Summary Of the Markets Today:

- The Dow closed down 333 points or 0.98%,

- Nasdaq closed down 1.62%,

- S&P 500 closed down 1.34%,

- Gold $1,964 up $28.30,

- WTI crude oil settled at $88 up $1.62,

- 10-year U.S. Treasury 4.911% up 0.064 points,

- USD Index $106.58 up $0.330,

- Bitcoin $28,242 down $300,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Privately‐owned housing units authorized by building permits in September 2023 were down 7.2% year-over-year. Privately‐owned housing starts in September were also down 7.2% year-over-year. Privately‐owned housing completions were up 1.0% year-over-year. Residential construction remains in the doldrums.

The October 18, 2023 Beige Book shows most Districts indicated little to no change in economic activity since the September report. Consumer spending was mixed, especially among general retailers and auto dealers, due to differences in prices and product offerings. Tourism activity continued to improve, although some Districts reported slight slowing in consumer travel, and a few Districts noted an uptick in business travel. Banking contacts reported slight to modest declines in loan demand. Consumer credit quality was generally described as stable or healthy, with delinquency rates still historically low but slightly increasing. Real estate conditions were little changed and the inventory of homes for sale remained low. Manufacturing activity was mixed, although contacts across multiple Districts noted an improving outlook for the sector. The near-term outlook for the economy was generally described as stable or having slightly weaker growth. Expectations of firms for which the holiday shopping season is an important driver of sales were mixed. [This report was prepared at the Federal Reserve Bank of St. Louis based on information collected on or before October 6, 2023. This document summarizes comments received from contacts outside the Federal Reserve System and is not a commentary on the views of Federal Reserve officials.]

Here is a summary of headlines we are reading today:

- India Looks To Green Hydrogen For Steelmaking As Coking Coal Costs Rise

- Energy Remains Top Priority In China’s $1 Trillion Belt And Road Initiative

- Oil Jumps Higher On Inventory Draws

- Rising Rates, Geopolitical Tensions, And Debt Maturities Create Risky Mix

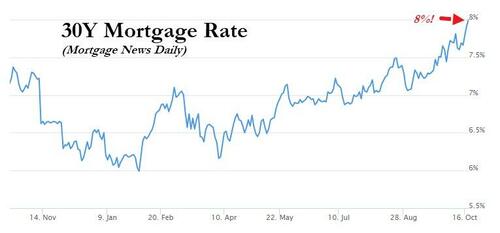

- The 30-year fixed mortgage rate just hit 8% for the first time since 2000 as Treasury yields soar

- Fed Chair Powell to deliver key speech Thursday. Here’s what to expect

- Rite Aid lost more than $1 billion in months before bankruptcy filing

- Beige Book Find “Little Change” As Outlook Turn Weaker But “Recession” Mentions Tumble

- Inflation: Milk, cheese and egg prices fall as petrol rises

- The Fed: Powell might be a bit more hawkish than his Fed colleagues on Thursday

- Market Snapshot: Dow falls almost 300 points with Treasury yields near 16-year highs, tech earnings ahead

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

India Looks To Green Hydrogen For Steelmaking As Coking Coal Costs RiseVia Metal Miner India has almost replaced China as the most important coking coal export destination for the near future. This comes after a significant increase in steel demand in the subcontinent. The expected resurgence in China’s economy, mainly due to the government’s efforts to kick-start sectors like construction, has not materialized. In response, sector experts are beginning to lose hope where steel consumption is concerned. In India, on the other hand, the story is one of growth and promise. Indeed, to build almost anything,… Read more at: https://oilprice.com/Energy/Energy-General/India-Looks-To-Green-Hydrogen-For-Steelmaking-As-Coking-Coal-Costs-Rise.html |

