Summary Of the Markets Today:

- The Dow closed down 191 points or 0.58%,

- Nasdaq closed up 0.27%,

- S&P 500 closed down 0.17%, (Low 4217)

- Gold $1,993 down $11.60,

- WTI crude oil settled at $86 down $2.18,

- 10-year U.S. Treasury 4.857% down 0.067 points,

- USD Index $105.64 down $0.520,

- Bitcoin $31,367 up $1,521,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

My favorite coincident indicator of the economy – The Chicago Fed National Activity Index three-month moving average, CFNAI-MA3, moved up to a neutral value in September 2023 from –0.14 in August. This means the economy expanded at its historical rate of growth. All four broad categories of indicators used to construct the

index increased, with two categories making positive contributions in September whilst the other two remained in negative territory.

Here is a summary of headlines we are reading today:

- How Australia Became The World’s Most Volatile Power Market

- Rising Interest Rates Pose Challenges For Gold And Oil

- No More Oil Hedging For Hess After $53B Chevron Acquisition

- German Coal Plants May Have To Remain On Standby Longer Than Planned

- Oil Prices Slide As Diplomatic Efforts Bear Fruit In Gaza

- Bill Ackman covers bet against Treasurys, says ‘too much risk in the world’ to bet against bonds

- Intel stock drops on report Nvidia is working on an Arm-based PC chip

- Nasdaq snaps four days of losses as 10-year Treasury yield retreats from 5%: Live updates

- ‘Marvel’s Spider-Man 2′ video game breaks PlayStation Studios’ 24-hour sales record

- “Worse Is To Come” – Home Sales Slide Far From Over As Goldman Sees “Sustained Higher Mortgage Rates”

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Australia Became The World’s Most Volatile Power MarketAustralia’s power market is now the most volatile in the world as unexpected losses of supply from unplanned coal generation outages and transmission line issues related to natural disasters lead to huge price fluctuations, according to Rystad Energy research. The country’s National Electricity Market (NEM), which interconnects power markets in Queensland, New South Wales (NSW), Victoria, Tasmania and South Australia is experiencing the most fluctuations in daily prices of any system worldwide. Rystad Energy has analyzed public price… Read more at: https://oilprice.com/Energy/Energy-General/How-Australia-Became-The-Worlds-Most-Volatile-Power-Market.html |

|

Kazakhstan’s Nuclear Power Plans Face Public OppositionThe authorities in Kazakhstan have for many years been toying with the idea of building a nuclear power plant, but they have lacked the nerve to take a decision in the face of strong public opposition. In September, President Kassym-Jomart Tokayev opted to punt his way out of the predicament by announcing a referendum on the question. While Tokayev is evidently in favor of nuclear power, he is eager not to be seen as acting in defiance of broader sentiment. “On one hand, Kazakhstan, as the largest uranium producer in the world, should have… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Kazakhstans-Nuclear-Power-Plans-Face-Public-Opposition.html |

|

Digital Yuan Completes First Cross-Border Oil DealChinese digital yuan has been used in its first cross-border oil deal for 1 million barrels on the Shanghai Petroleum and Natural Gas Exchange (SHPGX) from PetroChina International Corp Ltd.The transaction took place on October 19, and represents the first time, amid a slow-moving de-dollarization push, that digital yuan has been used to complete a translation for oil, though no further details of the transaction have been made available. The price of the deal has not been disclosed.The transaction was heralded by state-run China Daily as “another… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Digital-Yuan-Completes-First-Cross-Border-Oil-Deal.html |

|

$7 Trillion Needed To Secure Future Natural Gas SupplyThe world is in the midst of an energy transition; however, the complete transition from fossil fuels to renewables won’t be realized anytime soon. Natural gas is expected to replace dirtier fossil fuels through 2050. Yet, there are growing worries about the world’s NatGas supply, especially in the absence of new investments. To ensure a smooth energy transition, new figures show countries need to spend $7 trillion on new liquefied natural gas (LNG) export plants, upgrading facilities, and developing new gas fields, according to Bloomberg, citing… Read more at: https://oilprice.com/Energy/Natural-Gas/7-Trillion-Needed-To-Secure-Future-Natural-Gas-Supply.html |

|

Rising Interest Rates Pose Challenges For Gold And OilVia Metal Miner Precious metals like gold and silver are often seen as a safe haven asset during times of economic uncertainty. In recent weeks, we have witnessed a significant increase in the number of global conflicts, imposing high uncertainty and risk among markets for investors. Still, the jury is still out on how this will affect precious metal prices as a whole. As participants seek to hedge against the risks presented by these conflicts, buyers continue to pour money into gold, causing an uptick in demand for precious metals. However, the… Read more at: https://oilprice.com/Energy/Energy-General/Rising-Interest-Rates-Pose-Challenges-For-Gold-And-Oil.html |

