Summary Of the Markets Today:

- The Dow closed up 511 points or 1.58%,

- Nasdaq closed up 1.16%,

- S&P 500 closed up 1.20%, (Low 4,133: 4,200 = critical resistance level)

- Gold $2,006 up $7.60,

- WTI crude oil settled at $83 down $3.03,

- 10-year U.S. Treasury 4.879% up 0.034 points,

- USD Index $106.12 down $0.440,

- Bitcoin $34,444 down $145,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

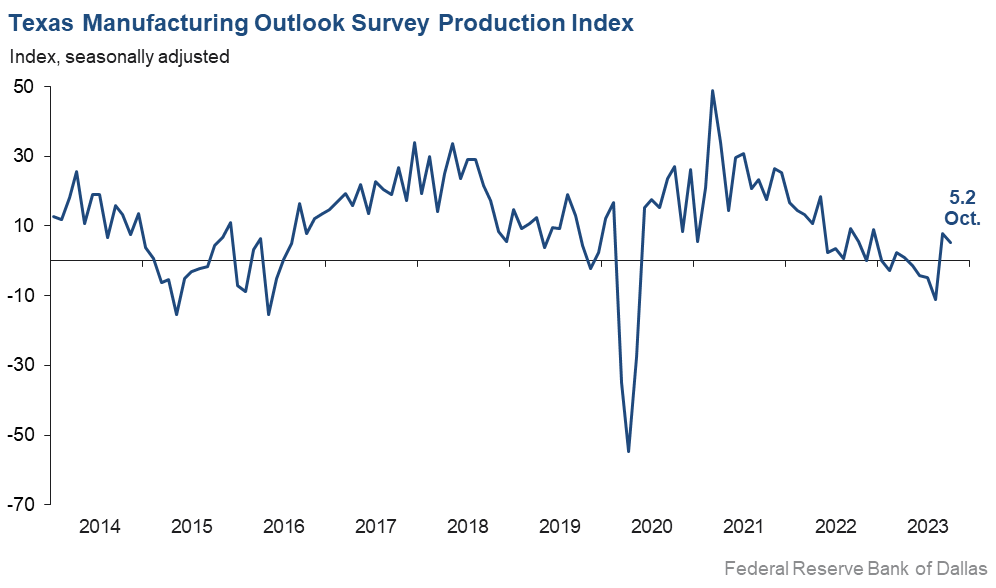

The Texas Manufacturing Outlook Survey declined in October 2023 but remains in positive growth territory. The production index, a key measure of state manufacturing conditions, posted a second positive reading after four months in negative territory. It edged down to 5.2, a reading that signals a modest pace of output expansion. Other measures of manufacturing activity showed mixed signals this month. The new orders index remained negative and slipped four points to -8.8. Most other of the regional fed’s manufacturing surveys show manufacturing remains in a recession.

Here is a summary of headlines we are reading today:

- Oil Prices Plunge 3% as Market Weighs Israeli Attack on Gaza

- China Sees Winter Peak Power Demand Surging By 12%

- Cobalt’s Unexpected Plunge Shocks Global Market

- Uranium Demand Hits Decade High As Nuclear Renaissance Gains Traction

- Weaker Asian Market Could Prompt Saudi Arabia To Halt Oil Price Hikes

- Stocks rebound to start week, Dow rallies 500 points for best day since June: Live updates

- Tesla shares drop 5% on Panasonic battery warning, down 18% since Q3 earnings report

- Shipping industry could lose $10 billion a year battling climate change by 2050

- Israel-Hamas war live updates: Israel confirms a hostage was freed during a ground operation; Netanyahu dubs Hamas hostage video cruel ‘propaganda’

- Saudis On High Alert After Yemen’s Houthis Fire Another Missile At Israel, Fresh Clashes Erupt

- The Ratings Game: McDonald’s set up well for 2024 as digital sales, restaurant growth, ramp up: Wells Fargo