|

Europe’s Gas Storage Is Full But Equinor Expects VolatilityWhile Europe is in a much better position in terms of energy supply heading into this winter than it was last year, Norwegian energy giant Equinor warns that markets will remain volatile due to weather and expectations of new competition from Asia for LNG, which would drive prices up further. Despite Europe’s better preparedness this year, “We actually expect the market to be quite volatile over the winter,” Equinor CEO Anders Opedal told the Energy Intelligence Forum in London on Wednesday. “We will do everything we can… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Gas-Storage-Is-Full-But-Equinor-Expects-Volatility.html |

|

North Korea’s Covert Role In Russian-Ukrainian ConflictNorth Korea appears to have begun secretly shipping large amounts of munitions to Russia, according to a new report, using ships and trains to move the weaponry and bolster Moscow’s war against Ukraine. The report, published on October 16 by the London-based Royal United Services Institute, is based on high-quality satellite imagery surveying ports and train shipments. It adds further evidence to accusations made by the United States and other Western countries that Pyongyang has been helping Russia rebuild its weapons stocks. More than 18… Read more at: https://oilprice.com/Geopolitics/International/North-Koreas-Covert-Role-In-Russian-Ukrainian-Conflict.html |

|

Energy Remains Top Priority In China’s $1 Trillion Belt And Road InitiativeIn hosting its third Belt and Road Initiative Forum on Tuesday and Wednesday of this week, China is welcoming representatives from around 130 countries for a diplomatic event focused on Xi Jinping’s now ten-year-old signature policy. While coming in for criticism related to the “accentuated debt distress” it has put some countries under, Statista’s Martin Armstrong notes that the Belt and Road Initiative (BRI) has created $1.01 trillion worth of investment and construction projects in 148 countries around the world. You will find more infographics… Read more at: https://oilprice.com/Energy/Energy-General/Energy-Remains-Top-Priority-In-Chinas-1-Trillion-Belt-And-Road-Initiative.html |

|

Republicans Want To Know Biden’s Commitment To Offshore Gulf Of Mexico LeasingThe Biden Administration’s true intentions regarding offshore oil and gas leases in the Gulf of Mexico are being called into question by House Republicans, a Tuesday hearing has revealed, according to the Houston Chronicle. Minnesota Republican representative Pet Sauber, chair of the House Subcommittee on Energy and Mineral Resources, asked the director of the Bureau of Ocean Energy Management to commit to holding the oil and gas lease sales that are scheduled to begin in 2025. The targets are questionable because a 2025 oil and gas lease… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Republicans-Want-To-Know-Bidens-Commitment-To-Offshore-Gulf-Of-Mexico-Leasing.html |

|

China And Russia Vie For Influence As Middle East Crisis EscalatesChina and Russia have hardened their positions toward the conflict in Gaza in recent days, as the war between Israel and Hamas aggravates existing geopolitical tensions. This new Middle East crisis could also benefit both Beijing and Moscow by diverting the attention of their main global rival: the United States. With that in mind, here’s a breakdown of what’s happened so far and what’s at stake in Israel, Gaza, and beyond. Finding Perspective: Shortly after Hamas’s attacks, China struck a neutral tone that angered many… Read more at: https://oilprice.com/Geopolitics/International/China-And-Russia-Vie-For-Influence-As-Middle-East-Crisis-Escalates.html |

|

British Energy Secretary Warns Of UK Dependence On Foreign RegimesUK Energy Secretary Claire Coutinho warned on Wednesday that Britain will see North Sea oil and gas production halve by 2030, placing the UK at the mercy of external forces should the Labour Party government come to power and refuse to allow new offshore drilling. Coutinho said the UK would be forced to import up to 80% of its oil and gas by 2030, rendering it “subservient to foreign regimes” and “decimating the same people and communities that we need to come with us on this green transition journey”, as reported… Read more at: https://oilprice.com/Latest-Energy-News/World-News/British-Energy-Secretary-Warns-Of-UK-Dependence-On-Foreign-Regimes.html |

