Summary Of the Markets Today:

- The Dow closed down 105 points or 0.32%,

- Nasdaq closed down 2.43%,

- S&P 500 closed down 1.43%, (Low 4,187: 4,200 = critical support level)

- Gold $1,992 up $6.10,

- WTI crude oil settled at $85 up $1.52,

- 10-year U.S. Treasury 4.942% up 0.102 points,

- USD Index $106.53 up $0.260,

- Bitcoin $34,731 up $936,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single‐family houses in September 2023 were 33.9% above September 2022 (blue line on the graph below). The median sales price of new houses sold in September 2023 was down 12.3% year-over-year. (red line on the graph below). The seasonally adjusted estimate of new houses for sale at the end of September was 435,000. This represents a supply of 6.9 months at the current sales rate. New home sales in 2023 remain relatively strong as house sizes have shrunk to maintain affordability.

source: NAHB

Here is a summary of headlines we are reading today:

- Hyperloop Technology Gains Momentum With New Freight System

- Libya’s Eastern Govt Calls For Oil Export Embargo For Israel Supporters

- Tensions Escalate As Russia Steps Away From Nuclear Treaty Commitment

- Oil Market Blind-sided By Israel’s War On Hamas

- Oil Ticks Lower On Inventory Build

- S&P 500 falls more than 1% to close below 4,200 for first time since May, Nasdaq notches worst day since February

- World’s Oldest Central Bank Seeking $7 Billion Bailout After Massive Bond Losses

- Mexican Media Magnate Says ‘Buy Bitcoin, Sell Bonds, Reject Inflation’

- Bond Report: Treasury yields end at some of 2023’s highest levels ahead of GDP, inflation data

- Market Snapshot: Nasdaq on pace to enter a correction as tech shares lead U.S. stocks lower after mixed earnings

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Hyperloop Technology Gains Momentum With New Freight SystemThe American research company HyperloopTT unveiled its latest hyperloop technology, an innovative freight capsule system that it claims will revolutionize freight shipping. The idea, first popularised by Elon Musk and SpaceX engineers over a decade ago, involves using magnetic propulsion to fire pods or trains through a network of tubes at up to 800 miles per hour. HyperloopTT believes its tech, developed alongside the design consultancy tangerine, can push out traditional high-speed rail systems while operating at a fraction of the cost. The… Read more at: https://oilprice.com/Energy/Energy-General/Hyperloop-Technology-Gains-Momentum-With-New-Freight-System.html |

|

Honda-GM Ditch $5B Plan To Jointly Develop Affordable EVsAs GM redirects its focus toward making a profit amid grim earnings outlooks, strikes, and rising costs, the U.S. auto giant has announced it is ditching a $5-billion plan to develop affordable EVs in partnership with Honda. The multi-billion-dollar plan was to beat Tesla at the sales game and the decision to scrap it comes only a year-and-a-half after its conception. “After extensive studies and analysis, we have come to a mutual decision to discontinue the program. Each company remains committed to affordability in the EV market,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Honda-GM-Ditch-5B-Plan-To-Jointly-Develop-Affordable-EVs.html |

|

Europe’s Appetite For Turkmen Gas Boosts Trans-Caspian Pipeline PlansTurkmenistan’s president is scheduled to travel to Turkey this week for talks expected to focus on natural gas transportation. For decades, thoughts about how to send Turkmen gas westward have centered around the need to build a trans-Caspian pipeline to Azerbaijan. Presumed resistance from Russia has long been the main perceived stumbling block. But that is only one part of the equation. For buyers in Europe to be able to import useful amounts of Turkmen gas, the capacity of the Trans-Anatolian gas pipeline, or TANAP, which crosses the length… Read more at: https://oilprice.com/Energy/Natural-Gas/Europes-Appetite-For-Turkmen-Gas-Boosts-Trans-Caspian-Pipeline-Plans.html |