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How The Energy World Will Look In 2030This October, the International Energy Agency (IEA) published its World Energy Outlook 2023, forecasting the likely end-of-decade energy scenario given the current global pipeline and climate policies. While the world’s renewable energy capacity is growing rapidly, thanks to huge investments in recent years and greater support from governments worldwide, the IEA suggests that not enough is being done to achieve end-of-decade global climate goals. And while the IEA is optimistic in its energy outlook, other organisations are doubtful that… Read more at: https://oilprice.com/Energy/Energy-General/How-The-Energy-World-Will-Look-In-2030.html |

|

Oil Prices Plunge 3% as Market Weighs Israeli Attack on GazaOil prices plunged by 3% on Monday as market sentiment hedged its bets that Israel’s ground invasion of Gaza would not have global repercussions impacting oil and gas supplies. On Monday at 1:45 p.m. Brent crude was trading down 3.09% at $87.68 per barrel for a loss of $2.80 on the day. West Texas Intermediate (WTI) was trading down 3.66% at $82.41 per barrel, for a loss of $3.13 on the day. The plunge in prices comes as Israel on Monday intensified its ground invasion in the northern Gaza Strip, with the death toll… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Plunge-3-as-Market-Weighs-Israeli-Attack-on-Gaza.html |

|

The Political And Economic Implications Of The EV TransitionThis essay is based on the opening remarks delivered at a recent SOHO Forum Debate on electric vehicles. If we could imagine a time machine bringing to New York City, an American citizen from the 19th century, odds are the one thing that would seem the most amazing about our time would be the proliferation of the personal automobile. Big buildings, big cities, roads, nighttime illumination would all be imaginable, even if different looking and greater in scale. But the one thing radically different about modern daily life is the convenience and… Read more at: https://oilprice.com/Energy/Energy-General/The-Political-And-Economic-Implications-Of-The-EV-Transition.html |

|

EU Legislation Targets Misleading Carbon ClaimsFollowing the EU ban on companies claiming their products are climate-neutral, many decarbonisation claims from a range of companies are under scrutiny. As international organisations and governments worldwide encourage all industries to decarbonise their operations, many companies have made bold claims about the practices in place used to cut carbon in their supply chains and manufacturing processes. As the trend has grown, many environmentalists have called for greater evidence to back up these claims, accusing many companies of greenwashing… Read more at: https://oilprice.com/Energy/Energy-General/EU-Legislation-Targets-Misleading-Carbon-Claims.html |

|

China Sees Winter Peak Power Demand Surging By 12%China expects its peak power demand could rise by 12.1%, or by 140 gigawatts (GW), this winter, a spokesperson for the National Energy Administration (NEA) said on Monday. Generally, China is certain that its winter power supply is guaranteed, but shortages could occur in the Yunnan province and in Inner Mongolia, according to NEA spokesperson Zhang Xing, quoted by Reuters. Previously, figures by the NEA have shown that the peak power demand in China was at 1,159 GW last winter. This winter, peak demand is expected… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Sees-Winter-Peak-Power-Demand-Surging-By-12.html |

|

Cobalt’s Unexpected Plunge Shocks Global MarketVia Metal Miner Analysts once hailed cobalt as a commodity whose price would rise forever. Used in the cathodes of many lithium-ion batteries to extend the life of the battery cell, investors and mine operators eagerly anticipated high returns on all cobalt investments. However, cobalt prices recently dropped to record lows amid global oversupply and a widespread slowdown in the battery market. Suddenly, those same traders and mine companies are scratching their heads. Most of the world’s cobalt supply originates from the Democratic Republic… Read more at: https://oilprice.com/Metals/Commodities/Cobalts-Unexpected-Plunge-Shocks-Global-Market.html |

|

COP28 And Renewables Groups Seek Tripling Of Clean Power By 2030The world could fast-track the energy transition and cut carbon emissions by tripling global renewable power capacity to 11,000 GW and double average annual energy efficiency improvements by 2030, the COP28 Presidency, the International Renewable Energy Agency (IRENA), and the Global Renewables Alliance (GRA) said on Monday. A report launched by the organizations and the presidency of the COP28 climate summit in Dubai next month offered policy recommendations for governments and the private sector on how to increase global renewable energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/COP28-And-Renewables-Groups-Seek-Tripling-Of-Clean-Power-By-2030.html |

