Summary Of the Markets Today:

- The Dow closed up 13 points or 0.04%,

- Nasdaq closed down 0.25%,

- S&P 500 closed down 0.01%,

- Gold $1,936 up $1.70,

- WTI crude oil settled at $87 up $0.55,

- 10-year U.S. Treasury 4.838% up 0.130 points,

- USD Index $106.19 down $0.050,

- Bitcoin $28,525 up $57,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production increased in September 2023 0.1% year-over-year – the three industrial production components manufacturing (red line on the graph below), utilities (green line on the graph below), and mining (orange line on the graph below) increased -0.8%, 2.0%, and 3.4% respectively year-over-year. Overall the manufacturing component remains in a recession and does not indicate an improving trend – and manufacturing represents approximately 20% of the economy.

Advance estimates of U.S. retail and food services sales for September 2023 were up 3.4% year-over-year (blue line on the graph below – unadjusted data). If one adjusts for inflation, retail and food sales were up 1.5% (red line on the graph below). This year-over-year growth rate is similar to last month thereby showing almost no acceleration month-over-month. Please do not be fooled by the bullshit reporting throwing out “Retail sales rose 0.7% in September, more than twice what economists had expected, and close to a revised 0.8% bump in August, the Commerce Department reported Tuesday.” There is no resilience of shoppers in the U.S. considering that gas stations are over 100% of the increase in spending year-over-year.

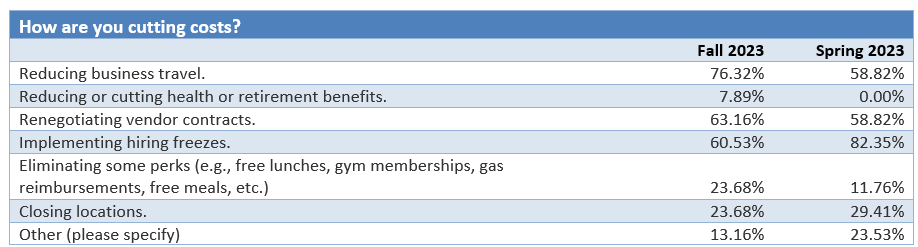

Several economic indicators suggest that while the labor market remains tight, consumers and businesses are approaching the end of the year with caution. In a new survey, 46% of companies expect a recession, with 24% actively planning for one. That number jumps to 52% for companies with more than 5,000 employees, according to new survey results released Wednesday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

CoreLogic’s Single-Family Rent Index (SFRI) shows annual U.S. single-family rent growth eased again in August 2023 but renters are still feeling the pinch. The average American renter household spends about 40% of its income on housing costs, with lower-income tenants bearing much of the brunt of inflation. The SFRI’s low tier saw the largest year-over-year rental cost gain in August (up by 4.2%), while the high tier registered a 2.4% annual increase. Molly Boesel, principal economist for CoreLogic added:

While annual single-family rent growth has returned to a moderate pace, more than three years of substantial increases will have a lasting impact on tenants’ budgets. Single-family rents grew by 30% since February 2020, and small drops in some areas barely put a dent in the overall, cumulative increase. For example, even though rents in the Miami metro area have declined by 0.5% since August 2022, they are still 51% higher than they were before the pandemic began.

Here is a summary of headlines we are reading today:

- EV Battery Costs Could Surge By 22%

- Goldman’s Grim Forecast: Shipping Industry Faces Prolonged Downturn

- Russian Oil Shipping Rates Jump As The U.S. Sanctions Price Cap Evaders

- Oil Markets Remain On Edge As Biden Heads To Israel

- Homebuilder sentiment drops to 10-month low, as mortgage rates soar

- S&P 500 closes little changed Tuesday as Treasury yields pop on hot retail sales data: Live updates

- Retail sales rose 0.7% in September, much stronger than estimate

- Wages overtake inflation for first time in nearly two years

- Market Extra: ‘Bond math’ shows traders bold enough to bet on Treasurys could reap dazzling returns with little risk

- 5 charts that show how the housing market crashed and burned in 18 months

- Shares of bankrupt Rite Aid plunge despite meme-stock chatter

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China Defends Belt And Road Initiative Amidst Global CriticismsDespite criticism that it has saddled some countries with unsustainable levels of debt since being launched 10 years ago, Chinese leader Xi Jinping is expected to tout the Belt and Road Initiative (BRI) as a foreign policy success while showcasing it as an alternative development model to the West at a major summit in Beijing. The third Belt and Road Forum will begin on October 17 and is set to be attended by representatives from around the world as China looks to cement the program championed by Xi as a key part of the country’s foreign policy.… Read more at: https://oilprice.com/Geopolitics/International/China-Defends-Belt-And-Road-Initiative-Amidst-Global-Criticisms.html |

|

Mexico Working On Famous 2024 Oil HedgeMexico is currently working to lock in crude oil prices for export for next year as part of its lucrative oil hedging program. Mexico’s oil hedging program—referred to as the Hacienda Hedge—is fairly universally thought of as quite remarkable—profitable more often than not—and in some years when oil prices fall sharply, extremely profitable. The idea behind Mexico’s well-to-do billion-dollar Hacienda Hedge allows Mexico to buy put options in the Fall of each year for the coming year that give Mexico the option… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mexico-Working-On-Famous-2024-Oil-Hedge.html |

|

EV Battery Costs Could Surge By 22%Via Metal Miner The Renewables MMI (Monthly Metals Index) saw a welcome boost month-on-month, rising 6.27%. Grain-oriented electrical steel, silicon, and neodymium were the main factors that increased the index, while the lithium-ion battery market remains a point of contention. In the case of silicon, futures initially rose back in June due to production cuts within China, the world’s #1 manufacturer. It appears the after-effects of the cuts finally impacted prices, mainly due to stockpiling buyers. That said, most steel… Read more at: https://oilprice.com/Metals/Commodities/EV-Battery-Costs-Could-Surge-By-22.html |

|

Trading Giant Says Some Of Europe’s Natural Gas Demand Is Lost For GoodSome of the lost European demand for natural gas due to the energy crisis and record-high prices could never return, Vitol Group’s chief executive Russel Hardy said at the Energy Intelligence Forum in London on Tuesday. “For gas, demand has plummeted in Europe, with double-digit percentage reductions. We expect some of the lost demand to be permanent,” Hardy told the forum. “Gas and power had a terrible year for demand (last year) And it continues to be very difficult in Europe … on the industrial side… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trading-Giant-Says-Some-Of-Europes-Natural-Gas-Demand-Is-Lost-For-Good.html |

|

Goldman’s Grim Forecast: Shipping Industry Faces Prolonged DownturnSince global shipping peaked during the Covid pandemic, A.P. Moller-Maersk has warned about an emerging downturn in the container shipping market. Goldman now forecasts a lengthier and potentially more severe downturn for the shipping industry, recommending a sell for the Danish shipping giant: “We believe market expectations are still too complacent on the depth and duration of the coming shipping recession,” Goldman analyst Patrick Creuset told clients Monday morning. Creuset said his fundamental perspective on the industry… Read more at: https://oilprice.com/Energy/Energy-General/Goldmans-Grim-Forecast-Shipping-Industry-Faces-Prolonged-Downturn.html |

|

Is The Saudi Arabia-Russia Oil Pact Showing Signs Of Weakening?The pact between Saudi Arabia and Russia to keep oil barrels off the market could be showing signs of weakening, with Russia’s oil exports now on the rise. Russia’s seaborne crude oil exports rose in the seven days to October 15, with Russia’s four-week average seaborne crude exports now at a three-month high. Russia’s crude exports now are at 3.51 million barrels per day, an increase of .285 million bpd from the seven days to October 8, according to tanker tracker data analyzed by Bloomberg. Four-week average outflows from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Is-The-Saudi-Arabia-Russia-Oil-Pact-Showing-Signs-Of-Weakening.html |

|

The Fate Of Kazakhstan’s Largest Steelworks Hangs In BalanceThe billowing smokestacks of Kazakhstan’s largest steelworks loom large over the town of Temirtau — just like the questions about the future of a plant where the country’s first president began his working life. Amid a trend of accidents and deaths in the mines that feed the steel mill and longstanding complaints about heavy pollution in the city, authorities have been talking tough on ArcelorMittal Temirtau, an offshoot of the global steel giant ArcelorMittal. At the same time, they don’t seem to have a plan to replace the investor… Read more at: https://oilprice.com/Geopolitics/International/The-Fate-Of-Kazakhstans-Largest-Steelworks-Hangs-In-Balance.html |

|

Russian Oil Shipping Rates Jump As The U.S. Sanctions Price Cap EvadersShipping rates for transporting Russian crude have surged since last week after the U.S. took a tougher stance on sanctions for vessels carrying Russia’s oil above the G7 price cap, traders have told Reuters. Last week, the United States took a tougher stance on the Western sanctions against Russia. The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed last Thursday sanctions on two entities and identified as blocked property two vessels that used Price Cap Coalition service providers… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Shipping-Rates-Jump-As-The-US-Sanctions-Price-Cap-Evaders.html |

|

Qatar’s Support For U.S. With Iran Sanction Is CrucialAt the time Russia invaded Ukraine in 2022, the U.S. had few allies left in the Middle East, following a period of disengagement from the region during the presidency of Donald Trump. The policy behind this was encapsulated in his ‘Endless Wars’ commencement address to the United States Military Academy at West Point on 13 June 202 in which he said that the days of the U.S. being the “policeman of the world” were over. This idea found resonance in the U.S. withdrawal from Syria (in 2019), Afghanistan (2021), and Iraq (2021).… Read more at: https://oilprice.com/Energy/Energy-General/Qatars-Support-For-US-With-Iran-Sanction-Is-Crucial.html |

|

Stockholm To Ban Gas And Diesel Cars From 2025The ban on gas and diesel vehicles is officially making its way across the globe, with Stockholm the next city in the queue. The Swedish capital now has a plan in place to ban gas and diesel cars in part of the city beginning in 2025, according to Bloomberg. The ban is going to begin in a 20 block area around the capital’s finance hub, the report says. The same area also houses the city’s main shopping attractions. It’ll only allow “electric cars, some hybrid trucks and fuel cell vehicles”, the report says, citing rules reported by SVT that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Stockholm-To-Ban-Gas-And-Diesel-Cars-From-2025.html |

|

President Sandu: Gazprom Can No Longer “Blackmail” Moldova Over GasMoldovan President Maia Sandu says steps taken by her country — one of Europe’s poorest — to diversify its gas supplies means Russia can no longer “blackmail” Chisinau “as it used to.” Speaking to RFE/RL at its headquarters in Prague on October 16, Sandu said Moldova’s move to access gas through purchases on the open market and not directly from Russian energy giant Gazprom has given independence it previously didn’t have. “We don’t buy Russian gas from Gazprom. We buy gas on the market, which means that Russia cannot blackmail us as it used… Read more at: https://oilprice.com/Energy/Natural-Gas/President-Sandu-Gazprom-Can-No-Longer-Blackmail-Moldova-Over-Gas.html |

|

World’s Top Oil Trader To Spend Half Of Its $2-Billion Capex On RenewablesVitol Group, the world’s largest independent oil trader, plans to spend half of its $2-billion capital expenditure on renewables, the group’s chief executive Russel Hardy said at the Energy Intelligence Forum in London on Tuesday. “We’ve got a fair amount of capex going into the renewables and power business. Half of the company’s capex, which is $2 bln so about $1 bln, is going into renewable business,” Hardy said at the event, as carried by Reuters. Commenting on oil demand and oil prices at the forum, Hardy said that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Top-Oil-Trader-To-Spend-Half-Of-Its-2-Billion-Capex-On-Renewables.html |

|

Oil Markets Remain On Edge As Biden Heads To IsraelOil prices have fallen back slightly on the news that the U.S. plans to ease sanctions on Venezuela’s oil exports, but geopolitical tension in the Middle East will keep oil markets on edge. Chart of the Week- Qatar has been actively leveraging fears over energy security in the long run with decades-long term LNG supply deals still only covering a third of its incremental production from the North Field East and North Field South expansions.- Once the world’s largest gas exporter dethroned by the US, Qatar is expected to regain that spot again… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Remain-On-Edge-As-Biden-Heads-To-Israel.html |

|

Switzerland Stops Strategic Fuel Stock Drawdowns As Supply NormalizesSwitzerland is repealing an ordinance from 2022 allowing drawdowns from its strategic fuel stockpiles after supply of petroleum products has now normalized, the Swiss government said on Tuesday. Last year, Switzerland started to release oil from its emergency reserves as it lowered the obligatory levels of petroleum stocks by 6.5% due to low water levels on the Rhine River and chaos in railway transportation. In 2022, heat waves and droughts in many parts of Europe drained the water levels at the biggest navigational rivers, including… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Switzerland-Stops-Strategic-Fuel-Stock-Drawdowns-As-Supply-Normalizes.html |

|

Saudi Aramco: The World Needs To Cut Emissions, Not Oil ProductionThe COP28 climate summit and the world should focus the debate on how to cut emissions, not on reducing oil and gas production, Saudi Aramco’s chief executive Amin Nasser said on Tuesday. “The focus should be on emissions. Today the focus is not purely on emissions, it is: we need to either shut or slow down big time your conventional (energy),” the top executive of the world’s largest oil firm said at the Energy Intelligence Forum in London, as quoted by Reuters. Earlier this month, OPEC Secretary General Haitham… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-The-World-Needs-To-Cut-Emissions-Not-Oil-Production.html |

|

Homebuilder sentiment drops to 10-month low, as mortgage rates soarBuilder sentiment for single-family homes dropped to the lowest level since January, as mortgage rates soar. Read more at: https://www.cnbc.com/2023/10/17/homebuilder-sentiment-drops-to-10-month-low-as-mortgage-rates-soar.html |

|

Jim Jordan loses first House speaker vote, prepares for second ballotRep. Jim Jordan, R-Ohio, fell short by 20 votes in the first ballot of voting for House speaker. Read more at: https://www.cnbc.com/2023/10/17/house-speaker-vote-jim-jordan-intends-to-wear-down-gop-opposition-with-multiple-votes.html |

|

GM to delay all-electric truck production at Michigan plant until late-2025GM will delay production of all-electric trucks at a Michigan plant by at least a year to “better manage capital investments” and implement other improvements. Read more at: https://www.cnbc.com/2023/10/17/gm-to-delay-ev-truck-production-at-michigan-plant.html |

|

S&P 500 closes little changed Tuesday as Treasury yields pop on hot retail sales data: Live updatesThe 10-year U.S. Treasury yield topped 4.8%, drawing attention. Read more at: https://www.cnbc.com/2023/10/16/stock-futures-tick-up-as-wall-street-look-towards-busy-earnings-week-live-updates.html |

|

Beware of these expensive stocks that analysts don’t likeAnalysts are cautious of these names, which are looking costly on a price-earnings basis. Read more at: https://www.cnbc.com/2023/10/17/beware-these-expensive-stocks-that-analysts-dont-like.html |

|

Israel-Hamas war live updates: Hamas says it will release civilian hostages if Israel stops Gaza strikesBiden is “coming here at a critical moment for Israel, for the region and for the world,” U.S. Secretary of State Antony Blinken said from Tel Aviv. Read more at: https://www.cnbc.com/2023/10/17/israel-hamas-war-gaza-live-updates-latest-news.html |

|

Thousands of casino workers go on strike in DetroitCasino workers in Detroit are seeking higher wages and better working conditions as the cost of living has increased in recent years. Read more at: https://www.cnbc.com/2023/10/17/casino-workers-go-on-strike-in-detroit.html |

|

Biden heads to Israel with Middle East on edge after Hamas attackBiden will travel to Israel to show solidarity with the country as it retaliates after the deadly Hamas attacks and advocate for humanitarian aid for Gazans. Read more at: https://www.cnbc.com/2023/10/17/biden-heads-to-israel-jordan-after-hamas-attack.html |

|

Trump appeals gag order in DC election caseTrump, who is campaigning for president in 2024, had vowed to challenge the gag order from U.S. District Judge Tanya Chutkan. Read more at: https://www.cnbc.com/2023/10/17/trump-appeals-gag-order-in-dc-election-case.html |

|

Instagram chief says Israel-Hamas war is ‘biggest safety focus’ on ThreadsAdam Mosseri says ‘biggest safety focus’ on Threads is around the Israel-Hamas war Read more at: https://www.cnbc.com/2023/10/17/israel-hamas-war-is-biggest-safety-focus-on-threads-instagram-chief.html |