|

DRC Cobalt Mines Grab Global Spotlight AgainVia Metal Miner It has the largest reserves of cobalt in the world and the 7th largest deposit of copper, making it the cynosure of the mining world. The Democratic Republic of Congo (DRC) plays a central role in the world’s rollover to renewable energy and in cobalt price movements. As a result, the central African nation surfaces in global headlines almost every other month. Last month, Amnesty International called the nation out for human rights abuses due to the expansion of its mines to extract cobalt and copper. Now, the DRC… Read more at: https://oilprice.com/Energy/Energy-General/DRC-Cobalt-Mines-Grab-Global-Spotlight-Again.html |

|

Libya’s Eastern Govt Calls For Oil Export Embargo For Israel SupportersLibya’s eastern-based House of Representatives (HoR) has called for the immediate exit of ambassadors supporting Israel amid airstrikes on the Gaza Strip and demanded that Libyan oil exports to those same countries be halted, according to Turkish and Libyan media reports. “We demand the government halt oil and gas exports to countries supporting Israel in case the Israeli massacres are not stopped,” parliamentary spokesman Abdullah Belihaq said in a statement on Wednesday. Specifically, Libya’s eastern-based parliament… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Eastern-Govt-Calls-For-Oil-Export-Embargo-For-Israel-Supporters.html |

|

Tensions Escalate As Russia Steps Away From Nuclear Treaty CommitmentThe Federation Council, the upper chamber of the Russian parliament, has voted in favor of legislation to revoke Moscow’s ratification of the Comprehensive Nuclear-Test-Ban Treaty (CTBT). The Federation Council approved the move by 156 votes to zero on October 25, the final stage before it goes to President Vladimir Putin for signing. Russia’s State Duma, the lower house of parliament, passed the bill earlier this month. Putin had called for the action to “mirror” the position of the United States, which has signed but never ratified… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tensions-Escalate-As-Russia-Steps-Away-From-Nuclear-Treaty-Commitment.html |

|

Porsche’s Electric Bet Is Paying Off In A Big WayPorsche has reported a jump in sales and profits in the first nine months of the year thanks to strong performances from its bestselling Cayenne series and all-electric Taycan. Sales revenue rose 12.6 percent to €30.13bn (£26.27bn) on the back of near 10 percent year-on-year rise in deliveries to 242,722. The revenue increase helped pre-tax profits come in at €5.6bn between January and September, up from €5.3bn in 2022. The Cayenne remained the marque’s bestselling series with sales reaching 69,461, while its electric… Read more at: https://oilprice.com/Energy/Energy-General/Porsches-Electric-Bet-Is-Paying-Off-In-A-Big-Way.html |

|

RBC: The U.S. Could Tighten The Oil Sanctions On IranThe United States is likely to tighten the sanction enforcement on Iran’s crude oil exports over the Hamas-Israel war and the Iranian backing of Hamas, Helima Croft, the head of global commodity strategy at RBC Capital Markets, told CNBC on Wednesday. “The Biden administration is desperate to contain this war, they clearly do not want it spilling beyond Gaza,” Croft told CNBC’s Dan Murphy on the sidelines of an investment forum in Saudi Arabia on Wednesday. On Tuesday, U.S. President Joe Biden spoke with… Read more at: https://oilprice.com/Latest-Energy-News/World-News/RBC-The-US-Could-Tighten-The-Oil-Sanctions-On-Iran.html |

|

Oil Market Blind-sided By Israel’s War On HamasIsrael is on the brink of a full invasion of the Gaza Strip, with the Israeli Armed Forces (IDF) prepared to implement a range of military strategies. While regional tensions are escalating, a full-scale war has not yet erupted on Israel’s northern borders with Lebanon and Syria, involving Hezbollah, a Shia terrorist organization, and its supporters. Diplomatic pressure from the USA and Arab nations is currently preventing Hezbollah from launching a large-scale offensive. This ongoing ‘stalemate’ is precarious, as it has the potential to trigger… Read more at: https://oilprice.com/Geopolitics/Middle-East/Oil-Market-Blind-sided-By-Israels-War-On-Hamas.html |