|

Biden’s Hydrogen Hubs Plan Slammed As Handouts To Big OilPresident Biden’s plan to extend $7 billion in grants to seven hydrogen hubs across America has come under fire from environmental organizations for supporting hydrogen production from natural gas. Numerous climate justice organizations have slammed the ambitious hydrogen plan of the U.S. Administration, saying it is extending the life of the fossil fuel industry while greenwashing its emission-reduction efforts. Some hydrogen hubs will rely on natural gas plus carbon capture and storage to produce hydrogen—the so-called blue hydrogen. The… Read more at: https://oilprice.com/Alternative-Energy/Fuel-Cells/Bidens-Hydrogen-Hubs-Plan-Slammed-As-Handouts-To-Big-Oil.html |

|

Oil Jumps Higher On Inventory DrawsCrude oil prices inched higher today after the U.S. Energy Information Administration reported an inventory decline of 4.5 million barrels for the week to October 13. That compares with a substantial build for the week before, which pressured oil prices. For the second week of October, the EIA reported 10.2 million barrels in additions to crude inventories. This Tuesday, however, the American Petroleum Institute estimated an inventory draw of 4.4 million barrels plus draws in fuels, too, which sent prices higher. Expectations… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Jumps-Higher-On-Inventory-Draws.html |

|

UK And Germany See No Way Back To Energy Trade With RussiaThe UK and Germany do not see a way back to energy trade relationships with Russia even if there is a regime change in Moscow, British and German officials said at the Energy Intelligence Forum in London on Wednesday. “There is no way back to energy relationship with Russia that we saw before the war. This relationship has ended,” said Miguel Berger, Germany’s Ambassador to the United Kingdom. The UK’s Minister of State for Energy Security and Net Zero, Graham Stuart, echoed those comments, saying that there would… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-And-Germany-See-No-Way-Back-To-Energy-Trade-With-Russia.html |

|

U.S. Natural Gas Output To Rise 5% In 2023 On Permian PushU.S. natural gas production will increase by 5% or 5 billion cubic feet per day in 2023, and by 2% next year, with growth primarily in the Permian basin region and driven by high oil prices and improved well-level productivity, the Energy Information Administration (EIA) forecast on Wednesday. The EIA estimates that Permian region natural gas production alone will increase by 11% in 2023 and 6% in 2024. Currently, the Permian region accounts for around 25% of all marketed natural gas produced in the U.S. Lower 48 states. Spurring… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Natural-Gas-Output-To-Rise-5-In-2023-On-Permian-Push.html |

|

Rising Rates, Geopolitical Tensions, And Debt Maturities Create Risky MixMany investors are warning of the risk of a debt crisis, but governments are ignoring all the signals. In an inflationary crisis, the government should reduce expenditures to help curb price increases while also anticipating a significant increase in borrowing costs. However, in this crisis, the United States administration is ignoring all the warning signs and continuing to borrow at a record pace. Debt crises always happen when even the most conservative investors refuse to add to a sovereign bond portfolio that is loss-making to begin with.… Read more at: https://oilprice.com/Finance/the-Economy/Rising-Rates-Geopolitical-Tensions-And-Debt-Maturities-Create-Risky-Mix.html |

|

Iran’s Call For Oil Embargo On Israel Falls On Deaf Ears In OPEC+The OPEC+ group doesn’t plan to take any immediate action in the wake of the Iranian call for Islamic countries to impose an oil embargo on Israel over the war with Hamas in Gaza, OPEC+ sources told Reuters on Wednesday. Earlier in the day, Iran urged Muslim countries – which are all of the OPEC+ producers in the Middle East – to impose an oil embargo on Israel over the latest deadly air strikes on the Gaza Strip. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Wont-React-Immediately-To-Irans-Call-For-An-Oil-Embargo-On-Israel.html |