|

The secret life of Jimmy Zhong, who stole – and lost – more than $3 billionCNBC obtained never-before-seen body camera footage that shows how investigators linked Jimmy Zhong to the Silk Road hack Read more at: https://www.cnbc.com/2023/10/17/crypto911.html |

|

Retail sales rose 0.7% in September, much stronger than estimateThe advanced retail sales report for September was expected to show a gain of 0.3%, according to a Dow Jones estimate. Read more at: https://www.cnbc.com/2023/10/17/retail-sales-september-2023-.html |

|

Is This The End Of Naked Short Selling?By James Stafford of Oilprice.com American investors have been taken for a trillion-dollar ride by naked short sellers, in what could turn out to be the biggest financial regulatory scandal in North American history. While what is now an all-out war on naked short sellers intensifies, there is a new flashpoint on the front line–a potentially devastating ruling targeting those who are alleged to make illegal naked short selling possible: The Facilitators: bankers and brokers. On September 29, Federal District Court Judge Lorna Schofield of the Southern District of New York issued a ruling that has the potential to significantly disrupt Wall Street compliance, and is a major first step towards protecting retail investors from fraud. In Harrington Global Opportunity Fund Ltd. v. CIBC World Markets, Inc et.al, Judge Schofield found that broker-dealers may be primarily liable for manipulative trading initiated by their customers because they serve as “gate-keepers” of trading on securities exchanges. These broker-dealers have a “continuing responsibility to ensure that their customer’s order flow … is in compliance with all applicable rules, regulations and laws and detect and prevent manipulative or fraudulent trading … under the supervision and control of the firm,” the judge ruled. The defendants in the case had moti … Read more at: https://www.zerohedge.com/markets/end-naked-short-selling |

|

Watch: Chinese Jets Come Within 5 Meters Of Canadian Spy Plane In ‘Very Aggressive’ InterceptIt’s not just US military aircraft which are operating with increasing frequency in skies off China’s coast, but now the Canadian Armed Forces are getting more involved, perhaps as the Pentagon’s junior partner. On Monday, Canada’s military condemned what it described as a “very aggressive” intercept of its spy plane by Chinese pilots. Canada’s Global News reports, “At least two different Chinese jets intercepted the Canadian plane consistently for multiple hours during the more than eight-hour-long mission. The Chinese jets came within about five meters of the Canadian plane.” “They became very aggressive and to a degree we would deem it unsafe and unprofessional,” Canadian Armed Forces Maj.-Gen. Iain Huddleston said in statements to the media. Global News was actually aboard the Canadian spy plane when the intercept took place and was able to get close-up footage. In the recent past CNN crews have also on occasion accompanied US reconnaissance flights to get live footage of the expected moments that Chinese PLA jets shadow or intercept Western military aircraft… At one point, one of the Canadian pilots says that the C … Read more at: https://www.zerohedge.com/geopolitical/watch-chinese-jets-come-within-5-meters-canadian-spy-plane-very-aggressive-intercept |

|

Terminal-Rate Pricing Doesn’t Look So Terminal In EuropeBy Ven Ram and Heather Burke, Bloomberg Markets Live reporters and strategists Interest-rate traders reckon that central banks in the US, euro zone and the UK are more or less done raising rates in this cycle. They may be: a) possibly right in the US; b) less so in the euro zone; and c) likely wrong in the UK. The Bank of England decided to pause its tightening last month having raised rates by 515 basis points in this cycle. While on the face of it, that seems like a staggering amount of tightening, it’s not a number that should be looked at in isolation. Rather, it is where the benchmark rate is in relation to inflation and whether that rate is restrictive enough. On that front, the BOE may be skating on thin ice (witness the UK’s still-sticky wages). Both in terms of realized and projected prices in the economy, its real policy rate is negative. Which is why the BOE’s chief economist, Huw Pill, remarked Monday:

Given that its real policy rate is negative, the BOE’s benchmark — despite being the highest in years — isn’t really posing much of a drag on inflation. Of course, it’s possible that inflation crumbles on its own from here toward 2%, but it seems unlikely. The European Central Bank is in a better position, given that it has a buffer of some 80 basis points by way of a real policy rate. That margin may be sufficient on a good day, but is by no means as compelling as the Fed’s 290 basis poin … Read more at: https://www.zerohedge.com/markets/terminal-rate-pricing-doesnt-look-so-terminal-europe |

|

Tucker Carlson’s Media Company Secures $15 Million Seed Round From ‘Anti-Woke’ Firm 1789 CapitalA $150 million fund with aims to capitalize on the parallel economy of conservative-friendly companies has seeded Tucker Carlson and Neil Patel’s new media company with $15 million, The Wall Street Journal reports. Since leaving Fox News in April, Carlson’s widely popular show on X has attracted hundreds of millions of views, underscoring his point that legacy corporate media is dying. In August, we cited a CNBC report that said GOP megadonors considered investing in Carlson’s show. WSJ now reveals that Omeed Malik, who launched 1789 Capital earlier this year, invested $15 million in Tucker Carlson and Neil Patel’s new media venture that is registered in Nevada under the holding company name Last Country, Inc. on Monday. The investment is structured as “SAFE,” short for Simple Agreement for Future Equity, a standard type of investment structure developed by Silicon Valley startup accelerator Y Combinator. People familiar with the deal said the goal of 1789 is to push the new media venture past the proof of concept for its online video-driven business model to raise millions of dollars in the future. Read more at: https://www.zerohedge.com/markets/tucker-carlsons-media-company-receives-15-million-seed-round-anti-woke-firm-1789-capital |

|

Wages overtake inflation for first time in nearly two yearsAverage pay growth outpacing inflation suggests the squeeze on living costs may be starting to ease. Read more at: https://www.bbc.co.uk/news/business-67121459?at_medium=RSS&at_campaign=KARANGA |

|

Rolls-Royce to axe up to 2,500 jobs in bid to cut costsThe engineering giant says redundancies will be made worldwide as part of a move to cut costs. Read more at: https://www.bbc.co.uk/news/business-67118265?at_medium=RSS&at_campaign=KARANGA |

|

Bedbugs: Hotels turn to tech as outbreaks riseFirms are turning to tech – both old and new – to catch outbreaks early, which is vital to stopping the spread. Read more at: https://www.bbc.co.uk/news/business-67123305?at_medium=RSS&at_campaign=KARANGA |

|

These 5 FMCG stocks record 52-week high on TuesdayOn Tuesday’s trading session, the Sensex benchmark index experienced an upswing of around 261 points, concluding the day at 66,428. During this upward trajectory, five stocks from the BSE FMCG index reached their highest prices in the past 52 weeks. This 52-week high holds particular significance for specific traders and investors, serving as a vital technical indicator to gauge a stock’s current value and predict potential price fluctuations. It signifies the highest price at which a stock has traded over the preceding year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-fmcg-stocks-record-their-new-52-week-high-do-you-own-any/on-a-high/slideshow/104502933.cms |

|

Tech View: Nifty bulls in buy-the-dip mode. What traders should do on WednesdayThe short-term trend remains strong as the index sustains above critical moving averages on the daily timeframe. A “buy on dips” strategy is favored as long as it remains above 19,550. On the higher end, it might move towards 20,000-20,200. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-in-buy-the-dip-mode-what-traders-should-do-on-wednesday/articleshow/104500414.cms |

|

India leads emerging market ETF inflows after $5 billion routRisk traders continue to tout India — the fastest-growing major economy — as a bright spot amid the volatility that has engulfed developing nations this year. As China’s growth-engine status weakens, investors are favoring places where growth is strong or the capacity to provide stimulus is high. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/india-leads-emerging-market-etf-inflows-after-5-billion-rout/articleshow/104490044.cms |

|

Market Extra: ‘Bond math’ shows traders bold enough to bet on Treasurys could reap dazzling returns with little riskAs investors snap up long-dated Treasurys following a historic rout that has seen the price of some issues cut in half, some traders are using esoteric “bond math” to justify making big contrarian bets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7280-C5095DAB4CCA%7D&siteid=rss&rss=1 |

|

5 charts that show how the housing market crashed and burned in 18 monthsThe ‘fastest Fed-driven housing slowdown on record’ has slowed the U.S. housing market with elevated prices and higher monthly mortgage payments. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7281-2CFE6F5FF838%7D&siteid=rss&rss=1 |

|

Shares of bankrupt Rite Aid plunge despite meme-stock chatterAfter halting on Monday, trading in Rite Aid’s stock resumed Tuesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7281-3671A98C791D%7D&siteid=rss&rss=1 |