|

Europe’s LNG Imports Set To Surge By 30% In NovemberAmid expected higher demand at the start of the heating season, LNG imports into northwest Europe are expected to soar by 30% in November compared to October, Montel reported on Wednesday, citing preliminary estimates from LSEG. With winter heating demand kicking in, LNG imports are set to rise materially in November, although they would be lower than in the same month of 2022 when Europe was scrambling to get its hands on LNG cargoes to replace pipeline Russian gas. Next month, northwest Europe is estimated to import around… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-LNG-Imports-Set-To-Surge-By-30-In-November.html |

|

Oil Ticks Lower On Inventory BuildCrude oil prices inched down today after the Energy Information Administration reported an inventory increase of 1.4 million barrels for the week to October 20. This compared with an inventory draw of 4.5 million barrels for the previous week. A day before the EIA’s report came out, the American Petroleum Institute estimated inventories had declined by 2.7 million barrels in the week to October 20. It also reported a sizeable gasoline inventory draw that helped push prices higher. According to the EIA, gasoline stocks added a modest 200,000… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Ticks-Lower-On-Inventory-Build.html |

|

Shell To Cut 15% Of Its Low-Carbon JobsShell plans to cut 15% of the 1,300 jobs in its Low Carbon Solutions business as it scales back some green energy ambitions and focuses on profitable projects including in the oil and gas sector. The UK-based supermajor plans to eliminate 200 jobs in its Low Carbon Solutions division next year, and is also reviewing the future of another 130 positions in the green energy business, which currently employs around 1,300 people, Shell told Reuters on Wednesday in response to a query. “We are transforming our Low Carbon Solutions (LCS) business… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-To-Cut-15-Of-Its-Low-Carbon-Jobs.html |

|

Ukraine Could Allow Foreign Traders To Use Half Of Its Natural Gas StorageUkraine is ready to allow non-resident traders to use up to half of its natural gas storage capacity, the country’s Prime Minister Denys Shmyhal told national television on Wednesday. Ukraine has 30 billion cubic meters (bcm) of underground storage capacity. As much as 12 to 15 bcm of this capacity could be allowed to be used by foreign traders to store gas, according to the prime minister. In April this year, Oleksiy Chernyshov, chief executive of Ukrainian state oil and gas firm Naftogaz, told EURACTIV that “Right now, we are able… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukraine-Could-Allow-Foreign-Traders-To-Use-Half-Of-Its-Natural-Gas-Storage.html |

|

Global Fossil Fuel Demand Set To Hit Record High In 2024Global energy and fossil fuel consumption is set to defy wars and high prices and hit a record high level in 2024, led by strong Asian demand, the Economist Intelligence Unit said in a new report on Wednesday. Next year, global energy consumption is expected to increase by 1.8%, according to the EIU report. “Despite still-high prices and unsolved supply chain disruptions, demand for fossil fuels will reach record levels, but demand for renewable energy will rise by 11%,” the authors of the report wrote. Oil demand alone is expected… Read more at: https://oilprice.com/Energy/Energy-General/Global-Fossil-Fuel-Demand-Set-To-Hit-Record-High-In-2024.html |

|

Hess Beats Q3 Earnings Estimates Ahead Of Acquisition By ChevronHess Corporation reported on Wednesday earnings for the third quarter that beat analyst estimates, after announcing earlier this week it had agreed to be acquired by supermajor Chevron. Hess said its net income stood at $504 million, or $1.64 per share, for the third quarter of 2023, slightly down from the $515 million net income for the same period of 2022, but higher than the analyst consensus of $1.22 earnings per share. Hess reported higher production in the Bakken shale play in the United States and offshore Guyana for the third quarter. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hess-Beats-Q3-Earnings-Estimates-Ahead-Of-Acquisition-By-Chevron.html |