|

South Africa Considers Including Denmark, The Netherlands In $8.5B Climate FundSouth Africa will soon decide whether to include Denmark and the Netherlands in the $8.5-billion agreement with developed economies to help the African country through the energy transition, a spokesman for the president told Bloomberg on Wednesday. “The matter will be tabled before cabinet and thereafter a decision will be communicated,” Vincent Magwenya, spokesman of South African President Cyril Ramaphosa told Bloomberg, without elaborating further on the issue. In June, the leaders of the Netherlands, Denmark, and South Africa… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Considers-Including-Denmark-The-Netherlands-In-85B-Climate-Fund.html |

|

Iran Calls For Oil Embargo On Israel As Middle East Tensions Flare UpIran is calling for an oil embargo on Israel over the latest deadly air strikes on the Gaza Strip amid growing tensions in the Middle East just as U.S. President Joe Biden arrived in Israel. Iran wants “an immediate and complete embargo on the Zionist regime by Islamic countries, an oil embargo against the regime,” according to a statement from the foreign ministry on Telegram quoted by Bloomberg. Iran’s Foreign Minister Hossein Amirabdollahian has also called for Muslim countries to expel their respective Israeli ambassadors… Read more at: https://oilprice.com/Energy/Energy-General/Iran-Calls-For-Oil-Embargo-On-Israel-As-Middle-East-Tensions-Flare-Up.html |

|

Netflix earnings are out — here are the numbersNetflix reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/10/18/netflix-nflx-earnings-q3-2023.html |

|

Tesla set to report third-quarter earnings after the bellTesla is set to report third-quarter earnings after the bell Wednesday. Earlier this month, Tesla announced a 7% decline in vehicle deliveries for Q3. Read more at: https://www.cnbc.com/2023/10/18/tesla-tsla-earnings-q3-2023.html |

|

The 30-year fixed mortgage rate just hit 8% for the first time since 2000 as Treasury yields soarMortgage rates are climbing, sending applications lower, as U.S. Treasury yields soar. Read more at: https://www.cnbc.com/2023/10/18/30-year-fixed-mortgage-rate-just-hit-8percent-for-the-first-time-since-2000.html |

|

Jim Jordan loses second House speaker vote, as GOP weighs dwindling optionsJim Jordan’s bid to become House speaker was in deep trouble Wednesday ahead of a second vote. Read more at: https://www.cnbc.com/2023/10/18/jim-jordans-house-speakership-bid-on-the-ropes-ahead-of-second-vote-.html |

|

Fed Chair Powell to deliver key speech Thursday. Here’s what to expectFederal Reserve Chair Jerome Powell is set to deliver what could be a key policy address Thursday. Read more at: https://www.cnbc.com/2023/10/18/fed-chair-powell-to-deliver-key-speech-thursday-heres-what-to-expect.html |

|

Biden to seek ‘unprecedented’ Israel aid package; pledges $100 million for humanitarian relief in Gaza and West BankBiden announced that his administration will commit $100 million to humanitarian assistance in Gaza and the West Bank. Read more at: https://www.cnbc.com/2023/10/18/biden-will-seek-unprecedented-israel-aid-package-.html |

|

Israel-Hamas war live updates: Death toll climbs as strikes continue; hundreds of Americans ask State Department for help leaving GazaBiden’s diplomatic trip to Israel is part of an effort to show “solidarity” with the country following a devastating Oct. 7 attack by Hamas. Read more at: https://www.cnbc.com/2023/10/18/israel-hamas-war-gaza-live-updates-latest-news.html |

|

Rite Aid lost more than $1 billion in months before bankruptcy filingRite Aid warned investors it may not be able to keep its business running. Read more at: https://www.cnbc.com/2023/10/18/rite-aid-lost-more-than-1-billion-before-bankruptcy-filing.html |

|

Analysts say growth concerns and increased competition in China are weighing on Apple stockShares of the iPhone and iPad maker have shed roughly 1.5% this week. Read more at: https://www.cnbc.com/2023/10/18/analysts-say-growth-outlook-china-business-weigh-down-apple-stock.html |

|

United Airlines will debut a new boarding order to save timeUnited Airlines said in an internal memo that it will board economy passengers with window seats before those with middle and aisle seats to save time. Read more at: https://www.cnbc.com/2023/10/18/united-airlines-to-debut-new-boarding-order.html |

|

iPhone 15 sales look like they’re starting off slow in China ahead of a critical holiday seasonInvestors are eager to see Apple return to growth this holiday season after three straight quarters of declining overall sales. Read more at: https://www.cnbc.com/2023/10/18/apple-iphone-15-sales-look-like-theyre-starting-off-slow-in-china.html |

|

Biden administration to invest $3.5 billion to improve the resiliency of the electric gridOn Wednesday, the Biden Administration announced $3.5 billion in federal funding is going to improve the resiliency of the aging electric grid in the U.S. Read more at: https://www.cnbc.com/2023/10/18/biden-administration-to-invest-3point5-billion-into-the-electric-grid.html |

|

As Rite Aid’s bankruptcy shutters drugstores, these retailers will benefitDrugstore closures could be a growth opportunity for several traditional retailers looking to gain market share in the health-care sector, according to UBS. Read more at: https://www.cnbc.com/2023/10/18/as-rite-aids-bankruptcy-shutters-drugstores-these-retailers-will-benefit.html |

|

Tesla Earnings Preview: Margins And Guidance Will Be Focus As Price Cutting ContinuesTesla is reporting earnings after the bell today and analysts will certainly be focusing on the company’s margins after yet another quarter of slashing prices. This report will also mark the first quarter since CFO Zachary Kirkhorn announced he would be stepping down from his position. Vaibhav Taneja now holds the roles of both CAO and CFO. Analysts are expecting $0.73 cents per share in earnings on $24.1 billion in revenue, per CNBC, who cited Refinitiv estimates. The company is expected to report diminished financials due to its aggressive cost cutting and the key question remains whether or not investors are willing to look forward and see Tesla as more than an automobile company for yet another quarter. While the fundamentals around the company’s auto business slow due to price cuts, the market is faced with the question of whether to value Tesla as a traditional automaker or an emerging tech “growth” company. Meanwhile, on the auto side of things, delivery guidance still stands at 1.8 million vehicles for the year and margins will continue to be the key focus, with Tesla continuing to aggressively slash the price of its vehicles moving into Q3 this year. We noted about a week ago that Tesla’s vehicles are now officially priced to compete with traditional ICE vehicles. And the company’s biggest analyst friend over the years, Adam Jonas, is feeling cautious heading into the report, Read more at: https://www.zerohedge.com/markets/tesla-earnings-preview-margins-continue-be-focus-cost-cutting-continued-q2 |

|

Beige Book Find “Little Change” As Outlook Turn Weaker But “Recession” Mentions TumbleThe Fed’s latest beige book released this afternoon was a rather boring affair, one signaling “little to no change in economic activity” since the September report. That said, one month after a rather downbeat Beige Book warned that consumers had “exhauste … Read more at: https://www.zerohedge.com/economics/beige-book-find-little-change-outlook-turn-weaker-and-recession-mentions-tumble |

|

As Mortgage Rates Hit 8%, US Housing Affordability At Lowest Level Since The ’80sUpdate (1320ET): The average rate on the popular 30-year fixed mortgage rate hit 8% Wednesday morning, according to Mortgage News Daily. That is the highest level since mid-2000.

“Here’s another milestone that seemed extreme several short months ago,” said Matthew Graham, chief operating officer of Mortgage News Daily.

As CNBC reports, to put it in perspective, a buyer purchasing a $400,000 home with a 20% down payment would have a monthly payment today of nearly $1,000 more than it would have been two years ago. Read more at: https://www.zerohedge.com/personal-finance/us-housing-affordability-lowest-level-80s-nar |

|

Jordan Falls Short Once Again After House Holds Second Speaker VoteJim Jordan lost the second round of voting for speaker, as 22 Republicans voted against him, two more than Tuesday’s initial vote. The final vote count was 212 for Hakeem Jeffries (D), 199 for Jordan (R) and 22 for ‘others’ (Scalise, etc.).

Read more at: https://www.zerohedge.com/political/jordan-falls-short-once-again-after-house-holds-second-speaker-vote |

|

Amazon plans drone deliveries for UK parcels next yearDeliveries will be in one area to begin with from late 2024 and only for items weighing up to 5lbs (2.2kg). Read more at: https://www.bbc.co.uk/news/business-67132527?at_medium=RSS&at_campaign=KARANGA |

|

Microsoft’s new AI assistant can go to meetings for youThe ChatGPT-style tech can write emails, create Powerpoints, and take care of other “drudgery”. Read more at: https://www.bbc.co.uk/news/technology-67103536?at_medium=RSS&at_campaign=KARANGA |

|

Inflation: Milk, cheese and egg prices fall as petrol risesThe battle to slow soaring prices is not over and means uncertainty over another interest rate rise. Read more at: https://www.bbc.co.uk/news/business-67142756?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How IRB Infrastructure, Triveni Engineering and Suzlon are looking on charts for Thursday’s tradeSuzlon stock went up to 5% in a single day and the overall sentiment of the stock is looking bullish. It took support above a trendline and for the past few days, it has been hitting the upper circuit. The stock is experiencing good buying pressure. The stock is heading toward its next target of Rs 37.20 level as Target 1 and Rs 45.20 level as Target 2 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-irb-infrastructure-triveni-engineering-and-suzlon-are-looking-on-charts-for-thursdays-trade/articleshow/104530464.cms |

|

10 commodity stocks hit their 52-week high on WednesdayDuring Wednesday’s trading session, the Sensex benchmark index experienced a notable decline of around 551 points, concluding the day at 65,877. Surprisingly, despite the overall market downturn, 10 stocks included in the BSE commodities index reached their highest prices within the last 52 weeks.The 52-week high is of great importance for particular traders and investors as it serves as a crucial technical indicator for assessing a stock’s present value and forecasting potential price fluctuations. This figure signifies the peak price at which a stock has traded over the course of the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/10-commodity-stocks-hit-a-52-week-high-do-you-own-any/new-highs/slideshow/104531731.cms |

|

Tech View: Nifty charts hint at further weakness ahead. What traders should do on ThursdayThe Futures Open Interest (OI) in the Nifty indicated a buildup of fresh short positions in index futures. Call writers were seen offloading their positions at the 19,800 strike, leading to a strong down in Nifty today. A double-top structure around the 19,850 levels is visible on the daily chart. A breakdown below the previous swing low of 19,635 can intensify the selling pressure, which can take the index to 19,480 levels, said Ashwin Ramani, Derivatives and Technical Analyst, SAMCO Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-further-weakness-ahead-what-traders-should-do-on-thursday/articleshow/104530348.cms |

|

Market Extra: Forget stocks! Gold enjoys a moment over the past year as it hurtles toward $2,000Gold futures rally on Wednesday, with prices looking to settle at their highest level since late August after an explosion at a Gaza City hospital. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7282-07582D0A769D%7D&siteid=rss&rss=1 |

|

The Fed: Powell might be a bit more hawkish than his Fed colleagues on ThursdayFederal Reserve Chairman Jerome Powell might be a bit more hawkish in his speech Thursday than his colleagues have been in recent speeches, economists said. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7282-5D0BC43CF146%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow falls almost 300 points with Treasury yields near 16-year highs, tech earnings aheadU.S. stock indexes fell on Wednesday as Treasury bond yields remained near fresh 16-year highs and geopolitical angst hit global sentiment. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7281-ACECD73D668C%7D&siteid=rss&rss=1 |