|

China Expands Central Asian Footprint With Billion-Dollar AgreementsDetails are emerging on the bevy of deals signed between Central Asian states and China on the sidelines of the Beijing jamboree celebrating the 10th anniversary of the Belt & Road initiative. Kazakhstan’s presidential press service reported that while President Kassym-Jomart Tokayev was in China in mid-October, officials signed 30 commercial documents worth an estimated $16.54 billion, “including investment and trade agreements, agreements on the transfer of technology for production, the opening of credit lines, etc.”… Read more at: https://oilprice.com/Geopolitics/International/China-Expands-Central-Asian-Footprint-With-Billion-Dollar-Agreements.html |

|

PetroChina Posts Record YoY Net Profit GrowthPetroChina has reported record year-on-year net profit growth of 21%, with third-quarter earnings reaching $6.3 billion on increased output and rising domestic fuel demand. The company saw a 4.3% year-on-year increase in crude oil output during the first nine months of this year and a 6.1% increase in natural gas output. While PetroChina realized lower oil and gas prices during the first nine months of this year, higher domestic fuel demand allowed it to increase production and boost net profit. Total fuel sales increased 13.4%… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Posts-Record-YoY-Net-Profit-Growth.html |

|

Uranium Demand Hits Decade High As Nuclear Renaissance Gains TractionNuclear is back. After decades of decline in the West’s nuclear energy industry, public and private support of nuclear energy is reversing course. As the specter of climate change grows and intensifies, increased nuclear power production has emerged as a promising pathway to solving the world’s energy trilemma: an energy supply that is secure, affordable, and sustainable. While nuclear has received a lot of bad press in the past thanks to high profile nuclear disasters like Fukushima, Chernobyl, and Three Mile Island, its… Read more at: https://oilprice.com/The-Environment/Global-Warming/Uranium-Demand-Hits-Decade-High-As-Nuclear-Renaissance-Gains-Traction.html |

|

Finland Finds Key Rare Earth Minerals For The First TimeTwo rare earth minerals have been found in Finland for the first time in what could be a boost to Europe’s supply of critical minerals necessary for the energy transition. Finnish Minerals Group said on Monday that Sokli and the Geological Survey of Finland had identified two new minerals, kukharenkoite and cordylite, through mineralogical characterization—the first such deposits identified in the country. The recently completed mineralogical analysis was aimed at charting the occurrence of rare earth elements (REE) in minerals. Sokli… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Finland-Finds-Key-Rare-Earth-Minerals-For-The-First-Time.html |

|

World Bank: Major Escalation In Israel-Hamas War Could Send Oil Soaring To $157Oil prices are set to average $81 a barrel in 2024 in case the Hamas-Israel war doesn’t spill over to the region—otherwise, in a ‘large supply disruption’ scenario, prices could spike to as high as $157 per barrel, the World Bank said on Monday. This quarter, oil prices are expected to average $90 per barrel – not too different from the price of oil early on Monday at just below $90, according to the World Bank’s latest Commodity Markets Outlook published today. So far, the conflict between Hamas… Read more at: https://oilprice.com/Energy/Energy-General/World-Bank-Major-Escalation-In-Israel-Hamas-War-Could-Send-Oil-Soaring-To-157.html |

|

The UK Awards 27 New North Sea Oil And Gas LicensesThe North Sea Transition Authority (NSTA), the oil and gas industry regulator, awarded on Monday 27 new licenses in the first batch of the latest licensing rounds, awarding areas with the potential to go into production more quickly than others. The UK launched the 33rd Oil and Gas Licensing Round in October last year, with 931 blocks and part-blocks made available for application. NSTA has received 115 applications from 76 companies for 258 blocks or part blocks. Subject to additional environmental checks, more blocks will be offered, the regulator… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-UK-Awards-27-New-North-Sea-Oil-And-Gas-Licenses.html |

|

Weaker Asian Market Could Prompt Saudi Arabia To Halt Oil Price HikesSaudi Aramco is expected to keep the price of its flagship crude grade for shipping to Asia in December unchanged from November’s pricing in view of lower refining margins in its top market, a Bloomberg survey showed on Monday. Saudi Arabia’s state oil giant Aramco typically announces the prices for the following month around the fifth of each month, setting the pricing trend for the other Middle Eastern oil exporters. A possible pause in the hikes of Saudi Arabia’s official selling prices (OSPs) for the Arab… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Weaker-Asian-Market-Could-Prompt-Saudi-Arabia-To-Halt-Oil-Price-Hikes.html |