|

S&P 500 falls more than 1% to close below 4,200 for first time since May, Nasdaq notches worst day since FebruaryTech stocks struggled on Wednesday as Wall Street parsed the latest slate of quarterly results while Treasury yields surged. Read more at: https://www.cnbc.com/2023/10/24/stock-market-today-live-updates.html |

|

Meta to report third-quarter earnings after the bellMeta is slated to report third-quarter earnings Wednesday, and analysts are expecting a return to growth rates above 20%. Read more at: https://www.cnbc.com/2023/10/25/meta-earnings-q3-2023.html |

|

Alphabet’s stock has its worst day since start of the Covid pandemic in March 2020Google’s Cloud revenue miss came in stark contrast to Microsoft’s earnings, which showed accelerated growth in its Intelligent Cloud business. Read more at: https://www.cnbc.com/2023/10/25/alphabet-stock-down-8percent-on-cloud-miss-as-investors-praise-microsoft.html |

|

Trump storms out of fraud trial after judge clashes with his attorneys, fines him $10,000 for violating gag orderDonald Trump will get another chance to stare down Michael Cohen, his former personal attorney, in court, as Cohen testifies in Trump’s fraud trial. Read more at: https://www.cnbc.com/2023/10/25/trump-fraud-trial-michael-cohen-testifies-in-fraud-trial.html |

|

Jefferies analyst says Microsoft can take cloud market share away from AmazonBrent Thill believes Microsoft has the upper hand in taking cloud market share, which should also help the firm’s artificial intelligence story. Read more at: https://www.cnbc.com/2023/10/25/jefferies-analyst-says-microsoft-can-take-cloud-market-share-away-from-amazon.html |

|

Mike Johnson elected House speaker, putting Louisiana Republican in the spotlightAll 220 Republicans who cast a ballot voted for Johnson, despite his being the fourth nominee tapped by the fractious conference in two weeks. Read more at: https://www.cnbc.com/2023/10/25/mike-johnson-house-speaker-louisiana-republican-in-the-spotlight.html |

|

Sam Bankman-Fried will take the stand at his fraud trial: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Elizabeth Lopatto, senior reporter at The Verge, discusses what’s ahead in the trial of Sam Bankman-Fried. Read more at: https://www.cnbc.com/video/2023/10/25/sam-bankman-fried-will-take-the-stand-at-his-fraud-trial-cnbc-crypto-world.html |

|

Israel-Hamas war live updates: Netanyahu says Israel is preparing a ground invasion; fuel and other supplies run dangerously low in GazaThe Israel Defense Forces insist that fuel is present in Gaza, but that Hamas is monopolizing it. Read more at: https://www.cnbc.com/2023/10/25/israel-hamas-war-updates-and-latest-news-on-gaza-conflict.html |

|

GM, Honda scrap plans to co-develop ‘affordable’ sub-$30,000 EVsThe cancellation by GM and Honda is the latest in a growing number of decisions by automakers to scale back or scrap previously announced EV plans. Read more at: https://www.cnbc.com/2023/10/25/gm-honda-scrap-plans-to-co-develop-affordable-sub-30000-evs.html |

|

Amazon’s focus on speed, surveillance drives higher warehouse worker injuries, study findsAmazon warehouse workers are suffering physical injuries and mental stress on the job due to Amazon’s focus on speed and pervasive surveillance, per a study. Read more at: https://www.cnbc.com/2023/10/25/study-amazons-focus-on-speed-surveillance-drives-worker-injuries.html |

|

Apple will reportedly release a bunch of new AirPods next yearApple plans to release new versions of its entry-level AirPods and its $549 AirPods Max headphones next year, according to a report from Bloomberg. Read more at: https://www.cnbc.com/2023/10/25/apple-will-reportedly-release-a-bunch-of-new-airpods-next-year.html |

