the next six months

- UAW Strike Ends But Spiking Labor Costs Will Hamper Detroit For Years To Come

- IPO Report: Ares Acquisition Corp., X-energy scrap $1.8B merger due to ‘persistently volatile public markets’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Hedge Funds Bet Big On Uranium StocksAs uranium ore trades at records highs, several hedge fund managers are expanding their allocations to uranium stocks, with a conviction that an increasing embrace of nuclear energy as part of a “green” future — along with geopolitically-rooted ambitions to reduce dependence on Russian oil and gas — means the trend has a lot of room to run. A dozen years after the disaster at Japan’s Fukashima reactor put nuclear energy on worldwide probation — and in, Germany, gave it a death sentence — various factors are combining to bring… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Hedge-Funds-Bet-Big-On-Uranium-Stocks.html |

|

New Tech Hubs Pave The Way for U.S. Leadership In Green InnovationPresident Biden has announced the creation of 31 new regional tech hubs aimed at advancing technologies critical to economic growth, national security and job creation. The growth of these designated areas is expected to support local development across several states, expanding regional economies and bringing in new jobs. Further, the move is expected to attract high levels of private investment in innovative new technologies supporting the green transition. For the last two years, President Biden has been driving forward his Made in America… Read more at: https://oilprice.com/Energy/Energy-General/New-Tech-Hubs-Pave-The-Way-for-US-Leadership-In-Green-Innovation.html |

|

Drought Increases VLGCs Shipping Rates To Record HighsA drought is causing significant delays for ships traversing the Panama Canal and increasing shipping rates for Very Large Gas Carriers to record highs. This, in turn, is increasing shipping costs for LPG from the United States, the Energy Information Administration said on Tuesday. The Panama Canal Authority has stated that the water levels at the artificial Gatun Lake are at their lowest levels in nearly 30 years on lower-than-normal precipitation. Gatun Lake lies between the Atlantic and Pacific locks, and is the reservoir for holding the water… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drought-Increases-VLGCs-Shipping-Rates-To-Record-Highs.html |

|

Belt And Road Bailouts Are Soaring As Partners StruggleAs China’s Belt and Road Initiative enters its second decade, the country has been celebrating with much pomp and many global leaders in attendance. But, as Statista’s Katharina Buchholz details below, China’s high-level infrastructure and international development program has not been free of controversy. The Kiel Institute for the World Economy has identified a major rise in emergency loans to countries having difficulty repaying debt taken on as part of Belt and Road projects. Additionally, China’s loan conditions and transparency practices… Read more at: https://oilprice.com/Geopolitics/International/Belt-And-Road-Bailouts-Are-Soaring-As-Partners-Struggle.html |

|

U.S. Crude Production Breaks RecordsU.S. crude oil production hit an all-time high in August, according to new data published by the Energy Information Administration on Tuesday, with production surpassing pre-covid levels. U.S. field production of crude oil reached 404.6 million barrels during the month of August, new EIA data shows, for an average of 13.05 million barrels per day–squarely breaking the previous record U.S. drillers set in July of 401.73 million barrels. Increases in production were seen in PADDs 1, 2, 3, and 4, with the largest percentage increase in production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Crude-Production-Breaks-Records.html |

|

Gold And Silver Shine As Global Safe HavensVia Metal MinerThis week, precious metals once again served as safe-haven assets for investors and market participants. That said, some precious metal prices, including platinum, continued to slide due to bearish pressure followed by falling demand. While the world continues to monitor the conflict in the Middle East, metals such as gold and silver have seen an uptick in demand. Indeed, the war is one of the main drivers causing an uptrend within these metals. Generally investors and traders alike will seek lower-risk assets during uncertain times.… Read more at: https://oilprice.com/Metals/Gold/Gold-And-Silver-Shine-As-Global-Safe-Havens.html |

|

BP’s Green Transition Plan Faces Investor SkepticismBP missed analyst expectations in its third-quarter earnings, with a 60 percent year-on-year decline in profits for the three months to October, blaming the underwhelming performance on poor gas trading. European inventories are well-stocked ahead of winter, slashing the earnings of commodities traders and making fossil fuel trading less lucrative. This has fuelled underwhelming trading across the industry, and BP‘s downturn in earnings follows sharp third-quarter declines posted over the past week from rivals including Chevron, Equinor,… Read more at: https://oilprice.com/Energy/Energy-General/BPs-Green-Transition-Plan-Faces-Investor-Skepticism.html |

|

Why Wall Street Financiers Are Flocking To Saudi ArabiaSaudi Arabia welcomed last week top financiers and technology tycoons to attract additional investments in its economy, which it is looking to diversify from oil. The Future Investment Initiative (FII) forum, dubbed by many observers ‘Davos in the Desert’, took place weeks after the power balance in the Middle East was upended again after the Hamas attack on Israel and the subsequent Israeli offensive on Gaza. The forum was attended by prominent Wall Street bankers such as JP Morgan’s chief executive… Read more at: https://oilprice.com/Energy/Energy-General/Why-Wall-Street-Financiers-Are-Flocking-To-Saudi-Arabia.html |

|

PetroChina Expects 10% Rise In Chinese Fuel Demand In Q4China’s fuel demand is set to jump by 10% this quarter compared to the same period of 2022 thanks to the latest economic stimulus policies, Huang Yongzhang, the president of state energy giant PetroChina, has said. “In the fourth quarter, China’s economic stimulus policy is going to yield more results, domestic consumptions are set to rebound further…and demand for industrial products is going to improve,” Huang told investors in an online roadshow, as carried by Reuters. PetroChina, the second largest refiner in the country… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Expects-10-Rise-In-Chinese-Fuel-Demand-In-Q4.html |

|

China’s Economic Woes Weigh On Oil PricesOil prices are once again under pressure due to uncertainty about China’s economy, with the latest manufacturing data reigniting demand fears.Chart of the Week- Uranium prices have soared in recent days to $74 per pound, a 50% increase in 2023 to date, as lower production guidance from Cameco and production disruptions in Niger added to worries about the world producing enough U308 to meet the industry’s growing needs.- Global nuclear capacity currently consists of 440 nuclear reactors in 33 jurisdictions, however by 2030 there will be some… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Economic-Woes-Weigh-On-Oil-Prices.html |

|

Oil Prices Could Test $115 If Hamas-Israel War Escalates Into Regional ConflictWeakening global economic growth could keep oil prices below $90 per barrel this year and next, barring a major escalation in the Hamas-Israel war that could spill over the Middle East and threaten supply, which could send oil to above $100 and testing $115 a barrel, analysts said in the monthly Reuters poll. Brent Crude prices are expected to average $84.80 per barrel this year and $86.62 next year, a Reuters survey of 40 analysts and economists found. So far this year, Brent Crude prices have averaged $82.60 a barrel. The estimates in the October… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Could-Test-115-If-Hamas-Israel-War-Escalates-Into-Regional-Conflict.html |

|

Russia’s Oil Exports Climb Despite Its Commitment To Cut SupplyRussia’s crude oil exports by sea have been exceeding the country’s targeted export reductions as part of the OPEC+ pact for weeks, with the most recent week’s observed shipments as high as 360,000 barrels per day (bpd) above target, tanker-tracking data monitored by Bloomberg showed on Tuesday. In the week to October 29, Russia shipped around 3.64 million bpd of crude oil from its oil export terminals, up by 110,000 compared to the week prior, according to the data reported by Bloomberg’s Julian Lee. Higher shipments… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Oil-Exports-Climb-Despite-Its-Commitment-To-Cut-Supply.html |

|

Marathon Petroleum Tops Profit Estimates On Strong Fuel DemandStrong U.S. fuel demand helped Marathon Petroleum (NYSE: MPC) easily beat analyst estimates after reporting on Tuesday an adjusted net income of $3.2 billion for the third quarter of 2023. Adjusted earnings per share came in at $8.14, above the analyst consensus estimate of $7.75 compiled by The Wall Street Journal. In the refining and marketing segment, adjusted EBITDA was $16.06 per barrel for the third quarter of 2023, down from $19.87 per barrel for the third quarter of 2022, due to lower market crack spreads. The refining and marketing (R&M)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marathon-Petroleum-Tops-Profit-Estimates-On-Strong-Fuel-Demand.html |

|

BP Misses Q3 Earnings Forecast On Weak Natural Gas TradingBP (NYSE: BP) reported on Tuesday lower-than-forecast earnings for the third quarter as weak gas marketing and trading and a charge in offshore wind weighed on the results and couldn’t offset a strong oil trading business. BP said its underlying replacement cost profit – the metric closest to net profit – was $3.3 billion for the third quarter of this year, up from $2.6 billion for the previous quarter. The earnings, however, were well below the analyst estimate for the third quarter of $4 billion. Following the results… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Misses-Q3-Earnings-Forecast-On-Weak-Natural-Gas-Trading.html |

|

Saudi Arabia’s Economy Contracts In Q3 As Oil Production Cuts Weigh On GrowthSaudi Arabia’s economy shrank in the third quarter by 4.5% year-over-year, due to lower oil production and activities, the General Authority for Statistics of the world’s top crude oil exporter said on Tuesday. The flash estimates of the authority showed that lower oil activities dragged down the economy into the first quarterly decline since the beginning of 2021. Non-oil activities and government activities grew by 3.6% and 1.9%, respectively, on an annual basis, during the third quarter. Seasonally adjusted real gross domestic product… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Economy-Contracts-In-Q3-As-Oil-Production-Cuts-Weigh-On-Growth.html |

|

S&P 500 closes higher Tuesday, but logs first 3-month losing streak since 2020: Live updatesThe major averages are set to close out a dismal month that saw Treasury yields surge to multiyear highs. Read more at: https://www.cnbc.com/2023/10/30/stock-market-today-live-updates.html |

|

Before the Fed decision, all eyes will be on this big Treasury debt announcement WednesdayWith debt, deficits and bond yields all surging, investors are watching closely how the government will go to market with its borrowing needs. Read more at: https://www.cnbc.com/2023/10/31/treasury-refunding-debt-announcement-all-eyes-on-it-before-fed.html |

|

Microsoft releases big Windows 11 update with Copilot AI assistant includedMicrosoft is bringing an artificial intelligence assistant to its next-generation PC operating system. It might prove more informative than Siri on the Mac. Read more at: https://www.cnbc.com/2023/10/31/microsoft-releases-windows-11-2023-update-version-23h2-with-copilot.html |

|

Jack Lew confirmed by Senate as Biden’s ambassador to IsraelThe Senate confirmed former treasury secretary Jack Lew to serve as U.S. ambassador to Israel. Read more at: https://www.cnbc.com/2023/10/31/jack-lew-confirmed-by-senate-as-bidens-ambassador-to-israel.html |

|

Sam Bankman-Fried defense rests in criminal trial, closing arguments kick off WednesdaySam Bankman-Fried’s criminal trial is about to wrap up after the defendant’s testimony concluded on Tuesday and the jury was sent home Read more at: https://www.cnbc.com/2023/10/31/sam-bankman-fried-defense-rests-in-criminal-trial-jury-decision-nears.html |

|

November is typically the best month of the year for these 4 Dow stocksOctober was a bleak month for the stock market, but history says that there could be relief in store for at least these four Dow Industrial companies. Read more at: https://www.cnbc.com/2023/10/31/november-is-usually-the-best-month-of-the-year-for-these-4-dow-stocks.html |

|

JetBlue sinks to 12-year low as airline forecasts more losses, Spirit antitrust trial beginsJetBlue faces the Justice Department in an antitrust trial over the carrier’s proposed acquisition of budget carrier Spirit Airlines. Read more at: https://www.cnbc.com/2023/10/31/jetblue-airways-forecasting-loss-spirit-antitrust-trial-kicks-off.html |

|

Israel-Hamas war live updates: Dozens of deaths reported in Gaza refugee camp airstrike; Hamas says it clashed with Israeli forcesClashes between Israeli forces and Hamas have escalated in the northwest of the Gaza Strip, according to an outlet affiliated with the militant group. Read more at: https://www.cnbc.com/2023/10/31/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Treasury Department announces new Series I bond rate of 5.27% for the next six monthsThe U.S. Department of the Treasury announced the new rate for Series I bonds through April 2024. Read more at: https://www.cnbc.com/2023/10/31/treasury-series-i-bond-rate-is-5point27percent-through-april-2024.html |

|

Biden will meet with China’s Xi Jinping next month, White House saysPresident Joe Biden will meet with Chinese President Xi Jinping next month, the White House says. Read more at: https://www.cnbc.com/2023/10/31/biden-will-meet-with-chinas-xi-jinping-next-month-white-house-says.html |

|

Zombie firms are filing for bankruptcy as the Fed commits to higher ratesBusinesses with rising debt and sinking sales are filing for bankruptcy, a sign of healthy creative destruction to U.S. central bankers. Read more at: https://www.cnbc.com/2023/10/31/zombie-firm-bankruptcies-amid-fed-interest-rate-hikes.html |

|

Southern California wildfire forces 4,000 residents to evacuate homesThe Highland Fire grew overnight to 2,200 acres and was zero percent contained as of Tuesday morning. Read more at: https://www.cnbc.com/2023/10/31/southern-california-wildfire-forces-residents-to-evacuate.html |

|

Three charged with sending Russia over $7 million in electronics to aid war on UkraineNikolay Goltsev, Salimdzhon Nasriddinov and Kristina Puzyreva are accused of evading sanctions in order to send Russia equipment used in their missile systems. Read more at: https://www.cnbc.com/2023/10/31/three-charged-with-sending-russia-electronics-for-ukraine-war.html |

|

Putin Issues Scathing Attack On West’s Role In Gaza Crisis, Blames Spies For Dagestan Airport RiotRussia says police have arrested 60 people in the wake of the Sunday mob attack on an airport in the southern Russian republic of Dagestan. Local police in the Muslim-dominant region said they had identified 150 rioters who had breached airport security while looking for Jews said to have arrived on a flight from Tel Aviv. Dramatic videos had shown men swarming an airplane, with some even jumping on its wings and waiving Palestinian flags, while the passengers huddled inside and the captain refused to open the door.

Read more at: https://www.zerohedge.com/geopolitical/putin-issues-scathing-attack-wests-role-gaza-crisis-blames-spies-dagestan-airport-riot |

|

UAW Strike Ends But Spiking Labor Costs Will Hamper Detroit For Years To ComeAfter the six week UAW strike ended officially yesterday, there’s one thing we know for sure: it’s going to put upward pressure on the price of vehicles for time to come. The six-week strike concluded on Monday when General Motors secured a provisional labor agreement with the UAW, following similar deals with Ford and Stellantis. But as the Wall Street Journal pointed out on Monday, the labor costs are going to hamper the automakers for years to come. Ford has already come out and said the new deal will add $850 to $900 per vehicle in additional costs. UAW President Shawn Fain, apparently unable to grasp the concept that if the automakers go bankrupt there’s a chance no one will have jobs, proudly proclaimed on Monday: “We wholeheartedly believe that our strike squeezed every last dime out of General Motors.” He added: “When we return to the bargaining table in 2028, it won’t just be with the Big Three, but with the Big Five or Big Six.” The Journal noted that by the contract’s 2028 expiration, most union workers at Detroit automakers would earn mid-$80,000s annually, excluding overtime. Initially resistant, companies eventually agreed to reinstate cost-of-living adjustments, relinquished by the UAW in 2009. The union also secured several key victories, including the right to strike over plant closures, better pay for temp workers, and a shorter path to max wages. Additionally, the UAW won the … Read more at: https://www.zerohedge.com/markets/uaw-strike-ends-spiking-labor-costs-will-hamper-detroit-years-come |

|

Peter Schiff: The US Isn’t Japan… It’s Argentina!Via SchiffGold.com, Does the massive national debt matter?

A lot of people don’t think it does, at least not yet. They point to Japan as an example of a country that has a much higher debt-to-GDP ratio and is doing fine. Peter Schiff said they’re looking at the wrong country. The US is more like Argentina than Japan. The debt to GDP ratio in Japan is over 200%. The US debt-to-GDP ratio is only around 125%. If Japan is doing fine, why should we worry here in the US? Peter notes the fact that Japan isn’t really doing “fine.”

Read more at: https://www.zerohedge.com/economics/peter-schiff-us-isnt-japan-its-argentina |

|

Israel Announces First Confirmed IDF Troop Deaths Of Gaza Invasion(Update1323ET): Israel has admitted that this war will be long and costly, including in human lives on both sides. It has announced what the IDF says are its first troop casualties of the Gaza campaign which are being publicly disclosed by the military (there could be more that aren’t publicly disclosed). Per Israeli media citing the Tuesday words of Defense Minister Yoav Gallant:

More tanks have been observed pouring into northern Gaza, as the scale of the operation continues to grow by the day.

|

|

Plans to close rail ticket offices in England scrappedThe government tells train firms to ditch the controversial closures, sparking anger from rail bosses. Read more at: https://www.bbc.co.uk/news/business-67263931?at_medium=RSS&at_campaign=KARANGA |

|

Carlsberg cuts ties with ‘stolen’ Russian businessThe Danish brewer says it refused to enter into negotiations after its Russian business was seized. Read more at: https://www.bbc.co.uk/news/articles/cgxkx9g2kn4o?at_medium=RSS&at_campaign=KARANGA |

|

Firms going bust on track for worst year since 2009Insolvencies rise 10% from a year ago in the three months to the end of September, official figures show. Read more at: https://www.bbc.co.uk/news/business-67261798?at_medium=RSS&at_campaign=KARANGA |

|

Q2 Results Tomorrow: What to expect from Britannia, Hero MotoCorp, Sun Pharma & Tata SteelApart from these four, the other major earnings that will be tracked by Dalal Street investors are Adani Wilmar, Ambuja Cements, Godrej Consumer Products, LIC Housing Finance, REC Ltd, Indraprastha Gas, and Kansai Nerolac Paints Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/q2-results-tomorrow-what-to-expect-from-britannia-hero-motocorp-sun-pharma-tata-steel/articleshow/104862996.cms |

|

These 4 Nifty stocks will trade ex-dividend this weekHere are four Nifty stocks that will trade ex-dividend later this week Read more at: https://economictimes.indiatimes.com/markets/web-stories/these-4-nifty-stocks-will-trade-ex-dividend-this-week/slideshow/104862853.cms |

|

4 midcap stocks hit 52-week high on Tuesday. Own any?In Tuesday’s trading session, the benchmark index Sensex saw a drop of approximately 238 points, closing the day at 63,874. However, despite this decline, 4 stocks within the BSE midcap index reached their peak prices in the past 52 weeks. The 52-week high is of significant importance to traders and investors, as it serves as a vital technical indicator for evaluating a stock’s current worth and predicting potential price changes. It represents the highest price at which a stock has traded over the previous year Read more at: https://economictimes.indiatimes.com/markets/stocks/news/4-midcap-stocks-hit-52-week-high-on-tuesday-do-you-own-any/standing-tall/slideshow/104862645.cms |

|

Market Extra: International equities are beating U.S. stocks in ‘rare’ outperformance. Should you lighten up on non-U.S. equities?U.S. stocks are lagging international equities over the past year, in an unusual occurrence, according to DataTrek Research. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728D-7DC9E64A56E6%7D&siteid=rss&rss=1 |

|

IPO Report: Ares Acquisition Corp., X-energy scrap $1.8B merger due to ‘persistently volatile public markets’The deal marks the 165th SPACs that has liquidated this year alone, according to SPAC Research. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728C-E673DBA3981E%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices post a loss for the month as fears of wider Israel-Hamas war fadeOil futures decline on Tuesday, contributing to a monthly loss as a risk premium tied to fears around a widening of the Israel-Hamas war fades. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728C-8E4CF933F5BD%7D&siteid=rss&rss=1 |

Screengrab of footage taken at Makhachkala Uytash airport in Dagestan, via Al JazeeraRussia’s interior ministry said 20 people were injured in the whole ordeal, which many publications are calling an antisemitic pogrom wherein secur …

Screengrab of footage taken at Makhachkala Uytash airport in Dagestan, via Al JazeeraRussia’s interior ministry said 20 people were injured in the whole ordeal, which many publications are calling an antisemitic pogrom wherein secur …