|

Chevron Expected To Revitalize Bakken Shale With Hess AcquisitionOil production in the Bakken shale play is set to increase after Chevron’s acquisition of Hess, although volumes are unlikely to hit the records seen before 2020, analysts have told Reuters. Last week, Chevron said it would buy Hess Corporation in an all-stock transaction valued at $53 billion with a total enterprise value, including debt, at $60 billion. The Hess deal will give Chevron 465,000 net acres of high-quality, long-duration inventory in the Bakken supported by the integrated assets of Hess Midstream, Chevron said. In the Bakken,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Expected-To-Revitalize-Bakken-Shale-With-Hess-Acquisition.html |

|

Stocks rebound to start week, Dow rallies 500 points for best day since June: Live updatesTraders braced for a big week filled with a Federal Reserve rate decision, jobs report and Apple’s earnings report. Read more at: https://www.cnbc.com/2023/10/29/stock-market-today-live-updates.html |

|

Treasury to borrow $776 billion in the final three months of the yearOfficials attributed the lower borrowing needs to higher receipts, which were offset somewhat by greater expenses. Read more at: https://www.cnbc.com/2023/10/30/treasury-to-borrow-776-billion-in-the-final-three-months-of-the-year.html |

|

Tesla shares drop 5% on Panasonic battery warning, down 18% since Q3 earnings reportTesla short sellers have made more than $3 billion since the company’s third-quarter earnings call, according to data from Ortex. Read more at: https://www.cnbc.com/2023/10/30/tesla-shares-drop-5percent-on-panasonic-battery-warning.html |

|

Shares of ON Semiconductor fall 21% as fourth-quarter guidance disappoints Wall StreetON Semiconductor shares fell after the company offered weaker-than-expected guidance. Read more at: https://www.cnbc.com/2023/10/30/shares-of-on-semiconductor-fall-20percent-on-bad-q4-guidance.html |

|

Israeli economists urge Netanyahu to re-open the nation’s budget to account for the warHundreds of influential Israeli economists are warning the government that it must make big economic changes quickly as the war with Hamas drags on. Read more at: https://www.cnbc.com/2023/10/30/israel-hamas-war-economists-urge-netanyahu-to-change-budget.html |

|

These stocks have earnings momentum heading into their reports this weekCNBC Pro screened for the S&P 500 companies reporting this week that analysts are most excited about, leading them to lift their earnings estimates. Read more at: https://www.cnbc.com/2023/10/30/these-stocks-have-earnings-momentum-heading-into-their-reports-this-week.html |

|

Shipping industry could lose $10 billion a year battling climate change by 2050Shipping is at increasing risk from tropical storms, inland flooding, sea level rise, drought and extreme heat. Read more at: https://www.cnbc.com/2023/10/30/climate-change-to-cost-shipping-industry-10-billion-a-year-by-2050.html |

|

Education Department penalizes Missouri lender for error that made 800,000 student loan borrowers delinquentThe Education Department announced it would penalize student loan servicer Mohela for its failure to send timely billing statements to 2.5 million borrowers. Read more at: https://www.cnbc.com/2023/10/30/education-dept-penalizes-student-loan-servicer-mohela-for-errors.html |

|

Israel-Hamas war live updates: Israel confirms a hostage was freed during a ground operation; Netanyahu dubs Hamas hostage video cruel ‘propaganda’Israel has pledged to continue its “large scale, significant strikes” in pursuit of Hamas militants responsible for the Oct. 7 carnage. Read more at: https://www.cnbc.com/2023/10/30/israel-hamas-war-live-updates-latest-news-on-gaza-conflict.html |

|

Alphabet CEO Sundar Pichai testifies in U.S. antitrust trial to defend Google’s search businessIt was the first opportunity for the government’s attorneys to press Google’s top executive in open court on actions to secure its search dominance. Read more at: https://www.cnbc.com/2023/10/30/google-ceo-sundar-pichai-testifies-in-us-antitrust-trial.html |