|

How the long-awaited recession became a ‘richsession’ for America’s wealthyThere may finally be proof of a recession, but only for the wealthy. Read more at: https://www.cnbc.com/2023/10/25/recession-vs-richsession-why-americas-rich-face-economic-headwinds.html |

|

California Gov. Gavin Newsom meets with China’s Xi Jinping to partner on climate agendaRelations between China and the United States at large are fragile due to trade tensions and other issues. Read more at: https://www.cnbc.com/2023/10/25/newsom-xi-jinping-meeting-to-talk-climate-agenda.html |

|

Texas AG Sues Biden Administration For Cutting Razor Wire At Southern BorderAuthored by Eric Lundrum via American Greatness, On Tuesday, Texas Attorney General Ken Paxton (R-Texas) filed a lawsuit against the Biden Administration over federal agents cutting away razor wire barriers that had been set up along the southern border by the state government.

As Fox News reports, Paxton’s lawsuit, filed in the U.S. District Court for the Western District of Texas, targets the Department of Homeland Security (DHS) and Customs and Border Protection (CBP), accusing the federal agencies of interfering with state efforts to secure the border by actively cutting away the razor wire barriers that had been set up by the state of Texas.

|

|

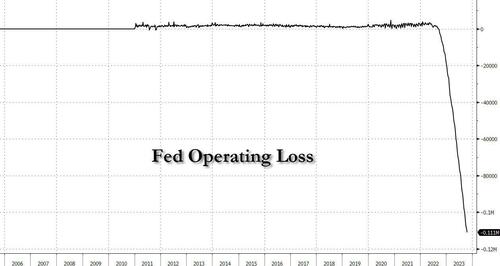

World’s Oldest Central Bank Seeking $7 Billion Bailout After Massive Bond LossesTwo weeks ago we reminded the world that thanks to soaring interest rates, which will only keep rising until the Fed figures out what “big-enough” crisis it uses to trigger QEx+1, the staggering losses on global fixed income securities which according to the IIF amount to $307 trillion – as calculated by DB’s Jim Reid – amount to a little bit over $100 trillion (and rising). And while thanks to such facilities as the BTFP much of the MTM risk has been transferred if only for the time being away from commercial banks and to the Fed, the cumulative losses at central banks are now absolutely staggering, starting with the biggest and baddest one of all, where the Fed operating loss is now $111 billion and rising with every day that the Fed pays out more in interest to banks and money market funds than it collects on its bond portfolio…

… while the cumulativ … Read more at: https://www.zerohedge.com/markets/worlds-oldest-central-bank-seeking-7-billion-bailout-after-massive-bond-losses |

|

Mexican Media Magnate Says ‘Buy Bitcoin, Sell Bonds, Reject Inflation’Authored by Reed MacDonald via BitcoinMagazine.com, Bitcoin Magazine sits down with Ricardo Salinas, chairman of Mexican media giant TV Azteca, to discuss his outlook for Bitcoin and why he believes it will reshape finance…. “Store your wealth in Bitcoin.” That was the message give by Ricardo Salinas, a prominent billionaire and the honorary chairman of TV Azteca, in an exclusive interview with Bitcoin Magazine reporter Isabella Santos last week. The rare sit-down interview, which marked the Mexican billionaire’s first Spanish-language interview on the topic. In the 20-minute interview, he discussed how the cryptocurrency can act as a safeguard against inflation and the pitfalls of traditional financial systems, the conversation taking place on the occasion of Salinas’ recognition by the Atlas Society, an organization known for promoting individualism and free-market philosophies. Salinas began by addressing the widespread issue of inflation, which he sees as an insidious tax eroding people’s savings without their consent. This is a concern not only in Mexico and Latin America but also globally. To counteract this, Salinas emphasized the value of Bitcoin as a means of protecting one’s wealth. He highlighted its u … Read more at: https://www.zerohedge.com/crypto/mexican-media-magnate-says-buy-bitcoin-sell-bonds-reject-inflation |

|

UBS Gives Qatari Sheikh $9 Billion Credit Line Amid Mideast ExpansionUBS Group AG has provided a $9 billion credit facility to Qatari Sheikh Hamad bin Jassim bin Jaber Al Thani (HBJ), as reported by Bloomberg, citing sources knowledgeable about the situation. This move signifies the Swiss bank’s efforts to broaden its presence in the Middle East. UBS agreed to provide the credit facility to the former Qatar prime minister, which is 50% more than the total of existing lines from UBS and Credit Suisse that it replaces.

Bloomberg explained the move by UBS is to keep a presence in the Middle East following the takeover of Credit Suisse earlier this year:

|

|

Watchdog: Ex-NatWest boss breached Nigel Farage’s privacyFormer Natwest boss Alison Rose should not have shared information on Nigel Farage, watchdog says. Read more at: https://www.bbc.co.uk/news/business-67222543?at_medium=RSS&at_campaign=KARANGA |

|

FTX: ‘King of Crypto’ to testify in fraud caseFormer crypto boss Sam Bankman-Fried has decided to speak in his own defence, his legal team says. Read more at: https://www.bbc.co.uk/news/business-67221161?at_medium=RSS&at_campaign=KARANGA |

|

Carnival cruise firm pays thousands over Covid ‘negligence’An Australian judge orders Carnival to pay medical bills of passenger who caught Covid on board one of its ships. Read more at: https://www.bbc.co.uk/news/business-67215595?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How to trade BSE, Prestige Estates and Adani Total Gas on ThursdayBSE was up by 4.5% on Wednesday due to news of increasing transaction charges on the equity derivative segment from 1 November 2023. The stock has given a good run up from Rs 1420-1820 levels in the last 2 months so we would avoid fresh longs at the current levels as we can see some divergence in RSI. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-to-trade-bse-prestige-estate-and-adani-total-gas-on-thursday/articleshow/104701639.cms |

|

5 commodities stocks hit 52-week lows. Do you own any?The 52-week low signifies the lowest price at which a stock has traded in the past year. Some traders and investors consider this technical indicator a crucial factor for evaluating a stock’s present worth and forecasting its future price movement. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/5-commodities-stocks-hit-52-week-lows-do-you-own-any/slideshow/104702981.cms |

|

Tech View: Nifty forms long bear candle. What traders should do on ThursdayThe short-term trend of Nifty continues to be negative. Having placed the long-term support at the lows, there is a possibility of a small upside bounce from near 19,100-19,000 levels. A breakdown of 19,000 is likely to open the next downside of 18,600 levels in the near term. Any upside bounce from here could find strong resistance around 19,250-19,350 levels, said Nagaraj Shetti, Technical Research Analyst, HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bear-candle-what-traders-should-do-on-thursday/articleshow/104701835.cms |

|

Bond Report: Treasury yields end at some of 2023’s highest levels ahead of GDP, inflation dataTwo- through 30-year Treasury yields jump as investors await U.S. economic growth and inflation data in the next few sessions. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7287-DF1A9C77B21F%7D&siteid=rss&rss=1 |

|

Market Snapshot: Nasdaq on pace to enter a correction as tech shares lead U.S. stocks lower after mixed earningsU.S. stocks are falling Wednesday, led by a slide in tech shares after behemoths Alphabet and Microsoft delivered a mixed picture of earnings. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7287-DE765EAC4F2E%7D&siteid=rss&rss=1 |

|

The Tell: Why U.S. stocks in these defensive sectors are set to outperform after failing to provide shelter throughout 2023It’s easy to forget the stock-market sectors labeled as “defensive” may sometimes fail to provide shelter to investors. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7288-BE1A0355DF20%7D&siteid=rss&rss=1 |