Summary Of the Markets Today:

- The Dow closed up 314 points or 0.93%,

- Nasdaq closed up 1.20%,

- S&P 500 closed up 1.06%,

- Gold $1,932 down $9.10,

- WTI crude oil settled at $87 down $0.87,

- 10-year U.S. Treasury 4.706% up 0.079 points,

- USD Index $106.19 down $0.450,

- Bitcoin $28,425 up $1,391,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

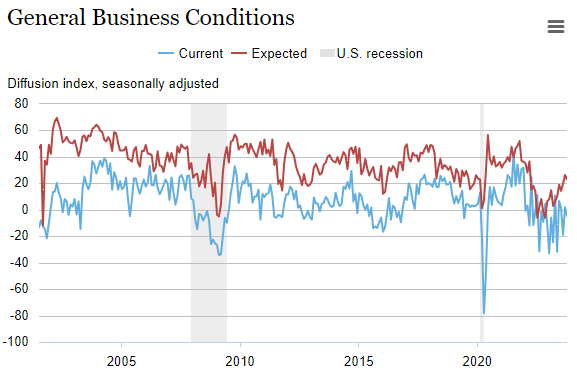

Business activity edged lower in New York State, according to firms responding to the October 2023 Empire State Manufacturing Survey. The headline general business conditions index fell seven points to -4.6. New orders fell slightly, while shipments were little changed. Last month’s modestly positive report should be ignored. Manufacturing remains in a recession. The New York Fed is the first district to report on manufacturing for October.

Here is a summary of headlines we are reading today:

- Big Oil Shares Up As Israel-Hamas Conflict Intensifies

- Glut Of Synthetic Diamonds Sparks Trouble For Lab-Grown Producers

- Indonesia Eyes “Critical Mineral Agreement” With U.S. For Nickel Exports

- Saudi Arabia’s Crude Oil Exports Slumped To 28-Month Low In August

- Meta’s unique approach to developing AI puzzles Wall Street, but techies love it

- Stocks close higher, Dow rallies 300 points as optimism over earnings outweighs higher rates: Live updates

- Israel-Hamas war live updates: Blinken meets with Israeli president, promises U.S. support; Gaza-Egypt border still closed

- Trump hit with partial gag order in DC elections case, barred from publicly targeting Jack Smith, potential witnesses

- 53% of Gen Z see high cost of living as a barrier to financial success. They’re ‘buckling down,’ expert says

- Moderna’s stock slides to three-year low as co-founder sells more shares

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Kenya’s Ambitious Carbon Capture Plant Sparks DebateAfrica is taking centre stage when it comes to the future of energy, with significant interest in the continent’s largely untapped oil and gas resources, as well as significant potential for the development of renewable energy operations. As oil and gas companies look to diversify their operations, many are looking to Africa to develop new “low-carbon” projects in largely unexplored areas. Meanwhile, there are increased calls from international organisations and governments to develop Africa’s green energy potential in support… Read more at: https://oilprice.com/Energy/Crude-Oil/Kenyas-Ambitious-Carbon-Capture-Plant-Sparks-Debate.html |

|

Big Oil Shares Up As Israel-Hamas Conflict IntensifiesShare prices in Big Oil companies soared on Monday, with Shell’s share price hitting a record high, as oil markets respond to an escalation of the Hamas-Israel conflict, and its potential to widen to multiple fronts. On Monday at 11:20 a.m. ET, shares of Shell (NYSE:SHEL) were trading up 1.10% at $68.12 per share. “The critical macro concern lies with the oil market reaction. Brent crude prices have not risen materially, but a significant escalation in tensions would likely apply further upward pressure,” the Guardian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Big-Oil-Shares-Up-As-Israel-Hamas-Conflict-Intensifies.html |

|

SOCAR And Lukoil Seal Unique Oil Deal Despite Western SanctionsAzerbaijan’s state oil company SOCAR has concluded a wide-ranging agreement with Russia’s Lukoil under which the Russian oil company will lend SOCAR $1.5 billion and supply SOCAR’s STAR oil refinery in Turkey with up to 200,000 barrels per day of Russian crude oil. The unusual agreement is apparently structured to overcome the problems SOCAR was facing in purchasing Russian crude oil for its STAR refinery due to the sanctions imposed by the West on Russia over its invasion of Ukraine. The sanctions prevent Western companies from both buying and… Read more at: https://oilprice.com/Energy/Crude-Oil/SOCAR-And-Lukoil-Seal-Unique-Oil-Deal-Despite-Western-Sanctions.html |

|

Indian Government Hesitant About Payments For Russian Oil In YuanPayment in Chinese currency of seven cargoes of Russian crude oil imported by state-run Indian oil refineries is being held up over the Indian government’s new-found hesitancy to accept this form of payment, Reuters cited unnamed Finance Ministry sources as saying on Monday. While there has been some delay in payment with some cargoes, Russian oil companies continue to supply Indian refiners, with India this year becoming the biggest importer of Russian seaborne crude at discounted prices. In July, some refiners began… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-Government-Hesitant-About-Payments-For-Russian-Oil-In-Yuan.html |

|

Glut Of Synthetic Diamonds Sparks Trouble For Lab-Grown ProducersThe second-largest US producer of lab-grown diamonds has filed for bankruptcy amid a massive glut of fabricated gemstones and plunging prices. Financial Times reports that Washington-based WD Lab Grown Diamonds filed for Chapter 7 in a Delaware bankruptcy court and had total liabilities of around $44 million and assets of $3 million. The company listed it had between 100 and 199 creditors. In 2020, WD Lab Grown Diamonds became the first diamond company to be certified under the “Standard for Sustainable Diamonds” by third-party verifier… Read more at: https://oilprice.com/Metals/Commodities/Glut-Of-Synthetic-Diamonds-Sparks-Trouble-For-Lab-Grown-Producers.html |

|

U.S. Additions Of Natural Gas Power Capacity Rise In 2023The United States is set to add a total of 8.6 gigawatts (GW) of natural gas-fired electric generating capacity in 2023, more than the gas-fired additions in 2022 and 2021, the U.S. Energy Information Administration (EIA) said on Monday. As many as 10 natural gas-fired power plants have already come online so far this year, adding 6.8 GW of electric generating capacity, EIA’s Monthly Electric Generator Inventory showed. Another six gas-fired power plants with a combined power generating capacity of 1.8 GW are expected to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Additions-Of-Natural-Gas-Power-Capacity-Rise-In-2023.html |

|

Indonesia Eyes “Critical Mineral Agreement” With U.S. For Nickel ExportsVia Metal Miner Nickel prices remained decidedly bearish throughout October, experiencing the largest monthly decline amongst base metals. Indeed, prices fell over 7% to their lowest level since October 2021. Overall, the Stainless Monthly Metals Index (MMI) continued to decline, dropping 5.74% from September to October. Stainless Mills Scramble For Orders After data from the World Stainless Association showed a 0.9% decline in stainless steel melt shop production during H1, by Q4, the stainless market remains bleak. Nonetheless, domestic… Read more at: https://oilprice.com/Metals/Commodities/Indonesia-Eyes-Critical-Mineral-Agreement-With-US-For-Nickel-Exports.html |

|

Norway To Drop ‘Petroleum’ From Energy Ministry’s NameNorway’s government decided on Monday to rename the current Petroleum and Energy Ministry to Energy Ministry, effective January 2024, dropping ‘petroleum’ as Western Europe’s top oil and gas producer aims to advance all energy sources in the energy transition. Consequently, as of January 1, 2024, the Petroleum and Energy Minister will be known as Energy Minister, the cabinet said, adding that the ministry’s responsibilities do not change and it will be overseeing and drafting a coordinated holistic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-To-Drop-Petroleum-From-Energy-Ministrys-Name.html |

|

Will The U.S. Clamp Down On Iranian Crude Exports?There have been calls on U.S. President Joe Biden to clamp down on lucrative oil and gas exports from Iran – widely believed to have played key role in the 7 October attacks by Palestinian political and military group Hamas on Israel. Some, such as U.S. senior Republican Senator, Lindsey Graham, have even suggested that the U.S. and Israel destroy Iran’s oil infrastructure entirely. “Without oil, they [the Iranians] have no money [and]… Without money, terrorism loses its biggest benefactor,” he underlined. Rising oil and gas… Read more at: https://oilprice.com/Energy/Crude-Oil/Will-The-US-Clamp-Down-On-Iranian-Crude-Exports.html |

|

Report: Deal To Ease Venezuela Oil Sanctions Could Be Signed TuesdayThe U.S. is preparing to ease sanctions on Venezuela’s oil in return for a pledge to hold free and fair internationally monitored presidential elections in 2024, the Washington Post reports, citing two anonymous sources. The report claims that Venezuelan President Nicolás Maduro will sign a deal with the country’s U.S.-backed opposition during a Tuesday meeting in Barbados, with U.S. officials standing by. That deal will allegedly see Maduro lift the bans on opposition presidential candidates. Once the deal is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Report-Deal-To-Ease-Venezuela-Oil-Sanctions-Could-Be-Signed-Tuesday.html |

|

Saudi Arabia’s Crude Oil Exports Slumped To 28-Month Low In AugustSaudi Arabia’s crude exports plunged to a 28-month low in August as the world’s largest crude oil exporter continued to cut its production to “stabilize” the market, data from the Joint Organizations Data Initiative (JODI) showed on Monday. Saudi crude oil exports fell to 5.58 million barrels per day (bpd) in August, down by 428,000 bpd from July—the lowest level in 28 months, according to the latest available data in JODI, which compiles self-reported data from many countries. The Kingdom’s crude… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Crude-Oil-Exports-Slumped-To-28-Month-Low-In-August.html |

|

Geopolitical Volatility Sends Gas Prices SoaringGas prices have soared over recent days, with geopolitical volatility rattling spot markets and escalating fears of supply shortages this winter. Having seemingly calmed from last year’s bumper commodity rally when prices topped out at record highs following Russia’s invasion of Ukraine, Europe’s benchmarks are surging again – with the UK recording its highest prices since February. These worries have been reflected on the spot market, where the Dutch TTF Futures market and UK Natural Gas Futures are trading at €55.28… Read more at: https://oilprice.com/Energy/Natural-Gas/Geopolitical-Volatility-Sends-Gas-Prices-Soaring.html |

|

Russia Expects Venezuela’s Maduro To Visit Moscow As Energy Ties GrowRussia expects to welcome Venezuela’s President Nicolas Maduro on a visit as part of the expanding Russia-Venezuela ties, including in the energy sector, Russian Deputy Prime Minister Alexander Novak said on Monday. “We expect the president of Venezuela to visit Russia per the invitation extended to him,” Novak, Russia’s top oil official, said, as carried by Russian news agency TASS. Novak did not provide details on a forthcoming visit. Maduro could visit Russia by the end of this year, an anonymous source with knowledge… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Expects-Venezuelas-Maduro-To-Visit-Moscow-As-Energy-Ties-Grow.html |

|

Airlines: Plan To Phase Out EU Fossil Fuel Subsidies Would BackfireAn idea in the EU to phase out subsidies for fossil fuels could backfire on the aviation industry, considering that there are no readily available alternatives to jet fuel at scale, executives at airlines have told the Financial Times. The EU is currently debating its common stance for the COP28 climate summit in Dubai next month, and some wealthy EU nations, including the Netherlands, are proposing an end date to fossil fuel subsidies for 2025. The plan, however, is meeting resistance among other EU member states with large fossil fuel industries… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Airlines-Plan-To-Phase-Out-EU-Fossil-Fuel-Subsidies-Would-Backfire.html |

|

Low Natural Gas Demand Helps Europe Boost InventoriesEuropean demand for natural gas remained near the bottom of the five-year seasonal levels in August, helping inventories end the month at around 93% full, data from the Joint Organizations Data Initiative (JODI) showed on Monday. Europe’s gas demand, measured in consumption in the EU and the UK, has trended lower for most of the past year amid energy savings measures, high prices last year, and demand destruction from slowing industrial activity. In August, the latest available data in JODI, natural gas demand in the EU and the UK rose slightly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Low-Natural-Gas-Demand-Helps-Europe-Boost-Inventories.html |

|

Meta’s unique approach to developing AI puzzles Wall Street, but techies love itMeta’s AI push, driven by its Llama large language model, takes a page out of the open source playbook Read more at: https://www.cnbc.com/2023/10/16/metas-open-source-approach-to-ai-puzzles-wall-street-techies-love-it.html |

|

Stocks close higher, Dow rallies 300 points as optimism over earnings outweighs higher rates: Live updatesEarnings season heats up this week with 11% of the S&P 500 slated to report results. Read more at: https://www.cnbc.com/2023/10/15/stock-futures-today-live-updates.html |

|

FTX top engineer testifies Bankman-Fried spent $1.13 billion on celebrities and sponsorshipsNishad Singh, FTX’s former engineering head, testified on Monday about Sam Bankman-Fried’s “excessive” spending Read more at: https://www.cnbc.com/2023/10/16/ftx-top-engineer-says-bankman-fried-spent-1point13-billion-on-celebrities.html |

|

Microsoft-owned LinkedIn lays off nearly 700 employees — read the memo hereRevenue growth at Microsoft’s business social network has slowed as advertisers pull back in an uncertain economy. Read more at: https://www.cnbc.com/2023/10/16/microsoft-owned-linkedin-lays-off-nearly-700-read-the-memo-here.html |

|

Israel-Hamas war live updates: Blinken meets with Israeli president, promises U.S. support; Gaza-Egypt border still closedIsrael is on its 10th day of an aerial bombardment campaign of the Gaza Strip as it readies for a potential ground invasion. Read more at: https://www.cnbc.com/2023/10/16/israel-hamas-war-updates-latest-news-on-gaza.html |

|

Jim Jordan’s House Speaker bid gains momentum as Biden warns of ‘dangerous’ leadership vacuum in CongressThe House is unable to move forward with Biden’s request for security assistance for Israel and Ukraine until the chamber elects a new speaker. Read more at: https://www.cnbc.com/2023/10/16/jim-jordans-house-speaker-bid-gains-fresh-momentum-.html |

|

Despite headwinds from the UAW strikes, Barclays sees 20% upside for this under-the-radar auto stockShares of this automobile manufacturer may be trading near all-time highs, but Barclays still believes it’s ‘relatively inexpensive.’ Read more at: https://www.cnbc.com/2023/10/16/barclays-sees-20percent-upside-for-this-under-the-radar-auto-stock.html |

|

Trump hit with partial gag order in DC elections case, barred from publicly targeting Jack Smith, potential witnessesAttorneys for Trump argued that limiting his out-of-court statements would undermine his First Amendment rights and his 2024 presidential campaign. Read more at: https://www.cnbc.com/2023/10/16/trump-election-case-judge-weighs-dc-gag-order-bid-by-jack-smith.html |

|

Biden tops Trump in 2024 campaign fundraising for third quarter, but ex-president’s war chest dwarfs GOP rivalsJoe Biden has outraised Donald Trump since July in the 2024 money race, but the former president dominated his Republican rivals. Read more at: https://www.cnbc.com/2023/10/16/biden-tops-trump-in-2024-campaign-fundraising-for-third-quarter.html |

|

FTX top engineer testifies on Sam Bankman-Fried’s ‘excessive’ spending at Alameda: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Robinson Burkey, the Wormhole Foundation’s EVP and head of strategy, discusses Lisbon’s role as one of the world’s top crypto hubs, the impact of the FTX collapse on the industry and more. Read more at: https://www.cnbc.com/video/2023/10/16/ftx-top-engineer-testifies-sam-bankman-fried-excessive-spending-alameda-cnbc-crypto-world.html |

|

53% of Gen Z see high cost of living as a barrier to financial success. They’re ‘buckling down,’ expert saysYoung individuals are “buckling down” when it comes to spending, a Bank of America executive said, following a new Gen Z-focused survey by the firm. Read more at: https://www.cnbc.com/2023/10/16/53percent-of-gen-z-see-high-cost-of-living-as-a-barrier-to-financial-success.html |

|

Taylor Swift Eras Tour film posts second-best October box office opening, behind ‘Joker’Taylor Swift’s Eras Tour concert film tallied $92.8 million during its debut, making it the second-highest domestic opening in October. Read more at: https://www.cnbc.com/2023/10/16/taylor-swift-eras-tour-box-office-weekend.html |

|

Cathie Wood says the bond market is key to a resurgence in her favorite innovation stocksArk Invest’s Cathie Wood said her innovation darlings are poised to lead the market once bonds start to rally and push interest rates lower. Read more at: https://www.cnbc.com/2023/10/16/cathie-wood-says-bonds-are-key-to-a-resurgence-in-her-favorite-stocks-.html |

|

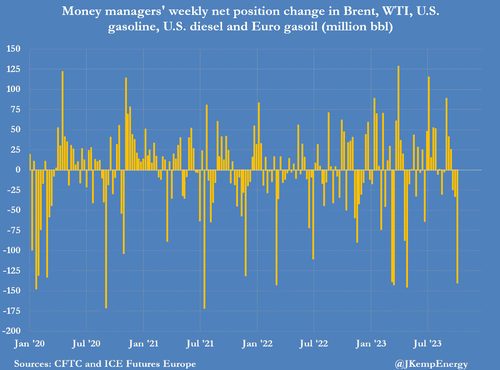

“Oil Bullish Froth Blown Away”: Hedge Funds Dumped Near-Record 140 Million Barrels Of Petroleum Last WeekBy John Kemp, Senior energy analyst at Reuters Portfolio investors have dumped positions in petroleum at some of the fastest rates in the last decade in the most recent week as the bullish sentiment that built up after OPEC+ production cuts evaporated. Investors reacted negatively to the end of the squeeze on inventories around the NYMEX delivery point, oil prices breaking lower, rising borrowing costs, and the growing threat of conflict in the Middle East. Hedge funds and other money managers sold the equivalent of 140 million barrels in the six most important petroleum futures and options contracts over the seven days ending on October 10. The sales volume was the 14th largest in 552 weeks since March 2013, based on records filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

Funds slashed their total positions by 197 million barrels over the most recent three weeks, reversing about half of the 398 million … Read more at: https://www.zerohedge.com/commodities/oil-bullish-froth-blown-away-hedge-funds-dumped-near-record-140-million-barrels |

|

IL Man Charged With Stabbing 6-Year-Old Muslim To Death Over Hamas-Israel WarAs right-leaning social media is abuzz with hand-wringing over the prospect of Hamas-style violence springing up in the United States – and with the FBI warning of the same – the first domestic death linked to the Hamas-Israel war is that of a Muslim, Palestinian-American child. On Saturday morning, an Illinois man stabbed a 6-year-old Muslim boy to death and slashed the boy’s mother, in a brutal assault motivated by last week’s Hamas attack on Israel, police say. The accused attacker, 71-year-old Joseph M. Czuba, is their landlord in Plainfield Township, about 40 miles southwest of downtown Chicago.

Six-year-old Wadea al-Fayoume was stabbed 26 times in an attack that police say arose from “the ongoing Middle Eastern conflict” (CAIR) … Read more at: https://www.zerohedge.com/political/il-man-charged-stabbing-6-year-old-muslim-death-over-hamas-israel-war |

|

Peter Schiff: The Government Is Lying About InflationVia SchiffGold.com, The CPI has cooled in recent months, but Americans say they’re still struggling with rising prices and they’re worried about inflation. Why is there this dichotomy between people’s perceptions and the official data?

Peter Schiff recently appeared on Real America with Dan Ball to talk about the economy. He said the problem is the government isn’t being honest about inflation. Dan opened the interview noting that the recent fight over the House speaker wasn’t really about the speaker. It was about the enormous national debt and ever-increasing government spending. The US government added over $1 trillion to the Read more at: https://www.zerohedge.com/markets/peter-schiff-government-lying-about-inflation |

|

Starboard Value Takes Position in News Corp, Eyes Strategic ChangesActivist hedge fund Starboard Value has acquired a position in News Corp., aiming for strategic and governance changes within Rupert Murdoch’s media empire. The $8 billion New York-based fund, led by Jeff Smith, “believes News Corp., one of the two arms of Rupert Murdoch’s media empire, trades at a significant discount to its fair market value due to its conglomerate structure,” according to The Wall Street Journal, citing people familiar with the matter. The people said Starboard’s stake in News Corp. is “sizeable” but provided no additional information on how large. Reuters first reported Starboard’s stake last Friday.

WSJ said Starboard would ask News Corp. to spin off its digital real estate division, which includes a stake in Australian online property site operator REA Group and Realtor.com parent Move Inc. Read more at: https://www.zerohedge.com/markets/starboard-value-takes-position-news-corp-eyes-strategic-changes |

|

Sacked banker loses case over two-sandwich lunch claimSzabolcs Fekete claimed two coffees, two sandwiches and two pasta dishes were consumed solely by him. Read more at: https://www.bbc.co.uk/news/business-67121456?at_medium=RSS&at_campaign=KARANGA |

|

PM urged to speed up bill to stop no-fault evictionsA group of 30 charities warn Rishi Sunak not to abandon the Renters Reform Bill. Read more at: https://www.bbc.co.uk/news/business-67118261?at_medium=RSS&at_campaign=KARANGA |

|

Former Bank of China boss arrested on bribery chargesHe is the latest banker to be prosecuted under Chinese President Xi’s anti-corruption crackdown. Read more at: https://www.bbc.co.uk/news/world-asia-china-67119687?at_medium=RSS&at_campaign=KARANGA |

|

IRM Energy IPO to open on October 18. 10 things to knowThe company’s shares are expected to get listed on both the exchanges. Here are 10 things to know about the offer Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/irm-energy-ipo-to-open-on-october-18-here-are-10-things-to-know-about-the-offer/articleshow/104475578.cms |

|

These 7 healthcare stocks record their fresh 52-week highsDuring Monday’s trading session, the benchmark index Sensex declined around 116 points, closing the day at 66,166. Seven stocks in the BSE healthcare index, however, reached their highest prices in the last 52 weeks. The 52-week high is of great importance to certain traders and investors because it serves as a crucial technical indicator for assessing a stock’s present worth and forecasting potential price changes. This figure signifies the highest price at which a stock has been traded in the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/7-healthcare-stocks-hit-their-fresh-52-week-highs-rally-up-to-25-in-a-month/new-highs/slideshow/104472263.cms |

|

Tech View: Nifty charts hint at indecisiveness. What traders should do on TuesdayThe daily and hourly momentum indicators provide divergent signals and in such a scenario a consolidation appears with high probability. Contraction of the Bollinger bands also supports our sideways outlook on the Index. The range of consolidation is likely to be 19,500 – 20,100 from a short-term perspective. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-indecisiveness-what-traders-should-do-on-tuesday/articleshow/104470841.cms |

|

Retirement Hacks: Medicare open enrollment: if you’re confused, this program can helpSHIPs may be what you need this Medicare open enrollment season Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7273-499861F675C1%7D&siteid=rss&rss=1 |

|

What’s driving up prices for sporting events? Taylor Swift is one factor. So are inflation and pent-up demand.Americans spent $36 billion watching sports in person in August, compared with $29 billion a year earlier, according to the latest data. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727D-9A7C8600BC63%7D&siteid=rss&rss=1 |

|

Moderna’s stock slides to three-year low as co-founder sells more sharesModerna’s stock slid toward a fourth straight loss Monday. The company’s co-founder and chair, Noubar Afeyan, has sold $3 million worth of shares in October. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727F-CE44AB56E73A%7D&siteid=rss&rss=1 |