|

‘Five Nights at Freddy’s’ rides PG-13 rating, video game fame to Halloween box office crown“Five Nights at Freddy’s” scored a 26% “rotten” rating on Rotten Tomatoes but that didn’t matter. Younger audiences turned out in droves. Read more at: https://www.cnbc.com/2023/10/30/five-nights-at-freddys-dominates-halloween-box-office.html |

|

‘Sesame Street’ will be revamped as Max streaming deal is set to expire“Sesame Street” is about to have a new look as it turns the page on season 55, ending its magazine-style format. Read more at: https://www.cnbc.com/2023/10/30/sesame-street-will-be-revamped-as-max-streaming-deal-set-to-expire.html |

|

Moscow claims the West is attempting to ‘split Russian society’ after airport stormed by mobPressure is mounting on Russia to protect the country’s Jewish community after an angry mob stormed an airport in Dagestan. Read more at: https://www.cnbc.com/2023/10/30/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Saudis On High Alert After Yemen’s Houthis Fire Another Missile At Israel, Fresh Clashes EruptIran-aligned Houthi rebels in Yemen have reportedly fired another missile aimed at Israel on Monday. An initial launch of a couple of missiles over a week ago saw a US warship of Yemen’s coast intervene to shoot down the projectiles. This time the Houthi missile flew over Saudi territory, putting the kingdom on a high state of alert. While fighting between the Saudi-UAE coalition and Yemen’s Houthis has raged since 2015 (also with Washington backing), the last days have seen an uptick in fighting, which regional observers believe is connected with events in Gaza. Israel too sees Yemen as a dangerous ‘pro-Iran’ base of operations threatening the broader region. However, the Houthis are by and large an impoverished rag-tag regional rebel movement which sees Riyadh as trying to bolster an unpopular puppet government by force of superior air power. Read more at: https://www.zerohedge.com/geopolitical/saudis-high-alert-after-yemens-houthis-fire-another-missile-israel-fresh-clashes-erupt |

|

“They’ll Bankrupt Us”: Rand Paul Rages That Dems & GOP “Want To Send $100 Billion To Everyone” In Foreign CountriesAuthored by Steve Watson via Summit News, Senator Rand Paul has warned that “the very existence” of the U.S. is under threat from Democrats and Republicans wanting to send “$100 billion to everyone,” in other countries.

In a Fox News interview, Paul warned that “they’ll bankrupt our country in sending money everywhere all over the planet,” adding “It is probably the greatest threat to our national security.” Paul further urged that “The greatest threat to it is the national debt. We borrowed a trillion dollars in the last three months. It is out-of-control spending, and we are threatening the very existence of our currency, and perhaps our country, by this crazy, profligate spending.” The Senator continued, “the big government Republicans in the S … Read more at: https://www.zerohedge.com/political/theyll-bankrupt-us-rand-paul-rages-dems-gop-want-send-100-billion-everyone-foreign |

|

DeSantis Warns China ‘Key Player’ Behind Ukraine, Israel WarsAuthored by Jackson Richman, Eva Fu and Jan Jekielek via The Epoch Times (emphasis ours), Florida governor and Republican presidential candidate Ron DeSantis warned on Oct. 27 that China is “the key player” behind the conflicts in Ukraine and Israel.

Read more at: https://www.zerohedge.com/geopolitical/desantis-warns-china-key-player-behind-ukraine-israel-wars |

|

“F*ck Regulators”: In Cross Exam, SBF Admits To Calling Some Customers “Dumb Motherf*ckers”“Cross examination of Sam Bankman-Fried began on Monday, led by prosecutor Danielle Sassoon, who clerked for Justice Antonin Scalia and has a law degree from Yale and a bachelor’s degree from Harvard. Earlier in the day Monday, direct examination concluded with SBF trying to explain why he promised FTX was “fine” in a Tweet on the morning of November 7th, according to CNN. SBF explained away his tweet by saying it wasn’t until the evening that the market crashed and the company was “risking a solvency crisis”. And that wasn’t even the best thing he said on Monday indicating he thought everyone else in the world was an idiot other than him… SBF has “appeared flustered and anxious” while being questioned by Sassoon before in hearings, CNN wrote.