|

No More Oil Hedging For Hess After $53B Chevron AcquisitionChevron Corp. will end crude oil hedging following the completion of its acquisition of Hess Corp. in a $53-billion mega deal, Bloomberg reported on Monday. Chevron announced the acquisitions of Hess, a major feature in Guyana offshore production, on Monday, in the second mega-merger announcement this month, following Exxon’s offer of a $59.5-billion all-stock deal for Pioneer Natural Resources. “We plan to discontinue the use of put options to hedge,” Chevron Chief Executive Officer Mike Wirth told Bloomberg on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/No-More-Oil-Hedging-For-Hess-After-53B-Chevron-Acquisition.html |

|

Bulgaria’s Controversial Gas Agreement Faces EU ScrutinyThe European Commission is investigating a deal allowing Bulgaria to access gas supplies via Turkey over a possible breach of the bloc’s antitrust rules. The agreement, signed in January 2023 between Bulgaria’s state gas company Bulgargaz and Turkey’s state supplier BOTAS, was hailed by the then-caretaker government in Bulgaria as a “historic” deal.But analysts expressed fears that the deal was unprofitable and would damage the country’s financial interests. They also warned that it could be used as a “back door”… Read more at: https://oilprice.com/Energy/Energy-General/Bulgarias-Controversial-Gas-Agreement-Faces-EU-Scrutiny.html |

|

Oil Stocks Drop Despite Major Chevron-Hess DealAmid lower crude oil prices, U.S. oil stocks and oil-tracking exchange-traded funds (ETF) opened lower on Monday, and even Hess’s shares slid after Chevron’s announcement it would buy the smaller U.S. oil firm in an all-stock deal. Hess Corporation (NYSE: HES) was down by 0.55% in pre-market trade, despite being the target of the Chevron acquisition, due to the all-stock nature of the announced transaction. Chevron (NYSE: CVX) was down 2.6% pre-market, after announcing earlier today an agreement to buy Hess Corporation in an all-stock… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Stocks-Drop-Despite-Major-Chevron-Hess-Deal.html |

|

EIA Sees Limited Growth In Venezuela’s Oil Production Despite Sanctions ReliefVenezuela is expected to raise its crude oil production by less than 200,000 barrels per day (bpd) until the end of 2024 as years of underinvestment and mismanagement will hamper rapid output growth following the effective lifting of most oil sanctions on Venezuela for six months, the U.S. Energy Information Administration (EIA) said on Monday. Last week, the United States lifted sanctions on Venezuela’s oil industry after the Nicolas Maduro government reached a deal with the opposition that could see elections held next year. The… Read more at: https://oilprice.com/Energy/Energy-General/EIA-Sees-Limited-Growth-In-Venezuelas-Oil-Production-Despite-Sanctions-Relief.html |

|

German Coal Plants May Have To Remain On Standby Longer Than PlannedThe German government is considering whether to extend the period in which old coal-fired power plants would be asked to remain on standby for emergency backup beyond the currently planned deadline in the spring of 2024, German business daily Handelsblatt reported this weekend, citing a spokeswoman for the economy ministry. Without Russian gas, last year’s energy and gas crisis in Germany, and in Europe, has been keeping utilities and governments on edge and ready to have mothballed coal-fired power plants on stand-by in the coldest winter… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Coal-Plants-May-Have-To-Remain-On-Standby-Longer-Than-Planned.html |

|

Qatar Signs 27-Year Deal To Supply LNG To ItalyQatarEnergy has signed another 27-year agreement to ship LNG to Europe by agreeing to deliver cargoes for Eni in Italy beginning in 2026, after similar deals with Shell and TotalEnergies for supply to the Netherlands and France, respectively. Under the latest deal with Eni, QatarEnergy and the Italian major will deliver LNG to FSRU Italia, a floating storage and regasification unit located in the port of Piombino, in Italy’s Tuscany region, the Qatari state-owned energy firm said on Monday. The deliveries are expected to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Signs-27-Year-Deal-To-Supply-LNG-To-Italy.html |

|

Chevron To Buy Hess In $53 Billion Deal As Merger Mania AcceleratesChevron will buy Hess Corporation in an all-stock transaction valued at $53 billion in another mega deal in the oil industry that will give the U.S. supermajor exposure to Guyana’s large offshore oil reserves. The all-stock transaction is valued at $171 per share based on Chevron’s closing price on October 20, 2023. The total enterprise value, including debt, of the transaction is $60 billion, Chevron said in a statement on Monday. This is the second major deal in the U.S. oil industry announced this month. Earlier in October, ExxonMobil announced a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-To-Buy-Hess-In-53-Billion-Deal-As-Merger-Mania-Accelerates.html |

|

Firms With Nearly $1 Trillion In Revenue Want Timeline For Fossil Fuel Phase-OutAs many as 131 companies representing nearly $1 trillion in global annual revenue are urging governments to set targets and timelines for the phaseout of unabated fossil fuels. Ahead of the COP28 climate summit in Dubai, companies representing $987 billion in global annual revenue including AstraZeneca, Ikea, Bayer, Iberdrola, Heineken, Danone, Ørsted, Volvo Cars, SAP, and Unilever, wrote a letter to the Heads of State who will be attending COP28, calling on “all Parties attending COP28 in Dubai to seek outcomes that will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Firms-With-Nearly-1-Trillion-In-Revenue-Want-Timeline-For-Fossil-Fuel-Phase-Out.html |

|

Oil Prices Slide As Diplomatic Efforts Bear Fruit In GazaCrude oil prices began the week with a decline, as continued diplomatic talks gave traders hope the conflict in the Middle East might not escalate into a full-scale regional war. In mid-morning trade in Asia earlier today, Brent crude had slipped by more than $1 per barrel from Friday’s close while West Texas Intermediate shed over $1.70 per barrel earlier in the session. Later in the day the benchmarks recouped some of the losses but were still trending down at the time of writing. “Israel agreed to hold off its attack on Hamas following… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Slide-As-Diplomatic-Efforts-Bear-Fruit-In-Gaza.html |

|

Russia To Boost Natural Gas Supply To Hungary And ChinaRussia’s Gazprom will supply more gas to Hungary and China during the winter, CEO Alexei Miller told Russian media, as cited by Reuters. The update comes on the heels of another report that said Gazprom was working on expanding its gas export infrastructure to China. The Hungary and China updates come during the Belt and Road summit in China, where Hungary’s Prime Minister Victor Orban met with Russia’s Vladimir Putin to discuss bilateral ties. Hungary is the only EU member still maintaining friendly relations with Moscow, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-To-Boost-Natural-Gas-Supply-To-Hungary-And-China.html |

|

Bill Ackman covers bet against Treasurys, says ‘too much risk in the world’ to bet against bondsThe billionaire hedge fund manager first disclosed his bearish position on 30-year Treasurys in August. Read more at: https://www.cnbc.com/2023/10/23/bill-ackman-covers-bet-against-treasurys-says-too-much-risk-in-the-world-to-bet-against-bonds.html |

|

Tesla discloses DOJ probes over vehicle range, personal benefits and moreTesla’s Q3 10-Q had some new information about the status of legal actions against the company. Read more at: https://www.cnbc.com/2023/10/23/tesla-discloses-doj-probes-over-vehicle-range-personal-benefits-more.html |

|

Intel stock drops on report Nvidia is working on an Arm-based PC chipIntel currently has the majority of the market for PC chips, with AMD coming in second. Read more at: https://www.cnbc.com/2023/10/23/intel-stock-drops-on-report-nvidia-is-working-on-an-arm-based-pc-chip.html |

|

Nasdaq snaps four days of losses as 10-year Treasury yield retreats from 5%: Live updatesThe tech-heavy Nasdaq Composite ended four days of declines. Read more at: https://www.cnbc.com/2023/10/22/stock-market-today-live-updates.html |

|

Goldman’s playbook for 5% 10-year yield. These strong balance sheet stocks are winners“We expect investors will continue to focus on balance sheet strength and avoid companies that are most vulnerable to increased borrow costs,” the firm said. Read more at: https://www.cnbc.com/2023/10/23/goldmans-playbook-for-5percent-10-year-yield-these-strong-balance-sheet-stocks-are-winners.html |

|

Wall Street hikes forecasts for anti-obesity drug sales to $100 billion and beyond — A look at the numbersCiti notched its estimate for incretin drug sales to $71 billion by 2035, up from its prior estimate of $55 billion. That view seems conservative. Here’s why. Read more at: https://www.cnbc.com/2023/10/23/wall-street-hikes-forecasts-for-anti-obesity-drug-sales-to-100-billion.html |

|

UAW expands strike to Stellantis pickup truck plant in MichiganThe work stoppage marks the first escalation in the union’s strike in nearly two weeks and the first new work stoppage at Stellantis in over a month. Read more at: https://www.cnbc.com/2023/10/23/uaw-expands-strike-to-stellantis-pickup-truck-plant-in-michigan.html |

|

Israel-Hamas war live updates: Hamas releases 2 more hostages; Gaza health ministry says death toll tops 5,000It’s been more than two weeks since the Palestinian militant group Hamas launched its assault on Israel. Read more at: https://www.cnbc.com/2023/10/23/israel-hamas-war-updates-and-latest-news-on-gaza-conflict.html |

|

Off-duty Alaska Airlines pilot charged with 83 counts of attempted murder in alleged engine shutdown attemptThe flight operated by an Alaska Airlines subsidiary bound for San Francisco diverted to Portland after an off-duty pilot tried to shut down the engines. Read more at: https://www.cnbc.com/2023/10/23/alaska-airlines-pilot-diverts-flight-after-security-threat-in-cockpit.html |

|

VCs Marc Andreessen, John Doerr among attendees at Schumer’s next AI forumAcademics and civil society leaders will also join the discussion about innovation and balancing a leading position in AI while ensuring its safety. Read more at: https://www.cnbc.com/2023/10/23/vcs-andreessen-doerr-among-among-attendees-at-schumers-next-ai-forum.html |

|

Tsingtao responds to viral video showing a Chinese beer worker urinating into a tankTsingtao Brewery said Monday that an investigation was currently underway after a viral video surfaced showing a staff member urinating into one of its tanks. Read more at: https://www.cnbc.com/2023/10/23/tsingtao-responds-to-viral-video-of-beer-worker-urinating-into-a-tank.html |

|

‘Marvel’s Spider-Man 2′ video game breaks PlayStation Studios’ 24-hour sales recordCustomers bought more than 2.5 million copies of “Marvel’s Spider-Man 2” in its first 24 hours. Read more at: https://www.cnbc.com/2023/10/23/marvels-spider-man-2-game-breaks-24-hour-playstation-studios-record.html |

|

Crypto-friendly Rep. Tom Emmer launches bid for House speaker: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Mayur Gupta, chief marketing officer of Kraken, explains the company’s latest ad initiatives to bring consumers to crypto. Read more at: https://www.cnbc.com/video/2023/10/23/crypto-friendly-rep-tom-emmer-launches-bid-for-house-speaker-cnbc-crypto-world.html |

|

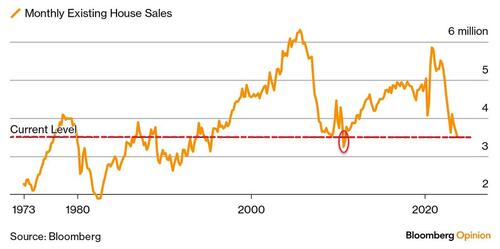

“Worse Is To Come” – Home Sales Slide Far From Over As Goldman Sees “Sustained Higher Mortgage Rates”Existing home sales plunged back below 4mm SAAR last month for the first time since the foreclosure crisis in 2010. Outside of the fallout from the Great Financial Crisis, home sales are the lowest in 27 years…

But, if Goldman Sachs’ Jan Hatzius and his team are right, worse is to come. Meanwhile, prices are not reflecting the sales pressure – doubling relative to sales in the last four years… just like they did into 2008’s peak… Read more at: https://www.zerohedge.com/personal-finance/worse-come-home-sales-slide-far-over-goldman-sees-sustained-higher-mortgage-rates |

|

President Biden’s Taunts To ‘Show Me The Money’ May Have Just BackfiredAuthored by Jonathan Turley, “Where’s the money?” That laughing quip from President Joe Biden was his surprising reaction to the disclosure that a trusted FBI informant had conveyed an alleged bribe worth millions, paid to Joe Biden by a Ukrainian businessman.

Biden seemed almost to morph into the Cuba Gooding Jr. character in “Jerry Maguire,” getting Tom Cruise’s character to chant “show me the money” over and over again. Much like in the movie, the pundits and politicians picked up the refrain, insisting that nothing matters unless critics can show a direct payment to Jill or Joe Biden among the millions sent to Biden family memb … Read more at: https://www.zerohedge.com/political/president-bidens-taunts-show-me-money-may-have-just-backfired |

|

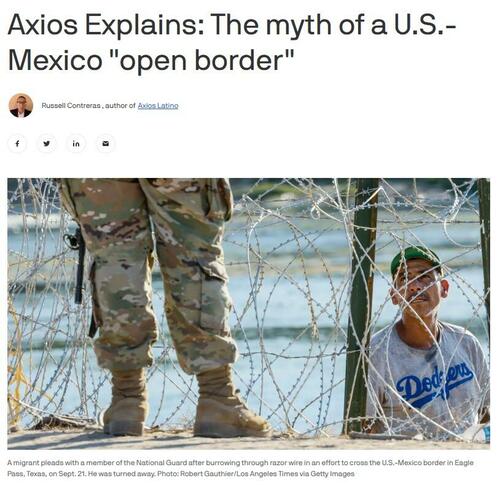

Biden Admin Quietly Admits Worst Ever Illegal Crossing Numbers As Axios Declares Border “More Fortified Than Ever”Gaslighting much…? Presumably these two things can be correct at the same time:

|

|

Why The ‘Uniparty’ Sabotaged Jim JordanAuthored by Jeffrey Tucker via The Epoch Times, In the backdrop of the controversies about who is to be voted Speaker of the House of Representatives is the awareness that this role is third in line for the presidency. The current president seems barely functional. The number two in line is absent without leave, never qualified in any sense, and is universally regarded as a joke if she is regarded at all, which she mostly is not. That leaves the Speaker of the House, very close to the center of power. For many people in Washington, this is a huge problem. The uniparty decided some years ago never to allow another “populist” – meaning someone who actually responds to the public in reality and not just in rhetoric – near the center of power. When the spot suddenly opened up, thanks to a vote pushed by a rebellious member, it threw the place into chaos. Jim Jordan of Ohio stepped up as the most respected and popular member among the grassroots of the party. Everyone has seen him on television. In his activism, he is everywhere at once, and a passionate opponent of business as usual on Capitol Hill. Read more at: https://www.zerohedge.com/political/why-uniparty-sabotaged-jim-jordan |

|

Police to treat shoplifting like organised crimeRetailers will help fund a specialist police unit to target gangs fuelling thefts in England and Wales. Read more at: https://www.bbc.co.uk/news/business-67191793?at_medium=RSS&at_campaign=KARANGA |

|

Tinder: Friends and family can now recommend matchesUsers of the dating app can now give friends and family access to their accounts to suggest potential matches. Read more at: https://www.bbc.co.uk/news/technology-67197467?at_medium=RSS&at_campaign=KARANGA |

|

Railway ticket office closure plans go too far, too fast, say MPsThe plans risk excluding some passengers from the railway, warns a committee of MPs. Read more at: https://www.bbc.co.uk/news/business-67193008?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty breaks below 100-DMA. What traders should do on WednesdayIn terms of Open Interest (OI) data, the highest OI on the call side was observed at 19,600, followed by the 19,500 strike prices. On the put side, the highest OI was at the 19,000 strike price. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-breaks-below-100-dma-what-traders-should-do-on-wednesday/articleshow/104652519.cms |

|

Stationery maker Cello World’s Rs 1,900-cr IPO to open on Oct 30Mumbai-based Cello World has a product portfolio across three key categories — consumer houseware, writing instruments and stationery, and moulded furniture and related products. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/stationery-maker-cello-worlds-rs-1900-cr-ipo-to-open-on-oct-30/articleshow/104648456.cms |

|

Chart Check: 40% rally in 3 months! NMDC breaks out from inverted Head & Shoulder pattern; time to buy?The breakout has opened room for the stock to head towards 200 levels in the next 3 months, suggest experts. Short-term traders can look to buy the stock around 160. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-40-rally-in-3-months-nmdc-breaks-out-from-inverted-head-shoulder-pattern-time-to-buy/articleshow/104640332.cms |

|

Outside the Box: Big tech is battling to put AI on your PC, laptop and smartphoneExpect Intel, AMD, Qualcomm and Nvidia to announce their plans for AI processing on personal technology devices. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7284-755A70B933E3%7D&siteid=rss&rss=1 |

|

The Tell: These stocks can boost your defensive positioning in a jittery market, says NuveenInvestors might consider these defensive plays as fears of higher-for-longer interest rates, geopolitical hostilities and other uncertainties rattle markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7286-43B25C0490A9%7D&siteid=rss&rss=1 |

|

Earnings Outlook: GM earnings: What to expect from carmaker facing UAW strikeGeneral Motors Co. is to report third-quarter earnings before the bell on Tuesday. Here’s what to expect. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7286-0F6F93DCD96C%7D&siteid=rss&rss=1 |