Read more at: https://www.zerohedge.com/markets/fck-regulators-sbf-grilled-cross-examination-admits-calling-some-customers-dumb |

|

Big banks accused of doing little for saversReturns have improved, but a group of MPs says big banks are doing “as little as they can” for savers. Read more at: https://www.bbc.co.uk/news/business-67263369?at_medium=RSS&at_campaign=KARANGA |

|

World Bank warns oil prices could reach $150 a barrelA prolonged conflict in the Middle East would lead to much higher energy prices, the global institution predicts Read more at: https://www.bbc.co.uk/news/business-67267719?at_medium=RSS&at_campaign=KARANGA |

|

Facebook and Instagram launch ad-free subscription tier in EUThe platforms’ owner Meta said its new subscription was about addressing EU concerns, rather than making money. Read more at: https://www.bbc.co.uk/news/technology-67226394?at_medium=RSS&at_campaign=KARANGA |

|

Trading Guide: Muthoot Finance among 2 stock picks for next sessionBenchmark equity indices closed higher on Monday, led by banking, and financial stocks. The S&P BSE Sensex closed 0.5% higher at 64,112, while the NSE Nifty50 index ended above the 19,100 level. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-trading-guide-muthoot-finance-among-2-stock-recommendations-for-tuesday/articleshow/104831829.cms |

|

How Welspun Living, Jindal Saw, Swan Energy look on charts for TuesdaySectorally, buying was seen in realty, telecom, energy, oil & gas, and banks while auto, consumer durables, FMCG, and metals stocks saw some selling pressure Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-welspun-living-jindal-saw-and-swan-energy-are-looking-on-charts-for-tuesday/articleshow/104828196.cms |

|

Q2 Results on Tuesday: What to expect from Bharti Airtel, L&T?Indian Oil Corporation, GAIL (India), Mankind Pharma, Jindal Steel & Power, Adani Total Gas, Star Health and Allied Insurance, Max Financial Services, Vedant Fashions, Motherson Sumi Wiring, and Ajanta Pharma, among others will also detail earnings on Tuesday Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/q2-results-tomorrow-what-to-expect-from-bharti-airtel-lt-tata-consumer/articleshow/104832865.cms |

|

The Ratings Game: McDonald’s set up well for 2024 as digital sales, restaurant growth, ramp up: Wells FargoMcDonald’s, which reported third-quarter results Monday, is well positioned for 2024, according to Wells Fargo. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728C-6B48177D978C%7D&siteid=rss&rss=1 |

|

Why aren’t homeowners selling their homes? Hint: It’s not just the ‘lock-in effect’The ‘golden handcuffs’ of having a mortgage with a comparatively low rate isn’t necessarily why homeowners aren’t listing their homes, Fannie Mae says Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728C-4AA6DA6901E1%7D&siteid=rss&rss=1 |

|

AMC shares set for largest percentage gain in more than 3 weeks, boosted by Taylor SwiftAMC is reaping the benefits of “Taylor Swift: The Eras Tour” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-728C-741EAC9F16F0%7D&siteid=rss&rss=1 |

Florida Gov. Ron DeSantis (R) during a Q&A with Epoch Times senior editor Jan Jekielek (L) and Heritage Foundation President Kevin Roberts at the Heritage Foundation in Washington on Oct. 27, 2022. (Erin Granzow)Appearing at an event hosted by the Heritage Foundation, a conservative think tank in Washington, in conjunction with The Epoch Times, Mr. DeSantis struck a hawkish tone toward Beijing, calling it a “key player” behind the conflicts in Ukraine and Gaza Strip.

Florida Gov. Ron DeSantis (R) during a Q&A with Epoch Times senior editor Jan Jekielek (L) and Heritage Foundation President Kevin Roberts at the Heritage Foundation in Washington on Oct. 27, 2022. (Erin Granzow)Appearing at an event hosted by the Heritage Foundation, a conservative think tank in Washington, in conjunction with The Epoch Times, Mr. DeSantis struck a hawkish tone toward Beijing, calling it a “key player” behind the conflicts in Ukraine and Gaza Strip. Sassoon (Photo:

Sassoon (Photo: